Back to Blog

7 Best Crypto Earning Apps for Passive Income (2025)

Discover the 7 best crypto earning apps for 2025. Our detailed roundup compares yields, fees, and features to help you find the right platform.

Oct 27, 2025

generated

The crypto market has matured far beyond simple buying and holding. Today, the most powerful opportunities lie in generating passive income, letting your digital assets work for you around the clock. The best crypto earning apps provide pathways to achieve this, from automated AI-driven strategies and complex DeFi protocols to straightforward staking rewards on major exchanges.

However, the sheer variety of options can be overwhelming. Choosing between a centralized platform like Coinbase, a liquid staking solution like Lido, or an AI-powered tool like Yield Seeker requires a clear understanding of their distinct advantages, risks, and fee structures. This guide is designed to cut through that complexity.

We provide a direct, side-by-side comparison of the top 7 platforms for 2025. Each review breaks down core features, earning potential, associated fees, and overall ease of use, complete with screenshots and direct links to get you started. Managing the returns from these platforms is also critical; to simplify reporting, it's wise to explore specialized crypto tax software that can integrate with your accounts and streamline the process.

Whether you're a crypto novice seeking a secure first step into earning yield or an experienced DeFi user aiming to optimize your returns, this comprehensive roundup delivers the actionable insights you need. Our goal is to equip you with the knowledge to confidently select the right application to match your specific financial goals and risk tolerance.

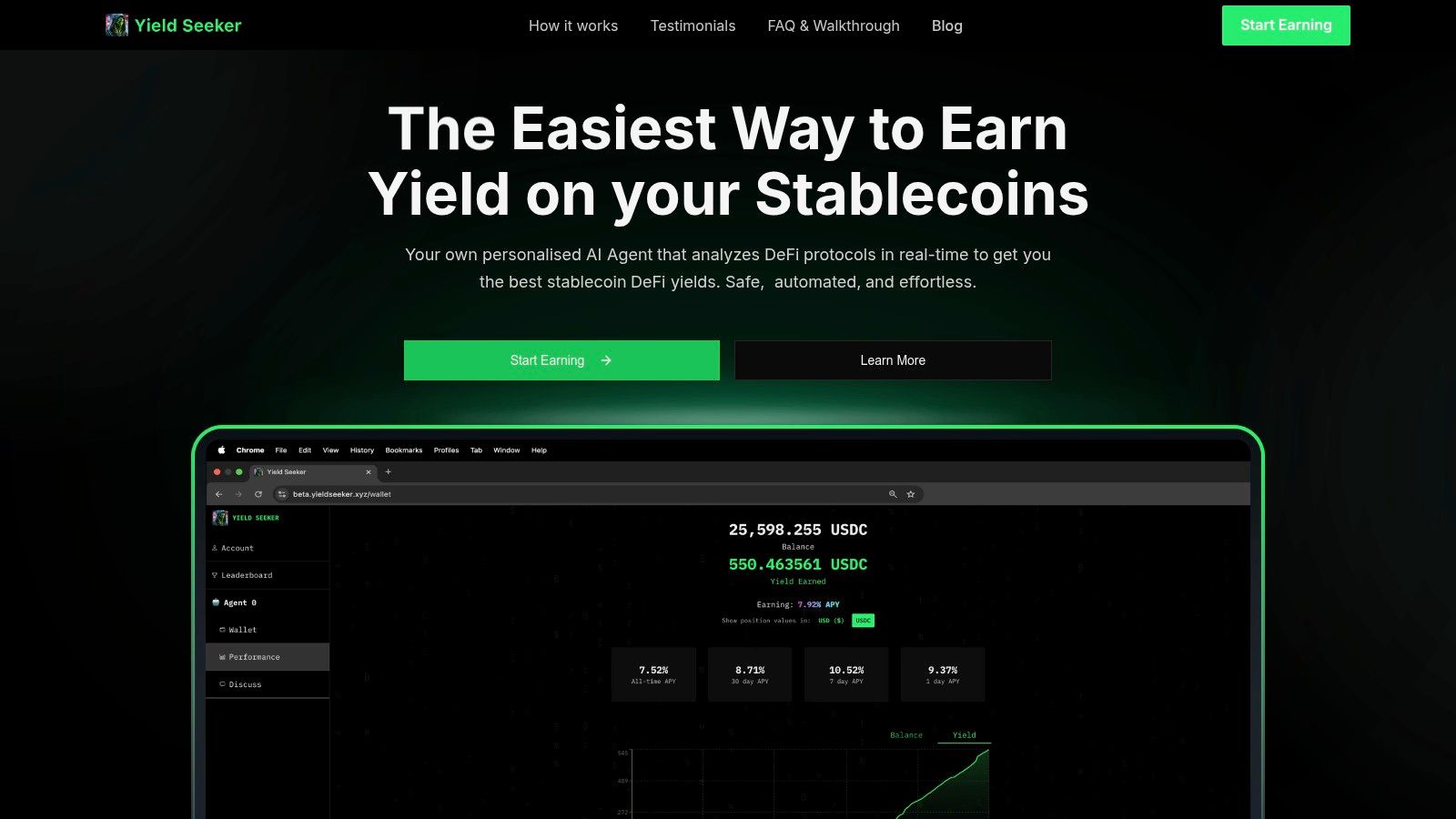

1. Yield Seeker

Yield Seeker emerges as a powerful contender for the best crypto earning apps, especially for users who prioritize automated, high-yield strategies without the traditional complexity of decentralized finance (DeFi). The platform uniquely leverages a personalized AI Agent to continuously scan, analyze, and engage with top DeFi protocols on the BASE blockchain. Its core mission is to make stablecoin yield farming simple, secure, and genuinely hands-off.

