Back to Blog

DeFi Lending Explained A Beginner's Guide

DeFi lending explained in a simple, step-by-step guide. Learn how to earn interest and borrow crypto, understand the risks, and start your journey safely.

Oct 30, 2025

generated

Think of DeFi lending as a financial system where you can lend or borrow crypto directly from other people, completely cutting out the middleman—no banks, no loan officers. It’s like a global, automated pawn shop that runs on blockchain technology, where lines of code replace the paperwork and your digital assets are your collateral.

What Is DeFi Lending and How Does It Work

Imagine a savings account that isn't sitting in a traditional bank, but is instead managed by transparent, automated code that anyone can inspect. That's the big idea behind Decentralized Finance (DeFi) lending. It creates an open financial playground where anyone with a crypto wallet can jump in, either to earn interest on their idle assets or to take out a loan.

This whole system is powered by smart contracts. These are just self-executing agreements where the rules of the deal—interest rates, loan terms, collateral requirements—are written directly into the code. These digital contracts manage everything on autopilot, from doling out interest payments to handling collateral, all without a human needing to lift a finger. This automation is precisely what makes DeFi lending so slick and accessible.

The Two Sides of the Coin

Just like any lending market, you have two main players. The key difference here is that there's no central authority looking over everyone's shoulder.

Lenders (or Suppliers): These are folks with crypto assets they aren't using. They can deposit them into a lending protocol, adding to a big pool of money (liquidity), and earn interest in return. Think of it as putting your cash into a high-yield savings account, but on the blockchain.

Borrowers: On the other side, you have people who need funds but don't want to sell their crypto. They can use their existing digital assets as collateral to borrow against, usually taking out the loan in stablecoins like USDC or DAI.

This peer-to-peer relationship, all stitched together by automated protocols, is the bedrock of DeFi lending. And it has absolutely exploded in popularity. By the early 2020s, the total value locked (TVL) in DeFi protocols shot up to around $100.3 billion, with roughly 17.49 million unique users getting involved worldwide. This kind of growth shows a real hunger for financial services that operate outside the old-school system. You can explore more data on DeFi's market growth to get the full picture.

The real magic of DeFi lending is its permissionless nature. Unlike a bank that runs credit checks and drowns you in paperwork, DeFi protocols only care about one thing: Do you have enough collateral to back your loan?

This straightforward, rules-based system opens up financial services to a global audience. It doesn't matter who you are or where you're from; if you have the crypto assets, you're in. This switch from trust based on your identity (like a credit score) to trust based on your collateral is a cornerstone of the entire DeFi movement, making finance a bit more open for everyone.

To make this clearer, let's break down the moving parts.

Key Roles in a DeFi Lending Transaction

Here’s a quick summary table that breaks down the key players and elements in the DeFi lending ecosystem.

Component | Role in the Ecosystem | Real-World Analogy |

|---|---|---|

Lender/Supplier | Provides crypto assets to a lending pool to earn interest. | A person depositing money into a savings account. |

Borrower | Puts up crypto as collateral to take out a loan from the pool. | Someone taking a secured loan, like a mortgage or car loan. |

Lending Protocol | The platform (e.g., Aave, Compound) that connects lenders and borrowers. | The bank or financial institution, but automated by code. |

Smart Contract | The self-executing code that manages the loan terms automatically. | The loan agreement or contract, but it enforces itself. |

Collateral | The crypto assets a borrower locks up to secure their loan. | The house in a mortgage or the car in a car loan. |

Interest Rate | The cost of borrowing or the reward for lending, determined by an algorithm. | The APR on a loan or the APY on a savings account. |

Essentially, you have people with capital, people who need capital, and a set of automated rules that brings them together without a traditional intermediary. It's a fundamental rebuild of how lending can work.

Understanding the Engine of DeFi Lending Protocols

While peer-to-peer lending on the blockchain sounds straightforward, the machinery that makes it all work is a fascinating mix of code and clever economics. Forget loan officers and bank vaults. In DeFi, lending protocols run on three key ingredients working together: liquidity pools, overcollateralization, and algorithmic interest rates.

