Back to Blog

Top 12 Best Micro Investing Apps for Beginners in 2024

Explore the best micro investing apps to start small, automate your investments, and grow wealth. Compare top options now!

Oct 11, 2025

generated

The idea that you need a fortune to start investing is a myth. Thanks to a new wave of financial technology, anyone can begin building wealth with just the spare change from their daily coffee. Micro investing apps have broken down the traditional barriers, allowing you to buy fractional shares of major companies, automate contributions, and grow your portfolio without needing a large upfront sum. These platforms solve a critical problem: making investing accessible to everyone, regardless of their starting capital or experience level.

This guide provides a detailed look at the 12 best micro investing apps available today. We'll analyze their unique features, fee structures, and ideal user profiles to help you find the perfect platform to start your investment journey. A key aspect of building long-term wealth through this method is knowing how to effectively diversify your investment portfolio to mitigate risk, and many of these apps offer tools to help you do just that.

We've done the research so you can make an informed choice. Each option below includes a practical overview, screenshots of the user interface, and direct links to get started. Whether you're a crypto beginner, a busy professional, or simply want to put your stablecoins to work, this comparison is designed to help you select the app that best aligns with your financial goals.

1. Acorns

Acorns is a pioneer in the micro-investing space, making it one of the best micro investing apps for beginners who want to automate their savings. The platform's signature feature, "Round-Ups," links to your bank accounts and credit cards, automatically investing the spare change from your daily purchases. This set-and-forget approach is ideal for those who struggle to save consistently.

It offers professionally managed, diversified portfolios composed of ETFs, tailored to your risk tolerance. Beyond basic investing, Acorns provides options for retirement (Acorns Later), checking (Acorns Checking), and even investment accounts for kids (Acorns Early). The user interface is clean and intuitive, making it easy to track your progress and see your small investments grow over time.

Key Details & Pricing

Best For: Hands-off investors and beginners who want to build a saving habit without thinking about it.

Unique Feature: The "Round-Ups" feature is the core of the experience, seamlessly turning everyday spending into investments.

Pricing: Acorns uses a subscription model with flat monthly fees. The Personal plan is $3/month, and the Family plan, which includes investment accounts for kids, is $5/month.

Pros & Cons

Pros | Cons |

|---|---|

Effortless Automation: Set it once and invest automatically. | Fees: The flat fee can be high for very small balances. |

All-in-One Platform: Integrates investing, retirement, and banking. | Limited Control: Not suitable for active or stock-specific trading. |

Bonus Investments: Earn extra money by shopping with partner brands. | No Tax-Loss Harvesting: Lacks advanced tax-optimization features. |

