Back to Blog

12 Best Wealth Management Apps for Automated Growth in 2025

Discover the 12 best wealth management apps for 2025. Our guide reviews top platforms for automated investing, goal planning, and AI-driven yield generation.

Oct 13, 2025

generated

Navigating the world of investing used to mean stuffy offices and complex jargon. Today, the most powerful financial tools fit right in your pocket. But with a sea of options, finding the right platform can feel overwhelming, especially when your goal is efficient financial growth. This guide cuts through the noise to reveal the best wealth management apps that automate, optimize, and simplify your journey to building wealth.

We will provide a detailed breakdown of each application, covering its core features, pricing structure, ideal user profile, and honest limitations. From established robo-advisors that manage traditional stock and bond portfolios to innovative platforms using AI for digital asset optimization, this list is designed to help you find the perfect match. The efficiency these apps bring to personal finance is part of a larger trend, similar to how businesses are adopting automated workflow solutions to streamline complex operations.

This curated list offers a practical comparison to help you identify the right tools for your specific financial goals. Whether you are a hands-off investor, a crypto enthusiast seeking reliable passive income, or a busy professional, you will find a solution here. Each review includes screenshots and direct links, enabling you to take immediate action and start building wealth on your own terms.

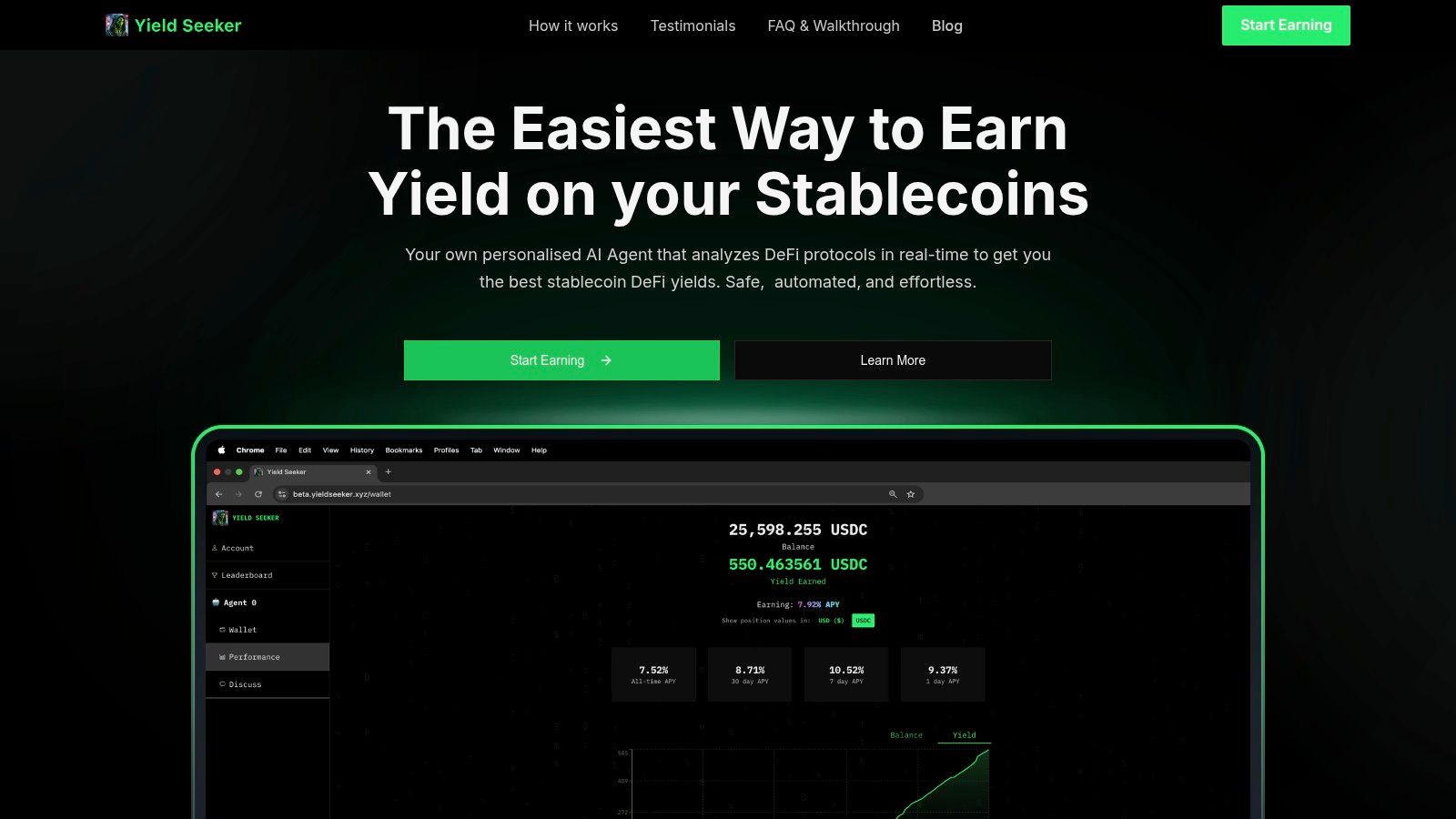

1. Yield Seeker

Best For: Automated, AI-driven stablecoin yield farming

Yield Seeker carves out a unique niche among the best wealth management apps by focusing exclusively on optimizing stablecoin yields through artificial intelligence. This platform is an exceptional choice for individuals seeking to generate passive income from their digital assets without the steep learning curve typically associated with Decentralized Finance (DeFi). Its core strength lies in its personalized AI Agent, which automates the entire process of finding and capitalizing on the highest-yielding opportunities for USDC on the BASE blockchain.

The platform is engineered for accessibility and transparency. Users can begin with as little as $10, making it highly approachable for beginners. There are no lockup periods or hidden fees, providing complete flexibility to withdraw capital and earnings at any time. This user-centric approach is a significant advantage, removing common barriers to entry in the DeFi space.

Key Strengths and Use Cases

Yield Seeker's standout feature is its real-time, autonomous optimization. The AI constantly monitors top DeFi protocols, moving funds to secure the best rates, a task that would require significant time and expertise to perform manually. This makes it ideal for busy professionals who want to put their stablecoins to work without constant monitoring. While these apps streamline your portfolio management, it's also crucial to understand broader comprehensive investment strategies to build a diversified financial plan.

The user experience is another major plus. The dashboard is clean and intuitive, clearly displaying your total capital, accumulated earnings, and the specific protocols your funds are interacting with. Backed by a team with deep crypto and fintech experience, the platform prioritizes security and reliability, building trust with its user base.

