Back to Blog

7 Best Alternative Investment Platforms for 2025

Explore the 7 best alternative investment platforms for 2025. Compare features, fees, and who they're for to diversify your portfolio beyond stocks.

Oct 26, 2025

generated

The traditional 60/40 stock and bond portfolio is facing unprecedented challenges in today's volatile market, prompting savvy investors to look elsewhere for growth and stability. Alternative investments, once the exclusive domain of institutional funds and the ultra-wealthy, offer a powerful solution. Asset classes like private real estate, fine art, venture capital, and farmland can provide crucial diversification and the potential for non-correlated returns.

Technology has democratized access to these markets, but navigating the crowded field of online platforms can be overwhelming. This guide is designed to cut through the noise. We provide a detailed, unbiased roundup of the best alternative investment platforms available today, helping you find the perfect fit for your specific financial goals, risk tolerance, and investment capital.

Each platform profile includes a comprehensive breakdown of its core offerings, fee structures, minimum investment requirements, and ideal user. We've included screenshots to guide your user experience and direct links to get you started immediately. Whether you are a busy professional seeking passive income, a crypto native exploring new yield opportunities, or an experienced investor looking to optimize your portfolio, this list will equip you with the actionable insights needed to make an informed decision and confidently expand your investment horizons.

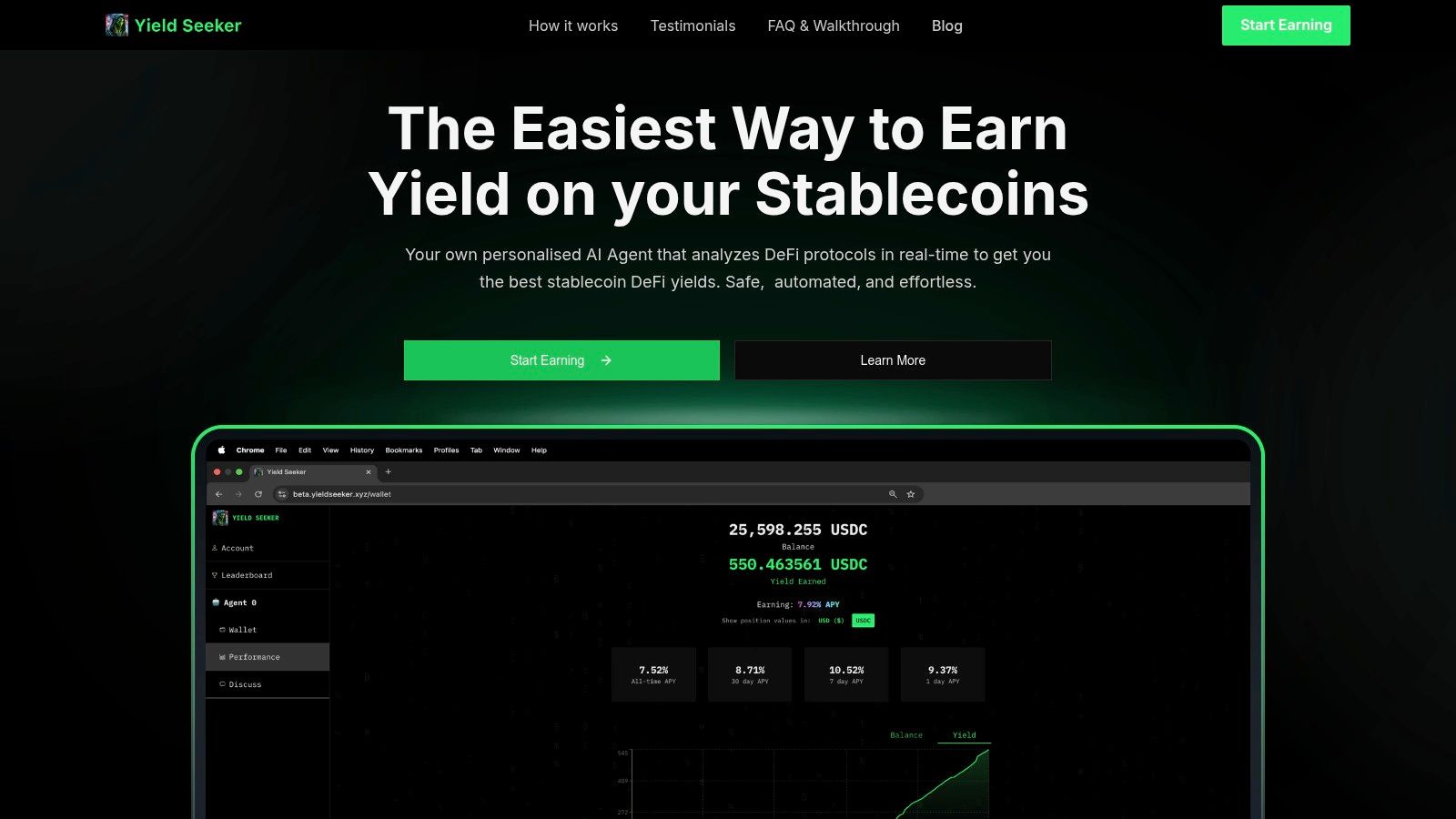

1. Yield Seeker: For AI-Automated DeFi Yield

For investors intrigued by the high-yield potential of decentralized finance (DeFi) but intimidated by its complexity, Yield Seeker presents a compelling solution. This platform distinguishes itself by leveraging a personalized AI Agent to automate the entire process of yield farming with stablecoins. It continuously scans top-tier DeFi protocols on the Base blockchain in real time, identifying and capitalizing on the most attractive, low-risk yield opportunities for your USDC.

This automated approach eliminates the manual research and constant rebalancing typically required to succeed in DeFi, making it one of the best alternative investment platforms for both newcomers and seasoned professionals. The platform's core value is its ability to translate sophisticated DeFi strategies into a simple, hands-off experience.

Key Features and User Experience

