Back to Blog

A Guide to DeFi Strategy Optimization for Stablecoin Yield

Master DeFi strategy optimization with this guide. Learn to define objectives, backtest, manage risk, and automate stablecoin yield strategies with AI.

Dec 31, 2025

generated

DeFi strategy optimization isn't just a fancy term; it's the active, hands-on process of tweaking your decentralized finance investments to squeeze out the best possible returns while keeping risks in check. This is a huge leap from the old "set and forget" mindset. Instead, you're using real data to constantly shift capital between different protocols and liquidity pools to stay on top.

Why DeFi Strategy Optimization Is No Longer Optional

Long gone are the days you could just park your stablecoins in a single protocol and watch the returns roll in consistently. The DeFi ecosystem is an incredibly competitive and fast-moving space. Yields can evaporate in an instant, new protocols pop up out of nowhere, and the risks are always changing. Simple yield farming just doesn't cut it anymore.

To succeed now, you need a dynamic, data-driven game plan to stay ahead of the curve.

Real DeFi strategy optimization isn't about blindly chasing the highest advertised APY. It's about building a tough, intelligent system that weighs reward against risk. This means you're constantly scouting for new opportunities, keeping an eye on protocol health, and moving funds around to make sure you’re always in the best possible position.

The Modern DeFi Reality

The market's wild swings are a perfect illustration of why a static strategy is doomed to fail. We all remember when the Total Value Locked (TVL) in DeFi hit a staggering $302 billion in 2021, only to plummet to $65 billion as the market turned.

But that downturn forced everyone to get smarter. TVL later roared back, surging 129% to $257 billion. This comeback was fueled by optimized strategies, like using Layer 2s to slash fees and boost speed. This massive resurgence proves that adaptive strategies can find growth even after a major market crash. You can dig deeper into this DeFi recovery in the 2024-2025 DeFi Report.

All this constant change makes trying to manage your portfolio by hand a massive headache. Staying on top of everything requires endless hours of research, complicated spreadsheets, and being glued to your screen 24/7—it's just too much for most people.

To give you a clearer picture, building a solid strategy from the ground up involves several key components.

Here's a quick look at the core pillars:

Key Pillars of a DeFi Optimization Strategy

Pillar | Objective | Example Metric |

|---|---|---|

Objective Setting | Define clear goals for your capital. | Target a 10% APY with moderate risk tolerance. |

Protocol Selection | Identify safe, high-performing DeFi protocols. | Protocol TVL > $50M; audited by a top firm. |

Allocation Rules | Create rules for how to distribute funds. | No more than 25% of capital in a single protocol. |

Backtesting | Simulate how the strategy would have performed. | Sharpe Ratio > 1.5 over the past 12 months. |

Risk Management | Implement controls to protect your assets. | Set a max impermanent loss threshold of 5%. |

Monitoring | Continuously track performance against goals. | Review risk-adjusted returns weekly. |

Iteration | Refine parameters based on new data. | Adjust allocation if a protocol's yield drops by 20%. |

As you can see, each pillar requires careful thought and continuous management to keep the whole system running smoothly.

Turning Complexity into Opportunity

This is exactly where automation goes from being a nice-to-have to an absolute must. Platforms like Yield Seeker are built to handle all this complexity for you. By using personalized AI agents, these systems automate the entire optimization process from start to finish.

An AI agent can:

Continuously scan hundreds of protocols on efficient chains like Base.

Analyze risk-adjusted yields in real-time, seeing past the flashy APYs.

Automatically rebalance your funds the moment a better opportunity pops up.

Execute trades while factoring in gas fees to make sure they're actually profitable.

The goal is simple: transform DeFi strategy optimization from a ridiculously complex and time-consuming chore into something anyone can do automatically. It lets you get professional-grade management, even if you're just starting with $10 USDC.

Ultimately, this shift makes earning a reliable yield something that's actually within reach. You can turn market volatility into a steady income stream by letting smart automation do the heavy lifting, ensuring your capital is always working as hard as possible for you.

Getting Clear on Your Goals and Risk Tolerance

Before you even think about deploying a single dollar into DeFi, you need a roadmap. It’s a simple but critical first step. The slickest DeFi strategy optimization tools on the planet are worthless if you don't know what you're trying to achieve.

So, start with a fundamental question: what is the primary job for this capital?

Are you shooting for aggressive growth, happy to stomach more volatility for a shot at double-digit APYs? Or is this about capital preservation—where a steady, reliable yield is far more important than chasing the highest number on the screen?

