Back to Blog

Your Guide to Real-Time Yield Monitoring in DeFi

Discover how real-time yield monitoring works. Learn to navigate DeFi protocols, track key metrics, and maximize returns with automated strategies.

Dec 21, 2025

generated

If you've ever tried to keep up with DeFi, you know it's like trying to drink from a firehose. One minute a yield opportunity is golden, the next it's gone. Real-time yield monitoring is the answer to this chaos—think of it as a live performance dashboard for your crypto portfolio, giving you the edge in markets that never sleep.

It gives you instant feedback on everything that matters: fluctuating Annual Percentage Yields (APYs), gas fees, and the health of different protocols. This lets you make sharp, informed decisions on the fly instead of getting left behind.

What Is Real-Time Yield Monitoring in DeFi

Imagine trying to drive a race car with a GPS that only updates once a day. That's pretty much what manual investing in Decentralized Finance (DeFi) feels like. The market moves in minutes, not hours, and a juicy yield farm can dry up before you've even had your morning coffee.

Instead of constantly hitting refresh on a dozen different websites and wrestling with spreadsheets, real-time yield monitoring automates the entire process. It’s like switching from an old paper map to Google Maps with live traffic updates. You get a constant stream of information, giving you an up-to-the-second view of your portfolio and what’s happening across the market.

Beyond the Manual Refresh

At its core, real-time yield monitoring takes the intense, often overwhelming, job of collecting and analyzing data off your plate. If you're new to this world, it's worth remembering that decentralized finance is a sprawling ecosystem of interconnected protocols, each with its own quirks, risks, and rewards. Automating how you track them is mission-critical.

These systems are always on, tracking key variables for you, including:

Fluctuating APYs: Instantly spot when yields in a liquidity pool or lending protocol spike or tank.

Transaction Costs (Gas Fees): Keep an eye on network congestion so you can time your transactions when fees are low, saving you money and boosting your net returns.

Protocol Health Metrics: Watch data like Total Value Locked (TVL) to get a feel for a platform’s stability and how much other users trust it.

Security Alerts: Get immediate notifications about potential smart contract bugs or, worse, active exploits.

The Power of Instant Data

The tech that makes this possible is all about real-time data processing, where information is captured, analyzed, and acted upon almost instantly. This isn't just about seeing numbers faster; it's about being able to make decisions at the speed the market actually moves. If you want to get into the nuts and bolts, this guide on real-time data processing is a great place to start.

By grabbing fleeting opportunities and dodging sudden risks, real-time yield monitoring completely changes the game for DeFi investors. It turns volatility from a threat into a potential advantage.

This constant flow of intel lets you execute strategies that would be flat-out impossible to do manually. Think about automatically shifting your funds to the highest-yielding stablecoin pool the second it pops up. You go from being a passive observer to an active, data-driven player in the wild west of DeFi.

How Monitoring Systems Track DeFi Yields

To really get what makes real-time yield monitoring so powerful, you have to look under the hood. Think of these systems as a hyper-specialized financial news wire, but instead of pulling headlines, they're grabbing raw, high-frequency data straight from the source—the blockchain itself.

These platforms are hooked into hundreds of different DeFi protocols at the same time, often spanning multiple blockchains. They use a mix of Application Programming Interfaces (APIs) that protocols make available and direct on-chain data scraping. This two-pronged approach gives them wall-to-wall coverage, pulling in data from a massive web of liquidity pools, lending platforms, and staking contracts.

What you get is a constant, live feed of financial activity. Every transaction, every interest rate tweak, every liquidity shift—it’s all captured the second it happens.

The Challenge of Raw Data

Just grabbing this mountain of data is the easy part. The real problem is that raw data from DeFi is messy and all over the place. One protocol might calculate yield one way, while another uses a totally different formula. Trying to compare them directly is like comparing apples and oranges; it's impossible to know where the best opportunity really is.

This is where the critical step of data normalization comes in. A good monitoring system acts as a universal translator. It takes all those complex, varied yield calculations from countless sources and standardizes them into clear, comparable metrics.

