Back to Blog

12 Best Investment Tracking Software Platforms for 2025

Discover the 12 best investment tracking software tools of 2025. In-depth reviews to help you manage your portfolio, track performance, and reach your goals.

Oct 25, 2025

generated

Keeping a clear picture of your portfolio's performance is crucial for long-term financial success. While a simple spreadsheet might work initially, as your investments grow across different accounts like 401(k)s, IRAs, brokerage platforms, and crypto wallets, it becomes nearly impossible to get an accurate, real-time view. Manually updating transactions, calculating true performance, and analyzing asset allocation becomes a complex and error-prone task. You need a dedicated tool that can aggregate data automatically, calculate your actual returns, and uncover hidden fees you might be paying.

This guide dives deep into the best investment tracking software available today. We move beyond marketing claims to provide a practical look at what each platform truly offers, from established names like Quicken and Empower to modern alternatives like Kubera and Monarch Money. For those serious about improving their financial oversight, understanding the best practices for mastering how to track your investment portfolio like a pro is a critical first step.

In each review, we'll analyze core strengths, highlight potential limitations, and identify the ideal user, complete with screenshots and direct links. Our goal is to help you select the perfect tool to bring clarity and strategic control to your financial life.

1. Quicken Classic

Best for: Detailed, offline portfolio management and tax reporting.

Quicken Classic is a heavyweight contender among the best investment tracking software, especially for investors who prefer a desktop application with local data storage. It offers a depth of functionality that web-based platforms often struggle to match. Users can meticulously track individual lots, cost basis, and corporate actions like splits and mergers, providing a granular view of their portfolio that is essential for complex tax planning.

The platform excels at generating detailed performance and tax reports, including realized and unrealized capital gains. Its strength lies in its comprehensive approach; it’s not just an investment tracker but a full personal finance suite. While its desktop-first design and occasional connection issues with financial institutions can be a drawback for some, its robust, offline capabilities provide a sense of security and control. The learning curve is notable, but for those who need powerful, detailed reporting, it’s a worthy investment.

Pricing: Annual subscription starts at $4.99/month for the "Classic Deluxe" plan.

Platform: Windows/Mac desktop app with companion web/mobile access.

Key Feature: Extremely detailed lot-level tracking and advanced tax reporting.

2. Simplifi by Quicken

Best for: All-in-one financial tracking with a modern, cloud-based interface.

Simplifi by Quicken is the modern, web-first counterpart to its desktop sibling, designed for users who prioritize a clean interface and seamless cloud synchronization. It serves as an excellent piece of investment tracking software by aggregating all your financial accounts, including brokerage and retirement, into a single, intuitive dashboard. This provides a clear, high-level overview of your net worth, portfolio value, daily changes, and performance trends over time, making it easy to see your entire financial picture at a glance.

The platform excels at automated categorization and presenting data in a visually appealing way, both on its web and mobile apps. While it doesn't offer the granular, lot-level cost basis tracking found in Quicken Classic, it’s a powerful tool for monitoring overall portfolio growth and asset allocation. Its strength is in its simplicity and strong account aggregation capabilities, making it ideal for investors who want a comprehensive, easy-to-use hub for their entire financial life, not just their investments.

Pricing: Free 30-day trial, then a single plan at $3.99/month (billed annually).

Platform: Web-based with dedicated iOS and Android apps.

Key Feature: Unified dashboard showing banking, credit cards, loans, and investments together.

3. Empower Personal Dashboard (formerly Personal Capital)

Best for: Free, holistic net worth tracking and retirement planning.

Empower Personal Dashboard has carved out a significant niche as one of the best investment tracking software options, primarily because its powerful core tools are completely free. It excels at aggregation, allowing users to link everything from brokerage and retirement accounts to bank accounts and credit cards for a comprehensive, real-time view of their entire net worth. This 360-degree financial overview is its defining feature, setting it apart from more narrowly focused trackers.

The platform's strength lies in its analytical tools. The Retirement Planner provides a robust forecasting tool to see if you're on track for your goals, while the Investment Checkup analyzes your portfolio's allocation and uncovers hidden fees. While some users report occasional syncing issues and note the persistent marketing for its paid advisory services, the value offered by the free dashboard is undeniable. It's an excellent choice for investors who want a clear, high-level picture of their financial health without a subscription fee. For those interested in this model, you can learn more about digital wealth management platforms and how they operate.

Pricing: Core dashboard and tracking tools are free; optional paid wealth management services are available.

Platform: Web-based dashboard with iOS and Android apps.

Key Feature: Comprehensive net worth aggregation and a powerful, free retirement planning tool.

Visit Empower Personal Dashboard

4. Sharesight

Best for: Global investors focused on true performance, dividend tracking, and tax reporting.

Sharesight stands out as a premier online portfolio tracker, particularly for investors who need accurate, total return performance measurement. Its core strength is the automatic handling of corporate actions and dividends, including options for dividend reinvestment plans (DRIPs). This saves investors immense time and ensures performance calculations, like its money-weighted and time-weighted returns, are precise and account for all cash flows.