Yield Seeker is engineered for accessibility and transparency. The signup process is exceptionally fast, and users can begin with a minimal deposit of as little as $10 USDC. A standout feature is the clean, intuitive dashboard that provides a unified view of your capital, earnings, and the AI Agent's specific protocol activities, demystifying where your funds are working.

For those eager to learn, a built-in terminal allows direct interaction with the AI Agent, offering a unique window into its decision-making process. This educational component, combined with a user-centric design, has earned praise for its seamless UX. As one user, Dan T, noted, "I rarely have time to look around DeFi protocols… so I let Yield Seeker do the hunting." This highlights its appeal to busy investors seeking passive income.

Platform Strengths and Limitations

Yield Seeker's primary advantage is its fire-and-forget automation, backed by a team of experienced crypto and fintech developers. The absence of lockups or hidden fees provides complete liquidity, allowing you to withdraw funds and accrued yield at any time.

However, prospective users should be aware of its current limitations. The platform operates exclusively with USDC on the Base chain, which may not suit investors seeking multi-chain or multi-asset diversification. Furthermore, like all DeFi applications, it carries inherent risks such as smart contract vulnerabilities and variable returns dependent on market conditions. While the platform lacks prominent display of third-party audits, its strong community testimonials and the founders' established track records offer significant social proof.

Feature Analysis | Details |

|---|---|

Automation Engine | Personalized AI Agent for real-time yield optimization. |

Minimum Deposit | As low as $10 USDC ($25 also noted in materials). |

Asset & Chain | Currently supports USDC on the Base blockchain. |

Fees & Lockups | No hidden fees or lockup periods. |

Transparency | Dashboard shows capital, earnings, and protocol activity. |

User Suitability | Beginners, busy professionals, and advanced DeFi users. |

Website: https://yieldseeker.xyz

2. Fundrise

Fundrise has carved out a significant niche by making institutional-quality private market investments, particularly real estate, accessible to the average retail investor. It stands out as one of the best alternative investment platforms for its incredibly low barrier to entry and its straightforward, portfolio-based approach. Instead of requiring users to be accredited investors or have tens of thousands of dollars, Fundrise allows anyone in the U.S. to get started with as little as $10.

