Back to Blog

What Is Capital Preservation? Protect Your Investments Today

Learn what is capital preservation and how it helps safeguard your investments from market volatility. Discover effective strategies to secure your financial future.

Oct 12, 2025

generated

Let's be honest, nobody likes losing money. That's the entire idea behind capital preservation in a nutshell. It’s an investment strategy that puts protecting your initial investment—your principal—ahead of chasing eye-watering returns.

Think of it as playing defense in your financial game plan. The main goal is to make sure the money you started with is still there, no matter how wild the market gets.

A Simple Guide to Capital Preservation

Imagine your investment portfolio is a ship sailing the choppy waters of the financial markets. Capital preservation is the reinforced hull, built to protect your precious cargo (your cash) from storms.

While aggressive, growth-focused strategies are all about hitting top speed to reach the destination faster, preservation strategies are about making sure the ship gets there in one piece, even if it’s a slower journey. This doesn't mean you avoid all risk—that's impossible. It's about managing it smartly to build a solid financial foundation.

Who Needs Capital Preservation Most?

While everyone should have a handle on this concept, it becomes absolutely essential for some people more than others, especially depending on where you are in life.

This strategy is a game-changer for a few key groups:

Retirees: If you're no longer earning a regular paycheck, that nest egg needs to last. Protecting it becomes priority number one.

Near-Retirees: For anyone 5-10 years away from retirement, the last thing you want is a massive market crash wiping out years of hard work.

Short-Term Savers: Got a big purchase coming up, like a down payment on a house? You can't afford to see your savings dip right when you need them.

Risk-Averse Investors: Some people just sleep better at night knowing their money is safe. If market volatility gives you anxiety, this is for you.

The Core Goal: Protecting Your Principal

The mission is crystal clear: don't lose your original investment.

If you put in $10,000, the absolute priority is making sure your portfolio value never drops below that $10,000 mark. Any yield you earn on top is a fantastic bonus, but it's not the main event. This mindset is crucial when the markets feel like a rollercoaster.

A focus on capital preservation helps investors ride out market storms. Take the dot-com bubble crash, for instance. U.S. equities plummeted, with returns hitting as low as -23% in 2002. Events like that are a stark reminder of why protecting your principal is just as critical as growing it. You can dive deeper into historical returns over at Visual Capitalist.

Getting your head around what is capital preservation is the first step toward building a truly balanced portfolio. It’s the defensive backbone that lets your more aggressive, growth-focused investments do their thing without putting your entire financial future on the line.

Why Protecting Your Capital Is More Crucial Than Ever

Let's be honest, the old playbook for saving and investing just doesn't cut it anymore. We're in a tricky financial environment where powerful forces are silently working against the money you've worked so hard to earn.

This makes the core principles of capital preservation more important than they've ever been.

We're dealing with a perfect storm of persistent inflation, wild interest rate swings, and general economic uncertainty across the globe. These aren't just abstract headlines; they have a real, direct impact on the value of your savings.

Focusing only on growth is exciting when the market is flying high, but it can leave your portfolio completely exposed. When the tide inevitably turns, a portfolio without a defensive strategy can get hit hard, potentially setting your financial goals back by years. That’s why a balanced approach is so critical for any kind of long-term success.

The Silent Threat of Inflation

Inflation has been called the "silent thief," and for good reason. It quietly eats away at the purchasing power of your money over time. A dollar today simply doesn't buy what it did a year ago, and if your savings aren't growing faster than inflation, you are effectively losing money.

This harsh reality means that just holding cash or stashing funds in a low-interest savings account is a losing game. Your balance might look the same on paper, but its real-world value is constantly shrinking.

