Back to Blog

10 Best Investment Strategies for Beginners in 2025

Discover the best investment strategies for beginners in 2025. This guide breaks down 10 simple, effective ways to start building wealth today.

Oct 17, 2025

generated

Investing can feel like a complex world reserved for experts, but it doesn't have to be. The journey to financial freedom begins with a single, informed step. The truth is, some of the best investment strategies for beginners are often the simplest, built on principles of consistency, diversification, and long-term thinking. Forget trying to "time the market" or chase risky, speculative trends.

This guide is designed to cut through the noise and provide a clear, actionable roadmap for building wealth. We will explore 10 proven strategies that empower you to start investing confidently, even with a small amount of money. From the "set it and forget it" power of index funds to the immediate returns of a 401(k) match, each approach is broken down into easy-to-understand steps.

While your investment journey might start with traditional financial products, exploring diverse asset classes like real estate can broaden your portfolio. For those interested, consider this practical guide to property investment for beginners for a deeper look into that specific area. This article, however, will focus on a range of accessible financial strategies, helping you choose the right path for your specific goals. Let’s begin your journey to a more prosperous future.

1. Index Fund Investing

Index fund investing is a cornerstone of beginner-friendly investment strategies. Instead of picking individual stocks and trying to outperform the market, you buy a single fund that holds all the stocks within a specific market index, like the S&P 500. This passive approach, championed by investment legends like John Bogle and Warren Buffett, aims to match the market's performance over time. It’s a powerful, set-it-and-forget-it method that provides instant diversification and lowers risk.

This strategy is one of the best investment strategies for beginners because it eliminates the complex and often stressful task of stock selection. By owning a small piece of hundreds or even thousands of companies through one fund, you are not overly exposed to the poor performance of any single company.

Why It Works for Beginners

The core benefit is simplicity combined with historically strong returns. You get broad market exposure without needing deep financial knowledge. These funds are also known for their incredibly low fees, or expense ratios, meaning more of your money stays invested and working for you. Famous examples include the Vanguard 500 Index Fund (VFIAX) and the SPDR S&P 500 ETF Trust (SPY).

How to Get Started

Choose a Broad Market Index: Start with a fund that tracks the S&P 500 or a total stock market index for maximum diversification.

Prioritize Low Costs: Compare expense ratios. A fund like the Fidelity ZERO Total Market Index Fund (FZROX) has a 0% expense ratio.

Invest Consistently: Use dollar-cost averaging by investing a fixed amount regularly (e.g., monthly). This reduces the risk of investing a large sum at a market peak.

Reinvest Dividends: Enable automatic dividend reinvestment to harness the power of compounding, where your earnings start generating their own earnings.

Think Long-Term: Plan to hold your investment for at least five years to smooth out market volatility and benefit from long-term growth trends.

2. Dollar-Cost Averaging (DCA)

Dollar-cost averaging (DCA) is a powerful strategy where you invest a fixed amount of money at regular intervals, such as weekly or monthly, regardless of asset prices. This systematic approach, championed by legendary investor Benjamin Graham, removes emotion from the investment process and prevents the risky temptation of trying to "time the market." By investing consistently, you automatically buy more shares when prices are low and fewer when they are high, which can lower your average cost per share over time.

This method is one of the best investment strategies for beginners because it promotes discipline and makes investing an accessible habit. Your 401(k) contributions deducted directly from your paycheck are a classic example of DCA in action, building wealth steadily without active management.

Why It Works for Beginners

The main advantage of DCA is its simplicity and ability to mitigate risk. Instead of needing a large lump sum, you can start with a small, manageable amount. It removes the stress of deciding the "perfect" time to buy and smooths out the impact of market volatility. For example, investing a consistent $100 weekly into a volatile asset like Bitcoin during the 2022 bear market would have resulted in a lower average cost than investing a large sum at the peak.

How to Get Started

Set Up Automatic Transfers: Automate a recurring transfer from your bank to your brokerage account to ensure consistency.

Invest on a Schedule: Choose a regular interval that aligns with your paychecks, like the 1st and 15th of every month.