Website: yieldseeker.xyz

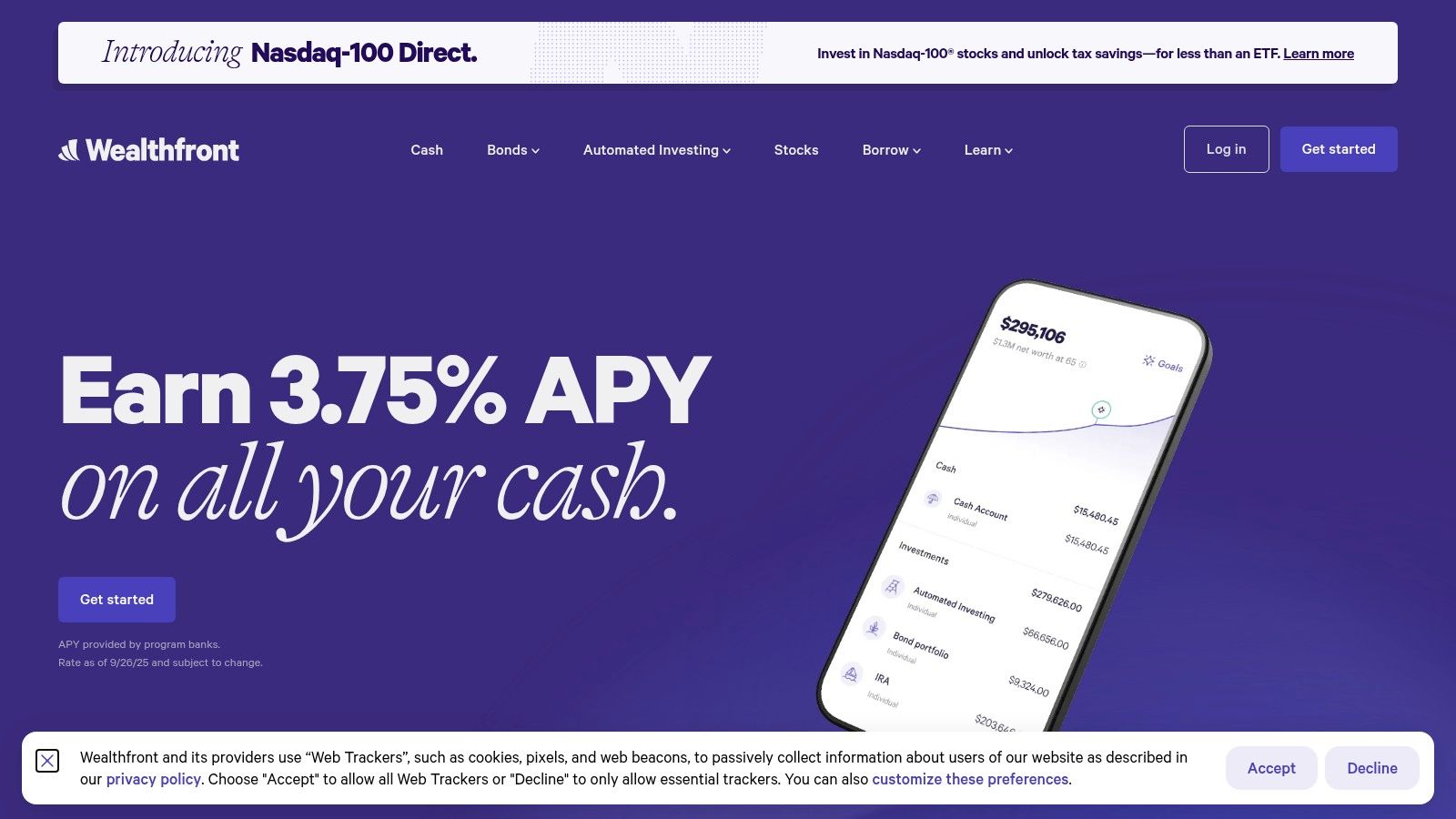

2. Wealthfront

Wealthfront stands out as a top-tier robo-advisor, making it one of the best wealth management apps for investors who prefer a hands-off, automated approach. It excels at creating diversified, goal-based portfolios tailored to your risk tolerance and time horizon. The platform is engineered for simplicity and efficiency, removing the complexity often associated with traditional investing.

Its core strength lies in powerful automation. Features like daily tax-loss harvesting and intelligent rebalancing work behind the scenes to optimize returns and minimize tax liabilities, a service that used to be exclusive to high-net-worth individuals. The user interface on both the website and its highly-rated mobile apps is clean, intuitive, and focused on tracking progress toward your financial goals, such as retirement or a down payment.

Key Details & Features

Pricing: A straightforward 0.25% annual advisory fee on invested assets, with no trading commissions or account maintenance fees.

Best For: Automated, long-term investing and individuals seeking robust tax-optimization strategies without needing human advisors.

Unique Offering: The platform offers a high-yield Cash Account that integrates seamlessly with your investment portfolio, providing a holistic view of your finances.

Limitations: Lacks a dedicated human advisor option, which may not suit investors who desire personalized guidance. Linking external accounts can occasionally be buggy due to reliance on third-party data aggregators.

Website: https://www.wealthfront.com/

3. Betterment

Betterment is a pioneer in the robo-advisor space and remains one of the best wealth management apps for its blend of automated investing and access to human advice. The platform excels at goal-based investing, helping users create diversified ETF portfolios tailored to specific objectives like retirement or building wealth. Its polished and highly-rated mobile experience makes managing finances intuitive for both new and seasoned investors.

The platform’s strength is its flexible, tiered service model that scales with user needs. It offers automated features like tax-loss harvesting and portfolio rebalancing, but its Premium tier provides a significant advantage by granting direct access to Certified Financial Planners (CFPs). This hybrid approach appeals to investors who appreciate algorithmic efficiency but still value the option of personalized human guidance for more complex financial planning. Learn more about how Betterment compares to other digital wealth management platforms.

Key Details & Features

Pricing: Digital plan is $4/month for balances under $20,000 or 0.25% annually above that threshold. The Premium plan with CFP access is 0.65% annually.

Best For: Investors who want a goal-oriented robo-advisor with the flexibility to access human financial planners as their needs grow.

Unique Offering: Its hybrid model provides a clear pathway from a purely digital experience to a more hands-on advisory relationship without needing to switch platforms.

Limitations: The $4 monthly fee for the Digital plan can be proportionally high for accounts with very small balances, and the Premium tier has a high minimum balance requirement.

4. Empower Personal Dashboard + Empower Advisory

Empower offers a unique hybrid model, making it one of the best wealth management apps for those who want a complete picture of their finances with the option to upgrade to professional guidance. It begins with its powerful and free Personal Dashboard (formerly Personal Capital), which aggregates all your financial accounts, from banking and investments to loans and mortgages, providing a real-time net worth calculation and portfolio analysis.

The platform’s strength is its seamless transition from a DIY tracking tool into a comprehensive advisory service. Users can leverage the free tools indefinitely for budgeting, cash flow tracking, and retirement planning. When ready, they can opt into the paid advisory service to work with a dedicated team of human financial advisors who build and manage a personalized ETF portfolio, offering a clear upgrade path for growing wealth.

Key Details & Features

Pricing: The dashboard is free. Advisory services have a tiered fee structure, starting at 0.89% AUM for the first $1 million.

Best For: Individuals who want robust, free financial aggregation tools and a clear path to transition to a full-service human advisory relationship.

Unique Offering: The combination of a top-tier free financial dashboard with access to dedicated human advisors for managed portfolios is unmatched.

Limitations: The advisory service has a relatively high investment minimum of $100,000, and its management fees are notably higher than most robo-advisor competitors.

