Back to Blog

12 Best Investment Tracking Apps for 2025: A Deep Dive

Discover the best investment tracking apps of 2025. Get in-depth reviews on features, pricing, and pros/cons to find the perfect tool for your portfolio.

Oct 4, 2025

generated

Keeping track of your investments can feel like a full-time job. With assets spread across various brokers, retirement accounts, and even crypto wallets, getting a clear picture of your total net worth is a significant challenge. Manually updating spreadsheets is tedious and prone to error, leaving you with an outdated and fragmented view of your financial health. The right technology, however, can transform this chaos into clarity.

This guide cuts through the noise to analyze the 12 best investment tracking apps available today. We'll move beyond marketing jargon and dive deep into real-world use cases, hidden limitations, and unique features. The magic behind seamless financial tracking often lies in sophisticated technologies that extract information. For those interested in the broader landscape of how financial systems process information, explore this guide on financial data extraction tools.

Our analysis is designed to help you choose the perfect tool to monitor, manage, and grow your wealth with confidence. Whether you're a crypto beginner, a busy professional, or an experienced DeFi enthusiast, you will find a solution tailored to your needs. Each review includes direct links and screenshots to give you a clear, practical understanding of how these platforms function, helping you find the right fit for your specific investment portfolio and goals.

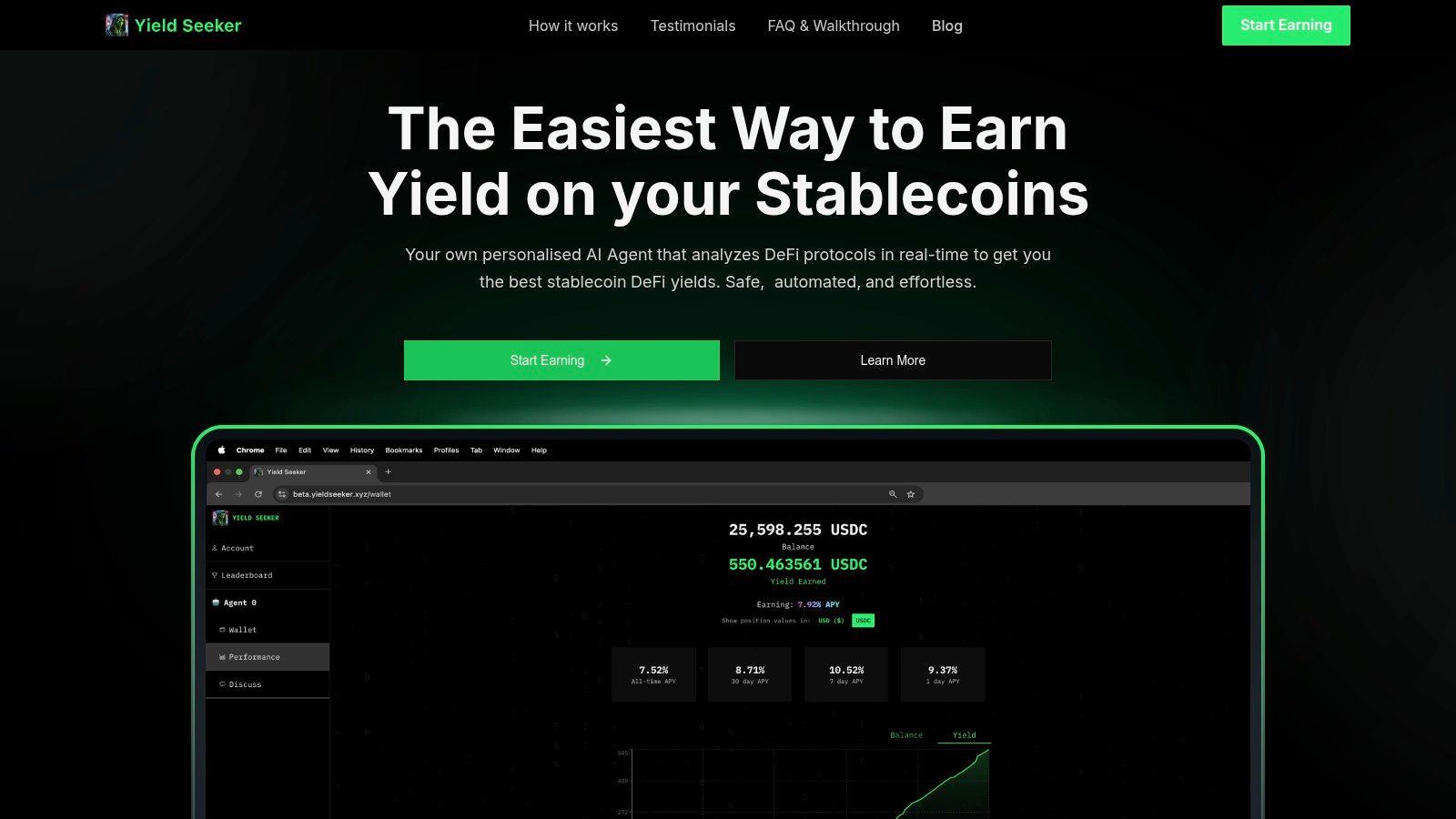

1. Yield Seeker

Yield Seeker sets a new standard for automated yield farming, making it a powerful contender among the best investment tracking apps for crypto enthusiasts. It distinguishes itself by leveraging a personalized AI Agent that continuously scans top DeFi protocols on the BASE chain, identifying and capitalizing on the most lucrative yield opportunities for USDC stablecoins in real time. This automated approach removes the steep learning curve and constant monitoring typically required in DeFi, making it highly accessible for both newcomers and seasoned investors.

The platform's core strength lies in its blend of simplicity and sophistication. Users can start with as little as $10, and the transparent dashboard provides a consolidated view of capital, earnings, and protocol activity. This unified interface transforms complex yield strategies into a manageable, passive income stream, allowing you to track your asset growth effortlessly.

