Back to Blog

Your Guide to Maximizing Base Chain Yield

Unlock the secrets to generating high Base chain yield. This guide breaks down proven DeFi strategies, risk management, and step-by-step actions on Base.

Dec 17, 2025

generated

Think of "Base chain yield" as putting your digital dollars to work on the Base network. It’s a lot like earning interest in a high-yield savings account, but with the potential for much better returns by plugging into the world of decentralized finance (DeFi). Instead of letting your stablecoins gather dust, you can turn them into active, income-generating assets.

What Is Base Chain Yield and Why Does It Matter?

Imagine your money working for you around the clock, earning a steady income without you lifting a finger. That's the core idea behind Base chain yield. Rather than just holding stablecoins like USDC in a wallet, you can deploy them across the DeFi ecosystem built on the Base network.

It’s a simple concept, really. A traditional bank takes your savings, lends it out to others, and gives you a tiny slice of the interest it earns. With DeFi on Base, you cut out the middleman and become the bank. You’re the one lending your assets directly to other users or providing the liquidity that powers trading platforms. In return, you pocket the lion's share of the fees and rewards.

The Core Opportunity for Stablecoin Holders

This is a game-changer for anyone holding stablecoins. By design, these assets are meant to hold their value, but they don’t grow on their own. Earning yield transforms them from a simple store of value into a productive investment.

Here's why this is a big deal:

Higher Potential Returns: DeFi protocols on Base often offer Annual Percentage Yields (APYs) that can dwarf what you’d find in even the best high-yield savings accounts.

Open to Everyone: Got an internet connection and a crypto wallet? You’re in. There are no gatekeepers, accredited investor rules, or lengthy approval processes.

Radical Transparency: Every transaction and the inner workings of these protocols are recorded on a public blockchain. This offers a level of transparency that traditional finance simply can't match.

At its heart, Base chain yield is about making your money work smarter. It taps into the raw efficiency of a modern blockchain to create financial opportunities that were once out of reach for most people.

Why Base Is the Perfect Playground for Yield

The Base network, an Ethereum Layer 2 built by the team at Coinbase, is practically tailor-made for generating yield. Its entire architecture is designed for speed and low costs, which has a direct impact on your bottom line.

Transaction fees, or "gas," on Base are incredibly cheap—often just a few cents. This makes it practical to move your funds around and compound your earnings frequently, something that would be prohibitively expensive on other networks. This low-cost environment is key, as it allows even small amounts of capital to be put to work effectively, boosting your overall returns over time. In this guide, we'll walk through exactly how you can tap into these opportunities safely.

How Yield Generation Actually Works on Base

So, how does this all work? You don't need a finance degree to get a handle on Base chain yield. Let's pop the hood and look at the engines generating these returns.

Think of your idle stablecoins as a skilled worker ready for a job. The various DeFi protocols on Base are like factories offering different roles, and each one has its own way of paying you.

We can break down these "jobs" into a few core categories. The most common ones are lending your assets, providing liquidity for traders, and jumping into special incentive programs. Each method puts your capital to work in a unique way, generating yield from real economic activity happening on the blockchain.

Lending Your Assets Like a Digital Bank

The most straightforward way to earn is by lending. Picture these platforms as peer-to-peer digital banks. Instead of putting your money in a traditional bank that skims most of the interest, you lend your stablecoins directly to other users through a smart contract.

Borrowers put up their own crypto as collateral to secure the loan and pay interest on what they borrow. As the lender, you receive the lion's share of that interest. It's a clean, direct system where you become the one profiting from the loan.

Popular lending spots on Base include big names like Compound and Aave. When you deposit your USDC, it gets pooled with funds from other lenders. Borrowers tap into this pool, and the interest rate they pay—and you earn—is automatically set by supply and demand.

By lending your assets on-chain, you're essentially cutting out the middleman. The profit that would normally pad a bank's balance sheet gets redirected straight to you, the one providing the capital.

