Back to Blog

Maximize Your Automated Crypto Earnings with Smart Contracts and Bots

Discover how automated crypto earnings generate passive income with smart contracts, bots, and stablecoin strategies. Start optimizing your returns today.

Dec 18, 2025

generated

Imagine waking up to see your crypto balance ticked up overnight. Automated crypto earnings swap endless spreadsheets and manual yield hunts for a hands-off system driven by bots and smart contracts.

Starting Automated Crypto Earnings

Think of automation as autopilot for your portfolio. While you sleep, it scans protocols, chases rewards, and reallocates funds—so you don’t have to.

Before you dive in, get clear on why you’re automating and which tactics make sense.

Hands-off Income that runs day and night

Dynamic Allocation across protocols to capture top yields

Fewer Manual Errors and missed swings

Instant Diversification in just a few clicks

Real-World Bot Example

Sam was glued to his screen, juggling spreadsheets and alerts—and still missed key market swings. He set up a grid trading bot and landed a 7% monthly yield without logging in once.

“My bot freed up hours each week and boosted returns,” says Sam, a crypto enthusiast.

Core Automation Strategies

Staking: Lock tokens to secure networks and earn block rewards

Yield Farming: Provide liquidity in return for fees and incentive tokens

Trading Bots: Execute buy and sell patterns in real time

Vault Aggregators: Harvest yields across funds and reinvest automatically

Stablecoin setups often feel like the reliable teammate in a relay race—offering 4%–12% APY on USDC deposits, so your earnings stay more predictable.

Why Automate Crypto Earnings

Imagine a gardener who never tires, watering plants on a strict schedule. Bots do the same for your crypto: staking, trading, compounding, all without emotion or fatigue.

Speed that outpaces any human trader

24/7 Monitoring with zero burnout

Less Emotional Error when markets wobble

Automatic Compounding for consistently growing balance

“Automation unlocked my time and boosted consistency,” says crypto auditor Maya.

Who Benefits Most

DeFi Newcomers seeking guided, low-friction setups

Busy Professionals who can’t stare at charts all day

Experienced Traders wanting hands-off execution

Web3 Teams managing treasuries or stablecoin reserves

Yield Seeker makes the jump easy. Its AI-driven agents spread your USDC across vetted DeFi protocols for risk-aware yield.

Initial Setup Process

Turning this concept into reality takes just a few clear steps:

Create a wallet and secure your seed phrase

Acquire USDC or your stablecoin of choice

Connect your wallet to a bot or vault platform

Approve smart contracts and define your parameters

Track performance, then adjust or let your returns compound

Get started in minutes with just $10 and explore our automated crypto investing guide: automated crypto investing guide now.

Next explore smart contract mechanics powering all strategies.

