Back to Blog

Cryptocurrency Mining Explained for Beginners

Cryptocurrency mining explained in a simple guide. Learn how mining works, what Proof of Work is, the hardware you need, and if it's still profitable.

Oct 23, 2025

generated

Ever wonder how cryptocurrencies like Bitcoin operate without a bank in the middle? The answer lies in a process called cryptocurrency mining.

Think of it as a global, competitive bookkeeping job. Miners are the bookkeepers, and the first one to solve a complex math puzzle gets to update the public digital ledger—the blockchain. For their hard work, they're rewarded with brand-new coins. This system is the engine that keeps many digital currencies secure and running.

What Is Cryptocurrency Mining Really?

At its heart, crypto mining isn't just about making new money. It actually serves three crucial functions that allow a decentralized network to work. It’s the process that guarantees the network's integrity, keeps it secure, and ensures it runs smoothly without a central authority calling the shots.

Imagine thousands of accountants worldwide, all racing to be the first to verify the latest batch of transactions. That race is mining. It makes sure every transaction is legit and stops anyone from trying to spend the same digital coin twice. Before we get into the nuts and bolts, it helps to have a handle on the fundamental concepts of blockchain solutions that this whole process underpins.

To really get what mining is all about, let's break down the three core jobs every miner performs. These tasks are all linked and are absolutely vital for the health of the blockchain.

The Three Core Jobs of a Crypto Miner

Here’s a simple breakdown of what a miner is actually doing when they fire up their rigs.

Function | Description | Simple Analogy |

|---|---|---|

Verifying Transactions | Miners grab pending transactions, bundle them into a "block," and double-check that the sender has the funds to make the payment. | A diligent cashier checking a customer's ID and account balance before approving a large purchase. |

Securing the Network | By using massive computing power to solve a puzzle (Proof of Work), miners build a powerful security wall around the blockchain. | A bank vault with a lock so complex that it would take an army of locksmiths years to crack. |

Issuing New Coins | The winning miner adds their verified block to the chain and gets rewarded with newly created crypto. This is how new money enters the system. | A central bank printing new bills, but instead of a government, it's a decentralized network rewarding honest work. |

This reward system is pretty clever. It perfectly aligns the miners' own financial interests with the security of the entire network. They’re motivated to play by the rules and contribute their computing power because that's how they earn rewards. You can learn more about how this digital ledger works in our guide to understanding blockchain technology.

The beauty of mining is that it turns self-interest into collective security. Each miner, competing for a personal reward, collectively builds an incredibly secure and trustworthy financial system without needing a central leader.

Ultimately, this process is what makes a cryptocurrency truly decentralized and "trustless." It replaces the need for a traditional bank or payment processor by creating a system where trust is built through raw computation and agreement among people all over the world.

How Proof of Work Secures the Network

The real magic behind giants like Bitcoin isn’t just the coins themselves—it's the ridiculously strong security holding everything together. This security comes from a clever system called Proof of Work (PoW). It's the engine that makes sure every single transaction is legit and the whole network stays honest, all without a central bank calling the shots.

Think of Proof of Work as a massive, worldwide competition. Miners are all in a mad dash, racing to solve the same mind-bendingly difficult math puzzle. This isn't a brain teaser you solve with a clever insight; it’s a pure numbers game that demands raw computing power. Miners fire up specialized hardware, making trillions of guesses every second, just hoping to be the first one to hit the jackpot.

When a miner finally cracks the puzzle, they win the right to add the next "block" of transactions to the blockchain. For all that hard work and electricity, they get a reward: a batch of brand-new crypto and all the transaction fees from that block. This intense computational grind is the "work" in Proof of Work, and it builds a formidable digital and economic fortress around the network.

The Role of Hashing in Mining

At the heart of this puzzle-solving race is a concept called hashing. A hash function is basically an algorithm that takes any kind of data—in this case, a block of transactions—and spits out a unique, fixed-length string of letters and numbers. This string is the "hash."

You can think of it like a digital fingerprint. If you change even the tiniest detail in the original data, like fudging a transaction by a single penny, the hash becomes completely different and unrecognizable. This is exactly what makes the blockchain "immutable," meaning it's incredibly resistant to being altered.

