Back to Blog

Unlocking DeFi with Capital Automation for Smarter Yield

Discover how capital automation is changing DeFi. Our guide explains how to use AI and smart contracts to optimize your crypto yield and earn smarter returns.

Dec 25, 2025

generated

Picture a tireless financial pro working for you 24/7, always hunting across the crypto market to find the best possible returns for your assets. That, in a nutshell, is capital automation. Instead of you having to manually chase yields, this tech does the heavy lifting. It turns your passive crypto holdings into active, income-generating tools, all without needing your constant attention.

What Is Capital Automation and Why It Matters Now

Capital automation is simply a system that uses technology—anything from basic rules to sophisticated AI—to strategically deploy your financial assets to boost returns and cut down on risk. Don't think of it like a dusty old savings account. It’s more like a dynamic, self-managing portfolio that’s always on the lookout for the next big opportunity.

In the ridiculously fast-paced world of decentralized finance (DeFi), yield opportunities can pop up and vanish in the blink of an eye. Trying to manage this all by hand is a massive headache. Chasing the best annual percentage yield (APY) means constant research, non-stop monitoring, and navigating complex transactions across a dozen different platforms. It’s not just time-consuming; it's also a recipe for human error and missed chances.

The Core Problem Automation Solves

At its heart, capital automation is a direct solution to the problem of inefficiency. Let's be real—if you're a busy professional, part of a Web3 team managing a treasury, or just don't have the time to become a full-time DeFi analyst, manually optimizing your capital just isn't going to happen. Automation steps in to fill that gap, executing strategies that would be flat-out impossible for one person to handle.

Here are the key headaches that automation just makes disappear:

Time Commitment: Forget spending hours every day on research and manual transactions. The system handles it.

Complexity Overload: It cuts through the noise of interacting with tons of different DeFi protocols, each with its own quirks and interfaces.

Emotional Decision-Making: By sticking to pre-set logic or AI-driven insights, it takes emotion out of the equation. No more panic-selling or chasing hype.

A Modern Approach to Capital Management

This isn't some crypto-only fantasy, either. In the traditional finance world, private equity and venture capital firms have been using automation for years to streamline everything from pulling data out of pitch decks to balancing the books. This frees up their teams to focus on the big picture instead of getting bogged down in grunt work. Capital automation is a key part of modern strategic bank capital planning, giving institutions the tools they need for smarter capital allocation.

In DeFi, capital automation takes this idea and puts it on steroids. It applies the same principles directly to generating yield, creating a system where your stablecoins are always working for you in the smartest way possible, around the clock.

By handing off the complex, repetitive tasks to an automated system, you get access to sophisticated financial strategies that used to be the exclusive playground of big financial institutions. This makes earning solid, passive returns on your digital assets a genuine reality for everyone.

How Capital Automation Actually Works

To really get what capital automation is all about, let's pop the hood and see how it works inside the world of DeFi. Think of it like a hyper-intelligent fleet of delivery drones zipping around a massive, constantly shifting city. But instead of packages, these drones are moving your capital, always finding the fastest and most profitable routes to generate yield.

At its heart, a capital automation platform is a powerful engine that's constantly crunching a staggering amount of real-time information. It scans countless lending protocols, liquidity pools, and other yield-bearing opportunities across the blockchain, 24/7. This isn't some simple "set it and forget it" tool; it's a living system that reacts instantly to every ripple in the market.

What's Fueling the Engine?

The whole decision-making process runs on a non-stop stream of data. These inputs are the eyes and ears of the automation engine, giving it all the context it needs to make smart moves with your money.

Here's the kind of data it's always looking at:

On-Chain Interest Rates: It’s constantly watching the ever-changing Annual Percentage Yields (APYs) offered by lending protocols like Aave and Compound.

Liquidity Pool Rewards: It keeps tabs on the fees and token rewards you can earn from providing liquidity on decentralized exchanges like Uniswap or Curve.

Transaction Costs (Gas Fees): The engine is smart enough to calculate the cost of moving funds, making sure a potential yield bump isn't completely eaten by high network fees.