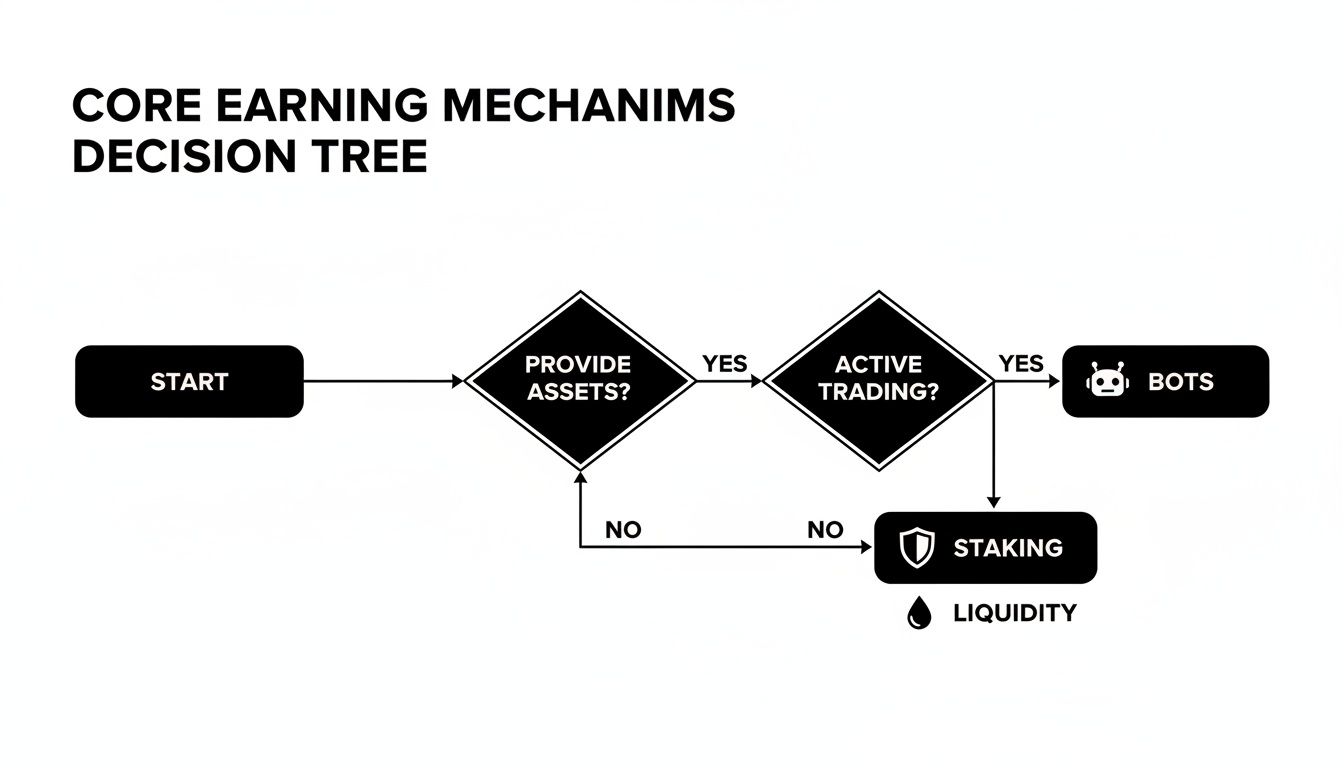

Understanding Core Earning Mechanisms

Crypto automation runs 24/7 on blockchain code that never sleeps. It takes care of securing your assets, executing trades, and growing your balance—all without you staring at charts.

Think of a smart contract as a digital vending machine: you insert tokens and, once the right conditions are met, out pop your rewards.

These invisible engines power familiar DeFi features like staking, yield farming, and trading bots. They free you from manual checks or one-off trades.

Smart Contract Fundamentals

Staking locks your tokens with validators to keep a blockchain honest. In return, you earn network fees.

Yield farming pools assets on decentralized exchanges so traders can swap. As a liquidity provider, you collect a slice of those trading fees.

Trading bots hook into exchange APIs and follow rule-based setups—whether that’s arbitrage, grid trading, or dollar-cost averaging.

For example, you’re staking SOL and the contract credits rewards every time a block finalizes. You don’t need to track block times or do yield math by hand.

In 2025, staking and yield farming have become pillars of automated crypto earnings. You can lock tokens on platforms like Ethereum or Solana and see returns of 4%–12% APY.

This all happens seamlessly. Validators and liquidity providers get credited in real time, without you needing to jump in and out of positions. Learn more on EZBlockchain.

Automating Liquidity Pools And Bots

Liquidity pools work like a communal cash register for token pairs. When traders swap, a tiny fee goes into the pot—then gets shared among contributors.

Key Points:

Fee Income: You receive a cut of trading fees based on your share.

Incentive Tokens: Some protocols top up your earnings with bonus tokens.

Impermanent Loss: Price swings between assets can shrink your net gains.

You’ll often see incentive programs that layer extra rewards on top of fee income. But keep an eye on pool ratios, or you might get surprised by shifting balances.