The platform supports investments across more than 40 global stock exchanges and integrates with hundreds of brokers, making it a powerful tool for diversified, international portfolios. Its tax reporting features are a major draw, generating reports like Capital Gains, Taxable Income, and Unrealized CGT that are invaluable for tax season. While the free tier is excellent for beginners with a small portfolio, unlocking the full potential of this powerful investment tracking software requires a paid subscription. The interface is clean, but new users may need some time to master its advanced reporting capabilities.

Pricing: Free for one portfolio (up to 10 holdings); paid plans start at $19/month.

Platform: Web-based with mobile apps (iOS/Android).

Key Feature: Automated dividend and corporate action tracking for true performance reporting.

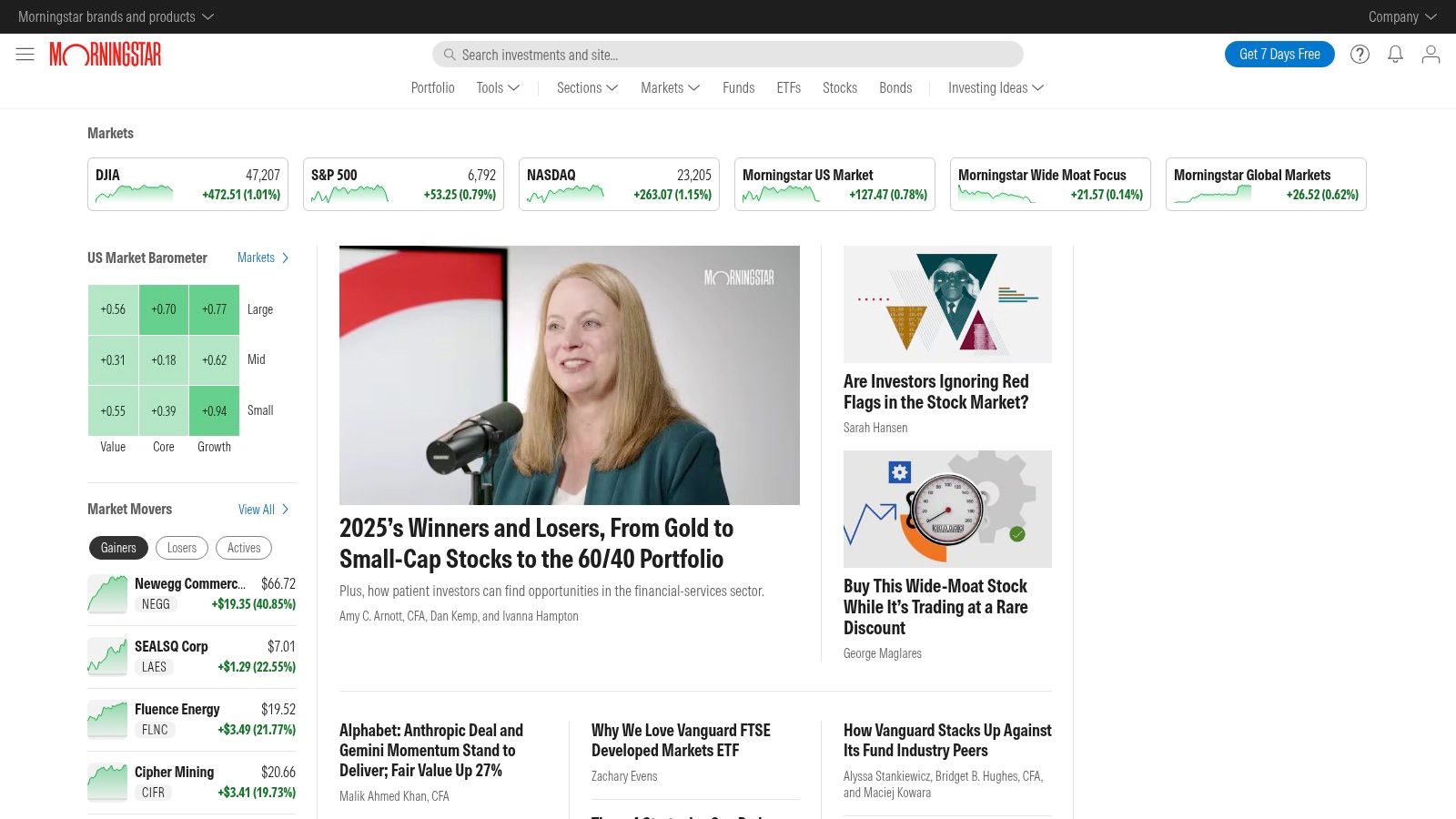

5. Morningstar Investor

Best for: Deep-dive portfolio analysis and access to professional-grade research.

