Back to Blog

12 Top Financial Planning Software Tools for 2025

Discover the 12 top financial planning software platforms of 2025. A detailed comparison of features, pricing, and pros/cons for advisors and DIY investors.

Oct 14, 2025

generated

Navigating the modern financial landscape to build and protect wealth demands the right set of tools. Whether you're a professional advisor designing complex retirement scenarios or an individual investor aiming to optimize returns, your choice of software is a critical decision. This guide moves beyond marketing jargon to provide a detailed, comparative analysis of the top financial planning software available today. We dive deep into each platform, evaluating everything from comprehensive advisor-grade systems like eMoney Advisor to innovative, AI-driven yield tools designed for the modern investor.

Our goal is to help you find the perfect match for your specific financial objectives and planning methodology. We'll explore the core functions that solve key problems, such as retirement income modeling, investment tracking, and cash flow analysis. Understanding the foundations of financial planning, such as creating accurate financial projections, can further empower your decision-making as you evaluate these powerful platforms.

Each review includes detailed feature breakdowns, pricing, screenshots, and direct links to help you make an informed choice. We assess the pros, cons, and ideal user for every tool, from crypto beginners seeking automated yield-farming to seasoned professionals managing client portfolios. Let’s explore the software that will best empower your financial journey.

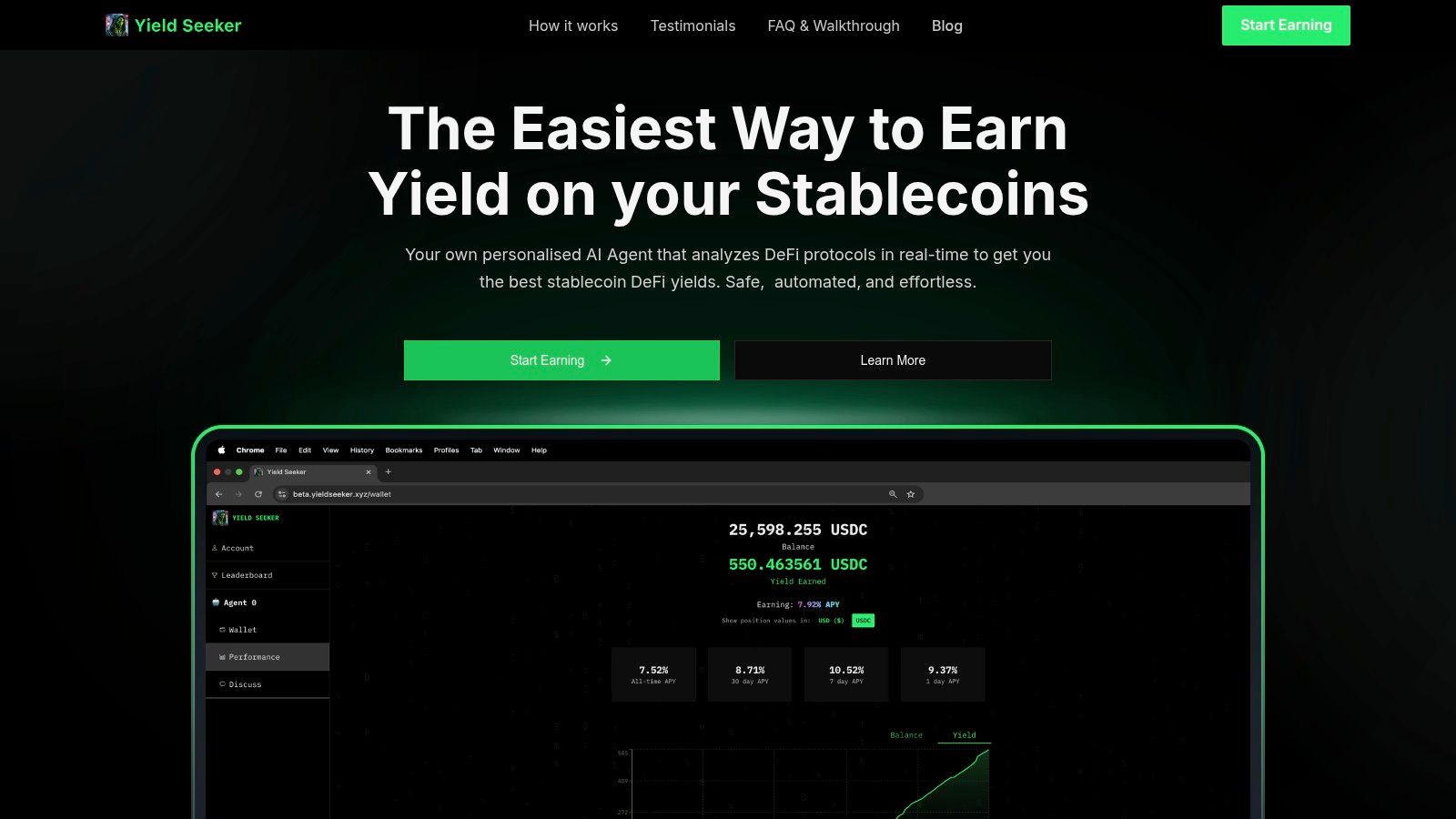

1. Yield Seeker

Yield Seeker stands out as a premier AI-driven platform for those looking to automate and maximize stablecoin yields. It carves a unique niche in the financial planning software landscape by focusing on a specific, high-demand area of decentralized finance (DeFi). The platform's core strength is its personalized AI Agent, which autonomously scans top DeFi protocols on the BASE chain in real time. This sophisticated technology identifies and captures the highest possible yields for USDC, removing the manual effort and guesswork typically associated with yield farming.