Key Features & Analysis

AI-Powered Yield Optimization: The platform’s AI Agent is its standout feature. Unlike static aggregators, it dynamically shifts capital between vetted protocols to maximize returns, a task that would require significant manual effort and expertise.

Complete Flexibility: With no lockup periods or hidden fees, Yield Seeker offers total liquidity. You can withdraw your initial capital and any earned yield at any time, providing peace of mind and control over your assets.

User-Centric Design: The intuitive dashboard is designed for clarity. It simplifies performance tracking by presenting all relevant data in one place, which is ideal for users who want to monitor their investments without getting lost in technical details.

Best for: Crypto investors at all levels seeking an automated, hands-off solution for generating passive income from their stablecoin holdings on the BASE chain.

Access it here: https://yieldseeker.xyz

2. Empower Personal Dashboard

Empower Personal Dashboard (formerly Personal Capital) stands out as one of the best investment tracking apps for its robust, free-of-charge financial overview. It excels at aggregating all your financial accounts, including bank accounts, brokerages, 401(k)s, and even mortgages, into a single, comprehensive dashboard. This provides an instant, real-time snapshot of your complete net worth.

What truly sets it apart is the depth of its analytical tools, which are rare for a free service. The Investment Checkup feature offers a detailed analysis of your portfolio's asset allocation, identifies hidden fees eating into your returns, and suggests rebalancing opportunities. Its Retirement Planner is another powerful tool, allowing you to run various scenarios to see if your savings are on track for your retirement goals.

While the platform is free, be aware that its business model involves upselling users to its paid wealth management services. You may receive occasional calls or emails from advisors. Despite this, the free tools offer immense value, making Empower an excellent choice for DIY investors seeking sophisticated portfolio analysis without the price tag.

Best For: Holistic net worth tracking and in-depth retirement planning.

Key Features: Net worth tracker, retirement planner, investment fee analyzer, cash flow tools.

Pricing: The dashboard and tracking tools are completely free. Advisory services are optional and fee-based.