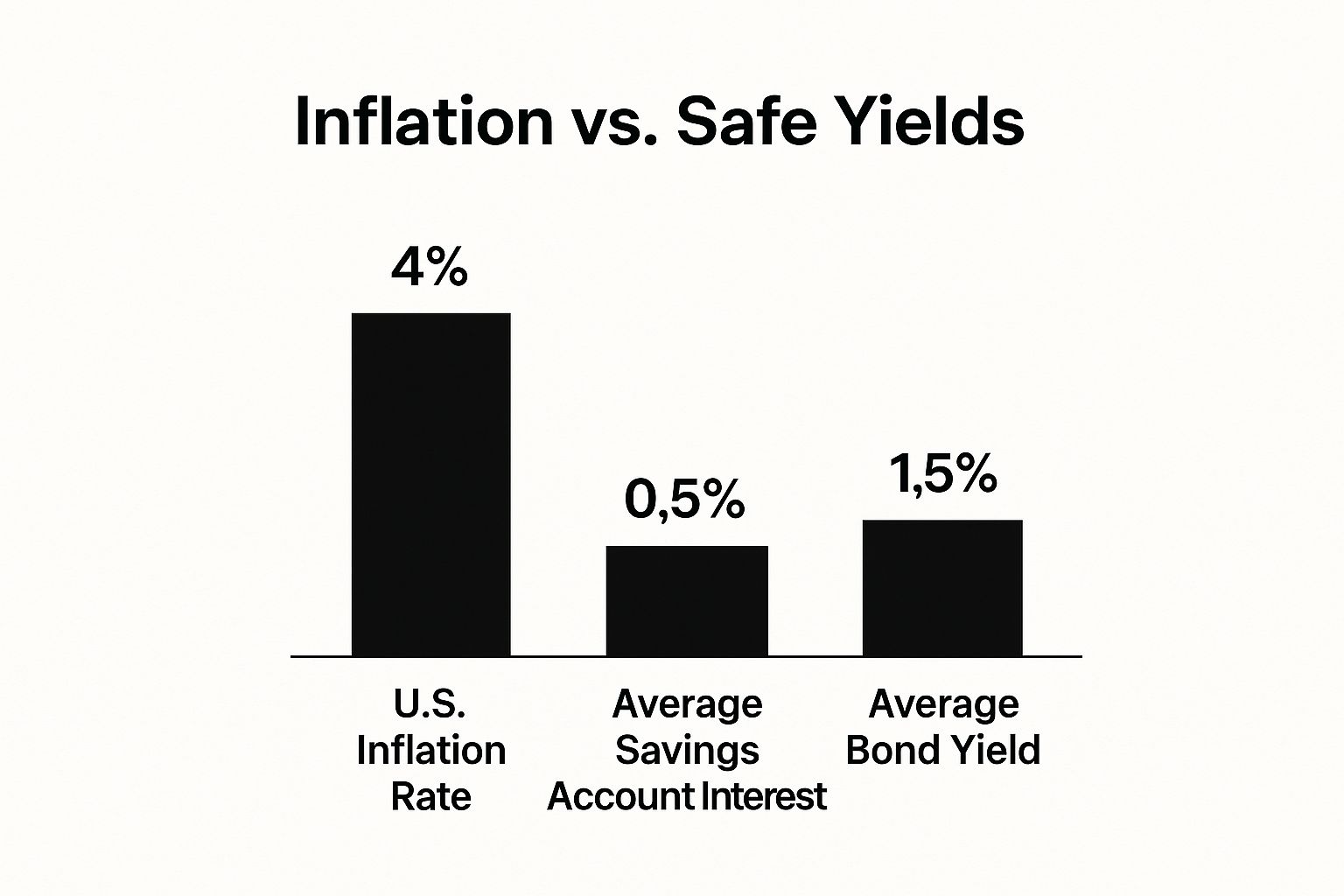

This infographic paints a pretty clear picture of the challenge, stacking up typical inflation rates against the yields you'd get from traditional "safe" options.

As you can see, conventional savings accounts and even some bonds often can't keep pace. The result? A net loss in your purchasing power. For a deeper dive, our guide breaks down how to protect against inflation using more modern strategies.

Navigating Market Volatility

Beyond inflation, market volatility is another huge hurdle. Geopolitical events, sudden policy changes, or even just shifts in investor mood can cause asset prices to swing dramatically. This is where a strategy focused on what is capital preservation becomes your anchor in the storm.

By prioritizing the protection of your principal, you create a stable foundation. This lets you weather market downturns without making panicked, emotional decisions. It's about building the financial resilience to stay the course and be ready to seize opportunities when they pop up.

This defensive mindset isn't about avoiding growth altogether. Not at all. It’s about building a smarter financial plan where your core capital is shielded, giving you the security to chase growth more strategically with other parts of your portfolio.

When you protect your base, you can afford to take calculated risks elsewhere, knowing your foundation is solid.

Time-Tested Strategies for Preserving Your Capital

Knowing what capital preservation is is one thing, but actually putting it into practice is a completely different ballgame. Thankfully, traditional finance gives us a well-stocked toolbox of low-risk instruments built specifically to protect your principal. These are the bedrock strategies of any defensive investing plan, helping you build a financial foundation sturdy enough to handle market storms.

