Back to Blog

The Top 12 Decentralized Income Tools to Watch in 2025

Discover the top 12 decentralized income tools for 2025. Explore platforms for automated yield, staking, and lending to find the right fit for your goals.

Dec 24, 2025

generated

The world of decentralized finance (DeFi) offers powerful ways to generate income outside of traditional financial systems, but navigating the complex landscape of lending protocols, liquidity pools, and yield aggregators can be overwhelming. Many investors, from stablecoin holders to Web3 treasury managers, seek to earn a return on their assets but are unsure where to start or which platforms are credible. This guide is designed to cut through the noise and provide a clear, actionable roadmap.

We will explore the top 12 decentralized income tools, breaking down exactly how each one works, the specific user it's best suited for, and a realistic look at the potential risks and returns involved. Our goal is to help you find the best platform for your specific financial goals and risk tolerance, whether you are a DeFi beginner seeking a guided experience or an experienced user looking to automate complex yield strategies.

Each entry in this comprehensive list includes a detailed analysis, setup tips, direct links to the platform, and screenshots to guide you through the process. While this guide focuses on leveraging decentralized finance, readers exploring diverse income streams might also be interested in other models, such as understanding how to set up and benefit from automated affiliate programs for passive income. For those focused on DeFi, the platforms ahead represent some of the most effective ways to put your crypto assets to work. Let's dive into the tools that can help you build a decentralized income strategy.

1. Yield Seeker: AI-Powered Stablecoin Yield

Yield Seeker stands out as a sophisticated yet remarkably accessible entry point into the world of decentralized finance. It offers a powerful solution for those looking to generate automated, risk-aware returns on their stablecoin holdings. This platform distinguishes itself by leveraging a personalized AI Agent that actively manages your capital, removing the complexity and constant monitoring typically required in DeFi.

The core of the platform is its AI-driven engine that continuously analyzes various DeFi protocols on the Base blockchain. It identifies and allocates your funds to the most competitive yield-generating opportunities in real time. This hands-off approach makes it an excellent choice among decentralized income tools for both newcomers and seasoned investors who value efficiency and automation.

Why It's a Top Choice

Yield Seeker’s strength lies in its blend of advanced AI technology with a user-centric design that prioritizes safety and ease of use. The platform's commitment to accessibility is evident in its low $10 USDC entry point and its policy of no advertised lockup periods or withdrawal fees, ensuring your capital remains liquid.

The user experience is clean and intuitive, complemented by a built-in terminal and visual walkthroughs that empower users to understand exactly where and how their funds are being utilized. This transparency, combined with a founding team that has a strong background in security, provides a level of trust and control that is often missing in automated yield platforms. For a deeper dive into how such platforms operate, Yield Seeker provides excellent resources on how to generate income with DeFi.

Practical Application & Ideal User

Ideal User: A stablecoin holder seeking passive, automated income without the steep learning curve or time commitment of manual DeFi participation.

Key Advantage: The personalized AI Agent acts as a dedicated portfolio manager, constantly optimizing for yield and mitigating risk by diversifying across vetted protocols on the Base chain.

Implementation Tip: While the platform automates allocations, use the visualizer tool to track your AI Agent's performance and understand the strategies it employs. This can be a valuable educational experience in itself.