3. Quicken Simplifi

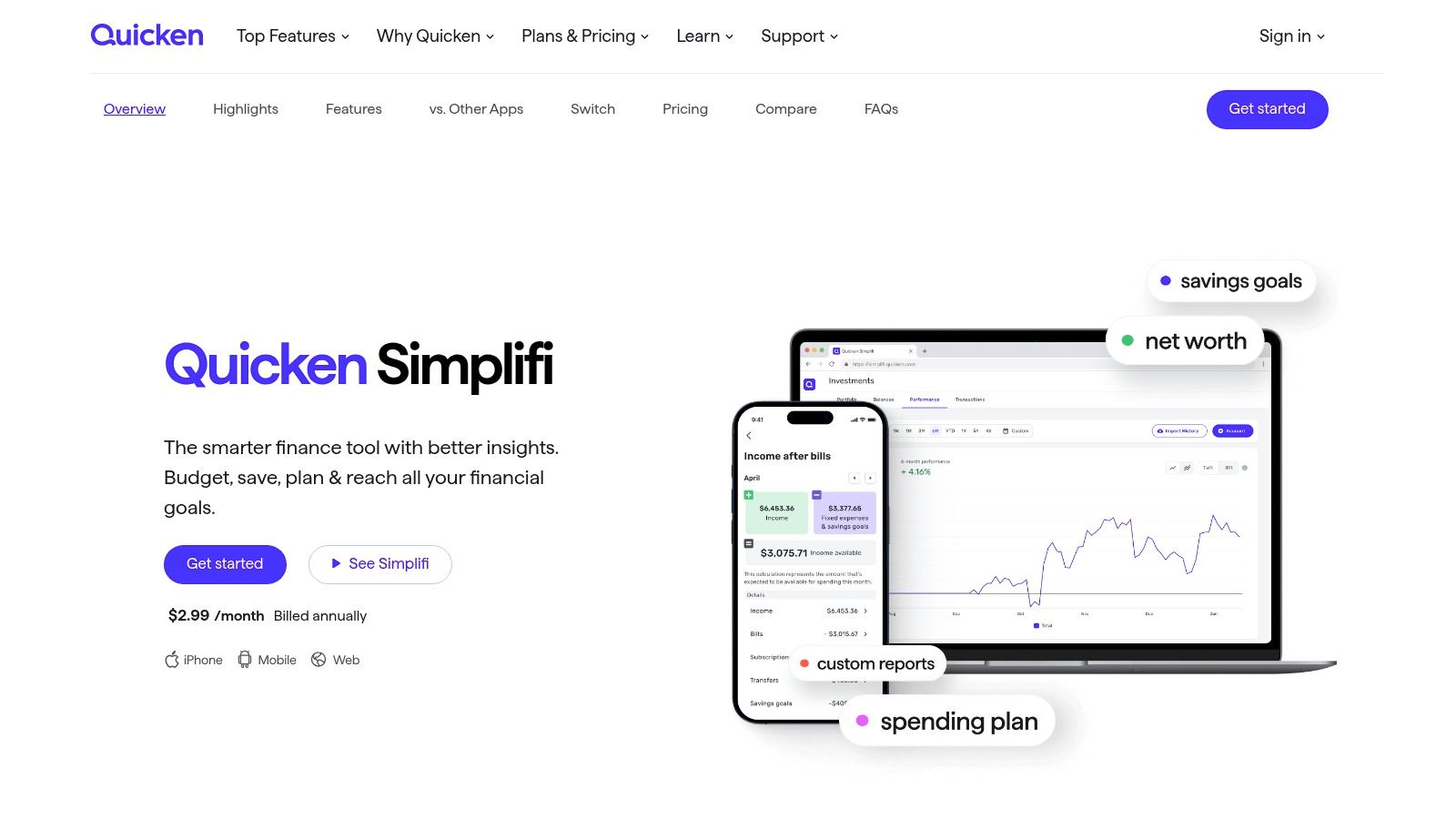

Quicken Simplifi is a modern, user-friendly budgeting and investment tracking app designed for those who want a clear, consolidated view of their finances without overwhelming complexity. It effectively bridges the gap between simple spending trackers and more complex investment platforms, offering a balanced approach to financial management. Users can link various accounts, including checking, savings, credit cards, and investments, to get a real-time overview of their net worth and spending habits.

What makes Simplifi a strong contender among the best investment tracking apps is its focus on clarity and actionable insights. The Investment View provides a clean summary of your portfolio’s performance, holdings, and value over time. While it doesn't offer the deep analytical tools of a dedicated brokerage, it excels at showing you how your investments contribute to your overall financial picture. Its projected cash flow and custom spending plan features help you see the immediate impact of your financial decisions.

The platform is subscription-based, but its affordable annual plan and frequent promotions make it highly accessible. While bank connection reliability can occasionally be an issue, its guided onboarding and clean interface make it a great starting point for those new to tracking their investments and net worth in one place.

Best For: Beginners seeking an all-in-one budgeting and basic investment tracking tool.

Key Features: Real-time alerts, spending plan, investment performance view, projected cash flow, reporting tools.

Pricing: Subscription-based with a monthly or annual fee. A 30-day trial is typically available.

Link: Quicken Simplifi

4. Quicken Classic Premier

For investors who prefer the control and depth of desktop software, Quicken Classic Premier remains a powerhouse among the best investment tracking apps. Unlike web-based aggregators, Quicken provides granular control over every transaction, allowing for meticulous record-keeping. It excels at tracking complex investment metrics like cost basis, capital gains (short and long-term), and return on investment with a level of detail that few online platforms can match.

What makes Quicken stand out is its robust reporting engine. You can generate highly detailed reports for tax planning, performance analysis, and asset allocation that are invaluable for serious DIY investors. The software also integrates comprehensive budgeting, bill pay, and debt management tools, creating a complete personal finance hub. Its "what-if" analysis tools allow you to model the potential tax implications of selling specific securities, a feature crucial for strategic portfolio management.

While it has a steeper learning curve and requires a subscription, its power is undeniable for those wanting full command over their financial data without relying solely on a cloud-based service. The software is installed locally, offering a different approach to data security.

Best For: Detailed investors who want deep reporting capabilities and full control over their transaction data.

