Back to Blog

How to Build Wealth in Your 20s: Tips for Financial Success

Learn how to build wealth in your 20s with practical strategies to save, invest, and grow your income. Start your path to financial freedom today!

Oct 16, 2025

generated

Let's be real: building wealth in your 20s isn't some complex mystery. It really just comes down to a simple, incredibly powerful formula: spend less than you make, invest the difference, and let time do all the heavy lifting for you.

This decade isn't just about getting a head start. It's the period where you have the single most powerful wealth-building tool on your side—a massive financial runway.

Why Your 20s Are the Most Important Decade for Wealth

Think of it like this: right now, you have something like a 40-year runway ahead of you. The small, consistent moves you make today will snowball into massive results later on, all thanks to the magic of compound interest.

This is the process where your investment earnings start generating their own earnings. The more time you give it, the more insane the growth becomes. And this isn't just some textbook theory. A quick story about two recent grads really brings home just how critical it is to get started now.

The Power of an Early Start

Imagine two friends, Alex and Ben.

Alex gets going right away and starts investing $200 a month at age 25.

Ben puts it off, finally starting at 35. To make up for lost time, he decides to invest double Alex's amount—$400 a month.

Fast forward to age 65. Assuming a pretty standard 8% annual return, Alex will have over $700,000. Ben, on the other hand, despite investing twice as much every single month, will end up with just over $540,000.

That extra decade of compounding earned Alex an additional $160,000, even though he put in less of his own money. It's a game-changer.

Your most powerful asset for building wealth isn't a huge paycheck; it's the decades of time you have ahead of you. Small, consistent actions now will always crush large, delayed efforts later.

Turning Small Habits into Big Fortunes

This is precisely why your 20s are your golden ticket. You don't need a six-figure salary or a lucky stock pick. You just need a plan and the discipline to stick with it.

