Back to Blog

Crypto Market Cap Explained for Beginners

What is crypto market cap? This simple guide has the crypto market cap explained with real examples, how it's calculated, and why it matters to investors.

Oct 10, 2025

generated

Ever heard someone talk about a crypto's "market cap" and wondered what they were really getting at? It's a term thrown around a lot, but it’s actually a super simple and powerful concept.

In a nutshell, crypto market cap is the total value of all of a cryptocurrency's coins currently out in the world. You just multiply the current price of one coin by the total number of coins in circulation. That's it. It’s the quickest way to get a feel for a crypto's overall size and influence in the market.

What Crypto Market Cap Actually Means

The easiest way to think about market cap is to compare it to the stock market. For a company like Apple, its market cap is the total value of all its shares. For a crypto like Bitcoin, it’s the total value of all its coins. It’s not about the price of a single coin, but the combined worth of all coins available to the public.

This one number gives you a fantastic snapshot of a cryptocurrency's scale and potential stability. It helps you see the bigger picture.

It's helpful to remember that many people view cryptocurrencies as alternative investments, sitting outside traditional stocks and bonds. And just like in traditional finance, market cap is the go-to metric for sizing up how significant an asset really is.

Understanding this is so fundamental that we cover it early in our guide to crypto investing for beginners. It's the first step to looking past just the price tag and seeing a project's true footprint in the crypto world.

How To Calculate Crypto Market Cap In Two Simple Steps

Figuring out a crypto's market cap isn't some high-level math problem. Thankfully, it’s a straightforward calculation using just two numbers you can easily find online.

The formula is refreshingly simple:

Market Cap = Current Price × Circulating Supply

Let's walk through it with Ethereum (ETH). First, you need its current price. Second, you need its circulating supply — that’s the total number of ETH coins actually out there and available to trade.

You don't have to go digging for this data. Websites like CoinMarketCap or CoinGecko have it all laid out for you in real-time.

So, if ETH's price is sitting at $3,500 and there are 120 million coins in circulation, you just multiply them together.

$3,500 (Price) × 120,000,000 (Circulating Supply) = a $420 billion market cap.

That massive number gives you a snapshot of Ethereum's total value at that moment. Understanding this is a fundamental piece of the puzzle when you start learning how to calculate investment returns, as it puts a project's overall size and valuation into perspective.

Comparing the Different Tiers of Crypto Market Cap

When you look at the crypto world, you'll quickly realize not all coins are built the same. The main way we slice and dice them is by their market cap. This helps us group them into different tiers: the established giants (large-caps), the up-and-comers (mid-caps), and the wildcards (small-caps).

Each of these tiers comes with its own unique blend of risk and potential reward, and knowing the difference is key for anyone getting involved in the space.

For a bit of perspective, the total global crypto market cap swelled to roughly $4.23 trillion in early 2025. A massive chunk of that—often over half—is just Bitcoin alone. This really drives home the sheer scale we're talking about. If you want to see this data live, platforms like CoinGecko's market charts are fantastic for keeping a pulse on the numbers.