Website: https://www.empower.com/products-solutions/personal-strategy

5. Fidelity Go

Fidelity Go leverages the power of one of the world's largest brokerage firms to offer a reliable and accessible robo-advisor service. It stands out by making professional portfolio management free for smaller accounts, positioning itself as one of the best wealth management apps for beginners or those just starting their investment journey. The platform is seamlessly integrated into Fidelity’s robust ecosystem, providing a familiar and trustworthy environment for existing customers and a comprehensive entry point for new ones.

The platform focuses on creating a diversified portfolio using Fidelity's own proprietary, zero-expense-ratio mutual funds. Its primary appeal is the low barrier to entry and the backing of a financial giant known for extensive investor education and customer support. The user experience is straightforward, guiding users through a simple questionnaire to determine their risk tolerance and goals before constructing and managing their portfolio automatically. This makes it an excellent choice for hands-off investors who value simplicity and trust.

Key Details & Features

Pricing: No advisory fee for balances under $25,000. A 0.35% annual advisory fee is applied to balances of $25,000 and above. There is no account minimum to open, but a $10 minimum is needed to start investing.

Best For: New investors, individuals with small account balances, and existing Fidelity customers seeking an integrated automated investing solution.

Unique Offering: The zero-fee structure for smaller accounts is a significant differentiator. For balances over $25,000, users gain access to unlimited one-on-one financial coaching sessions with advisors.

Limitations: The 0.35% advisory fee for larger accounts is higher than some key competitors. The platform offers limited portfolio customization, as investments are primarily in Fidelity's own funds.