Visit the website: https://yieldseeker.xyz

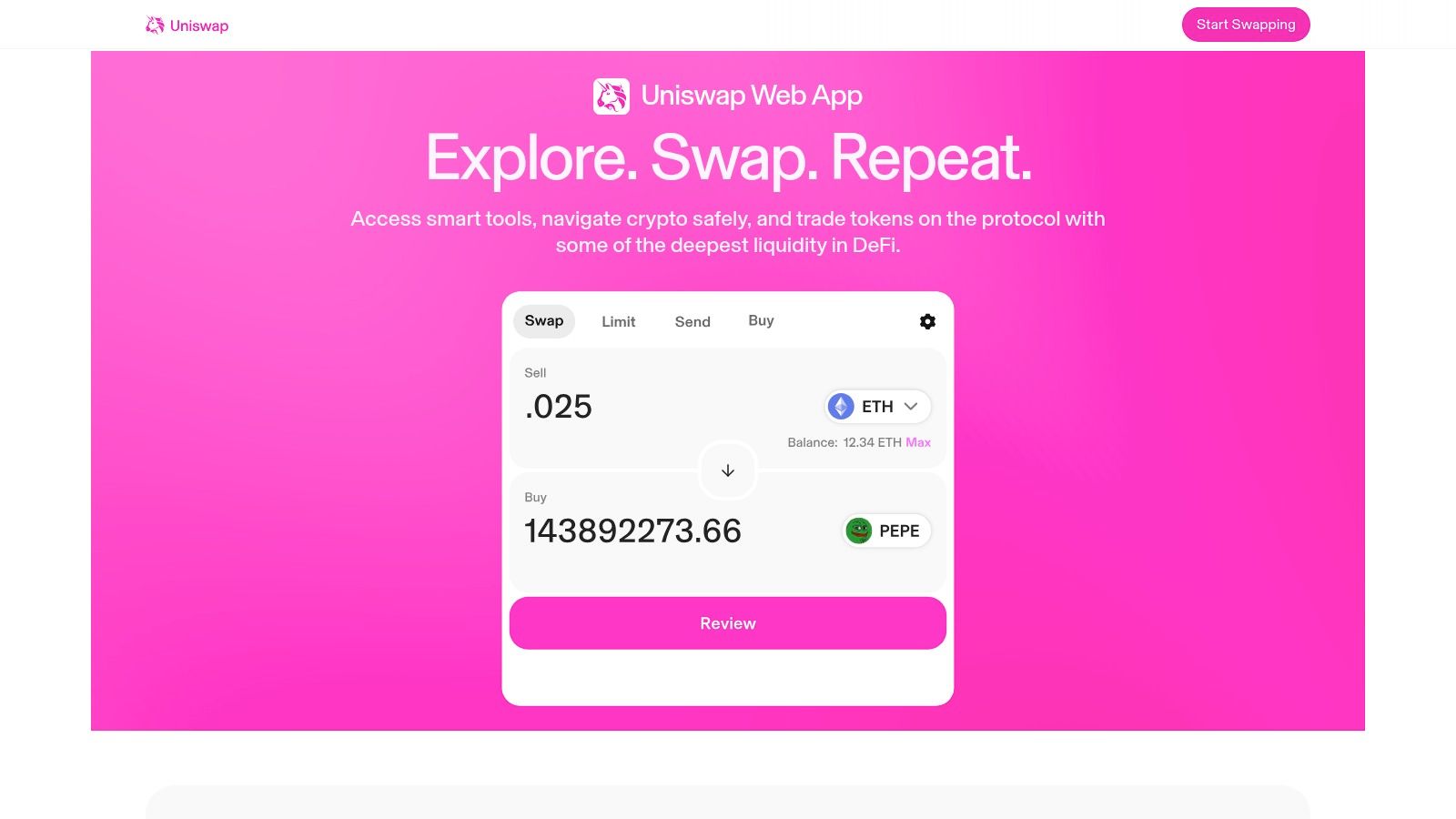

2. Uniswap Web App

The Uniswap Web App is the primary interface for the leading decentralized exchange (DEX), serving as a foundational decentralized income tool. Rather than passively holding assets, users can become Liquidity Providers (LPs) by depositing token pairs into liquidity pools. In return, they earn a proportional share of the trading fees generated whenever other users swap those tokens. This model transforms idle assets into active, fee-generating capital.

What makes Uniswap unique is its permissionless nature and deep liquidity across over 15 networks, including Ethereum and various Layer-2 solutions. The interface supports multiple protocol versions (v2, v3, and the upcoming v4), allowing users to choose their complexity level. Uniswap v3, for instance, introduced concentrated liquidity, enabling LPs to specify price ranges for their capital to earn fees more efficiently. This feature is ideal for sophisticated users aiming to maximize returns, especially with stablecoin pairs where price volatility is minimal.

Key Features and Considerations

Primary Income Stream: Earning a share of trading fees from token swaps.

Protocol Versions: Full support for v2 (simple), v3 (concentrated liquidity), and v4 (customizable hooks).

Risk Profile: The primary risk is impermanent loss, where the value of your deposited assets can decrease compared to simply holding them if token prices diverge significantly.

Best For: Users comfortable with active management who want direct exposure to on-chain trading activity.

Pro Tip: To mitigate high gas fees, consider providing liquidity on a Layer-2 network like Arbitrum or Optimism directly through the Uniswap interface.

Feature | Details | Ideal User |

|---|---|---|

Concentrated Liquidity (v3) | Provide liquidity within specific price ranges. | Hands-on user targeting high capital efficiency. |

Permissionless Pools | Anyone can create a new trading pair. | Users with new or niche tokens seeking liquidity. |

Multi-Chain Support | Access pools on Ethereum, Polygon, Arbitrum, etc. | Yield farmers looking for the best fee opportunities. |

Website: https://web.uniswap.org

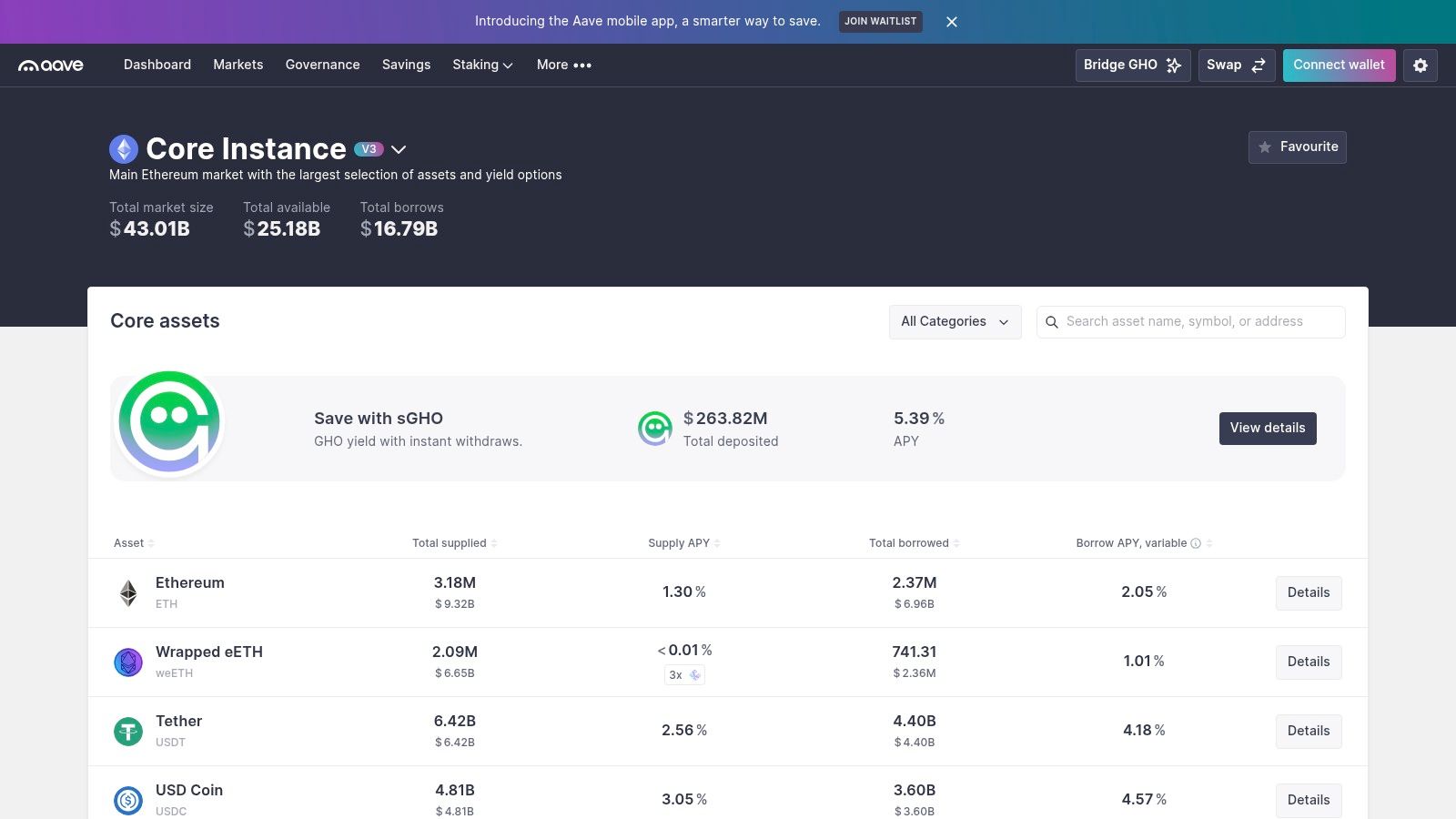

3. Aave Protocol

The Aave Protocol is a leading non-custodial liquidity protocol, functioning as one of the most fundamental decentralized income tools available. Users can supply assets like stablecoins or volatile cryptocurrencies to its money markets to earn a variable interest rate, paid out by borrowers. This model allows digital assets to generate passive yield instead of sitting idle in a wallet, making it a cornerstone of decentralized finance.