Your answer here sets the stage for every decision that follows, from the protocols you'll consider to the risk controls you'll need. There’s no such thing as a "best" strategy, only the one that's right for you.

Turning Vague Hopes Into Hard Numbers

"Make more money" isn't a strategy; it's a wish. To get serious, you need to define your objectives with specific, measurable targets. This is how you turn an abstract goal into an actual plan.

A solid target could be something like an 8% annualized return on your stablecoin stack. That's both ambitious enough to be interesting and achievable in today's DeFi climate. It gives you a clear benchmark to measure your performance against.

Once you have that target yield, you can work backward. You’ll know what kind of protocols and risk levels are required to get there, which makes it much easier to filter out the noise and shiny new farms that don't actually align with your objective. If you're looking for a structured way to think through this, applying essential decision-making frameworks can be a huge help.

Your goal is your north star. When the market gets choppy and some new protocol is promising a crazy APY, that predefined target is what keeps you disciplined. It stops you from making emotional, impulsive decisions that can blow up your portfolio.

This is about more than just numbers. It's about building a sustainable foundation for the long haul.

From "Feeling" Risk-Averse to Setting Concrete Rules

Defining your risk tolerance is just as important, but it has to be more than a feeling. You need to translate that feeling into a set of non-negotiable rules. Saying you're "risk-averse" is subjective; outlining specific constraints makes it real.

Think of these rules as guardrails for your strategy. They automatically disqualify certain protocols or allocations before you're even tempted, keeping you within your comfort zone.

You might build a checklist of rules for any potential DeFi play:

Protocol Audits: Will you only touch protocols with at least two independent security audits from reputable firms?

Max Allocation: What's the absolute most you'll put into a single protocol or pool? A common rule of thumb is no more than 25% of your total portfolio.

Protocol Age: Do you require a protocol to be battle-tested for a minimum period, say six months, before you'll consider depositing?

These aren't just suggestions. They're hard rules that protect you from unvetted risk and force your DeFi activities to stay aligned with your personal boundaries.

Let's see how this plays out with a real-world example.

A User's Strategy Blueprint in Action

Imagine a user with $10,000 USDC sitting on the Base network, looking to generate some passive income.

Primary Goal: Earn a consistent yield without putting the principal at major risk.

Yield Target: A stable 7-9% APY.

Risk Constraint: Cannot afford to lose more than 5% of the initial capital.

With these parameters defined, an AI-powered platform can translate these goals directly into automated actions. The agent immediately knows to ignore any unaudited, high-risk farms, no matter how juicy their advertised APYs are.

Instead, it focuses exclusively on proven, battle-tested protocols known for their security. It then structures the allocations across those protocols to hit the yield target while strictly honoring the 5% maximum loss constraint. This is DeFi strategy optimization in action—turning your personal financial goals into an intelligent, automated plan.

Okay, you've got your goals mapped out and you know your risk limits. Now for the fun part: deciding where to actually put your stablecoins to work. This isn't about chasing the latest shiny object protocol. It’s about a disciplined, repeatable process for picking winners and avoiding the duds.

The DeFi space is incredibly noisy. New protocols pop up every day promising absurd yields, but most aren't built to last. Your job is to cut through that noise by focusing on what really matters.

Doing Your Homework on Protocols

Before you even think about depositing a single USDC, you need to vet every potential protocol. Having a consistent checklist removes emotion from the equation and keeps you focused on stability and sustainable returns.

Here’s what I always look for:

Total Value Locked (TVL): Think of TVL as a crowd-sourced vote of confidence. A higher TVL—ideally north of $50 million—shows that other serious players trust the protocol with their capital.

Audit History: This is non-negotiable. Never, ever use a protocol that hasn't been audited. I look for multiple, independent audits from well-known security firms. This is your primary defense against smart contract bugs.

Team Reputation: Is the team public and active in the space, or are they a group of anonymous avatars? A transparent team with a solid track record brings a crucial layer of accountability.

Community and Activity: A lively Discord or an active X account is often a great sign. It tells you the project is alive, shipping updates, and has a real community behind it.

Sticking to these fundamentals immediately filters out 90% of the high-risk, unproven nonsense out there. You'll be left with a much smaller, higher-quality list of candidates.

Building a Resilient Allocation Structure

Diversification is just as critical in DeFi as it is in traditional finance. Putting all your eggs in one basket, even a really good one, is just asking for trouble. It creates a single point of failure that can wipe you out.