This platform is engineered for accessibility, allowing users to begin with as little as $10 to $25. Its commitment to transparency means there are no lockup periods or hidden fees, offering complete liquidity and control over your capital. This makes it an ideal tool for both crypto newcomers and seasoned DeFi veterans seeking an efficient, hands-off approach to generating passive income.

Key Features and User Experience

Yield Seeker's user interface is exceptionally intuitive, designed to provide a seamless experience from the moment you connect your wallet. The dashboard consolidates all critical information, giving you a clear, real-time overview of your deposited capital, total earnings, and the underlying protocols where your funds are deployed.

Personalized AI Agent: This is the platform's standout feature. The AI continuously analyzes the DeFi landscape to dynamically allocate funds to the most profitable and secure opportunities, functioning as an automated financial advisor for your stablecoins.

Low Barrier to Entry: With a minimum deposit of just $10, it's accessible to a wide range of users, from those just starting to explore DeFi to larger investors.

Full Transparency and Control: Users benefit from a clear fee structure and the ability to withdraw funds and accumulated yield at any time without penalty.

The platform is praised for its reliability and the trustworthiness of its development team, which has deep experience in crypto and fintech. This strong foundation provides users with confidence in the system's security and efficiency, making it a top choice for automated financial management in the crypto space.

Pros and Cons

Pros | Cons |

|---|---|

AI-powered agent automates complex yield strategies in real-time. | Currently limited to USDC on the BASE chain, restricting asset diversification. |

Extremely low entry point ($10-$25) and no lockups or hidden fees. | Users are still exposed to the inherent risks of the underlying DeFi protocols. |

Intuitive dashboard offers a clear view of capital, earnings, and activity. | As a newer platform, it lacks the long-term track record of traditional financial tools. |

Strong user testimonials highlight safety, efficiency, and a trusted team. |

Website: https://yieldseeker.xyz

2. eMoney Advisor

eMoney Advisor stands out as an enterprise-grade platform and is widely considered some of the top financial planning software for established advisory firms. It excels in delivering comprehensive, goals-based financial plans through a highly collaborative client portal. The platform's strength lies in its robust account aggregation and a detailed, cash-flow-based planning engine that allows for complex scenario modeling.

The interactive "Decision Center" is a key feature, enabling advisors to present plans digitally and adjust variables in real-time during client meetings. This dynamic approach helps clients understand the immediate impact of their financial decisions. The platform's commitment to continuous updates, recognized by industry awards, ensures it remains a cutting-edge tool for professionals. The detailed planning capabilities are particularly beneficial for complex client situations, a stark contrast to more simplified tools. For advisors focusing on younger clients, understanding these detailed features is crucial for long-term success. You can learn more about financial planning for millennials and how advanced tools can help.

Key Details & User Profile

Ideal For: Financial advisors and enterprise firms needing deep, collaborative financial planning tools.

Pros: Excellent client portal, powerful scenario modeling, and award-winning account aggregation.

Cons: Pricing is not publicly available (quote-based) and the platform has a significant learning curve.

Website: https://emoneyadvisor.com

3. Envestnet MoneyGuide

Envestnet MoneyGuide is renowned for its intuitive, goals-based approach, making it a contender for the top financial planning software for advisors who prioritize a clear and engaging client experience. It distinguishes itself with a highly visual, play-zone style interface that simplifies complex financial concepts into understandable outcomes. The platform's modular "MyBlocks" system allows clients to engage with specific financial topics relevant to their life stage, from buying a home to planning for retirement.

This modular design offers incredible flexibility, letting advisors deliver targeted advice without overwhelming clients with a full-scale plan. The platform is built to scale, serving everyone from solo practitioners to large enterprise firms with extensive integration capabilities, including optional Yodlee aggregation and the advanced Wealth Studios for deeper analytics. For advisors seeking a highly interactive and client-friendly planning tool that grows with their practice, MoneyGuide presents a compelling solution. Individual advisors can test the platform with a 14-day free trial.

Key Details & User Profile

Ideal For: Advisors and firms of all sizes seeking a client-friendly, goals-based planning experience.

Pros: Clear, client-friendly visuals, broad scalability, and the innovative MyBlocks modular experience.

Cons: Advanced analytics require higher-tier bundles or add-ons, and these costs can increase total pricing.

