Back to Blog

What Is Tokenomics and How Does It Work

Wondering what is tokenomics? This guide explains how token supply, utility, and governance create value in digital assets. Learn to analyze crypto projects.

Oct 8, 2025

generated

Let's be real for a moment. You wouldn't invest in a new country without first understanding its economy, right? You’d want to know how much money is floating around, if its central bank is printing cash like there’s no tomorrow, and what you can actually do with its currency.

That's tokenomics in a nutshell. It’s the economic blueprint for any digital coin, and it’s arguably the most critical factor determining if a project is built to last or destined to fail.

What Is Tokenomics and Why It Matters

The word itself is a simple mashup of "token" and "economics." It’s the entire set of rules that dictates a cryptocurrency's financial structure—how it's supplied, what its purpose is, and how it's managed over time. This isn't just fluffy marketing talk; it's all baked directly into the project's code for everyone to see.

A project with a shoddy economic model is like a leaky boat. It might float for a while, but eventually, problems like runaway inflation or a total lack of real-world demand will sink it, taking its value down with it.

On the flip side, a project with solid tokenomics aligns the goals of everyone involved. The developers, investors, and everyday users are all rowing in the same direction, creating a healthy, sustainable ecosystem that can actually grow.

The Three Pillars of Tokenomics

When you boil it down, tokenomics answers three fundamental questions that every savvy crypto user should be asking. Think of these as the three pillars holding up any project's entire economic design. They give you a crystal-clear framework for cutting through the noise.

Let's break them down in this handy table.

Pillar | Core Question It Answers | Real-World Impact |

|---|---|---|

Supply & Distribution | How many tokens will ever exist? How are they created and released? | Determines scarcity and fairness. A fixed supply like Bitcoin's 21 million creates digital gold, while a massive pre-mine for founders can be a huge red flag. |

Utility & Purpose | What can you actually do with the token? | Creates real demand beyond just speculation. Does it let you vote, pay network fees, or access special features? If not, it's just a digital pet rock. |

Incentives & Governance | How does the project encourage people to hold and participate? | Drives network security and user loyalty. Staking rewards, for example, encourage holding, which reduces the selling pressure and helps secure the network. |

By getting a handle on these three areas, you can see past the hype and really get a feel for the underlying health of a digital economy.

In essence, tokenomics is the rulebook that dictates a token's value. It determines whether a digital asset is designed for long-term stability and growth or is just a fleeting speculative bubble.

This is a crucial skill, especially when you start venturing into more complex areas like decentralized finance. If you're looking to go deeper down that rabbit hole, our guide on what is decentralized finance is the perfect next step. Grasping these core ideas is your first move toward making smarter, more confident decisions in crypto.

How Token Supply and Distribution Create Value

Right at the very heart of tokenomics sits a concept humans have understood for millennia: scarcity. The old laws of supply and demand aren't just for physical stuff like gold or real estate; they are the fundamental forces giving digital assets their economic pulse.

How many tokens exist, how many ever will exist, and how they find their way into the market—these are the bedrock principles that shape a token's long-term story. Think of a token's supply not just as one piece of the puzzle, but as the very box the puzzle comes in.

The Different Flavors of Supply

When you start digging into a token's supply, you'll bump into a few key terms. Getting these straight is the first step to really getting how a digital economy is built. You have to look beyond a single number to see the full picture.

There are three main metrics to keep an eye on:

Maximum Supply: This is the absolute hard cap on the number of tokens that will ever be created. Bitcoin’s famous 21 million coin limit is the perfect example—no more can ever be minted, creating a powerful sense of digital scarcity. Not every project has one of these.

Total Supply: This is the total number of tokens that exist right now, minus any that have been verifiably "burned" or destroyed. It can be the same as the maximum supply, or it can be lower if more tokens are still scheduled to be created.

Circulating Supply: This is the one that really matters for day-to-day trading. It’s the number of tokens actually available to the public and moving around on markets. This is the total supply minus any tokens locked up, reserved for the team, or otherwise kept out of public hands for a while.

That gap between the circulating supply and the total supply can tell you a lot. A big difference might mean a flood of tokens is set to be released down the road, which could create selling pressure and water down the value for everyone already holding.

Fixed vs. Inflationary Models

Projects usually pick one of two main supply models, and each has totally different economic vibes.

