Back to Blog

Defi Essentials: A Practical Guide to defi Concepts and Yields

Explore how defi works with clear basics, top yield strategies, risk tips, and a simple guide to evaluating defi projects.

Dec 11, 2025

generated

Picture a financial world with no banks, no middlemen, and no one asking for permission. A system that's open to anyone, anywhere, and runs on transparent rules that can't be secretly changed. That’s the big idea behind Decentralized Finance (DeFi). It’s a parallel financial universe being built on blockchain technology, designed from the ground up to be more open and efficient than what we have today.

What Is DeFi and Why Does It Matter?

At its core, DeFi is a radical departure from the traditional finance (or TradFi) we're all used to. Instead of relying on banks, brokers, and exchanges to approve and process our transactions, DeFi uses code to create a peer-to-peer system where you don't need to trust a central company. The whole thing runs on blockchains, which are basically shared, unchangeable public record books for every transaction.

This setup is what makes the key promises of DeFi possible:

It's Decentralized: No single person or company is in charge. Control is spread out among everyone who uses the network, making it incredibly resilient and hard to shut down or censor.

It's Transparent: Every transaction and all the code that runs the system are out in the open for anyone to see. This complete transparency is what builds trust—you can literally check the math yourself.

You're in Control: This is a big one. You, and only you, hold the keys to your assets in your own digital wallet. This is called self-custody, and it eliminates the risk of a bank or exchange going under and taking your money with it.

To get a better sense of how different this is, let's put the two systems side-by-side.

Traditional Finance vs. Decentralized Finance (DeFi)

Here's a quick comparison highlighting the fundamental differences between the legacy financial system and what DeFi brings to the table.

Feature | Traditional Finance (TradFi) | Decentralized Finance (DeFi) |

|---|---|---|

Control | Centralized (banks, governments) | Decentralized (user-run network) |

Access | Permissioned (requires approval) | Permissionless (open to anyone) |

Transparency | Opaque (internal operations are private) | Transparent (all activity is public on-chain) |

Custody | Third-party (banks hold your funds) | Self-custody (you control your funds) |

Operations | Manual processes, office hours | Automated 24/7 via smart contracts |

As you can see, DeFi isn't just a slight improvement; it's a complete reimagining of how finance can work, shifting power from institutions back to individuals.

The Engine of DeFi: Smart Contracts

So, what makes all this possible? The magic ingredient is the smart contract.

The easiest way to think of a smart contract is like a digital vending machine. You put in a coin (meet a condition), and it automatically gives you a snack (executes the outcome). No cashier needed.

In the old world, you need lawyers and courts to enforce a contract. With a smart contract, the agreement is just code. When certain things happen, the contract automatically does what it was programmed to do. A lending smart contract, for instance, could automatically hand back your collateral the moment you repay a loan, all without a single human needing to approve it.

If you want to dive deeper into the basics, we've put together a complete DeFi for Dummies guide.

An Ecosystem That's Exploding

DeFi's potential hasn't gone unnoticed. The space is attracting serious capital and attention. The global DeFi market was pegged at around USD 20.76 billion in 2024, but it’s projected to rocket to an eye-watering USD 637.73 billion by 2032.

This isn't just crypto die-hards, either. Big players are getting curious. One study found that 76% of global financial institutions are already looking into blockchain to see how it can help their own operations. You can find the full breakdown of these DeFi market projections here. With growth like that, understanding what DeFi is all about is becoming less of a niche interest and more of a necessity for anyone looking at the future of money.

Understanding the Core Components of DeFi

Decentralized Finance (DeFi) might look like a labyrinth from the outside, but it’s really just built on a few core, interconnected ideas. Get your head around these building blocks, and the whole ecosystem starts to make sense. It’s like learning the main parts of an engine—once you know what the pistons and crankshaft do, you can see how the whole machine roars to life.

Let’s break down the essential tech that makes DeFi tick. From the blockchains that form the foundation to the smart contracts that put it all on autopilot, these pieces work together to create a financial system that’s open, transparent, and puts you in control.

Blockchains and Smart Contracts: The Foundation

Everything in DeFi is built on a blockchain. Think of it as a giant, public spreadsheet that everyone can see, but no single person or company controls. This shared digital ledger is the bedrock that allows us to transact with each other without needing to trust a middleman. It's secure, transparent, and incredibly difficult to tamper with.

Running on top of these blockchains are smart contracts. A smart contract is just a bit of code that lives on the blockchain and automatically runs when certain things happen.