What distinguishes Aave is its robust security, deep liquidity, and multi-chain presence. The protocol's v3 deployment is available on numerous networks, including low-cost Layer-2 solutions, which makes earning yield accessible without facing high Ethereum gas fees. Its transparent interface clearly displays deposit APYs and borrowing rates, with detailed risk parameters for each asset. Users can also use their supplied assets as collateral to borrow other assets, creating opportunities for more complex strategies.

Key Features and Considerations

Primary Income Stream: Earning variable interest from supplying assets to lending pools.

Protocol Versions: v3 is the current standard, offering higher capital efficiency and risk mitigation features.

Risk Profile: The primary risks are smart contract vulnerabilities and liquidation risk if you borrow against your collateral and its value drops. For a deeper dive, learn more about DeFi risk management.

Best For: Users seeking a straightforward, passive yield on their assets with a high degree of trust and liquidity.

Pro Tip: Supply assets on a Layer-2 network like Arbitrum or Optimism via the Aave interface to earn yield with significantly lower transaction costs.

Feature | Details | Ideal User |

|---|---|---|

Variable Deposit APY | Earn interest based on market supply and demand. | Passive income seekers holding stablecoins or blue-chip crypto. |

Collateralized Borrowing | Use supplied assets to borrow other digital assets. | Advanced users looking to hedge or leverage their positions. |

Multi-Chain Markets | Access Aave on Ethereum, Polygon, Arbitrum, etc. | Yield farmers optimizing for the highest APYs across chains. |

Website: https://app.aave.com

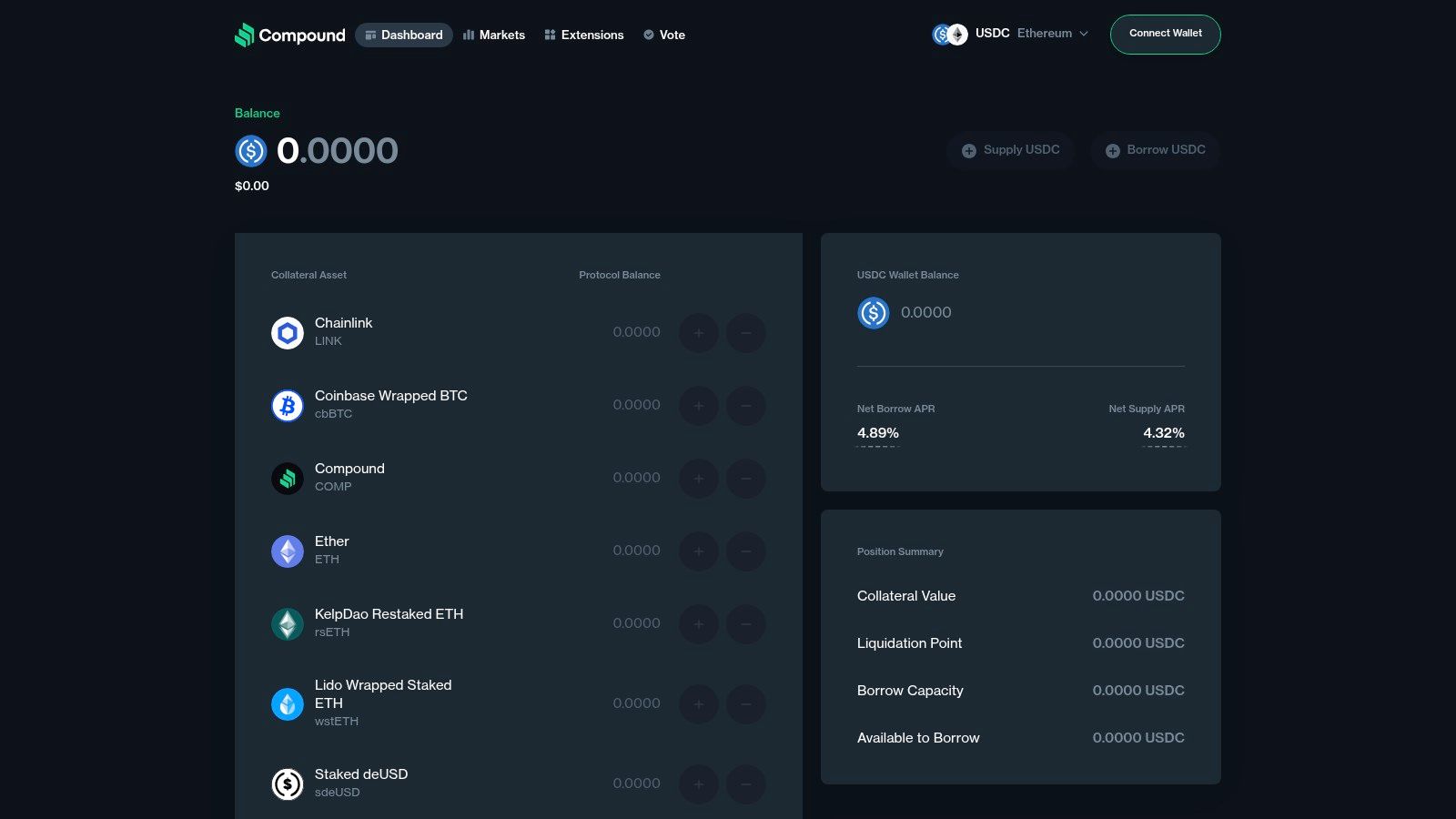

4. Compound

Compound is a foundational decentralized lending protocol, serving as one of the original and most reliable decentralized income tools. It allows users to earn interest on their crypto assets by supplying them to a lending pool. This supplied capital is then made available for others to borrow, and suppliers earn a variable interest rate paid by the borrowers. The process transforms static assets into productive capital within a highly audited and time-tested environment.