The whole point of a monitoring platform is to create a single source of truth. It turns chaotic, fragmented on-chain data into clean, actionable intel you can use to make smart financial moves on the fly.

This process ensures that when you see an Annual Percentage Yield (APY) of 8.7% on one platform and 9.2% on another, you know you're making a fair comparison. Normalization cuts through the noise and gives you the clarity you need.

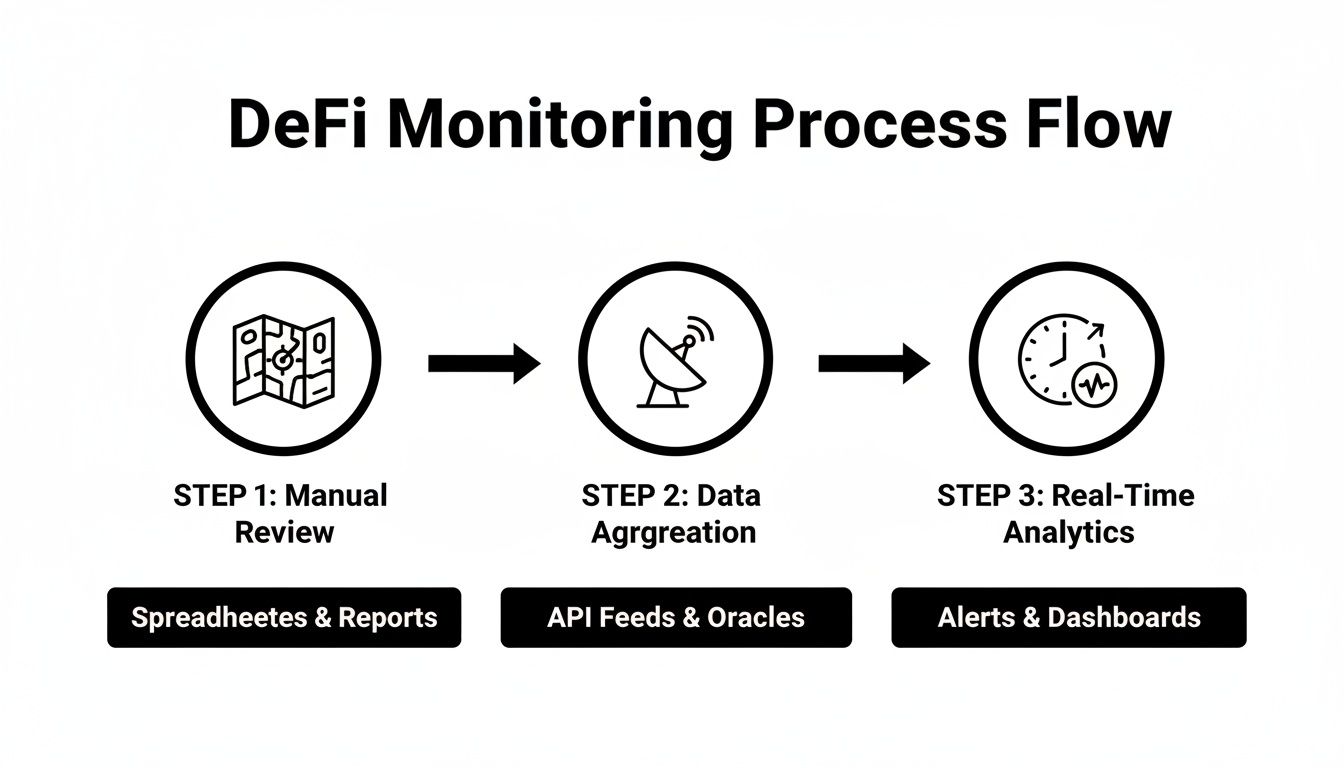

This flow shows the shift from slow, manual checking to a slick, automated process fueled by real-time data.

As you can see, moving from manual review to automated insight is a complete game-changer for making faster, better decisions in DeFi.