A smart contract is basically a high-tech vending machine. You put in your money (meet the conditions), and the machine automatically spits out your snack (executes the agreement). No cashier, no debates. The rules are baked into the code, and the outcome is guaranteed.

This automation is what kicks traditional financial middlemen like banks and brokers to the curb. To really get a feel for this, understanding decentralized app development is key, since every DeFi protocol is essentially a specialized dApp.

Automated Market Makers: The Robotic Traders

In the old financial world, trading relies on an order book where buyers and sellers are matched up. It works, but it can be slow and inefficient. DeFi often uses a slicker system: the Automated Market Maker (AMM).

An AMM is basically a "robotic trading pool" powered by a smart contract. Instead of waiting to be matched with another person, you trade directly with a big pool of crypto assets. These pools, known as liquidity pools, are filled by other users who deposit their tokens to earn a slice of the trading fees. This setup means there's always someone (or something) on the other side of your trade, providing constant liquidity. To see how this works in more detail, check out our guide on https://yieldseeker.xyz/yieldseekerblog/what-are-liquidity-pools.

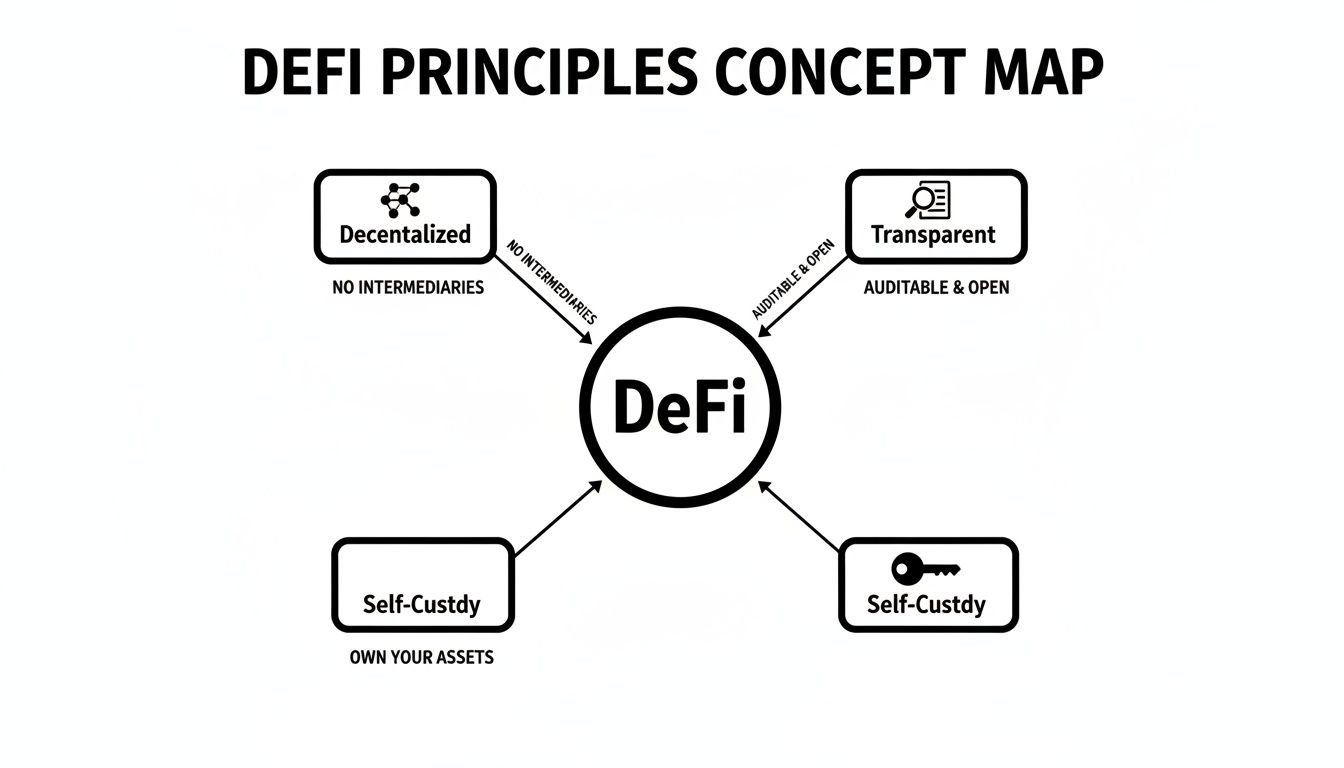

This map really drives home the core principles that make DeFi so different.

