Back to Blog

Top 12 Crypto Market Analysis Tools for 2025

Discover the 12 best crypto market analysis tools for traders and investors. Compare features, pricing, and use cases to find the right platform for you.

Oct 5, 2025

generated

The crypto market operates 24/7, generating a relentless stream of data that can overwhelm even the most seasoned investor. For traders and investors, sifting through this noise to find actionable signals is the key to success. This is where specialized crypto market analysis tools become essential. Whether you're a technical analyst charting price action, an on-chain detective tracking whale wallets, or a fundamental investor assessing protocol health, the right platform can transform your strategy from guesswork into a data-driven process.

Beyond just price data, understanding market sentiment is paramount. Leveraging advanced sentiment analysis techniques can uncover the underlying psychology driving market movements, offering a critical edge. This guide cuts through the complexity, providing an in-depth, side-by-side comparison of the 12 leading platforms available today. We'll break down the best tools for technical charting, on-chain intelligence, fundamental research, and derivatives analysis.

Inside, you will find a detailed overview of each tool, complete with screenshots, direct links, and an honest assessment of its features, pricing, and practical limitations. Our goal is to help you find the perfect crypto market analysis tools for your specific needs, whether you're a DeFi enthusiast, a busy professional, or a tech-savvy investor, and build a powerful analytics stack for 2025.

1. TradingView

TradingView is an indispensable hub for technical analysis, offering one of the most powerful and versatile charting packages available. It excels as a comprehensive platform where traders can analyze assets, including an extensive list of cryptocurrencies from over 70 exchanges. Its distinction comes from combining advanced charting tools with a vibrant social network, allowing users to share and discover trading ideas and custom indicators.

The platform’s Pine Script language is a key differentiator, empowering users to create their own complex indicators and automated strategies. This makes it one of the best crypto market analysis tools for both novice chart-watchers and quantitative traders. For those new to technical analysis, you can get a head start with our guide on how to read crypto charts.

Key Features & User Experience

Platform Accessibility: Seamlessly syncs across web, desktop, and mobile apps.

Unique Offerings: The custom Pine Script editor and a massive public library of community-built scripts are standout features not found elsewhere.

Pricing: A robust free version is available with ads and limitations. Paid plans (Pro, Pro+, and Premium) unlock more indicators per chart, multiple chart layouts, and advanced alerts, starting around $14.95/month.

Pros: Enormous community for learning, vast coverage of crypto pairs, and powerful multi-platform support.

Cons: Core features like multiple chart layouts require a subscription. Users must be cautious of unofficial app downloads.

Website: https://www.tradingview.com

2. CoinMarketCap (CMC) Pro API

The CoinMarketCap (CMC) Pro API is the industry-standard gateway for developers and researchers needing programmatic access to vast crypto market data. It excels at providing reliable, comprehensive information for building custom dashboards, backtesting trading strategies, or conducting quantitative analysis. Its primary distinction is its massive historical dataset, covering over 2.4 million assets and 790+ exchanges, making it a foundational data source for countless crypto applications and platforms.

This tool is less about visual charting and more about raw data provision, serving as a powerful engine for those who want to build their own crypto market analysis tools. The API provides numerous endpoints for everything from real-time quotes and listings to detailed OHLCV (Open, High, Low, Close, Volume) data, all supported by thorough documentation and easy key management.

Key Features & User Experience

Platform Accessibility: Accessible via any application capable of making REST API calls.

Unique Offerings: Unmatched historical data depth, with some datasets going back 14+ years, and broad coverage of assets and exchanges that is difficult to find elsewhere.

Pricing: A free Basic plan offers 10,000 monthly credits. Paid plans scale from Hobbyist ($79/month) to Professional and Enterprise tiers, unlocking more credits, advanced data endpoints, and full historical access.

Pros: Considered a stable and widely recognized data authority. Excellent for enterprise-level use and serious development projects.

Cons: Primarily for developers or data scientists. Full historical data access is locked behind expensive higher-tier plans.