Learn More: https://www.acorns.com/pricing/

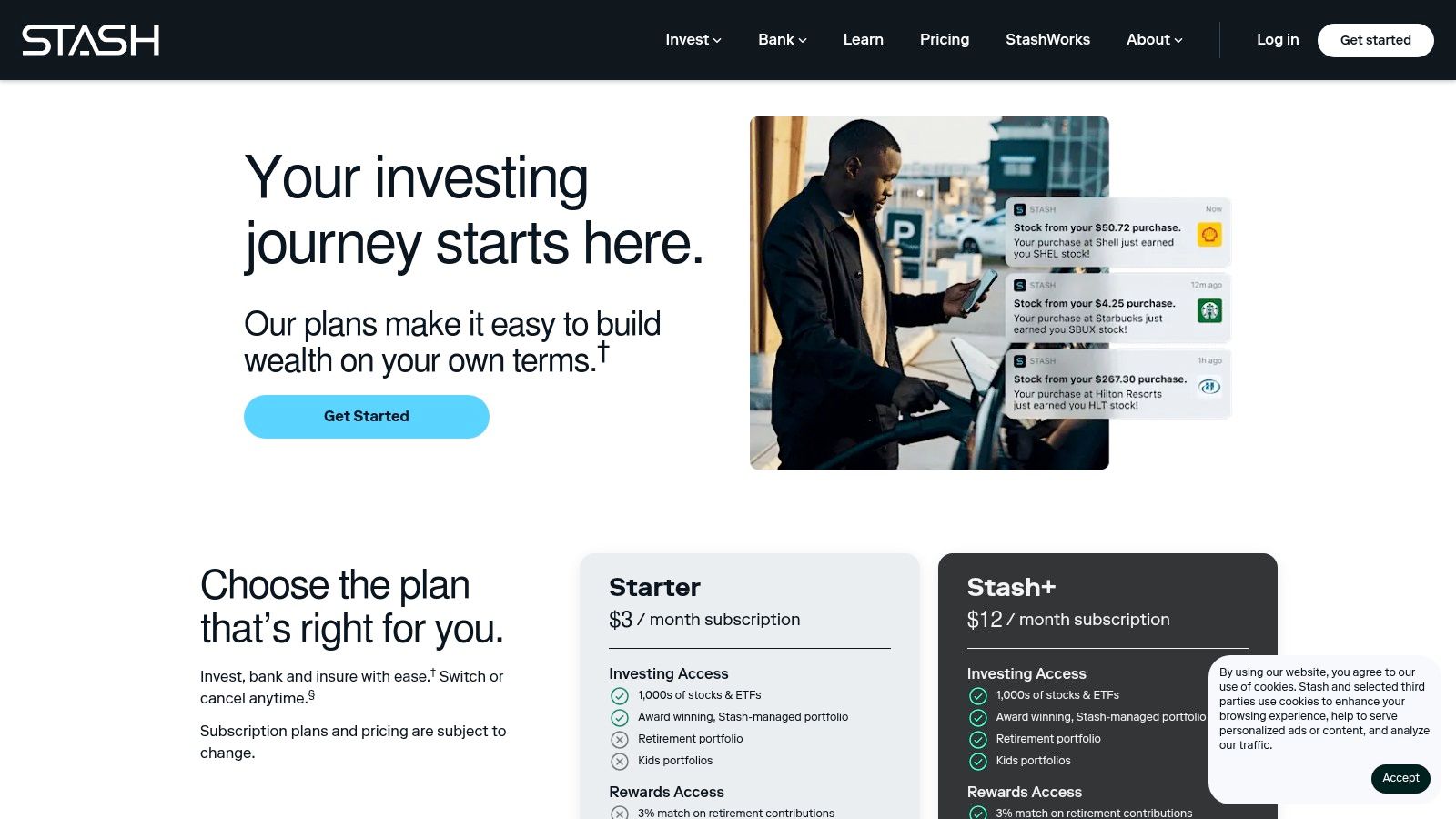

2. Stash

Stash empowers new investors by blending automated micro-investing with the freedom to choose individual stocks and ETFs. It's one of the best micro investing apps for those who want a guided experience but still desire some control over their portfolio. You can start with as little as $1 by purchasing fractional shares, making it accessible to build a portfolio of companies you believe in without needing a large amount of capital.

The platform provides educational content and thematic ETFs (like "Clean & Green" or "Modern Meds") to help you invest based on your values and interests. Stash also integrates banking features, including a Stock-Back® Card that rewards you with stock in the companies you shop with. This creates a holistic financial ecosystem for beginners to learn, save, and invest in one place.

Key Details & Pricing

Best For: Beginners who want to learn and actively pick some investments with guidance.

Unique Feature: The Stock-Back® Card offers a unique way to earn fractional shares from everyday spending.

Pricing: Stash offers two subscription plans. Stash Growth is $3/month, and Stash+ is $9/month, with each tier unlocking more features like retirement accounts and investment accounts for kids.

Pros & Cons

Pros | Cons |

|---|---|

Guidance with Flexibility: Pick stocks and ETFs with helpful tips. | Subscription Fees: Monthly fees can be costly for smaller accounts. |

Fractional Shares: Invest in expensive stocks with a small budget. | Trading Windows: Orders are not executed in real-time. |

Integrated Banking: The Stock-Back® Card links spending to investing. | Limited Advanced Tools: Not designed for experienced day traders. |

Learn More: https://www.stash.com/pricing/

3. Robinhood

Robinhood has become synonymous with commission-free trading, and its approach to fractional shares makes it a powerful choice among the best micro investing apps. The platform allows users to invest in thousands of stocks and ETFs with as little as $1, removing the high-cost barrier of owning shares in major companies. Its streamlined, mobile-first interface is designed for simplicity, making it incredibly easy to start building a portfolio.

While known for active trading, its micro-investing capabilities are robust. You can set up recurring investments to automatically buy small pieces of your favorite stocks on a set schedule. For those looking for more, the Robinhood Gold subscription offers premium features like a 3% match on IRA contributions and a high-yield APY on uninvested brokerage cash, blending micro-investing with more advanced financial tools.

Key Details & Pricing

Best For: New investors who want direct control over their stock and ETF picks without high minimums.

Unique Feature: The ability to buy fractional shares of a vast range of individual stocks for just $1, offering more granular control than ETF-only apps.

Pricing: Standard brokerage account is free (no commissions on trades). Robinhood Gold is $5/month for premium features like higher instant deposit limits and IRA matching.

Pros & Cons

Pros | Cons |

|---|---|

$1 Fractional Shares: Extremely low barrier to entry for any stock. | Limited Research Tools: Lacks the in-depth analytics of other platforms. |

Intuitive Mobile App: User-friendly design ideal for beginners. | Past Regulatory Scrutiny: Has faced controversy over its business practices. |

Instant Funding: Access to funds immediately for faster trading. | Focus on Active Trading: May encourage more frequent trading than passive investing. |

Learn More: https://robinhood.com/us/en/gold

4. Public.com

Public.com stands out by blending micro-investing with a vibrant social community, making it one of the best micro investing apps for those who want to learn from others. The platform allows you to invest in a wide array of assets, including fractional shares of stocks and ETFs, crypto, and even alternatives like Treasuries, with as little as $1. This accessibility is paired with a social feed where you can follow experienced investors, see their trades, and participate in community discussions and live town halls with company executives.

This educational layer helps demystify investing, providing context and insights directly within the app. Public.com offers a transparent fee structure, moving away from Payment for Order Flow (PFOF) and instead using an optional tipping model on trades. The platform is designed for both new and intermediate investors who value community insights and access to a diverse range of investment options beyond just stocks.