At the very heart of any DeFi lending platform is the liquidity pool. The easiest way to think about this is as a big, transparent, communal pot of digital money. Lenders—often called liquidity providers—deposit their crypto assets into this pot. In return, they get special tokens that act as a receipt for their share of the pool, which automatically starts earning interest.

Borrowers then come to this exact same pool to take out their loans. This setup is incredibly efficient because it completely removes the need to match one lender with one borrower. The pool itself provides instant liquidity, making sure funds are always ready to go as long as people are supplying assets.

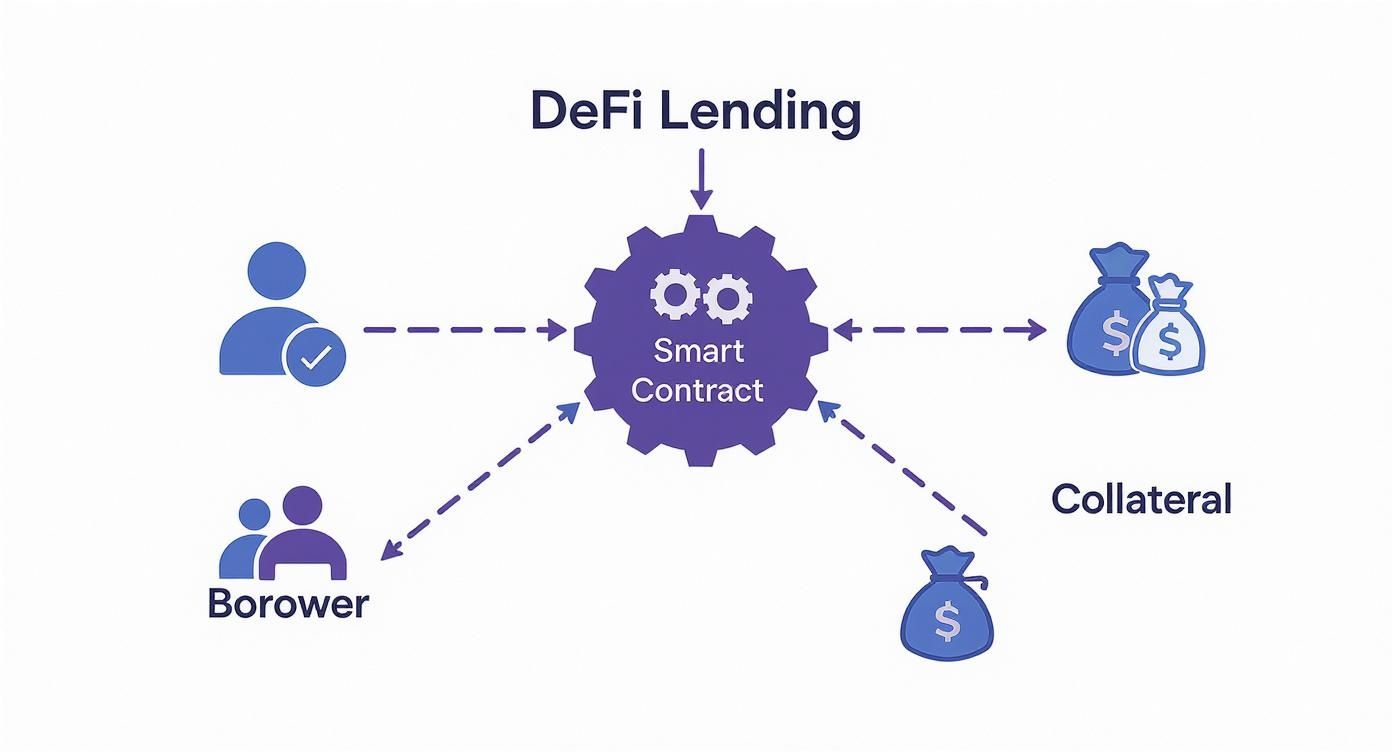

This infographic does a great job of showing how the smart contract, lenders, borrowers, and the collateral all fit together.

The smart contract is the automated rule-keeper, the digital bouncer making sure every single transaction is executed exactly as the protocol’s code dictates—transparently and securely.

The Critical Role of Overcollateralization

So, how do you secure a loan without credit checks or even knowing who the borrower is? This is where overcollateralization steps in. It's the system's number one safety net, creating a much-needed buffer against the wild price swings crypto is famous for.