Website: https://pro.coinmarketcap.com

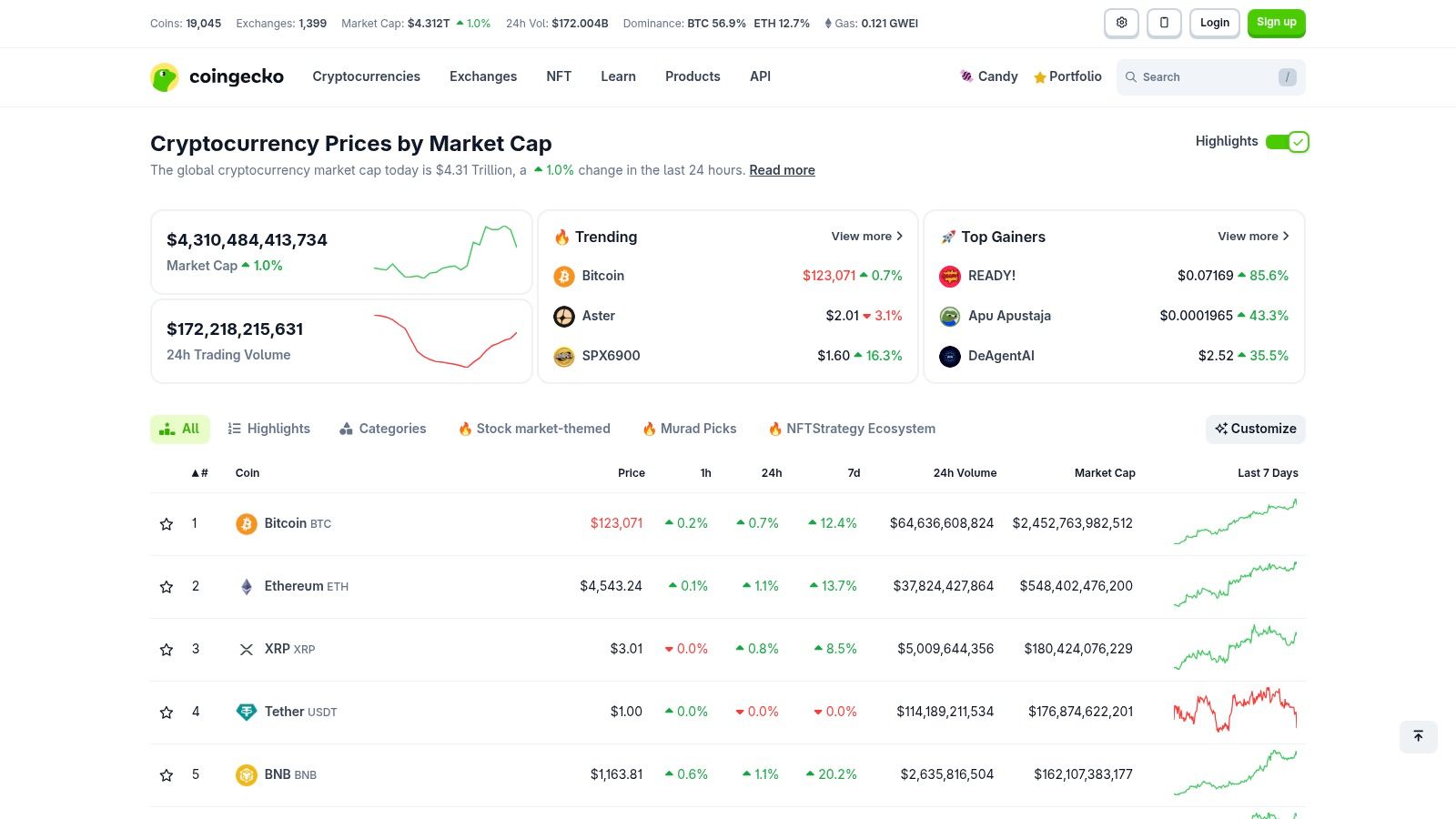

3. CoinGecko

CoinGecko is a foundational crypto market analysis tool, renowned for its comprehensive and independent aggregation of cryptocurrency data. It provides a bird's-eye view of the market, tracking prices, market capitalization, trading volume, and community growth for thousands of assets. Its strength lies in its meticulous data categorization, which allows users to discover new tokens by sector, narrative, or on-chain tags, making it invaluable for initial research and market pulse checks.