Key Details & Pricing

Best For: Community-focused investors and those wanting access to alternative assets like Treasuries.

Unique Feature: An integrated social feed that allows users to follow other investors and share insights.

Pricing: Commission-free stock and ETF trading. Public Premium is $10/month for advanced data and features. Inactivity and other minor fees may apply to standard accounts.

Pros & Cons

Pros | Cons |

|---|---|

Diverse Asset Classes: Invest in stocks, ETFs, crypto, and Treasuries. | Potential Inactivity Fees: Small, idle accounts may incur a fee. |

Strong Educational Focus: Social features promote learning. | Advanced Features are Gated: Some data requires a Premium subscription. |

Transparent Model: Does not use Payment for Order Flow (PFOF). | Social Feed Can Be Noisy: May be distracting for some investors. |

Learn More: https://public.com

5. SoFi Invest

SoFi Invest stands out as a comprehensive financial hub, making it one of the best micro investing apps for those who want to manage their money and investments in one place. It offers both active and automated investing, allowing users to start building a portfolio with as little as $5 through fractional shares. This flexibility caters to new investors who want to buy slices of their favorite stocks and ETFs without committing a large sum of capital.

The platform seamlessly integrates investing with SoFi's other products, including banking, loans, and credit cards, providing a holistic view of your financial life. For those who prefer a hands-off approach, SoFi’s robo-advisory service builds and manages a diversified portfolio for you with no management fees. The app is clean and packed with educational resources, empowering users as they grow more confident in their investment journey.

Key Details & Pricing

Best For: Individuals seeking an all-in-one financial app that combines banking, lending, and both active and automated micro-investing.

Unique Feature: A unified ecosystem where you can invest, bank, and borrow, providing a complete financial picture in a single dashboard.

Pricing: SoFi offers $0 commissions on stock and ETF trades and no management fees for its automated investing service.

Pros & Cons

Pros | Cons |

|---|---|

All-in-One Finance App: Manage multiple aspects of your finances conveniently. | Higher Minimum Investment: The $5 minimum for fractional shares is higher than some competitors. |

No Advisory Fees: Automated investing service comes without management fees. | Market Orders Only: Fractional share trades are currently limited to market orders. |

Active & Passive Options: Choose between self-directed trading and a robo-advisor. | Fewer Advanced Tools: Lacks the sophisticated research tools found on broker-centric platforms. |

Learn More: https://www.sofi.com/invest/fractional-shares/

6. M1 Finance

M1 Finance offers a unique, hybrid approach that combines automated investing with hands-on customization, making it one of the best micro investing apps for those who want more control. The platform is built around "Pies," which are visual representations of your investment portfolio. You can create custom Pies by selecting individual stocks and ETFs, assigning a target percentage to each "slice," and M1 will automatically maintain your desired allocation.

This model is perfect for rules-based, long-term investing using small, recurring contributions. The platform’s dynamic rebalancing automatically directs new funds to underweight slices, ensuring your portfolio stays on track without manual intervention. M1 also integrates its investing service with high-yield savings and flexible borrowing products, creating a cohesive financial ecosystem. Learn more about how M1 compares to other best automated investing platforms.

Key Details & Pricing

Best For: Intermediate investors who want to build and automate a custom portfolio with fractional shares.

Unique Feature: "Investment Pies" allow users to visually construct and automate their own custom portfolios.

Pricing: M1 Finance is generally free to use. A $3/month platform fee applies only to clients with less than $10,000 in combined M1 assets and no active M1 Personal Loan.

Pros & Cons

Pros | Cons |

|---|---|

Custom Automation: Build your own portfolio and fully automate it. | Platform Fee: A fee applies for accounts with smaller balances. |

Fractional Shares: Invest in slices of stocks and ETFs commission-free. | Not for Day Trading: Limited trading windows are designed for long-term investors. |

Dynamic Rebalancing: Intelligently allocates new funds to maintain targets. | Limited Crypto Options: Focus is primarily on stocks and ETFs. |

Learn More: https://m1.com

7. Fidelity 'Stocks by the Slice'

Fidelity, a brokerage giant, enters the micro-investing arena with its "Stocks by the Slice" feature, making it one of the best micro investing apps for those with long-term growth in mind. Instead of a standalone app, this feature is integrated into Fidelity’s powerful platform, allowing you to buy fractional shares of over 7,000 U.S. stocks and ETFs for as little as $1. This approach provides an excellent entry point into the market with a trusted, established firm.

The key benefit is scalability; you can start small with micro-investments and seamlessly grow into a full-fledged, diverse portfolio within the same ecosystem. Fidelity offers robust research tools, educational resources, and zero commissions on online U.S. stock and ETF trades. While the comprehensive platform can seem complex for absolute beginners, it's perfect for users who plan to expand their investing knowledge and portfolio over time without needing to switch platforms.

Key Details & Pricing

Best For: Long-term investors who want to start small but plan to grow into more advanced investing.