Supplying Liquidity to Power Decentralized Trading

Another huge source of Base chain yield is becoming a liquidity provider (LP). This is like being a micro-market maker for a decentralized exchange (DEX), such as Uniswap or Aerodrome.

These platforms need deep pools of assets so traders can swap tokens instantly. For a user to trade between USDC and ETH, for instance, the DEX needs a pool with both USDC and ETH in it. As an LP, you're the one who deposits assets into these pools.

In return for providing this vital service, you earn a tiny fee from every single trade that uses your pool. If you're in a busy trading pair, those small fees can quickly stack up into a serious return. It's like owning a tiny slice of a currency exchange booth at a packed international airport and getting a commission on every transaction.

You Deposit: You add your stablecoins (often paired with another asset) to a specific trading pool.

Traders Swap: People use the DEX to swap tokens, tapping into the liquidity you've provided.

You Earn Fees: A percentage of the trading fee is automatically paid out to you and the other LPs.

This is the lifeblood of decentralized finance, and providing liquidity is a fundamental way to earn directly from the economic pulse of the chain.

The Power of Incentives and Protocol Rewards

The last major piece of the yield puzzle comes from incentive programs. New protocols on Base need to attract users and liquidity to get going. To pull people in, they often offer their own native tokens as a bonus reward for early supporters.

This is what people call liquidity mining or yield farming. You might deposit your stablecoins into a lending market or a liquidity pool to earn the standard interest or trading fees. But on top of that, the protocol will "drip" you extra rewards in the form of its own token.

These incentives can seriously juice your overall APY, especially in a protocol's early days. It's their way of saying "thanks" for helping bootstrap the platform.

Since its launch, Base has become a magnet for capital precisely because of these opportunities. They often offer higher yields than Ethereum mainnet, thanks to lower gas fees and concentrated rewards. In its first six months, the total value locked (TVL) on Base shot up as farms advertised APYs in the 20–100% range for new pools, a testament to the power of these token emissions. You can read more about the early growth of Base's DeFi ecosystem to see just how powerful this effect was.

Why Base Is a Prime Hub for Yield Farming

Knowing how yield is generated is only half the battle. Just as important is where you put your capital to work. Some blockchains are just built differently, and Base has quickly become a go-to destination for earning Base chain yield for a few very good reasons.

At its core, Base is an Ethereum Layer 2. The easiest way to think about this is like an express toll lane built right alongside a permanently congested highway (that's Ethereum). It processes transactions in its own lane, bundles them up, and then settles them back on the main highway. This gives you the best of both worlds: you inherit Ethereum's top-tier security while getting a much faster, smoother ride.

This design is what makes higher net returns not just possible, but accessible to everyone.

The Magic of Low Fees and High Speed

Under the hood, Base is an Optimistic Rollup built with the OP Stack, making it fully compatible with the Ethereum Virtual Machine (EVM). This technical foundation is what allows for lightning-fast transactions at a fraction of the cost you'd find on Ethereum's mainnet. For a yield farmer, this isn't just a nice-to-have; it's a massive economic advantage.

Think about it. Say you wanted to compound your earnings daily on Ethereum. A single transaction could easily set you back tens of dollars in gas fees, completely eating up any profit you made. On Base, that same move costs just pennies.

This low-cost structure completely changes the game. It makes frequent actions like compounding interest, moving between protocols, or harvesting rewards economically viable, directly boosting your real, take-home APY.

This efficiency is a huge draw. While Ethereum's mainnet chugs along at around 15 transactions per second (TPS) with notoriously high gas fees, Base can breeze through hundreds or even thousands of TPS. Fees are typically in the $0.10–$0.20 range. As detailed in various analyses of Layer 2 performance, this low-friction environment allows protocols to offer more competitive yields from the get-go.

This screenshot from the official Base website gets right to the point—it's all about bringing the next billion users onchain, and that starts with making it cheap and easy for developers to build.

This vision of an open, global onchain economy only works if transacting is affordable and accessible, which is exactly what Base delivers.