The platform stands out by offering more than just price data; it integrates fundamental analysis metrics like developer activity and social media statistics. For beginners and seasoned investors alike, CoinGecko serves as a reliable starting point for due diligence, offering a clean interface to explore everything from trending narratives to historical data snapshots. It's an essential bookmark for anyone needing a quick, holistic overview of any digital asset.

Key Features & User Experience

Platform Accessibility: Available as a comprehensive website and a highly-rated mobile app for both iOS and Android.

Unique Offerings: In-depth Categories and on-chain tags allow for nuanced market discovery, alongside a vast library of educational content in the CoinGecko Academy.

Pricing: The core platform is completely free to use. An optional Premium plan ($5/month) removes ads and provides access to an exclusive newsletter, but doesn't add advanced analytical tools.

Pros: Enormous asset coverage, free for most tracking and discovery needs, and an excellent resource for finding trending tokens and categories.

Cons: The Premium plan offers limited analytical value, focusing more on user experience enhancements than advanced features.

Website: https://www.coingecko.com

4. Glassnode Studio

Glassnode Studio is a premier on-chain analytics hub, offering deep insights into blockchain activity. It specializes in providing macro-level metrics and curated dashboards that help investors and analysts understand long-term market cycles, investor behavior, and network health. Its strength lies in transforming raw blockchain data into actionable, research-grade intelligence, making it an essential crypto market analysis tool for identifying underlying trends.

The platform’s focus on cohort analysis (tracking wallets by age) and exchange flows provides a clear picture of accumulation and distribution patterns. Glassnode stands out by offering metrics like ETF and derivatives data, which are crucial for a holistic view of the market, moving beyond simple price action to reveal the convictions of different market participants.

Key Features & User Experience

Platform Accessibility: Primarily a web-based platform with a clean, intuitive interface designed for data exploration.

Unique Offerings: Features a vast library of unique on-chain metrics, including Net Unrealized Profit/Loss (NUPL) and Spent Output Profit Ratio (SOPR), that are industry standards for gauging market sentiment.

Pricing: A free "Standard" tier offers a solid range of basic metrics. The "Advanced" and "Professional" tiers unlock the full suite of metrics, higher resolution data, and derivatives history, starting at $29/month (paid annually).

Pros: Research-grade, clearly visualized on-chain data, a free plan that provides genuinely useful insights, and dashboards ideal for serious investors.

Cons: Access to the most powerful predictive metrics and high-frequency data requires a paid subscription.

Website: https://glassnode.com

5. Santiment (Sanbase)

Santiment stands out by blending on-chain data with social sentiment and developer activity, offering a holistic view of cryptocurrency market behavior. This platform is designed for analysts who want to look beyond price charts to understand the fundamental drivers behind market movements, such as social media hype, network growth, and whale activity. Its strength lies in synthesizing complex datasets into actionable insights through intuitive dashboards and screeners.

The platform provides unique metrics like Social Dominance and MVRV (Market Value to Realized Value), which are critical for gauging market tops and bottoms. For a deeper understanding of the methodologies used in social sentiment tracking, explore resources on AI-powered sentiment analysis. This makes Santiment an essential crypto market analysis tool for developing a narrative-driven trading strategy.

Key Features & User Experience

Platform Accessibility: Primarily a web-based platform (Sanbase), with API access and a Google Sheets plugin for custom analysis.

Unique Offerings: The combined view of on-chain, social, and development data in one place is its core differentiator. Custom alerts based on these unique metrics are also a powerful feature.