Key Features: In-depth investment performance and tax reporting, cost basis tracking, portfolio "what-if" analysis, integrated budgeting and bill pay.

Pricing: Requires an annual subscription, with the Premier version typically priced around $6.99/month (billed annually).

Link: Quicken Classic Premier

5. Sharesight

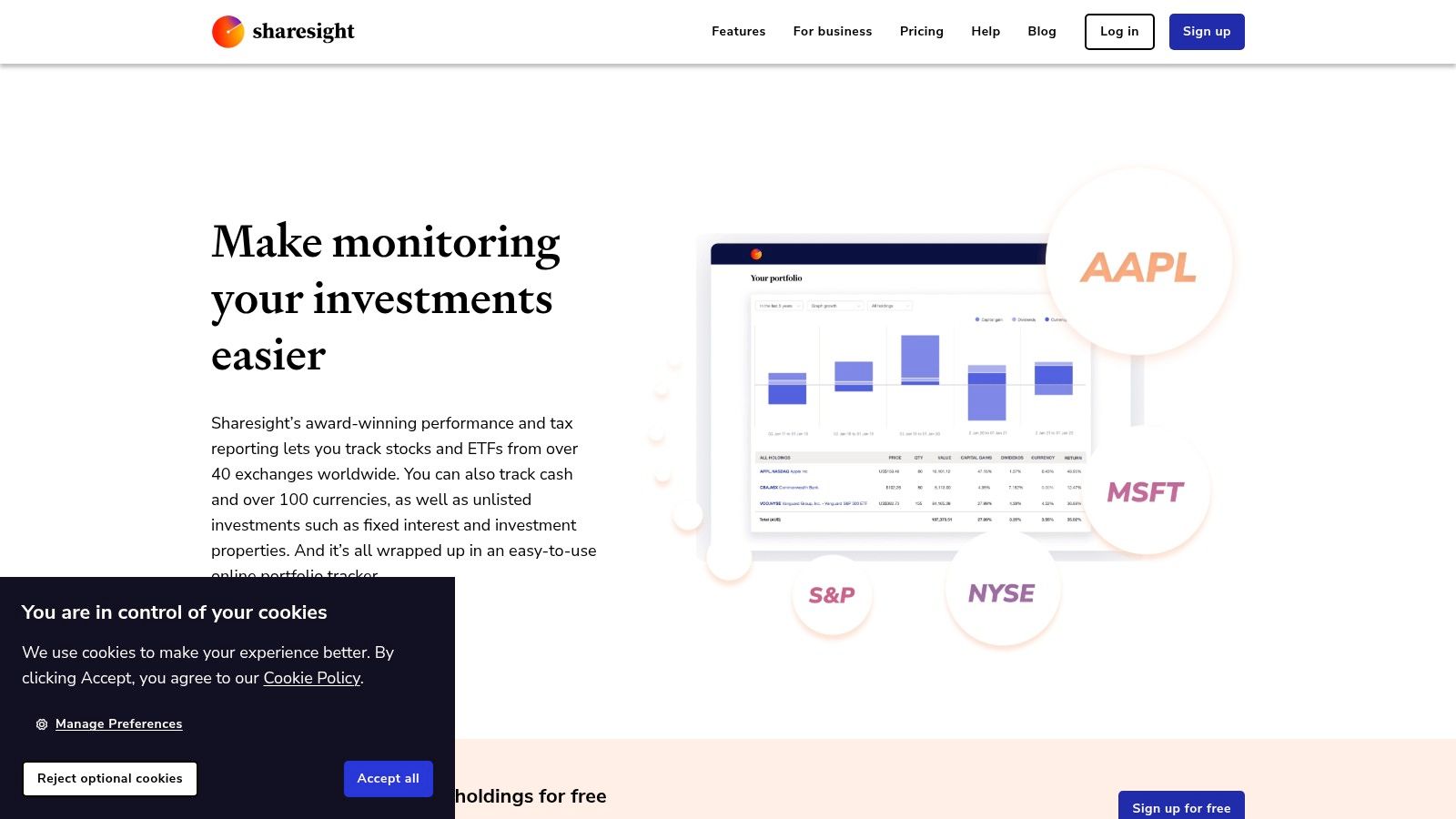

Sharesight carves out a niche as one of the best investment tracking apps for investors who prioritize performance and tax reporting over all-in-one financial management. It excels at tracking the true performance of your stock, ETF, and fund holdings by calculating time-weighted returns and accounting for dividends, stock splits, and currency fluctuations. This makes it an invaluable tool for accurately assessing how your investments are actually doing over time.