What makes Compound a cornerstone of DeFi is its simplicity and security-first approach. The interface is clean and presents transparent, real-time Annual Percentage Yields (APYs) for supplying and borrowing major assets like ETH, USDC, and DAI. Its programmatic interest rate model automatically adjusts based on supply and demand, creating an efficient money market. This battle-tested system provides a straightforward way for users to generate passive income with minimal active management.

Key Features and Considerations

Primary Income Stream: Earning variable interest by supplying crypto assets to lending pools.

Protocol Versions: The core protocol has evolved through versions, with Compound III offering enhanced security and capital efficiency.

Risk Profile: The main risks are smart contract risk (though heavily audited) and variable interest rates, which can fluctuate based on market demand for borrowing.

Best For: Conservative DeFi users, beginners, and those seeking a simple "supply and forget" method for earning yield on core assets.

Pro Tip: Always use the official web app. Be extremely cautious of fake mobile apps or phishing sites mimicking the Compound interface.

Feature | Details | Ideal User |

|---|---|---|

Programmatic Interest | Interest rates adjust algorithmically based on market supply and demand. | Passive income seekers who prefer a hands-off approach. |

Collateralized Borrowing | Users can supply assets as collateral to borrow other cryptocurrencies. | Traders or users needing liquidity without selling their assets. |

Blue-Chip Asset Support | Focuses on major, well-established cryptocurrencies for lending markets. | Risk-averse users wanting to avoid volatile, long-tail assets. |

Website: https://app.compound.finance

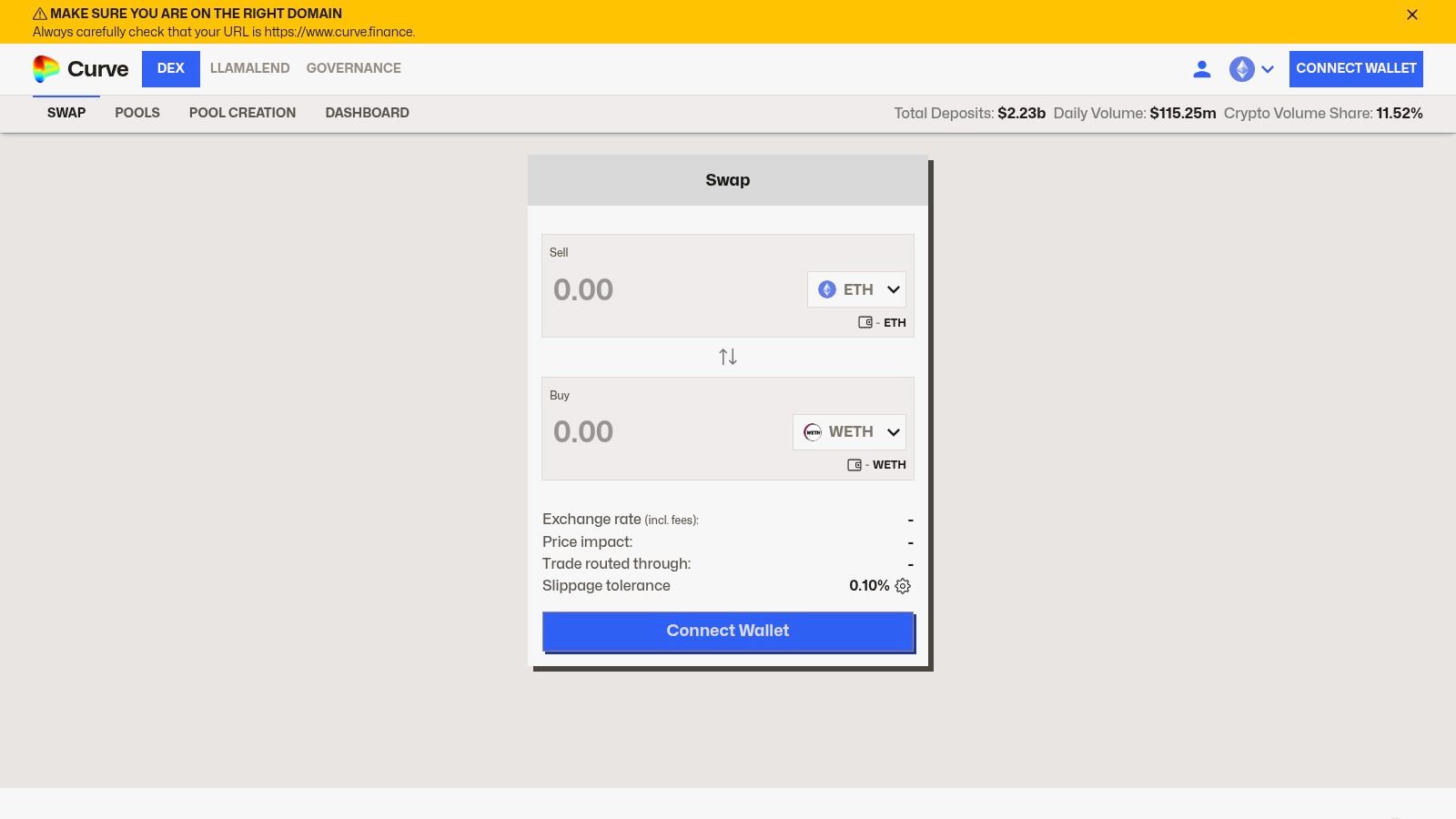

5. Curve Finance

Curve Finance is a decentralized exchange (DEX) specifically engineered for stablecoins and other similarly priced assets, making it a cornerstone decentralized income tool for risk-averse users. By providing liquidity to its pools, users earn trading fees generated from high-volume, low-slippage swaps. This model is exceptionally well-suited for generating stablecoin-denominated income, as it minimizes the price volatility risks common on other DEXs.

What sets Curve apart is its specialized Automated Market Maker (AMM) algorithm, which is optimized for assets that trade closely in value, like USDT/USDC or wBTC/renBTC. This unique design results in extremely low slippage and attracts deep liquidity, creating a reliable source of fee revenue for liquidity providers. The platform’s deep integrations with leading yield aggregators also allow users to easily auto-compound their earnings for a more hands-off approach.

Key Features and Considerations

Primary Income Stream: Earning swap fees and CRV token rewards by providing liquidity.

Specialized AMMs: Optimized algorithms for stablecoins and pegged assets reduce slippage and impermanent loss.

Risk Profile: While impermanent loss is minimal for stablecoin pools, risks include smart contract vulnerabilities and potential de-pegging of assets within a pool.