A fixed-supply model, like Bitcoin's, is designed to be deflationary. Since the supply is finite, as demand grows over time, the value of each token should, in theory, go up. This model takes a page from precious metals like gold, positioning the asset as a potential store of value.

On the other hand, some projects use an inflationary model, where new tokens are always being created with no hard cap. It sounds a bit risky, but it's often a clever way to fund ongoing network security and development. For instance, new tokens can be paid out as rewards to people who help validate transactions. The trick is making sure the inflation rate is predictable and controlled, so it doesn't spiral out of control and tank the currency's value.

The Critical Role of Distribution

Finally, how the tokens are handed out at the very beginning is a massive tell about a project's fairness and how decentralized it really is. If a project gives a huge chunk of its tokens to the founders and early VCs, you might run into centralization risks, with a small group holding way too much influence over the network and its price.

Some common ways tokens get out there include:

Fair Launch: Think Bitcoin, where everyone had a pretty equal shot from day one to get tokens through mining.

Initial Coin Offerings (ICOs): Public sales where investors can buy tokens before they hit the open market.

Airdrops: Free tokens given out to early users or community members to kickstart a user base.

How tokens are allocated to liquidity pools—which are the lifeblood of decentralized trading—is another crucial factor. This stuff is vital, and you can get a better handle on it by checking out our guide on what are liquidity pools.

At the end of the day, a transparent and fair distribution plan builds trust and sets the stage for a healthy, community-driven ecosystem.

The Power of Purpose: Understanding Token Utility

If token supply mechanics tell us how scarce a token is, its utility tells us why anyone should care. A token without a real job to do is just a speculative asset, like a key with no lock—it might look shiny, but it doesn't actually open any doors.

Utility is what gives a token purpose. It’s the magic ingredient that turns a string of code into an essential piece of a digital economy.

Think of it like going to an arcade. You hand over your dollars and get a cup full of custom tokens. Outside that building, they're worthless pieces of metal. But inside, they're everything. They let you play Pac-Man, challenge your friend to air hockey, and earn tickets. They are the lifeblood of that specific ecosystem.

That's exactly how token utility works in crypto. It's the specific set of jobs a token can do within its own network. This creates real, organic demand from people who actually want to use the platform, not just flip the token for a quick profit.

The Core Jobs of a Utility Token

While the exact functions can get pretty creative, most utility tokens are designed to do a few critical jobs. These roles are the gears that keep the whole machine running, making sure the network is secure, functional, and accessible.

Here are the most common forms of utility you'll run into:

Paying Network Fees: This is the most basic, yet crucial, job. On blockchains like Ethereum, every single transaction or smart contract interaction costs a small fee, known as "gas." You have to pay these fees in the network's native token (ETH), creating a constant, underlying demand.

Securing the Network (Staking): In Proof-of-Stake systems, users can lock up their tokens—a process called staking—to help validate transactions and keep the network secure. In return for their service, they earn rewards, which is a powerful reason to hold the token long-term.

Participating in Governance: Many DeFi projects are basically run by their communities. Holding a project's governance token is like owning shares in a company; it gives you voting rights. This lets you propose and vote on huge decisions that shape the protocol's future.

This kind of demand isn't built on market hype; it’s driven by actual activity. This is a huge piece of the puzzle in answering what is tokenomics, and it often dictates a token's price stability. Just look at Ether (ETH). It's essential for paying fees and interacting with dApps on Ethereum, which regularly processes over 1.2 million transactions daily. That activity generates millions in daily fees, anchoring ETH's value to the network's health. For a deeper dive, check out these insights on tokenomics.

Utility in Practice: Ethereum vs. Uniswap

To see this in action, let's compare two of the biggest players. Ethereum's ETH is the poster child for broad, foundational utility. You need it for practically everything on the network—sending funds, minting an NFT, or using a DeFi protocol. Its demand is directly tied to the success of the thousands of applications built on top of it.

Now, let's look at a different flavor. The UNI token from the decentralized exchange Uniswap has a much more focused job: governance. UNI holders get to vote on proposals that steer the platform's future, like which new fee tiers to introduce or how to spend the protocol's treasury. While it doesn't pay for transactions on Ethereum, its utility gives the community direct control over one of DeFi's most important platforms.