What makes Sharesight unique is its powerful focus on dividend and tax reporting. The platform automatically tracks all your dividend income, including handling dividend reinvestment plans (DRPs), and can generate detailed tax reports like Capital Gains and Taxable Income to simplify your year-end accounting. You can automate trade logging by forwarding broker confirmation emails, saving significant manual entry time for active investors.

While it lacks budgeting or bank account integration, its specialized focus is its strength. If you manage investments across multiple brokers or countries and need precise performance and tax data, Sharesight is an exceptional choice. Its free plan is generous enough for beginners to get started.

Best For: Detailed performance tracking and simplifying tax-time reporting for stock and ETF investors.

Key Features: True performance tracking (annualized returns), automatic dividend tracking, comprehensive tax reporting, multi-currency support, broker email import.

Pricing: Free for up to 10 holdings. Paid plans with more features and holdings start at $15/month.

Link: Sharesight

6. Kubera

Kubera positions itself as a premium, privacy-focused wealth tracker for the modern investor with a diverse portfolio. It moves beyond standard stocks and funds, allowing users to aggregate everything from brokerage accounts and crypto wallets to real estate, domain names, and even private equity stakes. This makes it one of the best investment tracking apps for individuals with complex, non-traditional assets who need a single, elegant interface to view their entire financial world.

What truly distinguishes Kubera is its strong commitment to privacy and its unique estate planning feature. The platform operates on a subscription model, meaning it doesn't sell your data or show ads. Its standout Beneficiary feature acts as a "dead-man's switch," securely passing on your complete financial portfolio to a designated heir if you become inactive. This focus on privacy and legacy planning is a key differentiator among other digital wealth management platforms. While its premium price tag puts it above free alternatives, the clean UI and broad asset support justify the cost for high-net-worth individuals.

Best For: High-net-worth individuals with diverse assets and a focus on privacy and estate planning.

Key Features: All-asset tracker (crypto, real estate, collectibles), beneficiary management, currency converter, secure document storage.

Pricing: Premium subscription-based model, typically around $150 per year after a trial period.