Website: https://www.moneyguidepro.com

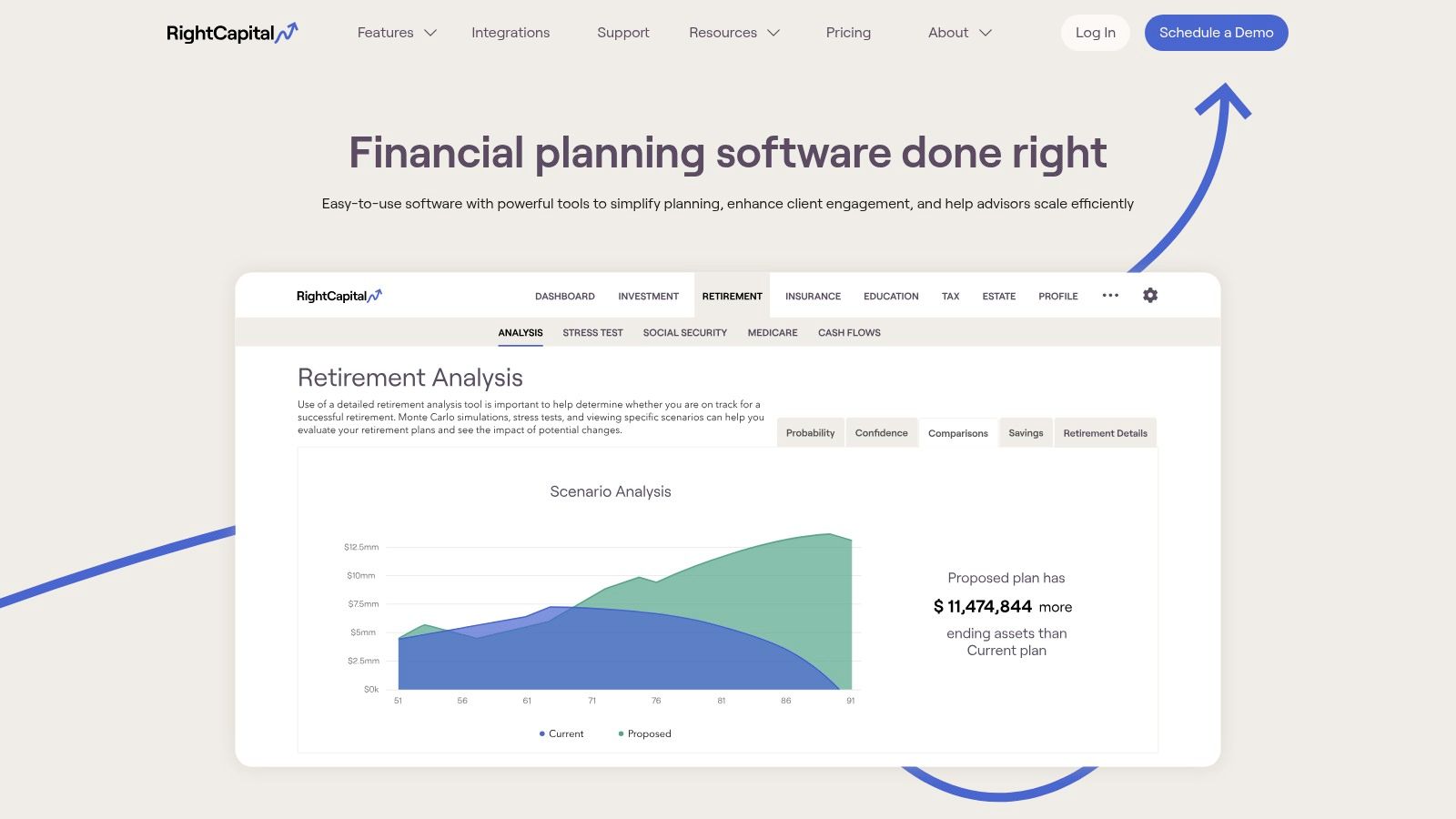

4. RightCapital

RightCapital has rapidly gained popularity among financial advisors for its modern interface and powerful, tax-focused planning capabilities. It distinguishes itself as some of the top financial planning software by offering a highly visual and interactive experience that simplifies complex financial scenarios for clients. The platform excels in retirement planning, tax analysis, and household cash-flow modeling, with frequent updates that keep it aligned with current tax laws and policies.

A key strength is its integrated toolset designed for firm growth, including prospecting tools like RightExpress and built-in billing management with RightPay. This comprehensive approach allows advisors to manage planning, client acquisition, and operations within a single ecosystem. The platform's transparent pricing and 14-day free trial make it accessible for independent advisors and growing firms looking to adopt sophisticated tools without the enterprise-level cost commitment. Its detailed tax analyzer and long-term care cost assumptions provide significant depth for comprehensive planning.

Key Details & User Profile

Ideal For: Independent financial advisors and growing firms needing robust tax and retirement planning tools.

Pros: Transparent pricing tiers with a 14-day trial, strong tax planning depth, and frequent policy updates.

Cons: Team collaboration features are only on the highest tier (Platinum), and there is an additional cost for assistant seats.

Website: https://www.rightcapital.com

5. Orion Planning

Orion Planning is an excellent choice for advisory firms already embedded within the Orion Advisor Tech ecosystem. It offers a powerful blend of goals-based and cash-flow planning, making it some of the top financial planning software for integrated practices. The platform's primary advantage is its seamless data flow, eliminating the need for manual data entry between portfolio management, reporting, and planning tools. This single-vendor solution simplifies the tech stack and creates a unified advisor and client experience.

A key differentiator is the integration of behavioral finance concepts, such as its PulseCheck feature, which helps advisors quantify and address client emotions around finances. Its modern reporting capabilities leverage existing Orion portfolio data, allowing for sophisticated portfolio comparisons and risk analysis directly within the planning context. This tight integration is a significant advantage over standalone tools, which often require complex integrations. By combining portfolio management and planning, advisors can more easily utilize automated risk assessment tools to provide holistic advice. The platform's consistent innovation keeps it competitive and highly functional.

