Back to Blog

Robo Advisor vs Human Advisor The Right Choice for You

Explore the robo advisor vs human advisor debate. Our guide analyzes costs, personalization, and real-world scenarios to help you choose the best fit.

Oct 2, 2025

generated

Picking between a robo advisor and a human advisor really boils down to your financial situation, how you like to invest, and whether you need a personal touch. Robo advisors are fantastic for low-cost, automated investing when you have straightforward goals. They're a perfect entry point for new investors.

On the other hand, human advisors are invaluable when your financial life gets complicated and you need someone to look at the whole picture, not just your portfolio. They provide that critical behavioral coaching when markets get rocky.

Choosing Your Financial Advisor

The whole robo advisor vs human advisor discussion is about so much more than just fees. It’s about finding an advisory model that actually fits your personal financial journey. This choice will fundamentally shape how you build wealth, handle risk, and plan for life's big moments.

Instead of just scratching the surface, this guide will give you a clear framework to make a decision you can feel confident about. We'll dig into the real differences between algorithm-driven automation and relationship-based counsel. Understanding the trade-offs in service, strategy, and personalization is the key.

Key Differences At A Glance

This table gives you a quick snapshot of the core distinctions, making it easy to see where each model shines.

Feature | Robo Advisor | Human Advisor |

|---|---|---|

Primary Service | Automated portfolio management | Comprehensive financial planning |

Best For | Straightforward goals, new investors | Complex needs, high-net-worth individuals |

Guidance | Algorithm-based, standardized | Personalized, relationship-driven |

Cost Structure | Low-cost percentage of assets | Higher fees, often asset-based |

The rapid growth of robo advisors shows a huge amount of market trust, especially with younger investors. By 2025, robo-advisors are on track to manage over $1.0 trillion in assets globally, with Millennials and Gen Z making up about 75% of their users.

For those with more detailed retirement plans, it's worth checking out some insights on choosing the right retirement advisor. And to get the full picture, understanding the wider world of digital wealth management platforms can give you some valuable context. By the end of this, you'll have a solid framework for picking the right partner for your money.

Comparing Costs and Accessibility

When you're weighing a robo advisor against a human advisor, the first things you'll likely run into are cost and accessibility. These two factors aren't just minor details; they often dictate whether you can even get professional advice and how much of your returns you get to keep.

The fundamental difference comes down to their business models. Robo advisors are built for scale and efficiency, using an automated approach that keeps their own costs down. They pass those savings on to you. Human advisors, on the other hand, deliver a hands-on, relationship-driven service, which naturally requires more resources and, as a result, higher fees.