This AI-driven approach sets it apart. Instead of requiring users to manually research fluctuating yields, assess protocol risks, and execute multiple transactions, Yield Seeker automates the entire process. Your AI Agent actively seeks the most profitable and secure opportunities for your USDC, deploying and rebalancing your capital in real time to maximize returns. This makes it an ideal solution for busy professionals and newcomers who want to generate passive income from their stablecoins but lack the time or expertise to navigate the volatile DeFi landscape.

Key Features and User Experience

Yield Seeker is engineered for both simplicity and transparency. The user experience is exceptionally streamlined, allowing you to sign up and fund your account in seconds.

AI-Powered Automation: The platform’s standout feature is its AI Agent, which acts as your personal DeFi analyst and portfolio manager. It constantly monitors the BASE ecosystem for the best USDC yields and automatically moves your funds to optimize earnings.

Low Barrier to Entry: Getting started is accessible, with a low minimum deposit (the website notes $10, while some product materials mention $25). This low threshold invites users of all portfolio sizes to test the platform.

Total Flexibility: Unlike many staking or earning platforms, Yield Seeker imposes no lockup periods. You can withdraw your principal and any accrued yield at any time, giving you complete control over your capital.

Transparent Dashboard: A single, intuitive dashboard provides a clear overview of your deposited capital, real-time earnings, and the specific protocols your funds are deployed in. This transparency demystifies the process, offering peace of mind for beginners and valuable insights for advanced users.

The platform is backed by experienced crypto and fintech builders A Fox and Krishan Patel, and its effectiveness is reinforced by strong user testimonials praising its safety, user-friendly interface, and powerful automation.

Practical Use and Considerations

Yield Seeker is tailored for anyone holding USDC who wants to put their stablecoins to work. For a crypto newcomer, it removes the steep learning curve of yield farming. For a DeFi power user, it offers an efficient way to automate and optimize a portion of their portfolio without constant manual intervention.

To get started, simply connect your wallet, deposit USDC, and activate your AI Agent. The platform handles the rest.

However, users should be aware of a few limitations. The service is currently focused exclusively on USDC on the BASE chain, which may not suit those looking to earn yield on other assets or across multiple blockchains. Additionally, like any DeFi platform, it carries inherent smart-contract and protocol risks, although the AI is designed to engage with vetted protocols to mitigate this.