Embrace Market Downturns: Do not pause your contributions when the market falls. These are the periods when your fixed investment buys more shares, making DCA most effective.

Choose Low-Cost Platforms: Use commission-free brokerages to ensure transaction fees don't erode your regular investments.

Start Small and Stay Consistent: Begin with an amount you can comfortably afford and stick with the plan. Consistency is more important than the amount.

3. Target-Date Retirement Funds

Target-date funds are an all-in-one investment solution that automatically adjusts its risk level as you get closer to retirement. These funds start with a growth-oriented mix, heavy on stocks, when you are young. As the specified retirement year approaches, the fund’s allocation automatically shifts toward more conservative investments like bonds to protect your capital. This built-in rebalancing makes them a top choice for hands-off investors.

This strategy is one of the best investment strategies for beginners because it simplifies long-term planning into a single decision. You pick a fund based on your expected retirement year, and the professional fund manager handles the complex asset allocation and rebalancing for you, ensuring your portfolio remains appropriate for your life stage.

Why It Works for Beginners

The main appeal is its "set it and forget it" nature, which removes emotion and guesswork from investing. It provides instant diversification across stocks and bonds in a single, professionally managed fund. These funds are also widely available in workplace retirement plans like 401(k)s and are typically very low-cost. Key examples include the Vanguard Target Retirement 2050 Fund (VFIFX) and the Fidelity Freedom Index 2055 Fund (FDEWX).

How to Get Started

Select Your Target Date: Choose a fund with a year in its name that most closely matches when you plan to retire (e.g., 2055, 2060).

Compare Expense Ratios: Even small differences in fees matter over decades. Look for low-cost index-based options.

Understand the 'Glide Path': Review how the fund's stock-to-bond ratio changes over time to ensure it aligns with your risk tolerance.

Consolidate Your Investment: Avoid owning multiple target-date funds or mixing one with other funds, as this can disrupt its intended asset allocation.

Commit Long-Term: These funds are designed for a decades-long timeline. Trust the process and avoid making changes based on short-term market news.

4. Dividend Growth Investing

Dividend growth investing is a strategy focused on buying stocks in established companies that not only pay dividends but consistently increase them year after year. This approach provides two potential avenues for wealth creation: regular income from dividend payments and capital appreciation as the company's value grows. It’s an excellent strategy for beginners seeking a more predictable income stream alongside long-term growth.

This method is one of the best investment strategies for beginners because it encourages a focus on high-quality, financially stable businesses. Companies with long track records of increasing dividends, often called "Dividend Aristocrats" or "Dividend Kings," tend to be resilient and well-managed. The regular cash flow from dividends can be reinvested to buy more shares, accelerating wealth through the power of compounding.

Why It Works for Beginners

The appeal lies in its combination of income, stability, and growth. Unlike purely growth-focused stocks, these companies provide a tangible cash return, which can be psychologically rewarding and financially beneficial during market downturns. The emphasis on dividend history, popularized by investors like Warren Buffett and Benjamin Graham, provides a clear metric for identifying fundamentally sound companies. Examples include Johnson & Johnson (JNJ) and The Coca-Cola Company (KO), both with over 60 years of consecutive dividend increases.

How to Get Started

Look for Sustainable Yields: Aim for a dividend yield between 2% and 6%. An unusually high yield can be a red flag indicating potential financial trouble.

Check the Payout Ratio: This metric shows what percentage of earnings is paid out as dividends. A ratio below 70% is generally considered safer and more sustainable.

Prioritize Dividend History: Focus on companies with at least 5-10 years of consistent dividend growth, as this signals financial health and shareholder commitment.

Use DRIPs: Enroll in a Dividend Reinvestment Plan (DRIP) to automatically use your dividend payments to purchase more shares of the same stock, maximizing compound growth.

Consider ETFs for Diversification: A fund like the Vanguard Dividend Appreciation ETF (VIG) provides instant exposure to a diversified portfolio of dividend-growing companies. For a deeper dive, you can learn more about passive income investments on yieldseeker.xyz.