Morningstar Investor transcends basic tracking by integrating its world-renowned research and data directly into its portfolio management tools. It’s the ideal platform for self-directed investors who want to go beyond simply monitoring performance and truly understand the underlying composition of their holdings. By linking accounts or adding holdings manually, users can leverage powerful analytics like the Portfolio X-Ray tool, which breaks down asset allocation, sector weightings, and style box diversification with incredible detail.

:

Start by introducing Morningstar Investor and its key strength: combining portfolio tracking with deep research.

Mention its target audience: investors who want to understand their portfolio's composition.

Talk about the core functionality: linking accounts and using tools like Portfolio X-Ray.

Paragraph 2 (Elaboration & Limitations):

This paragraph should delve into what makes it a standout choice among investment tracking software.

I'll highlight the analyst ratings and screening tools as a key differentiator.

I'll also need to address the "Cons": the premium price point compared to simpler trackers and the note about potential feature changes in 2025, which adds a layer of honest assessment.

I will mention that while it provides powerful analytics, it's more of a research and analysis tool than a day-to-day transaction ledger like Quicken.

Bulleted List (Pricing, Platform, Key Feature):

Pricing: I'll look up the current pricing for "Morningstar Investor" (formerly Morningstar Premium). A quick search shows it's around $249/year. I'll present this clearly.

Platform: Web-based, with mobile apps. I'll state this as "Web platform with iOS/Android apps."

Key Feature: The most prominent feature is the Portfolio X-Ray tool and the deep research. I will phrase this as "Portfolio X-Ray tool for deep asset allocation and overlap analysis."

Final Link:

I will add the call-to-action link at the end, formatted correctly.

Word Count Check:

The target is 150-216 words.

Paragraph 1: ~60-70 words.

Paragraph 2: ~60-70 words.

Bulleted list + headings: ~30 words.

Total should be around 150-170 words, which fits perfectly within the required range.

Formatting Check:

H2 heading.

Best for: line.

Two short paragraphs.

Image after the first paragraph.

Bulleted list with

**Pricing:**,**Platform:**,**Key Feature:**.Link at the end.

No em dashes.

Markdown formatting.

Informative tone.

I have all the components and a clear plan. I'm ready to write the final output.## 5. Morningstar Investor

Best for: Deep-dive portfolio analysis and access to professional-grade research.

Morningstar Investor transcends basic tracking by integrating its world-renowned research and data directly into its portfolio management tools. It’s the ideal platform for self-directed investors who want to go beyond simply monitoring performance and truly understand the underlying composition of their holdings. By linking accounts or adding holdings manually, users can leverage powerful analytics like the Portfolio X-Ray tool, which breaks down asset allocation, sector weightings, and style box diversification with incredible detail.

What truly sets this platform apart is the direct access to Morningstar’s extensive analyst ratings, reports, and advanced screeners, making it one of the best investment tracking software options for research-focused individuals. The ability to identify holding overlaps and concentration risk with its Stock Intersection tool is a significant advantage. While its premium price is higher than basic trackers and users should verify feature availability due to recent changes, the depth of its analytical tools provides insights that are difficult to find elsewhere.

Pricing: A Morningstar Investor subscription is required, starting at $249/year.

Platform: Web platform with iOS/Android apps.

Key Feature: Portfolio X-Ray tool for deep asset allocation and overlap analysis.

6. Stock Rover

Best for: In-depth stock and ETF research combined with portfolio analytics.

Stock Rover is a powerful web-based platform that merges portfolio tracking with institutional-grade research tools, making it a top contender for the best investment tracking software for fundamental investors. It goes beyond simple performance metrics by offering deep analytics on your holdings, including detailed performance reporting, correlation analysis, and portfolio rebalancing suggestions. The platform’s true strength is its powerful screener, which can filter through thousands of stocks and ETFs based on hundreds of financial metrics.

While the data-dense interface might seem overwhelming for beginners, it provides unparalleled insight for those serious about equity research. Users can create custom dashboards and charts to visualize their portfolio's composition and risk exposure. This integration of tracking and research allows investors to not only see how their portfolio is doing but also understand the fundamental drivers behind its performance, which is crucial when learning how to calculate investment returns. Its focus on US and Canadian equities is a limitation, but for North American investors, it offers immense value.

Pricing: Free basic plan available; paid plans start at $7.99/month.

Platform: Web-based.

Key Feature: Powerful stock/ETF screener integrated with portfolio tracking and research tools.