A token's utility is its reason for being. Strong, tangible use cases create a feedback loop where network growth drives token demand, which in turn supports the network's value and security.

Without a compelling reason to hold and use a token, a project is just a ship without a rudder. That’s why digging into a token’s real purpose is a non-negotiable step in analyzing its tokenomics. It's how you separate the projects with genuine economic substance from those built on nothing but hot air.

How Decentralized Governance Shapes a Project

If supply mechanics are the engine of a crypto project and utility is the fuel, then you can think of governance as the steering wheel. In the old world of traditional companies, a handful of executives and board members make all the big decisions behind closed doors. In DeFi, the community often gets to call the shots, and that’s a core piece of what tokenomics is all about.

This power shift is one of the most exciting parts of blockchain. Instead of a top-down structure, many projects are run from the bottom up by the very people using and owning a piece of the network. This all happens through things called governance tokens.

The Power of a Vote

Think of a governance token like a share in a company, but one that comes with real voting rights. Holding that token gives you a direct say in where the project is headed. The more tokens you hold, the more your vote counts. This model flips the script, turning passive users into active stakeholders who have a real interest in seeing the protocol succeed long-term.

With this power, community members can propose and vote on all sorts of critical changes.

Software Upgrades: Deciding which new features get built or what technical improvements are prioritized.

Fee Structures: Tweaking the protocol's fees to stay competitive or boost its revenue.

Treasury Management: Figuring out how to spend community-owned funds on things like developer grants, marketing campaigns, or new hires.

Parameter Changes: Adjusting key variables in a lending protocol, like interest rates or collateral requirements.

And this isn't just a suggestion box. It's a system where the outcome of a vote is often automatically executed by smart contracts. This makes sure the community's decision is carried out transparently, with no room for anyone to interfere.

Different Models of Community Control

Of course, not all governance systems are built the same. The most common approach is a simple one-token, one-vote system. It’s straightforward, but it can create problems where massive investors (or "whales") can dominate the decision-making and push through proposals that might not be in the best interest of smaller holders.

To fight this, some clever models have popped up. Some projects use quadratic voting, where the power of your vote doesn't scale linearly with the number of tokens you have, which gives smaller participants a louder voice. Others use time-locked voting—the longer you lock up your tokens, the more voting power you get, which encourages long-term thinking and commitment.

A strong, transparent governance model is absolutely essential for a project's health. It lets the protocol adapt and evolve in a way that aligns the incentives of everyone involved—from the core team to the newest user.

A project with a solid governance framework can navigate tough times and jump on new opportunities way more effectively than one controlled by a central team.

Governance in the Real World: MakerDAO

MakerDAO, the project behind the DAI stablecoin, is a classic example of decentralized governance in action. The whole show is run by holders of its MKR token. Anyone with MKR can vote on proposals that manage the entire Maker ecosystem, including the critical risk parameters that keep the DAI stablecoin pegged to the US dollar.

MKR holders have voted on everything from adding new types of collateral to adjusting the fees that keep the system stable. This community-led approach has helped MakerDAO survive some absolutely wild market swings and become a true cornerstone of DeFi.

The integrity of these votes hinges on the code running the show, which makes its security a top priority. This is where a smart contract security audit comes in—it’s the process of verifying that the code does exactly what it's supposed to, protecting the whole system from bugs or bad actors.

Ultimately, a project’s governance structure tells you a lot. It reveals who really holds the power and whether the project is built to serve its community or just a chosen few. Understanding this is a critical piece of the puzzle when you’re evaluating any project's tokenomics, as it points to its real chances of long-term survival and true decentralization.

Tokenomics in Action: Real-World Case Studies

Theory is one thing, but seeing tokenomics out in the wild is the best way to really get it. When you break down the economic wiring of actual projects, the abstract ideas click into place. You start to see how these carefully crafted rules create entire digital economies, each with its own quirks and goals.

Let's dive into some of the heavy hitters and see how their tokenomics work.

Bitcoin: The Original Digital Gold

Bitcoin (BTC) is the OG, and its tokenomics are beautifully simple. Everything revolves around a single, powerful principle: digital scarcity.