Unique Feature: Access to a massive selection of individual stocks and ETFs through fractional shares on a full-service brokerage platform.

Pricing: $0 account minimums and $0 commissions for online U.S. stock and ETF trades.

Pros & Cons

Pros | Cons |

|---|---|

Trusted, Established Broker: Backed by a major financial institution. | Complex Platform: Can be overwhelming for first-time investors. |

Seamless Scalability: Easily transition from micro to macro investing. | Share Limitations: Fractional shares have transfer and voting restrictions. |

No Account Fees: Free to open and maintain an account. | Not a Standalone App: It's a feature within a larger platform. |

Learn More: https://www.fidelity.com/trading/fractional-shares

8. Charles Schwab 'Stock Slices'

For investors who prefer a traditional brokerage but want the flexibility of micro-investing, Charles Schwab's 'Stock Slices' program is an excellent choice. Rather than using an app built around spare change, Schwab allows you to buy fractional shares of any company in the S&P 500 for as little as $5. This feature is integrated directly into its robust, well-regarded brokerage platform, giving you access to blue-chip stocks without needing hundreds or thousands of dollars for a single share.

This approach bridges the gap between the modern simplicity of the best micro investing apps and the powerful tools of a full-service broker. You can purchase up to 30 different stock slices in a single transaction, making it easy to build a diversified portfolio of high-quality companies on a small budget. Schwab’s renowned customer support and extensive research tools are also major advantages for investors who want to grow their knowledge.

Key Details & Pricing

Best For: Investors who want to own pieces of specific, well-known companies within a major brokerage account.

Unique Feature: The ability to buy fractional shares of any S&P 500 company, not just ETFs, with a low minimum.

Pricing: Stock Slices are commission-free. The only cost is the price of the slice itself, starting at a $5 minimum investment per stock.

Pros & Cons

Pros | Cons |

|---|---|

Access to Blue-Chip Stocks: Own fractional shares of top US companies. | Limited to S&P 500: You cannot buy slices of other stocks or ETFs. |

No Commissions: Trades are free, maximizing your small investments. | Not a Standalone App: It is a feature within a full brokerage account. |

Backed by a Major Broker: Benefit from Schwab's platform and support. | Less Automated: Lacks features like round-ups for passive saving. |