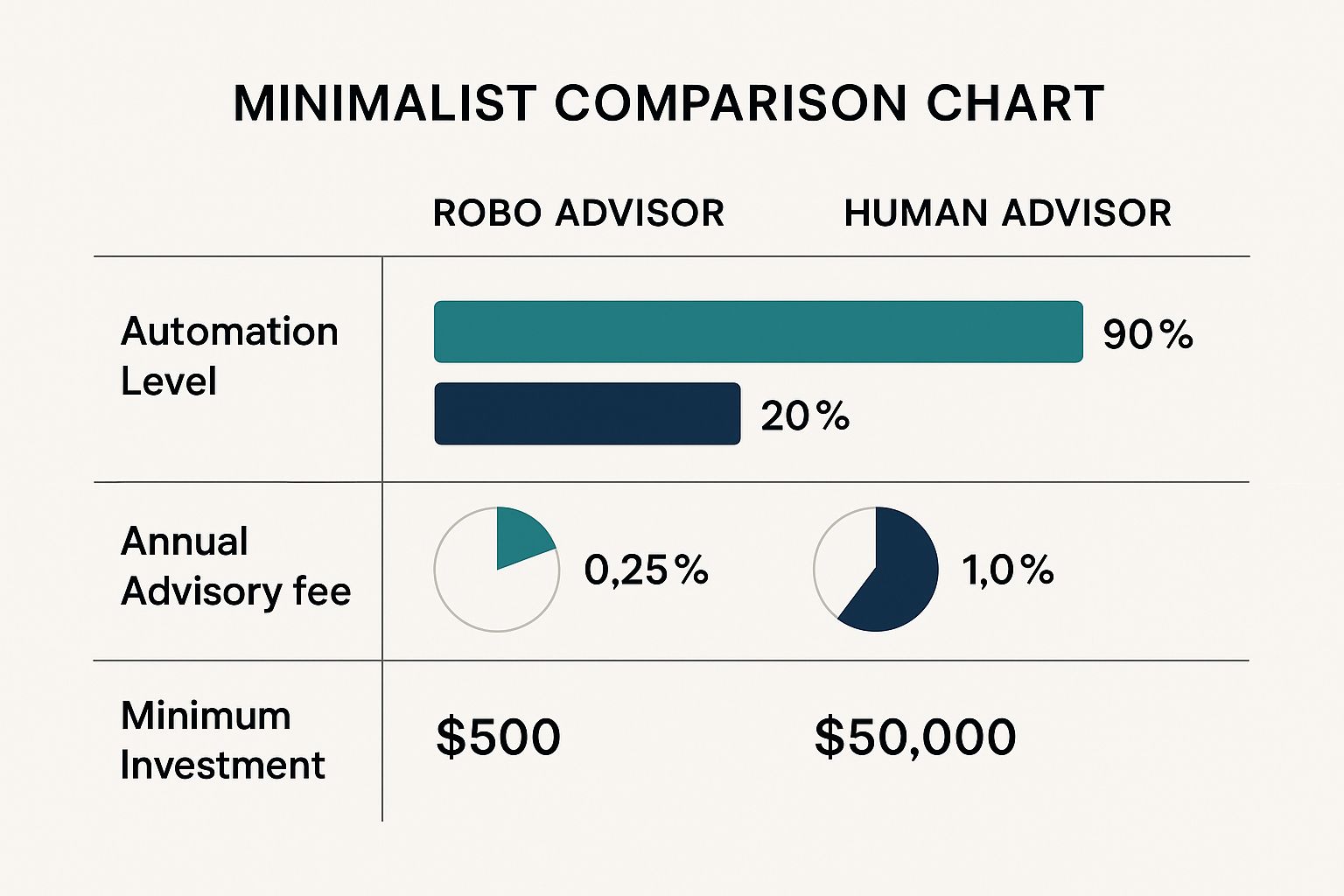

This image really breaks down the core distinctions in fees, minimum investment, and automation between the two.

As you can see, robo advisors open the door to professional-grade investing for just about everyone by dramatically lowering the financial barriers to entry.

To give you a clearer picture, let's put these differences side-by-side.

Comparing Robo Advisors and Human Advisors

Feature | Robo Advisor | Human Advisor |

|---|---|---|

Typical Fee | 0.25% - 0.30% of assets | ~1.0% of assets |

Minimum Investment | As low as $0 - $500 | Often $25,000 - $50,000+ |

Service Delivery | Automated, algorithm-driven | Personalized, one-on-one |

This table makes the contrast pretty stark. The low-cost, low-minimum model of robo advisors has genuinely changed the game for new investors.

The Real Impact of Advisory Fees

Human advisors most commonly charge an annual fee based on a percentage of your assets under management (AUM). While robo advisors use the same AUM model, their rates are a fraction of the cost. You'll typically see robo advisors charging between 0.25% to 0.30% annually, while human advisors are closer to 1%. You can dig deeper into what you need to know about robo advisors on morningstar.com.

That might not sound like a huge gap, but over an investing lifetime, the power of compounding turns it into a massive one.

Let's run through a quick, real-world scenario:

Investment: $100,000 to start.

Annual Return: 7% average annual return (before fees).

Time Horizon: 30 years.