A much smarter move is to spread your funds across several platforms.

As a general rule, I like to diversify across 3-5 different protocols. This insulates your portfolio. If one protocol has a bad day—maybe a bug is found or yields temporarily tank—it doesn't bring down your entire strategy. The goal is to build a system that can take a punch and keep going.

Smart allocation isn't just about spreading capital; it's about building an antifragile portfolio. By diversifying, you reduce the impact of any single failure and give your strategy the strength to perform consistently across various market conditions.

This is the exact logic an automated yield optimization protocol uses to protect and grow capital without being overexposed to any single source of risk.

How an AI Agent Might Structure an Allocation

Let's make this real. Imagine an AI agent on a platform like Yield Seeker is managing some USDC for you on the Base network. If you've set a moderate risk profile, it might come up with an allocation that looks something like this:

Protocol Category | Allocation Percentage | The "Why" Behind It |

|---|---|---|

Blue-Chip Lending (e.g., Aave) | 40% | This is the bedrock of the portfolio. It's allocated to a battle-tested protocol with deep liquidity and years of proven security. Super conservative. |

Stablecoin Swap Pool (e.g., Uniswap) | 30% | A slightly higher-yield position in a top-tier DEX. The risk is still very low since it's a stablecoin-to-stablecoin pool. |

Newer Audited Protocol | 30% | Here, the agent is hunting for a temporary yield boost from a newer, but fully audited, protocol. It enhances returns without taking on unvetted risk. |

See how that’s balanced? Most of the capital is anchored in proven, low-risk platforms. A smaller, strategic portion is then used to capture higher yields from newer opportunities that have passed a strict security check. Every decision is logical and directly tied to your stated goals.

And this isn't just theory—it's what the smart money is already doing. Data shows the top ten DeFi protocols now generate 60% of all fees, and the top twenty account for nearly 80%. As detailed in this deep dive into the state of DeFi, savvy users are flocking to platforms with deep liquidity and proven track records instead of chasing hype. When you follow a similar, data-first process, you're aligning yourself with the most successful and sustainable corner of the ecosystem.

How to Backtest and Simulate Your DeFi Strategy

Jumping into a new DeFi strategy without testing it first is like flying blind. Sure, you've got your goals and a few protocols picked out, but you have no real clue how your plan will hold up when the market gets choppy. This is where backtesting and simulation become your best friends in the DeFi strategy optimization game.

Think of backtesting as a dry run. You're taking historical market data and simulating how your specific rules and protocol choices would have performed in the past. It’s your chance to see the potential outcomes—both good and bad—before you put a single dollar of real capital on the line.

But this isn't just about chasing hypothetical profits. It's about putting your strategy through a proper stress test. How would it have held up during a brutal market crash? What about a stablecoin de-peg event or when gas fees on Base went through the roof? These historical scenarios are fantastic for revealing hidden weak spots that a simple APY forecast could never show you.

Key Metrics for Strategy Simulation

When you're running these simulations, you need to look past the flashy headline return. A strategy that looks profitable but exposes you to catastrophic risk isn't optimized—it's a ticking time bomb. Good backtesting zeroes in on a few crucial, risk-adjusted metrics to give you a much clearer picture of what's really going on.

Here’s what you should be tracking:

Sharpe Ratio: This is the gold standard for measuring risk-adjusted returns. A higher Sharpe ratio means you're getting more bang for your buck in terms of risk. For a stablecoin strategy, you should really be aiming for a Sharpe ratio above 1.0.

Maximum Drawdown: This tells you the biggest drop from a peak to a trough your portfolio would have seen. It’s a raw, honest measure of downside risk and gives you a gut check on the worst-case scenario you might have to stomach.

Impermanent Loss (IL) Exposure: If your strategy involves liquidity pools, you absolutely have to simulate potential IL. Even with stablecoin pairs, tiny price wobbles can chip away at your returns, and understanding this exposure is critical.

Looking at these numbers together gives you a balanced perspective. You might uncover a strategy that boasts a 12% APY but comes with a terrifying drawdown, making it a terrible fit for anyone who likes to sleep at night. Another might offer a steady 8% APY with almost no drawdown, making it a much more solid choice. A good DeFi yield farming calculator can help you model some of this by hand, but automated simulation is where the real power lies.

Backtesting isn't about perfectly predicting the future. It's about understanding the past so you can make smarter, more resilient decisions today. A strategy that survived the chaos of yesterday's market is far more likely to handle whatever comes next.