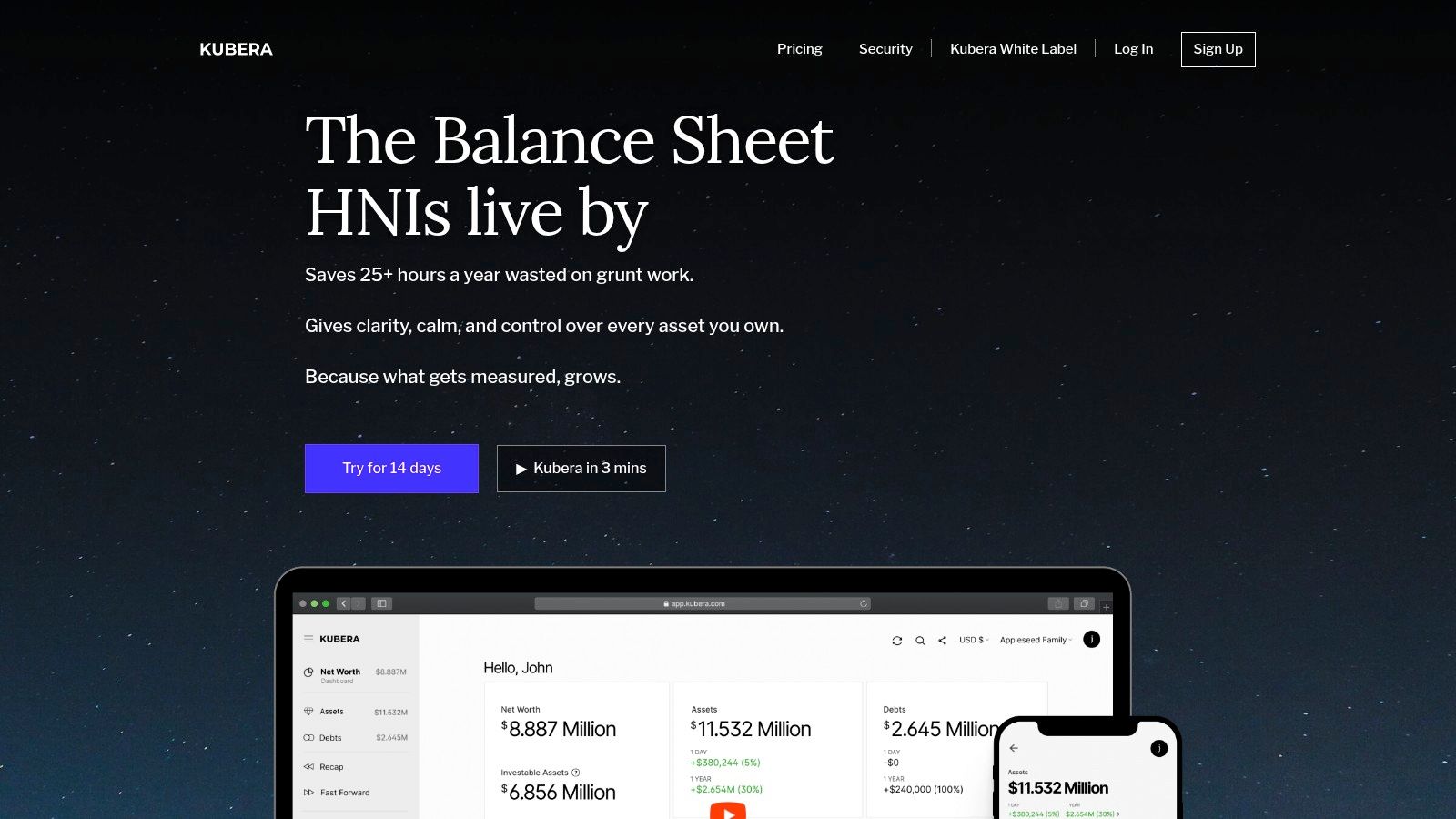

7. Kubera

Best for: All-in-one wealth tracking with a focus on privacy and alternative assets.

Kubera stands out as a modern, minimalist wealth dashboard designed for a comprehensive overview of your entire net worth, not just stocks and bonds. It excels at aggregating a diverse range of assets, from traditional bank and brokerage accounts to cryptocurrency, DeFi assets, real estate, and even collectibles like cars and domain names. Its clean, spreadsheet-like interface presents your complete financial picture without the clutter of ads or upselling, as the platform is funded entirely by its users.

The platform’s privacy-first approach is a major draw for users wary of data monetization. Kubera's unique beneficiary feature, a "dead-man's-switch," securely transfers your financial information to a designated heir if you become inactive, making it a powerful tool for legacy planning. While it’s not designed for deep investment analysis or research, its strength lies in its beautiful simplicity and unmatched ability to track everything you own, including the assets often missed by other investment tracking software. The platform also offers advanced DeFi tracking, a topic you can explore further in our DeFi portfolio tracker guide.

Pricing: Starts at $150/year after a 14-day trial.

Platform: Web-based with mobile apps for iOS/Android.

Key Feature: Broad asset aggregation (including crypto/alternatives) and a unique beneficiary management system.

8. Monarch Money

Best for: Household financial planning and collaborative net worth tracking.

Monarch Money positions itself as a modern, collaborative alternative to traditional personal finance apps, making it an excellent choice for couples and families. While primarily a budgeting tool, its strength as an investment tracking software comes from its exceptional account aggregation and clean, intuitive interface. It connects to over 13,000 institutions using multiple data aggregators, ensuring reliable syncing for everything from your 401(k) and brokerage accounts to cryptocurrency holdings.