With a human advisor charging 1% AUM, your portfolio grows to about $574,349. But with a robo advisor charging just 0.25%, that same portfolio swells to around $710,667. That tiny 0.75% difference in fees adds up to an opportunity cost of over $136,000.

This long-term "fee drag" is something every investor needs to take seriously. Lower fees can translate into hundreds of thousands of dollars more in your pocket, completely changing what your retirement looks like.

Who Can Actually Get In? Accessibility and Minimums

Beyond the fees, the biggest way robo advisors have shaken things up is by making investing accessible to everyone. Historically, getting personalized financial advice was something reserved for the wealthy. Human advisors often require high account minimums—we're talking $25,000 to $50,000 or more—just to open an account.

For a long time, this high bar locked a huge number of people out of professional investment management. Many younger or newer investors just don't have that kind of cash sitting around.

Robo advisors smashed that barrier. Most platforms have either no minimum investment at all or a very low one, sometimes just a few hundred bucks. This open-door policy means anyone, no matter how much they're starting with, can build a diversified, professionally managed portfolio. It has completely leveled the playing field, making long-term wealth creation a real possibility for a much wider audience.

Evaluating Investment Strategy and Personalization

Sure, the fee difference is a big deal, but where the robo advisor vs human advisor debate really gets interesting is in the strategy and personalization. This is where you see what each model is truly about, moving past basic portfolio construction and into the messy, complicated reality of an individual's financial life.

Robo-advisors are masters of standardization and diversification. You kick things off with a questionnaire that digs into your goals, timeline, and how much risk you're comfortable with. The algorithm takes that data and spins up a portfolio, usually from a basket of low-cost ETFs.

It's an incredibly efficient and solid way to handle common goals, like saving for retirement or just growing your money. But that cookie-cutter approach has its limits.

The Algorithmic Approach to Personalization

The "personalization" you get from a robo-advisor is entirely driven by your survey answers. It's a scalable and powerful model, don't get me wrong, but it can't read between the lines or understand anything that falls outside its pre-programmed questions. Many of these platforms use sophisticated tools like AI for financial analysis to power their recommendations.

This approach is perfect for investors whose financial lives fit neatly into the algorithm's boxes. It’s a fantastic, low-maintenance way to get started with a balanced portfolio. You can get a better sense of how tech is evolving in this space by checking out these automated risk assessment tools.

But when things get a little more complex, the algorithm starts to show its cracks.

Unique Assets: It struggles to factor in things like company stock options, rental properties, or private investments into a single, unified strategy.

Specific Goals: Niche objectives, like planning for a dependent with special needs or building a portfolio around strict ethical guidelines (ESG), demand a much more custom plan.

Life Events: Big changes—an inheritance, a divorce, selling a business—throw in variables that a simple questionnaire just can't handle.

The real magic of a human advisor is their ability to build a truly bespoke financial plan. They don’t just manage your investments; they weave every part of your financial world—from tax strategies to estate planning—into one cohesive strategy.

The Human Touch in Complex Situations

A human advisor proves their worth when the market gets choppy or when your life takes a sharp turn. They provide the behavioral coaching that stops you from panic-selling at the bottom of a downturn—something an algorithm could never do.

Think about these real-world situations where a person makes all the difference:

A Business Owner: They need to balance personal wealth with company assets, figure out a succession plan, and find tax optimizations that only entrepreneurs can access.

A High-Income Professional: They're trying to max out every possible tax-advantaged account while managing a big chunk of company stock.

A Retiree: They need a smart withdrawal strategy to make their money last, navigate sequence-of-return risk, and plan for potential long-term care costs.

In every one of these cases, the advisor is more than a manager; they're a strategic partner. They ask the questions an algorithm wouldn't even know to ask, uncovering the deeper goals and anxieties to build a plan that delivers not just returns, but genuine peace of mind. That deep, contextual understanding is what you're really paying for.