How AI Automates and Scales Backtesting

Let's be honest, manually collecting and crunching the mountain of on-chain data needed for a proper backtest is a nightmare. It’s incredibly tedious and time-consuming. This is exactly where AI-powered platforms like Yield Seeker give you a massive edge.

Instead of you having to build complex spreadsheets or write scripts, the AI agent does all the heavy lifting in the background. Before it even thinks about proposing or executing a strategy, the agent runs it through thousands of historical scenarios. It simulates how the strategy would perform against past gas fee spikes, sudden liquidity crunches, and wild yield fluctuations to prove its worth.

This kind of proactive analysis does two key things. First, it helps fine-tune the strategy's parameters for better, more consistent results. Second, it sets realistic expectations for performance, grounding your plan in hard data instead of wishful thinking. It’s a critical step that separates professional-grade optimization from just casually chasing yield.

This approach is a sign of a maturing market. The DeFi yield farming sector was valued at $79.4 million and is on track to hit $154 million by 2031, while the total value locked in DeFi has already blown past $90 billion. This growth is fueled by a demand for smarter, data-driven strategies. As detailed in this DeFi yield farming platform report, the players who come out on top are the ones who use data and simulation to get an edge.

Implementing AI-Powered Automation and Monitoring

DeFi markets never sleep, which means your strategy can't afford to, either. Trying to manually keep tabs on yields, gas fees, and protocol health across an ecosystem like Base is a surefire path to burnout and missed opportunities. This is where automation stops being a nice-to-have and becomes a core part of any serious DeFi strategy.

Going it alone isn't just inefficient; it's wide open to costly human errors. A solid system needs you to constantly track performance, compare your live APY against your goals, and figure out how much those wild gas fee swings are actually eating into your profits. This kind of round-the-clock vigilance is exactly what AI was built for.

The AI Agent as Your Digital Asset Manager

AI-driven platforms like Yield Seeker turn this chaotic, hands-on process into something smooth and automated. The best way to think about it is having a personal AI agent working as your digital asset manager, 24/7. It isn't just following a simple script; it's constantly scanning the entire Base ecosystem for tiny shifts in yield, new opportunities, and potential risks that are easy to miss.

This constant analysis lets the agent act with a speed and precision no human could ever hope to match. It knows the second a better risk-adjusted yield pops up somewhere else or when one of your current positions is no longer optimal.

Real-Time Rebalancing for Peak Performance

When the AI spots a better opportunity, it doesn't just ping you an alert—it can take action. The agent immediately calculates whether the potential gain from jumping to a new protocol outweighs the gas cost of the transaction. If the math checks out, it automatically executes a real-time rebalancing transaction, moving your capital to the more profitable spot.

This makes sure your USDC is always working as hard as it can, maximizing its earning potential without you lifting a finger. It's a world away from a fixed rebalancing schedule because it adapts to market events the moment they happen.