This approachability is central to the user experience. The platform uses technology to automate portfolio construction based on your stated financial goals, such as long-term growth, balanced investing, or supplemental income. This simplifies the process for beginners who may not have the expertise to select individual assets. For investors interested in expanding their real estate portfolio, understanding how to crowdfund real estate can provide deeper insights into the models that platforms like Fundrise have pioneered.

Key Features & Offerings

Fundrise primarily offers investments through its proprietary eREITs (electronic Real Estate Investment Trusts) and eFunds, which hold diversified portfolios of private real estate assets. Beyond its core real estate offerings, the platform has expanded to include private credit and even a venture capital fund called the Innovation Fund, allowing investors to get exposure to high-growth private tech companies.

A key advantage is its transparent fee structure. Investors pay a combined annual fee of approximately 1%, consisting of a 0.15% advisory fee and a 0.85% asset management fee for most real estate funds. This is notably lower than many traditional private funds.

Feature | Details |

|---|---|

Minimum Investment | $10 for taxable accounts; $1,000 for IRAs |

Investor Requirements | Open to all U.S. investors (non-accredited included) |

Primary Assets | Diversified real estate (eREITs), private credit, venture capital |

Fee Structure | ~0.15% advisory fee + ~0.85% fund management fee |

Liquidity | Quarterly redemption windows (subject to limitations and potential penalties) |

While Fundrise excels at access and diversification, investors should be aware of its limitations. Liquidity is constrained compared to public markets, as withdrawals are only processed quarterly and can be restricted during times of economic stress. Additionally, you are investing in a fund, not picking individual properties. However, for those seeking a hands-off way to add private market assets to their portfolio, Fundrise is an exceptional entry point. Its focus on real estate and private credit also makes it a strong candidate for those looking to build diverse passive income streams.

Visit Website: https://fundrise.com

3. Yieldstreet

Yieldstreet has established itself as a premier marketplace for private market investments, offering a curated selection of opportunities typically reserved for institutional investors. What makes it one of the best alternative investment platforms is its breadth of offerings, spanning private credit, real estate, art finance, and multi-asset class funds. It caters to a more experienced investor base, providing both individual deal access and diversified fund options.

The platform is designed for those looking to build a sophisticated portfolio of alternatives. While many of its single offerings are limited to accredited investors, Yieldstreet has made a significant stride in accessibility with its flagship Alternative Income Fund. This product allows non-accredited investors to gain exposure to a diversified, income-generating portfolio of private credit assets. To succeed on this platform, it is crucial to understand how to evaluate investment opportunities, as each deal comes with its own risk and return profile.

Key Features & Offerings

Yieldstreet’s core strength lies in its diverse asset menu. Investors can choose to participate in specific deals, such as financing a commercial real estate property or a portfolio of art, or they can opt for broader exposure through managed funds. The Alternative Income Fund is a standout, structured as an open-ended fund to provide more regular, albeit limited, liquidity options compared to closed-end private placements.

The fee structure is transparent but varies significantly by offering. Investors must carefully review the documents for each deal to understand the associated management, servicing, and performance fees. For its flagship funds, Yieldstreet provides clear expense breakdowns in its extensive help center, empowering investors to make informed decisions.