Getting to Grips with Performance and Investor Value

When you're weighing a robo-advisor vs. a human advisor, performance is probably the first thing that comes to mind. But "performance" isn't just about the raw numbers your portfolio pulls in. True investor value is a cocktail of financial results and the behavioral guidance that keeps you from torpedoing your own strategy.

While both are built to grow your money, how investors feel about their contribution is worlds apart. It's not just about the figures on a screen; it's about the confidence and calm that come with having someone in your corner. A big piece of this is knowing exactly how to calculate investment returns to get the complete picture.

How We Perceive Value

Here’s a fascinating quirk of investor psychology: people often give human advisors more credit for their portfolio's success, even when an algorithm might generate similar or better raw returns. This really shines a light on the psychological comfort a human relationship provides.

A major study by Vanguard covering over 1,500 investors really drove this point home. Clients with robo-advisors saw an average portfolio return of 24% over three years but only credited the robo-advice with 3 percentage points of that growth.

On the other hand, investors with human advisors saw a 15% average return but credited their advisors with 5 percentage points of it. That's a much bigger slice of the credit pie, even with lower overall returns. You can check out the full findings on advice clients value here.

This tells us that a human advisor’s value goes way beyond just building a portfolio. It’s about providing emotional stability, building confidence, and offering the reassurance that a real expert is steering the ship.

The Power of Behavioral Coaching

So, what explains this gap? It almost always boils down to one critical service an algorithm just can't offer: behavioral coaching. A human advisor's most important work often happens when the market is going haywire.

They're the steady hand that helps investors sidestep classic, emotionally-driven blunders:

Panic Selling: They talk you off the ledge and provide the long-term view needed to stop you from selling at the absolute bottom.

Chasing Hype: They help you resist the urge to pile into speculative assets right as they're peaking.

Staying the Course: They remind you why your financial plan exists, especially when the headlines are screaming doom.

This kind of coaching is priceless because it protects you from your own worst instincts, preserving your capital and keeping you on the path to your goals. The true measure of an advisor isn't just the upside they help you capture—it's also the downside they help you dodge. After all, the best strategy is the one you actually stick with, and a human advisor is uniquely equipped to make sure you do.

Making the Right Choice for Your Situation

Look, figuring out whether to go with a robo advisor or a human advisor isn't about finding some magical "best" option. It’s about what fits your life right now. The whole robo advisor vs human advisor debate really just comes down to your personal finances, your goals, and honestly, your personality.

What works for a 22-year-old opening their first Roth IRA is going to be completely wrong for a business owner trying to map out a tax-efficient exit strategy. Simple as that.

So, let's cut through the noise and figure out which camp you fall into. By matching your situation to one of these profiles, you'll know exactly which path to take.

Who Should Use a Robo Advisor?

An automated platform is brilliant when your financial needs are pretty straightforward and you want to keep costs as low as humanly possible. A robo advisor is probably your best bet if any of these sound like you:

The New Investor: Just getting started? A robo advisor strips away all the intimidating parts of investing. You can kick things off with a small amount of cash, thanks to low (or no) account minimums, and still get a diversified portfolio without paying a fortune for it.

The Set-It-and-Forget-It Saver: If you just want to consistently sock away money for retirement or some other big goal without having to think about it, a robo advisor is your best friend. It handles all the tedious stuff—automatic contributions, rebalancing, tax-loss harvesting—so your plan stays on track while you live your life.

The Cost-Conscious Optimizer: Maybe you're comfortable with a digital-first approach and your main objective is to crush fees to let your money grow faster. With costs often sitting at 0.25% or even less, you just can't beat the value a robo advisor offers.

Bottom line: if your financial world is mostly a W-2 income and standard accounts like an IRA or 401(k), a robo advisor is an incredibly efficient and cheap way to get the job done.

When Is a Human Advisor the Right Call?