Key Details & User Profile

Ideal For: Financial advisors and firms heavily invested in the Orion Advisor Tech platform.

Pros: Simplifies data flow through its integrated ecosystem, innovative behavioral finance tools, and consistent product updates.

Cons: Best value is realized when bundled with other Orion tools; standalone pricing is not publicly available.

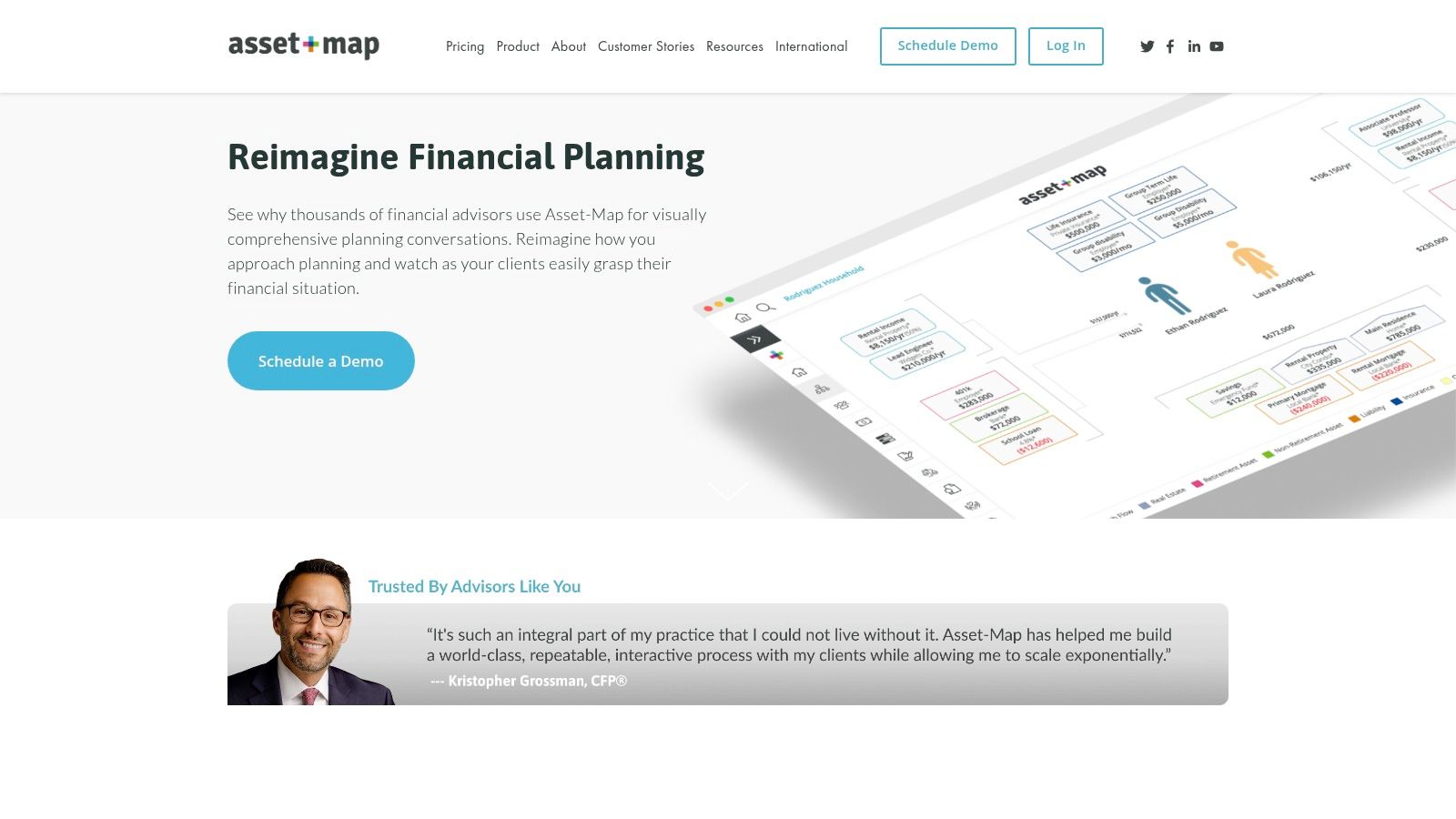

6. Asset-Map

Asset-Map revolutionizes client conversations by transforming complex financial data into a single, intuitive visual overview. Unlike traditional document-heavy plans, it delivers a clear, one-page "Asset-Map" that provides an at-a-glance summary of a client's entire financial household. This approach is designed to accelerate understanding and engagement, making it a powerful tool for initial client meetings and ongoing reviews. The platform is considered some of the top financial planning software for advisors who prioritize visual communication and efficiency.

The platform's strength is its simplicity and speed, allowing advisors to build a comprehensive financial picture in minutes, often collaboratively with the client. It also offers "Target-Maps" to visually track progress toward specific financial goals, helping clients connect their assets to their aspirations. While it doesn't offer the deep, cash-flow-based modeling of more comprehensive systems, its focus on clear, actionable visuals makes it an exceptional tool for client acquisition and relationship management. It integrates with many other financial tools, allowing it to serve as a high-level dashboard within a larger tech stack.