Website: https://yieldseeker.xyz

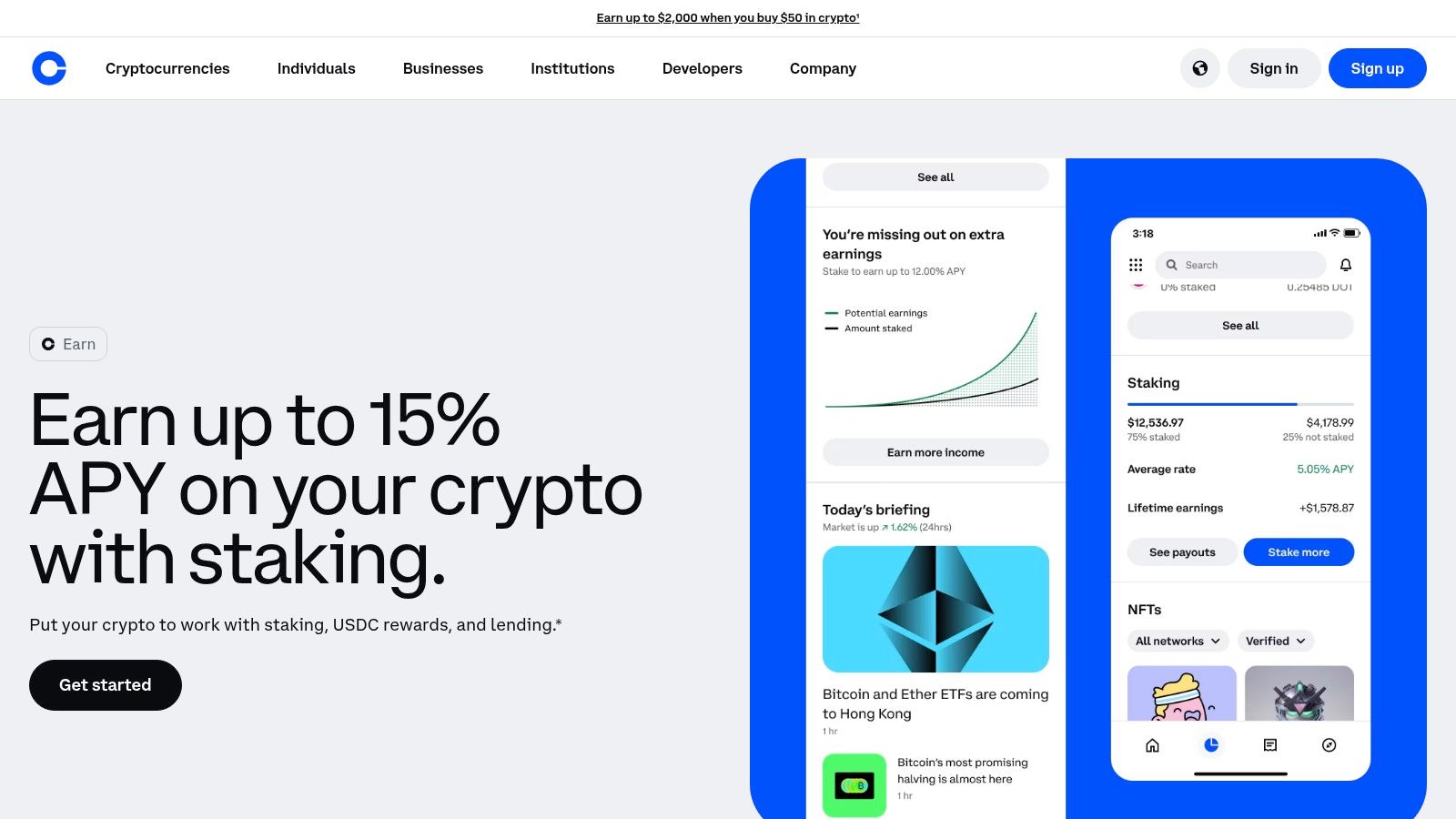

2. Coinbase

Coinbase stands out as one of the best crypto earning apps, particularly for users in the United States seeking a simple, regulated, and all-in-one platform. It aggregates several earning methods into a user-friendly interface, making it an ideal entry point for beginners and a convenient option for seasoned investors who prioritize security and ease of use. The platform bundles protocol staking, stablecoin rewards, and on-chain lending into a single, cohesive experience.

Unlike DeFi protocols that require self-custody and technical know-how, Coinbase handles the complexities of staking and lending on your behalf. This custodial approach removes significant barriers to entry, allowing users to start earning passive income with just a few clicks. Its status as a publicly traded, US-regulated company provides a layer of trust and transparency that many competitors lack.

Key Earning Features

Coinbase offers three primary ways to generate yield on your digital assets, each designed for different user needs:

Protocol Staking: Users can stake popular Proof-of-Stake (PoS) assets like Ethereum (ETH), Solana (SOL), Cardano (ADA), and Polkadot (DOT). Coinbase manages the technical side, from running validator nodes to distributing rewards. Payout frequencies and unstaking periods are clearly listed for each asset.

USDC Rewards: Simply holding USD Coin (USDC) in your Coinbase account automatically enrolls you in their rewards program. It offers a variable APY (for example, around 3.85% at times) without any lockup periods, providing a flexible way to earn on your stablecoins.

On-chain Lending: For those comfortable with DeFi yields, Coinbase provides a streamlined portal to lend USDC directly on-chain to protocols like Compound. The APYs are variable and determined by market demand, but you retain the ability to withdraw funds at any time, subject to network liquidity.

User Experience and Accessibility

The platform’s strength lies in its simplicity. The interface clearly displays your staked balances, pending rewards, and total earnings. For those new to the space, Coinbase is recognized as one of the best cryptocurrency exchanges for beginners due to its intuitive design.

However, access to certain features is location-dependent. Staking, for instance, is not available to residents of New York, and other states may have specific restrictions. Coinbase excels at providing clear, state-by-state eligibility disclosures within its help documentation, ensuring users understand what is available to them.

Practical Tip: Before purchasing an asset for staking on Coinbase, always check the platform's help section for your state's eligibility. This ensures you can access the earning features you intend to use without any surprises.

Pros and Cons

Pros | Cons |

|---|---|

Simple User Experience: Ideal for beginners, with clear reward schedules and asset minimums. | Geographic Restrictions: Staking features are limited or unavailable in certain US states. |

High Security and Regulation: As a large, publicly traded US exchange, it offers robust security. | Variable APYs: All yields are subject to market conditions and Coinbase's commission. |

Multiple Earning Options: Provides staking, stablecoin rewards, and on-chain lending in one place. | Custodial Risk: You do not control your own private keys, trusting Coinbase to secure your funds. |