Once your financial picture starts getting more complicated, the personalized, big-picture advice from a human expert becomes absolutely essential. You should almost certainly be talking to a human advisor in these scenarios:

High-Net-Worth Individuals: Big money brings big problems. We're talking about complex tax planning, setting up trusts, managing a huge chunk of company stock, and so on. A human advisor acts as the quarterback, coordinating with your accountant and lawyer to build a solid wealth plan.

Business Owners and Entrepreneurs: When your personal and business finances are tangled together, you need specialized help. An advisor can walk you through succession planning, figure out the best way to pull income from the business, and structure investments in a way a robo platform could never dream of.

Those Nearing or in Retirement: Switching from saving money to spending it is a huge mental and strategic shift. A real advisor helps you build a withdrawal plan that lasts, manage the risk of a market downturn early in retirement, and make the right calls on things like pensions and Social Security.

Navigating Major Life Events: Getting a big inheritance, going through a divorce, or selling a business can be emotionally draining and financially complex. An advisor provides both the strategic playbook and the behavioral coaching to keep you from making bad decisions when you're stressed.

The real magic of a human advisor is their ability to see everything. They’re not just looking at your portfolio; they're looking at your entire financial life to give you genuine peace of mind when things get complicated.

It's also worth mentioning the hybrid model, which has popped up as a fantastic middle ground. Many firms now give you a slick digital platform but also let you call up a human financial consultant when you need one. This can be the perfect setup if you like the low fees and ease of a robo but still want that professional sounding board for big questions.

Common Questions About Financial Advisors

Even after weighing the pros and cons, a few practical questions always pop up when people are deciding between a robo and human advisor. Let's tackle these head-on, because they're not just small details—they’re about your money's security, your strategy's flexibility, and the real-world logistics of it all.

Can I Use Both a Robo Advisor and a Human Advisor?

Absolutely. In fact, running a hybrid strategy is becoming a really popular—and smart—way to manage your money. It lets you snag the best of both worlds: low-cost automation for the simple stuff and specialized expertise where the stakes are higher.

You could, for example, let a robo-advisor handle your Roth IRA, where its automated rebalancing and diversification are a perfect fit. At the same time, you might bring in a human advisor to navigate more complex situations, like:

Figuring out what to do with a large chunk of company stock options.

Building a sophisticated plan to minimize your tax bill.

Setting up a comprehensive estate plan for your family.

This blended approach is all about optimizing for cost where it makes sense, without sacrificing high-touch, personal guidance when you truly need it. Many firms are even rolling out their own "hybrid" models now, giving you a digital platform with access to human advisors on demand.

How Safe Are My Investments with a Robo Advisor?

Your money is very secure with any reputable robo advisor. These platforms aren't the wild west; they operate under the same strict regulations as traditional brokerage firms, overseen by bodies like the SEC.

Critically, they are also members of the Securities Investor Protection Corporation (SIPC). This provides a crucial safety net, insuring your securities up to $500,000 if the firm itself were to fail.

Just be clear: SIPC doesn't protect you from market risk. The value of your investments will go up and down with the market, whether a human or an algorithm is at the wheel. The insurance is for firm failure, not for investment losses.

How Do I Move from a Robo Advisor to a Human Advisor?

Making the switch from a robo to a human advisor is a pretty standard and straightforward process. Once you’ve picked a new advisor, they’ll walk you through all the necessary steps to make it as smooth as possible.

The whole thing usually happens through what’s called an ACAT (Automated Customer Account Transfer Service) transfer. Your new advisor will help you with the paperwork to get it started.

Most of the time, your assets are moved "in-kind." This means your stocks, ETFs, and other investments are transferred directly to the new account without being sold first. That's a huge plus because it helps you avoid triggering capital gains taxes during the move. Your new advisor handles the entire process, which typically only takes a few weeks to complete.

Ready to put your stablecoins to work without the hassle? Yield Seeker uses a personalized AI Agent to find and manage the best yield opportunities for you automatically. Start earning more with just $25 and zero lockups. Find out more at https://yieldseeker.xyz.