Best For: Stablecoin holders seeking consistent, low-volatility yields and users who prioritize capital efficiency.

Pro Tip: Use the "Deposit & Stake in Gauge" option when providing liquidity to earn both trading fees and additional CRV token incentives, maximizing your potential returns.

Feature | Details | Ideal User |

|---|---|---|

StableSwap AMM | Low-slippage trading for pegged assets. | Stablecoin holders looking to minimize impermanent loss. |

Gauge Weight Voting | CRV token holders can vote to direct rewards to specific pools. | Advanced users seeking to influence and capitalize on yield. |

Multi-Chain Presence | Available on numerous networks like Ethereum, Arbitrum, and Polygon. | Yield farmers searching for the best stablecoin rates across chains. |

Website: https://curve.fi

6. Yearn Finance

Yearn Finance is a pioneering yield aggregator that offers automated vault strategies, making it one of the most accessible decentralized income tools for passive investors. Users deposit assets like stablecoins or ETH into a Yearn Vault, and the protocol automatically allocates those funds to the most optimal, risk-adjusted yield-generating strategies across the DeFi ecosystem. This process includes auto-compounding, saving users significant time and gas fees.

What sets Yearn apart is its "set-it-and-forget-it" approach, powered by a community of strategists who constantly research and implement new yield opportunities. Its v3 Vaults introduce enhanced modularity and security, allowing for more dynamic and resilient strategies. By aggregating user deposits, Yearn socializes gas costs and provides access to complex strategies that would be impractical for individual users to manage. To learn more about how this works, you can read this guide on what a yield aggregator is in crypto.

Key Features and Considerations

Primary Income Stream: Earning yield from automated, auto-compounding DeFi strategies.

Protocol Versions: Support for legacy vaults and the new, more flexible v3 vaults.

Risk Profile: Vaults are subject to the underlying risks of the DeFi protocols they interact with (smart contract risk). APYs are variable and not guaranteed.

Best For: Users seeking hands-off, passive yield generation without needing to manage complex positions.

Pro Tip: Check the strategy description for each vault to understand where your funds are being deployed and the associated risks before depositing.

Feature | Details | Ideal User |

|---|---|---|

Automated Vaults | "Set-and-forget" strategies that auto-compound yield. | Time-constrained investors seeking passive returns. |

Strategy Rotation | Vaults can automatically shift capital to new, higher-yield strategies. | Users who want continuous optimization. |

Multi-Chain Access | Vaults are available on Ethereum, Arbitrum, Optimism, and Fantom. | Yield farmers looking for opportunities on various networks. |

Website: https://yearn.fi

7. Lido

Lido is the market leader in liquid staking, offering one of the most accessible decentralized income tools for Ethereum holders. Users can stake any amount of ETH and receive stETH (staked ETH) in return, a liquid token that accrues daily staking rewards. This model solves the main drawbacks of native ETH staking, such as high capital requirements (32 ETH), technical complexity, and locked liquidity, by giving users a tokenized version of their staked position.

What makes Lido a cornerstone of DeFi is the widespread integration of its stETH token. Unlike traditionally staked ETH, stETH can be used as collateral in lending protocols, provided as liquidity in decentralized exchanges, or deposited into yield-aggregating vaults to compound returns. This transforms a typically illiquid, yield-bearing asset into a versatile, capital-efficient building block for more advanced income strategies, all while continuously earning the underlying ETH staking rewards.

Key Features and Considerations

Primary Income Stream: Earning Ethereum staking rewards, reflected in the increasing value of stETH.

Tokenized Liquidity: Receive stETH or wstETH (wrapped stETH), which remain liquid and usable across DeFi.

Risk Profile: Involves smart contract risk and potential slashing risk if the Lido-selected validators are penalized. There are also ongoing community discussions regarding Lido's market share and its implications for network decentralization.

Best For: ETH holders seeking a simple, liquid way to earn staking yield without running their own validator.

Pro Tip: Use the wrapped version, wstETH, when providing liquidity or using it as collateral on Layer-2 networks to avoid complexities with the rebasing nature of stETH.

Feature | Details | Ideal User |

|---|---|---|

Liquid Staking | Stake any amount of ETH and receive a liquid token (stETH). | Anyone holding ETH, from small retail to large institutions. |

Daily Rewards | Staking rewards are added to your stETH balance automatically each day. | Passive investors who want a "set-and-forget" yield source. |

Broad DeFi Integration | Use stETH/wstETH on platforms like Aave, Curve, and MakerDAO. | DeFi users aiming to stack yields and maximize capital efficiency. |