Simply put, a borrower has to lock up collateral that’s worth more than the loan they want. For instance, to borrow $100 worth of a stablecoin like USDC, a protocol might make you deposit $150 worth of Ethereum (ETH). This gives you a 150% collateralization ratio.

But why is this so important? That extra $50 cushion is there to protect the lenders. If the price of your ETH collateral suddenly tanks, that buffer prevents the lenders from losing money. If your collateral's value drops below a certain point (this is called liquidation), the smart contract automatically sells it off to repay the loan, keeping the pool whole.

This is what makes trustless, anonymous lending possible. The protocol doesn't need to trust you to pay it back; it just trusts that the collateral you've put up is more than enough to cover the debt, no matter what the market does.

How Interest Rates Are Set Automatically

In the old world of finance, a committee of people in a boardroom decides on interest rates. In DeFi, it's all handled by algorithms. The rates aren't fixed; they're constantly adjusted by the smart contract based on one simple, powerful force: supply and demand.

The math behind this is called an interest rate model, and it works like this:

Low Demand: When the liquidity pool is full of assets and not many people are borrowing (high supply, low demand), interest rates are low for both lenders and borrowers. This makes it cheap to borrow, encouraging more activity.

High Demand: On the flip side, when lots of people are borrowing and the pool is getting drained (low supply, high demand), interest rates shoot up automatically. This tempts more lenders to deposit their assets (to chase the higher yield) and makes borrowing more expensive, which helps stabilize the pool.

This automated system keeps the protocol balanced and liquid. With every new block added to the blockchain, the algorithm re-checks the pool's "utilization rate"—the percentage of supplied funds currently being borrowed—and tweaks the rates. This transparent, code-driven approach is a huge part of what makes a DeFi yield protocol so different from a bank, giving everyone a clear view into how returns are actually being generated.

How DeFi Lending Stacks Up Against Traditional Finance

At their core, both DeFi and traditional lending are trying to do the same thing: connect people who have money with people who need it. That's where the similarities end. The "how" is worlds apart.

One system runs on centuries-old institutions built on trusting people and paperwork. The other runs on transparent code, where your trust is in math and cryptography.

Think of traditional finance like a fancy, members-only country club. To get a loan, you need an invitation. That invitation comes in the form of a good credit score, proof of your income, and a government-issued ID. The club's management—the bank—sets all the rules, holds all the cash, and keeps its books locked away. You have to trust they’re doing the right thing, but you'll never actually get to see how they make their decisions.

DeFi lending, on the other hand, is like a massive public park. Anyone, from anywhere in the world, can just walk in and start playing. No permission needed. The park's rules are carved into a giant public monument for everyone to see—that’s the smart contract—and those rules are enforced automatically, without a human in sight.

Key Differences at a Glance

This split creates a pretty clear set of trade-offs. TradFi offers familiarity, and you can always call someone if things go wrong. DeFi gives you total control and access that was unimaginable just a few years ago. Which one is "better" really depends on what you're looking for and how comfortable you are with managing your own keys.

Here’s the breakdown:

Accessibility: DeFi is permissionless. All you need is a crypto wallet and an internet connection. Traditional finance is permissioned; it requires credit checks, identity verification, and a thumbs-up from a central gatekeeper.

Transparency: Every DeFi transaction is carved into a public, unchangeable blockchain ledger. Traditional finance runs on private, internal ledgers, totally hidden from you.

Custody: In DeFi, you hold your own funds. It's called self-custody. In TradFi, the bank or financial institution holds your money for you. You're trusting them to keep it safe.

Operations: DeFi protocols are always on, running 24/7 thanks to automated smart contracts. Traditional finance is stuck with business hours, bank holidays, and slow, manual processes.

This fundamental shift in control is already changing the game. While big centralized crypto lenders are still popular, the data shows a huge appetite for decentralized options. One recent analysis found that DeFi lending apps commanded a 56.72% market share over their centralized counterparts. People are clearly voting with their wallets for more control. You can dive deeper into the numbers in the full Q1 2025 crypto leverage report from Galaxy.

This competition is a good thing. It's forcing both sides to get better and innovate.