Think of these tools not as get-rich-quick schemes, but as your stay-secure-plan. They’re absolutely essential for protecting money you've set aside for major life goals, like building an emergency fund or saving up for a down payment. If you're looking for pointers on that, our post on how to build an emergency fund lays out a detailed roadmap.

Common Low-Risk Investment Vehicles

When your number one goal is to avoid losing money, you turn to assets known for their stability and predictability. These options usually offer pretty modest returns, but in exchange, they give you a high degree of confidence that you’ll get your initial investment back in full. They form the core of any classic capital preservation strategy.

Here are a few of the most popular choices:

Government Bonds: Think of these as loans you make to a government, like U.S. Treasury bonds. They’re considered one of the safest investments on the planet because they're backed by the full faith and credit of the government. This makes the risk of default incredibly low.

Certificates of Deposit (CDs): Offered by banks, CDs ask you to lock up your money for a specific amount of time—anywhere from a few months to several years. In return, you get a fixed interest rate that’s usually better than a standard savings account.

Money Market Funds: These are mutual funds that invest in a mix of short-term, high-quality debt. They are super liquid, meaning you can get your cash out easily, and they work hard to keep a stable value.

Comparing Your Options for Safety

Picking the right tool really boils down to your specific needs. How long can you lock your money away? How quickly might you need to access it? Each option strikes a slightly different balance between safety, returns, and liquidity.

To help you see the differences more clearly, we've put together a simple comparison of these traditional low-risk assets.

Comparison of Traditional Capital Preservation Methods

Asset Type | Primary Feature | Risk Level | Best For |

|---|---|---|---|

Government Bonds | Backed by the government, offering maximum security | Very Low | Long-term savings where safety is paramount |

Certificates of Deposit (CDs) | Fixed, predictable returns for a set term | Very Low | Short- to mid-term goals with a defined date |

Money Market Funds | High liquidity and stable value | Very Low | Parking cash you may need to access quickly |

This table gives you a quick snapshot, but the world of finance is always evolving. To truly get the most out of these strategies, modern investors can benefit from powerful new tools. Making sense of all the different options is a lot easier when you're skilled at leveraging AI for financial analysis. By picking the right instruments, you can build a defensive layer in your portfolio that lets you sleep well at night, knowing your capital is secure.

Capital Preservation in the Digital Age of DeFi

The old-school ideas about protecting your money aren't just for Wall Street anymore. They’ve found a new, surprisingly fitting home in the world of decentralized finance (DeFi). Even with all the new tech, the core goal of capital preservation is identical: keep your starting investment safe from dumb risks.

In the wild ride that is the crypto market, this rule is more important than ever. Prices for big names like Bitcoin and Ethereum can swing wildly. This creates amazing chances to grow your stack, but it also brings huge risks for anyone who isn't ready. That’s where a modern approach to capital preservation becomes your best friend.

Stablecoins: The Digital Safe Harbor

In DeFi, your primary tool for protecting capital is the stablecoin. Just think of a stablecoin as a crypto version of a regular currency, like the U.S. dollar. Its entire job is to hold a steady value, usually pegged 1:1 to its real-world equivalent.

This stability is a game-changer. It gives you a safe place to park your funds right inside the crypto ecosystem. When the market starts to tank, you can move your money out of volatile assets and into something like USDC. It's the DeFi version of shifting from stocks to cash—a simple move to shield your capital from losses while you wait out the storm.

By holding stablecoins, you're just applying a timeless financial principle in a new digital world. You're choosing to protect what you have over chasing risky gains, making sure your digital wealth holds its value no matter what the market is doing.

This powerful but simple strategy lets you manage your risk without having to cash out and leave the crypto space entirely.

Applying Old Rules to a New Game

Of course, DeFi isn't risk-free. The protocols and platforms that make it all work are built on complex bits of code called smart contracts. Making sure those contracts are secure and do what they're supposed to is everything when it comes to protecting user funds. This is where good risk management becomes crucial, a topic we explore more in our guide on the best practices for risk management in DeFi.

For anyone serious about DeFi, verifying protocol security is a non-negotiable step; that's why digging into the best smart contract audit tools is a must. When you pair the stability of assets like stablecoins with solid security checks, you can confidently use capital preservation strategies. It's about bringing a trusted, age-old goal—safeguarding your wealth—to an exciting new frontier.

The Hidden Risks of Playing It Too Safe

Sticking to capital preservation sounds like a rock-solid plan. I mean, what could possibly be wrong with keeping your money safe? While having a defensive mindset is crucial, going too cautious has its own set of traps that can sink your long-term goals just as fast as a market crash.