Pricing: A free plan is available with data that is lagged by 30 days. The Pro plan (around $49/month) provides real-time data, while the Max plan offers full historical data and higher API limits.

Pros: Excellent mix of on-chain and social signals, insightful weekly reports, and accessible pricing for serious individual analysts.

Cons: The free plan's 30-day data lag makes it unsuitable for active trading. Some of the most powerful metrics are reserved for higher-tier plans.

Website: https://app.santiment.net

6. CryptoQuant

CryptoQuant specializes in providing institutional-grade on-chain and market data, making it a go-to platform for traders who want to look beyond price action. It offers deep insights into exchange flows, miner activity, and whale movements, which are crucial for forecasting market sentiment and potential price shifts. The platform is designed for both discretionary and systematic traders, offering a suite of tools to validate trading theses with hard data.

Its distinction lies in the granularity of its data and the integration of unique features like a powerful screener, backtesting capabilities, and an AI assistant. This combination makes it one of the most comprehensive crypto market analysis tools for data-driven decision-making. Users can create custom alerts based on specific on-chain metrics, gaining an edge by reacting to market changes faster than the crowd.

Key Features & User Experience

Platform Accessibility: Primarily a web-based platform with a clean and data-rich interface.

Unique Offerings: The AI assistant for news and strategy queries, plus extensive backtesting and live testing features, provide a significant advantage for systematic traders.

Pricing: Offers several tiers, including a free plan with basic data. Paid plans start at a competitive price for serious hobbyists, unlocking minute-level data, advanced automation, and higher API limits.

Pros: Automation-friendly platform with frequent updates, a growing feature set including AI, and competitive pricing for advanced data.

Cons: Live testing is limited on lower pricing tiers, and some advanced automation tools require a higher-tier subscription.

Website: https://cryptoquant.dev

7. IntoTheBlock

IntoTheBlock is a market intelligence platform that demystifies on-chain data, making it accessible for traders who want to look beyond price charts. It offers a suite of over 260 proprietary signals and indicators derived from blockchain analytics. The platform’s key strength lies in its ability to translate complex wallet-level data into actionable insights, such as understanding holder profitability and concentration.

This focus on holder behavior provides a unique layer of market sentiment analysis, helping users gauge whether large investors are accumulating or distributing their assets. As a result, IntoTheBlock is one of the best crypto market analysis tools for those seeking an edge through fundamental on-chain metrics without needing deep technical expertise. The clean interface visualizes complex data points like "In/Out of the Money" analysis, making it easy to see key support and resistance levels based on wallet cost basis.

Key Features & User Experience

Platform Accessibility: Available via a web-based application, with API access for institutional clients on higher tiers.

Unique Offerings: The "In/Out of the Money" analysis, which shows the average cost basis of current holders, is a standout feature for identifying potential price barriers.

Pricing: A free plan is available but has a 14-day data lag. The "Advanced" plan offers real-time data and starts at $10/month, with a "Pro" plan for more advanced users and API access.

Pros: Very affordable entry point for real-time on-chain data, powerful wallet-level insights, and an intuitive user interface.

Cons: The free plan's data lag makes it unsuitable for active trading. Core institutional-grade features and API access are locked behind the most expensive tiers.

Website: https://app.intotheblock.com

8. Nansen

Nansen is a blockchain analytics platform that specializes in providing actionable on-chain data, particularly through its sophisticated wallet-labeling system. It shines by helping users track the activities of "smart money," such as venture capital funds, whales, and highly profitable traders. This allows investors to see where influential market participants are moving their capital, offering a significant edge in identifying emerging trends in both DeFi and NFTs.

The platform’s dashboards are data-rich, presenting everything from token flows to NFT minting activity in a digestible format. A standout feature is its new AI-powered assistant, which lets users query complex on-chain data using natural language, making it one of the more innovative crypto market analysis tools. To explore how AI is shaping investment strategies, read our guide on AI in crypto investing.