To create a valid block, a miner has to find a hash that meets certain rules set by the network—usually, it needs to start with a specific number of zeros. The only way to find this special hash is through brute-force trial and error. Miners are constantly changing a tiny piece of data in the block, called a nonce (which just means "number used once"), and re-hashing it over and over until they strike gold.

This infographic breaks down the simple flow of how a miner's work gets validated and rewarded.

It shows the core loop perfectly: verify transactions, solve the cryptographic puzzle, and get paid. That's the Proof of Work model in a nutshell.

Building an Unbreakable Chain

Once a miner finds a valid hash and their block is added to the chain, their job isn't quite done. The hash of their new block gets included in the data of the next block, creating a chronological and cryptographic link that chains them all together.

This linking is what makes the blockchain a fortress. Let's walk through what it would take for a bad actor to try and change a transaction from the past.

Alter the Transaction: First, they’d have to find the block with the transaction they want to change and modify the data.

Break the Hash: The second they do that, the block's original hash becomes invalid. The digital fingerprint no longer matches.

Recalculate the Work: The attacker would then have to re-mine that entire block from scratch to find a new, valid hash. This is already a massive task.

Catch Up to the Network: But here’s the real kicker. They don't just have to re-mine that one block. They have to re-mine every single block added to the chain since then, because each one contains the hash of the block before it.

To successfully attack a Proof of Work network, an attacker would need to control more than 51% of the entire network's mining power. This "51% attack" is theoretically possible but practically unfeasible for major networks like Bitcoin due to the immense cost of acquiring and running that much hardware.

Trying to pull this off would require an astronomical amount of electricity and specialized gear, easily costing billions of dollars. And all the while, the honest miners are still chugging along, adding new blocks and making the chain even longer. The cost of an attack is so ridiculously high that it far outweighs any potential gain, giving everyone a powerful financial incentive to just play by the rules.

Choosing Your Tools for Crypto Mining

Long gone are the days when you could mine crypto as a hobby on a spare home computer. Today, it’s a cut-throat, specialized industry where your success hinges entirely on having the right gear. The hardware powering crypto mining has evolved at a blistering pace, all thanks to a constantly rising network difficulty that demands more power and more efficiency.

Think of it like upgrading your tools for a job that gets exponentially harder each day. You might start with a simple hand tool, but you'll need a full-blown factory assembly line before you know it. Understanding this tech arms race is the key to seeing why modern mining looks the way it does.