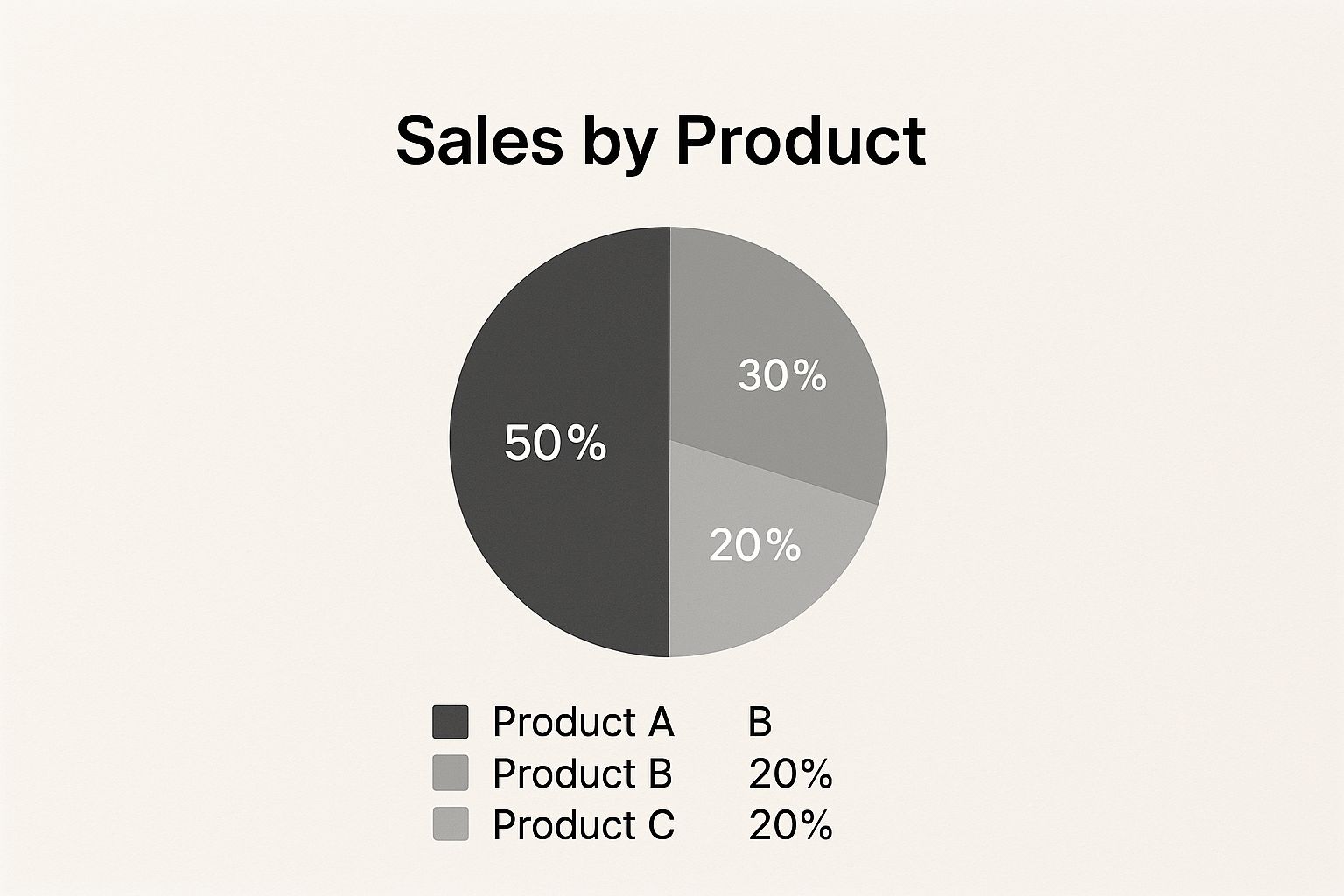

The average net worth for Americans in their 20s is around $121,004, but that number hides a more important truth: the people who build wealth effectively are the ones who save and invest consistently, no matter what.

Starting with just $500 a month at 25 could easily grow to over $1 million by retirement. But if you wait until 35 to start, you slash that potential amount nearly in half. For more on these trends, check out the latest report from Empower.

The next sections lay out the exact blueprint to make this happen, starting with getting your cash flow under control and then making your first smart investments. Your journey starts right now.

Build Your Financial Foundation, Master Your Money

Before you try to build a skyscraper, you need a rock-solid foundation. It’s the exact same story with your finances. Forget about complicated spreadsheets or budgets that make you feel guilty for buying a coffee. Building wealth in your 20s starts with one simple goal: understanding and controlling where your money goes.

This isn’t about penny-pinching. It's about consciously directing your money toward your future self. The most powerful way to do this? Automation.

The infographic below shows exactly how to set up your paycheck to build savings and investments automatically, without even thinking about it.

By setting up automatic transfers, you make sure your wealth-building goals get first priority the moment you get paid. It turns a chore into an effortless habit.

Pay Yourself First Through Automation

The "Pay Yourself First" method is a total game-changer. Instead of saving what’s leftover after a month of spending, you flip the script and save first. The moment your paycheck hits your account, automated transfers should be whisking money away to your savings and investment accounts.

This simple shift puts your financial goals on autopilot. It removes the daily temptation to spend that cash and guarantees you're consistently building for the future.

The most powerful financial habit you can build in your 20s is automating your savings and investments. It’s the difference between hoping you’ll have money left over and guaranteeing you’re building wealth every single month.

A great way to structure this is the 50/30/20 rule. It’s a simple, flexible guideline for your after-tax income:

50% for Needs: This bucket covers your essentials—rent, utilities, groceries, and transportation.

30% for Wants: This is your lifestyle fund for things like dining out, entertainment, hobbies, and travel.

20% for Savings & Debt Repayment: This is the magic number. This slice is dedicated to building your future, from investments and retirement contributions to knocking out debt.

This framework gives you a clear target. If you automate 20% of your income straight into savings and investments, you're already way ahead of the curve.

To make this crystal clear, let's look at a real-world example.

50/30/20 Budget Breakdown Example

Here's a sample budget for a 25-year-old with a $60,000 annual salary, showing how they might allocate their after-tax income. This person's take-home pay is roughly $3,750 per month after taxes.

Category | Percentage | Monthly Amount | Examples |

|---|---|---|---|

Needs | 50% | $1,875 | Rent, groceries, utilities, car payment, insurance |

Wants | 30% | $1,125 | Dining out, shopping, travel, subscriptions, hobbies |

Savings & Debt | 20% | $750 | 401(k) contributions, Roth IRA, student loans, emergency fund |

This is just a guideline, of course. You can and should adjust the percentages to fit your own life and financial goals. The key is having a plan and making it automatic.

Confront The Ultimate Wealth Destroyer: High-Interest Debt

While you’re building great habits, you also have to tackle the number one obstacle to building wealth in your 20s: high-interest debt. Credit card balances, personal loans, and payday loans are like financial quicksand, with interest rates often soaring above 20%.