A Thriving and Secure Ecosystem

Beyond the tech specs, Base has another major ace up its sleeve: its deep connection to Coinbase, one of the most trusted and established players in crypto. This affiliation brings a level of credibility that attracts a steady stream of both builders and users to the network.

What you get is a powerful positive feedback loop:

Developer Confidence: Top-tier developers are more willing to build innovative DeFi protocols on a platform they know is secure and well-supported.

User Inflow: A constant flow of new users injects fresh capital into the ecosystem, deepening liquidity and making everything more robust.

More Opportunities: This buzz of activity naturally leads to more protocols, more trading pairs, and ultimately, more diverse ways to earn yield.

This strong foundation means you aren't just farming on some random, fly-by-night chain. You're plugging into an ecosystem with real momentum and a serious commitment to security. For anyone looking to fine-tune their returns, understanding the landscape of the highest APY yield farming opportunities is the logical next step.

Ultimately, it’s this powerful mix of smart technology and a booming, well-backed community that makes Base an ideal playground for anyone serious about generating yield with their stablecoins.

Getting Real About the Risks in DeFi Yield Farming

Those high APYs on the Base chain look incredible, but they don't just fall out of the sky. Nothing in finance is ever truly "free," and in the wild west of DeFi, knowing what can go wrong is your best line of defense. Just jumping in without understanding the risks is a fast way to lose your shirt.

Think of it this way: the more you know about the potential pitfalls, the smarter your decisions will be. It’s the key to protecting your hard-earned capital and engaging with this new financial world with confidence, not fear.

Let's unpack the main challenges you’ll run into.

Smart Contract Risk: The Code is Law

Every DeFi protocol is built on smart contracts—bits of code that run automatically on the blockchain. These contracts are like digital vaults that hold and manage everyone's money. The problem? If that code has a bug or a vulnerability, it's like leaving a back door to the vault wide open for hackers.

This is smart contract risk, and frankly, it's one of the biggest dangers out there. Even the most brilliant developers can make mistakes, and a single error in the code can lead to millions of dollars being drained in minutes.

So, how do you protect yourself? Look for protocols that have been put through the wringer with multiple security audits from well-known firms like Trail of Bits or OpenZeppelin. Audits aren't a foolproof guarantee, but they’re a huge signal that a project takes security seriously.

Protocol and Counterparty Risk: Who's Behind the Curtain?

Beyond the code itself, you have protocol risk. This is all about the project as a whole—the team, the economic model, and their intentions. A protocol might crumble because its tokenomics are flawed, the founding team could simply walk away from the project, or worse, it could be an outright scam designed to steal your money (what the community calls a "rug pull").

This is where you have to put on your detective hat and do some serious due diligence. Who is the team? Are they anonymous or public? Do they communicate openly and have a clear, long-term vision? A vibrant and engaged community is often a great sign that a project is legitimate and building for the long haul.

We take a much deeper look at this spectrum of issues in our guide on the key yield farming risks, which can help you spot the red flags.

Be skeptical of sky-high APYs. Often, insane returns are used to distract from a protocol's fundamental weaknesses. Real, sustainable value comes from solid projects, not just flashy numbers that seem too good to be true.

Impermanent Loss: The Liquidity Provider's Dilemma

If you're providing liquidity to a decentralized exchange, you need to get familiar with a tricky concept called impermanent loss (IL). It happens when the price of the two tokens you've deposited into a liquidity pool changes relative to each other. The more their prices drift apart, the bigger your potential loss.

Here's a simple breakdown. Let's say you deposit an equal value of ETH and USDC. If ETH's price suddenly moons, the automated market maker (AMM) rebalances your position. You'll end up holding less of the high-performing ETH and more USDC than you started with. This "loss" is called impermanent because it only becomes a real, concrete loss when you withdraw your funds.

Example: You deposit 1 ETH (worth $3,000) and 3,000 USDC. Your total initial value is $6,000.

The price of ETH doubles to $6,000. Your stake in the pool might now be rebalanced to something like 0.707 ETH and 4,242 USDC.