Website: https://www.fidelity.com/managed-accounts/fidelity-go/overview

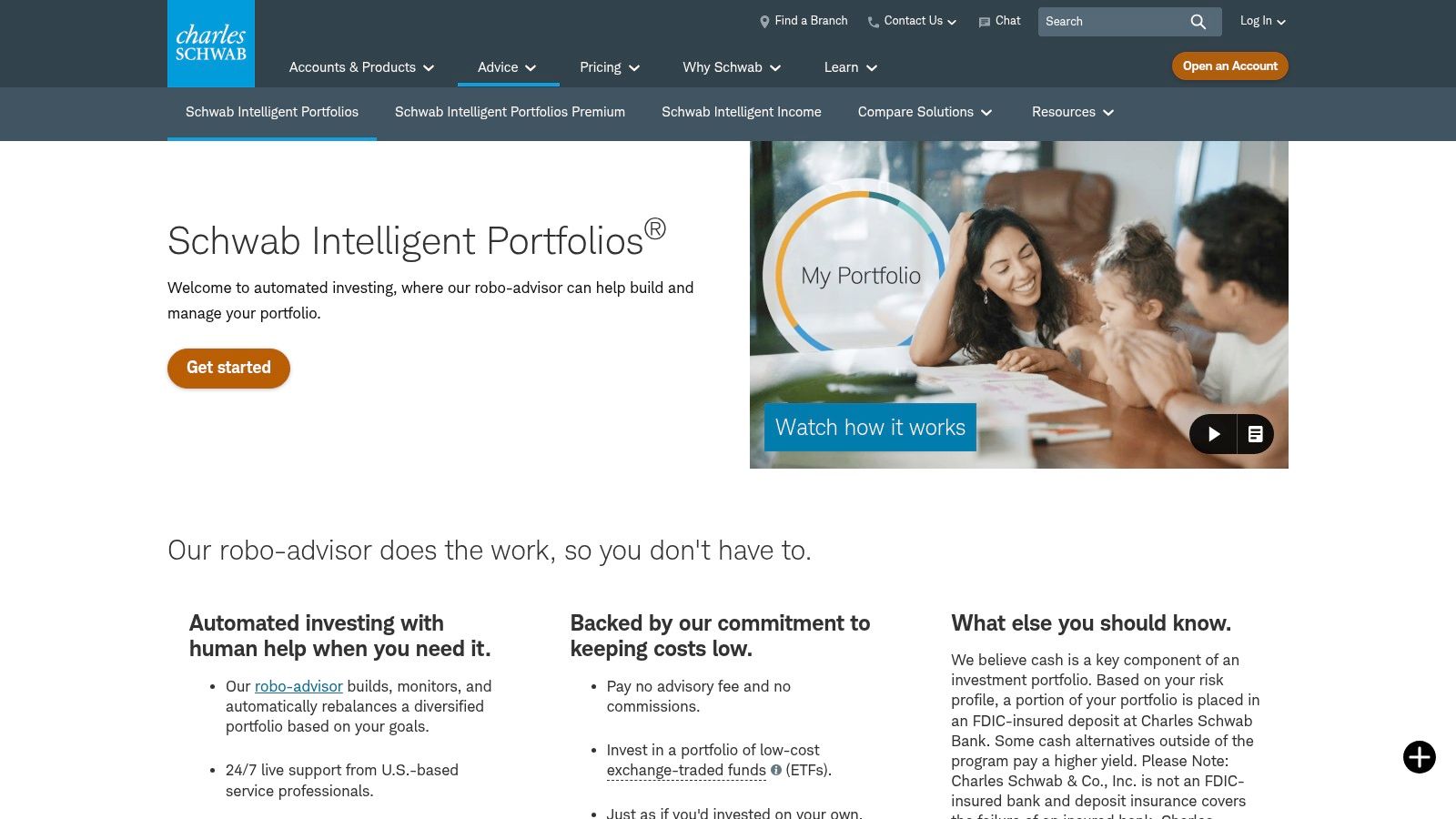

6. Schwab Intelligent Portfolios

Schwab Intelligent Portfolios leverages the trust and scale of a major brokerage to offer a compelling robo-advisor service, making it one of the best wealth management apps for cost-conscious investors. The platform provides automated portfolio management using a diverse range of ETFs tailored to your goals and risk profile. It stands out by eliminating advisory fees on its digital-only plan, a significant advantage for those looking to maximize their returns.

The service is built for efficiency, featuring daily monitoring and automatic portfolio rebalancing to keep your asset allocation on track. For accounts with higher balances, tax-loss harvesting is available to help reduce your tax burden. The platform is backed by Schwab's robust infrastructure and 24/7 customer support, offering a level of security and assistance that newer fintech startups often can't match. A premium tier is also available for those who want access to a certified financial planner.

Key Details & Features

Pricing: $0 advisory fee for the digital plan ($5,000 minimum). The Premium plan adds a $300 one-time planning fee plus $30 per month for unlimited CFP access.

Best For: Investors who want a no-advisory-fee automated portfolio backed by a large, reputable financial institution.

Unique Offering: The combination of zero advisory fees on its base plan and the backing of a major brokerage like Charles Schwab is a rare and powerful value proposition.

Limitations: The mandatory cash allocation within portfolios can act as a drag on performance during strong market uptrends. The $5,000 minimum investment is higher than many competitors.

Website: https://www.schwab.com/intelligent-portfolios

7. Vanguard Digital Advisor

Vanguard Digital Advisor leverages the company's long-standing reputation for low-cost, disciplined investing and brings it into the robo-advisor space. This platform is ideal for fee-conscious investors who trust Vanguard's index-centric philosophy and want a straightforward, set-it-and-forget-it portfolio. It provides algorithm-driven advice to build a diversified portfolio using Vanguard's signature low-cost ETFs.

The service stands out by integrating holistic financial planning nudges, encouraging users to consider debt payoff and emergency savings alongside their investment goals. While the core offering is digital-only, it serves as an accessible entry point into the Vanguard ecosystem, making it one of the best wealth management apps for beginners. The user interface is clean and goal-oriented, focusing on long-term progress rather than short-term market fluctuations.