Paying off this kind of debt is like getting a guaranteed investment return equal to its interest rate. It's one of the smartest things you can do with your money. Two popular strategies can help you get it done.

The Debt Avalanche Method (Mathematically Optimal) This approach has you focus on the debt with the highest interest rate first, while making minimum payments on everything else.

List all your debts from the highest interest rate to the lowest.

Make minimum payments on all debts except the one at the very top.

Throw every extra dollar you can find at that top-priority debt until it's gone.

Once it’s paid off, you roll that entire payment amount (the minimum plus the extra) onto the debt with the next-highest interest rate.

Repeat this process until you are completely debt-free.

This method will save you the most money on interest over time, period.

The Debt Snowball Method (Psychologically Powerful) With this strategy, you pay off the smallest debt first, completely ignoring the interest rate.

List your debts from the smallest balance to the largest.

Make minimum payments on all debts except the smallest one.

Attack that tiny debt with any extra money until it's paid off.

Celebrate that quick win, then roll its payment into the next-smallest debt.

The fast wins from the snowball method can give you a huge motivational boost to keep going. Getting a handle on your financial picture is a big deal, and if you really want to go deeper, it helps to understand how to analyze financial statements.

Which method is right for you? It really depends on what gets you fired up more: saving the most money (avalanche) or getting quick, motivating wins (snowball). Both are proven paths to becoming debt-free and freeing up your income to work for you.

And before you start pouring money into investments, it’s crucial to build a safety net. You can learn more about exactly how to build an emergency fund in our detailed guide.

Your Guide to Smart Investing in Your 20s

Alright, you've got your financial house in order and kicked that nasty high-interest debt to the curb. Now for the fun part: investing. This is where your money stops just sitting there and actually starts working for you, creating its own momentum through the magic of compound interest.

The whole idea of "investing" can sound pretty intimidating, but it's way simpler than most people think. You don't need a finance degree or a huge pile of cash to get in the game. The real secret is just to start now, be consistent, and let time do the heavy lifting.

Start with Tax-Advantaged Accounts

Before you even think about picking stocks, you need to get familiar with two of the most powerful tools in your wealth-building arsenal: the 401(k) and the Roth IRA. Think of them as special accounts with superpowers—they offer massive tax breaks that can seriously boost your long-term growth.

Your Employer's 401(k) Match If your job offers a 401(k) with a company match, this is your number one priority. No exceptions. A typical match is something like 50% of whatever you contribute, up to 6% of your salary.

Let's put that in real numbers. Say you make $60,000 a year. You put in 6% of your salary, which is $3,600. Your employer then drops an extra $1,800 into your account. For free. That’s an instant 50% return on your money. You will literally never find a guaranteed return like that anywhere else. Not taking the full match is like telling your boss you don't want a raise.

The Roth IRA Advantage Next up is the Roth IRA, an individual retirement account you open yourself. You fund it with money you've already paid taxes on. The payoff? Your investments grow completely tax-free, and when you pull money out in retirement, you won't owe a single dime to the IRS.

For anyone in their 20s, a Roth IRA is a game-changer. You're likely in a lower tax bracket now than you will be later in your career. By paying a little tax today, you get to keep all the explosive growth from the next 40+ years entirely for yourself, tax-free.

For 2024, you can put up to $7,000 into a Roth IRA. Don't sweat it if you can't hit the max. Even starting with $50 a month will put you miles ahead.

Keep Your Investments Simple and Low-Cost

So, what do you actually buy inside these accounts? Forget the hype about trying to find the next Tesla or Amazon. The most proven path to building wealth is also the most boring (and effective): low-cost index funds and ETFs.

An index fund is a basket that holds all the stocks in a market index, like the S&P 500. An ETF (Exchange-Traded Fund) is a close cousin that trades on the stock exchange just like a regular stock. When you buy one, you instantly own a tiny slice of hundreds, sometimes thousands, of companies.

This strategy is brilliant for a few reasons:

Instant Diversification: You're not putting all your eggs in one basket. Your risk is spread out over the entire market.

Dirt-Cheap Fees: These funds are managed by computers, not expensive fund managers, so the fees (called expense ratios) are incredibly low—often under 0.10%. High fees will eat away at your returns over time.

Proven Performance: Over the long haul, the stock market has always trended up. Trying to outsmart the market is a game that even most pros lose. It's much smarter to just own the market itself.