Market Volatility: It pays attention to the broader market vibes, because high volatility can change the risk profile of certain yield sources in a heartbeat.

Protocol Risk Scores: More sophisticated systems even bake in the security and reliability of different DeFi protocols, steering clear of those with known red flags.

By analyzing all this on the fly, the platform builds a live, comprehensive map of the entire yield landscape. It doesn't just find the highest APY; it finds the safest and most cost-effective path to get there.

Putting the Strategy into Action

Once the engine has done its analysis, it spits out an automated action. These outputs are the engine's hands, executing transactions on the blockchain to shift your capital into a better position. An AI-powered platform like Yield Seeker uses these inputs to direct a personalized AI Agent that carries out these complex strategies for you.

The output is essentially a sequence of smart contract interactions designed to pull your funds from a lower-performing spot and deposit them into a higher-performing one. This can all happen in a single, seamless series of transactions.

This whole process happens way faster and more often than any human could ever hope to manage. While you might check your portfolio once a day, the automation engine is on standby every single minute, making sure your capital is never just sitting around. Grasping the mechanics of a yield optimization protocol is crucial to understanding how these automated moves create better returns over time.

The growth here is pretty staggering. Algorithmic cash management and yield-optimizing strategies now look after billions of dollars, with big institutions jumping on board since 2020. Market reports show a clear trend towards automated strategies that can pump up APY in real-time without sacrificing liquidity.

This idea of automating complex financial jobs goes far beyond just DeFi. In the traditional world, for example, automation is completely changing fields like insurance claims processing automation, making it faster and more accurate. By linking smart data analysis with automated execution, these systems take what used to be an impossibly complex task and make it accessible for everyone.

Comparing the Different Automation Strategies

Not all capital automation is created equal. In DeFi, the engine driving your asset allocation can be anything from a simple script to a sophisticated AI. Nailing down these differences is the key to picking a platform that actually matches your goals for returns, flexibility, and security.

Let's break down the three main strategies you'll run into. Each one takes a different swing at the core challenge of finding the best yield, and each comes with its own pros and cons.