Link: Kubera

7. Yahoo Finance

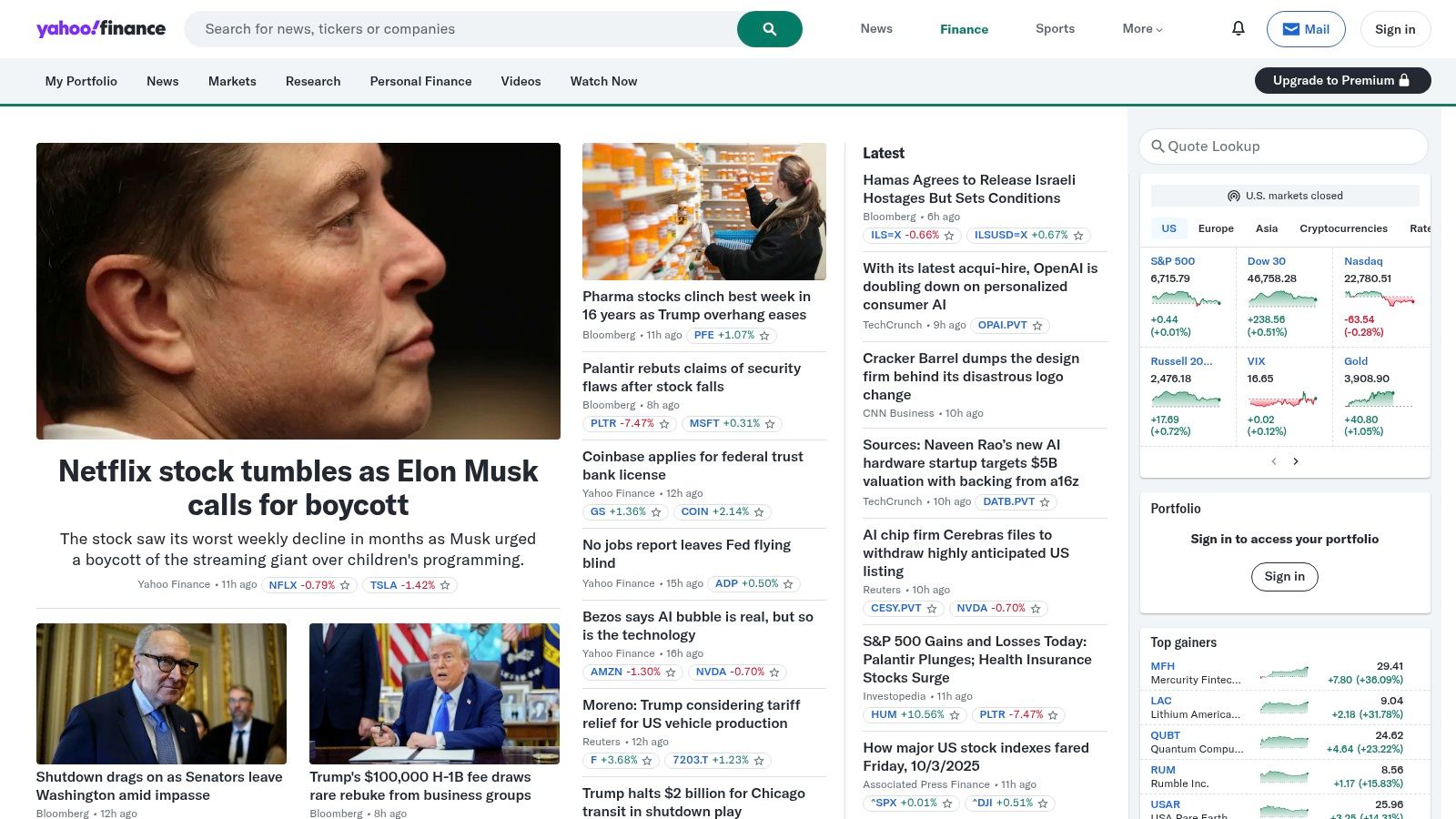

Yahoo Finance has long been a go-to source for market news and data, but it also functions as a surprisingly capable investment tracking app. Its core strength lies in its seamless integration of portfolio tracking with real-time news, quotes, and fundamental data. You can easily create multiple watchlists and portfolios, linking your brokerage accounts for automatic syncing or entering positions manually to monitor performance in one centralized location.

While the free version is excellent for basic monitoring, the true power is unlocked with its paid tiers. The Yahoo Finance Plus plans offer advanced portfolio analytics, including detailed performance analysis, holdings characteristics, and integration with third-party research from firms like Morningstar. This makes it a powerful all-in-one platform for investors who want their tracking, research, and news consolidated. Despite its robust features, some users report occasional glitches with portfolio syncing, and the most advanced tools are locked behind a subscription.

Best For: Investors who want an integrated platform for news, data, and portfolio tracking.

Key Features: Brokerage account linking, real-time quotes, advanced charting, multiple watchlists, integrated news.

Pricing: Free for basic portfolio tracking. Paid plans (Plus Lite, Essential, and Platinum) start at around $20/month for advanced features.

Link: Yahoo Finance

8. Delta Investment Tracker

Delta Investment Tracker positions itself as a premier mobile-first solution for investors who need to monitor a diverse portfolio on the go. It shines in its ability to consolidate traditional assets like stocks and ETFs alongside modern investments such as cryptocurrencies and NFTs, all within a sleek, intuitive interface. Users can connect a wide array of brokerages, exchanges, and crypto wallets, or use CSV imports for a complete financial picture.

What makes Delta one of the best investment tracking apps, especially for active traders, is its focus on timely, relevant information. The “Why is it moving?” feature (available with PRO) provides context behind price fluctuations, while its notification system is highly customizable and responsive. While the free version is functional, the real power, including advanced metrics and unlimited connections, is unlocked with a paid subscription. For those deeply invested in crypto, Delta offers a comprehensive view that few competitors can match, making it a powerful tool for the modern investor. For a deeper look, you can find a comprehensive review of the Delta Investment Tracker on yieldseeker.xyz.

Best For: Mobile-first investors with mixed crypto and traditional asset portfolios.

Key Features: Multi-asset tracking (stocks, crypto, NFTs), broker/exchange sync, advanced portfolio analytics, price movement alerts.

Pricing: Free version with limitations. Delta PRO starts at $8.99/month for advanced features.

Link: Delta Investment Tracker

9. Monarch Money

Monarch Money is a premium, subscription-based platform designed for households seeking an integrated view of their entire financial life. It skillfully combines detailed budgeting and spending analysis with robust investment and net worth tracking, connecting to over 13,000 financial institutions. This all-in-one approach provides a clear, unified picture of cash flow alongside portfolio performance, making it one of the best investment tracking apps for users who want to see how daily habits impact long-term goals.

What makes Monarch stand out is its clean, ad-free user experience and modern interface. It offers unique integrations with services like Coinbase, Zillow, and even the Apple Card, providing a more comprehensive net worth calculation. The platform is built for collaboration, allowing partners or family members to share a single plan with customized access. While some users report occasional issues linking specific niche accounts, the platform's strengths in budgeting and goal-setting complement its solid investment tracking capabilities. If you're looking for a user-friendly tool to manage your finances, Monarch Money's features make it a strong contender among the best investment apps for beginners.

Best For: Households and partners seeking a combined budgeting and investment tracking tool.

Key Features: Collaborative dashboard, net worth and investment tracking, integrations with Coinbase and Zillow, customizable budgeting and financial goals.

Pricing: Subscription-based with a free trial. No permanent free tier is available.