Key Details & User Profile

Ideal For: Advisors who want a highly visual, easy-to-understand tool to facilitate client conversations and fact-finding.

Pros: Extremely intuitive and quick to learn, affordable pricing for solo advisors, and creates powerful client-facing visuals.

Cons: Lacks the deep cash-flow modeling of more robust platforms; advanced integrations are tied to higher-priced tiers.

Website: https://www.asset-map.com

7. Elements

Elements offers a unique and modern approach to financial planning by focusing on simplicity and client engagement. It centers its methodology on a "financial vitals" scorecard, assessing 11 key metrics to provide a quick, digestible snapshot of a client's financial health. This system is designed to facilitate fast, repeatable planning conversations, making it some of the top financial planning software for advisors who work with mass-affluent clients or within employer-sponsored programs. Its core is the One-Page Plan, which simplifies complex financial data into an actionable summary.

The platform’s strength is its rapid onboarding and modern client experience, driven by a mobile app and powerful automations. Integrations with Plaid, Morningstar, and Zapier streamline data gathering and workflow, while marketing tools like Easy-Invites help advisors grow their business. Elements is particularly effective as a front-end system to engage clients and identify needs before moving them into a more detailed planning tool if required. This approach prioritizes conversation and progress over complex, report-heavy processes.

Key Details & User Profile

Ideal For: Advisors seeking a streamlined, conversation-starting tool for mass-affluent clients or corporate wellness programs.

Pros: Extremely fast time-to-value, excellent modern client experience, and serves as a great front-end for deeper planning.

Cons: Not built for detailed cash-flow analysis or complex scenario modeling, and pricing requires a demo.

Website: https://getelements.com

8. Income Lab

Income Lab specializes in advanced retirement income planning, setting itself apart with dynamic, guardrail-based strategies. It is among the top financial planning software for advisors focused on the decumulation phase, shifting the conversation from simple projections to adaptable, real-world income adjustments. The software's core strength is its ability to create and monitor tax-smart distribution plans that respond to market fluctuations, ensuring clients stay on track.

Key tools include a powerful "Tax Lab" for optimizing withdrawals and a Social Security optimizer to maximize benefits. A major differentiator is its client-facing "Life Hub," a standalone add-on that provides intuitive visuals to help retirees understand their income plan, spending, and financial health. This focus on clear, ongoing communication makes complex retirement strategies accessible and less stressful for clients, while automated monitoring helps advisors manage plans efficiently.

Key Details & User Profile

Ideal For: Financial advisors and firms specializing in retirement planning and managing client income streams.

Pros: Sophisticated distribution and tax planning, dynamic guardrail strategies, and an excellent client-facing visual dashboard.

Cons: Advisor-only platform with no direct consumer access; it is a specialized tool, not an all-purpose budgeting app.

