Back to Blog

Learn How to Set Financial Goals & Achieve Success

Discover how to set financial goals effectively and turn your financial dreams into reality. Start building a better future today!

Oct 15, 2025

generated

We've all said it before: "I need to save more money." It feels like a step in the right direction, but honestly, it’s more of a financial wish than a real goal.

To actually get somewhere, you need to ditch the vague hopes and build a concrete roadmap. This is about transforming a fuzzy desire like "I want to be wealthy" into an actual plan: "I will invest $500 every month into a low-cost index fund to build a $1M portfolio in 30 years." See the difference?

Why Vague Goals Like 'Saving More' Fail

It’s a familiar story. You glance at your bank account and think, "This month, I'm really going to get better with money." It's a noble thought, but it's missing the critical ingredients for success. Your brain simply doesn't know how to act on a fuzzy command like "be better."

When you don't have a specific target, how can you measure your progress? How do you celebrate the small wins or even know if you're heading in the right direction? This ambiguity is precisely why so many financial resolutions fall apart within a few weeks. It's like pointing at a distant mountain and saying "I want to go there" versus actually having a map, a compass, and a planned route to the summit.

The Power of Clarity

The secret to setting financial goals that actually work is just one word: clarity. When you define exactly what you want, why you want it, and the specific steps to get there, you're giving your brain a clear directive. You're turning a passive wish into an active pursuit.

This isn't just some motivational fluff; it's grounded in decades of research. According to Goal Setting Theory, a staggering 80% of people perform better when they have clear objectives compared to those with vague or no goals at all. And if you combine those specific goals with regular feedback? Performance can jump by another 30%. You can dig into the research behind effective goal setting here.

Vague goals create vague results. If you don't define what success looks like, you’ll never know if you've achieved it. An actionable goal gives you a finish line to run toward.

Think about it in real-world terms. A goal to "pay off debt" is overwhelming. Where do you even start? But a goal to "pay an extra $150 toward my highest-interest credit card each month for the next 12 months" is a crystal-clear instruction. You know exactly what you need to do, every single month, to make real progress.

From Vague Hopes to Actionable Goals

Let’s look at how to transform those common financial daydreams into something you can actually work on.

Vague Hope | Actionable Goal |

|---|---|

"I want to save for a down payment." | "I will save $800 per month for the next 24 months in a high-yield savings account to reach my $20,000 down payment goal." |

"I need to get out of debt." | "I will pay an extra $200 per month on my credit card with the highest APR until it's paid off, then roll that payment to the next card." |

"I should invest more." | "I will open a Roth IRA and set up an automatic transfer of $300 on the 1st of every month to invest in a target-date fund." |

"I want to travel." | "I will save $250 per month for 18 months in a dedicated 'Travel' savings account for a $4,500 trip to Japan." |

This simple shift from wishing to planning is the first—and most important—step you can take. It creates the foundation for everything that follows.

Connect Your Money to Your Life's Vision

Moving from vague wishes to actual, achievable goals really comes down to one thing: motivation. And I've found the strongest motivation kicks in when you connect your money to what you genuinely care about. Before you can set any meaningful financial goals, you need to get crystal clear on your personal "why."

What does a rich life actually look like to you? Is it the freedom to travel six months a year? The peace of mind that comes with owning your home outright? Maybe it's the ability to bankroll a cause you believe in.

Your financial plan should be a direct reflection of these core values, not just a spreadsheet full of numbers. When your goals are tied to this bigger vision, you’re so much more likely to stick with them when things get tough.

If you really want to lock this in, a great exercise is learning how to write a personal mission statement. Think of it as your financial north star.

Start with a Personal Financial Audit

To figure out where you're going, you first need a map of where you are right now. A personal financial audit isn't about judging your past decisions; it's about gaining clarity. This process has two simple parts that give you a complete picture of your financial health.