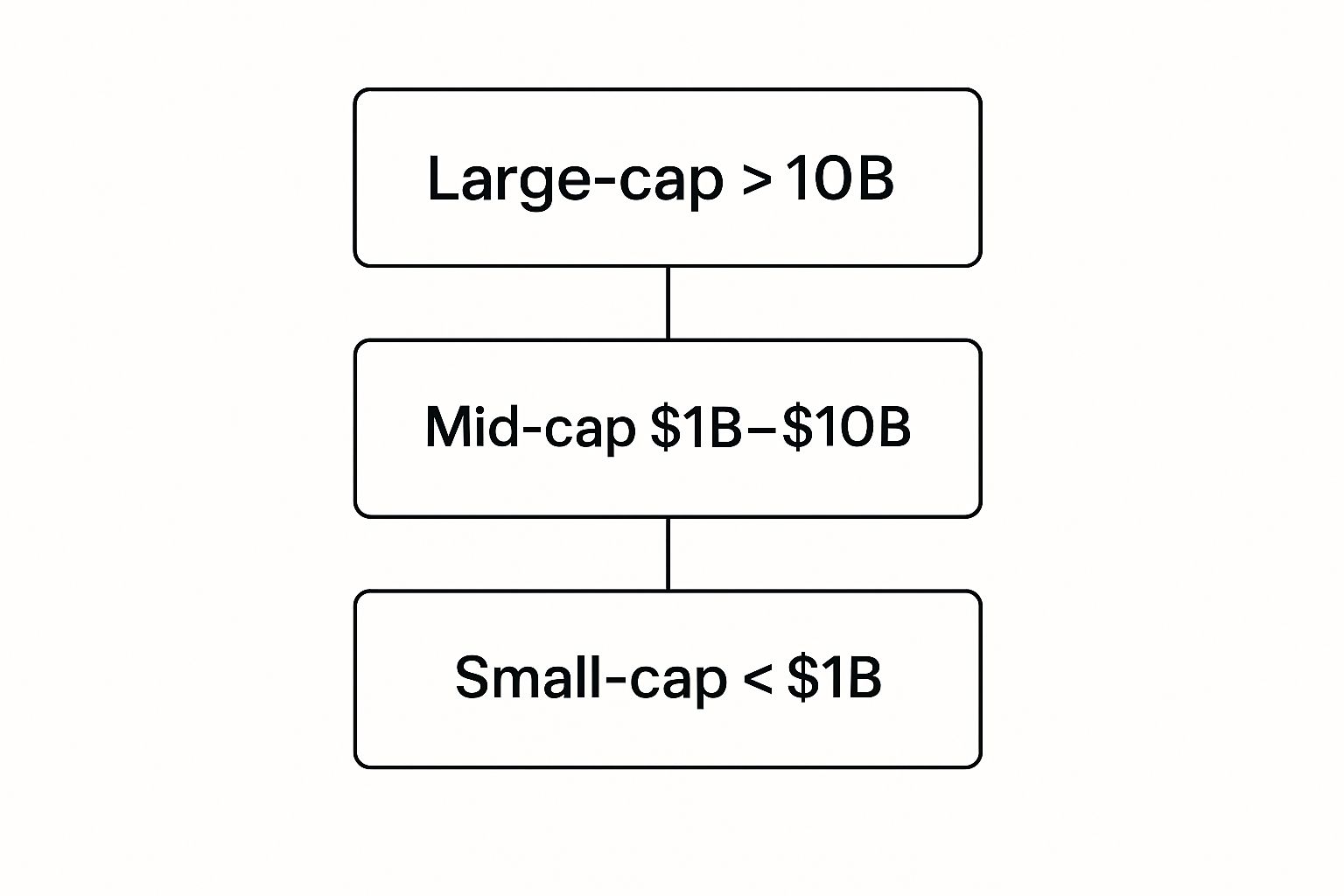

This infographic gives a great visual breakdown of what these tiers actually look like in terms of valuation.

As you can see, there's a huge valuation gap between the household names in the large-cap bucket and the newer, more speculative small-cap tokens. Let's break that down a bit more clearly.

Crypto Market Cap Tiers Compared

To make this even more practical, here’s a table comparing what you can typically expect from each tier—from their size and stability to their potential for explosive growth.

Tier | Market Cap Range (Approx.) | Characteristics | Examples |

|---|---|---|---|

Large-Cap | $10 Billion+ | Established, well-known projects with high liquidity and lower volatility. Considered the "blue chips" of crypto. | Bitcoin (BTC), Ethereum (ETH) |

Mid-Cap | $1 Billion - $10 Billion | Projects with established use cases but still have significant room for growth. More volatile than large-caps. | Chainlink (LINK), Polygon (MATIC) |

Small-Cap | Under $1 Billion | Newer, more experimental projects with the potential for massive gains but also carry the highest risk of failure. | Various emerging altcoins |

Essentially, as you move down from large-cap to small-cap, you're trading stability for higher growth potential. Large-caps form the bedrock of many portfolios, while mid- and small-caps are where investors often look for those moonshot returns, fully aware of the risks involved.

Why Market Cap Is a Smarter Metric Than Price Alone

It’s a classic rookie mistake: getting fixated on a coin's price. Seeing a crypto trading for pennies can feel like you’ve stumbled upon an incredible bargain, but here’s the thing—price is pretty much useless without knowing how many coins are out there.

This is where understanding market cap becomes a total game-changer for any serious investor.

Let me put it this way: would you rather own 1% of a company worth a million dollars, or 50% of a company worth just ten thousand? The first option, right? It's way more valuable, even though your ownership stake is smaller. That’s the exact same logic we apply to crypto with market cap.

A cheap coin with a massive supply can easily have a larger market cap—and therefore be a more significant project—than an expensive coin with few in circulation. This fundamental insight helps you assess a project's true scale and long-term potential.

The Limitations You Need to Understand About Market Cap

While market cap is often the first number people look at, it's definitely not the whole story. You have to be careful, because it can be pretty misleading if you don't know its weak spots.

The biggest issue is how easily it can be manipulated, especially with thinly-traded or low-volume coins. A few strategic trades can pump up the price, making the market cap look huge even if there's very little actual money flowing into the project.

It also doesn't tell you a thing about liquidity. A project might have a $1 billion market cap on paper, but that doesn't mean you can instantly cash out $1 billion. Trying to sell a large amount could crash the price.

Another quirky detail is that "lost coins"—tokens in wallets where the keys have been lost forever—are still counted in the circulating supply. This slightly inflates the numbers and doesn't reflect the true, accessible value of the network.

Key Takeaway: Think of market cap as a starting point, not the final word. It's a quick snapshot, but you always need to dig deeper. Combining it with other metrics like trading volume, project development, and community engagement gives you a much healthier, more complete picture of what's really going on. For more on this, check out our full guide on how to invest in cryptocurrency safely.

Got questions about crypto market cap? Let's clear up some of the most common ones.

FAQ on Crypto Market Cap

Question | Answer |

|---|---|

What Is The Difference Between Market Cap And Trading Volume? | Market cap is the total value of all of a crypto's coins, showing its overall size. Trading volume is the value of coins traded in a 24-hour period, which tells you more about its current activity and how easily you can buy or sell it. |

Can a Cryptocurrency's Market Cap Go to Zero? | Absolutely. If a project fails and its coin price crashes to effectively zero, the market cap follows suit. It's a stark reminder that the project has lost all its market value. |

Is High Market Cap a Guarantee? | Not at all. A high market cap often suggests a more stable, trusted project, but it's no crystal ball for future success. Think of it as just one useful tool in your research toolkit, not a guarantee. |

Hopefully, that clears things up! Market cap is a foundational concept, but it's crucial to understand what it can—and can't—tell you.