On the trading bot side, automation lives in exchange APIs. Bots can:

Run grid strategies across price bands

Exploit arbitrage gaps between markets

Apply systematic dollar-cost averaging

This dashboard gives you a live view of accrued rewards and contract health. You can see exactly how much yield you’ve built up before hitting “claim.”

Stablecoin Yields And Risk Profiles

Stablecoins anchor your earnings to fiat, so your balance stays more predictable. Vaults built around USDC or DAI focus on steady APYs.

Behind the scenes, automated vaults might:

Reinvest your rewards

Shuffle allocations to chase yields

Pause during bouts of market stress

For instance, USDC vaults on Ethereum often use vault aggregators to shift funds to top performers. That way, you lock in a smoother APY.

Watch out for these risks:

Impermanent Loss: Diverging pair prices can erode your returns on withdrawal.

Smart Contract Risk: Flaws or hacks in code could put funds at stake.

Liquidity Risk: Thin pools can trap your tokens or spike slippage.

Oracle Vulnerabilities: Bad price feeds might trigger wrong actions.

Admin Key Exposure: Centralized keys can change rules without notice.

Size up these variables before you automate. When you understand each mechanism, you can fine-tune strategies that match your risk comfort and yield targets.

Key Takeaway

Automated strategies merge code-driven rigor with protocol design. Your job is to choose the right mix for your goals.

Next, we’ll compare automation approaches side by side to identify the best fit.

Comparing Automation Strategies

Every crypto investor comes with different goals and comfort levels. Whether you crave hands-off simplicity or crave higher returns with a bit more legwork, there’s an automation method tailored for you. Below is a snapshot of the four main approaches and what they demand.

Comparison Of Automated Crypto Earning Methods

Approach | Mechanism | Typical APY | Entry Requirements |

|---|---|---|---|

Staking | Lock tokens in network protocols | 4%–12% | Network access, token minimum |

Trading Bots | Execute API trades via grids, arbitrage, DCA | 6%–20% | Exchange account, API key, capital |

Yield Aggregators | Harvest and reinvest protocol rewards | 10%–25% | Wallet, aggregator interface familiarity |

Stablecoin Vaults | Deposit stablecoins for predictable yield | 4%–8% | USDC/DAI, minimal $10 |

Use this chart to match your risk appetite, technical skills, and desired APY range.

Popular Bot Strategies

Trading bots never sleep. They follow simple rules to spot profit opportunities around the clock.

Grid Trading: Place staggered buy and sell orders to catch swings in price.

Arbitrage: Jump on price differences between exchanges for low-risk gains.

Dollar-Cost Averaging (DCA): Schedule regular buys to smooth out market ups and downs.

AI-Driven Signals: Trigger trades based on indicators like RSI, MACD, and Bollinger Bands.

Many seasoned traders lean on platforms like 3Commas, Pionex, Cryptohopper, Bitsgap, or KuCoin to set up these strategies with minimal fuss. For a deep dive into the top bots, check out our guide on best automated crypto trading bots on Yield Seeker.

Vault Aggregator Mechanics

Yield aggregators do the heavy lifting of farming and compounding returns for you.

Auto-Harvest reinvests your rewards without you lifting a finger.

Dynamic Allocation shifts funds to the best-performing pools in real time.

Stablecoin Vaults stick to USDC or DAI, aiming for steady, predictable yields.

In practice, stablecoin vaults typically offer 4%–8% APY with just a handful of dollars required to start.

Key Takeaway

Each automation path carries its own blend of ease, risk, and reward. Choose based on how much time and technical know-how you’re willing to invest.

Factors To Consider

Your personal style and capital size will guide the right pick.

Technical skill: Bots often demand API setups and dashboard navigation.

Entry capital: Staking may require hefty token minimums, while vaults start low.

Volatility: Automated trading can spike profits—and losses—when markets swing.

Principal safety: Stablecoin options focus on preserving your starting balance.