From Clean Data to Automated Action

Once the data is collected and cleaned up, the real magic starts. This standardized information becomes the fuel for automated strategies run by smart contracts. Platforms like Yield Seeker use this data to power AI agents that can jump on opportunities the moment they pop up.

Here’s how it might play out:

Spot a Yield Spike: The system flags that a stablecoin lending pool's APY just shot up from 7% to 11% because of a sudden spike in borrowing.

Calculate the Real Return: It instantly crunches the numbers to see if the move is profitable after accounting for transaction costs (gas fees) and any protocol fees.

Execute the Play: If the net return is solid, the system’s smart contracts can automatically pull funds from a lower-performing pool and zap them into this new, higher-yielding one.

This whole sequence—from seeing the data to making a profitable trade—can happen in seconds. That's way faster than any human could ever hope to react. This is the core advantage of real-time yield monitoring; it doesn’t just show you what’s happening, it lets automated systems act on that information immediately. It closes the gap between insight and execution, making sure you never miss out just because you blinked.

The Key Metrics That Actually Matter

Chasing the highest Annual Percentage Yield (APY) in DeFi is a bit like judging a car's performance just by its top speed. Sure, it's an impressive number, but it tells you nothing about the handling, safety, or how often you'll be stopping for gas. A flashy 100% APY can nose-dive into negative territory once you factor in all the hidden costs and risks.

This is where effective real-time yield monitoring comes in. It’s about looking beyond the sticker price and getting a true sense of an opportunity's health and profitability.

To make smart moves, you need to think more like an analyst and less like a degen chasing the next pump. Once you've got the basics of real-time monitoring down, the next step is pinpointing the key metrics to track for genuinely useful insights. It’s all about getting the complete financial picture, not just the highlights.

Net APY: The True Rate of Return

If there's one metric that cuts through the noise, it's Net APY. This is your bottom line—the profit you're left with after every single expense has been paid. It takes the advertised yield and brings it back down to earth, showing you what you can realistically expect to pocket.

Think of it like the difference between a restaurant's menu price and the final bill after tax and a tip. The menu looks tempting, but it's that final number that really hits your wallet.

Net APY = Gross APY - (Gas Fees + Protocol Fees + Slippage)

A good monitoring platform does this math for you on the fly, offering a crystal-clear view of your actual earnings. It keeps tabs on all those little costs that nibble away at your returns, which is especially critical if you're frequently rebalancing or operating when the network is congested.

Gauging Stability and Trust

Beyond pure profit, a few key indicators can tell you a lot about the health and trustworthiness of a DeFi protocol. Ignoring them is like driving with the check engine light on—you might get away with it for a bit, but you're flirting with a total breakdown.

Total Value Locked (TVL): This is the total sum of assets users have deposited into a protocol. A consistently high or climbing TVL is a great sign; it suggests strong user confidence and deep liquidity, which makes for a more stable environment. On the flip side, a sudden, sharp drop in TVL is a massive red flag. A protocol with $500 million in TVL is just fundamentally more robust than one with $5 million.

Impermanent Loss (IL) Projections: This is a risk unique to anyone providing liquidity on a decentralized exchange. IL happens when the price of the assets you've deposited changes from when you first put them in. A top-tier monitoring tool won't just tell you about past IL; it uses real-time price data to project potential future losses. This helps you figure out if the trading fees you're earning are actually worth the risk.

Smart Contract Security Score: The entire foundation of a DeFi protocol rests on its smart contracts. A security score, usually based on audits from reputable firms like CertiK or Trail of Bits, gives you a quick read on how resilient the code is to common hacks. A score above 90 is considered strong. Anything below 75? Proceed with extreme caution. Any automated system worth its salt should be prioritizing protocols with high security scores to keep your capital safe.

Putting It All Together

Here's the thing: no single metric ever tells the whole story. A truly effective real-time monitoring strategy is all about weighing these data points against each other. That high Net APY looks amazing, but not if it's coming from a protocol with a nosediving TVL and a sketchy security score.

By building a framework that balances the potential rewards with the very real risks, you can navigate the DeFi space with far more precision and confidence. This analytical approach is what separates calculated investing from pure speculation, making sure your decisions are backed by comprehensive, up-to-the-second data—not just an attractive headline number.