Website: https://lido.fi

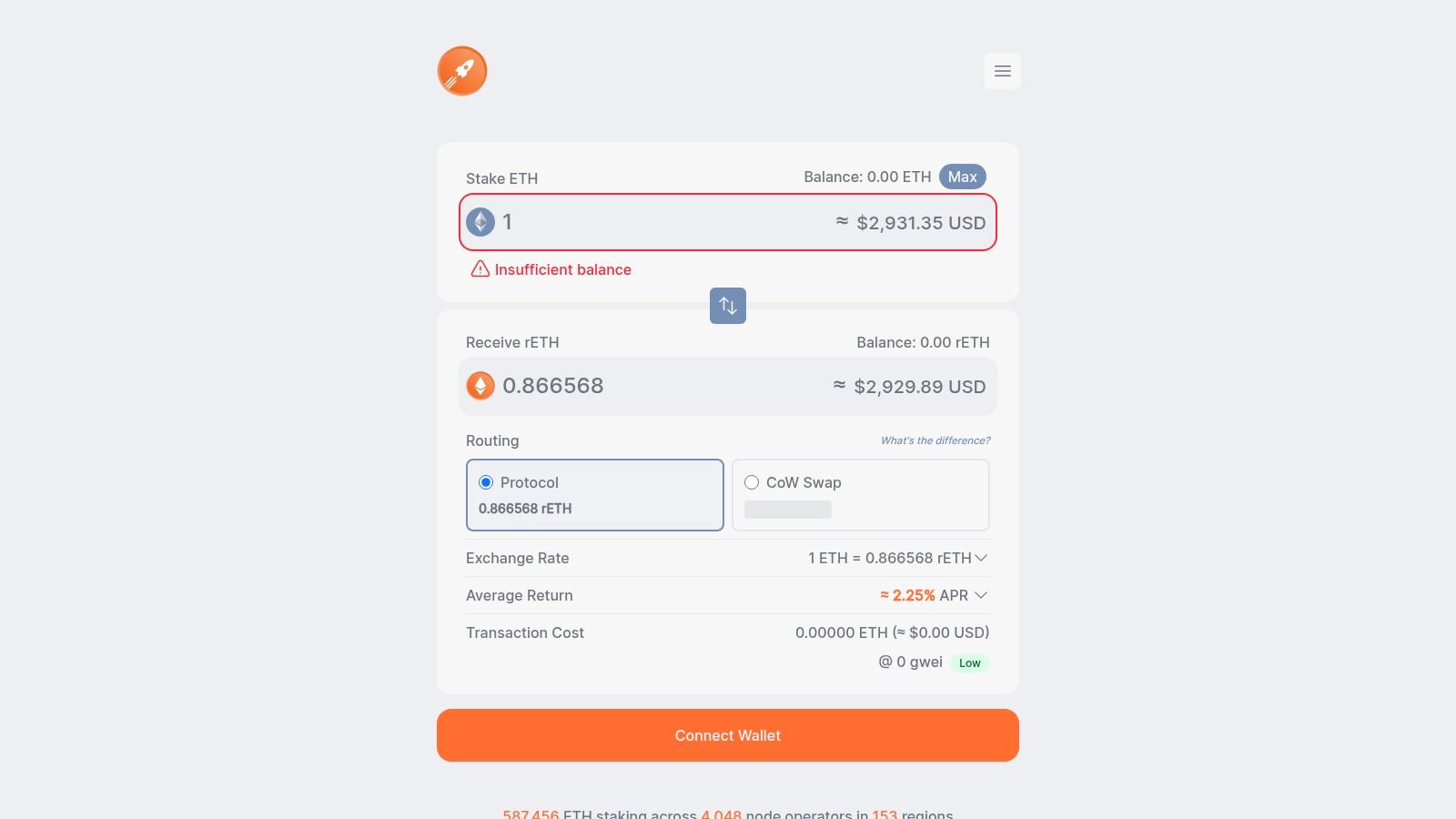

8. Rocket Pool

Rocket Pool is a decentralized Ethereum staking protocol that prioritizes network health and accessibility, making it a powerful decentralized income tool. It allows users to stake as little as 0.01 ETH in exchange for rETH, a liquid staking token that represents their staked ETH plus accrued rewards. Unlike some staking solutions, rETH's value increases over time relative to ETH, reflecting the accumulated staking rewards in its price rather than increasing in quantity.

What makes Rocket Pool unique is its commitment to decentralization through a permissionless node operator network. This model allows anyone to run a validator node with a reduced bond of just 8 or 16 ETH, broadening participation and strengthening the Ethereum network. For passive stakers, this distributed infrastructure provides a more robust and censorship-resistant method for earning ETH staking rewards. The rETH token is also deeply integrated across the DeFi ecosystem, enabling users to deploy it in liquidity pools or as collateral.

Key Features and Considerations

Primary Income Stream: Earning ETH staking rewards, reflected in the appreciating value of the rETH token.

Decentralized Infrastructure: A large, permissionless network of node operators enhances security and reduces single points of failure.

Risk Profile: The primary risks include smart contract vulnerabilities and potential slashing events where a node operator is penalized, which could slightly impact returns.

Best For: Long-term ETH holders who want to earn yield while contributing to network decentralization.

Pro Tip: Use the rETH token in other DeFi protocols, such as lending platforms or liquidity pools, to stack yields on top of your base staking rewards.

Feature | Details | Ideal User |

|---|---|---|

Liquid Staking (rETH) | Stake as little as 0.01 ETH to mint the rETH token. | Small-scale investors seeking easy access to ETH staking. |

Permissionless Node Operation | Run a validator with a reduced 8 or 16 ETH bond. | Technical users wanting to earn higher yields and support the network. |

DeFi Integrations | rETH is widely supported across lending, borrowing, and LP protocols. | Yield strategists aiming to compose multiple income streams. |

Website: https://stake.rocketpool.net

9. Pendle Finance

Pendle Finance introduces a sophisticated layer to decentralized income tools by enabling the tokenization and trading of future yield. It splits a yield-bearing asset, like a staked Ether token (LST), into two components: a Principal Token (PT), which represents the underlying asset redeemable at maturity, and a Yield Token (YT), which represents the future yield. This separation allows users to lock in fixed rates by buying PTs at a discount or to speculate on yield changes by trading YTs.

What makes Pendle unique is its creation of a dedicated "yield market," a concept gaining significant traction with institutional players. Instead of just earning yield, users can actively manage and trade it. For example, a user expecting staking yields to rise can buy YT to get leveraged exposure to that yield. Conversely, a user seeking predictability can sell their future yield upfront for a fixed return. This innovative model provides unparalleled flexibility for managing DeFi yield strategies.

Key Features and Considerations

Primary Income Stream: Fixed yields via Principal Tokens, trading yield via Yield Tokens, or earning fees and incentives as a liquidity provider.

Asset Support: Deep integration with major Liquid Staking Tokens (LSTs), Liquid Restaking Tokens (LRTs), and yield-bearing stablecoins.

Risk Profile: The model is complex and introduces risks like yield volatility and market pricing risk. Understanding the relationship between PT, YT, and the underlying asset is crucial to avoid losses.

Best For: Advanced DeFi users, yield strategists, and institutional traders looking to hedge or speculate on interest rate fluctuations.

Pro Tip: Start by providing liquidity to a familiar PT/underlying asset pool to earn fees and Pendle incentives while learning the platform's mechanics with lower directional risk.

Feature | Details | Ideal User |

|---|---|---|

Principal & Yield Tokens | Splits yield-bearing assets into tradable PT and YT. | User wanting to separate principal from yield. |

Fixed Yield Vaults | Purchase Principal Tokens (PT) at a discount to lock in a fixed APY. | Risk-averse investor seeking predictable returns. |

Leveraged Yield Exposure | Purchase Yield Tokens (YT) to speculate on future yield rates. | Sophisticated trader with a strong view on the market. |

Website: https://www.pendle.finance

10. GMX

GMX is a leading decentralized perpetuals and spot exchange where users can generate income by providing liquidity to traders. Instead of a traditional order book model, GMX utilizes a shared liquidity pool (known as GLP or GM pools, depending on the network) that acts as the counterparty for all trades. Liquidity providers deposit assets like ETH, BTC, or stablecoins into this pool and, in return, earn a significant portion of the platform's trading fees, including swap fees and funding payments from leveraged positions.