Aligning Method To Goals

Not sure where to begin? Here are a few scenarios:

Beginner investor: Lock USDC in a vault at 5% APY with just $50.

Intermediate user: Deploy a BTC–USDC grid bot aiming for around 8% monthly.

Advanced strategist: Mix ETH and stablecoin vaults in an aggregator to target 12% APR.

This simple framework helps you zero in on the right setup.

Next Steps

Ready to roll? Follow these steps:

Fund your wallet with a small stablecoin amount.

Connect to your chosen platform or bot.

Allocate only a fraction of your holdings at first.

Track performance, then adjust or scale as needed.

A small test run builds confidence and limits exposure.

Bringing It Together

Comparing these automation options shines a light on where you should deploy time and capital. Yield Seeker further simplifies the process by offering preconfigured vaults and bots, complete with AI-driven tweaks for stablecoin yields.

Always start small, spread your bets, and tweak settings as market conditions shift.

Best Practices

Stick to audited smart contracts and review yields regularly.

Watch gas fees and time transactions smartly.

Guard your API keys—rotate and store them safely.

Rebalance periodically when yields or risk profiles change.

With this guide in hand, you’re set to choose and launch the automated strategy that aligns with your goals. Feel free to revisit the comparison table anytime your objectives evolve.

Selecting The Best Crypto Earning Platform

Picking the right platform can make or break your DeFi journey. A solid choice not only safeguards your funds but also maximizes your returns.

By lining up protocols side by side, you sidestep guesswork and uncover hidden fees before they bite. Each platform—whether it leans on vaults, bots, or liquidity pools—carries its own risk profile. Knowing what to look for helps you dodge the most common traps.

Key Evaluation Criteria

On-Chain Transparency shows live transactions, contract balances, and token flows.

Smart Contract Audits confirm security reviews by firms like CertiK or Trail of Bits.

Fee Structures cover gas fees, performance cuts, and withdrawal charges.

User Interface Clarity surfaces essential data and flags potential issues.

Community Governance gauges protocol upgrades, roadmaps, and voting power.

Keeping these factors in view keeps surprises to a minimum and your strategy on track.

Red Flag

Anonymous or unverified teams increase smart contract risk.

Red Flag

Opaque lock-up terms can trap funds during market swings.

Red Flag

Unrealistic APY above 20% with no clear strategy often signals a scam.

Platform Comparison Table

Platform | Focus | Typical APY | Audit Status |

|---|---|---|---|

Yield Seeker | Stablecoin Vaults | 4%–8% | Audited by CertiK |

SafeRack | Trading Bots | 6%–12% | No public audit |

PoolMaster | Yield Aggregator | 10%–15% | Audited by PeckShield |

VaultWise | Multi-Asset Vaults | 5%–9% | Audited by Trail of Bits |

This snapshot lays out real-world APYs alongside each protocol’s security track record.

Platform Vetting Checklist

Inspect open-source contracts on a block explorer for deposit and withdrawal logic.

Verify audit reports for date, scope, and conclusions.

Tally all fees—gas, performance cuts, and withdrawal charges—to find net yield.

Navigate the UI to ensure you can track deposits, earnings, and contract addresses.

Browse governance forums to measure developer activity and community discussion.

Walking through these steps shines a light on critical details before you move any capital.

How To Spot Subtle Red Flags

Delayed contract verification or missing source code.

Multi-signature keys held by a single entity.

Sudden, unexplained protocol changes or hidden upgrade powers.

Lack of transparency around fee calculations and treasury balances.

Catching these warning signs early can save you from major losses down the road.

Why Yield Seeker Stands Out

Yield Seeker zeroes in on stablecoin yield with almost zero friction.

AI-Driven Agent that shifts USDC dynamically across top DeFi protocols.

No Lockups—withdraw any time with no penalties.

Low Entry from just $10 USDC on the Base chain.

Transparent Dashboard showing every on-chain move and earnings.

Community Forum for peer support and strategy sharing.