It shows how decentralization, transparency, and self-custody aren't just buzzwords; they're the pillars holding up the entire structure, shifting power from big institutions back to individuals.

Stablecoins: The Digital Anchors

Let's be real: one of crypto's biggest headaches is volatility. Prices swing wildly, which makes it tough to use crypto for normal financial stuff like lending or getting paid. This is where stablecoins save the day.

Stablecoins are a type of crypto designed to hold a steady value, usually by pegging their price 1:1 to a real-world asset like the U.S. dollar. This stability makes them the perfect "digital anchor" for just about everything in DeFi.

Here’s why they’re so important:

A Reliable Yardstick: They give us a dependable way to measure value, just like the dollar does in traditional finance.

Chill Yield Farming: You can lend, borrow, and earn yield on stablecoins without sweating over the price of your underlying asset collapsing overnight.

Easy On-Ramp: They provide a dead-simple bridge for moving money from your bank account into DeFi and back again.

Thanks to their stability, stablecoins have become the backbone of most DeFi strategies. They let you chase returns while keeping market volatility at arm's length. Even major financial players are now seeing regulated stablecoins as the bridge between the old and new financial worlds. These core components—blockchains, smart contracts, AMMs, and stablecoins—are the essential pieces that make the entire DeFi landscape work.

How People Generate Yield in DeFi

Okay, so understanding the building blocks of DeFi is one thing. But putting them to work to actually earn something? That's where it all clicks. This is where theory meets reality.

Unlike the old-school finance world, where getting a decent return often means you need a pile of cash or access to exclusive deals, DeFi cracks the door wide open. It offers a few surprisingly straightforward ways for anyone to make their assets productive.

The explosive growth in DeFi is proof that these opportunities are real. The market is expected to jump from USD 51.22 billion in 2025 to a whopping USD 78.49 billion by 2030. A big piece of that pie comes from decentralized exchanges (DEXs), which grabbed over 32% of the market share in 2024 as people moved away from centralized platforms. You can dig into more of these numbers over at Mordor Intelligence's DeFi market report.

For most folks dipping their toes in, the easiest starting point is using stablecoins. This lets you sidestep the wild price swings you see with other crypto assets. Let's break down the most popular ways people are putting their stablecoins to work.

Supplying Assets to Lending Protocols

One of the most foundational ways to earn in DeFi is by supplying your assets to a lending protocol. Think of it like a high-yield savings account, but supercharged. You simply deposit your tokens—like USDC or DAI—into a big pool managed by a smart contract.

From there, other users can take out loans from that pool, and they pay interest for the privilege. As a supplier, you get a cut of that interest, which shows up as a variable annual percentage yield (APY). It's simple: your earnings come directly from the demand for the assets you've supplied.

Key Takeaway: You essentially become the bank. Your capital provides the liquidity that makes borrowing possible, and you're rewarded with a slice of the interest payments—all handled automatically by code.

This method is popular because it's so direct. You deposit your funds, start earning, and can usually pull your money out whenever you want.

Providing Liquidity to Trading Pools

Another powerful strategy is to become a liquidity provider (LP) for an Automated Market Maker (AMM). In plain English, you’re acting like a tiny market-making operation. You deposit a pair of assets—say, an equal value of USDC and ETH—into a trading pool.

These assets are what the AMM uses to let other people trade. Every time someone swaps between USDC and ETH using that pool, they pay a small fee. As a liquidity provider, you earn your proportional share of those fees.

Here, the yield is generated purely from trading activity. The more people trade, the more fees the pool collects, and the higher your potential returns. It can be quite lucrative, especially for popular trading pairs with tons of volume. For those wanting to go deeper, we've got a whole article on the ins and outs of staking LP tokens.

Staking Tokens for Network Security

Staking is a bit different from the other two methods. Instead of providing liquidity for trading or lending, you're locking up your tokens to help keep a blockchain network secure. This is the backbone of networks that use a Proof-of-Stake (PoS) consensus mechanism.

Here’s the process:

You "stake" your tokens, effectively locking them with the network. This gives you the ability to help validate transactions and create new blocks.

For your contribution, the network rewards you with newly created tokens.

Your yield is a direct payment from the network for helping maintain its security and integrity. While you can stake a network’s main token (like ETH on Ethereum), many DeFi protocols also have their own tokens you can stake to earn a share of the protocol's revenue.