Key Features & User Experience

Platform Accessibility: Available on web and through dedicated mobile apps for iOS and Android.

Unique Offerings: Its labeled wallet database across over 25 blockchains is a core differentiator, providing unparalleled insight into smart-money movements and whale tracking.

Pricing: A free account offers limited access to dashboards. Paid plans (Standard, VIP, and Alpha) unlock full data access and advanced features, starting around $99/month.

Pros: Actionable smart-money analytics, rapid feature development, and an integrated points program with partner perks.

Cons: The depth of data can be overwhelming for new users, and there is no free trial for premium features.

Website: https://nansen.ai

9. Token Terminal

Token Terminal shifts the focus from price charts to fundamental analysis, treating crypto protocols like traditional businesses. It provides standardized financial and alternative data, offering metrics such as revenue, fees, and price-to-sales (P/S) ratios. This platform is a go-to for investors who want to evaluate the underlying financial health and usage of a network, making it one of the best crypto market analysis tools for on-chain due diligence.

The platform’s strength lies in its ability to present complex on-chain data through familiar, business-centric dashboards. Users can compare the performance of different protocols side-by-side using standardized metrics, similar to how one might analyze stocks. For investors focused on tracking protocol performance, you can explore more tools in our guide to the best DeFi portfolio trackers.

Key Features & User Experience

Platform Accessibility: Primarily a web-based platform with robust data export capabilities.

Unique Offerings: Standardized financial metrics like P/S and P/F ratios for crypto protocols are its core differentiator, bridging the gap between TradFi and crypto analysis.

Pricing: A free version provides access to core dashboards with limited data history. The Pro plan, aimed at professionals and institutions, costs $333/month and unlocks full data, API access, and advanced features.

Pros: Clear and comparable fundamental metrics across protocols, analyst-friendly data exports (CSV/Excel), and strong enterprise integration options.

Cons: The pro plan is expensive for retail users, and access to raw, decoded data requires an even pricier enterprise-level subscription.

Website: https://tokenterminal.com

10. Dune

Dune is a powerful, community-driven platform for deep on-chain analytics, leveraging SQL queries to explore and visualize blockchain data. It stands out by giving users direct access to raw blockchain data, allowing them to create custom dashboards for everything from DeFi protocol health and NFT market trends to specific wallet activity. Its open nature means you can fork, edit, and build upon thousands of existing community-created queries and dashboards.

This makes Dune one of the most flexible crypto market analysis tools for data-savvy users, developers, and researchers who need granular, bespoke insights that go beyond pre-packaged metrics. The ability to write and share custom SQL queries gives it an unmatched level of depth and customizability for on-chain investigation.

Key Features & User Experience

Platform Accessibility: Primarily a web-based platform with robust data export and API options.

Unique Offerings: The core strength is its SQL query engine paired with a massive, open-source library of user-generated dashboards and analytics.

Pricing: A generous free plan allows unlimited queries (with performance limitations) and public dashboards. Paid plans start at $399/month, offering faster queries, private dashboards, API access, and dedicated support.

Pros: Unparalleled customization for on-chain data, strong developer workflow support, and a free-to-start model that is highly scalable.

Cons: Has a steep learning curve for users unfamiliar with SQL. Heavy or commercial usage can become costly.

Website: https://dune.com

11. Kaiko

Kaiko is a leading institutional-grade data provider, offering high-fidelity, granular market data essential for enterprises. It serves financial institutions, asset managers, and researchers with clean, normalized data feeds, including trades, order books, and aggregates from over 100 exchanges. Its distinction lies in its compliance-first approach, providing auditable and regulatory-ready data crucial for financial reporting and risk management.

The platform is designed for quantitative analysis, algorithmic trading, and backtesting, making it one of the most reliable crypto market analysis tools for professional firms. Kaiko’s commitment to data integrity, evidenced by its SOC 2 Type II and EU BMR compliance, makes it an indispensable resource for businesses operating in regulated financial environments.