Its creator, the mysterious Satoshi Nakamoto, hard-coded a maximum supply of exactly 21 million BTC. That’s it. It’s a non-negotiable hard cap, meaning no more can ever be created. This masterstroke was designed to mirror the finite supply of precious metals like gold, positioning Bitcoin as a potential store of value and a hedge against inflation.

BTC's utility is refreshingly straightforward. It’s designed to be a peer-to-peer electronic cash system. Its main job is to provide a secure, decentralized way to send and store value without relying on a bank. There’s no complex governance model—the rules were set in stone from day one, and changing them requires a level of consensus that’s nearly impossible to achieve.

Key Takeaway: Bitcoin's tokenomics puts scarcity and security above everything else. Its fixed supply and simple purpose are all about creating a tough, decentralized monetary asset.

Ethereum: Fuel for the World Computer

Ethereum (ETH) went down a completely different road. It wasn't trying to be digital gold; it was built to be the fuel for a decentralized "world computer." This core difference shows up everywhere in its tokenomics.

Originally, Ethereum had no maximum supply. This made it an inflationary asset, designed to continuously reward miners for keeping the network secure. But things have gotten a lot more interesting since then. With massive upgrades like "The Merge" and the introduction of token burning (EIP-1559), ETH's model has shifted dramatically. It's now potentially deflationary, meaning more ETH can be destroyed than created.

ETH’s utility is huge and has many layers:

Gas Fees: You absolutely need ETH to pay for any transaction or smart contract you run on the Ethereum network. It's the cost of doing business.

Staking: Holders can "stake" their ETH to help secure the network, and they earn more ETH as a reward for doing so.

DeFi Collateral: It's the number one asset used as collateral in the world of decentralized finance, backing up everything from loans to stablecoins.

This deep, multi-faceted utility creates constant, organic demand that’s tied directly to the health and growth of its entire ecosystem.

Uniswap: Power to the People

Jumping into the DeFi space, Uniswap (UNI) is a perfect example of tokenomics built for community governance.

The main reason the UNI token exists isn't to pay for transactions, but to give its holders governance rights. Every UNI token acts as a vote, putting the community in the driver's seat of one of DeFi’s most important pieces of infrastructure. Holders can propose and vote on everything from changing protocol fees to deciding how to spend funds from the community treasury.

This setup is all about shifting power away from the founding team and into the hands of the people who actually use the platform. The incentive is crystal clear: if you depend on Uniswap, holding UNI gives you a real say in its future.

Axie Infinity: Fueling a Digital Nation

Finally, let's take a look at the metaverse. Axie Infinity uses a clever dual-token model to power its sophisticated play-to-earn economy.

Axie Infinity Shards (AXS): This is the governance token. Think of it like holding a share in the government of this digital nation. AXS holders can stake their tokens to earn rewards and vote on where the Axie universe goes next.

Smooth Love Potion (SLP): This is the utility token. You earn it by playing the game, and its main purpose is breeding new Axies. It has an uncapped supply, creating a neat circular economy where players earn SLP, use it to create new assets (the Axies), and can then sell those assets to new players.

This dual-token system cleanly separates governance from the day-to-day in-game economy. It gives the developers the flexibility to tweak the game's economy without messing with the core power structure. It’s a fantastic look at how tokenomics can be used to build complex, self-sustaining digital worlds.

To really see how these designs differ, it helps to compare them side-by-side.

Tokenomics Comparison of Major Cryptocurrencies

The table below breaks down the key tokenomic differences between Bitcoin, Ethereum, and a leading DeFi token like Uniswap. It highlights how their intended purpose directly shapes their economic DNA.

Project | Supply Model | Primary Utility | Governance Mechanism |

|---|---|---|---|

Bitcoin | Hard-capped at 21 million BTC. Designed for absolute scarcity. | Peer-to-peer value transfer and store of value. | Minimalist; changes require near-unanimous network consensus. |

Ethereum | Potentially deflationary. Supply changes based on network activity. | "Gas" for transactions, staking for security, and collateral in DeFi. | Off-chain social consensus and core developer coordination. |

Uniswap | Fixed supply of 1 billion UNI. Primarily for governance, not fees. | Voting on protocol upgrades, fee changes, and treasury allocations. | On-chain voting directly controlled by UNI token holders (a DAO). |

As you can see, there's a world of difference between a model designed for scarcity versus one built for utility or governance.