Learn More: https://www.schwab.com/fractional-shares-stock-slices/

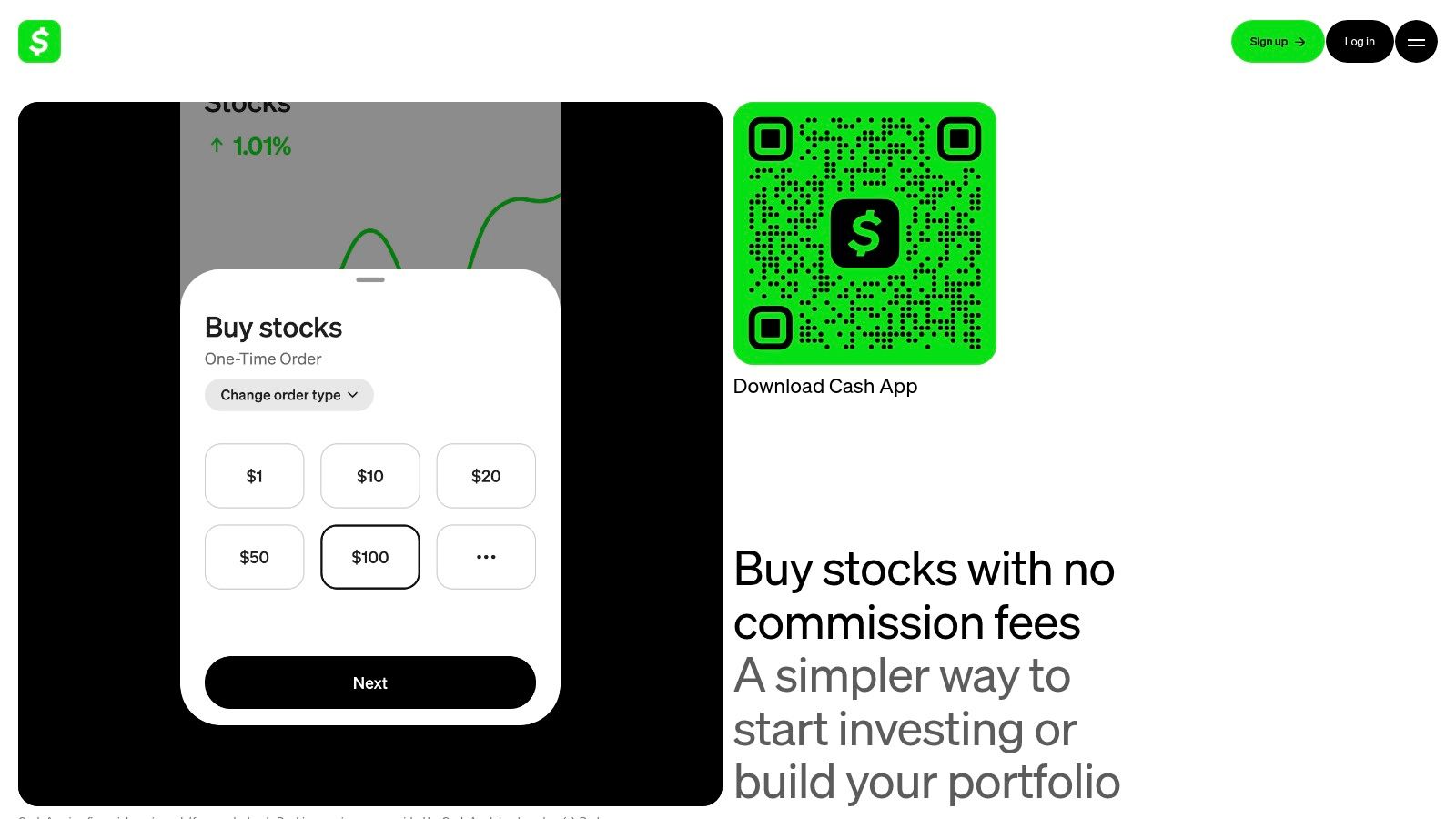

9. Cash App Investing

For the millions who already use Cash App for peer-to-peer payments, Cash App Investing offers one of the most accessible entry points into the stock market. Integrated directly into the familiar app, it allows users to buy and sell stocks and ETFs with as little as $1, making it a frictionless addition for existing users. The platform strips away the complexity of traditional brokerages, focusing on a simple, mobile-first experience.

The platform supports basic automation through recurring buys and a "Round Ups" feature linked to the Cash Card, which invests spare change from purchases. While it lacks the advanced research tools and account types of dedicated brokerage apps, its simplicity is its greatest strength. It’s one of the best micro investing apps for those who want to dip their toes into investing without leaving an ecosystem they already know and trust. For those exploring similar convenient financial tools, see our guide on the best passive income apps.

Key Details & Pricing

Best For: Existing Cash App users and absolute beginners who prioritize convenience and simplicity over advanced features.

Unique Feature: Seamless integration into the Cash App ecosystem, allowing users to invest directly from their cash balance.

Pricing: There are no commissions to buy or sell stocks and ETFs. However, be aware of potential SEC and TAF fees on stock sales.

Pros & Cons

Pros | Cons |

|---|---|

Extremely Convenient: Invest directly within the popular payment app. | Limited Investment Options: Primarily focused on stocks and ETFs. |

No Commissions: Trade stocks and ETFs without commission fees. | Basic Research Tools: Not suitable for in-depth investment analysis. |

Low Barrier to Entry: Start investing with just $1. | Transfer Restrictions: Fractional shares cannot be transferred out. |