Key Features & User Experience

Platform Accessibility: Data is delivered via a unified REST/WebSocket API, flat files, and cloud-based services.

Unique Offerings: Its compliance-ready data feeds are designed for GAAP/IFRS workflows, tax reporting, and audits, a feature rarely found in other data providers.

Pricing: Pricing is enterprise-oriented and available via custom quotes, tailored to specific data needs and usage volume. It is not intended for individual retail traders.

Pros: Delivers exceptionally reliable, clean, and trusted data. Robust compliance frameworks meet the needs of financial institutions.

Cons: Pricing and complexity make it inaccessible and unsuitable for casual users or individual retail traders.

Website: https://www.kaiko.com

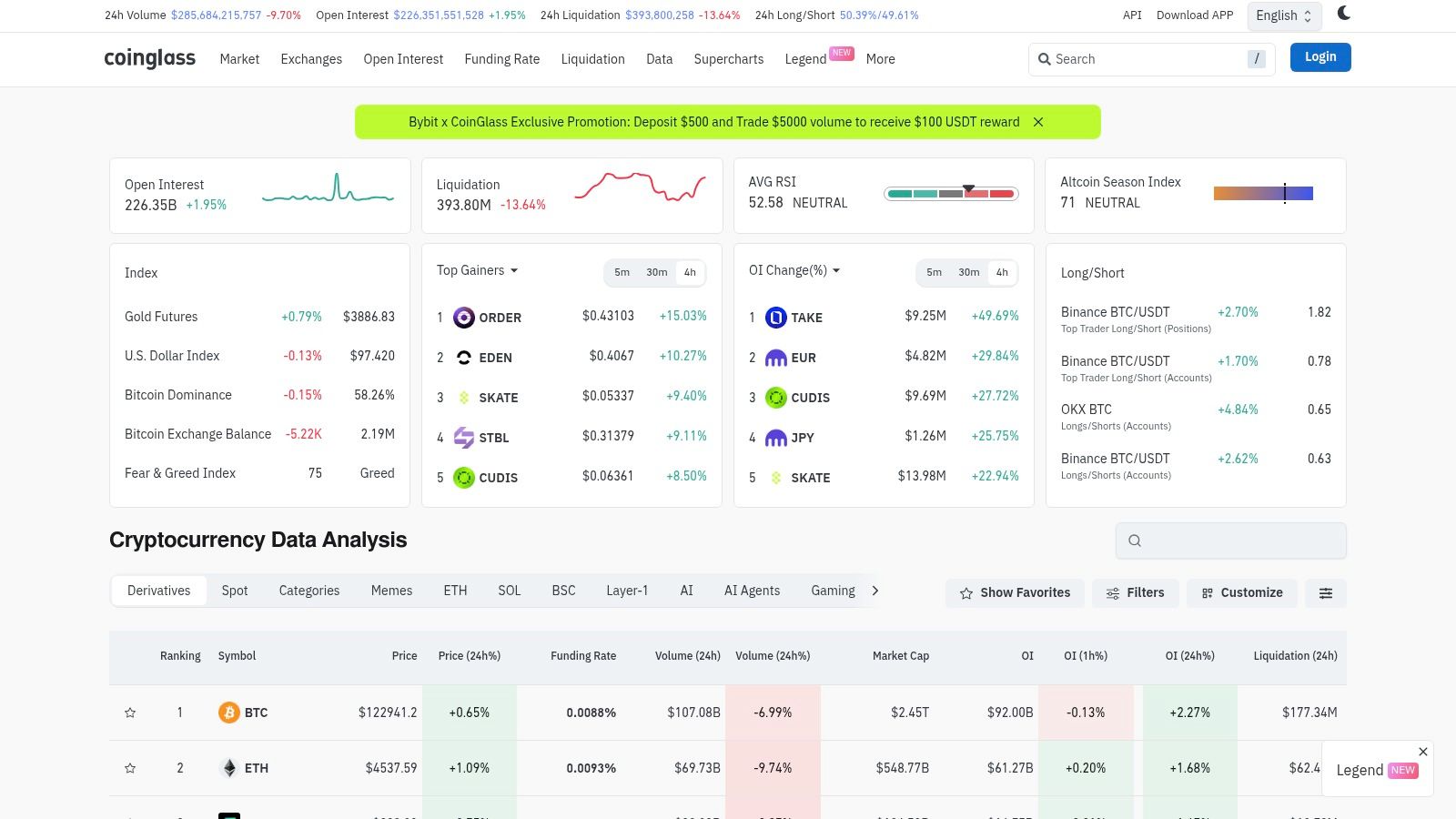

12. CoinGlass

CoinGlass is a derivatives-focused data platform that has become essential for traders seeking an edge in leveraged markets. It provides a deep dive into futures and options data, offering crucial metrics like open interest, funding rates, and liquidation levels that are often opaque on exchanges. The platform’s strength lies in its ability to visualize complex market dynamics, helping traders identify potential support, resistance, and high-volatility zones.

This specialization in derivatives makes CoinGlass one of the best crypto market analysis tools for monitoring risk and anticipating short-term market movements. Its real-time liquidation heatmaps and funding rate dashboards provide a clear view of market sentiment and leverage, which is invaluable for timing entries and exits in a volatile environment.

Key Features & User Experience

Platform Accessibility: Primarily a web-based platform with a robust public site and dedicated API endpoints.

Unique Offerings: The platform's liquidation heatmaps and comprehensive funding rate dashboards offer an unparalleled look into the derivatives landscape. It also provides detailed crypto ETF data.