Website: https://incomelaboratory.com

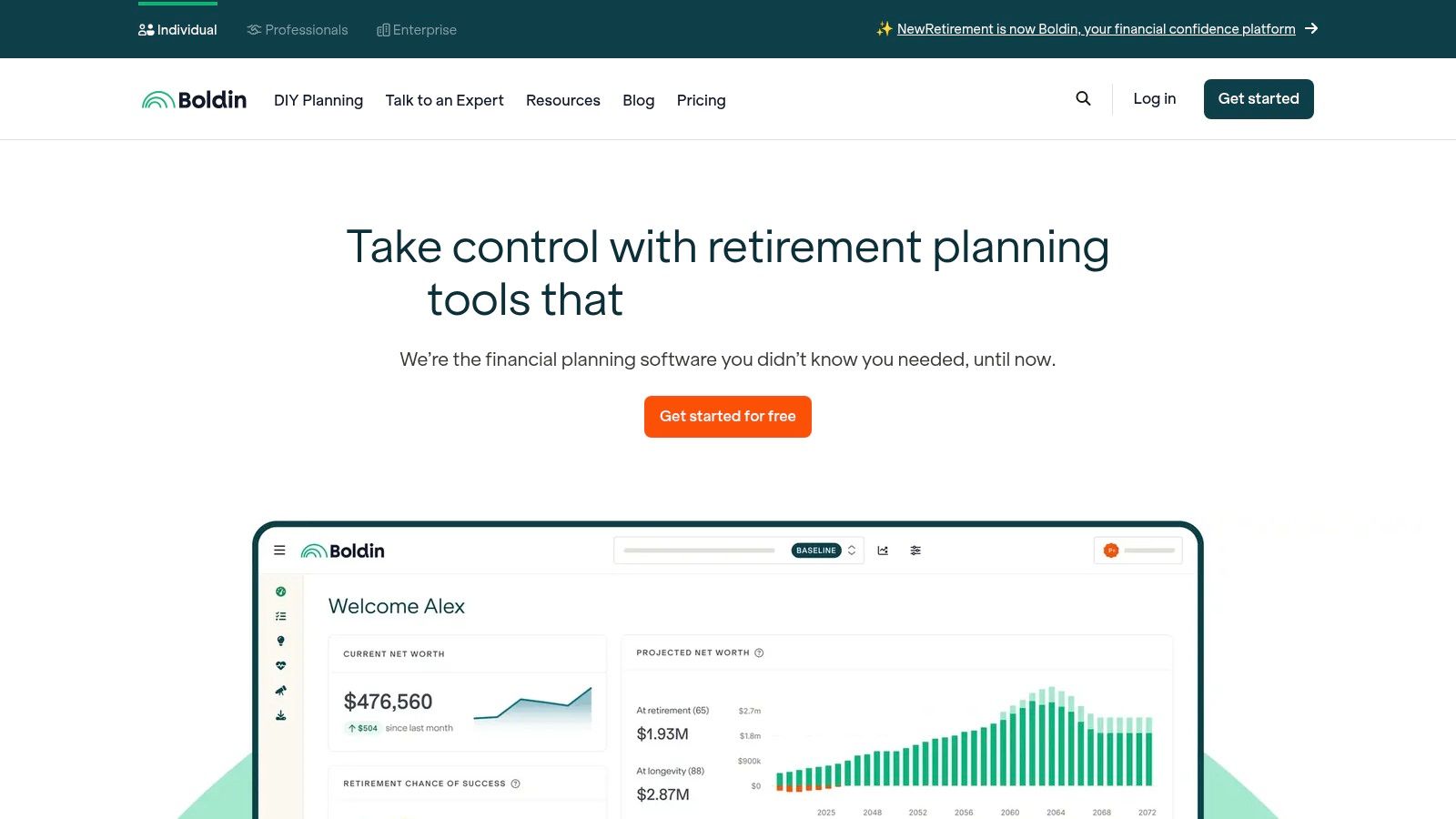

9. Boldin (formerly NewRetirement) – PlannerPlus

Boldin, previously known as NewRetirement, carves out a unique niche as a consumer-friendly yet powerful retirement planning tool. It is designed primarily for individuals managing their own financial futures, particularly those approaching retirement. The platform empowers users with sophisticated features often reserved for professional software, making it some of the top financial planning software for the DIY investor. It excels at detailed, long-term retirement income planning, tax estimations, and Social Security optimization.

The PlannerPlus tier offers unlimited scenario modeling, including powerful Monte Carlo simulations and Roth conversion analysis, allowing users to stress-test their plans against various market conditions. A standout feature is its educational component, which includes access to advisor Q&A sessions and classes, blending robust software with human guidance. This focus on empowering users with both tools and knowledge makes it an excellent choice for individuals who want deep control over their retirement strategy without the high cost of a dedicated financial advisor.

Key Details & User Profile

Ideal For: Pre-retirees and DIY investors seeking detailed, consumer-focused retirement planning tools.

Pros: Inexpensive compared to advisor-grade tools, strong focus on education and community resources.

Cons: Consumer feature updates can vary in pace, and some financial institution integrations are limited.