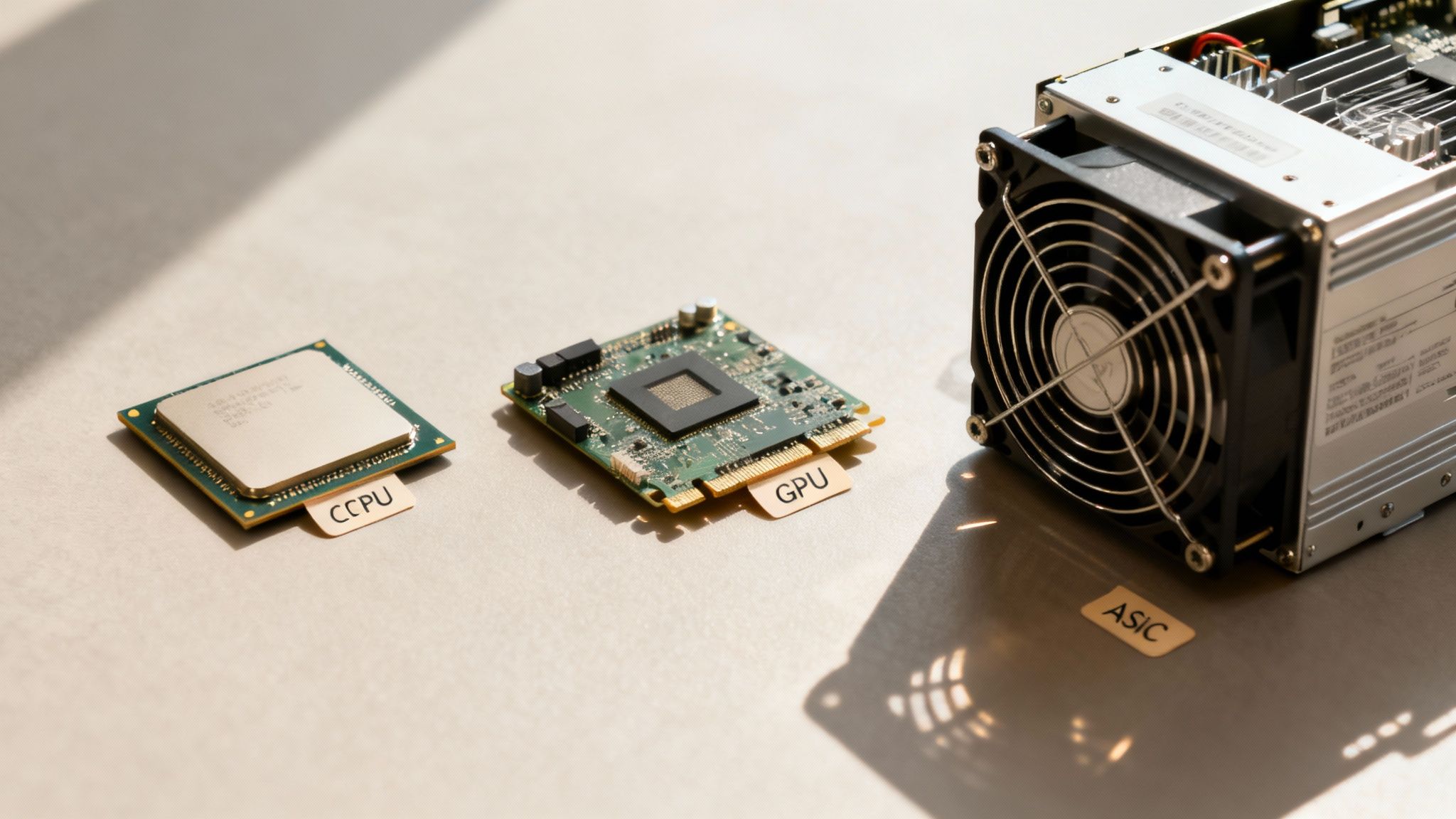

The Evolution from CPUs to ASICs

In the very beginning, mining Bitcoin was simple enough for a standard computer processor—a CPU—to handle. The CPU is the brain of your computer, designed as a jack-of-all-trades. It's like a Swiss Army knife: good at many things, but a master of none. As Bitcoin’s value took off and more people jumped in, the network's difficulty shot through the roof. CPUs just couldn't hang.

This forced miners to pivot to Graphics Processing Units (GPUs). GPUs were originally built to render complex graphics for video games, packing thousands of cores that crush repetitive calculations in parallel. This made them exponentially better at the brute-force guessing game of hashing. It was like upgrading from that Swiss Army knife to a workshop full of powerful, specialized tools.

But even GPUs eventually hit a wall. The final leap in this technological race was the birth of Application-Specific Integrated Circuits (ASICs). These aren't general-purpose tools at all; they are custom-built factory machines designed to do one single thing: mine a specific cryptocurrency algorithm at mind-boggling speeds.

Just look at the intricate circuitry inside an ASIC chip to see how specialized it is.

Every single component is optimized for one job, which is exactly why ASICs are thousands of times more powerful than even the best GPUs for mining.

Building a Modern Mining Rig

A beast of an ASIC is just the centerpiece. To run a professional mining rig today, you need a serious investment in supporting infrastructure to keep it running safely and efficiently. Without this gear, the best ASIC on the market would fry itself in minutes.

The key components you can't skip are:

Robust Power Supply Units (PSUs): Mining rigs are insanely power-hungry. You need a high-wattage, reliable PSU to deliver a stable flow of electricity and prevent your expensive hardware from getting damaged.

Advanced Cooling Systems: ASICs generate a tremendous amount of heat. Overheating will kill the hardware, so miners use a combination of high-RPM fans, ventilation systems, and sometimes even liquid immersion cooling to keep things from melting down.

Physical Infrastructure: A professional setup needs a dedicated space with proper shelving, industrial-grade wiring, and serious ventilation. This isn't something you can just tuck away in a closet; it often looks more like a small data center.

The upfront hardware investment is the single biggest barrier for anyone looking to get into mining. A single high-performance ASIC rig can set you back anywhere from $2,000 to $20,000, depending on its hashing power and efficiency.