Website: https://www.coinbase.com/earn

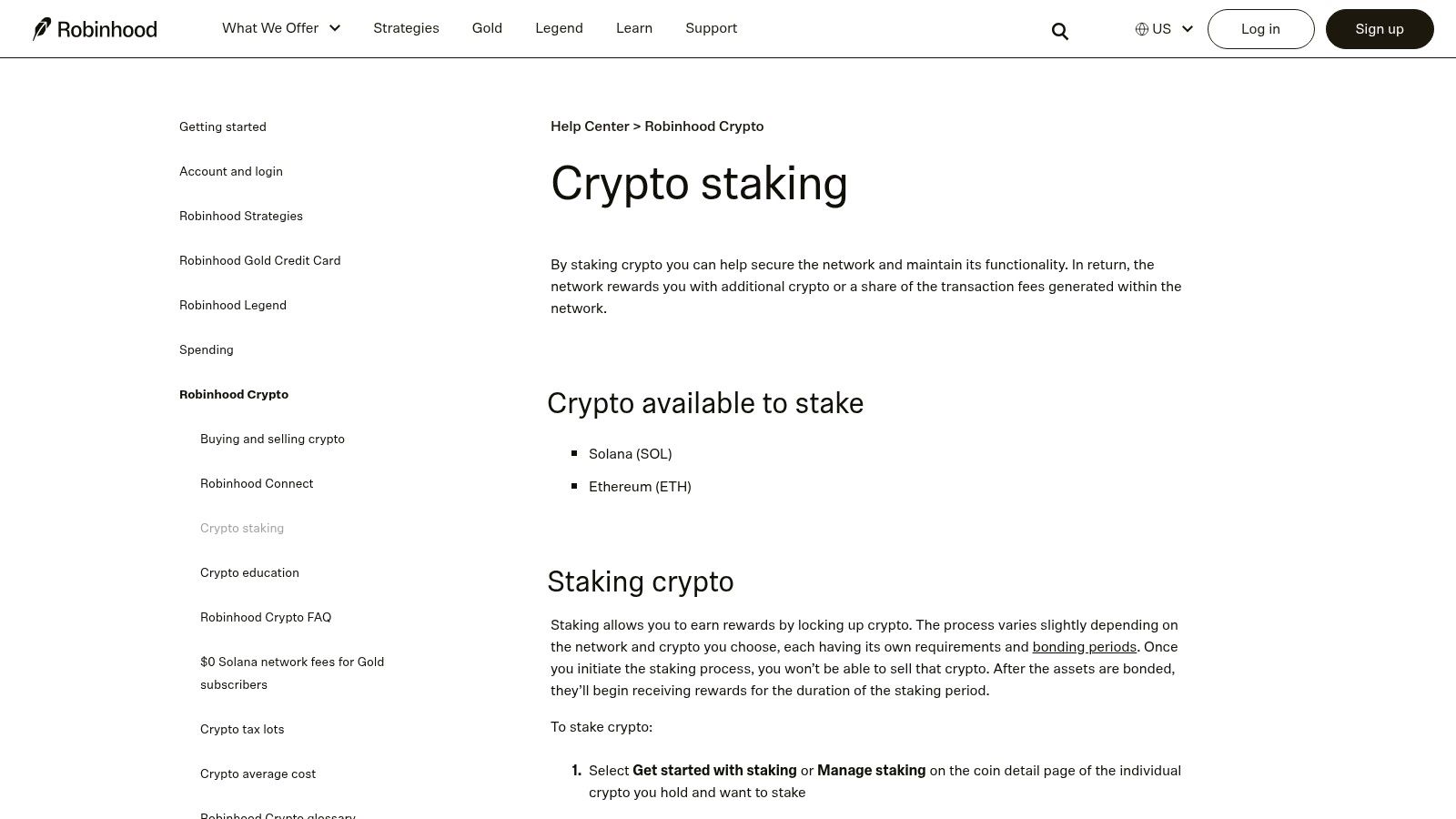

3. Robinhood Crypto

Robinhood Crypto enters the list of best crypto earning apps by extending its signature simplicity from stock trading into the world of digital asset staking. It offers a brokerage-style experience for earning yield, making it an excellent choice for existing Robinhood users or newcomers who want a familiar, low-friction entry point into passive crypto income. The platform focuses on making staking accessible without requiring deep technical knowledge.

Unlike dedicated crypto exchanges that may offer a wide array of complex products, Robinhood's approach is streamlined and integrated directly into its main app. Users who already trade stocks or ETFs can start staking popular assets like Ethereum and Solana with just a few taps. This removes the need to create new accounts on different platforms, simplifying portfolio management for a mainstream audience.

Key Earning Features

Robinhood's staking is built for ease of use, with key information presented clearly within the app:

In-App Staking: Users can stake Ethereum (ETH) and Solana (SOL) directly from each coin's detail page. The process is designed to be intuitive, showing the estimated APY upfront.

Pooled Validator Approach: For Ethereum, Robinhood pools user funds to run validator nodes. This approach allows users to stake with small amounts and abstracts away the technical requirements of running a node.

Transparent Timelines: The platform clearly discloses bonding and unbonding wait times, ensuring users understand the lock-up periods associated with staking their assets. Rewards are paid out periodically in the native crypto.

State-by-State Availability: Robinhood provides a clear, published list of states where staking is currently ineligible (such as California, Maryland, New Jersey, New York, and Wisconsin), which helps manage user expectations.

User Experience and Accessibility

Robinhood’s core strength is its user experience. The interface is clean, uncluttered, and designed for mobile-first users. Staking an asset feels as simple as buying a stock, with the estimated APY displayed prominently. No special memberships or account tiers are required, making it accessible to anyone with a Robinhood Crypto account in an eligible state.

However, this simplicity comes with a trade-off. The rewards are paid net of fees taken by Robinhood and its staking partners, which means the APY may be slightly lower than what could be achieved through more complex, on-chain staking methods. The platform is best suited for those who prioritize convenience over maximizing yield.

Practical Tip: Because staking availability is state-dependent, check Robinhood's support documentation for your specific location before buying crypto with the intention to stake. This will prevent any issues after you've already committed capital.

Pros and Cons

Pros | Cons |

|---|---|

Very Low Barrier to Entry: You can stake small amounts with a few taps in a familiar interface. | Geographic Restrictions: Staking is unavailable in several key US states, limiting access. |

Integrated Brokerage UI: Perfect for users who already trade stocks and crypto on Robinhood. | Net Rewards: APYs are net of Robinhood/partner fees and may be lower than native protocol rates. |

No Memberships Required: Staking is a standard feature, not a premium service. | Limited Asset Selection: Staking is currently only offered for a few major PoS assets. |

Website: https://robinhood.com/us/en/support/articles/staking/

4. Crypto.com

Crypto.com establishes itself as a strong contender among the best crypto earning apps by offering a diverse, multi-track ecosystem for generating yield. It uniquely combines traditional finance concepts with crypto-native opportunities, catering to a wide spectrum of users from beginners to seasoned investors. The platform bundles cash-based yields, fixed-term crypto deposits, and on-chain staking into a single, mobile-first application.