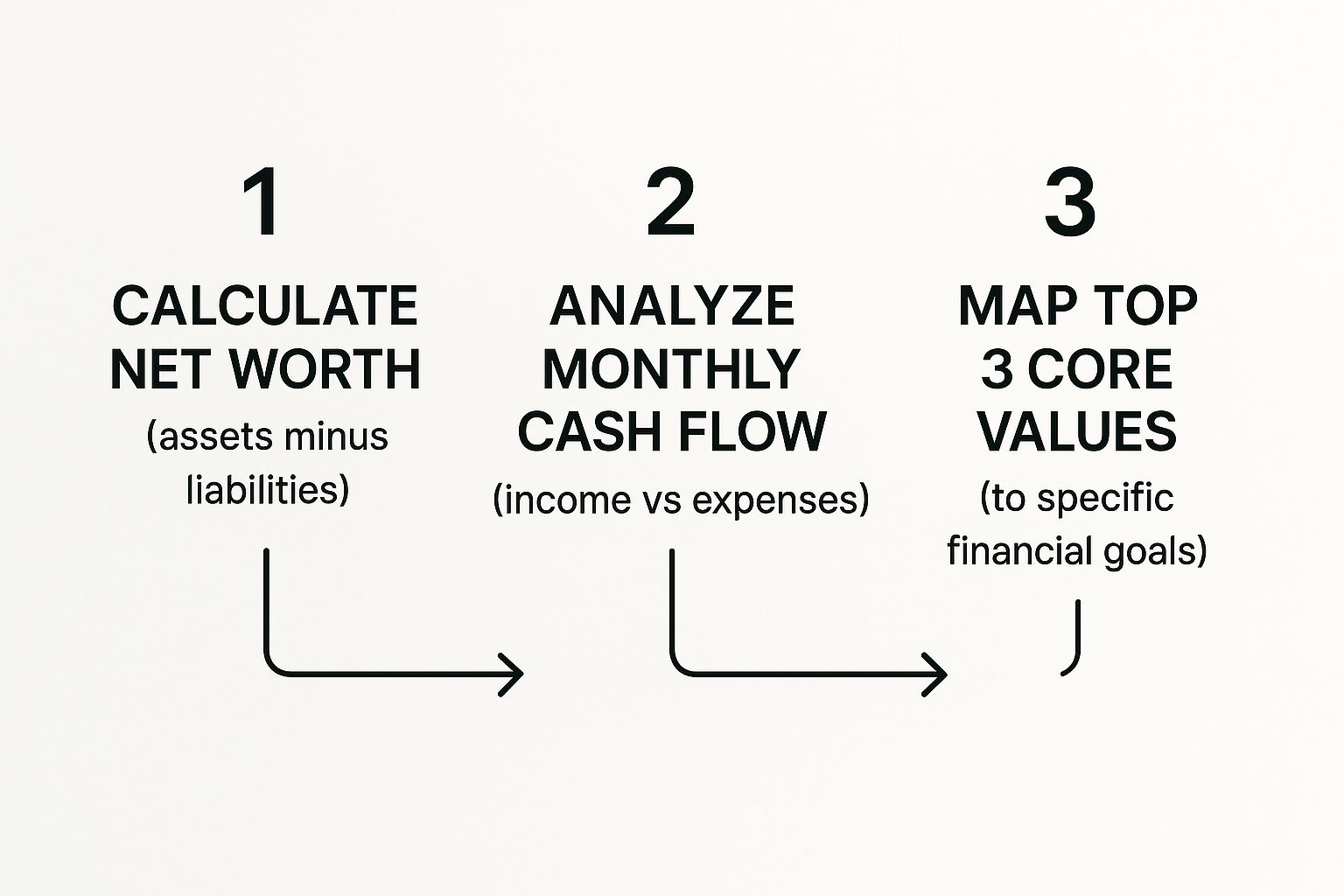

Calculate Your Net Worth: This is the ultimate snapshot of your financial position. Just add up all your assets (cash, investments, property) and subtract your liabilities (any debts like loans and credit card balances).

Analyze Your Cash Flow: Next, track your income versus your expenses for a month. This shows you exactly where your money is going and, crucially, how much you have left over to put toward your new goals.

This infographic breaks down how you can connect that raw financial data to what really matters.

As you can see, the numbers on their own are just numbers. Their real power is unlocked when you use them to build a life that’s aligned with your values.

Your net worth and cash flow aren't just metrics; they are the raw materials you'll use to build the life you envision. Understanding them is the first practical step toward making that vision a reality.

Crafting Your Goals with the SMART Framework

Alright, you’ve connected your money to what you actually want out of life. That’s the hard part. Now, we need to give those big ideas some structure.

To do this, we'll lean on a classic for a reason: the SMART framework. It’s not just some corporate buzzword; it’s a filter that turns a vague wish like "I want to be rich" into an actual, actionable plan you can start on today.

Instead of just running through the acronym, let's see how it works by building a few goals from the ground up.

Short-Term Goal Example: An Emergency Fund

Let's start with a non-negotiable goal that protects everything else: your emergency fund. This is the buffer that keeps a surprise car repair or medical bill from blowing up your entire financial plan.

Vague Idea: "I need to save for emergencies."

SMART Goal: "I will save $1,000 for my emergency fund by depositing $200 from each paycheck into a high-yield savings account for the next five months."