Why Real-Time Monitoring Crushes Manual Checks

In DeFi, the market moves in minutes, not days. Trying to keep up with periodic manual checks is like navigating a high-speed freeway on a bicycle—you’re just not equipped for the environment. The gap between checking your portfolio once a week and having a system that watches it 24/7 isn't just about convenience; it's a massive strategic advantage.

Manual checks are always reactive. By the time you notice a golden opportunity, it’s probably already gone. Real-time yield monitoring completely flips the script, shifting your strategy from reactive to proactive. It gives you the power to jump on market movements the second they happen.

Capturing Opportunities You’d Otherwise Miss

Let's paint a picture with two different investors. First, meet 'Manual Mike.' He’s a diligent guy who sets aside time every Sunday to go over his DeFi positions. One Tuesday, a stablecoin lending protocol gets a huge surge in demand, pushing its APY from a respectable 8% to a juicy 15%. This spike only lasts for about six hours before things go back to normal.

When Mike logs in on Sunday, that opportunity is a distant memory. He can see the blip on the historical chart and kicks himself for the earnings he missed. He just wasn't there when it mattered.

Now, let’s look at 'Automated Anna.' She uses a real-time monitoring platform like Yield Seeker to manage her stablecoins. Her system spotted that same APY spike within minutes. It automatically ran the numbers, checked the potential profit against gas fees, confirmed the protocol’s safety rating, and shifted a chunk of her funds to grab the higher yield. A few hours later, as the APY dropped, it moved her capital right back to its original spot.

Anna didn’t have to lift a finger. Her automated system acted on her behalf, seizing a profitable but short-lived window that Mike completely slept on. This is the real magic of real-time monitoring—it maximizes your gains by acting on data instantly.

Your 24/7 Risk-Management Watchdog

The perks of constant oversight go way beyond just snagging better yields; it's an absolutely critical tool for managing risk. DeFi is still the wild west, and protocols can get exploited or hit with sudden liquidity crunches. If you're only checking in manually, you're leaving yourself dangerously exposed.

Imagine a serious vulnerability is found in a protocol where Mike has his funds parked. The news breaks on a Wednesday. By the time he gets around to his Sunday check-in, panicked users have already drained the liquidity pools. His assets are either gone or stuck.

Anna’s system, on the other hand, would have picked up the warning signs right away. Real-time monitors track key metrics like sudden drops in Total Value Locked (TVL) and weird transaction volumes. Her platform would have flagged the risk and automatically pulled her funds to a safer, pre-approved protocol, protecting her capital while Mike was still days away from even knowing there was a fire.

Let's lay it out clearly. The difference between these two approaches is night and day.

Real-Time Monitoring vs Periodic Manual Checks

Feature | Real-Time Yield Monitoring | Periodic Manual Checks |

|---|---|---|

Speed of Action | Instantaneous, automated responses to market changes. | Delayed, often hours or days after the event. |

Opportunity Capture | Captures short-lived APY spikes and fleeting yields. | Misses most short-term opportunities between checks. |

Risk Management | Proactive defense; immediately detects red flags. | Reactive; vulnerable to sudden exploits or crashes. |

Efficiency | Fully automated, requires minimal hands-on time. | Time-consuming and requires constant manual effort. |

Profit Potential | Maximizes compounding and overall returns. | Leaves significant potential earnings on the table. |

Mental Load | "Set it and forget it" peace of mind. | Constant worry and need to stay glued to charts. |

The contrast is stark. One approach is passive and leaves you vulnerable, while the other is active and defensive.

For stablecoin holders who want consistent, risk-managed growth, the benefits of real-time yield monitoring are a no-brainer. It gives you the speed to capture upside and the vigilance to dodge disasters, making sure your strategy is built for the market as it is, not as it was last week.

How to Choose the Right Monitoring Platform

With more and more tools popping up that promise to put your DeFi strategy on autopilot, picking the right one can feel like a chore. The platform you choose is basically your financial co-pilot, so it’s critical to look past the slick marketing and see what really matters for performance and security. A little systematic evaluation goes a long way in making sure you pick a partner that actually fits your goals and risk tolerance.