Learn More: https://cash.app/stocks

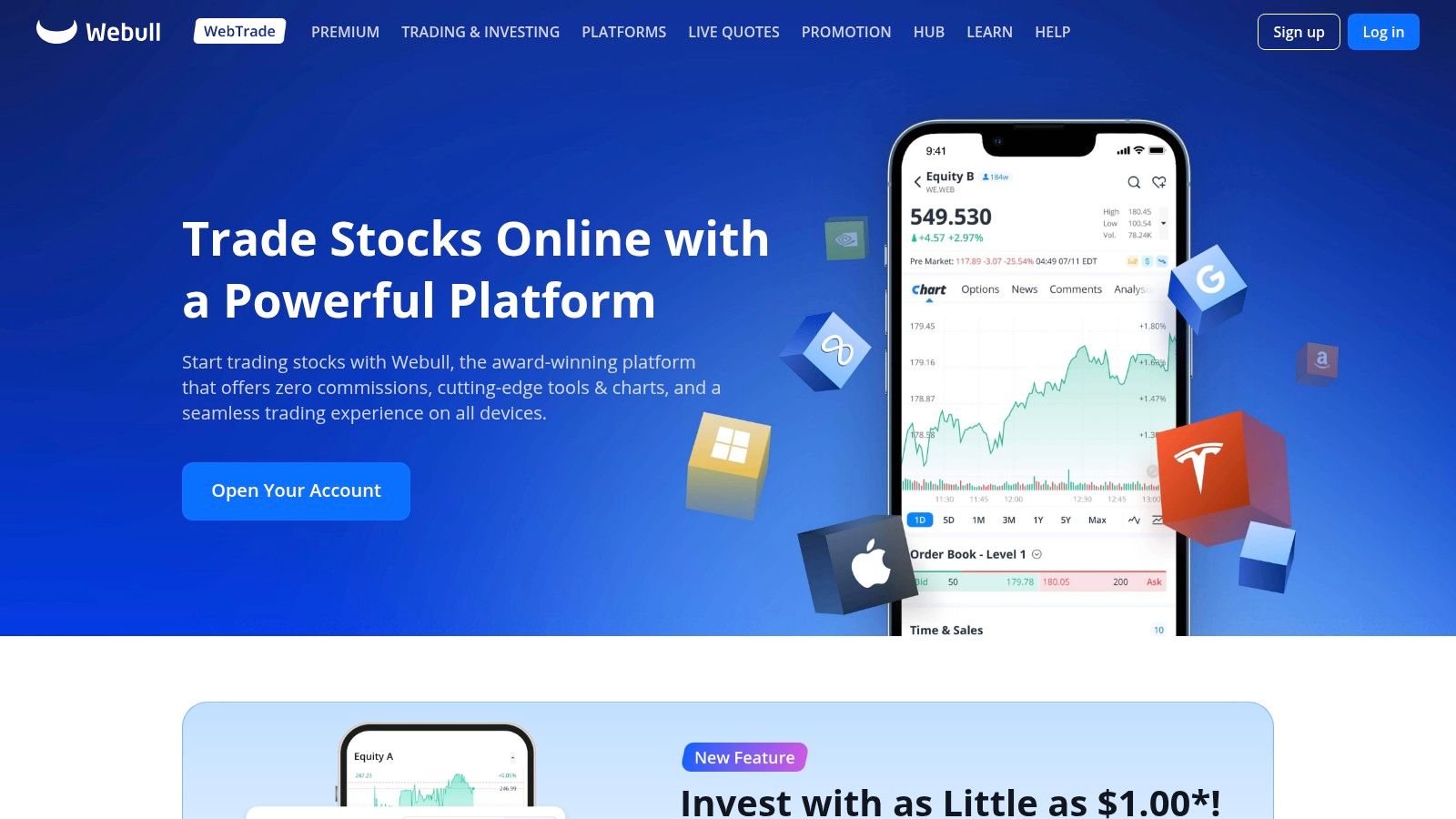

10. Webull

Webull is a commission-free trading platform that has become one of the best micro investing apps for those who want more control and advanced tools. While known for active trading, its fractional share feature allows users to buy pieces of their favorite stocks and ETFs with as little as $1. This makes it a powerful option for building a custom portfolio on a small budget, without being locked into a pre-made robo-advisor selection.

The platform is designed for users who want to graduate from basic micro-investing and engage more deeply with the market. It offers sophisticated charting tools, in-depth analysis, paper trading to practice strategies, and access to options and futures. The user interface is more complex than beginner-focused apps, but it provides a wealth of data for those ready to take a hands-on approach to their small investments.

Key Details & Pricing

Best For: Aspiring active investors who want advanced tools to manage their micro-investments.

Unique Feature: Access to professional-grade charting, technical indicators, and paper trading at no cost.

Pricing: $0 commission on stock, ETF, and options trades. Optional subscriptions are available for advanced data feeds like Level 2 market data.

Pros & Cons

Pros | Cons |

|---|---|

Powerful Trading Tools: Advanced charts and analytics are free. | Steeper Learning Curve: Can be overwhelming for complete beginners. |

Wide Asset Range: Invest in stocks, ETFs, options, and more. | Trading Restrictions: Fractional share trades only execute during market hours. |

No Management Fees: You control your portfolio without advisory fees. | Limited Educational Focus: Less guidance compared to robo-advisors. |