Link: Monarch Money

10. Tiller

For investors who live and breathe spreadsheets, Tiller offers a unique and powerful approach to financial management. Instead of a dedicated app interface, Tiller automatically feeds all your financial transactions and balances, including investment accounts, directly into your own Google Sheets or Microsoft Excel files. This provides a live, bank-grade data feed that updates daily, giving you complete control over your financial data in a familiar environment.

What sets Tiller apart is its ultimate flexibility. The platform provides a foundation of raw data and a library of pre-built templates, including a robust Investment Tracking Dashboard developed by its community. Users can track performance, asset allocation, and dividend income, or build entirely custom reports from scratch. This makes it one of the best investment tracking apps for DIY investors who want to create a truly personalized financial overview without being locked into a specific app's ecosystem. The learning curve is steeper, but the payoff is unparalleled customization and data ownership.

Best For: Spreadsheet enthusiasts and DIY investors who want ultimate control and customization.

Key Features: Automated transaction feeds into Google Sheets/Excel, pre-built templates, strong community support, full data ownership.

Pricing: Free 30-day trial, then $79 per year.

Link: Tiller

11. Fidelity Full View

For investors already embedded in the Fidelity ecosystem, Fidelity Full View offers a seamless and powerful aggregation tool at no extra cost. Powered by eMoney Advisor, this feature allows you to link all your external financial accounts, from other brokerages and 401(k)s to bank accounts and credit cards, creating a unified financial picture directly within your Fidelity dashboard. This centralization provides a convenient, real-time calculation of your total net worth.

The primary advantage of Full View is its deep integration with Fidelity's existing suite of planning and guidance tools. Your aggregated data can be used to inform retirement projections and other financial modeling, making it one of the best investment tracking apps for users who want a one-stop shop. While its core functionality is portfolio aggregation and net worth tracking, it also includes basic budgeting features like transaction categorization.

Although a fantastic free perk for Fidelity clients, it's less compelling for those without a primary account at the brokerage. Some users occasionally report synchronization issues with external accounts, a common challenge for aggregation services. Nevertheless, for those invested with Fidelity, it provides immense value by consolidating your financial life under one secure roof.

Best For: Fidelity customers seeking to centralize their entire financial portfolio within one platform.

Key Features: Unlimited external account linking, net worth tracking, transaction categorization, integration with Fidelity planning tools.

Pricing: Completely free for Fidelity customers.

Link: Fidelity Full View

12. Seeking Alpha

Seeking Alpha transcends traditional portfolio tracking by integrating powerful, crowdsourced research and analysis directly with your holdings. It’s less about a simple net worth overview and more about providing a dynamic research hub tailored to the assets you own. You can link your brokerage accounts to monitor performance while simultaneously receiving a curated feed of news, expert analysis, and proprietary "Quant Ratings" for each stock or ETF.

What makes Seeking Alpha one of the best investment tracking apps for active investors is its ability to turn monitoring into actionable insight. Instead of just seeing price changes, you get access to earnings call transcripts, author ratings, and factor grades (like value and growth) tied directly to your portfolio. This context helps you understand the "why" behind market movements and make more informed decisions on buying, selling, or holding.

While a basic portfolio tracker exists for free, the platform's true power is unlocked with a Premium subscription. This paywall gates the most valuable features, like the advanced screeners and unlimited access to in-depth analysis. It’s an ideal tool for investors who want to combine tracking with deep, ongoing research in a single, cohesive ecosystem.

Best For: Active investors who want deep research and data integrated with their portfolio tracking.

Key Features: Portfolio monitoring with news and ratings, advanced stock screeners, Quant Ratings, earnings call transcripts, crowdsourced investment analysis.

Pricing: Limited free version available. Seeking Alpha Premium is required for most key features (currently $239/year).

Link: Seeking Alpha

Investment Tracking Apps Feature Comparison

Platform | Core Features / Yield Focus | User Experience / Quality ★ | Value Proposition / Price 💰 | Target Audience 👥 | Unique Selling Points ✨ |

|---|---|---|---|---|---|

🏆 Yield Seeker | AI-driven, real-time DeFi yield optimizer for USDC on BASE chain | ★★★★★ Transparent, intuitive dashboard | 💰 Low $10 min deposit, no fees | Novices & seasoned DeFi users | ✨ Personalized AI Agent, automated yield maximization, no lockups |

Empower Personal Dashboard | Free portfolio & net worth tracking across banks | ★★★★ Robust analytics, occasional sync issues | 💰 Free (with advisory upsells) | Investors wanting free analytics | ✨ Fee & retirement analysis |

Quicken Simplifi | Cloud budgeting & investment tracker | ★★★★ Beginner-friendly UI, reliable alerts | 💰 Paid plans, affordable | Beginners & budget-conscious users | ✨ Real-time alerts & cross-platform |