Key Details & Features

Pricing: Gross advisory fees are approximately 0.20% annually, often reduced by credits from the underlying Vanguard ETFs, making it one of the lowest-cost options available.

Best For: Cost-sensitive, long-term investors who prefer a hands-off approach grounded in a proven index investing strategy.

Unique Offering: A clear and affordable upgrade path to the Vanguard Personal Advisor service, a hybrid model that adds access to human financial advisors for a 0.30% AUM fee once you meet the $50,000 minimum.

Limitations: The platform offers less portfolio customization compared to more flexible competitors. Access to a human advisor requires upgrading to a separate, more expensive service tier with a higher investment minimum.

Website: https://investor.vanguard.com/advice/digital-advisor/

8. SoFi Automated Investing

SoFi Automated Investing positions itself as a powerful hybrid, blending the low-cost efficiency of a robo-advisor with the valuable option of human financial guidance. Integrated within the broader SoFi financial ecosystem, it offers a seamless experience for users who already engage with SoFi's banking, loan, or credit products. This platform is ideal for new and intermediate investors looking for a guided, low-minimum entry into diversified investing.

The platform constructs portfolios using a mix of low-cost ETFs and allows users to choose from themes like Classic, Sustainable, and portfolios with Alternatives. A key differentiator is that it provides access to human financial planners at no extra cost, a feature often reserved for premium services. This makes it one of the best wealth management apps for those who want the convenience of automation but appreciate having professional support available when needed.

Key Details & Features

Pricing: A competitive 0.25% annual advisory fee on assets under management.

Best For: Beginners and cost-conscious investors who want both automated portfolio management and access to human financial advisors.

Unique Offering: The platform is part of a comprehensive financial ecosystem, allowing users to manage investing, banking, and loans all in one place.

Limitations: Some of the underlying ETFs in their portfolios may carry higher expense ratios compared to competitors, and there is a $100 fee for outward account transfers.