Learn More: https://www.webull.com/fractionalshares

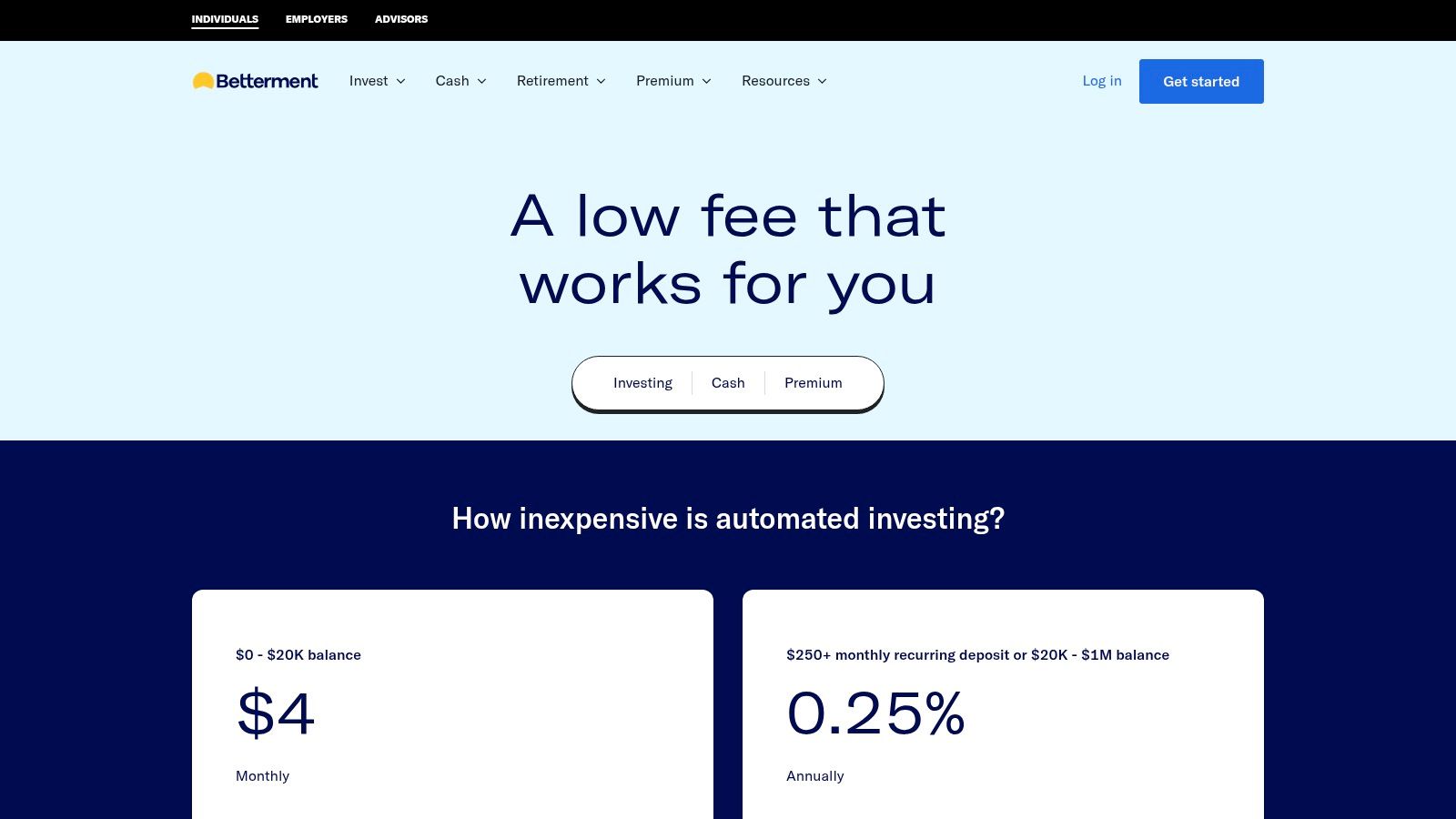

11. Betterment

Betterment is a leading robo-advisor that excels at making sophisticated, goal-based investing accessible, which is why it’s one of the best micro investing apps for long-term planners. The platform automates everything from portfolio selection to rebalancing and dividend reinvestment, allowing you to set up recurring deposits and let the algorithm handle the rest. It's designed for hands-off investors who want a professionally managed portfolio without high fees.

You can set up multiple goals, such as saving for a down payment or retirement, each with its own tailored portfolio and timeline. Betterment also offers advanced features like tax-loss harvesting, which helps optimize your returns by offsetting capital gains. The platform extends beyond investing to include high-yield cash accounts and checking services, creating a holistic financial ecosystem.

Key Details & Pricing

Best For: Goal-oriented investors who want a sophisticated, automated portfolio with tax optimization features.

Unique Feature: Goal-based portfolio management combined with automated tax-loss harvesting to maximize long-term returns.

Pricing: The standard Digital plan charges an annual advisory fee of 0.25% of your balance. The Premium plan, which includes access to human financial advisors, charges 0.40% for balances over $100,000.

Pros & Cons

Pros | Cons |

|---|---|

Sophisticated Automation: Automatic rebalancing and tax-loss harvesting. | Advisory Fees: A percentage-based fee is charged, unlike some free brokers. |

Goal-Based Investing: Easily set up and track multiple financial goals. | Limited Control: You cannot buy individual stocks or ETFs. |

Low Account Minimum: No minimum balance required to get started. | Human Advisor Costs: Access to personalized advice requires a larger balance and higher fee. |

Learn More: https://www.betterment.com/pricing

12. NerdWallet (curated comparison)

While not a micro-investing app itself, NerdWallet is an indispensable resource for comparing the best micro investing apps on the market. It serves as a comprehensive, regularly updated hub that provides detailed editor reviews, side-by-side comparisons, and rankings of top platforms. This makes it a crucial first stop for anyone trying to navigate the crowded landscape of beginner-friendly brokers and find the perfect fit for their financial goals.

The platform excels at breaking down complex fee structures, account minimums, and promotional offers into easily digestible information. By curating this data, NerdWallet helps you quickly identify key differences between apps like Acorns, Stash, and others. This allows you to make an informed decision without spending hours researching each option individually. For further reading, you can also explore other lists of the best investment apps for beginners.

Key Details & Pricing

Best For: New investors who want to research and compare multiple micro-investing apps before committing to one.

Unique Feature: Side-by-side comparison tables that clearly highlight fees, minimums, and current promotions across different platforms.

Pricing: The resource is completely free to use. NerdWallet earns revenue through affiliate partnerships when users sign up for services via their links.