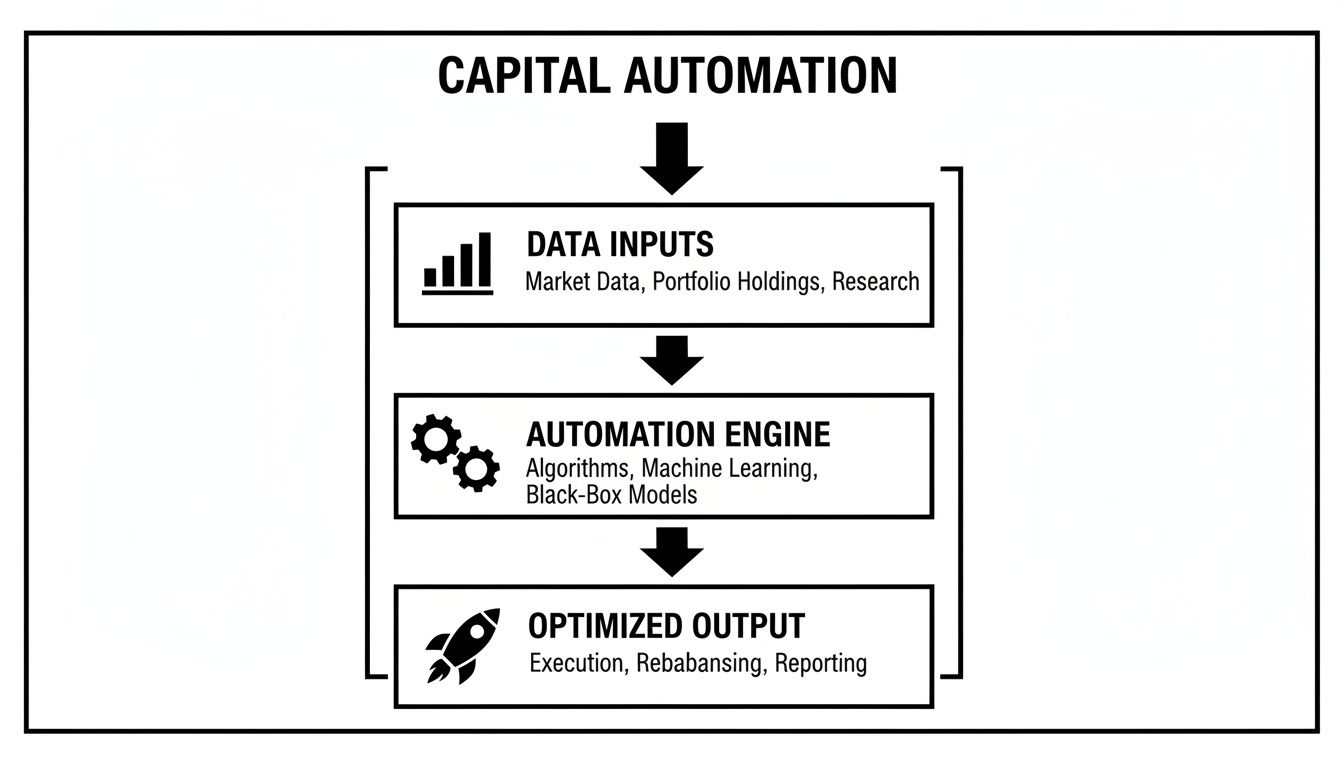

The general idea follows a simple flow: market data goes in, an automation engine crunches the numbers, and an optimized strategy comes out the other end.

This process visualizes how raw market data gets turned into smart capital movements, transforming information into action.

Rules-Based Systems

The most basic form of capital automation is the rules-based system. Just think of it as a simple "if this, then that" command for your crypto. You or the platform sets specific, rigid conditions that trigger an action.

For example: "IF the APY on Protocol A drops below 5%, THEN move all funds to Protocol B, as long as its APY is above 5.5%."

This approach is predictable and super easy to wrap your head around. But its greatest strength is also its biggest weakness: it’s rigid. It can't adapt to new information or complex market shifts. A rules-based bot won’t notice that rising gas fees might wipe out a potential yield gain, nor can it judge the risk of a new protocol offering a suspiciously high APY. It just follows the rules, for better or worse.

On-Chain Smart Contract Automation

A more advanced and crypto-native method uses smart contracts to automate strategies directly on the blockchain. These are just self-executing contracts where the rules are baked directly into the code. This is the approach often used by a yield aggregator in crypto, which pools user funds together to execute strategies more efficiently and save on gas fees.

These systems are decentralized and transparent because their logic is right there for anyone to see on-chain. They can execute complex moves, like automatically harvesting rewards and reinvesting them, without a middleman. While powerful, their strategies are still pre-programmed. They can't make predictive calls or react to weird market events that weren't anticipated in their original code.

A huge plus here is trustlessness. The automation runs exactly as coded on the blockchain, so you don't have to trust a company to manage the funds correctly. The downside is that the strategy itself is fixed until the contract is updated.

Machine Learning and AI Agents

This is where things get really dynamic. Instead of relying on static "if-then" rules, platforms like Yield Seeker use personalized AI Agents that analyze tons of data streams all at once. These agents don't just glance at the APY; they weigh gas costs, protocol risk scores, market sentiment, and historical performance data.

This multi-factor analysis lets the AI make predictive moves. It can start to anticipate which yield sources are likely to become more profitable and which ones might be hiding nasty risks.

Real-world example: An AI might see a protocol's APY spike to a juicy 20%, but its risk analysis flags some sketchy on-chain activity. A simple rules-based system would dive right in. The AI agent, however, would likely steer clear, choosing to protect your capital over chasing a risky, short-term gain.

This method allows for a much smarter, more adaptive strategy. The AI learns and adjusts over time, refining its approach based on what's actually happening in the market. It's the difference between a simple calculator and a seasoned financial analyst, constantly balancing the hunt for high returns with solid risk management.