Making a smart choice means having a clear framework. This isn't just about chasing the highest advertised yields; it’s about checking out the platform's core tech, how serious they are about security, and whether it’s actually easy to use.

Let's break down the essentials into a practical checklist.

Core Functionality and Protocol Support

First thing's first: how much of the DeFi world can it actually see? The ecosystem is spread out across a ton of different blockchains, and a platform is only as good as the protocols it connects to. If a tool only supports a handful of options on one chain, it's severely boxing you in.

You need a platform that can operate across multiple chains. Look for one that integrates with a wide variety of vetted DeFi protocols—everything from the blue-chip lending platforms to newer, audited liquidity pools. This is key to making sure your capital can be moved to the best opportunities, no matter where they pop up.

Also, think about the assets you're holding. If your main goal is stablecoin yield—which it is for a lot of people trying to avoid market volatility—make sure the platform specializes in USDC, USDT, and other major stablecoins. A specialized focus usually means they've built much better, more optimized strategies for those specific assets.

Automation and User Control

The level of automation is a huge differentiator. Some platforms are just fancy dashboards that show you data but leave all the work to you. True real-time yield monitoring platforms go a step further by automatically rebalancing your funds and executing strategies for you. This is where you really unlock that hands-off growth potential.

But automation shouldn't mean you give up all control. The best platforms strike a great balance. They offer powerful automation but still give you a clear view of what’s happening and the ability to set your own rules.

Here are a few features to look for:

Customizable Risk Levels: Can you tell the platform how much risk you're comfortable with? For instance, can you instruct it to only interact with protocols that have top-tier security scores?

Transparent Strategy Logic: Does the platform actually explain why it's moving your funds? A clear interface that shows the decision-making process is a massive trust-builder.

Manual Overrides: Can you hit the pause button on the automation or pull your funds out whenever you want, without getting hit with penalties? Your money, your rules. Liquidity and control are non-negotiable.

Security and Trustworthiness

In DeFi, security is the name of the game. An automated system is completely useless if it’s just going to expose your funds to hacks and exploits. Digging into a platform's security setup is probably the most important part of this whole process. A great way to start is by using a specialized DeFi portfolio tracker to get a clear picture of where your assets are before you even think about moving them to a new platform.

Start by looking for third-party audits. Reputable security firms like Trail of Bits, CertiK, or OpenZeppelin perform deep dives into a project's code to sniff out vulnerabilities. If a platform hasn't been audited by at least one well-known firm, that’s an immediate red flag.

A platform's commitment to security isn't just about passing an audit; it's about showing a culture of transparency and proactive risk management. Look for clear documentation on their security practices and what they'd do in an emergency.

Next, figure out if the solution is custodial or non-custodial. A non-custodial platform means you, and only you, hold the private keys to your wallet. This is the gold standard for security in DeFi because it means the platform itself can't be a single point of failure or run off with your funds.

Finally, check out the fee structure. Are the fees transparent and easy to wrap your head around? Sneaky or complicated fees can quickly chip away at your Net APY. Look for a simple, performance-based fee model—that way, the platform only makes money when you do. It keeps everyone's interests aligned.

Navigating the Risks of Automated DeFi

Automated tools bring incredible efficiency to DeFi, but they're not a free lunch. They also introduce their own unique set of risks.

While real-time yield monitoring empowers you to act faster than ever, that speed is a double-edged sword if you're not careful. Trusting any system to manage your capital requires a deep understanding of what could go wrong—both with the protocols it interacts with and the platform itself.

This isn’t about avoiding automation; it’s about embracing it smartly. The goal is to use these powerful tools while staying vigilant, building a strategy that's both profitable and resilient. Every automated action carries an underlying risk, and your first line of defense is simply being aware of them.

