Back to Blog

What Is a Blockchain Wallet? A Simple Explainer

Asking what is a blockchain wallet? This guide explains how they work with simple analogies, compares hot vs. cold types, and reveals their role in DeFi.

Oct 1, 2025

generated

Ever wondered how you actually own your crypto? It’s not sitting in an account like at a bank. Instead, you interact with it through a blockchain wallet, which is your personal gateway to decentralized networks like Bitcoin and Ethereum.

Think of it less like a physical wallet stuffed with cash and more like a specialized, secure digital keychain. This keychain doesn't hold the coins themselves, but it holds the keys that prove you own them and give you the power to send them.

Your Digital Keychain to the Blockchain

It’s a classic crypto misconception that wallets "store" your assets. In reality, your cryptocurrency always lives on the blockchain—a massive, public ledger shared across the globe. Your wallet is the tool that holds the cryptographic keys needed to access and manage your slice of that ledger.

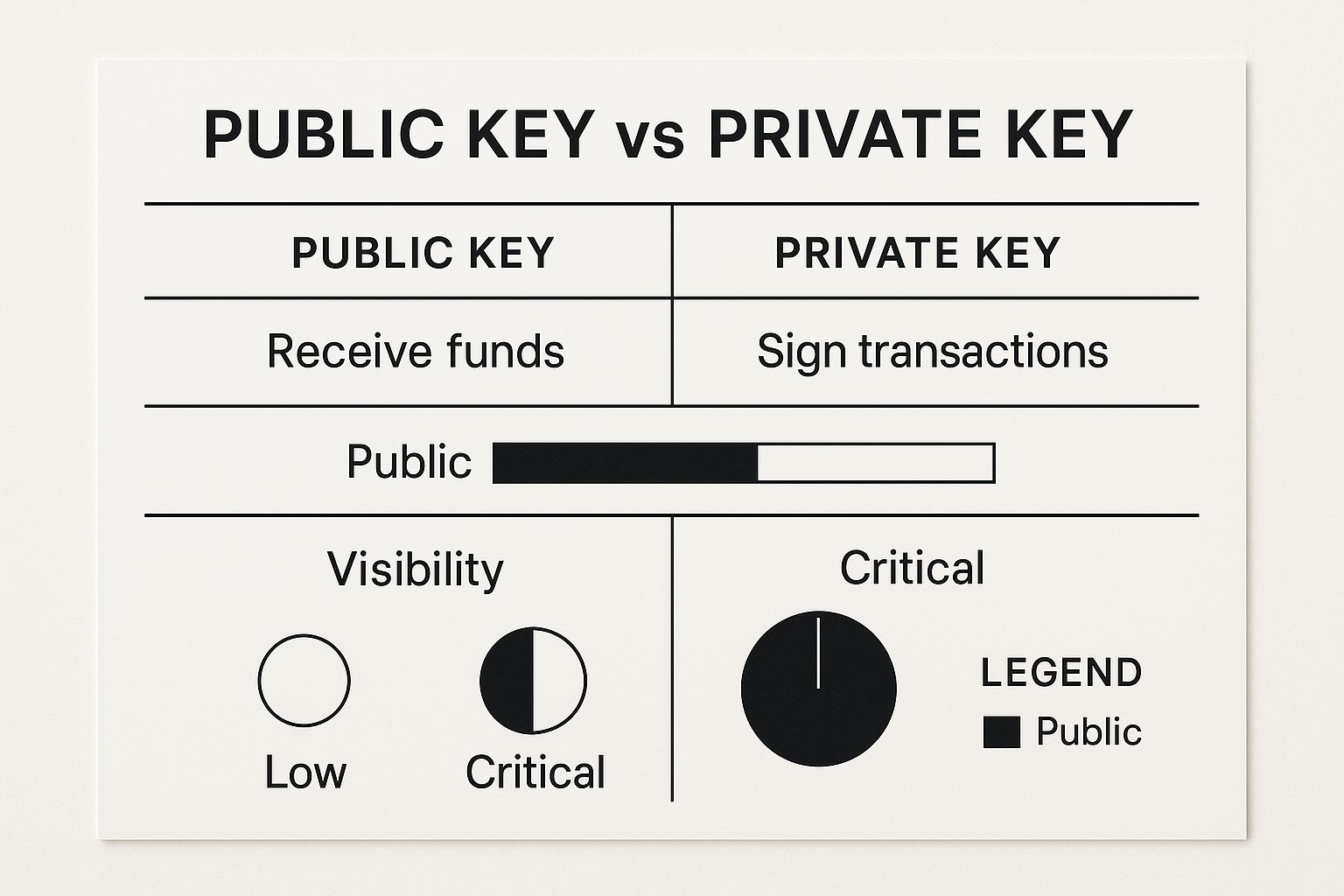

At the heart of every wallet are two critical components: a public key and a private key. Getting your head around how these two work together is the first major step to using crypto safely.

Public Key: Your Digital Mailbox

Your public key is a bit like your home address or your bank account number. You can share it with anyone, anywhere, without putting your funds at risk. It’s what you give people when they want to send you crypto.

This key is used to generate a public address, which is just a shorter, more convenient version you can copy and paste. Simple.

Private Key: Your Master Password

Now, the private key is the complete opposite. This is the master secret, the one piece of information that gives you—or anyone who gets their hands on it—total control over your funds. Think of it as the password and signature for every transaction you ever make.

Critical Takeaway: Never, ever, under any circumstances, share your private key. Guard it with your life. If you lose it, your crypto is gone forever. No customer support, no password reset—just gone.

This elegant public/private key system is what makes the whole crypto world tick. It allows for secure, verifiable transactions without needing a middleman like a bank to approve anything.

To make these concepts even clearer, here's a quick breakdown comparing wallet components to things you already know.

Blockchain Wallet Concepts at a Glance

Wallet Component | Simple Analogy | Primary Function |

|---|---|---|

Blockchain Wallet | Secure Digital Keychain | Interface to manage your crypto assets. |

Public Key | Bank Account Number | Generates addresses to receive funds safely. |