Capital Automation Methods Compared

To make it even clearer, here's a quick table breaking down how these three approaches stack up against each other. Each has its place, but they serve very different needs.

Approach | Decision Logic | Adaptability | Best For |

|---|---|---|---|

Rules-Based Systems | Simple "if-then" conditions (e.g., if APY > X%, move funds) | Low. Static rules require manual updates to change strategy. | Simple, predictable tasks where conditions rarely change. |

Smart Contract Automation | Pre-programmed logic coded directly onto the blockchain. | Medium. Can execute complex strategies but can't adapt to new events without a contract upgrade. | Decentralized, transparent strategies like auto-compounding in yield aggregators. |

Machine Learning / AI Agents | Multi-factor analysis and predictive modeling. | High. Learns from market data and adjusts its strategy in real-time. | Navigating complex, volatile markets by balancing yield opportunities with risk. |

Ultimately, the goal is to move from a rigid, reactive system to one that's intelligent and proactive. While rules-based systems were a great starting point, the complexity of modern DeFi really calls for a more dynamic approach—one that can think, learn, and adapt on your behalf.

The Real Benefits of Automating Your Capital

So, beyond all the technical jargon, what does capital automation actually do for you? Let's get real. Understanding the "why" is where its power becomes obvious. It's about changing how you deal with your assets—moving from a hands-on, grind-it-out approach to simply overseeing a system that does the heavy lifting for you.

This simple shift brings three massive advantages that are nearly impossible to get by doing things manually. First, you get a huge boost in efficiency. Second, it enforces a much smarter way to manage risk. And finally—the big one—it consistently finds better returns by jumping on opportunities a human would simply miss.

Unlocking Superior Efficiency

The most immediate win from capital automation is the time it gives you back. The DeFi world never sleeps; it’s a 24/7 global market that's all over the place. Staying on top of it means constantly researching, tracking APYs, checking protocol health, and moving funds around. It's a full-time job.

Automation takes that entire workload and boils it down to one managed process. Forget spending hours every week chasing the best yield. You just set your strategy and let the system run with it.

This is about reclaiming your most valuable asset—your time. It lets a busy professional generate passive income without derailing their main career, or helps a Web3 team manage its treasury without needing a dedicated analyst on payroll.

Think about someone like Alex, who was totally swamped by DeFi's complexity. After getting an automated system up and running, Alex went from spending five hours a week digging through protocols to just a few minutes checking a dashboard. The system handled the grind, turning a source of stress into a hands-off income stream.

Enhancing Risk Management

Let’s be honest: emotions are the enemy of a good financial plan. Fear and greed push us to make bad calls, like chasing crazy-high yields on some sketchy new protocol or panic-selling when the market dips. Capital automation takes all that emotional guesswork out of the picture.

By running on pure logic—either pre-defined rules or AI-driven risk models—the system makes decisions based on cold, hard data. It brings a level of discipline that’s tough for any human to stick to.

Key risk management features usually include things like:

Automated Diversification: Spreading your capital across several vetted protocols so that if one fails, it doesn’t take all your funds with it.

Pre-set Safety Parameters: AI agents can be told to steer clear of protocols that don't meet certain safety checks, like having no audits or dangerously low liquidity.

Real-time Threat Monitoring: The best systems can spot weird on-chain activity and automatically pull funds away from a protocol that might be getting hacked.

Capturing Better Returns

At the end of the day, the goal is to make your capital work harder for you. Automation nails this by being faster and more precise than any human could ever be. The DeFi market moves at lightning speed, and the juiciest opportunities often pop up and disappear within minutes.

A person just can't react quickly enough to grab those moments. An automated system, on the other hand, can fire off a whole sequence of transactions in seconds to lock in a high-yield opportunity the instant it appears.

This isn’t just a crypto thing; it mirrors a huge trend in the broader economy. Studies show that automation is reshaping entire industries by shifting capital to more productive uses. Some analysts even predict automation could impact up to 40% of tasks in certain fields, driving major efficiency gains. To see how this is playing out on a larger scale, it’s worth checking out the detailed findings on industrial automation trends.

