Back to Blog

A Guide to Yield Farming Automation for Passive Income

Discover how yield farming automation works. This guide explains how to earn passive income on your crypto with automated, AI-driven DeFi strategies.

Dec 30, 2025

generated

Think of yield farming automation as your own personal finance bot, working tirelessly around the clock to hunt down and capture the best returns in DeFi. It takes what is normally a complex, hands-on slog and turns it into a simple, automated way to generate passive income. This makes some pretty sophisticated DeFi strategies accessible, even if you're not a crypto wizard.

What Is Yield Farming Automation and How Does It Work?

Imagine trying to get the absolute best interest rate on your savings by physically moving your money between different banks every single hour of the day. You’d have to constantly research rates, pay transfer fees, and stay awake 24/7 just to keep up. Honestly, that’s what manual DeFi yield farming can feel like—a high-stress, full-time job.

Yield farming automation is the tech that does all of that heavy lifting for you. It’s the difference between driving a stick shift and hopping into a self-driving car. With a manual, you’re in charge of every gear change, every turn, every tap of the brake. With a self-driving car, you just punch in your destination, and it handles the rest. Automated platforms are the self-driving cars of DeFi, navigating all the complex moves on your behalf.

The Shift from Manual Effort to Automated Efficiency

The core idea is beautifully simple: instead of you chasing the best yields, an automated system does it for you. These platforms use smart contracts and algorithms to shuttle your capital between different lending protocols, liquidity pools, and other DeFi opportunities. The goal is always to maximize your returns while cutting down on pesky costs like transaction fees.

This "set it and contribute" approach creates a genuinely hands-off way to earn yield on assets like stablecoins. If you want to get back to basics, check out our guide that explains DeFi yield farming in more detail.

This shift has been a game-changer for the industry. We've seen DeFi evolve from a hype-driven gold rush of insane triple-digit APYs to a more sustainable model, and automation is a huge reason why. As the total value locked (TVL) in DeFi blew past $90 billion, automated yield platforms became a cornerstone of the ecosystem, with the market projected to hit $154 million by 2031.

Pioneers like Yearn Finance and Beefy led the charge, offering reliable returns by plugging into audited, battle-tested protocols like Curve.

By taking constant manual meddling and emotional decision-making out of the equation, yield farming automation unlocks a level of efficiency and consistency that's almost impossible to achieve by hand. It’s not just about saving time; it's about making smarter, data-driven financial moves 24/7.

How Automated Yield Farming Platforms Operate

To really get what makes yield farming automation tick, you have to look under the hood. Don't think of an automated platform as a single tool. Instead, picture it as a team of digital asset managers working around the clock, executing complex financial strategies that you wouldn't have the time to do yourself.

At the core of these platforms, you'll find strategy vaults or smart agents. These are basically pools of capital run by smart contracts—code that executes itself on the blockchain. When you deposit your funds, you're putting them into a specific vault programmed with a set of rules all aimed at one thing: generating yield.

These agents operate with a speed and precision that's simply not humanly possible. They are constantly scanning the DeFi landscape, ready to pounce on opportunities the second they pop up, 24/7.

Core Automated Strategies in Action

While the tech behind it all is pretty complex, the strategies these vaults run are based on straightforward, profit-driven ideas. They're built to do two things really well: push earnings as high as possible and keep costs as low as possible.

Here are a few of the most common moves they make:

Auto-Compounding: This is the crypto version of a snowball rolling downhill and getting bigger. Instead of letting your earned rewards just sit there, the system scoops them up and reinvests them straight back into the strategy. This can happen multiple times a day, creating a powerful compounding effect that can seriously boost your annual percentage yield (APY) over time.

Dynamic Asset Allocation: The DeFi market is always moving; yields can swing wildly in just a few minutes. Automated platforms are constantly scanning hundreds of different protocols to sniff out the highest, most stable returns. If a better, safer opportunity shows up, the smart agent can automatically move your funds over to grab that higher yield. This is often called rebalancing.