5. Robo-Advisor Investing

Robo-advisor investing leverages technology to provide automated, algorithm-driven portfolio management. These platforms build and manage a diversified portfolio for you based on your financial goals, risk tolerance, and time horizon. After you answer a simple questionnaire, the service automatically invests your funds, typically into a mix of low-cost exchange-traded funds (ETFs), and handles complex tasks like rebalancing and tax optimization. It’s like having a digital financial advisor without the high fees.

This strategy is one of the best investment strategies for beginners because it provides sophisticated portfolio management with minimal effort and cost. It removes the guesswork and emotional decision-making from investing, making it an accessible, hands-off way to build wealth.

Why It Works for Beginners

The main appeal is its combination of professional-grade management, low costs, and extreme simplicity. You gain access to a globally diversified portfolio without needing any prior investment knowledge. Platforms like Betterment and Wealthfront pioneered this space, offering services that were once reserved for wealthy investors. Major firms like Vanguard and Schwab now also offer competitive robo-advisor services, often with very low minimum investment requirements.

How to Get Started

Answer the Questionnaire Honestly: Your portfolio is built on your responses. Be truthful about your risk tolerance and financial situation for the best results.

Compare Platform Fees: Look at both the advisory fee (typically a percentage of your assets) and the expense ratios of the underlying ETFs.

Set Up Automatic Deposits: Automate your contributions to invest consistently and take advantage of dollar-cost averaging.

Utilize Goal-Setting Tools: Many platforms allow you to set specific goals, like saving for retirement or a down payment, and track your progress.

Consider Tax-Loss Harvesting: If you are investing in a taxable account, look for a robo-advisor that offers tax-loss harvesting to potentially lower your tax bill. To dive deeper, you can explore the best automated investing platforms.

6. The 60/40 Portfolio

The 60/40 portfolio is a classic and time-tested asset allocation strategy. It involves investing 60% of your portfolio in stocks for growth and the remaining 40% in bonds for stability and income. This balanced approach, a cornerstone of traditional retirement planning, aims to capture stock market gains while using bonds to cushion the portfolio during economic downturns. It provides a simple, proven framework that balances growth potential with risk management.

This strategy is one of the best investment strategies for beginners because it offers a built-in, disciplined approach to diversification. The relationship between stocks and bonds often acts as a seesaw; when stocks are down, high-quality bonds tend to hold their value or even rise, smoothing out your overall returns and reducing panic-inducing volatility.

Why It Works for Beginners

The main advantage is its simplicity and historical reliability in providing respectable returns with lower risk than an all-stock portfolio. It removes the guesswork of market timing by creating a pre-set allocation that automates risk management. You get exposure to growth without the full whiplash of market corrections. A fund like the Vanguard Balanced Index Fund (VBIAX) implements this strategy in a single, low-cost product.

How to Get Started

Build Your Portfolio: Combine low-cost index funds, such as a total stock market fund and a total bond market fund, to achieve the 60/40 split.

Rebalance Regularly: At least once a year, review your portfolio. If stocks have performed well and now make up 70% of your holdings, sell some and buy bonds to return to your 60/40 target.

Adjust for Your Age: While 60/40 is a great starting point, you might consider a more aggressive 80/20 split if you're young or shift toward more bonds as you near retirement.

Stay the Course: The strategy’s effectiveness depends on sticking with it, especially during market volatility. Don't abandon your bond allocation when stocks are soaring.

Consider Tax Placement: If possible, hold bonds in tax-advantaged accounts like an IRA, as their income is often taxed at a higher rate than stock gains.

7. Real Estate Investment Trusts (REITs)

Real Estate Investment Trusts (REITs) offer a way to invest in income-producing real estate without the hassle of buying or managing physical properties. REITs are companies that own, operate, or finance real estate across sectors like residential, commercial, and industrial properties. They are legally required to pay out at least 90% of their taxable income to shareholders as dividends, making them a popular choice for generating passive income.

This strategy is one of the best investment strategies for beginners because it provides real estate exposure with the same convenience as buying a stock. You can get instant diversification across numerous properties and geographic locations through a single investment, significantly lowering the barrier to entry for real estate investing.