Understanding and Mitigating the Key Risks

While the upside of capital automation is massive, we wouldn't be giving you the full picture without talking about the risks. The world of DeFi moves at lightning speed, but that innovation comes with its own set of challenges. Simply ignoring them isn't a strategy—it's a gamble.

The smarter approach is to understand these potential downsides from the get-go. Knowing what to watch for is the first step to protecting your assets and using automation platforms with confidence. The risks generally boil down to three main areas.

Smart Contract Vulnerabilities

The entire DeFi world is built on smart contracts—bits of code that automatically execute on the blockchain. But this code is written by humans, and humans can make mistakes. A bug or an overlooked vulnerability in a lending protocol your automation platform uses could put your funds on the line.

Even the biggest, most audited protocols have been hit by exploits, sometimes leading to huge losses. This is just a fundamental risk of playing in the on-chain world.

The core takeaway is that your automated strategy is only as secure as the underlying protocols it interacts with. A great platform can't completely eliminate the risk of a bug in a third-party contract.

To stay safe, look for platforms that are totally transparent about the protocols they connect to. Stick with services that interact with well-established, battle-tested DeFi applications that have been audited to death.

Platform-Specific Security Risks

Beyond the protocols themselves, the automation platform you choose is another layer of risk. This could be anything from a vulnerability in the platform's own smart contracts to a problem with its backend servers or even the AI models making the decisions.

A huge distinction to make here is whether a platform is custodial or non-custodial. A custodial service holds your private keys, which means you're trusting them completely with your money. A non-custodial platform, like Yield Seeker, is built so you always keep control of your keys and your assets.

Here’s how to sidestep platform risks:

Insist on Non-Custodial Solutions: Your keys, your crypto. Always pick platforms where you are the only one who can move your funds.

Check for Security Audits: Reputable platforms get independent security audits from well-known firms and publish the results for everyone to see. Don't settle for less.

Look at the Team: Is the team public and experienced? That's usually a much better sign than an anonymous crew.

Unpredictable Market Volatility

Finally, you've got market risk. DeFi can be wildly volatile. "Black swan" events—those completely unexpected market meltdowns—can cause sudden, chaotic shifts. We're talking liquidity drying up on lending platforms or a stablecoin losing its peg, which can throw even the smartest automated strategies for a loop. If you want to go deeper on this, our guide to DeFi risk management is a great place to start.

While capital automation can react way faster than a person can, it can't predict the future. An AI might be programmed to pull back during shaky market conditions, but no system is bulletproof against a total market shock. Knowing this helps you set realistic expectations for how your agent will perform when things get crazy.

Your First Steps into Capital Automation

Ready to dive in? Getting started with capital automation might feel like a big leap, but it’s actually more straightforward than you’d think. The trick is to start with the right foundation—choosing a platform you trust and taking small, deliberate steps. Let's walk through it together and turn theory into practice.

Choosing the Right Platform

Your first, and most important, decision is picking a platform. This choice will shape your entire experience, so let’s cut through the noise and focus on what really matters: security and your control over your own money. Forget the flashy marketing and promises of impossible returns.

Here are the non-negotiables:

Non-Custodial Security: Stick exclusively to platforms where you—and only you—hold your private keys. If a platform ever asks for your keys or tells you to send funds to a central wallet, run the other way. It's your money; you should be the only one who can access it.

Proven Security Audits: A trustworthy platform isn't afraid to have its code put under the microscope. Look for publicly available audit reports from well-known security firms. This shows they're serious about finding and fixing any weak spots in their smart contracts.

Clear Fee Structures: You need to know exactly how the platform makes money. Whether it’s a small fee on profits or a management fee, the costs should be simple and spelled out right from the start. No surprises.

The shift toward capital automation is more than just a trend in personal finance; it's a massive economic force. It's reshaping how corporations spend, with projections for the global industrial automation market expected to hit $200–$240 billion by 2025. That number is forecast to soar to $449.77 billion by 2032—a clear sign that automated systems are here to stay. You can dive deeper into these numbers by reading the full research on industrial automation.