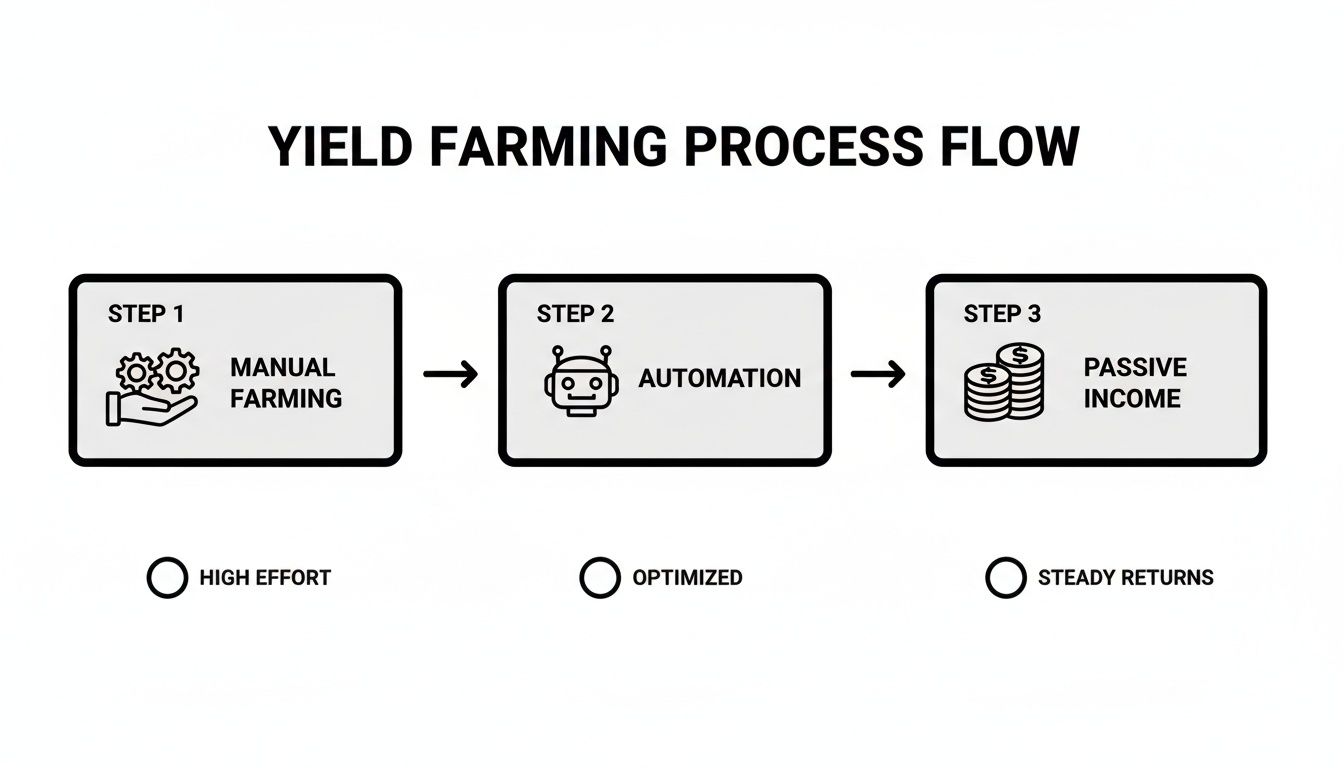

This diagram breaks down the shift from the high-effort grind of manual farming to a smooth, automated income stream.

You can see how automation is the key piece in the middle, turning all that manual work into a passive reward system.

The Art of Automated Harvesting

Let's use a garden analogy. Think of your deposited funds as seeds you've planted in different DeFi gardens (protocols). These seeds grow and produce fruit (your yield). If you were farming manually, you'd have to decide exactly when to pick that fruit.