Why It Works for Beginners

The main advantage is liquidity and diversification. Unlike direct property ownership, REITs can be bought and sold easily on major stock exchanges. They provide a steady stream of dividend income and the potential for long-term capital appreciation. Excellent examples include the diversified Vanguard Real Estate ETF (VNQ) and specific companies like Realty Income Corporation (O), known as "The Monthly Dividend Company."

How to Get Started

Start with a Diversified ETF: Instead of picking individual REITs, begin with a broad REIT ETF like VNQ to gain exposure to the entire sector.

Consider Different Sectors: As you learn more, you can explore specialized REITs in growing sectors like data centers, cell towers, or industrial logistics, such as Prologis (PLD).

Use a Tax-Advantaged Account: REIT dividends are typically taxed as ordinary income, so holding them in an IRA or 401(k) can be more tax-efficient.

Allocate Strategically: Limit your REIT allocation to between 5-15% of your overall portfolio to maintain proper diversification.

Understand Key Metrics: Look beyond dividend yield. Research metrics like funds from operations (FFO) to gauge a REIT's financial health and performance.

8. Three-Fund Portfolio

The three-fund portfolio is an elegant strategy that delivers global diversification with minimal complexity. Pioneered by Vanguard founder John Bogle and the Bogleheads community, this approach uses just three low-cost index funds: a U.S. stock market fund, an international stock market fund, and a U.S. bond market fund. It’s a powerful method for building a complete, well-rounded portfolio without the need to manage dozens of individual investments.

This strategy is one of the best investment strategies for beginners because it simplifies asset allocation while ensuring you are invested across major global markets. It provides a built-in balance of higher-growth stocks and lower-risk bonds, making it a robust, set-and-forget solution for long-term investors who value simplicity.

Why It Works for Beginners

The strength of the three-fund portfolio lies in its simplicity and comprehensive diversification. You gain exposure to thousands of U.S. and international companies, plus the stability of bonds, all in one streamlined package. This approach removes the guesswork from building a balanced portfolio and keeps management fees exceptionally low. Classic examples include Vanguard's trio of VTI (U.S. Stocks), VXUS (International Stocks), and BND (U.S. Bonds).

How to Get Started

Determine Your Allocation: Start with a balanced mix, such as 60% U.S. stocks, 20% international stocks, and 20% bonds. Adjust the bond percentage upward based on your age and risk tolerance.

Select Low-Cost Funds: Choose the lowest-cost index funds available at your brokerage. Schwab offers funds like SWTSX and SWISX, while Fidelity offers FSKAX and FTIHX.

Keep It Simple: Resist the urge to add more funds. The power of this strategy comes from its simplicity and broad market coverage.

Rebalance Annually: Once a year, check if your allocations have drifted more than 5% from their targets. If so, sell some of the overperforming asset and buy the underperforming one to return to your original mix.

Adjust Over Time: As you get closer to retirement, gradually increase your allocation to bonds to reduce portfolio risk and preserve capital.

9. High-Yield Savings and CDs (Certificates of Deposit)

While not growth-focused investments, high-yield savings accounts and Certificates of Deposit (CDs) are foundational to any sound financial plan. These FDIC-insured accounts are designed for capital preservation and offer guaranteed returns, making them a crucial part of the best investment strategies for beginners. They provide a safe, risk-free place to store money for short-term goals or an emergency fund, earning significantly higher interest than traditional savings accounts.

This strategy is perfect for beginners because it provides stability and liquidity without exposure to market volatility. By parking cash needed in the next one to five years in these accounts, you ensure the principal is protected while still earning a modest, predictable return. This approach is universally recommended by financial advisors as the first step before taking on market risk.

Why It Works for Beginners

The primary benefit is security. Your money is FDIC-insured up to $250,000 per depositor, per institution, meaning you can't lose your initial deposit. These accounts currently offer competitive Annual Percentage Yields (APYs), often far exceeding inflation and providing a real return without risk. Popular options include Marcus by Goldman Sachs, Ally Bank, and Discover Bank, all known for their competitive rates.