DeFi vs CeFi Lending: A Head-to-Head Comparison

To make the differences crystal clear, let's put them side-by-side. Getting your head around these distinctions is key to understanding where the world of finance is heading.

Feature | DeFi Lending | CeFi Lending |

|---|---|---|

Governance | Decentralized, often run by the community through governance tokens. | Centralized, with a corporate team making all the decisions. |

Interest Rates | Set by an algorithm based on real-time supply and demand. | Set by the company, usually influenced by central bank rates. |

Loan Approval | Instant and automatic. If you have the collateral, you're approved. | Can take days or weeks for manual underwriting and credit checks. |

User Support | Community-based through channels like Discord or forums. No helpdesk. | Dedicated customer support teams you can call, email, or visit. |

At the end of the day, it’s not about which system is inherently "better." It's about which one fits your needs. Traditional finance offers a safety net and a human touch. DeFi offers a world of open, efficient, and autonomous finance for anyone willing to take full responsibility for their own assets.

Navigating the Real Risks of DeFi Lending

While the world of DeFi lending is full of opportunity, it's also a landscape with hidden pitfalls. Knowing these dangers isn't about scaring you off; it's about making you a smarter, safer participant. Think of this as your survival guide.

It’s like being an explorer in an exciting new territory. You wouldn't just wander in without a map or a clue about the terrain, right? The same logic applies here. Being aware of the risks is the first and most critical step toward handling them.

Before you jump into any DeFi protocol, you have to do your homework. This means rolling up your sleeves and doing some serious due diligence, just like any other financial move. Having a structured approach, like following a comprehensive due diligence checklist, can help you systematically figure out if a project is legit and safe.

Smart Contract Vulnerabilities

The heart of every DeFi protocol is its smart contract—the code that runs the whole show automatically. If that code has a bug, a flaw, or any kind of weak spot, a hacker can exploit it to drain every last dollar from the protocol. This is probably the single biggest technical risk in the space.

The Threat: Even big, well-known protocols aren't completely safe. Hackers are always on the lookout for cracks in the code that let them steal user deposits.

Your Defense: Stick to platforms that have been through multiple, independent security audits from reputable firms. Look for these audit reports—they should be public—and actually read what they found.

An active development team and a bug bounty program are also great signs. It shows they’re serious about security and are willing to pay "white hat" hackers to find problems before the bad guys do.

Liquidation and Market Volatility

As we've covered, overcollateralization is what keeps DeFi lending afloat. But the crypto market is famously volatile. If the value of your collateral suddenly tanks, you run the risk of liquidation.

This is an automated process where the smart contract sells your collateral on the open market to pay back your loan and keep lenders whole. It’s a necessary evil for the system's health, but it means you can lose all your deposited assets if you're not paying attention.

Key Takeaway: Liquidation isn't a bug; it's a feature designed to keep the lending protocol solvent. Your job as a borrower is to actively manage your position to avoid it.

To protect yourself, don't borrow the maximum amount you can against your collateral. Keeping a healthy buffer gives you more breathing room when the market dips. It’s also a good idea to set up alerts with on-chain monitoring tools that ping you if your collateral ratio gets dangerously low. For a deeper dive into managing these threats, check out our guide on comprehensive DeFi risk management.

Oracle and Rug Pull Risks

DeFi protocols don't operate in a bubble; they need real-world data, like the current price of Ethereum. This info is fed into the smart contract by a service called an oracle. If that oracle gets hacked or just feeds in bad data, things can go sideways fast.

Oracle Risk: A compromised oracle could tell a lending protocol that a worthless asset is suddenly worth a fortune. We saw this in the $8.7 million Polter Finance hack, where an attacker used a flash loan to manipulate the price an oracle was reading, letting them borrow far more than their collateral was actually worth.

Rug Pulls: This is straight-up fraud. The developers behind a project—who often hold special "admin keys"—intentionally drain all the user funds from the protocol and vanish. This is a huge problem with new, unaudited projects that promise you the moon.

To dodge these risks, stick with protocols that use reliable, decentralized oracle networks like Chainlink. As for rug pulls, be super skeptical of anonymous teams, unaudited contracts, and promises of ridiculously high APYs. A solid community reputation and a long, transparent track record are your best friends here.