Feature | Details |

|---|---|

Minimum Investment | Varies by offering; $10,000 for the Alternative Income Fund |

Investor Requirements | Primarily for accredited investors; some funds are open to all |

Primary Assets | Private credit, real estate, art finance, specialty finance, multi-asset funds |

Fee Structure | Varies by deal; investors must review each offering's documents |

Liquidity | Illiquid for most single offerings; quarterly repurchase offers for the Alternative Income Fund (subject to limits) |

While Yieldstreet provides unparalleled access to unique private market deals, its primary drawback is that the highest-potential offerings are often restricted to accredited investors with high minimums. The deal-specific fee structures also require more due diligence from the user compared to platforms with a flat-rate model. However, for investors who meet the criteria and are willing to do the research, Yieldstreet offers a powerful platform for building a truly diversified alternative portfolio.

Visit Website: https://www.yieldstreet.com

4. Masterworks

Masterworks has democratized the world of blue-chip art, transforming a historically exclusive and illiquid asset class into a tangible investment for everyday investors. The platform meticulously researches and acquires multi-million-dollar artworks by iconic artists like Banksy, Picasso, and Warhol, then securitizes them through an SEC-qualified offering. This process allows investors to purchase fractional shares, giving them direct ownership in a specific piece of art without needing millions in capital.

The platform is designed to be accessible, though it maintains a degree of exclusivity with a potential waitlist and interview process for new members. The onboarding is educational, guiding users through the value propositions of art as an asset. For those looking to gain a deeper appreciation for the assets on platforms like Masterworks, Understanding Art History Periods can provide invaluable context for the provenance and significance of various works. Masterworks stands as one of the best alternative investment platforms for its unique focus and execution in this niche market.

Key Features & Offerings

The core offering is the ability to buy and sell shares of individual, high-value artworks. Masterworks’ research team uses a proprietary data-driven approach to identify artists whose works show strong historical appreciation potential. Once an artwork is acquired and securitized, investors can participate in the initial offering.

A standout feature is its secondary market, which provides a degree of liquidity rarely seen in art investing. This allows investors to trade their shares with others on the platform before the artwork is eventually sold, which typically occurs within a 3-10 year timeframe. The fee structure is transparent, mirroring a hedge fund model with a 1.5% annual management fee (paid in equity) and a 20% performance fee on any profits realized upon the sale of the artwork. This structure helps investors understand how to calculate their potential investment returns net of fees.

Feature | Details |

|---|---|

Minimum Investment | Varies by offering, but practical minimums often start around $1,000-$5,000 |

Investor Requirements | Open to all U.S. investors, but may involve an interview/waitlist |

Primary Assets | Fractional shares of blue-chip artwork |

Fee Structure | 1.5% annual management fee + 20% performance fee on profits |

Liquidity | Secondary market available for trading shares before the final asset sale |

While Masterworks provides unparalleled access, investors should note the higher fee structure compared to traditional index funds. The platform’s value proposition lies in its expertise, curation, and the creation of a liquid marketplace for an otherwise illiquid asset. For those looking to diversify their portfolio into a non-correlated asset class with a rich cultural history, Masterworks offers a compelling and well-managed solution.

Visit Website: https://www.masterworks.com

5. AcreTrader

AcreTrader provides accredited investors with direct access to one of the oldest and most resilient alternative asset classes: U.S. farmland. The platform simplifies what has historically been a complex and relationship-driven market, allowing individuals to invest in specific parcels of farmland without needing to manage the land or farm it themselves. This unique focus makes it one of the best alternative investment platforms for those seeking portfolio diversification through tangible, income-producing assets with low correlation to the stock market.

The user experience is centered on a curated marketplace of individual farm offerings. Each listing includes comprehensive due diligence materials, covering everything from soil quality and water rights to tenant history and financial projections. Investors purchase shares in a unique LLC created for each farm, and AcreTrader's team handles all aspects of administration, from leasing the land to farmers to managing insurance and distributing any passive income.

Key Features & Offerings

AcreTrader's core offering is fractional ownership of individual U.S. farms, spanning row crops, permanent crops, and timberland. The platform has also expanded its product suite through its broker-dealer capabilities to include more sophisticated structures like 1031 exchange-eligible DSTs (Delaware Statutory Trusts), catering to a broader range of real estate investor needs.