What makes GMX a distinct decentralized income tool is its direct exposure to trader activity. LPs essentially bet against the traders on the platform; they profit when traders lose and vice versa. This creates a unique risk-reward dynamic compared to standard AMMs. The platform's transparent, on-chain analytics allow LPs to monitor pool composition, trader PnL, and fee generation in real time, making it easier to assess performance. With deployments on low-fee networks like Arbitrum and Avalanche, it provides an accessible entry point for earning real yield from derivatives trading.

Key Features and Considerations

Primary Income Stream: Earning fees from leveraged trading, swaps, and liquidations.

Unique Risk: LPs are exposed to the profit and loss (PnL) of traders. If traders are net profitable, the value of the LP token can decrease.

Risk Profile: The primary risk is trader PnL exposure. The value of your LP position is directly affected by the aggregate success of traders on the platform.

Best For: Users who want to earn yield from derivatives trading and are comfortable with the unique risk of acting as the house.

Pro Tip: Regularly check the GMX analytics page to understand the current pool composition and historical trader PnL before providing liquidity.

Feature | Details | Ideal User |

|---|---|---|

Shared Liquidity Pool (GLP/GM) | A multi-asset pool acts as the counterparty to traders. | Users seeking a diversified way to earn fees from multiple assets. |

Real Yield | Income is paid in native tokens (like ETH or AVAX) derived from platform fees. | Yield farmers focused on sustainable, non-inflationary rewards. |

On-Chain Analytics | Transparent dashboards display all platform metrics. | Data-driven investors who want to monitor their position's performance. |

Website: https://gmx.io

11. Spark (Maker‑aligned)

Spark is a DeFi lending protocol designed to integrate directly with the MakerDAO ecosystem, offering a streamlined front-end for some of DeFi’s most robust income streams. Its primary function is providing direct access to the Dai Savings Rate (DSR) through sDAI (Savings Dai), allowing users to earn a variable yield on their DAI stablecoins with just a few clicks. This makes it a powerful decentralized income tool for those seeking native, low-risk yield directly from a core DeFi primitive.

What makes Spark unique is its alignment with MakerDAO, which provides deep liquidity and stability. Beyond savings, SparkLend offers borrowing and lending markets for other assets, often with highly competitive rates for DAI. The platform clearly displays the live APY for sDAI before you deposit, removing guesswork. This direct pipeline to Maker’s core mechanics positions Spark as an efficient and reliable hub for stablecoin-based yield generation.

Key Features and Considerations

Primary Income Stream: Earning the Dai Savings Rate (DSR) by holding sDAI.

Protocol Integration: Direct connection to MakerDAO's liquidity and stability modules.

Risk Profile: The main risk is governance risk, as the DSR is variable and can be adjusted by MakerDAO token holders based on market conditions.

Best For: Stablecoin holders who want a simple, "set-and-forget" yield on DAI with minimal protocol risk.

Pro Tip: Use Spark on a Layer-2 network like Gnosis Chain to access the DSR with significantly lower transaction costs compared to Ethereum mainnet.

Feature | Details | Ideal User |

|---|---|---|

Direct DSR Access (sDAI) | Deposit DAI into a savings vault to mint sDAI and earn yield. | Passive income seekers wanting native stablecoin yield. |

Efficient Lending Markets | Borrow and lend assets, leveraging Maker's deep DAI liquidity. | DeFi users looking for competitive borrowing rates. |

Transparent APY | The live APY for sDAI is clearly displayed on the interface. | Beginners who value clarity and ease of use. |

Website: https://spark.fi

12. Summer.fi

Summer.fi, the evolution of the trusted Oasis.app, is a DeFi management hub deeply integrated with the MakerDAO ecosystem. It serves as a unified front-end for deploying complex strategies, most notably providing streamlined access to the Dai Savings Rate (DSR) for generating yield on DAI. The platform allows users to manage positions across protocols like Maker, Spark, Aave, and Ajna from a single, intuitive interface, making it a powerful decentralized income tool for both beginners and veterans.

What sets Summer.fi apart are its automation features and comprehensive guides. Users can set up advanced actions like stop-loss or auto-buy/sell triggers on their collateralized debt positions, turning complex management tasks into simple, set-and-forget strategies. The platform’s guides on using the DSR and its tokenized version, sDAI, are particularly valuable for those new to stablecoin yield farming, lowering the barrier to entry for earning passive income directly from the Maker protocol.

Key Features and Considerations

Primary Income Stream: Earning yield on DAI via the Maker protocol's Dai Savings Rate (DSR).

Automation: Set up protective measures like stop-loss and automated trading actions for supported positions.

Risk Profile: While DSR is considered low-risk, platform-specific risks include smart contract vulnerabilities and potential front-end costs. Always verify you are on the correct

summer.fiURL.Best For: Users who want to access DSR yield while also managing more complex DeFi strategies in one place.

Pro Tip: Use the platform's educational resources to fully understand how DSR and sDAI work before depositing significant funds to maximize your yield strategy.

Feature | Details | Ideal User |

|---|---|---|

Unified DeFi Dashboard | Manage Maker, Aave, Spark, and Ajna positions from one interface. | DeFi power users managing multiple protocol positions. |

DSR Integration | Simple one-click access to deposit DAI and earn the Savings Rate. | Stablecoin holders seeking low-risk, on-chain yield. |

Advanced Automation | Implement stop-loss, auto-buy, and auto-sell on collateral. | Active traders and borrowers looking to de-risk positions. |

Website: https://summer.fi

Decentralized Income Tools: 12-Project Comparison

Product | Core features | UX & Trust (★) | Value & Price (💰) | Best for (👥) | USP (✨) |

|---|---|---|---|---|---|

🏆 Yield Seeker | AI Agent automates USDC yield on Base; no lockups; start $10 | Clean dashboard + terminal; strong social proof ★★★★☆ | Low entry; funds accessible anytime; fee model TBD 💰 | 👥 Busy professionals & crypto natives | ✨ Personalized AI allocation; safety & transparency |

Uniswap Web App | Permissionless swaps & LP (v2/v3/v4) across chains | Deep on‑chain liquidity; audited code ★★★★☆ | Earn LP fees; high gas on Ethereum mainnet 💰 | 👥 Traders & LPs seeking token exposure | ✨ Broad token coverage; customizable v4 pools |