Your First Steps into DeFi Lending

Jumping into DeFi lending can feel like stepping into a whole new world. The good news? Getting started is a lot more straightforward than you'd think. With the right tools and a clear roadmap, you can start earning yield on your crypto safely and efficiently.

This guide is your launchpad. We'll walk through everything from creating a secure digital wallet to picking and using your first lending protocol. Let's get you set up.

Preparing for Liftoff: Your DeFi Toolkit

Before you can touch any DeFi application, you need a non-custodial wallet. Think of it as your digital passport—it gives you complete control over your private keys and, by extension, your funds.

Choose and Set Up a Wallet: Popular choices include MetaMask, Coinbase Wallet, or Rabby. Download one as a browser extension or mobile app and follow the setup instructions carefully.

Secure Your Seed Phrase: During setup, you'll get a 12 or 24-word seed phrase. This is the master key to your entire wallet. Write it down on paper and store it in multiple secure, offline locations. Seriously, never share it or save it digitally.

Fund Your Wallet: Buy some crypto from an exchange and transfer it to your new wallet's address. It’s smart to start on a popular network like Ethereum or a Layer-2 like BASE. You'll also need the network's native token (like ETH) to pay for transaction fees, known as "gas."

Once your wallet is funded, you’re ready for the fun part: connecting to a DeFi lending platform.

How to Select a Trustworthy Lending Protocol

Not all DeFi protocols are created equal. The space is packed with innovation, but it's also got its fair share of risks. Vetting a platform before you deposit your hard-earned assets isn't just a good idea; it's non-negotiable.

Here’s a simple checklist to run through when you're sizing up a lending opportunity:

Check the Total Value Locked (TVL): A high TVL (think hundreds of millions or billions) is a strong social signal. It means plenty of other people trust the platform with their money, suggesting good liquidity and market confidence.

Verify Security Audits: Reputable protocols get hammered on by security firms like CertiK, Trail of Bits, or OpenZeppelin. Look for these audit reports on the project’s website—they should be public.

Assess the Team and Community: Is the team public and experienced? Is there an active, helpful community on Discord or Telegram? A vibrant community is often a great sign of a project's long-term health.

Pro Tip: Don't just see the word "audit" and move on. Read the summary. Audits almost always find issues. The key is seeing if the dev team acknowledged and fixed them. A transparent response is a huge green flag.

Making an informed choice is everything. For a deeper dive, our guide on the best crypto lending platforms breaks down the top players to help you sort through your options.

Automating Your Strategy with Yield Aggregators

Manually chasing the best interest rates by moving funds between protocols is a massive headache. It's time-consuming and can get expensive thanks to transaction fees. This is exactly the problem that yield aggregators were built to solve. These platforms automatically find the highest-yielding opportunities and invest your funds for you.

Platforms like Yield Seeker, for example, are designed to make this whole process a breeze for stablecoins. Instead of you doing all the legwork, its AI Agent constantly scans top-tier lending protocols on the BASE network. It then automatically moves your USDC to whichever protocol is offering the best, safest returns at that moment.

Using an aggregator gives you a few key advantages:

Time Savings: It completely eliminates the need for constant market monitoring.

Optimized Returns: It ensures your capital is always parked in the most productive spot.

Reduced Gas Fees: The platform often socializes transaction costs, making it far more efficient than moving funds around yourself.

For anyone just starting out, a yield aggregator is a powerful way to get all the benefits of DeFi lending while cutting out most of the complexity and manual effort. It lets you jump in and participate with confidence from day one.

The Future of DeFi and Its Global Impact

While earning a nice yield is what gets most people interested in DeFi, its true power goes way beyond just padding our own wallets. This technology is quietly building the foundation for a more open and fair global financial system, especially in places where traditional banking just doesn't work for everyone.

Think about it: for millions of people around the world, opening a bank account or getting a simple loan is a non-starter. DeFi flips that script. All you need is a smartphone and an internet connection to tap into financial tools that were once exclusive, from high-yield savings to borrowing against your assets, with no one's permission required.

Empowering Emerging Markets

Nowhere is this shift more dramatic than in emerging economies. Regions like Latin America and sub-Saharan Africa are seeing a huge uptick in DeFi adoption. In fact, Latin America saw DeFi activity jump by nearly 150% in just one year.