The total value of your liquidity is now $8,484. But wait—if you had just held your original assets, you'd have 1 ETH (now worth $6,000) plus 3,000 USDC, for a total of $9,000. That $516 difference is your impermanent loss.

The fees you earn from trades can often make up for IL, but it’s a critical risk to grasp. This is also why stablecoin-only pairs are so popular; since their prices don't fluctuate much, the risk of impermanent loss is practically zero. Managing these kinds of financial risks is a skill, and exploring general risk management best practices can give you a solid foundation that applies well beyond just crypto.

Alright, theory is great, but the real magic happens when you put your money to work. Let's walk through exactly how to do that, turning all this knowledge into actual yield.

I'll guide you through the whole process, from setting up a wallet to making your first deposit. We'll use a real-world example, depositing stablecoins into a popular and battle-tested protocol like Aerodrome Finance. By the end of this, you'll have a clear playbook to follow.

Step 1: Get Your Digital Wallet Ready

Before you can do anything on Base, you need a self-custody wallet. Think of it as your passport to the world of DeFi—it gives you 100% control over your funds. It’s your own personal bank vault where only you have the keys.

If you're already in the Coinbase ecosystem, the Coinbase Wallet is a fantastic place to start. It's a separate app from the main exchange but connects seamlessly, making it super easy to get funded. Other great choices are MetaMask or Rainbow Wallet.

Whichever one you pick, the setup is pretty much the same:

Download the app: Grab the official wallet app from the app store or install the browser extension on your computer.

Create a new wallet: Just follow the on-screen instructions. It’s a quick process.

Secure your seed phrase: This is the most important part. You’ll get a 12 or 24-word "seed phrase." Write this down on paper and store it somewhere safe and offline. Never, ever share this phrase or save it digitally. It's the master key to your entire crypto life.

Step 2: Fund Your Wallet and Bridge to Base

Okay, wallet's ready. Time to load it up. You'll need two things: the stablecoins you want to earn with (like USDC) and a little bit of ETH on the Base network to cover transaction fees (known as gas).

First, get some ETH and USDC on your main Coinbase account or another exchange. Then, send them over to your new self-custody wallet address. Once they land, you need to "bridge" them from Ethereum over to the Base network.

A bridge is just a tool that moves your assets from one blockchain to another. The official Base Bridge is the most reliable and secure way to do this.

Think of bridging like sending a package internationally. You drop it off at a port (the bridge), it travels to its destination country (the Base network), and then you can use it in the new location.

The process is simple. Connect your wallet to the bridge site, pick the asset you want to move (USDC), type in the amount, and confirm the transaction in your wallet. Give it a few minutes, and your USDC will pop up in your wallet, now officially on the Base network.

Step 3: Connect to a DeFi Protocol

This is where the fun begins. You’re ready to connect to a DeFi protocol and let your stablecoins do the work. We'll stick with our example and use Aerodrome Finance, a top decentralized exchange on Base.

Head over to the official Aerodrome website. Always double-check that URL to make sure you're not on a phishing site. Once you’re there, look for the "Connect Wallet" button, which is usually in the top-right corner. Click it, choose your wallet (like Coinbase Wallet), and approve the connection request that pops up.

Boom. Your wallet is now linked to the protocol. It can see your balances and suggest transactions for you to sign off on.

Step 4: Deposit and Start Earning

On Aerodrome, the main way to earn yield is by providing liquidity. You'll want to head to the "Pools" section to find a good spot for your USDC. A great starting point for beginners is a pool that pairs USDC with another stablecoin, like USDC/USDbC. This setup nearly eliminates the risk of impermanent loss, making it a safe first step.

Here’s how to finish it off:

Find your pool: Look for the stablecoin pool you want to join.

Deposit your assets: Enter the amount of USDC you want to add. The app will automatically figure out how much of the other stablecoin is needed.

Approve and Supply: You'll need to sign two transactions. The first is an "approve" transaction, which gives the protocol permission to interact with your USDC. The second is the "supply" or "deposit" transaction, which officially places your funds into the liquidity pool.