The fee structure is transparent and tied to the management of the asset. AcreTrader typically charges an annual administration fee, often around 0.75% of the property value, which is paid to the platform from the farm's rental income. This covers all ongoing management, reporting, and administrative work, making it a hands-off investment for the end-user.

Feature | Details |

|---|---|

Minimum Investment | Varies by deal, typically $15,000 - $40,000 |

Investor Requirements | Accredited investors only |

Primary Assets | U.S. farmland (row crops, permanent crops, timber) |

Fee Structure | ~0.75% annual administration fee; closing fees vary |

Liquidity | Highly illiquid; tied to the sale of the underlying property (typically a 5-10 year hold) |

While AcreTrader excels at providing direct, professionally managed farmland exposure, its key limitations are its high barrier to entry and illiquidity. Investments are restricted to accredited investors, and the minimums per deal are significantly higher than on platforms like Fundrise. Furthermore, capital is typically tied up for a multi-year hold period until the farm is sold. However, for qualified investors seeking a non-correlated, tangible asset with the potential for both appreciation and passive income, AcreTrader offers an unparalleled and streamlined solution.

Visit Website: https://acretrader.com

6. Republic

Republic has democratized early-stage venture capital, bringing private startup investing to the masses. It operates as an equity crowdfunding platform where non-accredited investors can participate in Regulation Crowdfunding (Reg CF) and Reg A+ offerings. This model breaks down the traditional barriers of high minimums and accreditation requirements, making Republic one of the best alternative investment platforms for accessing high-growth potential startups.

The platform allows individuals to invest in a diverse range of private companies, from tech and gaming to real estate and crypto, often with minimums as low as $50. This micro-investment approach enables retail investors to build a diversified venture portfolio, a strategy previously reserved for institutional funds and high-net-worth individuals. Republic’s user experience is designed to be educational, providing detailed information about each offering, the founding team, and the associated risks.

Key Features & Offerings

Republic's core offering is its curated selection of startup investment opportunities. Beyond individual companies, the platform facilitates investments into specialized vehicles like Deal Room SPVs (Special Purpose Vehicles) for accredited investors and has pioneered initiatives using tokenized assets. This provides multiple avenues for engaging with private markets. The platform also has a limited secondary market, offering a potential path to liquidity for certain eligible assets before a company IPOs or is acquired.

A key advantage is the transparent fee structure and clear guidance on SEC-mandated investment limits for non-accredited investors. While the risks are high, the potential for significant returns from a successful startup makes it an attractive proposition.

Feature | Details |

|---|---|

Minimum Investment | Typically $50–$250 for Reg CF deals; varies for others |

Investor Requirements | Open to non-accredited investors (subject to SEC limits) |

Primary Assets | Startup equity, crypto/tokenized assets, real estate, gaming |

Fee Structure | Investor admin fee of 2.5% (min $5; cap $250), varies by offering |

Liquidity | Highly illiquid; limited secondary market for eligible assets |

While Republic opens the door to venture investing for everyone, it’s crucial to understand the high-risk nature of these assets. Many early-stage companies fail, and investments can become worthless. The platform’s illiquidity means your capital will be tied up for years with no guarantee of a return. However, for investors with a high risk tolerance seeking to add asymmetric upside potential to their portfolios, Republic provides unparalleled access and deal flow.

Visit Website: https://republic.com

7. StartEngine

StartEngine has established itself as a dominant force in equity crowdfunding, offering retail investors direct access to early-stage startup and growth-company investments. Following its acquisition of SeedInvest, it cemented its position as one of the largest platforms, providing a vast and diverse deal flow. What truly sets StartEngine apart is its commitment to addressing the long-standing illiquidity problem in private markets through its SEC-registered Alternative Trading System (ATS), StartEngine Secondary.