Each of these strategies—supplying, providing liquidity, and staking—offers a different flavor of income generation in DeFi. They turn what would otherwise be idle assets sitting in a wallet into an active, income-generating endeavor.

Navigating the Most Common DeFi Risks

The high yields in decentralized finance are a huge draw, but they don't come for free. Every juicy opportunity has some level of risk attached, and the key to playing this game long-term is understanding what can go wrong. This isn't meant to scare you off; it's about giving you the tools to make smarter decisions with your money.

Big returns almost always come with big risks, and DeFi is no exception. By going in with your eyes wide open, you can protect your capital while still taking part in this incredible financial experiment. Let's break down the main risks you'll run into.

Smart Contract Risk

At the core of every single DeFi protocol is a smart contract—basically, just a piece of code that runs automatically. This automation is what makes DeFi so powerful, but it's also its biggest weakness. If there’s a bug, a tiny oversight, or an exploit in that code, hackers can potentially drain a protocol of every last cent.

Think of a smart contract like a high-tech digital vault. A well-built one is practically bulletproof. But a single flaw in the design is all a thief needs to get in. This is easily the most common and devastating risk in DeFi, responsible for billions of dollars in losses over the years.

A critical part of navigating DeFi is understanding that "trustless" doesn't mean "riskless." You're not trusting a person or a company; you're trusting the integrity and security of the underlying code.

Because this risk is so massive, any serious project invests a ton of money into third-party security audits. These audits are like hiring a team of the world's best safecrackers to try and break into your vault before you put anything valuable inside. Always, always look for multiple, recent audits from reputable firms before you even think about putting money into a new protocol.

Impermanent Loss

This one is a weird, often misunderstood risk that’s specific to being a liquidity provider in Automated Market Makers (AMMs). Impermanent loss happens when the price of the tokens you've deposited into a liquidity pool changes relative to each other after you've put them in.

Imagine you deposit an equal value of ETH and USDC into a liquidity pool. If the price of ETH suddenly moons, the pool's algorithm will rebalance your position, selling off some of your ETH for USDC to keep the balance. If you were to pull your funds out at that exact moment, the total value might be less than if you had just held the original ETH and USDC in your wallet. It's an opportunity cost.

The "loss" is called "impermanent" because it only becomes real when you withdraw. If the prices swing back to where they were when you deposited, the loss vanishes. But in a wild, volatile market, it can become very permanent, very quickly.

Regulatory and Market Risks

The DeFi world is still the Wild West, and governments globally are just starting to figure out how to deal with it. This creates a cloud of regulatory uncertainty. New rules could pop up overnight that completely change how a protocol operates, which could hammer its value.

Beyond that, you have the usual market risks to worry about:

Counterparty Risk: DeFi is supposed to be peer-to-peer, but some protocols still have central points of failure. You need to know who, or what, is on the other side of your trade.

Stablecoin De-Peg Risk: Even stablecoins, which are meant to hold a solid 1:1 peg to the dollar, can break under extreme market pressure. When a major stablecoin de-pegs, it sends shockwaves through the entire ecosystem.

Your DeFi Risk Checklist

To keep things straight, it helps to have a mental checklist when you're looking at a new DeFi protocol or strategy. This isn't exhaustive, but it's a great starting point for developing your own due diligence process.

Here's a simple table to help you think through the main risk categories and what you should be looking for.

Risk Type | What to Look For | Mitigation Strategy |

|---|---|---|

Smart Contract | Multiple, recent audits from reputable firms. Active bug bounty program. Code has been live and battle-tested for a while. | Only use well-audited, established protocols. Start with small amounts to test the waters. |

Impermanent Loss | Pools with highly correlated assets (e.g., stablecoin pairs). Understand the fee structure vs. potential IL. | Choose pairs you're bullish on long-term. Provide liquidity for less volatile assets. Use tools that help model potential IL. |

Stablecoin Peg | The stablecoin's backing mechanism (collateralized, algorithmic). Historical performance during market stress. | Diversify across different types of stablecoins. Avoid over-reliance on a single, unproven stablecoin. |

Regulatory | The project's team location and legal structure. The general regulatory sentiment in major jurisdictions. | Stay informed about crypto regulations. Be prepared for the possibility that rules may change unexpectedly. |

Counterparty | Is there a multisig controlled by a few people? Is the protocol governance truly decentralized? | Prefer protocols with transparent, on-chain governance. Understand who holds the "admin keys." |

This checklist forces you to actively consider what could go wrong, which is the most important step in protecting yourself.