Playing it too safe can be a surprisingly risky move. The biggest threats aren't the dramatic market swings you see on the news, but the silent, slow-moving forces that quietly eat away at your wealth. Getting a handle on these is key to building a financial plan that actually works.

The Slow Burn of Inflation

The number one risk of being overly defensive is inflation. Think of it as a tiny, slow leak in your financial boat. You might be avoiding all the big storms of market volatility, but this steady drain will eventually leave you with less real-world value than you started with.

Let's say your "safe" investments are pulling in a 1% return, but inflation is humming along at 3%. In that scenario, you're actually losing 2% of your purchasing power every single year. Your account balance might look the same, but what it can actually buy is shrinking.

Sticking your money under a mattress (or in a savings account earning next to nothing) isn't a preservation strategy; it's a guaranteed way to lose money over time. The real goal isn't just to keep the same number of dollars, but to make sure those dollars can still pay for things in the future.

The High Price of Missed Opportunities

The other major downside is opportunity cost. This is the growth you give up by choosing safety over a bit of calculated risk. Every dollar you park in an ultra-safe asset is a dollar that isn't out there working for you, generating potentially higher returns in stocks or even higher-yield DeFi protocols.

Avoiding risk feels comfortable, sure, but it comes at a steep price. Over a few decades, the compounding growth you miss out on can be the difference between a comfortable retirement and just scraping by. A strategy that only asks "what is capital preservation" often forgets that you need a little offense to actually build wealth.

This isn't just a challenge for you and me. Even the big players in private markets feel the heat. From 2022 to 2023, interest rates shot up—over 500 basis points in the U.S. alone. This made it incredibly tough for private equity firms to protect their capital as the cost of borrowing money went through the roof and the whole economy got shaky. You can dig deeper into these macroeconomic pressures in a detailed McKinsey report on private markets.

True financial security is all about finding that sweet spot between defense and offense. It's about protecting what you have, but not at the expense of your future. You need a plan that guards against immediate losses without giving up on long-term growth.

Got Questions About Capital Preservation? We've Got Answers.

Even when you get the basic idea, applying something like capital preservation to your own money can bring up a lot of questions. This isn’t a one-size-fits-all kind of deal, and nailing the details is what makes it work.

Let's clear the air on a few of the most common hang-ups. Think of this as bridging the gap between knowing the theory and actually using it, so you can confidently find that sweet spot between safety and growth in your own portfolio.

Is Capital Preservation Just for Retirees?

Not a chance. While it's absolutely essential for retirees who need to protect their nest egg, capital preservation is a smart move for investors at any age. It’s all about how you use it.

Someone in their twenties might use it to protect the money they’re saving for a down payment on a house. An investor of any age could use it to dial back risk when the market gets choppy.

The trick is to blend preservation with growth strategies based on your personal timeline, goals, and how much risk you’re comfortable with. It's never an all-or-nothing choice; it’s just one crucial piece of a balanced plan.

So, a 25-year-old might keep a small slice of their portfolio in preservation-mode for short-term goals, while a 65-year-old might have the lion's share of their assets focused on keeping their capital safe.

Can I Actually Lose Money with a Capital Preservation Strategy?

Look, while the main goal is to keep your initial investment from taking a hit, no strategy is completely bulletproof. The biggest risk isn't some dramatic market crash, but the quiet, creeping damage from inflation.

If your returns aren't beating the rate of inflation, your money is losing its buying power. Your account statement might show the same number, but those dollars just don’t stretch as far as they used to.

There's also opportunity cost—the gains you could have made by putting that money into something with higher growth potential. But when it comes to the risk of losing your principal? It's significantly lower than with growth-focused investments like stocks.

How Is Capital Preservation Different from Capital Appreciation?

The main difference is the end game. It’s like playing offense versus defense in a sports match.

Capital Preservation (Defense): The playbook is safety first. Your primary focus is on protecting your initial investment (your principal). Any growth you get is just a nice bonus.

Capital Appreciation (Offense): This strategy is all about growth first. The goal is to increase the value of your investment over time, which usually means taking on more risk for a shot at bigger returns.

A truly solid portfolio doesn't pick one over the other—it uses both. You need a strong defense to protect your base and a smart offense to put points on the board and build your wealth.

Ready to put capital preservation to work without sacrificing yield? Yield Seeker uses an AI Agent to automatically find the best stablecoin yield opportunities for you in DeFi, ensuring your capital is both protected and productive. Get started in seconds at https://yieldseeker.xyz.