Website: https://www.sofi.com/invest/automated/

9. M1 Finance

M1 Finance offers a unique hybrid approach, blending the control of DIY investing with the convenience of automation, making it a powerful wealth management app for those who want to be hands-on with their portfolio construction. The platform is built around its signature "Pies," which are customizable portfolios of stocks and ETFs. Users can create their own Pies or choose from expert-curated options, and M1 automatically manages rebalancing and invests new deposits according to the set targets.

This model gives investors complete control over their asset allocation while removing the tedious work of maintaining it. M1's all-in-one platform also integrates spending and borrowing capabilities, allowing users to manage their entire financial life in one place. Its sleek, modern interface provides a clear and consolidated view of your investments, making it simple to track progress and stay on course. For more information, you can explore various automated investing platforms.

Key Details & Features

Pricing: A $3/month platform fee applies. This fee is waived for accounts with at least $10,000 in M1 assets or an active M1 Personal Loan. There are no trading commissions.

Best For: Self-directed investors who want to build and automate their custom portfolios without the complexity of constant manual trading.

Unique Offering: The customizable "Pie" investing system is a standout feature, offering unparalleled flexibility in portfolio automation compared to traditional robo-advisors.

Limitations: The platform does not offer tax-loss harvesting or access to human financial advisors, which are key features of many other wealth management services.

Website: https://m1.com/

10. Apple App Store (iOS)

While not a wealth management app itself, the Apple App Store is the essential gateway for iOS users to access nearly every service on this list. It serves as a secure, centralized marketplace to find and download the official, verified versions of the best wealth management apps, from established robo-advisors like Betterment to specialized platforms. Its inclusion is critical for ensuring you download legitimate software and avoid fraudulent copies.

The platform’s strength lies in Apple’s stringent security and privacy standards. Each app is reviewed before release, and clear privacy labels detail how your data is used, a crucial factor when dealing with sensitive financial information. User ratings, detailed reviews, and version histories provide valuable social proof and insight into the app's performance and reliability before you commit to downloading it.

Key Details & Features

Pricing: Free to browse and download apps; individual apps may have their own subscription or advisory fees.

Best For: iOS users seeking a trusted, single source to securely download and manage their financial and investment applications.

Unique Offering: Apple’s ecosystem provides a high level of security and integrated privacy features, such as "App Tracking Transparency," giving users more control over their data than other platforms.

Limitations: The platform is exclusive to Apple devices (iPhone, iPad). App availability and features can also differ based on your geographical region due to local regulations.