This hefty price tag is a core part of what cryptocurrency mining has become: an industrial-scale operation. The supply chain for this hardware is also heavily centralized, dominated by a few giants like Bitmain and MicroBT.

The good news? Despite the high initial costs, the price per terahash (a measure of mining power) has dropped to around $16 from $80 just a few years ago, making the tech a bit more accessible. You can learn more about the global bitcoin mining landscape to see how these economics play out worldwide. This price drop has helped miners stay profitable even as the network difficulty keeps marching upward.

The Real Economics of Cryptocurrency Mining

So, after sinking all that cash into powerful hardware and watching the electricity meter spin, is crypto mining actually profitable?

The short answer? It's a high-stakes game with razor-thin margins. Profitability isn't a simple "yes" or "no." It's a constantly shifting equation that pits massive costs against rewards that can be both sky-high and incredibly volatile.

Success here isn't just about owning the fastest machine. It's about mastering several key variables. Miners are constantly juggling the upfront cost of their rigs, the ongoing price of power, the crypto's market value, the network's mining difficulty, and the size of the block reward.

This delicate balancing act is exactly why mining has migrated from hobbyist basements to industrial-scale data centers. Big operations can negotiate cheaper electricity rates and buy hardware by the truckload, giving them an economic edge that an individual simply can't compete with.

The Profitability Equation Explained

Think of a mining operation just like any other business. You've got your capital expenditures (the hardware) and your operational costs (the electricity bill). Your goal is to make sure your revenue (block rewards and transaction fees) covers all of that and then some.

Here’s a look at the core factors that make or break a miner:

Hardware Costs: This is your big upfront investment. A top-of-the-line ASIC miner can set you back thousands of dollars, and its useful lifespan is painfully short as newer, more efficient models are always hitting the market.

Electricity Price: This is the killer. It's the most significant ongoing expense by a long shot. A difference of just a few cents per kilowatt-hour can decide whether you're in the black or deep in the red. This is why you see massive mining farms popping up in places with dirt-cheap energy.

Cryptocurrency Value: The revenue side of your ledger is completely at the mercy of the market price of whatever coin you're mining. A bull run can make even the most inefficient setups wildly profitable, while a bear market can send them into bankruptcy.

Network Difficulty: As more miners jump onto the network, the cryptographic puzzle gets harder to solve. This is by design. But it means your hardware earns less and less crypto over time for the same amount of work.

Figuring out your potential earnings means constantly keeping an eye on all these moving parts. If you're keen to dive into the financial side of things, our article on how to calculate investment returns gives you a solid framework for these kinds of assessments.

Understanding the Bitcoin Halving

One of the most dramatic economic events baked into the crypto world is the halving. It’s hardcoded right into Bitcoin's protocol, and it does exactly what it sounds like: it cuts the block reward miners receive in half. This happens like clockwork, roughly every four years (or every 210,000 blocks mined).

The whole point of the halving is to control the supply of new coins, creating a digital scarcity that mimics precious metals like gold. By systematically slowing down the rate of new coin creation, it guarantees that the total supply will never exceed 21 million coins.

A halving event instantly makes mining less profitable at the current price. It's a brutal shock to the system that forces miners to either get more efficient or hope for a price surge to stay afloat. The most recent Bitcoin halving in April 2024 slashed the block reward from 6.25 BTC to just 3.125 BTC.

This pre-programmed scarcity is a fundamental piece of Bitcoin's economic DNA. Historically, each halving has been followed by a major bull run, though there's never a guarantee it will happen again. For miners, it’s a recurring stress test that weeds out the weakest players and reinforces the need for industrial-scale efficiency.

All these economic pressures have turned crypto mining into a massive global industry. Total revenue is projected to hit around $20.4 billion, a 9% jump from the previous year. Bitcoin mining still makes up about two-thirds of that pie, showing just how dominant it remains. You can dig into more stats about the global scale of crypto mining on Coinlaw.io. This massive scale isn't an accident; it's a direct result of economic forces like the halving that demand peak performance just to survive.

Exploring Proof of Stake: A Greener Alternative

The brute-force computational race of Proof of Work isn't the only game in town for securing a blockchain. As concerns over PoW's massive energy bill grew, a powerful alternative stepped into the spotlight: Proof of Stake (PoS). This model completely flips the script on how new blocks get made, swapping raw processing power for economic investment.