Unlike platforms focused solely on decentralized finance (DeFi), Crypto.com provides a more centralized and streamlined experience. It simplifies earning by managing the technical complexities, making passive income accessible without requiring deep knowledge of blockchain protocols. Its major strength lies in offering distinct earning pathways that let users choose their preferred risk and reward levels, all within one integrated app.

Key Earning Features

Crypto.com presents several distinct methods for users to earn on their assets, with specific features tailored for its US customer base:

Cash Earn: A US-specific product that bridges traditional finance with crypto rewards. Users deposit USD, and the funds are swept to FDIC-insured partner banks. The yield (e.g., up to 5.00% APY) is paid out in Crypto.com's native token, CRO, offering a regulated and insured foundation for earning.

Crypto Earn: This feature allows users to lock up their crypto assets for fixed terms (e.g., one or three months) or keep them in flexible-term accounts to earn interest. Rates vary by token, lockup period, and the user's CRO stake, with periodic promotional offers providing enhanced yields.

On-chain Staking: For select Proof-of-Stake (PoS) tokens, users can participate in on-chain staking directly through the app. Crypto.com manages the validator process, and some assets offer flexible staking with no lockup period, providing greater liquidity than traditional fixed-term staking.

User Experience and Accessibility

The Crypto.com app is designed for mobile users, with a clean interface that clearly separates its different earning products. Navigating between Cash Earn, Crypto Earn, and staking is straightforward. The platform provides detailed FAQs and documentation explaining the state-by-state availability of each feature, which is crucial for US-based users.

However, accessibility is highly dependent on location. For example, the app is not available to residents of New York, and certain features like staking or the "Level Up" rewards benefits are restricted in other states. Users must verify their local eligibility before committing funds to a specific earning strategy.

Practical Tip: Always consult the official Crypto.com help center to confirm which earning products are available in your state. Token availability and promotional rates can change quickly, so checking for the latest jurisdictional updates is essential.

Pros and Cons

Pros | Cons |

|---|---|

Multiple Earning Modalities: Combines cash yield, crypto deposits, and on-chain staking in one app. | Significant Geographic Restrictions: Key features and app access are unavailable in several US states, like New York. |

Clear Eligibility Documentation: Provides detailed information on state-by-state availability. | Variable Availability: Promotional offers and supported tokens can change frequently by jurisdiction. |

Ecosystem Benefits: Staking CRO can unlock higher reward rates across the platform. | Custodial Platform: You do not hold your private keys, entrusting Crypto.com with your assets. |