Instant Notifications when performance changes or upgrades roll out.

Every allocation is logged on-chain, so auditing is a breeze.

“Yield Seeker cut my setup time in half and delivered consistent returns.”

— Alex, DeFi hobbyist

Before committing large sums, start small to confirm the workflow and security measures.

Final Best Practices

Use hardware wallets for sizable balances.

Rotate API keys and update passwords regularly.

Schedule reviews of fresh audit reports.

Diversify funds across two to three trusted protocols.

Keep detailed records for tax and compliance.

Monitor gas prices to avoid spikes.

Set up alerts for any suspicious contract activity.

Implement these habits, and you’ll mitigate risk while steadily growing your automated crypto earnings. Always begin with a small slice of your portfolio, review performance monthly, and fine-tune your approach as the market evolves.

Setting Up Your First Automated Strategy

Getting your automated earnings off the ground can feel overwhelming. Breaking it into manageable steps makes the process as straightforward as following a recipe.

First, you’ll need a wallet that handles stablecoins. This is your base camp—secure it well.

Choose a reputable wallet such as MetaMask or Ledger Live and back up your recovery phrase offline.

Enable two-factor authentication to safeguard access.

Store your seed phrase in a hardware wallet or a secure offline vault.

Creating A Secure Wallet

Always pick a non-custodial option to keep full control of your funds. Think of it like holding the keys to your own safe.

Verify any extension’s web address before downloading from the official site.

For balances over $1000, consider using a hardware wallet.

Keep your wallet software up to date—patches close security holes fast.

Converting Funds Into Stablecoins

Stablecoins are the fuel for your automated strategies, locking in a predictable 4%–8% APY range. Turning fiat or other crypto into USDC or DAI is the next stop.

Use platforms like Coinbase or Binance for swift fiat-to-USDC transactions.

Bridge tokens on lower-fee networks to reduce gas costs.

Always confirm the exact stablecoin amount in your wallet before moving on.

Approving Smart Contracts

When you connect to a DeFi service or bot, you grant a smart contract permission to handle your tokens. Treat each approval like a temporary key to your vault.

Go to the protocol’s official site and select Connect Wallet.

Review which contract you’re interacting with and inspect the allowance.

Limit approvals to the exact amount you plan to deposit—avoid open-ended permissions.

Confirm and wait for on-chain verification.

Check the protocol’s dashboard to make sure your funds show up.

Always set a custom gas limit to reduce transaction fees during peak network congestion.

Configuring Your Bot Parameters

Now it’s time to dial in your automation. Think of this as setting the rules of the road—allocation size, risk tolerance, and rebalancing frequency.

Test Amount | Advantage | Recommendation |

|---|---|---|

$10–$50 | Low risk for initial testing | Start here to gain confidence |

$100+ | More meaningful yield data | Scale up after successful tests |

Once your bot is live, watch its first run closely. Learn more about smart contract security in our guide on smart contract security audits at Yield Seeker (https://yieldseeker.xyz/yieldseekerblog/smart-contract-security-audit).

Monitoring And Scaling

Checking your dashboard is like a daily wellness check for your strategy. Early detection of anomalies keeps your capital safe.

Schedule trades during off-peak hours to save up to 30% on gas fees.

Store API keys securely and rotate them monthly.

Begin with small deposits, then scale up as you confirm settings work.

With confidence built, you can gradually increase your allocation. This measured approach turns your initial experiment into a reliable income stream.

Final Checks

Before you go all in, do one more pass over your approvals and settings. Think of it as a pre-flight checklist.

Ensure no expired allowances or unknown addresses linger.

Backup your wallet and export activity logs regularly.

And that’s it—you’re ready to let your bot do the heavy lifting.

Real Examples And Return Expectations

Let’s walk through three actual user journeys to see automated crypto earnings at work. You’ll spot gross APY, the fees or impermanent-loss cuts, and the net return each approach delivers. Keep in mind, seasonality swings and promotional boosts will nudge these figures up or down.