That’s it! Once that final transaction confirms on the blockchain, your money is officially deployed. You're now earning a slice of the trading fees from every swap that goes through that pool. You can track your earnings right on the Aerodrome dashboard and watch your Base chain yield grow in real time.

Advanced Tools for Optimizing Your Yield

So, you’ve made your first deposit and started seeing some yield roll in. That’s the first step. But if you’re wondering how to take your Base chain yield strategy to the next level, you’re in the right place. The pros in DeFi don't just "set it and forget it"; they use specialized tools to save time, cut down on fees, and squeeze every last drop of return from their capital without being glued to their screens.

Think of these tools as your own personal crypto assistants, working for you 24/7. They help you shift from simply earning passively to actively managing your portfolio with a lot more efficiency and insight. Let's dig into two types of tools that can seriously upgrade your yield game.

Automate Your Strategy with Yield Aggregators

A yield aggregator is a protocol that puts your yield farming strategy on autopilot. Platforms like Beefy essentially act as automated financial advisors for your crypto. Instead of you having to manually claim rewards and reinvest them, an aggregator handles it all behind the scenes.

This process is called auto-compounding, and it’s a real game-changer on a low-fee network like Base. By reinvesting your earnings over and over again, these platforms tap into the power of compound interest way more effectively than a human ever could. It saves you a ton of time and, just as importantly, saves you the gas fees you'd burn on dozens of separate transactions.

It’s pretty simple:

You Deposit: Put your funds into a "vault" on the aggregator.

It Optimizes: The vault automatically claims your rewards from whatever protocol you're earning from.

It Reinvests: Those rewards get put right back to work, growing your principal and boosting what you'll earn next.