Website: https://apps.apple.com/us/

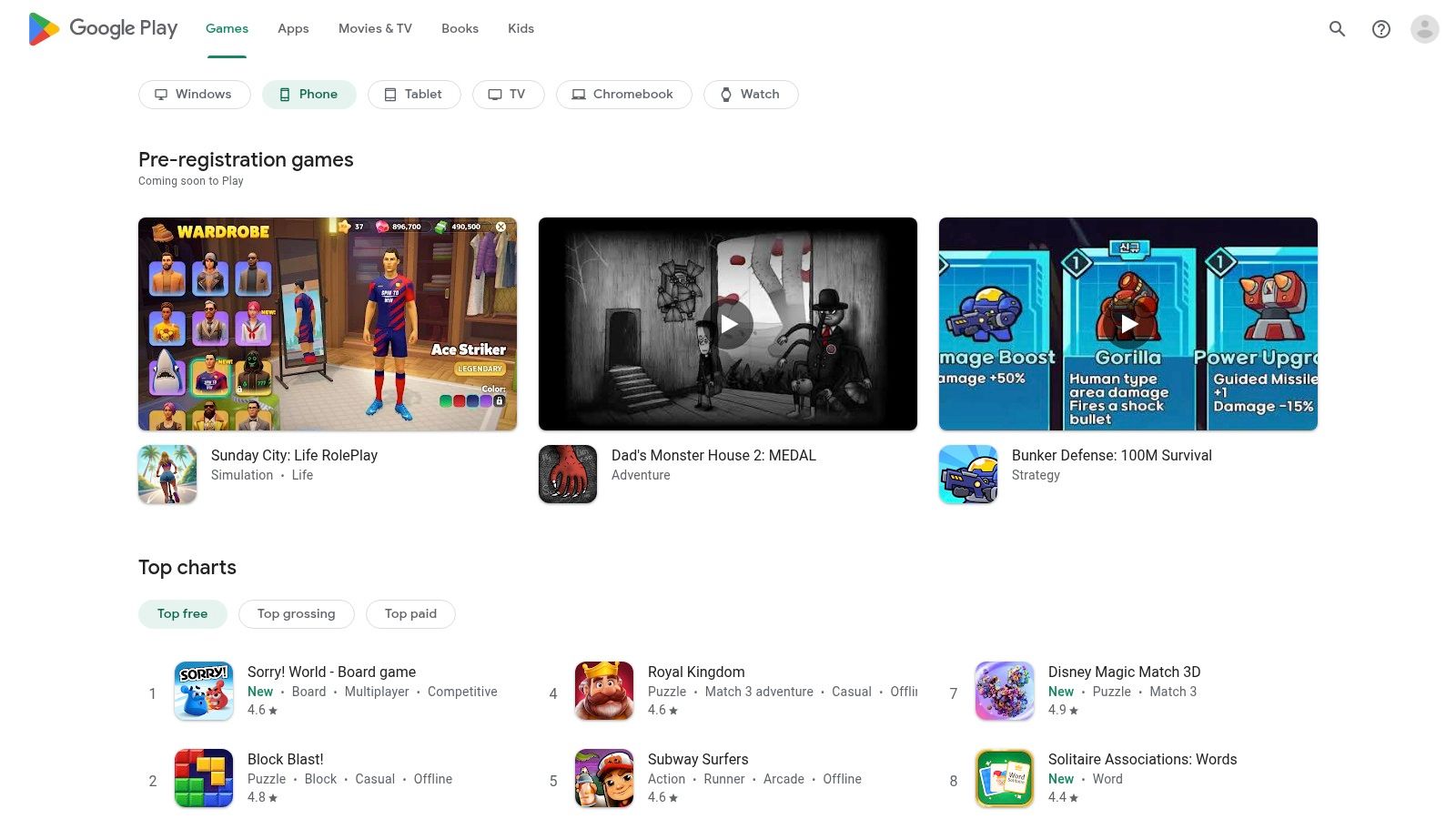

11. Google Play Store (Android)

While not a wealth management app itself, the Google Play Store is the essential starting point for Android users seeking the best wealth management apps. It serves as the official, secure marketplace for downloading trusted financial tools, from robo-advisors like Wealthfront and Betterment to comprehensive portfolio trackers. The platform provides a crucial layer of security, verifying developers and scanning apps to protect users from malicious software.

Its value lies in the aggregated user feedback and transparency it offers. Prospective users can compare apps using ratings, read thousands of authentic user reviews, and review critical data-safety labels before installing. This ecosystem makes it an indispensable research tool for vetting the authenticity and quality of any financial application on the Android platform, ensuring you download legitimate software directly from the official source.

Key Details & Features

Pricing: The platform itself is free to use. Individual apps have their own pricing models.

Best For: Android users needing a secure and reliable source to discover, research, and download official wealth management and investment apps.

Unique Offering: Integrated Google Play Protect security scans all apps, providing a safe download environment. The user review system offers real-world insights into app performance and reliability.

Limitations: The platform is exclusive to Android devices. App availability and features can vary significantly based on your geographical region and device compatibility.

Website: https://play.google.com/store

12. Forbes Advisor – Best Robo-Advisors

While not a wealth management app itself, Forbes Advisor’s "Best Robo-Advisors" list is an indispensable resource for anyone starting their investment journey. It acts as a powerful research hub, providing expert-driven, independent rankings and detailed comparisons of the top automated investment platforms. The platform excels at demystifying the crowded robo-advisor market by breaking down complex fee structures and features into easy-to-understand summaries.

Its core strength is its comprehensive, regularly updated analysis. Instead of visiting dozens of sites, users can get a clear, side-by-side view of account minimums, advisory fees, and unique features, helping them quickly shortlist the services that best fit their financial goals. This makes it an essential first stop before committing to a platform, similar to how one might research the best passive income apps before diversifying their strategy.

Key Details & Features

Pricing: The resource is completely free to access.

Best For: Individuals in the research phase who want to compare the leading robo-advisors and understand their key differences without bias.

Unique Offering: An independent editorial methodology that clearly outlines how platforms are evaluated, providing transparency in its rankings and recommendations.

Limitations: The editorial picks are generalized and may not perfectly align with every user’s specific financial situation. It is crucial to verify details on the provider's website as offers and terms can change.

Website: https://www.forbes.com/advisor/investing/best-robo-advisors/

Top 12 Wealth Management Apps Comparison

Product / Platform | Core Features / Highlights | User Experience & Ratings | Value & Pricing | Target Audience | Unique Selling Points |

|---|---|---|---|---|---|

🏆 Yield Seeker | AI-powered real-time yield optimization on BASE chain USDC ✨ | ★★★★☆ Transparent, intuitive UI | 💰 Low $10–25 min deposit, no lockups or hidden fees | 👥 Beginners & DeFi experts | Personalized AI agent, seamless automation |

Wealthfront | Automated investing, tax-loss harvesting, cash mgmt | ★★★★☆ Strong app experience | 💰 0.25% advisory fee | 👥 Goal-oriented investors | Robust automation, low fee |