Quicken Classic Premier | Desktop investment tracking with tax reports | ★★★★ Deep, detailed reports but desktop-only | 💰 Paid software | Advanced investors preferring desktop | ✨ Full transaction control |

Sharesight | Multi-broker stock & dividend tracker | ★★★★ Strong dividend/tax views | 💰 Free tier up to 10 holdings | Multi-market investors | ✨ Tax reports, broker import |

Kubera | Premium, privacy-focused multi-asset tracker | ★★★★ Elegant UI, privacy-first | 💰 High subscription | Wealthy individuals & advisors | ✨ Estate planning, broad asset coverage |

Yahoo Finance | Market portal with portfolio & advanced analytics | ★★★★ News, data, alerts, cross-platform | 💰 Free + paid advanced tiers | General investors | ✨ Third-party research integration |

Delta Investment Tracker | Mobile-first multi-asset portfolio tracker | ★★★★ Strong mobile UX & notifications | 💰 Free + PRO subscription | Mobile users, crypto & traditional investors | ✨ Crypto & NFT support |

Monarch Money | Subscription money manager with budgeting & tracking | ★★★★ Clean UX, unlimited connections | 💰 Paid subscription | Households with budgeting needs | ✨ Apple Card, Coinbase, Zillow integration |

Tiller | Spreadsheet automation feeding bank-grade data | ★★★★ Ultimate customization, DIY setup | 💰 Paid subscription | Spreadsheet-savvy DIY users | ✨ Bank-grade feeds into Sheets/Excel |

Fidelity Full View | Fidelity client portfolio & budgeting snapshot | ★★★★ Free for Fidelity users, some sync issues | 💰 Free for Fidelity users | Fidelity customers | ✨ Household aggregation with eMoney integration |

Seeking Alpha | Portfolio tool + alerts & crowdsourced analysis | ★★★★ Extensive research, paid Premium tier | 💰 Paid Premium needed for full features | Research-focused investors | ✨ Quant grades, earnings transcripts |

Choosing the Right App for Your Investment Style

Navigating the crowded landscape of financial technology can feel overwhelming, but selecting from the best investment tracking apps is a crucial step toward achieving financial clarity and control. As we've explored, the ideal platform is not a one-size-fits-all solution; it is deeply personal and depends entirely on your investment philosophy, the complexity of your portfolio, and your long-term goals.

The journey begins with an honest assessment of your needs. Are you a meticulous budgeter who lives and breathes spreadsheets? A tool like Tiller or Quicken Classic Premier will feel like a natural extension of your process, offering unparalleled control and customization. Conversely, if you're a busy professional who simply wants a high-level, automated overview of your net worth, the powerful and free analytics of Empower Personal Dashboard or the sleek interface of Monarch Money will serve you best.

Aligning Tools with Your Investment Strategy

The most effective approach is to match the tool to your primary objective. Consider the following archetypes to find your best fit:

The Holistic Planner: For investors who need to see everything in one place, from their 401(k) and brokerage accounts to real estate and crypto, Empower, Kubera, and Fidelity Full View excel. They consolidate disparate assets into a single, comprehensive dashboard.

The Active Researcher: If your strategy involves deep dives into individual stocks and market analysis, Seeking Alpha and the advanced charting tools within Yahoo Finance provide the research and data necessary to make informed decisions.

The Set-It-and-Forget-It Optimizer: For crypto-savvy investors focused on passive income without the daily grind, a specialized platform is essential. A tool like Yield Seeker stands out by automating complex DeFi strategies, making it perfect for those wanting to maximize returns on stablecoins with minimal effort.

The Global and Niche Investor: Portfolios that include international stocks or less common asset classes require specialized tracking. Sharesight is a leader in this area, offering robust multi-currency and tax-reporting features that generalist apps often lack. If your investment style leans towards currency exchange, consider exploring dedicated platforms. For instance, you might find valuable insights in articles discussing the top forex apps for trading, which cater specifically to foreign exchange markets.

Final Thoughts on Implementation

Ultimately, the best investment tracking app is the one you will consistently use. Don't be afraid to take advantage of free trials to test the user interface and connection stability with your financial institutions. The right app will transform your relationship with your finances, shifting you from a passive observer to an empowered architect of your financial future. It provides the data-driven confidence needed to navigate market volatility, identify opportunities, and stay firmly on course toward your wealth-building objectives.

Ready to put your stablecoins to work? If you're looking for an intelligent, hands-off approach to generating yield in the DeFi space, explore Yield Seeker. It's the perfect tool for investors who value an automated, optimized strategy for passive income. Visit Yield Seeker to learn how AI-powered agents can enhance your crypto portfolio.