This platform empowers everyday, non-accredited investors to get in on the ground floor of emerging companies across sectors like tech, consumer goods, and biotech. The user interface is straightforward, presenting each company's fundraising campaign with detailed information, including the pitch deck, business plan, and terms of the offering. This structure allows investors to perform their own due diligence before committing capital, making it one of the best alternative investment platforms for hands-on venture investing.

Key Features & Offerings

StartEngine's primary function is facilitating Regulation Crowdfunding (Reg CF) and Regulation A+ offerings, which allow startups to raise capital from the general public. Investors can browse hundreds of live deals at any given time, with minimums often starting at just a few hundred dollars. The platform also offers an optional "Venture Club" membership for a yearly fee, which provides perks like a 10% bonus on shares for participating investments.

The most distinctive feature is StartEngine Secondary, an ATS where investors can trade shares of certain companies that previously raised capital on the platform. While liquidity is not guaranteed and is subject to issuer eligibility and market demand, it provides a rare potential exit path long before a traditional IPO or acquisition. Investors typically pay no fees on primary investments, though some offerings may have processing fees, and sellers on the secondary market pay a 5% commission.

Feature | Details |

|---|---|

Minimum Investment | Varies by offering, often starting at $100-$500 |

Investor Requirements | Open to all U.S. investors (non-accredited included) |

Primary Assets | Equity and debt in startups and growth-stage companies |

Fee Structure | $0 for investors on most primary offerings; 5% seller commission on secondary trades |

Liquidity | Highly illiquid; potential for secondary trading on StartEngine Secondary ATS for eligible companies |

While the potential for high returns is significant, startup investing is inherently risky, and thorough diligence is crucial. The wide variance in the quality and terms of each deal means investors must carefully vet each opportunity. However, for those looking to build a diversified portfolio of private-company equity and gain access to potential secondary trading, StartEngine offers an unparalleled ecosystem.

Visit Website: https://www.startengine.com

Top 7 Alternative Investment Platforms Comparison

Product | Implementation complexity 🔄 | Resource requirements ⚡ | Expected outcomes ⭐ | Ideal use cases 💡 | Key advantages 📊 |

|---|---|---|---|---|---|

Yield Seeker | Low — plug-and-play onboarding with AI automation | Very low capital; $10–$25 min; no accreditation; Base/USDC only | ⭐⭐⭐ — automated stablecoin yield; variable by protocol | Beginners, busy professionals, USDC holders wanting hands-off income | Real-time AI scanning, low min, transparent dashboard, no lockups |

Fundrise | Low — automated, goal-based portfolios | Low min ($10 taxable; $1,000 IRA); non‑accredited | ⭐⭐⭐ — diversified real‑estate income and appreciation over time | Retail investors seeking simple real‑estate exposure and long‑term savings | Low barrier to entry, transparent fees, fund diversification |

Yieldstreet | Moderate — mix of funds and deal-by-deal offerings; due diligence needed | Many deals require accreditation; some $10k mins; variable docs | ⭐⭐⭐⭐ — curated private‑market/income opportunities; deal‑dependent | Accredited investors seeking alternative income and private-credit exposure | Broad asset menu, deal-level access, detailed disclosures |

Masterworks | Moderate — SEC‑qualified art offerings and secondary trading | Higher practical minimums; onboarding/waitlist possible; higher fees | ⭐⭐⭐ — art appreciation potential; long holds and high variability | Investors seeking blue‑chip art exposure and alternative assets | Access to blue‑chip art, secondary market, research-driven acquisitions |

AcreTrader | Moderate — property-specific offerings; platform handles operations | Often for accredited investors; higher per-deal mins; multi‑year lockups | ⭐⭐⭐⭐ — stable farmland income and potential appreciation; lower volatility | Accredited investors seeking direct farmland diversification | Professional management, direct land exposure, tax-advantaged structures |