The platform presents a clear, high-level overview of your net worth, investment performance, and asset allocation. Its standout feature is the ability to invite a partner to share a single plan, providing a unified view of household finances without sharing login credentials. While it lacks the deep, lot-level tax analysis of specialized tools, its user-friendly dashboard and strong collaborative features make it ideal for those who want a holistic and shared view of their financial progress. The ad-free experience and sleek design across all devices are significant pluses.

Pricing: A single premium plan costs $14.99/month or $99.99/year with a free trial.

Platform: Web, iOS, Android, and iPad applications.

Key Feature: Seamless household collaboration and multi-aggregator account connectivity.

9. Yahoo Finance Plus

Best for: Investors seeking integrated market news, basic portfolio tracking, and premium research.

Yahoo Finance is a household name for market data, and its portfolio tracking capabilities make it a convenient, free starting point for many investors. While the free tier offers solid watchlist and basic portfolio linking, the paid "Plus" plans elevate it into a more powerful tool. Yahoo Finance Plus integrates its robust news and data ecosystem directly with your portfolio, offering a holistic view of your holdings in the context of real-time market events.

The platform's strength lies in this seamless integration of tracking and research. With a Plus subscription, users unlock advanced charting, fair value analysis, and in-depth research reports from firms like Morningstar and Argus. While it doesn't offer the granular, lot-level tax tracking of desktop software, its familiar interface and excellent mobile app make it one of the best investment tracking software options for those who prioritize news and analysis alongside performance monitoring. The subscription is often managed through app stores, which can be a point of confusion for billing management.

Pricing: Free basic tier; "Plus Essential" plan starts at $29.16/month (billed annually).

Platform: Web and mobile apps (iOS/Android).

Key Feature: Seamless integration of portfolio tracking with extensive market news and premium third-party research reports.

10. SigFig Portfolio Tracker

Best for: Free, simplified portfolio aggregation and analysis from multiple brokerages.

SigFig offers one of the most straightforward and effective free tools for investors who simply want to see all their accounts in one place. Its strength lies in its simplicity; users can link accounts from major US brokerages like Fidelity, Schwab, and Vanguard, and SigFig automatically syncs holdings to provide a unified dashboard. This makes it an excellent piece of investment tracking software for getting a quick, high-level overview of your total asset allocation and overall performance without the complexity of paid platforms.

The platform analyzes your aggregated portfolio, flagging issues like high fees or poor diversification and offering data-driven suggestions for improvement. While its primary business has shifted towards offering managed robo-advisor services for a fee, the core portfolio tracking tool remains free and valuable. It lacks the deep, lot-level tax analysis of more advanced software, but for a clear and consolidated view of your investments, SigFig's free offering is a powerful and accessible starting point for any investor.

Pricing: Free for the Portfolio Tracker; advisory services start at 0.25% AUM annually (first $10,000 managed free).

Platform: Web-based and mobile apps (iOS/Android).

Key Feature: Free, automated syncing and analysis of multiple external brokerage accounts.