How to Get Started

Build Your Emergency Fund: Use a high-yield savings account to store 3-6 months' worth of essential living expenses. This is your financial safety net.

Shop for the Best Rates: APYs change frequently, so compare offerings from different online banks to maximize your earnings.

Use CDs for Specific Goals: If you're saving for a down payment or a car purchase in 1-5 years, lock in a fixed rate with a CD.

Create a CD Ladder: For better liquidity, consider a CD ladder. Stagger multiple CDs with different maturity dates (e.g., 1-year, 2-year, 3-year) so you have access to funds annually.

Focus on Short-Term Needs: Remember, these tools are for short-term savings and capital preservation, not long-term retirement growth.

10. Employer 401(k) Match - 'Free Money' Investing

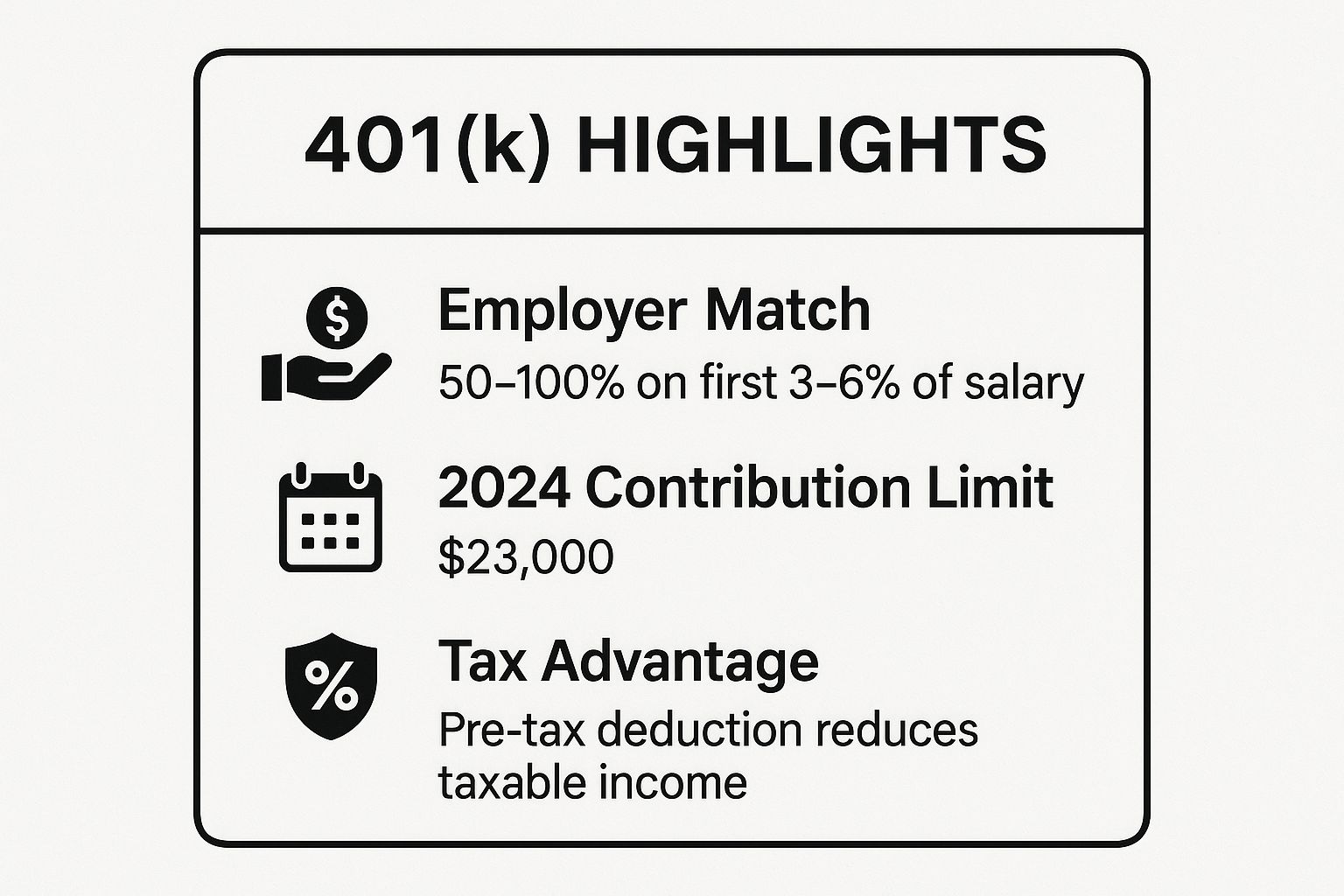

Contributing to your employer's 401(k) plan, especially enough to capture the full company match, is arguably the best investment a beginner can make. This strategy offers an immediate, guaranteed return on your investment, often ranging from 50% to 100%. Many employers will match a percentage of your contributions, typically up to the first 3-6% of your salary. This match is essentially free money, providing an unparalleled boost to your retirement savings from day one.

This is one of the best investment strategies for beginners because it combines automatic savings with tax advantages and a powerful incentive. The process is simple: money is deducted directly from your paycheck, making consistent investing effortless. This approach should be the first financial priority for anyone with access to a workplace retirement plan with a company match.

To visualize the core benefits, the infographic below highlights the key features of a 401(k) plan.

The data illustrates how the employer match, generous contribution limits, and tax deductions create a powerful savings vehicle.

Why It Works for Beginners

The primary benefit is the guaranteed return from the employer match, which you cannot find anywhere else. For example, if your company matches 50% on the first 6% of your salary, contributing 6% instantly turns into 9% of your salary saved. This strategy also simplifies investing by offering a limited, pre-vetted menu of investment options, such as low-cost index funds or target-date funds, and automates the entire process through payroll deductions.