Republic | Low — crowdfunding flow but deal terms vary; simple participation | Open to non‑accredited investors; very low mins ($50–$250); high risk | ⭐⭐ — venture‑style outcomes: high upside, high failure/illiquidity risk | Retail investors wanting small‑ticket startup or tokenized exposure | Low entry, diverse deal flow, clear regulatory guidance |

StartEngine | Low‑Moderate — crowdfunding with an ATS for some secondary trades | Non‑accredited access; low mins; secondary liquidity limited; optional paid perks | ⭐⭐⭐ — startup equity upside with uncertain liquidity | Retail startup investors seeking primary raises and occasional secondary trades | Large deal flow, StartEngine Secondary ATS, established platform |

How to Choose the Right Platform for Your Portfolio

Navigating the expansive world of alternative investments can seem daunting, but as we've explored, the landscape is richer and more accessible than ever before. From automated DeFi yields with Yield Seeker to fractional shares of fine art on Masterworks and farmland on AcreTrader, modern platforms have unlocked opportunities previously reserved for the ultra-wealthy. This journey has shown that diversifying beyond traditional stocks and bonds is not just a strategy for institutions; it's a tangible path for individual investors to build more resilient portfolios.

The key takeaway is that there is no single "best" alternative investment platform for everyone. Your ideal choice depends entirely on your personal financial situation, goals, and comfort with risk. What works for a busy professional seeking passive income from stablecoins will differ greatly from what an aspiring venture capitalist looking to fund the next big startup on Republic needs.

An Actionable Framework for Your Decision

To help you select the right tool from this list, use the following framework to clarify your investment strategy. Think of this as your personal checklist for navigating the diverse options and finding the platform that aligns perfectly with your objectives.

Define Your Goals: First, pinpoint your primary objective. Are you aiming for steady passive income, like the stable, asset-backed returns offered by platforms like Yieldstreet? Or is your focus on long-term capital appreciation, where the high-growth potential of startups on StartEngine or art on Masterworks might be more appealing? Your goal dictates the asset class you should explore.

Assess Your Risk Tolerance: Be honest about your comfort with risk. Venture capital and startup equity (Republic, StartEngine) carry high risk but offer explosive growth potential. In contrast, asset classes like private credit (Yieldstreet) or real estate (Fundrise) are backed by tangible assets, generally offering a more moderate risk profile. For those in the crypto space, using a tool like Yield Seeker to access vetted DeFi protocols can help manage risk compared to manually navigating the ecosystem.

Check Your Accreditation Status: This is a crucial, non-negotiable step. Many of the most compelling alternative investment platforms, particularly those dealing in private securities, are legally required to limit access to accredited investors. Determine your status before you get too deep into due diligence on a specific platform to avoid disappointment.

Consider Your Desired Liquidity: How soon might you need to access your invested capital? Alternative assets are notoriously illiquid. An investment in a startup or a piece of farmland could be tied up for 5-10 years or more. If you need more flexibility, consider platforms that offer secondary markets or shorter-duration assets.

Your Next Step Toward a Diversified Future

The proliferation of these platforms marks a significant shift, empowering individual investors to construct sophisticated, multi-asset portfolios once exclusive to institutional funds. The best alternative investment platforms provide not just access, but also the educational resources and transparency needed to invest with confidence.

Your journey doesn't end here. The final, most important step is to take action. Start small, continue learning, and always perform your own due diligence. By thoughtfully adding non-correlated assets to your portfolio, you are not just chasing returns; you are building a more robust financial foundation designed to weather market volatility and seize unique opportunities for growth.

Ready to explore the power of DeFi without the steep learning curve? If you're looking for a simple, automated way to earn yield on your stablecoins, Yield Seeker is the perfect starting point. Visit Yield Seeker to see how our AI-powered tool can help you access vetted, high-yield opportunities in decentralized finance, effortlessly.