Navigating these risks successfully comes down to doing your homework, constantly learning, and having a healthy dose of skepticism. By starting small, sticking to platforms with a proven track record, and never investing more than you can afford to lose, you can explore the incredible opportunities in DeFi much more safely.

How to Evaluate DeFi Protocols Yourself

With thousands of DeFi protocols all competing for your attention, it’s easy to get drawn in by slick websites and promises of sky-high APYs. But telling the difference between a solid project and a potential disaster requires a bit of detective work. Honestly, learning to do your own research is the single most important skill you can have to navigate DeFi safely.

This isn't about becoming a coding expert overnight. It’s about knowing what to look for and where to find it. By putting together a simple evaluation framework, you can cut through the marketing hype and get a real sense of a protocol's health and its chances of sticking around for the long haul. A little proactivity here goes a long way in building a more resilient DeFi strategy.

Start with Security Audits

Before you even think about depositing a single dollar, your first stop should always be the security audits. A smart contract audit is just a fancy way of saying a specialized third-party firm has combed through a protocol's code. Their job is to hunt for bugs, vulnerabilities, and potential exploits before the bad guys do.

Think of it like getting a home inspection before you buy a house. You want an expert checking the foundation and the wiring for any nasty surprises.

What to look for in an audit:

Reputable Firms: Look for audits from well-known names in the space like Trail of Bits, OpenZeppelin, or CertiK. A good reputation matters.

Recency and Completeness: Make sure the audits aren't ancient history and that they actually cover the specific smart contracts you’ll be interacting with.

Resolved Issues: Check if the development team has actually acknowledged and fixed the critical issues the auditors found. An audit is useless if the team ignores the findings.

A protocol with no public audits is a massive red flag. It suggests they're not serious about security, and you should be extremely cautious or just walk away entirely.

Analyze the Total Value Locked

One of the quickest ways to get a feel for a protocol's traction and how much users trust it is by checking its Total Value Locked (TVL). TVL is simply the total amount of assets currently deposited in a protocol's smart contracts. It’s a key metric for measuring its market share and overall health.

A high and steadily growing TVL usually means that users find the protocol valuable and are confident enough to lock up serious capital. On the flip side, a TVL that's dropping like a rock can signal a loss of faith, a potential security scare, or that the juicy yields are drying up.

When evaluating DeFi protocols, tools that provide crucial data are indispensable. Platforms that aggregate TVL and other performance metrics give you a clear, unbiased view of a project's standing in the wider ecosystem.

For instance, using a tool like DefiLlama for in-depth analytics lets you compare the TVL of different protocols, see how it's grown over time, and check how it stacks up against its rivals. This data-driven approach helps you take the emotion out of your decisions.

Investigate the Team and Community

The code and the numbers only tell you part of the story. The people behind a protocol are just as critical. A strong, transparent team and an active, engaged community are often signs of a healthy project with real long-term potential.

Start by looking into the development team. Are they public about who they are and what their experience is? While an anonymous team isn't automatically a deal-breaker, a team that's willing to put their names and reputations on the line adds a layer of accountability.

Next, dive into their community channels like Discord and Telegram. Is the community actually helpful and active, or is it just a ghost town full of spam and hype? A vibrant community where people are genuinely discussing the protocol and helping newcomers is a great sign. This active user base is growing fast; in mid-2025, active DeFi users hit about 14.2 million wallet addresses worldwide, with weekly transaction volumes topping USD 48 billion. It just goes to show how much community trust matters for growth. At the end of the day, a project's survival often comes down to the strength of its community.

The Future of AI and Automation in DeFi

Let's be honest: navigating decentralized finance can be a full-time job. It's a hands-on world that demands constant research and active management just to stay on top of the best opportunities—let alone do it safely. But the next chapter in DeFi is all about changing that, pairing its powerful financial tools with the brains of AI and the muscle of automation. This isn't just a minor upgrade; it's a shift designed to tear down the walls, making sophisticated strategies available to everyone, not just the experts who live and breathe this stuff 24/7.

This evolution is giving birth to a new breed of tools you might hear called DeFi robo-advisors or yield aggregators. The best way to think of them is as a personal fund manager for your crypto. Instead of you spending hours glued to screens, comparing yields, and trying to audit the risk of dozens of protocols, these automated systems do all the heavy lifting. They can scan the entire DeFi landscape in real-time, sniff out the most promising risk-adjusted returns, and automatically put your funds to work.