Scenario Breakdown

Here’s how three strategies stack up in practice:

Stablecoin Vault User

Gross APY: 6% from USDC vaults

Protocol Fee: 0.5%

Performance Cut: 0.2%

Net APY: ~5.3%

Mid-Level Grid Bot Trader

Gross Yield: 15% over 30 days (BTC–USDC grid)

Exchange Fees: 1%

Bot Subscription: 0.5%

Net Return: ~13.5% monthly

Multi-Asset Yield Farmer

Gross APY: 25% across ETH, DAI, SOL pools

Impermanent Loss Adjustment: –3%

Net APY: ~20%

Scenario | Gross APY | Fees & IL | Net APY |

|---|---|---|---|

Stablecoin Vault | 6% | 0.7% | 5.3% |

Grid Trading Bot | 15% | 1.5% | 13.5% |

Multi-Asset Yield Farming | 25% | 5% | 20% |

“Seeing my net yields in a simple chart changed how I allocate capital,” says Jane, a DeFi strategist.

Shifting from vaults to bots to farming highlights how much control—and risk—moves back into your hands as strategies grow more dynamic. Vaults cap volatility; bots chase momentum; farming asks you to rebalance.

Yield Variables To Watch

Understanding these drivers helps you tweak or pause your strategies exactly when it makes sense:

Market Seasonality: Bull runs can lift gross yields by 30% in three months.

Impermanent Loss: A volatile pair might need two weeks of APY to recoup a 2% IL hit.

Promotional Boosts: Early adopters often snag an extra 2%–5% APY during launch windows.

Fee Timing: Network congestion can spike gas costs, trimming monthly yields by 1%–2%.

Case Study Example

Alice paused her ETH–USDC bot for a week before a hard fork, avoiding a 3% drawdown.

Bob rebalanced his vault allocation every month, capturing a mid-cycle 1.5% boost without extra risk.

Key Takeaway

Realistic net returns range from 4% in low-risk vaults to 20% in active farming after all costs.

Each scenario shows how variables like IL, fees, and market patterns drive the final numbers. With this context, you can set expectations that match your risk profile and time horizon.

Ready to test these ideas risk-free? Try Yield Seeker’s platform today:

Deposit from $10 and choose a stablecoin vault for a 5% APY.

Activate a grid bot in one click and watch the real-time charts.

Combine assets in the multi-pool tool to target 18–22% APY.

Set thresholds to pause or reallocate when net yields dip.

Start small, learn fast, and scale up as you gain confidence. Yield Seeker makes it straightforward.

FAQ

Here are the questions I hear most often when people dive into automated crypto earnings.

What’s the Minimum Capital Needed To Start?

You can begin with just $100 in stablecoins, whether you’re using vaults or grid bots. That said, small balances feel the pinch of fees—so look for platforms with low-fee tiers or rebate programs.How Do I Choose Between Staking, Bots, And Yield Aggregators?

It really depends on how hands-on you want to be.

• Staking is like setting your coins on cruise control—easy and reliable.

• Bots let you fine-tune buys and sells but need regular check-ins.

• Yield aggregators automatically shuffle funds across protocols, saving you the manual work.

Choosing Strategies

Which Security Measures Are Essential?

I always start with a hardware wallet. For bigger pools, add multi-sig, rotate your API keys on a schedule, and confirm every smart contract address against official project docs before hitting “approve.”

Expert Tip

Never rush contract approvals—always verify addresses on the project’s genuine channels.

How Do Network Upgrades Affect My Strategies?

Upgrades can throw automation off course. Here’s my playbook:

• Keep tabs on governance forums for upcoming forks.

• Pause your bots around major upgrades.

• Once the network stabilizes, tweak your settings to align with any new parameters.

This FAQ is your launchpad. Dive into our full guides to sharpen your approach and keep your automated earnings on track.

Ready to automate your stablecoin yield? Try Yield Seeker for a low-friction way to earn.