Betterment | Digital & premium plans, human advisor access | ★★★★☆ Polished mobile apps | 💰 $4/mo or 0.25% AUM; +0.65% premium tier | 👥 Flexible investors | Human advice option |

Empower Personal Dashboard + Advisory | Free financial tracking + paid advisory services | ★★★★ Comprehensive tracking | 💰 Advisory fees from 0.89%, $100k minimum | 👥 High-net-worth transitioning | Hybrid DIY and human advisor |

Fidelity Go | Tiered fees, no advisory fee under $25k, financial coaching | ★★★★ Seamless Fidelity integration | 💰 $0 under $25k; 0.35% advisory fee over $25k | 👥 Small to mid-size investors | No minimum balance, coaching |

Schwab Intelligent Portfolios | No-fee digital plan, premium advisor access | ★★★★ 24/7 US support | 💰 $0 advisory fee (digital), premium fees apply | 👥 Cost-conscious investors | No advisory fee base option |

Vanguard Digital Advisor | Low fees, index-focused, optional advisor upgrade | ★★★★ Trusted brand | 💰 ~0.20%-0.25% digital; 0.30% advisor upgrade | 👥 Fee-conscious investors | Index investing focus |

SoFi Automated Investing | Low fee, human advisor access, diversified ETFs | ★★★★ Part of wider SoFi ecosystem | 💰 0.25% advisory fee; $50 minimum | 👥 Beginners & tech-savvy | Advisor access, low minimum |

M1 Finance | Customizable “Pies”, auto-invest & rebalance, borrow/spend | ★★★★ Great for DIY investors | 💰 $3/mo fee waived over $10k assets | 👥 DIY investors | Unique portfolio customization |

Apple App Store (iOS) | Official iOS app marketplace for robo-advisors | ★★★★★ Secure, trusted downloads | 💰 Free app access | 👥 iOS users | Security, official app source |

Google Play Store (Android) | Official Android marketplace for robo-advisors | ★★★★★ Secure, auto-updates | 💰 Free app access | 👥 Android users | Wide variety, verified content |

Forbes Advisor – Best Robo-Advisors | Independent robo-advisor rankings and reviews | ★★★★ Comprehensive and current | 💰 Free access to comparisons | 👥 Robo-advisor shoppers | Trusted expert analysis |

Final Thoughts

Navigating the crowded market of digital finance tools can feel overwhelming, but finding the right platform is the first crucial step toward achieving your financial goals. Throughout this guide, we've explored a diverse range of the best wealth management apps, each catering to different investor profiles, risk appetites, and technological preferences.

We've seen how established players like Wealthfront, Betterment, and Schwab Intelligent Portfolios offer robust, time-tested automated investing based on traditional market principles. These platforms are excellent for hands-off investors seeking set-it-and-forget-it portfolio management grounded in Modern Portfolio Theory. For those who want more control or a hybrid approach, tools like M1 Finance and Empower provide greater customization and a comprehensive financial overview.

However, the landscape of wealth management is rapidly evolving beyond traditional stocks and bonds. The emergence of decentralized finance (DeFi) has unlocked new, powerful avenues for generating yield, particularly for those holding stablecoins. While this new frontier offers significant opportunities, its complexity can be a major barrier. This is precisely where innovative, specialized tools like Yield Seeker distinguish themselves, offering a new paradigm for wealth generation.

How to Choose the Right App for You

Making the final decision comes down to a clear-eyed assessment of your personal financial situation and long-term objectives. Ask yourself these critical questions before committing to a platform:

What is my primary investment goal? Are you saving for retirement, building a down payment, or seeking to generate high-yield passive income from digital assets? Your goal dictates the best tool for the job.

What is my risk tolerance? Traditional robo-advisors are designed to manage risk through diversification in familiar markets. DeFi platforms operate in a different risk environment, though solutions focused on stablecoin yields aim to mitigate market volatility.

How much am I willing to pay? Advisory fees can range from zero to over 0.40% annually. Compare the fee structures of platforms like Fidelity Go (which has no advisory fees under $25,000) with the gas fees and smart contract risks associated with DeFi protocols.

How much control do I want? If you prefer a completely passive approach, a traditional robo-advisor is ideal. If you're interested in leveraging cutting-edge technology like AI agents to actively optimize returns in the crypto space, a specialized platform is a better fit.

Ultimately, the best wealth management apps are not one-size-fits-all. The ideal choice is the one that aligns seamlessly with your financial DNA. Whether you are a traditional investor or a DeFi enthusiast, the perfect tool is available to help you build, manage, and grow your wealth with confidence and clarity.

Ready to move beyond traditional returns and explore the future of automated, high-yield finance? Discover how Yield Seeker uses AI agents to autonomously find and capture the best stablecoin yields in DeFi, simplifying a complex process into a powerful, passive income solution. Visit Yield Seeker to see how our technology is redefining wealth management for the digital age.