A fantastic starting point for most people is a simple S&P 500 index fund (tickers like VOO or FXAIX) or a total stock market index fund (like VTI or FSKAX).

Setting Up Your First Investment Account

Getting your first account open is shockingly easy. You just need to open a brokerage account, which is basically a bank account for investments. The whole thing usually takes less than 15 minutes.

Here's the quick-and-dirty guide:

Choose a Brokerage: Stick with the big, reputable names like Vanguard, Fidelity, or Charles Schwab. They're known for low costs and have a huge selection of funds and ETFs with zero trading fees.

Open Your Account: A Roth IRA is usually the best place to start. You'll just need your Social Security number and some basic personal info.

Fund the Account: Link your checking account and move some money over. You can often start with as little as $25.

Set Up Automatic Investments: This is the most crucial step. Set up a recurring transfer—weekly or monthly—from your bank to your brokerage. This is called dollar-cost averaging. It puts your investing on autopilot and means you're consistently buying, whether the market is up or down.

Picking the right platform can make a big difference in how easy this is. For a full breakdown, check out our guide on the best investment apps for beginners to see which one fits you best.

Let’s see how this plays out for a real person.

Case Study: The Power of $50 a Week Meet Maya. She's 24 and decides to automatically invest $50 every week into an S&P 500 index fund in her Roth IRA. That’s a simple $200 a month. Assuming a historical average return of 9% per year, let's see what happens.

Age | Total Contributed | Account Value |

|---|---|---|

34 | $24,000 | ~$38,000 |

44 | $48,000 | ~$121,000 |

54 | $72,000 | ~$325,000 |

64 | $96,000 | ~$830,000 |

By just setting and forgetting a small amount each week, Maya ends up with a portfolio worth over $800,000. She only ever put in $96,000 of her own money. The other $734,000 was pure compound growth. It just goes to show that how consistently you invest is far more important than how much you start with. Time is your single greatest asset—start using it now.

Accelerate Your Wealth by Growing Your Income

While mastering your budget and investing are the foundations of building wealth, there's a third pillar that can supercharge your progress: growing your income. Nailing a 20% savings rate is a huge win, but what if you could grow the paycheck itself? This is how you shave years—maybe even decades—off your timeline to financial freedom.

The most direct route is usually your 9-to-5. It’s shocking how many young professionals sell themselves short, hesitant to ask for what they're truly worth. Trust me, this is a massive, costly mistake over the long run.

Securing a Raise at Your Current Job

Walking into your manager's office and asking for more money can be intimidating, but the real work starts long before that conversation. A successful negotiation isn't about what you feel you deserve; it's about building an undeniable case based on cold, hard facts.

For the next three to six months, start keeping a detailed "brag sheet." Seriously, document everything.

Specific Wins: Did you lead a project that boosted efficiency by 15%? Write it down.

Positive Feedback: Save that email where a client or a senior leader praised your work.

Extra Responsibilities: Are you taking on tasks outside your original job description? List them out.

This evidence transforms your request from a simple "ask" into a data-driven business case. You're no longer just saying you work hard; you're proving the tangible value you deliver.

The goal of a salary negotiation is to reframe the conversation. You're not asking for more money because you need it; you're demonstrating that your market value and contributions have outgrown your current compensation.

Next up, do your homework on market value. Jump on sites like Glassdoor, Payscale, and LinkedIn Salary. Find out what professionals with your exact skills, experience, and location are earning. This gives you a realistic salary range to anchor your negotiation and shows you've done your due diligence.

When you're ready, schedule a formal meeting. Present your accomplishments clearly and confidently, and then state the salary you’re looking for. Even if the answer isn't an immediate "yes," you've planted a powerful seed and shown your ambition.

Launching a Strategic Side Hustle

Beyond your main gig, creating another income stream is a total game-changer. This isn't about burning yourself out. It's about strategically monetizing a skill or passion in a way that fits your life, not takes it over.

Think about what you're already good at. Are you a talented writer? A graphic design whiz? A social media guru? These are all highly marketable skills you can freelance with on platforms like Upwork or Fiverr.

Let's play out a scenario. Say you're a marketing coordinator who's a great writer. You could start a side hustle writing blog posts for small businesses, charging $150 an article. Just two articles a week brings in an extra $1,200 a month. That’s real money.