Smart Contract and Platform Vulnerabilities

The biggest danger in automated DeFi comes from smart contract risk. Every single DeFi protocol is built on code, and no code is perfect. A bug or exploit in a liquidity pool’s smart contract can lead to a complete and total loss of funds. This isn't a theoretical risk—it has happened time and again, leading to billions of dollars lost across the industry.

When you use an automated platform, you're actually exposed to two layers of this risk:

The underlying protocol risk: The platform might move your funds into a protocol that has an undiscovered vulnerability.

The platform’s own risk: The smart contracts of the automation platform itself could have flaws. A chain is only as strong as its weakest link.

A solid platform will only interact with protocols that have gone through multiple, tough, independent audits from top security firms. This drastically cuts down the risk, but it never completely eliminates it. For a deeper dive, our guide on comprehensive DeFi risk management provides a much more detailed breakdown.

True security in automated DeFi isn't about finding a platform that's "hack-proof"—it's about using a platform that is transparent about risks and has layers of defense to protect your capital.

Strategies for Protecting Your Capital

Staying safe in this environment requires a proactive, multi-layered approach to security. You can't just "set it and forget it" without putting some guardrails in place first. Think of it like building a fortress around your assets, where a failure in one wall doesn't bring the whole thing crashing down.

Here are a few actionable strategies you can put in place:

Prioritize Audited Platforms: Never, ever use a platform that hasn’t been thoroughly audited by reputable third-party security experts. Check their website for the audit reports and actually verify them.

Diversify Your Platforms: Avoid putting all your capital into a single automated tool. Spreading your funds across two or three well-vetted platforms mitigates the damage from a single point of failure.

Use a Hardware Wallet: Always interact with DeFi platforms using a hardware wallet. This keeps your private keys completely offline, making it nearly impossible for hackers to drain your account even if your computer gets compromised.

Evaluate Centralization Risk: Get a feel for how decentralized the platform's operations really are. Does a single person or company have the power to freeze funds or change the contracts? True decentralization adds a powerful layer of security and censorship resistance, protecting your financial freedom.

Got Questions? We've Got Answers

Jumping into automated DeFi can definitely bring up a few practical questions. Let's break down some of the most common things investors ask when they first start exploring real-time yield monitoring.

How Does All This Automated Rebalancing Affect My Taxes?

This is a big one. Every single time an automated system sells one asset to buy another in the hunt for better yield, it can create a taxable event. When you've got a system making moves frequently, these transactions can stack up fast, turning into a massive headache when it's time to do your taxes.

That’s exactly why you need to plug in a crypto tax tool from day one. Lots of these tools are built to connect right into DeFi platforms, automatically logging every trade. This makes figuring out your capital gains or losses way simpler and keeps you on the right side of the tax man.

Is This Stuff Actually Suitable for a DeFi Beginner?

Good question. While the technology running in the background is pretty complex, many of the best platforms are designed to be incredibly simple on the surface. For a beginner, getting started is often as easy as a few clicks—deposit your funds, and the system takes it from there.

But, and this is important, a simple user interface doesn't mean you can skip the homework. Newcomers absolutely need to get a handle on the basic risks in DeFi, like smart contract bugs or impermanent loss. A great platform makes the doing part easy, but it's no substitute for knowing what you're getting into.

The core difference between APY and APR is all about compounding. Real-time yield monitoring is obsessed with APY because its entire strategy of high-frequency rebalancing is built to squeeze every last drop out of compounding returns.

What’s the Real Difference Between APY and APR Anyway?

Getting this straight is crucial. Think of APR (Annual Percentage Rate) as simple, flat-rate interest. It's the return you'd get over a year if you didn't touch anything and just let it sit. It’s straightforward, but it doesn't tell the whole story.

APY (Annual Percentage Yield) is where the magic happens. It includes the powerful effect of compounding—your earnings generating their own earnings. Because automated strategies are constantly reinvesting for you, APY gives you a much truer picture of what you can actually expect to earn in a system that's always working for you.

Ready to put your stablecoins to work without all the manual clicking and chasing? Yield Seeker uses AI-powered agents to sniff out and capture the best risk-adjusted yields for you, completely on autopilot. Start earning smarter today.