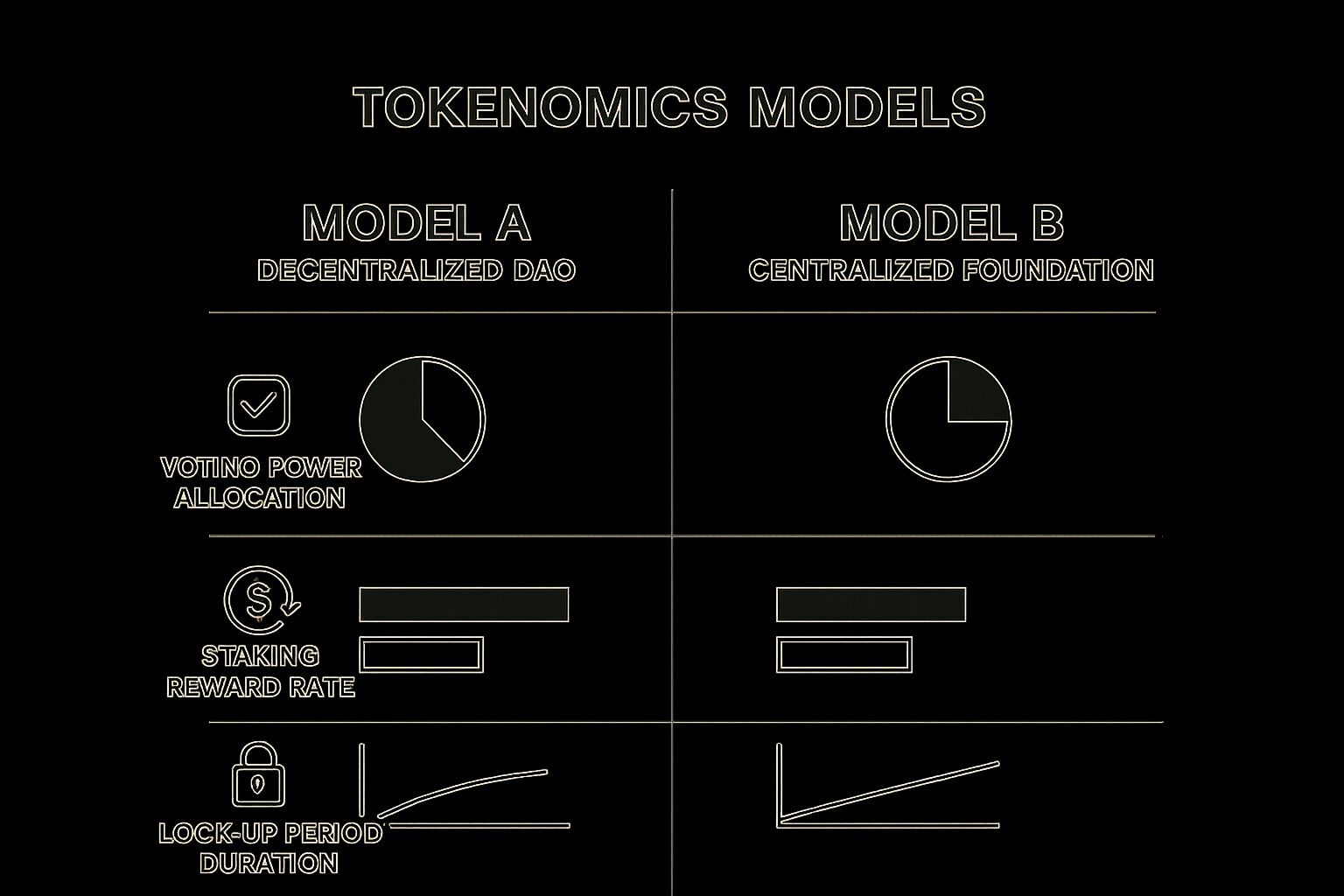

The chart below also shows two common approaches to distributing power and incentives, contrasting a decentralized model with a more centralized one.

This visual makes it clear that while DAOs spread power out more evenly, a centralized foundation can sometimes offer more stable incentives. From Bitcoin's beautiful simplicity to Axie's intricate internal market, these examples prove there’s no single right answer. Tokenomics is a powerful toolkit for building entirely new digital worlds, each with its own set of rules.