Here are a few ideas to get the wheels turning:

For the organized planner: Virtual assistant services for busy entrepreneurs.

For the creative type: Selling digital products like templates or presets on Etsy.

For the subject matter expert: Online tutoring or creating short-form video courses.

The key is to find something that doesn't feel like a second full-time job. It should be something you're good at and, ideally, actually enjoy. For a deeper dive on finding the right fit, check out our guide on how to create multiple income streams.

Channeling Your Extra Income with Purpose

This last step is the most critical: have a plan for every extra dollar you earn. Without one, that new income can easily vanish into lifestyle creep—more expensive dinners, newer gadgets, pricier vacations.

You have to direct this new cash with intention. Funnel that raise or side hustle money straight into your wealth-building machine. That could mean aggressively tackling student loans, maxing out your Roth IRA, or stacking cash for a down payment. And don't just stop at active income; exploring different strategies for building passive income can pour even more fuel on the fire.

By putting this new money to work immediately, you kickstart its compounding potential that much sooner. An extra $500 a month invested from age 27 instead of spent could mean an extra $400,000+ by retirement. That's the raw power of growing your income and making it work for your future self.

Let's Get Real About the Obstacles

Look, building wealth in your 20s isn't just a matter of skipping lattes and diligently following a budget. Anyone telling you that is ignoring the giant elephant in the room. You're trying to build your financial foundation in a world with some serious economic headwinds.

We need to talk about these hurdles—from the mountain of student loan debt many are starting with to the wealth gaps that have existed for generations. This isn't about making excuses. It's about getting smart, understanding the game, and finding the tools to win, no matter where you're starting from.

Facing the Financial Hurdles Head-On

For a lot of young adults, the starting line isn't at zero; it's way back in the negative. Student loan debt is at an insane all-time high, and it's putting a serious brake on big wealth-building moves like buying a home or even consistently putting money into an investment account. That pressure can feel suffocating, making it seem like you’re just running in place.

And let’s be honest, these challenges aren't spread out evenly. Systemic issues and historical disadvantages are very real and have a massive impact on someone's ability to get ahead. For instance, young adults of color in the U.S. often run into more barriers. Census data from 2020–2022 showed that only 65% of Black young adults felt they could confidently cover their rent or mortgage. For their white peers? That number was 85%.

That kind of financial stress directly eats away at your ability to save and invest. If you want to dig into the numbers, The Aspen Institute has a great data sheet on young adult financial well-being.

The trick is to zero in on what you can control while actively looking for resources that are designed to level the playing field.

First-Generation? Your Credit Score is Your Foundation

If you're the first in your family to seriously build wealth, your credit score is one of the most powerful tools you have. Think of it less as a grade and more as a key. A great score unlocks better interest rates on everything from a car loan to your first mortgage, which can literally save you thousands upon thousands of dollars over time.

So, how do you build it from scratch?

Secured Credit Cards: Don't have any credit history? A secured card is your best first move. You put down a small cash deposit (say, $200) which then becomes your credit limit. It’s a super low-risk way to show lenders you can handle credit responsibly.

Credit-Builder Loans: These are awesome. You can find them at most credit unions. The bank essentially lends you money but holds it in a savings account. You make small, regular payments, they report it to the credit bureaus, and at the end, you get the money. It's a forced savings plan that builds your credit.

Become an Authorized User: Got a parent or family member with a rock-solid credit history? Ask if they'll add you as an authorized user to one of their cards. Their good payment history can give your score a nice little boost.

No matter which path you take, consistency is everything. Pay every bill on time, every time. And try to keep your credit utilization—how much of your available credit you're using—below 30%.

You Don't Have to Go It Alone: Find Mentors and Knowledge

Trying to figure all this out by yourself is a recipe for frustration and costly mistakes. Seriously, finding a good mentor and soaking up financial education can put you on the fast track.

Financial literacy is the bedrock of wealth creation. Learning the language of money—from compound interest to asset allocation—empowers you to make informed decisions that align with your long-term goals.

Start by looking for non-profit organizations that offer free financial counseling. Groups like the National Foundation for Credit Counseling (NFCC) are a goldmine. They can connect you with certified counselors who can help you map out a budget, tackle debt, and polish up your credit.

There are also tons of online platforms and even local community centers offering courses on investing, buying a home, or starting a business. Treating this knowledge hunt as an investment in yourself is a move that will pay off for the rest of your life. When you face these obstacles head-on with the right support system, you're not just surviving—you're building a real path to lasting wealth.