Private Key | Master Password / Key | Authorizes transactions and proves ownership. |

Getting these basics down is essential. Your public key is for sharing, and your private key is for your eyes only. That one simple rule is the foundation of self-custody and financial sovereignty in the world of DeFi.

How Your Wallet Interacts With The Blockchain

So, your wallet holds your keys, but how does it actually use them to get stuff done? Let's walk through what happens when you send some crypto to see this digital keychain in action.

It's a surprisingly slick and secure process that all happens in seconds behind the scenes.

Imagine you want to send 1 ETH to a friend. You’d open your wallet, hit "Send," and paste their public address into the recipient field. After typing in the amount, you confirm the transaction. This is where the magic really kicks in.

Your wallet grabs the transaction details—the amount and the recipient—and uses your private key to create a totally unique digital signature. Think of it like a one-of-a-kind wax seal on an old-school letter that can't be faked.

This signature mathematically proves two critical things:

Authenticity: It confirms the transaction request really came from you.

Integrity: It guarantees the transaction details haven't been messed with since you signed it.

The best part? This all happens without your private key ever being revealed to the network.

Broadcasting And Validating Your Transaction

Once signed, your wallet shouts the transaction out to the entire blockchain network. Computers (or "nodes") all over the world hear it, use your public key to quickly check the digital signature, and make sure you actually have the funds to send.

If everything looks good, your transaction gets bundled into a new block and becomes a permanent part of the blockchain's history.

This whole setup hinges on one master key to rule them all. When you first create a non-custodial wallet, you’re given a seed phrase, sometimes called a recovery phrase.

A seed phrase is typically a list of 12 or 24 random words. It's the ultimate master backup that can be used to regenerate all your private keys and restore full access to your funds on any device.

Seriously, protecting this phrase is the number one rule of self-custody. If you lose your phone or your hardware wallet gets run over by a bus, this phrase is the only way you're getting your assets back.

Write it down—offline—and store it somewhere safe where nobody else will ever stumble upon it.

Choosing the Right Type of Blockchain Wallet

Now that we've covered the basics of how a wallet works, let's get into the important part: picking the right one for you. It’s not a one-size-fits-all situation. The best wallet really comes down to a classic trade-off between everyday convenience and ironclad security.