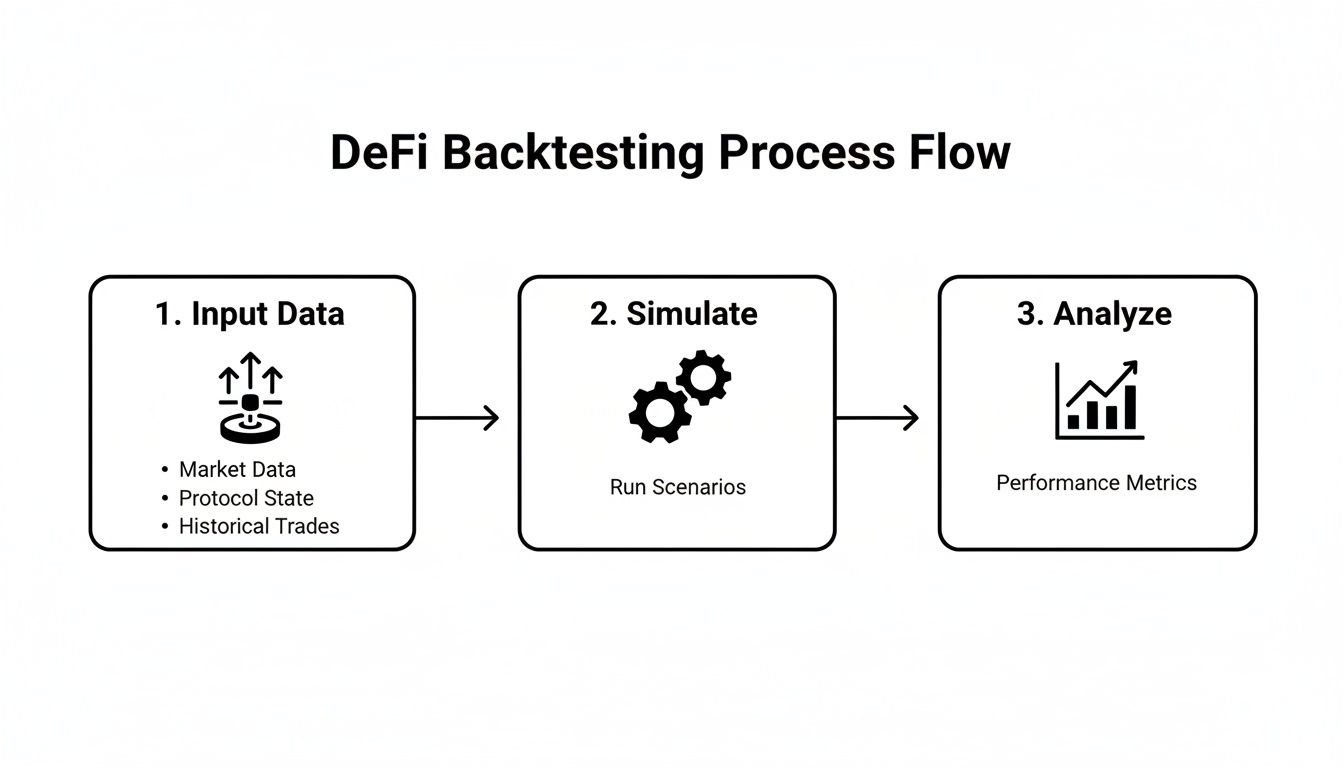

The diagram below shows the basic logic behind this data-driven process, breaking down how a strategy gets tested before it ever touches your funds.

This flow really highlights the systematic approach AI takes, starting with raw data, running it through stress tests, and ending with clear, actionable analysis.

Key Metrics an AI Agent Actually Watches

An AI agent's real power comes from the data it tracks. It goes way beyond just glancing at the advertised APY.

Net Yield: It calculates the real return after subtracting all gas fees and potential slippage. This gives you the true picture of what you're actually earning.

Protocol Health: The agent keeps an eye on on-chain metrics like a protocol's Total Value Locked (TVL) and transaction volumes to spot any early warning signs of instability.

Gas Fee Spikes: It analyzes network congestion on Base to time transactions for when fees are lower, saving you money on every single rebalance.

Risk Scores: It pulls in data from smart contract audits and considers a protocol's age to assign a dynamic risk score, making sure your funds stay within your comfort zone.

By pulling all these data points together, the agent builds a complete picture of the market, allowing it to make decisions that aren't just profitable but also smart and safe. For a deeper dive, our guide on https://yieldseeker.xyz/yieldseekerblog/ai-crypto-investing explains how these autonomous systems are changing the game.

The Clear Advantage of Automation

Putting a manual approach side-by-side with an AI-powered one shows a pretty stark difference in both the effort required and the results you get. One is reactive and a ton of work; the other is proactive and basically effortless.

Manual vs. AI-Powered Strategy Management

The table below breaks it down. While manual management gives you a sense of control, AI-powered automation offers efficiency and precision that's impossible to replicate by hand.

Feature | Manual Management | AI-Powered Automation (Yield Seeker) |

|---|---|---|

Monitoring | Sporadic; requires constant screen time and manual data checks. | 24/7 continuous monitoring of hundreds of data points in real time. |

Rebalancing | Slow and infrequent; often delayed by emotion or indecision. | Instant, data-driven rebalancing whenever a better opportunity is found. |

Gas Optimization | Hard to time transactions for low fees, often leading to overpayment. | Automatic execution during periods of low network congestion to cut costs. |

Risk Assessment | Relies on manual research and subjective judgment. | Systematic risk analysis based on on-chain data and predefined rules. |

Scalability | Gets exponentially harder to manage as your portfolio grows. | Effortlessly scales from $10 to much larger amounts with the same efficiency. |

Ultimately, the goal is to let the system do the heavy lifting so you can focus on the bigger picture.

The core benefit of AI automation is simple: it turns market volatility from a threat into an opportunity. By constantly scanning for and capitalizing on small inefficiencies, the AI agent generates a more consistent and optimized return over time.