A Few Common Questions I Get Asked All The Time

Jumping into personal finance can feel like you're trying to learn a completely new language. It's totally normal to have a ton of questions when you're just starting to figure out how to build wealth in your 20s.

Let's clear up some of the most common dilemmas you'll run into with some straight-up, practical answers.

Should I Pay Off Debt or Invest First?

Ah, the classic financial tug-of-war. The right move here usually boils down to a simple math problem. You just need to compare the interest rate on your debt to what you could reasonably expect to earn from your investments.

High-interest debt, like a credit card balance that’s charging you 20% or more, is a five-alarm fire. Wiping that out is like giving yourself a guaranteed 20% return on your money. You'll never find a consistent, guaranteed return like that in the stock market. Ever.

But here's the thing: it’s not always an either/or situation. You can—and often should—do both at the same time.

First things first: Always, always contribute enough to your 401(k) to get the full employer match. This is literally free money, an instant 50% or 100% return on your contribution. Don't even think about leaving that on the table.

Next up: Go after any debt with an interest rate above 7-8% like your life depends on it. This is where most credit cards and personal loans fall.

Then, consider this: If you're dealing with low-interest debt (think student loans or a car loan under 5%), it often makes more sense mathematically to put your extra cash into investments, since historical stock market returns have consistently beaten that rate over the long haul.

The smartest play is usually a hybrid approach. Snag that 401(k) match, then throw every spare dollar you have at high-interest debt until it's gone. Once you've slayed that dragon, you can unleash your full financial firepower into your investment accounts.

Seriously, How Much Money Should I Have Saved by 30?

Forget those rigid, one-size-fits-all benchmarks. All they do is create anxiety. The internet is full of articles telling you that you need X amount by Y age, but a much healthier way to think about it is to focus on a milestone that's tied to your own journey.

A great target to shoot for is having one year's salary saved and invested by the time you hit 30. I love this goal because it scales with your income and keeps the focus on your progress, not on keeping up with someone else. If you make $60,000, your goal is $60,000. If you pull in $80,000, you're aiming for $80,000.

This approach really drives home that building wealth in your 20s is a marathon, not a sprint. If you're not quite there yet, don't panic. The most important thing is that you've built strong, consistent saving and investing habits. Progress always beats perfection.

What Are the Biggest Financial Mistakes I Should Avoid?

Everyone's path is a bit different, but there are a few classic screw-ups that can seriously set you back. Avoiding these is just as crucial as building good habits.

Racking Up High-Interest Credit Card Debt: This is the undisputed champion of wealth destruction. Just don't carry a balance on a credit card. If you already have one, your number one mission is to create a plan and pay it off as fast as humanly possible.

Not Investing Early: Talk to anyone in their 40s or 50s, and their biggest financial regret is almost always "not starting sooner." People get paralyzed by fear, inertia, or the feeling that they don't have "enough" money to start. You can start with $25 a month. The habit is what counts, not the amount.

Giving in to Lifestyle Inflation: Getting a raise is awesome, but it's also a major test. Instead of immediately upgrading your apartment or your car, make a pact with yourself to automatically invest at least half of that new income. This one move alone will radically speed up your path to wealth.

I'm Overwhelmed. What Should I Do if I Have No Idea Where to Start?

Feeling lost is completely normal. The trick is to break it down into ridiculously small, manageable steps that build momentum. If you're staring at this mountain and don't know where to put your foot first, here's a simple three-step plan to get you moving today.

Step 1: Open a high-yield savings account. Right now. Then, set up an automatic transfer for just $50 from every paycheck. This kicks off the all-important "pay yourself first" habit.

Step 2: Open a Roth IRA with a major brokerage like Fidelity or Vanguard. It takes about 10 minutes. Move your first $100 into a simple S&P 500 index fund or a target-date fund. Done.

Step 3: For the next 30 days, just track your spending. Use an app, a spreadsheet, or a notebook. Don't change a thing or judge yourself—just observe. Awareness is the first step toward taking control.

These tiny actions are the first dominoes. Pushing them over is how you start your journey to financial independence.

Ready to put your stablecoins to work? With Yield Seeker, you can effortlessly maximize your returns without the guesswork. Our AI-driven platform finds the best yield opportunities in DeFi, so you can earn passive income safely and automatically. Start with as little as $25 and watch your wealth grow. Join us today at https://yieldseeker.xyz.