Setting Up and Connecting

Once you've landed on a platform that ticks all the security boxes, it's time to connect your wallet and get ready to deposit. The whole process is designed to be user-friendly, even if you’re new to DeFi.

Think of it like linking your bank account to a new investment app, but with the added layer of blockchain security. You’ll typically use a popular wallet like MetaMask or Coinbase Wallet to interact with the platform.

Here's what that usually looks like:

Head to the Platform: Open the official website, like Yield Seeker.

Connect Your Wallet: Find the "Connect Wallet" button. You'll get a prompt in your wallet's browser extension to approve the connection. This just creates a secure link; it doesn't give the platform permission to spend your funds.

Explore the Dashboard: Take a minute to get your bearings. A good platform will have a clean interface that clearly shows your portfolio, performance, and options to deposit or withdraw.

Making Your First Deposit

Now for the fun part: putting your capital to work. My advice? Start small. This lets you get a feel for the platform and see how the system works without taking on much risk.

Let's walk through an example. Say you want to deposit $50 of USDC.

You’ll go to the deposit area on the platform, type in the amount, and then approve two transactions in your wallet. The first is an "approval," which basically gives the platform's smart contract permission to interact with your USDC. The second transaction is the actual deposit that moves your funds into the automated strategy.

Key Insight: This two-step process is a standard security feature in DeFi. The approval step gives you precise control, letting you decide exactly which contracts can access your tokens and how much they can use.

After that’s done, your dashboard will refresh to show your active balance. From here, the AI agent or automated system takes the wheel, allocating your capital to start generating yield. You can sit back, monitor its performance, and watch your earnings grow—all while knowing you can withdraw at any time. This hands-off approach is what great capital automation is all about.

Still Have Questions? Let's Clear a Few Things Up

Even after you get the hang of the technology, a few practical questions always pop up when you're thinking about capital automation. This final section is all about tackling those common queries to clear up any doubts about who can use it, how safe it is, and where it fits in the wider world of finance.

Is Capital Automation Just For The Big Whales?

Not at all. One of the best things about modern DeFi is that it's open to everyone. Platforms are being built for everyday users, letting you get started with as little as $10.

The tech behind the scenes is designed to optimize returns no matter the size of your stake. This means powerful passive income strategies, once the exclusive domain of high-net-worth individuals, are now in the hands of anyone with a crypto wallet. It's a genuine leveling of the playing field.

How Do I Know My Funds Are Safe?

Security is everything, and any platform worth its salt puts it front and center. There are a few non-negotiables to look for.

First, and most importantly, the service must be non-custodial. This is a critical feature that means you—and only you—hold the private keys to your funds. The platform never takes control of your assets; they simply follow your instructions.

Next, you'll want to see that the platform has gone through rigorous security audits from well-known firms. These audit reports are usually public and show that they've had independent experts try to break things and have fixed any potential issues.

Finally, stick with services that are totally transparent about the DeFi protocols they're using. You should always have a clear view of where your capital is and what it's doing. No black boxes, no guesswork.

Isn't This Just a Robo-Advisor For Crypto?

It’s easy to see the parallel, but they're fundamentally different beasts operating in completely different universes. Comparing them is like trying to compare a speedboat to a spaceship—they're both vehicles, but they navigate totally different environments.

A traditional robo-advisor shuffles your money between stocks and bonds, usually through ETFs, within the old-school financial system. It might rebalance your portfolio once a quarter, maybe once a year.

Capital automation in DeFi, on the other hand, lives entirely on the blockchain. It's constantly moving digital assets like stablecoins between different decentralized protocols to chase the best yield. It's not reacting to the market quarterly or even daily; it's reacting minute-by-minute to capture tiny windows of opportunity that a regular robo-advisor isn't even built to see.

Ready to put your capital to work without all the manual clicking and screen-staring? Yield Seeker’s AI-powered platform makes earning a smarter, automated yield on your stablecoins completely effortless. You can get started in minutes and let your own personalized AI Agent hunt down competitive, risk-aware yields for you.