See the difference? It's powerful because it answers all the important questions. You know exactly what to do, how much to set aside, where the money goes, and when you’ll hit the target.

Mid-Term Goal Example: A House Down Payment

Now for something bigger, a goal that takes more patience and consistency. Let's say you've got your sights set on buying a house.

Vague Idea: "I want to buy a house someday."

SMART Goal: "I will save $20,000 for a down payment on a home by automatically transferring $555 per month into a separate investment account for the next three years."

The key here is that automated action. Setting up that recurring transfer is a one-time task that puts your progress on autopilot. You're not relying on willpower every single month to make it happen.

Long-Term Goal Example: Retirement Savings

Finally, let's use the framework for a goal that often feels distant and fuzzy: retirement. It’s easy to put this one off without a concrete plan.

Vague Idea: "I should probably save for retirement."

SMART Goal: "I will contribute $400 per month to my Roth IRA, investing it in a low-cost S&P 500 index fund, to reach a portfolio value of $50,000 in seven years."

A well-crafted SMART goal is more than just a statement; it's a commitment. It transforms a passive wish into an active instruction, giving you a clear and repeatable process for any financial target you set.

Once you get comfortable setting your goals this way, you can get even more granular. Think about implementing 'Smart Project' management principles to break these larger goals into smaller weekly or monthly tasks, making them even easier to manage over time.

Building Your Goal-Driven Action Plan

A perfectly crafted SMART goal is a great start, but it’s pretty useless without a system to actually bring it to life. This is the part where you stop planning and start doing. You need an action plan that makes progress feel automatic, not like a chore you have to force yourself to do every month.

The single most effective way I've seen to do this is with goal-based budgeting. Instead of just tracking where your money went last month, you design your spending plan to fund your goals first.

Before a single dollar goes to your morning coffee or that new streaming subscription, you're allocating money to your priorities. It’s the classic "pay yourself first" mentality, but with a twist—it treats your goals like non-negotiable bills that have to be paid.

How to Prioritize When You Have Competing Goals

Most of us face the same classic dilemma: "Should I throw every spare dollar at my student loans, or should I start investing for retirement?" The truth is, the answer usually isn't one or the other. It’s about striking the right balance.

Here’s a simple framework to help you decide:

High-Interest Debt vs. Investing: A good rule of thumb is to compare the interest rate on your debt to the return you expect from your investments. If your debt has an APR over 7-8% (think credit cards or some personal loans), it often makes sense to prioritize paying that down. Wiping out that debt is a guaranteed return on your money.

Emergency Fund vs. Everything Else: Your emergency fund is the financial shield that protects all your other goals. Before you get aggressive with other targets, make sure you have a solid safety net in place. If you're not sure where to start, check out our guide on how to build an emergency fund.

The best action plan isn't about magically finding more money. It’s about directing the money you already have with intention. Prioritizing simply tells your money exactly where to go.

Put Your Progress on Autopilot

Let's be honest: relying on willpower to manually transfer savings each month is a recipe for disaster. Life gets busy, and it's easy to forget or "borrow" from your savings. The real secret is to remove yourself from the equation completely.

Automate it.

Set up automatic transfers from your checking account to your various savings and investment accounts. The key is to schedule these transfers to happen the day after you get paid.

This one simple action turns your financial goals into a background process that just works, ensuring you make consistent progress without lifting a finger. This is how you build a financial system that works for you, not against you.

How to Stay on Track When Life Happens

Let's be real. Even the best financial plans get punched in the mouth by reality. An unexpected car repair, a sudden job change, or just a massive dip in motivation can make you feel like you've been completely derailed.

But here's the thing: resilience isn't something you're born with; it's a skill you can build right into your financial strategy.

The trick is to just accept that disruptions will happen. This is exactly why an emergency fund is so much more than another line item in your budget—it’s your financial shield. It’s what protects your big-picture goals, like that down payment or retirement fund, from getting raided when a surprise $800 expense inevitably pops up.

It's no surprise that this is where a lot of people stumble. A recent survey found that nearly 4 in 5 Americans with savings goals hit a wall, usually because of rising costs or a drop in income. While 65% were trying to save, the obstacles were real. You can dig into some of those common financial hurdles on NerdWallet.

Build a Resilient System

To stay on track when life gets messy, you need a few simple systems to keep you grounded. I've found that these habits can make all the difference in keeping your eyes on the prize.

Find an Accountability Partner: Seriously, don't underestimate this. Sharing your progress with a friend or partner creates a bit of healthy external pressure. A quick weekly check-in is often all it takes to reignite your focus when it starts to fade.