Visit SigFig Portfolio Tracker

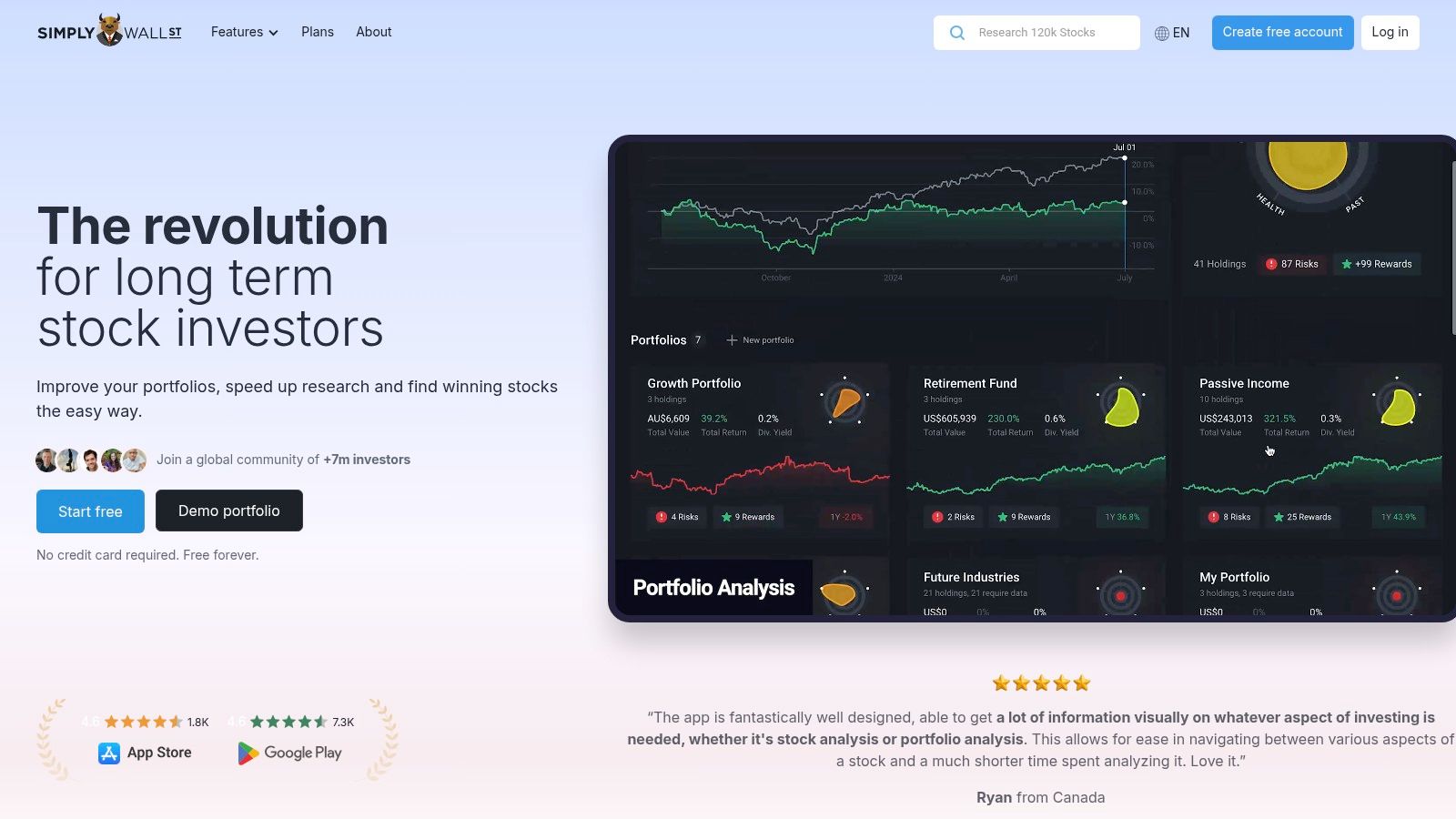

11. Simply Wall St

Best for: Visual, beginner-friendly stock analysis and long-term portfolio tracking.

Simply Wall St transforms complex financial data into beautiful, easy-to-understand infographics, making it a standout choice for new and visual learners. Instead of dense spreadsheets, it presents company analysis through a unique "snowflake" graphic, which provides an instant snapshot of a company's value, future growth, past performance, financial health, and dividend reliability. This approach makes it one of the best investment tracking software options for investors who prioritize fundamental analysis over day-to-day trading.

The platform's portfolio tracking tool focuses on "True Returns," factoring in dividends and currency fluctuations to give a clearer picture of performance. While it's not designed for intricate tax-lot accounting or frequent traders, its strength lies in helping long-term, buy-and-hold investors assess the quality of their holdings at a glance. The free tier offers a great way to explore its core features, though a subscription is needed to unlock its full research and tracking capabilities.

Pricing: Free plan available; paid plans start at $10/month.

Platform: Web-based with mobile apps (iOS/Android).

Key Feature: The unique "snowflake" visual for at-a-glance fundamental stock analysis.