How to Get Started

Contribute Enough for the Full Match: This is the top priority. Find out your employer's matching formula and contribute at least that amount.

Choose Low-Cost Funds: Within your plan, select low-cost index funds or a target-date fund that aligns with your expected retirement year.

Understand Your Vesting Schedule: Be aware of how long you must work for the company to keep the employer's contributions.

Increase Contributions Annually: Aim to increase your contribution rate by 1% each year or with every raise. You can explore how this fits into your overall financial goals with our guide on financial planning for millennials.

Avoid 401(k) Loans: Try not to borrow from your 401(k), as it can derail your long-term retirement progress.

Top 10 Beginner Investment Strategies Comparison

Investment Strategy | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

Index Fund Investing | Low - simple, passive management 🔄 | Low - minimal time and expertise ⚡ | Market-matching returns, ~10% long-term 📊 | Long-term growth, beginners seeking broad exposure 💡 | Low fees, diversification, tax efficiency ⭐ |

Dollar-Cost Averaging (DCA) | Low - fixed periodic investments 🔄 | Low - small consistent amounts ⚡ | Smooths purchase price, reduces timing risk 📊 | Beginners with limited capital, habit-building 💡 | Reduces emotional investing, mitigates timing risk ⭐ |

Target-Date Retirement Funds | Low - automated adjustments 🔄 | Moderate - initial setup, ongoing management ⚡ | Gradually conservative returns, designed for retirement 📊 | Retirement savings with hands-off management 💡 | Automatic rebalancing, age-adjusted risk ⭐ |

Dividend Growth Investing | Moderate - requires stock research 🔄 | Moderate - capital for stocks or ETFs ⚡ | Regular income through dividends plus growth 📊 | Income-focused investors, long-term wealth building 💡 | Passive income, inflation-beating dividend growth ⭐ |

Robo-Advisor Investing | Very low - automated platform 🔄 | Low - low minimum investment ⚡ | Professionally managed, tailored portfolios 📊 | Beginners wanting hands-off, customizable investing 💡 | Low fees, tax optimization, 24/7 access ⭐ |

The 60/40 Portfolio | Moderate - requires periodic rebalancing 🔄 | Moderate - requires multiple funds ⚡ | Balanced growth with reduced volatility 📊 | Moderate risk tolerance, retirement planning 💡 | Simplicity, historical performance, stability ⭐ |