Pros & Cons

Pros | Cons |

|---|---|

Saves Research Time: Consolidates all key info in one place. | Affiliate Model: Always verify final details on the provider's site. |

Highlights Promotions: Easily find sign-up bonuses or offers. | US-Focused: Content is primarily tailored to a US-based audience. |

Objective Reviews: Provides unbiased, expert analysis of each app. | Overwhelming Options: The sheer number of choices can still feel daunting. |

Learn More: https://www.nerdwallet.com/best/investing/stock-apps

Top 12 Micro Investing Apps Comparison

Platform | Core Features / Automation | User Experience / Quality | Value Proposition | Target Audience | Unique Selling Points | Pricing |

|---|---|---|---|---|---|---|

Acorns | Round-ups, expert portfolios | ★★★★ Ease of use | 💰 Subscription + family plans | 👥 Micro-investors, families | ✨ Auto round-ups, kid accounts | 💰 Moderate monthly fee |

Stash | Fractional shares, automated deposits | ★★★★ Beginner guidance | 💰 Subscription-based | 👥 Beginners | ✨ Banking + investing combo | 💰 Subscription fees |

Robinhood | $1 fractional shares, instant funding | ★★★★ Mobile-first, instant | 💰 Free commissions, Gold perks | 👥 New/informal investors | ✨ Gold with cash APY, IRA match | 💰 Free + Gold fee |

Public.com | Fractional shares, social investing | ★★★★ Community & education | 💰 Transparent fees | 👥 Social, education-focused | ✨ Options rebates, social feed | 💰 Mostly free, Premium |

SoFi Invest | Fractional shares from $5, robo-advisory | ★★★★ All-in-one finance app | 💰 Automated portfolios | 👥 Micro + automated investors | ✨ Banking + loans ecosystem | 💰 Free + some fees |

M1 Finance | Pie-based fractional portfolios, auto-rebalancing | ★★★★ Strong automation | 💰 Commission-free, rules-based | 👥 Rules-driven investors | ✨ Custom portfolio pies | 💰 $3/mo under $10k |

Fidelity "Stocks by Slice" | $1 fractional shares, research tools | ★★★★★ Reliable, robust | 💰 No commission, strong safety | 👥 Long-term investors | ✨ SIPC protection, large stock list | 💰 Free trading |

Charles Schwab "Stock Slices" | $5 S&P 500 slices, integrated tools | ★★★★ Stable platform | 💰 Commission-free trades | 👥 Blue-chip stock buyers | ✨ S&P 500 focus | 💰 Free trading |

Cash App Investing | $1 fractional shares, recurring buys | ★★★ Ease of use | 💰 No commissions | 👥 Casual Cash App users | ✨ Round Up automation | 💰 Free trading |

Webull | $1 fractional shares, advanced tools | ★★★★ Powerful tools | 💰 Commission-free | 👥 Active small investors | ✨ Level 2 data, paper trading | 💰 Free trading |

Betterment | Automated portfolios, tax loss harvesting | ★★★★ Polished robo-advisor | 💰 Low advisory fees | 👥 Hands-off investors | ✨ Goal tracking & Premium plan | 💰 Advisory fees apply |

NerdWallet (curated) | Reviews & side-by-side comparisons | ★★★★ Time-saving guidance | 💰 Highlights promos & fees | 👥 All beginner investors | ✨ Updated curated comparisons | 💰 Free resource |

Choosing Your Path to Consistent Small-Scale Investing

Navigating the landscape of the best micro investing apps can feel overwhelming, but as we've explored, the diversity of options is a significant advantage. The ideal platform for you isn't necessarily the one with the most features or the lowest fees in a vacuum. Instead, it’s the one that seamlessly integrates with your financial habits, aligns with your long-term goals, and matches your preferred level of hands-on involvement. The journey from saving spare change to building a substantial portfolio is paved with small, consistent actions, and these tools are designed to make that first step as frictionless as possible.

Key Takeaways for Your Decision

Reflecting on the detailed comparisons, several core themes emerge. For the investor who craves simplicity and a true "set-it-and-forget-it" experience, automated robo-advisors like Acorns and Betterment are unparalleled. They remove the guesswork by investing your spare change or recurring deposits into diversified, expert-built portfolios.

Conversely, if you're eager to learn the ropes of stock picking and want granular control over your investments, platforms such as Robinhood and Webull offer sophisticated tools without the high-cost barrier. For those seeking a balanced approach, Stash and SoFi Invest provide an excellent middle ground, offering educational resources and guided thematic investing alongside the freedom to choose your own assets.

Making Your Final Choice

Ultimately, selecting your app comes down to a few critical questions:

Automation vs. Control: Do you want an algorithm to manage everything, or do you want to be in the driver's seat, making every trade?

All-in-One vs. Specialized: Are you looking for a dedicated investing app, or a comprehensive financial hub that includes banking, budgeting, and lending?

Simplicity vs. Sophistication: Do you need a clean, straightforward interface, or do you prefer access to advanced charting and market data?

No matter which micro investing app you choose, understanding the core principles of successful investing, such as knowing how to evaluate investment opportunities, is paramount. The app is merely the vehicle; your knowledge and strategy are the engine.

The most powerful feature shared by all these platforms is their ability to leverage the principle of compound growth. By starting now, automating your contributions, and staying consistent, you are giving your money the most valuable resource of all: time. The small amounts you invest today are the seeds of your future wealth, so choose the tool that helps you plant them most effectively and get started on your path to financial growth.

As you grow your portfolio with traditional assets, you might explore the high-yield potential of decentralized finance (DeFi). Yield Seeker simplifies this complex world, using AI to find and manage the best yield-farming opportunities for your crypto. Let our intelligent agents automate your DeFi strategy and maximize your passive income.