Instead of miners duking it out with power-hungry hardware, a PoS network is run by validators. These folks lock up, or "stake," their own coins as collateral for a chance to be chosen to approve transactions and create the next block. Think of it less like a sprint and more like a lottery—the more tickets you hold (by staking more coins), the better your odds of being picked.

It sounds like a simple change, but the implications for the entire network are huge.

How Staking Secures the Network

In a Proof of Stake world, security is all about having skin in the game. Validators are financially motivated to play by the rules because their own money is on the line. If someone tries to pull a fast one and approve phony transactions, they can lose a chunk—or even all—of their staked coins. This penalty mechanism is known as slashing.

This economic threat serves the same purpose as the astronomical electricity costs in PoW: it makes cheating incredibly expensive. Why would you attack the network when you stand to lose far more than you could ever gain?

This approach has worked so well that some of the biggest players in crypto have made the switch. The most famous example is Ethereum, which pulled off its massive transition from PoW to PoS in 2022 in an event dubbed "The Merge."

Ethereum’s move to Proof of Stake cut its energy consumption by a mind-blowing 99.95%. This single upgrade wiped out a carbon footprint roughly the size of a small country, showing just how game-changing the environmental benefits of PoS can be.

Proof of Work vs Proof of Stake Head to Head

To really get a feel for the differences, it helps to see them side-by-side. PoW and PoS are two fundamentally different philosophies for achieving the same goal: decentralized consensus.

Feature | Proof of Work (PoW) | Proof of Stake (PoS) |

|---|---|---|

Method | Miners solve complex math problems | Validators lock up coins (stake) |

Resource | Computational Power (Electricity) | Economic Investment (Capital) |

Security | Cost of energy makes attacks expensive | Risk of losing staked capital (slashing) |

Energy Use | Extremely High | Very Low (over 99% less) |

Hardware | Specialized, expensive ASICs | General-purpose computers |

Entry Barrier | High (hardware & electricity costs) | Lower (owning the cryptocurrency) |

Centralization Risk | Mining pools in regions with cheap power | Large holders ("whales") can have more influence |

Example | Bitcoin (BTC) | Ethereum (ETH), Solana (SOL) |

While both have their own trade-offs, the trend is clearly shifting. The efficiency and accessibility of PoS are making it the go-to choice for new and evolving blockchains.

Key Advantages of Proof of Stake

The move towards staking isn't just about saving energy; it brings a handful of compelling benefits that are shaping the future of crypto.

Massive Energy Efficiency: This is the big one. Without the constant need for heavy-duty number crunching, PoS networks use a tiny fraction of the electricity of their PoW counterparts. This makes them a far more sustainable and environmentally sound choice.

Lower Barriers to Entry: You don't need to buy a warehouse full of specialized ASIC miners to participate. Instead, you just need to own the network's crypto, which opens the door for a much wider range of people to get involved.

Enhanced Decentralization: By lowering the bar for entry, PoS can foster a larger and more geographically diverse group of validators, which in turn makes the network more resilient. PoW mining can easily centralize around whoever has the cheapest electricity, but staking can be done from anywhere with an internet connection.

For anyone looking to get involved, a whole ecosystem of platforms has popped up to make staking simple. If you want to check it out, our guide on the best crypto staking platforms is a great place to start earning rewards. This evolution from mining to staking is more than just a technical tweak—it’s a whole new way of thinking about network security.

Where is Cryptocurrency Mining Headed?

If you've followed along so far, you know how much mining has changed. Its future now rests on a tricky balance of new tech, economic realities, and governments figuring out what to do with it all. The days of mining from your garage are pretty much over. The industry is growing up, quickly consolidating into the hands of huge, publicly traded corporations.

These massive mining farms are playing a different game. They use their size to get cheaper electricity and deploy the absolute latest hardware, which completely changes who can compete. This professionalizes the industry, for sure, but it also sparks some real debate about centralization. When just a few powerful players control most of the network's hashing power, it makes you think. On top of all that, regulators worldwide are still trying to get a handle on this whole new asset class, leaving miners in a state of constant uncertainty.