Aave Protocol | Supply/borrow markets; v3 on L2s; per‑asset risk params | Large liquidity; transparent rate models ★★★★☆ | Earn supply interest; rates variable, liquidation risk 💰 | 👥 Lenders/borrowers needing flexible markets | ✨ Transparent rate mechanics & L2 deployments |

Compound | Programmatic lending (supply/borrow) with simple UI | Mature, audited, reliable accounting ★★★★☆ | Earn interest; variable APYs & liquidation risk 💰 | 👥 Yield farmers & long‑term lenders | ✨ Simple UI + proven protocol history |

Curve Finance | Stablecoin‑optimized AMMs; low‑slippage pools | Efficient stable markets; heavy volume ★★★★☆ | Earn fees + incentives; gauge complexity possible 💰 | 👥 Stablecoin LPs & yield aggregators | ✨ Low‑slippage stable swaps & deep integrations |

Yearn Finance | Vaults that auto‑compound & rotate strategies | Hands‑off UX; active strategy research ★★★★☆ | Optimized returns; some vaults may charge performance fees 💰 | 👥 Passive yield seekers | ✨ Curated auto‑optimizing vault strategies |

Lido | Liquid ETH staking (stETH/wstETH); daily rewards | Easy staking UX; broad integrations ★★★★☆ | Staking rewards accrue; smart‑contract/validator risk 💰 | 👥 ETH stakers wanting liquidity | ✨ Liquid staking with wide DeFi support |

Rocket Pool | rETH minting; permissionless node operators | Decentralized operator set; good docs ★★★★☆ | Small‑ticket staking; redemption/liquidity varies 💰 | 👥 Decentralization‑focused stakers | ✨ More decentralized node model; low min stake |

Pendle Finance | Tokenize yield into PT (principal) & YT (yield) | Advanced UX; active markets ★★★☆☆ | Lock/fix or trade yield; complexity & pricing risk 💰 | 👥 Sophisticated traders & institutions | ✨ Tradeable, composable yield instruments |

GMX | Perpetuals & swaps; LPs earn trader fees/funding | Straightforward UI; on‑chain analytics ★★★★☆ | Historically strong fee flow; exposure to trader PnL 💰 | 👥 LPs & derivatives traders | ✨ Fee income from leveraged trading |

Spark (Maker‑aligned) | sDAI/DSR access + lending markets (SparkLend) | Maker‑aligned front‑end; clear APY display ★★★★☆ | Access DSR yields; governance can change params 💰 | 👥 DAI holders seeking stable DSR yields | ✨ Direct sDAI/DSR access & Maker integration |

Summer.fi | Unified front‑end for DSR, Maker & strategy tools | Trusted Maker front‑end; automation features ★★★★☆ | DSR + automation; gas/front‑end costs apply 💰 | 👥 Users wanting DSR + automated strategies | ✨ Unified DSR interface + automation tools |

Choosing the Right Tool and Managing Your Risk

Navigating the landscape of decentralized income tools can feel like both an immense opportunity and a significant challenge. We've explored a dozen powerful platforms, from foundational money markets like Aave and Compound to sophisticated liquid staking derivatives from Lido and Rocket Pool, and innovative yield tokenization with Pendle. Each tool offers a unique pathway to earning, but none is a one-size-fits-all solution.

The key takeaway is that your personal financial goals and risk profile must be the compass guiding your decisions. The allure of high APYs can be strong, but it should never overshadow the importance of security, sustainability, and alignment with your own strategy. A platform like GMX might offer high real yields from trading fees, but it comes with market exposure risk that a stablecoin-focused tool like Curve or Yearn Finance is designed to minimize.

A Framework for Your Decision

Making a confident choice requires a structured approach. Before you commit capital to any of these decentralized income tools, run through this mental checklist to match the platform to your personal needs.

Assess Your Risk Tolerance (Honestly): Are you aiming for slow, steady stablecoin growth, or are you comfortable with the price volatility of assets like ETH or GMX? Your answer immediately narrows the field. Low-risk investors should gravitate towards battle-tested stablecoin pools on Curve or blue-chip lending on Aave. Those with a higher risk appetite might explore liquidity provision on Uniswap V3 or leveraged strategies via Summer.fi.

Evaluate Your Time Commitment: Do you have the time to actively manage positions, rebalance, and harvest rewards? If not, automated yield aggregators are your best friend. Yearn Finance is the classic "set-and-forget" option, while AI-powered solutions like Yield Seeker take this concept a step further by actively managing risk and optimizing for you. If you enjoy hands-on management, building your own LP position on Uniswap or manually compounding on GMX could be more engaging.

Define Your Asset Type: Your starting capital dictates your options. Are you holding stablecoins (USDC, DAI), a base layer asset (ETH), or a more niche token? For ETH holders, liquid staking with Lido or Rocket Pool is a logical first step. For stablecoin treasuries, a diversified approach across Aave, Spark, and Yearn can balance risk and reward effectively.

Final Safety and Implementation Checks

Once you've shortlisted a few tools, the final due diligence phase is non-negotiable. Never skip these steps.

Audit Verification: Check the platform's official documentation for security audit reports from reputable firms like Trail of Bits, OpenZeppelin, or ConsenSys Diligence. Multiple, recent audits are a strong positive signal.

Team and Community: Is the team public or anonymous? While anonymity is common in DeFi, a transparent, active team that communicates regularly in a public Discord or on Twitter can build confidence. Gauge the community's sentiment: is it helpful and engaged, or full of complaints and unresolved issues?

Total Value Locked (TVL) and Longevity: A high TVL (as seen on sites like DefiLlama) and a long operational history are indicators of trust and resilience. Platforms that have weathered multiple market cycles, like Aave and Uniswap, have proven their robustness.

The world of decentralized finance is a powerful engine for financial autonomy. By approaching these decentralized income tools with a clear strategy, a healthy respect for risk, and a commitment to thorough research, you can harness their potential to build a more resilient and productive digital asset portfolio. The journey begins not with a frantic chase for the highest yield, but with a thoughtful selection of the right tool for the job.

Ready to put your stablecoins to work with an intelligent, automated strategy? Yield Seeker simplifies the entire process by using AI to navigate the complexities of DeFi, automatically finding and managing the best risk-adjusted yields for you. Stop chasing APYs and start earning smarter with Yield Seeker.