Pricing: A significant amount of data is available for free. Paid subscriptions unlock real-time data, advanced features, and API access, with tiers starting around $39/month.

Pros: Excellent, trader-oriented visualizations for complex derivatives data. Competitively priced and powerful API options are available for automated strategies.

Cons: Some of the most actionable features require a paid subscription. API subscriptions are non-refundable.

Website: https://coinglass.com

Top 12 Crypto Market Analysis Tools Comparison

Platform | Core Features / Capabilities | User Experience / Quality ★ | Value Proposition 💰 | Target Audience 👥 | Unique Selling Points ✨ |

|---|---|---|---|---|---|

TradingView | Multi-asset charts, alerts, Pine Script coding | ★★★★☆ Multi-platform, synced | 💰 Free & paid tiers, advanced req. | 👥 Traders, analysts | 🏆 Massive community, broker integration |

CoinMarketCap Pro | Market data API, 14+ yrs data, 790+ exchanges | ★★★★ Stable, extensive coverage | 💰 Paid tiers for full data | 👥 Developers, enterprises | ✨ Industry-standard market data |

CoinGecko | Market tracking, watchlists, educational content | ★★★★ Easy, mobile friendly | 💰 Mostly free, Premium for UX | 👥 General users, beginners | ✨ Huge asset coverage, free usage |

Glassnode Studio | On-chain metrics, cycle data, customizable alerts | ★★★★ Visual, research-grade | 💰 Free & paid plans | 👥 Investors, funds | 🏆 Macro on-chain insights |

Santiment (Sanbase) | On-chain + social data, alerts, API | ★★★ Balanced, useful reports | 💰 Free lagged & Pro plans | 👥 Analysts, sentiment traders | ✨ Mixed on-chain & social signals |

CryptoQuant | On-chain & derivatives data, AI assistant | ★★★★ Competitive, automation friendly | 💰 Affordable tiers, advanced paid | 👥 Traders, hobbyists | ✨ AI assistant & strategy backtests |

IntoTheBlock | 260+ signals, wallet insights, NFT & DeFi analysis | ★★★ Easy, approachable UI | 💰 Low entry, upgrade path | 👥 Individual traders | ✨ Wallet-level insights |