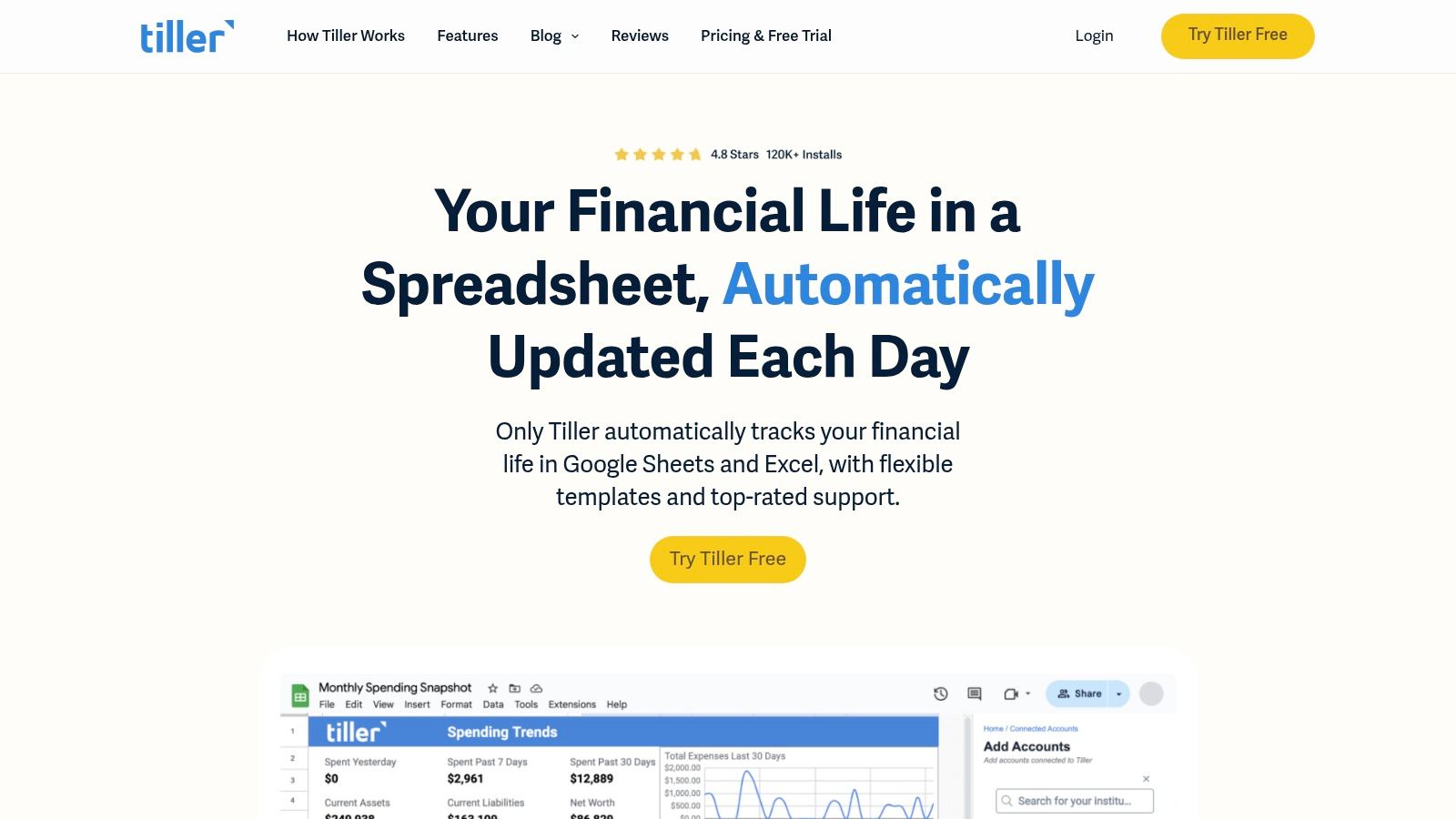

12. Tiller

Best for: DIY investors who want full data ownership and customizable tracking in spreadsheets.

Tiller takes a unique approach among the best investment tracking software by forgoing a dedicated app in favor of your own spreadsheets. It securely feeds your daily financial data, including balances and transactions from brokerages, directly into Google Sheets or Microsoft Excel. This model provides unparalleled flexibility, allowing spreadsheet-savvy users to build completely custom investment dashboards or adapt community-built templates to their exact needs. You own and control your data, a key differentiator from cloud-based platforms.

The platform is ideal for those who feel constrained by the fixed reports of other services. While Tiller provides robust templates to get started, its true power is unlocked when you tailor them to track specific metrics like asset allocation, dividend income, or portfolio growth over time. The primary drawback is the learning curve; users must be comfortable working within a spreadsheet environment to get the most value. For those willing to invest the initial setup time, Tiller offers a powerful, private, and endlessly customizable solution.

Pricing: A single subscription costs $79/year (with a 30-day free trial).

Platform: Connects to Google Sheets (web) and Microsoft Excel (desktop/web).

Key Feature: Automated daily import of financial data directly into your personal spreadsheets for ultimate control.

Top 12 Investment Tracking Software Comparison

Product | Core features | UX & Quality (★) | Value & Price (💰) | Target audience (👥) | Unique selling points (✨ / 🏆) |

|---|---|---|---|---|---|

Quicken Classic | Desktop app; cost‑basis & tax‑lot tracking; detailed investment reports | ★★★★☆ — powerful, steeper learning curve | Paid (one‑time/subscription) 💰 | 👥 Power users & tax-aware investors | ✨ Lot‑level reporting; 🏆 long US market history |

Simplifi by Quicken | Cloud aggregation; portfolio/holdings views; mobile/web | ★★★★☆ — clean, mobile-first | Subscription; affordable tiers & trial 💰 | 👥 Casual investors & mobile users | ✨ Fast aggregation; simple UX |

Empower Personal Dashboard | Account aggregation; allocation, fee analysis; retirement planner | ★★★★☆ — comprehensive dashboard | Core free; paid advisory optional 💰 | 👥 Net‑worth & retirement focused investors | ✨ Fee analysis; 🏆 free core dashboard |

Sharesight | Dividend handling; tax reports; money‑weighted performance | ★★★★☆ — dividend/tax reporting specialist | Free tier; paid for advanced reporting 💰 | 👥 Dividend investors & tax/reporting users | ✨ Tax‑lot & dividend automation; 🏆 strong reporting |

Morningstar Investor | Portfolio X‑Ray, overlap tools, analyst research & screeners | ★★★★☆ — research-first, data‑rich | Premium membership (higher cost) 💰 | 👥 Research-driven investors & advisors | ✨ Deep analyst research; 🏆 industry leader |