Website: https://www.boldin.com

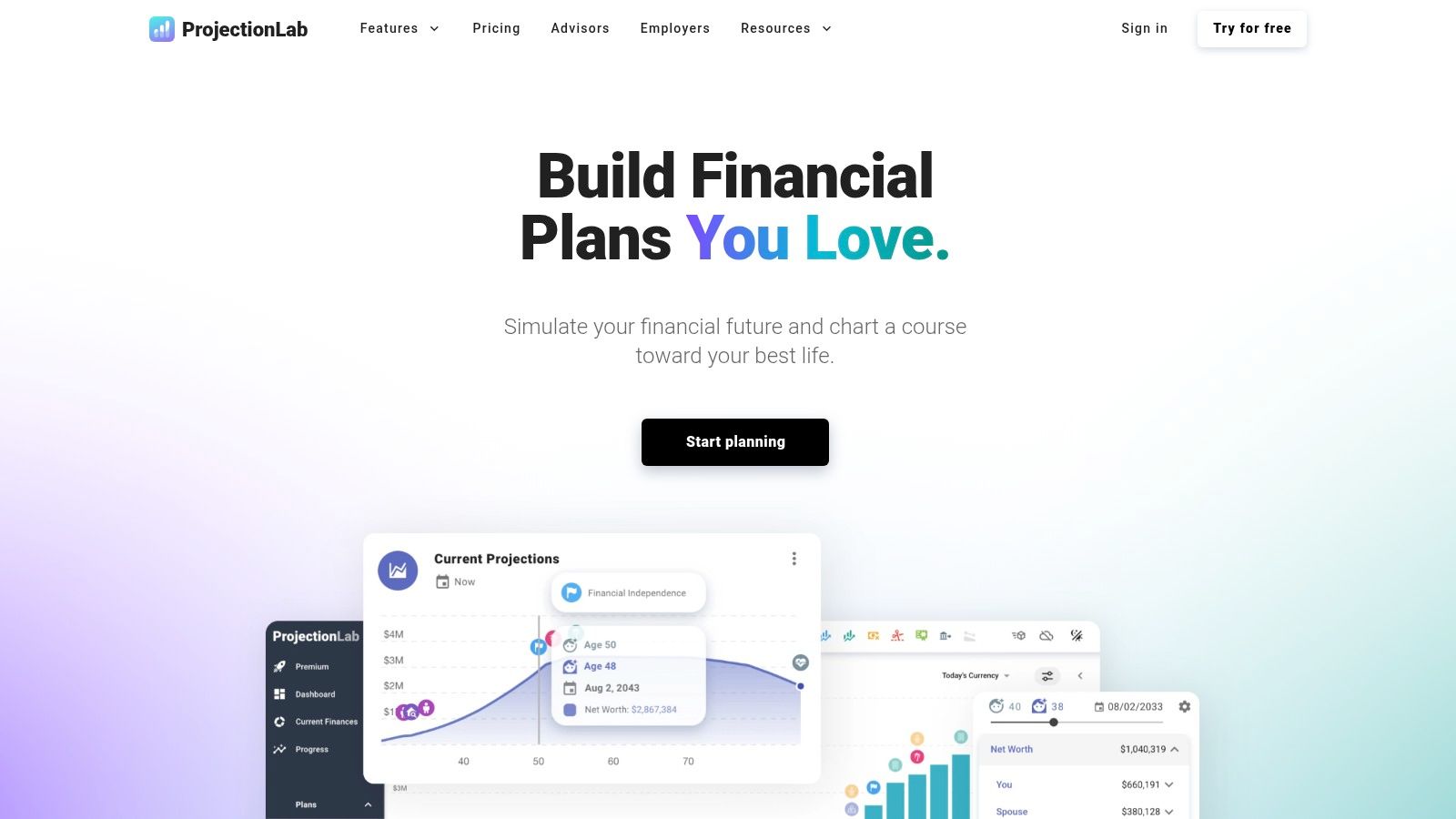

10. ProjectionLab

ProjectionLab offers a modern, visual-first approach to DIY financial planning, making it some of the top financial planning software for individuals and advisors who prioritize detailed cash flow analysis. It distinguishes itself with an intuitive interface that allows users to build and visualize long-term financial projections, from retirement savings to complex withdrawal strategies. The platform's strength is its powerful "what-if" modeling, enabling users to explore scenarios like Roth conversions or international moves with detailed tax estimations.

Unlike all-in-one budgeting apps, ProjectionLab focuses purely on long-range forecasting, providing clarity on future financial health. Its transparent development roadmap and active community give users a voice in its evolution. The platform offers tiers for both individual consumers and professionals, with an "Advisor Pro" version that includes client seat management. This focus on detailed, forward-looking analysis makes it a compelling tool for anyone serious about mapping out their financial future.

Key Details & User Profile

Ideal For: DIY investors and financial advisors who need a powerful, visual tool for long-term cash flow projections and scenario modeling.

Pros: Affordable with transparent pricing (including a lifetime license option), active community, and powerful "what-if" analysis.

Cons: Not a comprehensive personal finance manager for daily budgeting; Advisor Pro tier has client seat limits with fees for additional seats.

Website: https://projectionlab.com

11. Tiller

Tiller offers a unique, spreadsheet-based approach to personal finance, bridging the gap between manual data entry and fully automated apps. It automates the process of pulling transaction and balance data from banks and credit cards directly into Google Sheets or Microsoft Excel. This makes it a powerful tool for DIY investors and planners who want complete control and customization over their financial tracking and analysis without the manual labor of data aggregation.

The platform's strength is its flexibility, enhanced by a community-driven library of templates for everything from detailed budgeting to retirement planning. Unlike rigid software, Tiller allows users to build their own financial dashboards, reports, and models from the ground up. This makes it a standout choice for those comfortable working within spreadsheets and who find traditional budgeting apps too restrictive. As some of the most accessible top financial planning software for spreadsheet lovers, it empowers users to create a system that perfectly fits their individual needs, starting with a 30-day free trial.

Key Details & User Profile

Ideal For: Individuals and families who are proficient with spreadsheets and want ultimate control over their budgeting and financial data.

Pros: Highly flexible and customizable, affordable annual subscription, and strong community support with a rich template library.

Cons: Requires spreadsheet knowledge to use effectively and is not a comprehensive planning engine on its own.

Website: https://tiller.com

12. Quicken Simplifi

Quicken Simplifi is a highly accessible and user-friendly app designed for individuals who want to master their budgeting and cash flow. While not a full-scale retirement planning tool, it serves as an excellent foundational step, offering projected cash flows, investment tracking, and goal-setting capabilities. Its strength lies in providing a clear, real-time picture of spending habits and financial health, making it some of the top financial planning software for those just starting their financial journey.

The platform’s intuitive interface and customizable reports make it easy to see where your money is going. Its investment tracking dashboard offers a consolidated view of your portfolio, a feature that can be particularly useful when managing diverse assets. While Simplifi focuses on day-to-day finances, the skills it helps build are invaluable for more complex future planning. For instance, understanding your investment allocations here can provide a solid basis before you learn more about cryptocurrency portfolio rebalancing and other advanced strategies. Available across iOS, Android, and web apps, Simplifi ensures you can manage your finances from anywhere.

Key Details & User Profile

Ideal For: Individuals and couples seeking a simple, powerful tool for budgeting, expense tracking, and basic investment monitoring.

Pros: Very low price, often with promotional deals, broad account connectivity, and simple onboarding.

Cons: Lacks a permanent free tier and focuses on budgeting over advanced retirement or tax planning.