How Automation Makes DeFi Human-Friendly

These smart platforms are built to solve some of the biggest headaches for anyone trying to earn in DeFi. While their main job is to hunt for the best yield, the benefits run much deeper, turning a ridiculously complex process into something you can actually manage.

Here’s what they bring to the table:

Non-Stop Optimization: The best yield opportunity today is rarely the best one tomorrow. AI-driven tools are always watching the market. They can rebalance your portfolio on their own, making sure your capital is always in the most productive spot.

Automated Risk Management: This is a big one. It's not just about chasing high APYs. These systems monitor protocol health around the clock, tracking things like smart contract security, liquidity levels, and even market sentiment to steer clear of dodgy platforms. That's a task that’s basically impossible for a human to do consistently.

Lower Transaction Costs: By bundling transactions together and finding the smartest routes, automated platforms can often execute strategies far more cheaply than an individual could. Over time, those saved gas fees really add up.

This move towards automation is absolutely critical for bringing the next wave of people into DeFi. For the average person or busy professional, the idea of manually juggling a complex crypto portfolio is a complete non-starter.

Automation transforms DeFi from a high-effort, expert-driven game into a more passive and approachable way to build wealth. It lets you set the strategy and then hand off the execution to the system, a lot like a traditional robo-advisor for the stock market.

The Rise of AI-Powered Agents

Looking just a bit further down the road, the idea of personalized AI agents is already becoming a reality. Platforms like Yield Seeker are at the forefront of this, creating an experience where an AI agent acts on your behalf based on your specific risk tolerance and financial goals. This is the "set and forget" dream that was pretty much unimaginable in the wild, fast-paced world of DeFi until now.

This whole evolution fundamentally changes what it means to be a DeFi user. It shifts the focus from constant button-pushing and manual trades to simply providing strategic oversight. You get to benefit from DeFi's incredible potential without needing to become a full-time financial analyst. As these technologies get better, they're going to make decentralized finance a safer, smarter, and way more approachable world for everyone.

Still Got Questions?

Even after wading through all the concepts, it’s totally normal to have a few questions still rattling around. The world of DeFi is deep, and sometimes a few straightforward answers are all you need to connect the dots and feel ready to dive in.

Let’s tackle some of the most common things people ask when they're just getting their feet wet. This is about bridging that gap between knowing what DeFi is and feeling confident enough to actually use it.

Do I Need a Ton of Money to Get Started?

Absolutely not. This is probably one of the biggest myths floating around about DeFi. You see the headlines about protocols with billions of dollars locked up and assume it's a whale's game, but the reality is the complete opposite.

Most platforms will let you get started with as little as $10 or $20. The whole point of this permissionless world is that it’s open to everyone, no matter the size of your bank account. You can learn the ropes with an amount you're comfortable with, which is exactly how most of us started.

Is DeFi Totally Anonymous?

Not quite. While you don’t have to hand over your name and address like you would at a bank, every single transaction gets etched onto a public blockchain for all to see. Your wallet address and its entire history—every trade, every deposit—is out there in the open.

Think of it less as anonymous and more as pseudonymous. Your real-world identity isn't directly linked to your wallet, but your on-chain identity is an open book.

This level of transparency is actually a huge plus for security and lets anyone audit what's happening. Just remember, your financial moves aren't truly private.

What's a Gas Fee?

A gas fee is basically the toll you pay to use a blockchain network. Whenever you send crypto, swap tokens on a DEX, or interact with a smart contract, you're asking a global network of computers to do the work of processing and confirming your transaction.

The gas fee is your payment to them for that work. These fees aren't fixed; they go up and down based on how busy the network is. On a popular network like Ethereum, fees can get pretty spicy during peak hours, which is a big reason why Layer 2 solutions and other blockchains with cheaper fees have become so popular for day-to-day DeFi stuff.

Can DeFi Actually Replace My Bank?

For most people, not yet. While DeFi offers many of the same services as traditional banking—lending, borrowing, earning interest—it's not a one-for-one replacement. Your regular bank account comes with things like deposit insurance and a much simpler, more familiar experience.

But here’s the thing: DeFi is evolving at an incredible pace. For specific goals, like earning a much higher yield on your savings than any bank could dream of offering, DeFi is already a powerful alternative. It's best to see it as another tool in your financial toolkit, one that gives you far more control and options for your money.

Ready to put your stablecoins to work without the endless research? Yield Seeker uses personalized AI Agents to find and manage competitive, risk-aware yield opportunities for you. Start earning smarter, not harder.

Explore automated DeFi yields at https://yieldseeker.xyz.