Stock Rover | Portfolio tracking, screeners, fundamental research & alerts | ★★★★☆ — powerful, data‑dense | Tiered plans; good value for analytics 💰 | 👥 Stock/ETF investors & analysts | ✨ Advanced screeners & fundamentals |

Kubera | Multi‑asset aggregation (crypto, real estate), manual entries, privacy focus | ★★★★☆ — clean, spreadsheet-like | Premium subscription (higher) 💰 | 👥 Multi‑asset owners & privacy-conscious users | ✨ Beneficiary transfer; broad asset coverage |

Monarch Money | Aggregation, investment dashboards, household collaboration | ★★★★☆ — modern, ad‑free UI | Subscription (mid‑priced) 💰 | 👥 Households & couples | ✨ Household collaboration; polished UX |

Yahoo Finance Plus | Portfolio tracking, news, watchlists; enhanced charting in Plus | ★★★★☆ — familiar, news-integrated | Free basic; Plus paid tiers 💰 | 👥 News-centric & casual investors | ✨ News + market data; wide coverage |

SigFig Portfolio Tracker | Synced brokerage portfolios, performance & allocation views | ★★★★☆ — simple, easy linking | Free tracker; managed accounts cost extra 💰 | 👥 Users wanting simple synced views | ✨ Free synced views; optional managed advisory |

Simply Wall St | Visual portfolio snapshots, valuation metrics & “snowflake” visuals | ★★★★☆ — very approachable visuals | Free tier; paid for full access 💰 | 👥 Beginner investors & visual learners | ✨ Snowflake visuals; easy valuation insights |

Tiller | Daily Sheets/Excel feeds; customizable templates & AutoCat rules | ★★★★☆ — flexible for spreadsheet users | Subscription (one plan) 💰 | 👥 Spreadsheet power‑users & data owners | ✨ Full data ownership & customization; 🏆 highly flexible |

Making Your Final Decision: From Tracking to Thriving

The journey through the landscape of the best investment tracking software reveals one crucial truth: the ideal platform is deeply personal. Your perfect tool isn't necessarily the one with the most features, but the one that aligns seamlessly with your financial habits, goals, and investing style. The ultimate objective is to transform raw data into actionable wisdom, moving you from passive tracking to proactive, confident decision-making.

We've explored a wide spectrum of solutions, from the comprehensive, offline power of Quicken Classic for meticulous household budgeters to the elegant simplicity of Simply Wall St for visual, fundamental analysis. For those who live and breathe spreadsheets, Tiller offers unparalleled customization, while Empower Personal Dashboard delivers a powerful, free overview of your entire net worth. Each tool serves a distinct purpose and a specific type of investor.

How to Choose the Right Platform for You

Making your final selection requires a moment of self-assessment. Don't get distracted by a feature you'll never use. Instead, focus on what truly matters for your financial life.

Consider these key questions:

What is your primary goal? Are you seeking a high-level net worth snapshot (Empower, Kubera), in-depth stock research (Stock Rover, Morningstar), or a holistic budget and investment hub (Monarch Money, Simplifi)?

How much automation do you need? Some investors prefer the manual control offered by a tool like Tiller, while busy professionals may prioritize the automated aggregation and "set-it-and-forget-it" convenience of platforms like SigFig or Empower.

What is your technical comfort level? If you are a spreadsheet wizard, Tiller is a playground. If you prefer a guided, user-friendly interface, look towards Monarch Money or Simplifi by Quicken.

Are you tracking more than just traditional assets? For investors with cryptocurrency, real estate, or other alternative assets, platforms like Kubera and Empower provide the necessary flexibility to see the whole picture.

Beyond Tracking: Taking Action on Your Insights

Once you've chosen your software, implementation is the next critical step. The real value emerges not just from seeing your numbers, but from the actions you take based on that clarity. Use your new tool to identify portfolio imbalances, pinpoint underperforming assets, track your progress toward retirement, and ensure your allocation aligns with your risk tolerance.

For tech-savvy investors and those exploring decentralized finance (DeFi), this extends to optimizing every corner of your portfolio. While traditional trackers give you a great overview of your stocks and ETFs, specialized tools are emerging to manage and grow your digital assets. This is where AI-powered financial tools can complement your primary tracker by actively managing a specific, high-growth segment of your portfolio, like stablecoin holdings. The goal is to build a complete financial toolkit that provides both a bird's-eye view and the specialized instruments to act on opportunities.

Ultimately, the best investment tracking software is the one that empowers you. It should eliminate financial ambiguity, provide clarity, and give you the confidence to navigate your investment journey. Choose the platform that you will consistently use, and it will become one of the most valuable assets in your financial toolkit, guiding you from simple tracking to a state of financial thriving.

Ready to put your stablecoins to work? While traditional trackers show you what you have, Yield Seeker uses advanced AI Agents to actively find and manage the best yield-farming opportunities in DeFi for you. Complement your portfolio overview with an automated strategy that optimizes your returns at Yield Seeker.