Nansen | Wallet labeling, AI chatbot, smart-money analytics | ★★★★ Fast dev, integrated perks | 💰 No free trial, free limited acct | 👥 DeFi/NFT users, smart traders | 🏆 Smart-money flow & AI assistant |

Token Terminal | Fundamentals, financial metrics, dashboard & API | ★★★★ Analyst friendly | 💰 High pricing, pro focus | 👥 Professionals, enterprises | 🏆 Standardized financial data |

Dune | SQL-based on-chain analytics, public dashboards | ★★★ Flexible, developer-focused | 💰 Free start, paid scaling | 👥 Developers, data analysts | ✨ Custom SQL queries |

Kaiko | Institutional market data, compliance-ready analytics | ★★★★ Trusted, compliant | 💰 Enterprise custom pricing | 👥 Institutions, enterprises | 🏆 GAAP/IFRS & regulatory reporting |

CoinGlass | Derivatives data, liquidation heatmaps, ETF flows | ★★★ Trader-focused visuals | 💰 Tiered subscriptions | 👥 Short-term traders, risk managers | ✨ Derivatives & ETF data |

Building Your Edge: From Analysis to Action

Navigating the volatile crypto market without the right instruments is like sailing a treacherous sea without a compass. Throughout this guide, we have explored a dozen of the industry's most powerful crypto market analysis tools, each offering a unique lens through which to view market dynamics. From the unparalleled charting capabilities of TradingView to the deep on-chain intelligence of Glassnode and the customizable SQL queries of Dune, the resources available are more sophisticated than ever.

The core takeaway is that a one-size-fits-all solution does not exist. Your success hinges on strategically combining these platforms to build a personalized analysis stack that aligns with your specific goals, risk tolerance, and time commitment. A holistic view is paramount; relying solely on technical indicators without understanding on-chain fundamentals, or vice versa, leaves you vulnerable to blind spots.

Crafting Your Personal Analysis Stack

To translate insight into action, consider how these tools complement each other. For instance, a long-term investor might combine fundamental metrics from Token Terminal with on-chain accumulation trends from CryptoQuant to validate a thesis. In contrast, a derivatives trader would find the combination of CoinGlass for open interest data and TradingView for precise charting indispensable.

When selecting your tools, consider these crucial factors:

Your Strategy: Are you a day trader, a long-term HODLer, a DeFi farmer, or an institutional analyst? Your answer will immediately narrow down the most relevant platforms.

Data Focus: Do you prioritize technical analysis, on-chain metrics, fundamental analysis, or derivatives data? A well-rounded approach often requires a mix, but your primary focus should guide your main tool.

Budget: Many tools offer robust free tiers (like CoinGecko and Dune's community dashboards), while others like Nansen and Glassnode require a significant subscription fee for advanced features. Start with free versions to test their utility before committing financially.

Learning Curve: Platforms like Dune demand SQL knowledge, whereas IntoTheBlock excels at simplifying complex data with clear signals. Be honest about the time you are willing to invest in mastering a new tool.

From Active Analysis to Automated Action

Ultimately, the goal of using any of these crypto market analysis tools is to gain a competitive edge and make more informed decisions. This process can be intensive, requiring constant monitoring and re-evaluation. However, another approach exists for those seeking to capitalize on market opportunities without dedicating hours to manual research.

This is where automated solutions come into play, performing the analysis on your behalf to execute a specific strategy. For those focused on passive income, particularly within the stablecoin ecosystem, leveraging AI to find the best yield becomes the most efficient strategy. Whether you choose to become an expert chartist or let technology handle the heavy lifting, remember that the tools you wield are the bridge between raw data and profitable outcomes.

Tired of manually hunting for the best yields in DeFi? The same analytical rigor discussed in this article can be automated. Yield Seeker uses AI-powered analysis to constantly scan protocols and find the highest, most reliable stablecoin returns, so you can earn passive income without the endless research. Explore automated DeFi opportunities at Yield Seeker today.