For even more advanced strategy building, tools like an AI-powered Finance Investment Analyst can provide sophisticated insights and help automate complex decision-making. At the end of the day, bringing in this level of automation and monitoring is what takes your DeFi game from a hobby to a serious, performance-driven strategy.

Even with a solid plan, jumping into DeFi can feel like you're learning a new language. You're going to have questions, and getting clear, no-nonsense answers is the key to feeling confident enough to actually pull the trigger.

Let's tackle some of the most common questions that pop up when you're trying to fine-tune a DeFi strategy. Think of this as the practical stuff—the real-world concerns beyond the theory.

How Often Should I Rebalance My DeFi Portfolio?

Forget a fixed calendar schedule, like checking in every Tuesday or on the first of the month. The right time to rebalance depends entirely on what the market is doing, how much gas fees are, and what your goals are. You could try checking weekly, but honestly, it's a pretty inefficient way to operate. You might miss a golden opportunity that only lasts a few hours, or you could end up paying gas to rebalance when there was no real need.

This is where an AI-powered platform really shines. Instead of looking at the clock, an AI agent watches the market 24/7 and only makes a move when a data-driven opportunity appears. For instance, it might spot a new protocol where the yield is high enough to more than cover the gas cost of switching your funds over.

This kind of event-driven approach is just way more efficient than a rigid schedule. It makes sure your capital is always in the best possible spot, without you having to stare at charts all day or burn cash on pointless transactions.

What Are The Biggest Risks In Stablecoin Yield Farming?

Stablecoin farming is definitely one of the safer neighborhoods in DeFi, but that doesn't mean it's completely risk-free. Knowing what you're up against is the first step to protecting your capital.

You're mainly dealing with three types of risk here:

Smart Contract Risk: This is the big one. It’s the risk that a bug or exploit in a protocol's code could be found, leading to a loss of funds.

Counterparty Risk: This is basically a bet on the people behind the project. It's the risk that the team could rug pull or just mismanage the protocol into the ground.

De-Pegging Risk: This is the chance that a stablecoin loses its $1 peg. It’s rare for the big, reputable stablecoins, but as we've seen, it's a risk you can't just ignore.

So how do you handle these? It really boils down to two things: solid due diligence and smart diversification. Never, ever put 100% of your capital into a single protocol. A much smarter move is to spread your funds across 3-5 well-audited, established protocols that have been around the block. AI-driven platforms often build these checks right in, automatically filtering out sketchy protocols and sticking to ones with multiple audits, high TVL, and a proven track record.

Can I Start Optimizing DeFi Strategies With A Small Amount Of Money?

You absolutely can. This is probably one of the biggest myths out there. A few years ago, when your only real option was Ethereum mainnet, high gas fees would have eaten up any profits from a small deposit. But the game has totally changed.

The rise of Layer 2 networks like Base has crushed transaction costs, making it completely viable to start small. For example, some AI-powered platforms let you get going with as little as $10 USDC. The agent can pool your funds with others to execute transactions efficiently, giving you access to the same kind of optimization that used to be reserved for crypto whales.

This low barrier to entry is perfect for anyone wanting to learn the ropes of DeFi strategy without having to risk a huge chunk of capital.

What Is Impermanent Loss And How Does It Affect Stablecoin Strategies?

Impermanent Loss (IL) has a scary-sounding name, but the idea is actually pretty simple. It's the difference in value you see between holding two assets in a liquidity pool versus just holding them separately in your wallet. IL happens when the prices of the two assets you deposited move in different directions.

But here’s the key takeaway for stablecoin strategies: the risk of impermanent loss is extremely low.

Why? Because IL is all about price divergence. If you’re providing liquidity to a USDC-DAI pool, both assets are pegged to $1. They barely move in price relative to each other, so you’re just not going to see any significant IL. The real danger comes when you pair a volatile asset with a stablecoin, like in an ETH-USDC pool. If ETH’s price skyrockets or tanks, that’s when IL will hit you hard.

For this reason, sticking to stablecoin-only pools is a cornerstone of any conservative, effective DeFi optimization plan. It lets you collect those sweet trading fees without getting exposed to the crazy volatility that causes impermanent loss.

Ready to put these insights into practice? With Yield Seeker, you can deploy your USDC and let a personalized AI agent handle the optimization for you, ensuring your capital is always working smarter. Start your automated yield journey today at https://yieldseeker.xyz.