To make the right call, you need to understand two key distinctions: hot vs. cold wallets and custodial vs. non-custodial wallets.

This isn't just theory; it's a practical decision facing millions of people. As of 2025, there are over 814 million active crypto wallets in the wild. The Asia-Pacific region is way out in front, accounting for 43% of that massive global total. With so many people jumping in, knowing how to protect your assets has never been more critical.

Hot Wallets vs Cold Wallets

Think about it like this: a hot wallet is your everyday spending cash, and a cold wallet is your savings locked away in a high-security vault.

Hot Wallets: These are wallets connected to the internet. We're talking about mobile apps like MetaMask or simple browser extensions. They’re fantastic for making quick trades, interacting with DeFi apps, and generally being active in the space. The downside? That constant internet connection makes them a bigger target for hackers and scams.

Cold Wallets: These are kept completely offline, usually on a physical hardware device like a Ledger or Trezor. Because your private keys never touch the internet, cold wallets offer the highest level of security possible. They are the go-to choice for storing large amounts of crypto for the long haul. If you want to dive deeper into securing your long-term stash, check out our guide on the best cold storage wallets.

The decision boils down to what you prioritize: easy access or maximum security. Many serious users actually use both—a hot wallet for daily transactions and a cold wallet for their main holdings.

To make this crystal clear, here’s a quick breakdown of how they stack up against each other.

Hot Wallets vs Cold Wallets A Quick Comparison

Feature | Hot Wallet (e.g., Mobile App) | Cold Wallet (e.g., Hardware Device) |

|---|---|---|

Connectivity | Always online | Completely offline |

Security Level | Good, but vulnerable to online threats | Highest level of security |

Best For | Frequent trading, daily use, DeFi | Long-term holding ("HODLing") |

Convenience | Very high, instant access | Less convenient, requires physical access |

Cost | Often free | Requires purchasing a device |

Risk Profile | Higher risk of theft | Very low risk of theft |

This table shows the fundamental trade-off: hot wallets are built for speed and ease, while cold wallets are built like a fortress.

Custodial vs Non-Custodial Wallets

This next distinction is arguably even more important. It all comes down to one question: who actually controls your private keys?

A custodial wallet is when a third party, like a big crypto exchange, holds your private keys for you. This can feel easier for beginners because if you forget your password, you can just reset it. But there’s a massive catch—you don’t truly own your crypto. You're trusting that company to keep your assets safe from hacks, bankruptcy, or even just locking you out of your account.

The Golden Rule of Crypto: "Not your keys, not your coins."

A non-custodial wallet is the embodiment of this rule. It gives you—and only you—complete control over your private keys and your seed phrase. You become your own bank. This offers incredible financial freedom but also means you are 100% responsible for your own security. Lose your seed phrase, and your funds are gone forever.

This image does a great job of showing how your public and private keys work together, which is the core concept behind self-custody.

As you can see, the private key is your secret password to unlock your funds, while the public key is like your bank account number—safe to share with others so they can send you crypto.

Your Passport to Decentralized Finance (DeFi)

Think of a non-custodial wallet as more than just a place to store your crypto; it’s your personal passport to the entire world of Decentralized Finance (DeFi). This isn't just about holding assets anymore. It's about putting them to work.

Your wallet is the key that unlocks a new universe of financial services, letting you connect directly to platforms where you can lend, borrow, trade, and earn yield, all without needing a bank. It’s a fundamental shift from passively holding crypto to actively participating in its economy. If you want to dive deeper, we've got a great guide on what is decentralized finance that breaks it all down.

How DeFi Integration Works

Connecting to a DeFi app might sound complicated, but it's designed to be surprisingly straightforward while keeping you firmly in control of your funds. The magic is that DeFi platforms are built to interact with your wallet without ever getting their hands on your private keys.

This seamless integration is exactly how a platform like Yield Seeker operates. The workflow is simple and secure:

Connect Your Wallet: You link your wallet to the platform with just a couple of clicks—no lengthy sign-up forms here.

Deposit Assets: Transfer your stablecoins into a fully audited and secure smart contract. Your assets are never mixed with anyone else's.