Website: https://www.quicken.com/simplifi

Top 12 Financial Planning Software Comparison

Platform | Core Features / Unique Selling Points ✨ | User Experience / Quality ★★★★☆ | Value Proposition / Price 💰 | Target Audience 👥 | Recommended 🏆 |

|---|---|---|---|---|---|

Yield Seeker | Personalized AI Agent, real-time DeFi yield scanning, no lockups | Intuitive dashboard, seamless setup, transparent UI | Low entry $10-$25, no hidden fees, flexible withdrawals | Crypto novices & DeFi veterans | 🏆 Recommended for stablecoin yields |

eMoney Advisor | Enterprise-grade planning, client portal, strong account aggregation | Robust updates, award-winning platform | Enterprise pricing (quote-based) | US financial professionals | |

Envestnet MoneyGuide | Goal-based planning, modular client experiences, broad scalability | Client-friendly visuals, scalable | Add-on costs, higher tiers for analytics | Solo advisors to enterprises | |

RightCapital | Tax & retirement planning, billing integration, risk & firm analytics | Transparent pricing tiers, 14-day trial | Tiered pricing, add-ons for advanced features | Financial advisors | |

Orion Planning | Behavioral finance tools, portfolio integration, single vendor ecosystem | Consistent innovation, simplified data flow | Bundle pricing, optimized with Orion suite | Firms using Orion platform | |

Asset-Map | Visual financial maps, goal-based templates, collaboration options | Quick learning curve, strong visuals | Affordable tiers for small firms | Solo advisors & small firms | |

Elements | Financial vitals scorecard, mobile app, marketing tools | Fast onboarding, modern UX | Pricing by demo/contact only | Employer programs, mass-affluent | |

Income Lab | Retirement income & tax-smart distribution planning | Flexible licensing, client visuals | Accessible pricing for Life Hub add-on | Retirement-focused advisors | |

Boldin – PlannerPlus | US retirement planning, scenario modeling, educational resources | Affordable consumer tool, active community | Inexpensive vs. advisor tools | Preretirees & DIY planners | |

ProjectionLab | DIY cash-flow projections, Monte Carlo simulation, tax estimation | Transparent pricing, active development | Lifetime license option | Consumers & financial pros | |

Tiller | Spreadsheet-based budgeting, automated bank feeds, customizable templates | Highly flexible, strong community support | Low annual subscription | DIY planners comfortable with sheets | |

Quicken Simplifi | Budgeting, cash-flow, investment tracking, multi-platform | Easy onboarding, broad connectivity | Low-cost, promotional pricing available | Consumers starting budgeting |

Making Your Final Decision

Navigating the landscape of financial planning tools can feel overwhelming, but this guide has equipped you with the insights needed to select the right platform for your journey. We've explored a diverse range of the top financial planning software, from comprehensive enterprise solutions like eMoney Advisor and Envestnet MoneyGuide, designed for professional advisors, to more accessible and visually intuitive platforms such as Boldin and ProjectionLab, which empower individuals to take direct control of their financial futures.

The key takeaway is that there is no single "best" software; the ideal choice is entirely dependent on your specific circumstances, goals, and technical comfort level. A seasoned financial advisor requires different features than a crypto native looking to optimize their digital asset returns. Your selection process should be a deliberate reflection of your unique financial reality.

A Framework for Your Choice

To distill this complex decision into actionable steps, consider these crucial factors before committing to a platform. This isn't just about features; it's about finding a tool that integrates seamlessly into your life or professional practice.

Define Your Primary Goal: Are you focused on traditional retirement planning (RightCapital, Income Lab), visualizing your current financial state (Asset-Map), managing day-to-day cash flow (Tiller, Quicken Simplifi), or generating passive income through innovative means? Your main objective will immediately narrow the field.

Assess Your User Profile: Are you a professional financial advisor needing client management and deep analytics (Orion Planning, eMoney)? Or are you an individual investor who prefers a direct, hands-on approach (ProjectionLab, Boldin)? Be honest about your technical skills and how much time you're willing to invest.

Evaluate the Cost-to-Benefit Ratio: A high-end subscription is only worthwhile if you use its advanced features. Conversely, a free or low-cost tool might lack the sophisticated forecasting you need. Match your budget to the value you expect to receive.

Consider Your Financial Ecosystem: Do you need a tool that integrates with various brokerage accounts, banks, and other financial services? Or is your focus more specialized, like managing and growing stablecoin holdings where a tool like Yield Seeker excels?

Taking the Next Steps

The most critical action you can take now is to move from analysis to experimentation. Reading reviews and comparing feature lists is essential, but nothing replaces hands-on experience.

Shortlist Your Top 2-3 Candidates: Based on the profiles in this article and your self-assessment, pick the platforms that seem most aligned with your needs.

Utilize Free Trials and Demos: Nearly every software provider offers a trial period or a guided demo. Use this opportunity to test the user interface, input your actual financial data (if comfortable), and see if the workflow feels intuitive to you.

Test for a Specific Use Case: Don't just browse the platform. Try to accomplish a specific task, such as creating a retirement projection, tracking your monthly spending against a budget, or exploring investment scenarios. This will reveal the software's true strengths and weaknesses.

Ultimately, the right financial planning software is a powerful ally, transforming abstract goals into a concrete, actionable plan. It provides clarity, confidence, and control, empowering you to build the secure financial future you deserve. Choose wisely, and you'll have a partner that grows with you every step of the way.

Ready to put your stablecoins to work? While traditional software helps you plan, Yield Seeker helps you earn. As a premier AI-driven tool for optimizing stablecoin yield, it automates complex DeFi strategies to generate reliable passive income, adding a powerful, modern dimension to your financial plan. Explore how automated yield farming can accelerate your goals at Yield Seeker.