Website: https://crypto.com/en/product-news/cash-earn-us

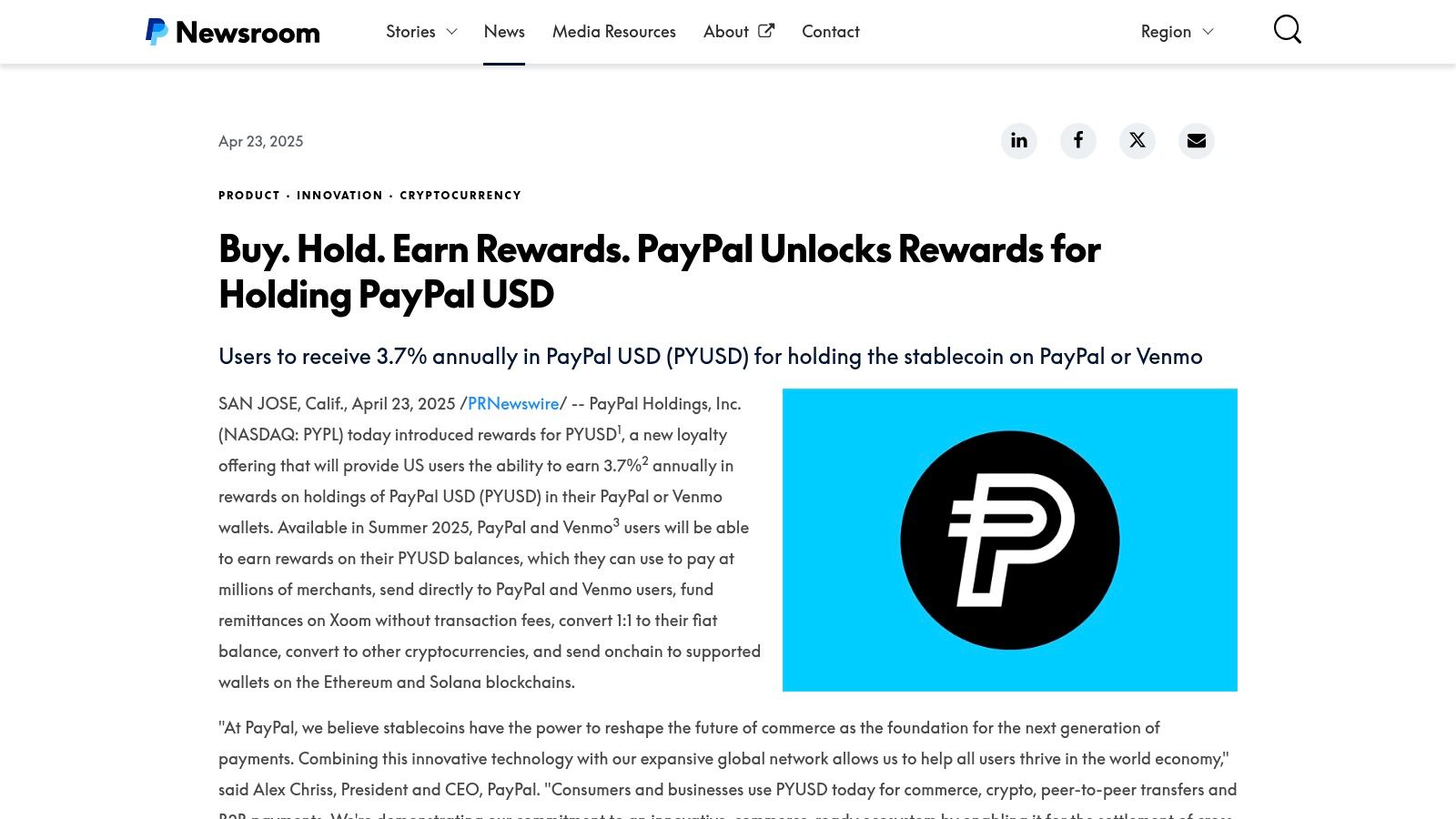

5. PayPal / Venmo (PYUSD Rewards)

PayPal and Venmo have entered the crypto earning space by leveraging their massive user base and familiar fintech interfaces. This makes them one of the best crypto earning apps for beginners, offering a seamless way to earn rewards on stablecoins without navigating the complexities of DeFi. By holding PayPal USD (PYUSD), users can generate a predictable yield directly within the apps they already use for daily transactions.

This approach stands out by abstracting away the technical backend of crypto. Users don't need to manage private keys, connect wallets, or interact with smart contracts. The platform’s core strength is its accessibility, turning a crypto-native yield concept into a simple, opt-in feature for millions of mainstream users. This low-friction entry point democratizes stablecoin yield, making passive income accessible to those who might be hesitant to join a dedicated crypto exchange.

Key Earning Features

The earning mechanism is straightforward, designed for simplicity and ease of use. It revolves entirely around holding PYUSD.

PYUSD Rewards: Users can buy or receive PYUSD in their PayPal or Venmo accounts and earn rewards on their balance. At launch, the announced rate was 3.7% APY, which accrues daily and is paid out monthly in the form of additional PYUSD.

Integrated Ecosystem: The earned PYUSD is not just for holding. It can be used for peer-to-peer payments, merchant checkouts, or converted back to USD within the app, creating a fluid ecosystem for spending and earning.

On-Chain Functionality: Unlike closed-loop reward systems, PYUSD can be sent off-platform to external wallets on supported blockchains like Ethereum and Solana. This provides an on-ramp to the broader DeFi world for users who want to explore further.

Flexible Participation: The rewards program is an opt-in feature with no lockup periods. Users can opt out at any time, and program terms, including the rewards rate, are subject to change as disclosed by PayPal.

User Experience and Accessibility

The user experience is exceptionally simple. For existing PayPal or Venmo users, acquiring PYUSD and earning rewards requires just a few taps within a familiar interface. There is no new app to download or complex verification process to complete.

However, availability is a key consideration. The PYUSD rewards program is offered to eligible US customers, but certain states, such as New York, may have regulatory restrictions that limit access. Users should verify eligibility within the app or on the PayPal help center.

Practical Tip: To maximize utility, consider using your PYUSD balance for small, everyday peer-to-peer transfers on Venmo or PayPal. This allows your primary balance to continue earning rewards up until the moment you spend it.

Pros and Cons

Pros | Cons |

|---|---|

Extremely Easy On-Ramp: Leverages familiar apps, making it ideal for absolute crypto beginners. | Discretionary Reward Rate: The APY is set by PayPal and can change at any time. |

High Utility and Integration: PYUSD can be used for payments, transfers, and on-chain sends. | Single-Asset Focus: Rewards are exclusively tied to holding PYUSD, with no other crypto assets offered. |

Backed by a Major Corporation: Offers a level of corporate transparency and user trust. | Geographic Limitations: Program is not available in all US states, such as New York. |

6. Aave

Aave is a cornerstone of decentralized finance (DeFi), positioning itself as one of the best crypto earning apps for users who prioritize self-custody and direct on-chain interaction. As a leading decentralized lending market, it allows users to supply crypto assets to earn a variable yield or borrow against their holdings. Because it is non-custodial, you retain full control over your funds using a Web3 wallet, interacting with the protocol's smart contracts directly without a centralized intermediary.

Unlike custodial platforms that manage assets on your behalf, Aave offers a transparent, market-driven experience. Yields, known as the supply APY, are determined algorithmically based on the borrowing demand for each asset. This direct exposure to DeFi market rates means you can capture pure on-chain yields, making it a powerful tool for experienced users and those looking to graduate from centralized services.

Key Earning Features

Aave's core functionality revolves around its liquidity pools, which are accessible across numerous blockchain networks:

Multi-Network Markets: Users can supply assets on major networks like Ethereum, Arbitrum, Optimism, Base, and Avalanche. This allows you to choose a network based on your preferred ecosystem or to optimize for lower transaction (gas) fees.

Broad Asset Support: The platform supports a wide array of assets for earning, including major stablecoins (USDC, USDT), volatile assets like ETH and WBTC, and liquid staking tokens (LSTs) such as stETH and wstETH. This variety provides flexibility in your earning strategy.