Tackling the Environmental and Tech Challenges

The biggest cloud hanging over mining’s future is its environmental footprint. The sheer amount of energy that Proof of Work networks chew through is a massive sticking point, and it's forcing the entire industry to look for greener ways to operate. Miners are now actively hunting for sustainable energy to power their rigs.

You're seeing a few key trends pop up in response:

Going Green: More and more mining farms are being built in strategic locations to soak up surplus solar, wind, and hydroelectric power. It’s a smart move that turns a potential environmental problem into a real asset for local energy grids.

Turning Waste into Work: Some miners are teaming up with oil and gas companies to capture flared natural gas. This stuff is a byproduct of oil drilling that would normally just be burned off and wasted, but instead, it's being used to power mining rigs.

Smarter, Not Just Stronger Hardware: The race for more powerful and energy-efficient hardware never stops. Every new generation of ASIC miners delivers a better hash rate for every watt of power consumed, making the whole process a little bit greener with each upgrade.

The future of mining isn’t just about finding more power anymore; it’s about finding smarter, cleaner, and more sustainable sources of it. This isn't just about PR, either. It’s a push driven by public pressure, regulatory risk, and the simple economic fact that cheaper energy means bigger profits.

The Rise of Hybrid Models

Beyond just the hardware and power sources, the actual consensus mechanisms—the rules of the game—are changing too. Bitcoin is sticking with Proof of Work, no doubt about it, but tons of newer projects are getting creative with hybrid consensus models.

The goal here is to get the best of both worlds: the rock-solid, time-tested security of Proof of Work combined with the energy efficiency and lower barrier to entry of Proof of Stake.

This constant tinkering and innovation mean that crypto mining is anything but a static industry. Whether it’s through greener energy, slicker hardware, or completely new ways of securing a blockchain, it’s always adapting. The core job of verifying transactions and keeping the network safe isn’t going anywhere, but how that job gets done is becoming more diverse and sophisticated by the day.

Got Questions About Crypto Mining?

Even after you get your head around the main ideas, a bunch of practical questions always pop up. It's totally normal. Let's tackle some of the most common ones I hear to clear things up.

Is This Stuff Actually Legal?

This is a big one, and the answer is: it completely depends on where you live.

In places like the United States and Canada, mining crypto is generally fair game for both individuals and companies. But other countries have slammed the door shut, putting strict bans in place over concerns about massive energy use and losing control over their financial systems.

It is absolutely essential to check the specific rules in your country or state before you even think about buying any gear. These laws can shift quickly, so staying on top of them is key to not getting into hot water.

Look, the technology itself isn't good or bad—it just is. But how you use it is definitely subject to local laws. Firing up a mining rig in a country with a ban can lead to some serious pain, like hefty fines or even having all your expensive hardware taken away.

Can I Still Mine Bitcoin on My PC?

Technically? Yes, you can download the software and run it on your desktop. Realistically? You will make absolutely nothing. In fact, you'll almost certainly lose money on your electricity bill.

The days of mining Bitcoin on a home computer are long gone.

The network's difficulty is just astronomically high now. To have even a sliver of a chance, you need specialized hardware called ASIC (Application-Specific Integrated Circuit) machines. Trying to mine Bitcoin with a PC today is like showing up to a Formula 1 race with a kid's scooter. Sure, you're on the track, but you have zero chance of winning anything.

What’s a Mining Pool?

Think of a mining pool as a group lottery ticket. A bunch of individual miners team up and throw their computing power—their "hash power"—into one big pot.

Why? To dramatically increase their chances of solving a block and grabbing that reward.

Instead of one person having a microscopic chance of hitting the jackpot, the whole group has a much, much better shot. When they win, the prize gets split up among everyone.

How it works: You point your mining hardware's power at the pool instead of trying to go it alone.

The rewards: When the pool successfully mines a block, the crypto reward is shared. Your cut is based on how much work you contributed to the effort.

The benefit: This creates a much more stable and predictable trickle of income. For smaller miners who would otherwise almost never find a block by themselves, it's a game-changer.

Honestly, unless you're running a massive, warehouse-sized mining farm, joining a pool is pretty much the only way to go.

Ready to grow your crypto holdings without all the mining headaches? With Yield Seeker, our AI-driven platform finds the best stablecoin yields in DeFi for you, completely on autopilot. Put your capital to work safely and let the AI do the heavy lifting. Explore your options at https://yieldseeker.xyz.