Real Estate Investment Trusts (REITs) | Moderate - selecting ETFs or REITs 🔄 | Moderate - stock-like capital ⚡ | High dividend income with moderate risk 📊 | Income seekers, real estate exposure without property 💡 | Liquidity, diversification, inflation hedge ⭐ |

Three-Fund Portfolio | Low - only 3 funds to manage 🔄 | Low to moderate - depends on funds ⚡ | Broad global diversification, market returns 📊 | Beginners wanting simplicity with global exposure 💡 | Low cost, easy maintenance, comprehensive coverage ⭐ |

High-Yield Savings and CDs | Very low - simple accounts 🔄 | Low - minimal funds required ⚡ | Guaranteed but modest returns 📊 | Emergency funds, short-term savings, low risk 💡 | Zero risk, FDIC insured, liquidity ⭐ |

Employer 401(k) Match | Low - payroll deduction setup 🔄 | Low - partial salary contribution ⚡ | Immediate 50-100% return plus tax advantages 📊 | Maximizing employer benefits, long-term retirement 💡 | Free money match, tax benefits, automatic investing ⭐ |

Taking the Next Step: From Strategy to Action

You have now explored a comprehensive roundup of the best investment strategies for beginners, moving from foundational concepts like index funds and dollar-cost averaging to more structured approaches like the three-fund portfolio and target-date retirement funds. We've demystified everything from the simplicity of robo-advisors to the passive income potential of REITs and dividend growth stocks. The journey from understanding to execution is the most critical step you can take toward securing your financial future.

Distilling the Core Principles

The most powerful takeaway is not about picking the single "perfect" strategy. Instead, it's about recognizing the common threads that bind them all together: consistency, diversification, and a long-term perspective.

Consistency is Your Superpower: Whether you're using Dollar-Cost Averaging to automate contributions or consistently maximizing your 401(k) match, the habit of regular investing is what builds significant wealth over time. It transforms market volatility from a threat into an opportunity.

Diversification is Your Safety Net: Strategies like the 60/40 portfolio, target-date funds, and the three-fund portfolio are all built on the principle of not putting all your eggs in one basket. Spreading your capital across different asset classes helps cushion your portfolio against inevitable market downturns.

Time is Your Greatest Ally: The magic of compound interest, which is the engine behind dividend growth and index fund investing, needs time to work. Starting today, even with a small amount, gives your money the longest possible runway to grow exponentially.

Your Actionable Blueprint for Getting Started

Knowledge without action is just potential. The key is to translate what you've learned into concrete, manageable steps. Don't let analysis paralysis stop you. The most successful investors are not the ones who find the most obscure opportunities, but those who start early and stay the course with a simple, proven plan.

Here is a practical sequence you can follow right now:

Secure the 'Free Money': If your employer offers a 401(k) match, your absolute first priority is to contribute enough to receive the full amount. This is an immediate, guaranteed return on your investment that is impossible to beat.

Automate Your Foundation: Choose a foundational strategy to automate. This could be opening an IRA with a robo-advisor, setting up automatic purchases of a low-cost index fund, or implementing a simple three-fund portfolio. Automation removes emotion and ensures you invest consistently.

Optimize Your Cash: For the cash you're holding, ensure it's working for you. A high-yield savings account or a CD ladder can provide a safe, reliable return that outpaces traditional savings accounts.

Remember, the goal is progress, not perfection. Starting with one of these strategies is infinitely more powerful than waiting for the perfect moment or the perfect plan. As you gain confidence and your financial situation evolves, you can begin to layer in other approaches, such as adding REITs for real estate exposure or exploring individual dividend stocks. By mastering these fundamental best investment strategies for beginners, you are building not just a portfolio, but a lifelong habit of disciplined wealth creation.

Ready to apply these principles of automation and optimization to your digital assets? For those holding stablecoins and seeking simplified, high-yield opportunities in the crypto space, Yield Seeker uses advanced AI Agents to automatically find and manage the best returns for you. Discover how easy it can be to put your crypto to work at Yield Seeker.