Earn Yield: Our platform then gets to work finding the best yield opportunities, and all your earnings are paid directly back into your wallet.

This shows how your wallet empowers you to be an active participant. You always have full custody and can withdraw your funds whenever you choose.

The growing power of DeFi is why wallet adoption is exploding. The blockchain technology market is projected to hit a staggering $393.42 billion by 2032, a massive jump from $31.18 billion in 2025. This isn't just hype; it's a reflection of more people wanting direct control over their own money. Discover more insights about blockchain adoption trends.

Essential Security Practices for Your Wallet

When you use a non-custodial wallet, you're not just holding crypto—you're basically becoming your own bank. That means you're also the head of security. It might sound like a big deal, but honestly, a few smart habits will protect you from the most common threats out there.

The absolute number one rule of wallet security is to protect your seed phrase (sometimes called a recovery phrase). This isn't just a password. It's the master key that unlocks everything.

Crucial Reminder: If someone gets your seed phrase, they get everything. There's no customer support line to call or password reset button to click. Game over.

Protect Your Seed Phrase

Your main job is to keep that seed phrase completely offline and away from prying eyes. Never, ever store it on your computer, in a password manager, or as a picture on your phone. Digital storage is just asking for trouble.

Write It Down: Go old school. Use a pen and paper. It’s way safer than any file on your computer.

Store It Securely: Stick that piece of paper in a fireproof safe, a safety deposit box, or another place you know is secure.

Make a Few Copies: Store backups in different secure spots. This way, if one is lost to a fire or flood, you're not totally out of luck.

Smart Security Habits

Beyond guarding your master key, a little bit of daily awareness goes a long way. Most hackers don't crack complex code; they trick people into making mistakes.

Use a Hardware Wallet: If you're holding any serious amount of crypto, this is non-negotiable. A hardware (cold) wallet keeps your private keys completely offline, even when you’re signing transactions.

Watch Out for Phishing: Be suspicious of random emails, DMs, or links that promise you free crypto. Scammers build fake websites that look identical to the real thing just to steal your keys.

Double-Check Addresses: Before you hit "send," check the recipient's address character by character. One wrong letter can send your funds into a black hole, lost forever.

For a deeper dive into keeping your assets safe, check out our complete guide on how to secure your cryptocurrency. Make these practices second nature, and you’ll be managing your wallet like a pro.

Frequently Asked Questions About Blockchain Wallets

Even after you've got the basics down, a few practical questions always seem to pop up. Let's run through some of the most common ones to make sure you're feeling confident managing your assets.

Can I Hold Multiple Cryptocurrencies in One Wallet?

Absolutely. Most modern crypto wallets are built to be multi-currency, letting you manage assets like Bitcoin (BTC) and Ethereum (ETH) from a single dashboard.

But here’s a crucial tip: always double-check that a wallet supports the specific blockchains you plan to use. For instance, an Ethereum-native wallet won't magically work with assets on the Solana network unless it’s explicitly designed to. It's a simple check that can save you a lot of headaches (and money).

What Happens If I Lose My Hardware Wallet or Phone?

This is a scary thought, but if your device gets lost, stolen, or just stops working, your funds are completely safe—as long as you have your seed phrase.

Your seed phrase (often called a recovery phrase) is a string of 12 or 24 words that acts as the master key to your entire wallet. You can just punch those words into a new wallet on a new device, and voilà, you’ve restored full access to all your crypto. This is exactly why protecting that phrase is the single most important rule of self-custody.

Is an Exchange Wallet the Same as a Non-Custodial Wallet?

Nope, they're worlds apart. A wallet on an exchange like Coinbase or Binance is custodial. This means the exchange holds your private keys for you. It’s convenient, sure, but you're trusting them with your assets. This is where the old crypto saying comes from: "not your keys, not your coins."

A non-custodial wallet puts you in exclusive control of your private keys. This is the gold standard for security and gives you direct, unfiltered access to the world of DeFi. The trade-off? All the security responsibility rests squarely on your shoulders.

Ready to put your stablecoins to work safely and effortlessly? Yield Seeker uses an AI Agent to find the best yield opportunities in DeFi, so you can earn more without the manual work. Start earning with Yield Seeker today.