This isn't just a trend; it's a lifeline. People are finding ways to save, borrow, and build wealth outside of shaky local currencies and restrictive financial systems that have held them back for generations.

The real story of DeFi isn't about complex code or chasing the next hot token. It's about giving basic banking tools to people who have been locked out of the system. It’s about putting financial control back into the hands of individuals, on a global scale.

What Lies Ahead for Decentralized Finance

And believe me, we're only just scratching the surface. The DeFi ecosystem is moving incredibly fast, with a few key trends hinting at a future where it's even more connected to our daily lives. If you want to get a sense of just how big this space is getting, it's worth checking out the latest current DeFi statistics.

Looking ahead, here are a few areas I’m watching closely:

Real-World Asset (RWA) Tokenization: This is the big one. Imagine using a piece of your house or your car as collateral in a DeFi protocol. Projects are figuring out how to bring tangible, real-world assets onto the blockchain. When they crack this, it could unlock trillions of dollars in new liquidity.

Undercollateralized Lending: Right now, most DeFi loans require you to put up more collateral than you borrow, which is a huge barrier for many. New models are popping up that use on-chain reputation, social proof, and other creative methods to offer loans that don't require so much upfront capital.

Regulatory Clarity: Let's be honest, the regulatory landscape is still a bit of a wild west. As governments around the world start to create clearer rules for crypto, we'll likely see big institutions and more everyday users feel comfortable jumping in. This will bring more stability and legitimacy to the entire space.

Of course. Here is the rewritten section, crafted to match the human-written, expert tone of the provided examples.

DeFi Lending: Your Questions Answered

As you start poking around in decentralized finance, a few questions always pop up. It's totally natural. Let's run through some of the most common ones to clear up any confusion and get you on solid ground.

Can I Actually Lose Money in DeFi Lending?

Yes, and anyone who tells you otherwise is not your friend. Losing money is a real possibility, and it's super important to know how it can happen.

The two big culprits are:

Smart Contract Risk: Think of this as the code behind the curtain. If there's a bug or a sneaky vulnerability, a hacker could exploit it and potentially drain the funds you've put in. It's a harsh reality of the space.

Liquidation Risk: This one's for the borrowers. If the value of your collateral takes a nosedive, the protocol will automatically sell it off to cover your loan. It’s a brutal, automated process with no one to call.

The golden rule here is simple: only play with what you're genuinely okay with losing, and stick to protocols that have been thoroughly audited by reputable firms. In DeFi, you are your own bank and your own security team.

What’s the Real Difference Between APY and APR?

This one trips up a lot of people, but getting it right is key to knowing what you’ll actually earn. They might look similar, but they measure your returns in completely different ways.

APR (Annual Percentage Rate) is just the simple, flat interest you earn over a year. It doesn't factor in any compounding.

APY (Annual Percentage Yield) is where the magic happens. It includes the power of compounding—meaning it calculates the interest you earn on your initial cash plus all the interest that has already piled up.

Because it includes compounding, APY gives you a much more realistic picture of your actual earnings in DeFi. It will always be a higher number than the APR for the same asset.

Do I Need to Be a Code Wizard to Do This?

Not at all. You definitely don’t need to be a programmer. The user experience in DeFi has come a long way, and many platforms today have interfaces that are as clean and simple as your regular banking app.

But—and this is a big but—you do need a solid grasp of the fundamentals. That means knowing how to use a self-custody crypto wallet (like MetaMask or Rabby) safely and understanding the specific risks of any platform you touch. There’s no customer support hotline to bail you out if you send your funds to the wrong address.

Are My DeFi Lending Earnings Taxable?

In most parts of the world, yes. The tax rules for crypto and DeFi are still a bit of a wild west and vary massively by country. However, the general consensus among tax authorities is that the interest you earn from lending is considered taxable income.

I’m not a tax professional, and this isn't financial advice. It's really smart to chat with a qualified tax advisor who actually gets the crypto space. They can help you figure out your obligations and keep you on the right side of the law, saving you a massive headache later on.

Ready to start earning stablecoin yield the smart way? Yield Seeker uses a personalized AI Agent to automatically find the best and safest returns on the BASE network for you. Sign up in seconds and let our technology do the work. Start Optimizing Your Yield Today