Use Visual Trackers: There's something incredibly powerful about seeing your progress. A simple chart on your fridge showing your debt balance shrinking or savings growing gives you a daily dose of encouragement.

Celebrate the Small Wins: Did you crush a small debt or hit a $1,000 savings milestone? Take a moment to acknowledge it! Celebrating these little victories reinforces good habits and makes the long haul feel way more enjoyable.

Think of your financial plan less like a rigid script and more like a flexible roadmap. The goal isn't to never get lost, but to have the right tools to find your way back to the path.

Ultimately, staying on track is all about course correction, not perfection. If your income takes a hit, it might be time to look into ways for how to earn money while working to keep your main goals moving forward. By building in that flexibility from the start, you ensure that a minor setback doesn't snowball into a major failure.

Checking In and Adjusting Your Course

Let's be real: setting financial goals isn't a "set it and forget it" kind of deal. You don't just carve your plan into stone and hope for the best. Life happens. Your income might go up (or down), your family could grow, and the market will absolutely do its thing.

A good financial plan is a living, breathing document. It has to be flexible enough to bend without breaking—or making you feel like you've failed when things change.

Think of it less like a rigid blueprint and more like navigating with a map and compass. You know your destination, but you’ve got to be ready to find a new route if a road is closed. Regular check-ins are your chance to pull over, look at the map, and adjust your path. This is the secret to actually getting where you want to go.

Your Quarterly Financial Check-In

I'm a big fan of a simple, low-stress financial review every three months. We're not talking about a full-blown audit here, just a quick pulse check to make sure you’re still headed in the right direction.

Here’s a practical way to approach it:

Review Your Progress: Take a look at each of your goals. How far have you come? Are you still putting away the money you planned? This is also the perfect time to check in on how your portfolio is doing. Getting a handle on how to calculate investment returns is a crucial skill here, as it tells you what’s really working.

Assess Your Budget: How’s the cash flow looking? Are you consistently blowing the budget on takeout, or are you finding extra cash left over at the end of the month? A quick glance at your spending can show you exactly where you can redirect a little more money toward your goals.

Adjust for Life Changes: Did you get a raise? Awesome! Now’s the time to decide how much of that extra cash goes straight to your goals before "lifestyle creep" eats it all up. Got hit with an unexpected car repair? Figure out how to tweak your budget to absorb it without derailing everything.

A financial plan that can't bend will eventually break. The point of a quarterly check-in isn't to judge yourself for past slip-ups; it's to give your future self the best possible shot with the most current information.

This simple habit ensures you're always moving forward, even when life throws you a curveball.

Got Questions About Financial Goals?

Even with the best plan in the world, a few questions always pop up when you start getting serious about your financial goals. That's totally normal. Let's run through a couple of the most common ones I hear, just to clear the air so you can move forward with confidence.

How Long Should My Goals Be?

This is probably the biggest one: "What's the right timeframe for a goal?"

There’s no single right answer, but the best approach is a balanced one. You want a mix of short-term wins to keep you fired up, medium-term targets to build real momentum, and of course, those big long-term ambitions that act as your north star.

Here’s how I break it down:

Short-Term (Less than 1 year): Think of these as quick, encouraging victories. Things like building a $1,000 emergency fund or finally knocking out that nagging credit card balance.

Mid-Term (1-5 years): This is where you start aiming for bigger targets. Saving for a down payment on a house or a new car fits perfectly here.

Long-Term (5+ years): This bucket is for the major life milestones. Retirement is the classic example, but it could also be paying off your mortgage ahead of schedule.

What If I'm Doing This With a Partner?

Setting goals with a spouse or partner is another area where people often get stuck. Let's be real, money can be a touchy subject. But getting on the same page is absolutely non-negotiable if you want to succeed together.

The trick is to build shared goals that reflect what you both value. This doesn’t mean you can't have your own individual goals—you absolutely should—but the core financial direction has to be a team effort.

My advice? Schedule regular, low-pressure "money dates." Grab a coffee or a glass of wine and just talk. Check in on progress, see if your budget needs tweaking, and make sure you're both still excited about the future you're building.

The most powerful financial plans I've ever seen are built on shared understanding and mutual support. It’s not about having identical spending habits; it's about rowing in the same direction toward a shared vision.

At the end of the day, remember to be flexible. Life happens. If you have an off month and get derailed, don't just throw the whole plan out the window. Acknowledge it, figure out what happened, and get right back on track. It’s all about consistent progress, not flawless perfection.

Ready to put your savings on autopilot and watch your returns grow? With Yield Seeker, you can let an AI Agent find the best stablecoin yields for you, 24/7. Start maximizing your earnings effortlessly at https://yieldseeker.xyz.