Using Tokenomics to Make Smarter Crypto Decisions

So now you can see that digging into what is tokenomics is way more than just a box-ticking exercise—it’s probably the most powerful research tool you have. It's easy to get distracted by flashy price charts and all the noise on social media, but that stuff often tells a fleeting story. The real, long-term potential of any digital asset is written in its economic code.

A project’s tokenomics is its DNA. It lays bare whether an ecosystem is actually built for sustainable growth or if it’s just a house of cards waiting for the wind to change. Once you learn to read this economic blueprint, you can start moving beyond pure speculation and making strategic moves with a whole lot more confidence.

A Practical Checklist for Evaluating Projects

To put this into action, I've got a simple framework of questions for you. Before you even think about getting involved with a new crypto project, run it through this tokenomics checklist. The answers will give you far more clarity than any price prediction ever could.

Supply Dynamics: Is the total supply capped like Bitcoin’s, or is it inflationary? If new tokens are always being created, what’s the emission rate? Critically, does it outpace any token-burning mechanisms? A fast-inflating supply will eat away at the value of your holdings over time.

Token Utility: What’s the token's actual job in the ecosystem? Is it absolutely essential for paying fees, taking part in governance, or using the project’s services? A token without a clear, compelling purpose is going to struggle to create real, organic demand.

Distribution Fairness: How were the tokens handed out at the start? You want to look for red flags, like a massive chunk of the supply being held back for the team and early investors. That can lead to centralization and create huge selling pressure down the road when they decide to cash out.

Value Accrual: How does the project’s success actually benefit you as a token holder? Does the protocol generate real revenue, and is any of that value channeled back to the people who own the token? This could be through things like buybacks or sharing a cut of the fees.

Ultimately, solid tokenomics aligns the incentives of everyone involved. It ensures that as the project grows and succeeds, so do the community members who support it.

By asking these key questions, you shift your entire focus from short-term hype to long-term health. You’re no longer just taking a guess; you’re analyzing the fundamental economic design. This is how you start to navigate the wild world of crypto with clarity, spotting the durable projects that are actually built to last.

Frequently Asked Questions About Tokenomics

Even after getting the basics down, it’s totally normal for a few questions to pop up. Let's run through some of the most common ones to clear up any lingering confusion and make sure you've got a solid grasp of tokenomics.

What Is the Difference Between Tokenomics and Economics?

Think of economics as the huge, big-picture study of how entire countries and societies handle their money—everything from national interest rates to global trade falls under its umbrella. It's macro.

Tokenomics, on the other hand, is a super-specialized niche within that world. It takes those same broad economic ideas and applies them to the tiny, self-contained economy of a single crypto asset. It's the set of rules, all written in code, that dictates how one specific token lives and breathes.

What Does It Mean to Burn Tokens?

Token burning is just a fancy way of saying tokens are being permanently destroyed and removed from circulation. Projects do this by sending them to a special, one-way digital address that no one can access. Think of it like a digital black hole; once tokens go in, they never come out.

The whole point of burning tokens is to create a deflationary effect. By shrinking the total supply, the tokens that are left become scarcer. The idea is that this scarcity will, in theory, drive up the value for everyone still holding them.

How Can I Research a Project’s Tokenomics?

Getting a handle on a project's economic model is one of the most important things you can do before putting any money in. Your research should always start with a few key sources to get the full story.

Here’s a simple, three-step approach that works every time:

Read the Whitepaper: This is the project's official playbook. It should spell out everything you need to know about supply, how tokens are handed out, and what you can actually do with them.

Verify with Data Aggregators: Don't just take their word for it. Use trusted, independent sites like CoinGecko or CoinMarketCap. These platforms give you the real-time, unfiltered data on things like circulating supply, total supply, and market cap.

Explore Official Docs: Go beyond the whitepaper. Check out the project’s website, forums, and community channels (like Discord). This is where you’ll see how the token is actually being used and whether the governance model works in practice.

Ready to put your knowledge to work without the endless research? Yield Seeker uses an AI Agent to automatically find and manage the best stablecoin yields in DeFi for you. Start earning smarter, not harder, in just a few clicks. Learn more at https://yieldseeker.xyz.