Variable Supply APY: By supplying an asset to a market, you begin earning a variable interest rate paid by borrowers. These rates fluctuate in real-time and are clearly displayed on the Aave dashboard for each asset and network.

Transparent Governance: Aave is governed by its community, which votes on risk parameters, asset listings, and protocol upgrades. All changes are publicly documented, providing a high degree of transparency.

User Experience and Accessibility

Aave is designed for users comfortable with Web3 wallets like MetaMask or Coinbase Wallet. The interface is clean and functional, presenting live market data, your current supply balance, and earned interest. While it requires more technical understanding than a centralized app, it has become a benchmark for usability within DeFi. As one of the best crypto lending platforms, its design sets a high standard.

Accessibility is global, but the primary requirement is self-custody. Users are responsible for managing their own private keys and paying network gas fees for every transaction, such as supplying or withdrawing funds.

Practical Tip: Before supplying an asset, check the current gas fees on your chosen network. On Ethereum, high fees can eat into your returns, especially for smaller amounts. Consider using a Layer-2 network like Arbitrum or Optimism for a more cost-effective experience.

Pros and Cons

Pros | Cons |

|---|---|

Full Self-Custody: You maintain complete control over your private keys and assets. | Smart Contract Risk: As with any DeFi protocol, there is an inherent risk of bugs or exploits. |

Transparent On-chain Rates: Yields are determined by open market dynamics, not a central entity. | Variable APYs: Earning rates can fluctuate significantly based on market demand. |

Broad Asset & Network Support: Offers extensive flexibility to earn across different blockchains. | Gas Fees Required: Every action on the blockchain costs a network transaction fee. |

Mature and Battle-Tested: One of the oldest and most trusted protocols in the DeFi space. | Risk of User Error: You are solely responsible for your wallet security and transaction approvals. |

Website: https://aave.com/

7. Lido

Lido has established itself as a cornerstone of decentralized finance, offering one of the most popular liquid staking solutions for Ethereum and other Proof-of-Stake networks. It addresses a core challenge in traditional staking: the illiquidity of staked assets. By allowing users to stake their ETH and receive a tokenized version called stETH (staked Ether) in return, Lido ensures their capital remains active and usable across the DeFi ecosystem while earning staking rewards.

This model makes Lido one of the best crypto earning apps for users who want to maximize capital efficiency. Instead of locking assets away, users can deploy their stETH as collateral in lending protocols, provide liquidity in decentralized exchanges, or use it in other yield-generating strategies. This "compounding" of opportunities is a significant advantage over simple, locked staking. The protocol is managed by the Lido DAO (Decentralized Autonomous Organization), giving it a community-governed structure.

Key Earning Features

Lido's core functionality revolves around its liquid staking derivatives, which are designed for flexibility and ease of use within DeFi:

Liquid ETH Staking (stETH): When you stake ETH, you receive an equivalent amount of stETH. This token automatically rebases daily, meaning your stETH balance increases to reflect the accumulated staking rewards. This provides a direct and visible representation of your earnings.

Wrapped Staked ETH (wstETH): For compatibility with certain DeFi protocols that don't support rebasing tokens, Lido offers wstETH. Instead of the balance increasing, the value of wstETH itself accrues the staking rewards. Users can wrap their stETH into wstETH and unwrap it at any time on the Lido platform.

Broad DeFi Integration: The primary benefit of stETH and wstETH is their widespread acceptance across DeFi. Users can lend their liquid staking tokens on Aave, use them as collateral on MakerDAO, or pair them with other assets in liquidity pools on Curve or Balancer to earn additional fees and rewards.

User Experience and Accessibility

While Lido is a decentralized protocol, its user interface is designed to be straightforward. The platform provides clear guides for connecting popular wallets like MetaMask, Ledger, and Trust Wallet to stake assets. The process involves on-chain transactions, which requires users to have enough native tokens (like ETH) to pay for gas fees.

Because it operates on-chain, Lido is globally accessible without the geographic restrictions common to centralized platforms. Its non-custodial nature means you always retain control of your funds via your own wallet. For those looking to compare its decentralized model with other options, it is frequently featured among the best crypto staking platforms.

Practical Tip: When deciding between stETH and wstETH, check the requirements of the DeFi protocol you plan to use. Many lending platforms and liquidity pools prefer the non-rebasing wstETH for simpler accounting and integration.

Pros and Cons

Pros | Cons |

|---|---|

Maintain Liquidity: Use stETH/wstETH across DeFi to earn multiple layers of yield. | Smart Contract Risk: As a DeFi protocol, it is subject to potential bugs or exploits. |

Extensive Ecosystem Support: Widely integrated and accepted across the DeFi landscape. | Price Deviation Risk: The price of stETH can de-peg from ETH in secondary markets during volatility. |

Decentralized and Non-Custodial: Users retain full control of their assets via their personal wallet. | Requires On-Chain Interaction: Users must pay gas fees and manage their own wallet security. |

Website: https://lido.fi/

Top 7 Crypto Earning Apps Comparison

Product | Complexity 🔄 | Resources ⚡ | Expected Outcomes ⭐📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

Yield Seeker | 🔄 Low — turnkey AI automation and fast setup | ⚡ Small min deposit (~$10–$25); USDC on BASE; web account | ⭐ Competitive automated USDC yields; variable and protocol/smart‑contract risk | 💡 Busy professionals, stablecoin holders, DeFi newcomers who want passive yield | ⭐ Hands-off AI optimization, transparent dashboard, no lockups |