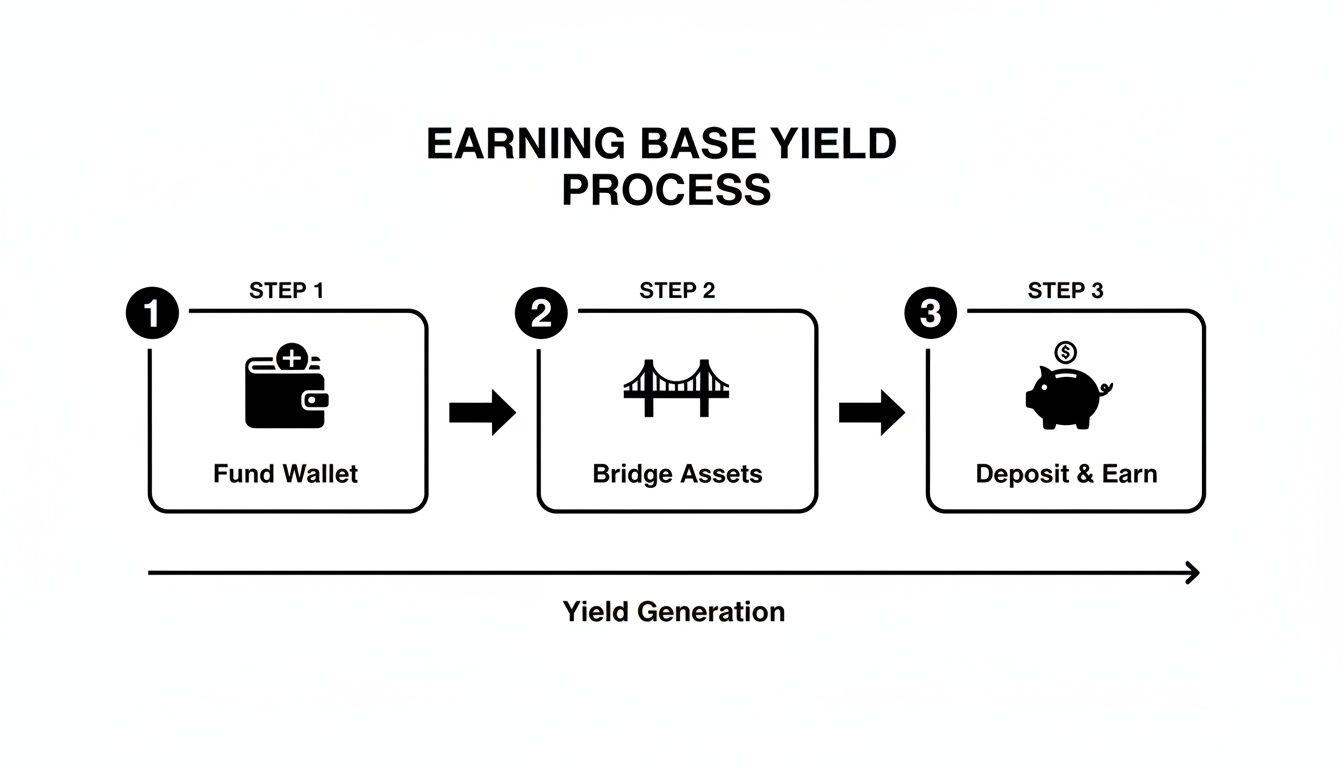

The graphic below shows the basic three-step journey to start earning on Base. These advanced tools are all about optimizing this exact process.

This simple flow—funding, bridging, and depositing—is the foundation that more sophisticated, automated strategies are built upon.

Gain a Market Edge with Analytics Platforms

To make smart moves, you need good data. On-chain analytics platforms like DeFiLlama are your command center for the entire DeFi world. They give you a bird's-eye view of where the money is flowing across different chains and protocols.

Think of these platforms as your personal research team. They track critical metrics like Total Value Locked (TVL), let you compare APYs across hundreds of opportunities, and help you get a feel for the health and momentum of a protocol before you put your money in.

Using these tools, you can start to spot emerging trends and find opportunities that others might be overlooking. And the opportunity is huge—macro stats show that only 8–11% of the total crypto market cap is actually earning any kind of on-chain yield. This is exactly why low-fee networks like Base are so important for putting idle capital to work. You can read more about this on-chain yield opportunity on coinchange.io.

Getting comfortable with these tools helps you move with more confidence. And for those who like to map things out, using a DeFi yield farming calculator can give you some valuable projections on what your returns might look like.

A Few Common Questions on Base Chain Yield

Jumping into Base chain yield definitely brings up some questions. It’s totally normal. Getting those questions answered is the best way to get comfortable and start managing your own strategy.

Let’s run through some of the ones we hear the most.

What’s a Realistic APY I Can Actually Expect on Base?

This is the big one, right? The honest answer is: it varies wildly.

You'll see safer, more established lending platforms hovering around a respectable 5-15% APY. Then you'll spot brand new liquidity pools promising over 50%, usually juiced up with extra token incentives. The golden rule here is that monster APYs almost always come with monster risk. It's a balancing act between chasing those juicy returns and weighing things like smart contract security or the sting of impermanent loss.

Cool, but How Do I Get My Money Back to Ethereum?

Getting your funds off Base is just the reverse of how you got them on—you’ll use a bridge.

You can go with the official Base Bridge or pick a third-party option you trust. This lets you send your assets straight back to the Ethereum mainnet. Once they're there, you can move them to any major exchange that lists your token.

Do I Have to Pay Taxes on My Earnings?

Yes, almost certainly. In most places, any profit you make from DeFi yield farming is treated as taxable income. This covers everything from the rewards you get for providing liquidity to the interest you earn from lending out your stablecoins.

Look, we're DeFi builders, not tax advisors. It is absolutely essential to chat with a tax professional who knows your local rules. Tax laws can be tricky and change from one country to another.

Tired of manually chasing the best yields and constantly worrying about risk?

At Yield Seeker, our AI-powered platform does the heavy lifting for you. It sniffs out and manages the top risk-aware yield opportunities on Base so you don't have to. It's time to start earning smarter, not harder.