Coinbase | 🔄 Low — custodial, guided UX with clear flows | ⚡ Custodial account, KYC; state-by-state eligibility | ⭐ Moderate, regulated yields (staking & USDC rewards); APYs vary with fees/networks | 💡 US-based users seeking regulated, custodial staking and simple stablecoin yield | ⭐ Strong compliance, security, simple onboarding |

Robinhood Crypto | 🔄 Low — in‑app staking via brokerage interface | ⚡ Robinhood account; state restrictions apply | ⭐ Small–moderate staking rewards; net of platform/partner fees | 💡 Existing Robinhood traders wanting one‑tap staking | ⭐ Very low barrier; integrated into mainstream brokerage UI |

Crypto.com | 🔄 Low–Moderate — multiple products and promotional offers | ⚡ Account with state‑dependent access; CRO ecosystem benefits | ⭐ Variable outcomes (Cash Earn up to ~5% in CRO; promos change by market) | 💡 Users wanting multiple earn tracks (cash + crypto + staking) in one app | ⭐ Multiple earning modalities; FDIC sweep for Cash Earn partners |

PayPal / Venmo (PYUSD) | 🔄 Very low — opt‑in rewards inside familiar fintech apps | ⚡ PayPal/Venmo account; must hold PYUSD | ⭐ Announced ~3.7% PYUSD rewards; discretionary and subject to change | 💡 Mainstream users desiring easiest on‑ramp to stablecoin yield | ⭐ Extremely simple UX; on‑chain/send interoperability; merchant integration |

Aave | 🔄 Moderate–High — Web3 access and DeFi composability | ⚡ Web3 wallet, self‑custody, gas fees; cross‑chain support | ⭐ Market‑driven variable yields; transparent on‑chain rates; composable liquidity | 💡 DeFi users wanting non‑custodial lending, borrowing, and integrations | ⭐ Non‑custodial control, broad asset support, open governance |

Lido | 🔄 Moderate — on‑chain staking and token rebasing considerations | ⚡ ETH to stake, gas fees; wallet access (stETH/wstETH) | ⭐ Earn ETH staking rewards while retaining liquidity via stETH/wstETH; market deviation risk | 💡 ETH holders wanting liquid staking and DeFi utility for staked ETH | ⭐ Preserves liquidity while staking; wide DeFi integrations |

Making Your Final Choice: Automation vs. Control

Navigating the landscape of the best crypto earning apps can feel overwhelming, but the journey to passive income becomes clearer when you define your core priorities. We've explored a diverse range of platforms, from AI-powered automation to hands-on DeFi protocols. Your ideal choice hinges on a fundamental question: Do you value automated, optimized simplicity, or do you prefer direct, granular control over your digital assets?

This decision isn't just about features; it's about your financial philosophy and how you want to interact with the decentralized world. When making your final choice, the trade-off between automation and control often hinges on understanding the fundamental differences between custodial vs. non-custodial wallets. Centralized platforms offer convenience by managing your keys, while DeFi protocols give you sovereign ownership, along with the responsibility that entails.

A Quick Recap: Matching Your Profile to the Platform

To help you synthesize the information from this guide, let’s revisit the core strengths of each platform in the context of different user needs:

For the "Set and Forget" Investor: If your goal is to maximize stablecoin yields with minimal effort, Yield Seeker stands out. Its AI-driven agent automates the entire process, from research to execution, making it the top choice for busy professionals or anyone new to DeFi who wants an optimized, hands-off experience.

For the Cautious On-Ramper: Beginners who prioritize security, brand recognition, and a simple user interface will find Coinbase and Robinhood Crypto to be excellent starting points. They offer straightforward staking and earning features integrated directly into platforms you may already use.

For the All-in-One Power User: If you want a single app that combines trading, earning, a crypto debit card, and a wide array of supported assets, Crypto.com offers a comprehensive ecosystem. It’s a good middle-ground for those who want more features than a basic exchange but still prefer a centralized, custodial setup.

For the DeFi Purist: Experienced users who want full control over their funds and the ability to interact directly with decentralized protocols will gravitate towards Aave and Lido. These platforms offer non-custodial lending and liquid staking, giving you the keys to true financial self-sovereignty and composability within the broader DeFi ecosystem.

Actionable Steps to Get Started

Feeling ready to make a move? Don't let analysis paralysis stop you. Here’s a simple, three-step plan to begin your crypto earning journey today:

Define Your Primary Goal: Are you seeking the highest possible APY on stablecoins, earning a small yield on your long-term Bitcoin holdings, or exploring complex DeFi strategies? Write it down. A clear objective will instantly narrow your options.

Assess Your Time Commitment: Be realistic. If you have a demanding job and can only check in once a week, an automated solution like Yield Seeker is a far better fit than a hands-on protocol like Aave that may require active management.

Start Small and Test: You don’t need to move your entire portfolio at once. Choose one or two of the best crypto earning apps that align with your goals and start with a small, manageable amount. Track your earnings, get comfortable with the interface, and build your confidence before committing more significant capital.

Ultimately, the power of crypto is choice. Whether you opt for the AI-powered efficiency of an automated yield agent or the self-custodial freedom of a DeFi protocol, you are taking a proactive step toward making your assets work for you. The tools are here, the opportunities are real, and your journey into a more dynamic financial future starts now.

Ready to put your stablecoins to work with zero effort? Let an AI agent find and manage the best yields for you. Get started with Yield Seeker today and experience the future of automated, intelligent crypto earning.