Do you harvest every hour? The gas fees might eat up all your profits. Do you wait a week? You could miss out on the chance to reinvest your earnings and let them compound.

Automated yield farming takes all the guesswork and emotion out of this crucial decision. By analyzing network fees and expected earnings, the platform figures out the most profitable moment to 'harvest' your rewards, making sure transaction costs never cancel out your gains.

This optimization is a core function of platforms known as yield aggregators. If you want to go deeper on this, you can explore our detailed guide on how a yield aggregator works in crypto.

The Power of Smart Agents and Vaults

Platforms like Yield Seeker push this idea even further by giving each user their own personalized AI Agent. Instead of lumping everyone's funds into one giant vault with a single, one-size-fits-all strategy, these agents manage your capital based on your personal profile and how much risk you're comfortable with.

This approach has some clear wins:

Personalized Strategy: The agent can tailor its moves to your specific goals, not just follow the crowd.

Enhanced Transparency: You can see exactly what your agent is up to and which protocols it's using.

Improved Security: Your funds are managed in a more contained way, which can reduce certain types of systemic risk.

By combining auto-compounding, dynamic allocation, and smart harvesting, automated platforms create a seriously efficient engine for passive income. They cut out human error, take emotional decision-making off the table, and execute strategies at a scale and speed that you just can't match on your own.

Comparing Automated Versus Manual Yield Farming

Thinking about how to approach yield farming? It’s a lot like choosing between being a full-time day trader or a passive index fund investor. Both want to see their money grow, but the journey to get there couldn't be more different. One path demands your constant attention and hands-on effort, while the other is built from the ground up for efficiency and simplicity.

Manual yield farming essentially makes you a DeFi portfolio manager. Your days are spent hunting for new high-yield protocols, digging into smart contract risks, and manually shuffling your funds around to chase the highest returns. Every single transaction is on you, from harvesting your rewards to compounding them back into your position.

This isn't a casual hobby; it demands a huge time commitment and some serious expertise. You need a solid grasp of market dynamics, you have to stay on top of protocol security updates, and you must time your transactions perfectly to avoid getting crushed by gas fees. It's a high-stakes job where one mistake—like miscalculating gas or jumping into a risky new protocol—can vaporize your hard-earned profits.

The Automated Advantage: Set It and Contribute

Yield farming automation completely flips the script. It’s a ‘set it and contribute’ approach where sophisticated algorithms and smart contracts do all the heavy lifting. Instead of you spending hours researching and executing trades, the platform handles it for you, 24/7.

These systems are fine-tuned to optimize every single step. They automatically compound your earnings at the most cost-effective moments, making sure gas fees don't chip away at your returns. They also rebalance your capital across a carefully vetted portfolio of DeFi protocols, seamlessly moving funds to capture better yields as the market shifts.

The real magic of automation is that it removes human error and emotional decision-making from the equation. An algorithm doesn't get greedy or fall prey to fear; it just executes its strategy based on cold, hard data, leading to far more consistent and disciplined performance over time.

This makes DeFi accessible to a much wider audience. You don't need to be a blockchain wizard or dedicate your entire day to market analysis to get involved. With platforms like Yield Seeker, you can simply deposit stablecoins and let a personalized AI Agent manage the complex allocation and optimization for you. It turns a high-effort, high-stress activity into a genuinely passive one.

A Head-to-Head Breakdown

To really see the difference, let’s put the two approaches side-by-side. The contrast becomes pretty stark when you weigh the resources required against the potential outcomes.

Manual vs Automated Yield Farming: A Head-to-Head Comparison

The table below breaks down the key differences between doing it all yourself and letting a platform handle the work.

Feature | Manual Yield Farming | Automated Yield Farming |

|---|---|---|

Time Investment | A significant daily commitment, often hours per day. | Minimal after initial setup; a 'set it and contribute' model. |

Required Expertise | High; requires deep knowledge of DeFi, risk assessment, and transaction management. | Low; designed for both beginners and experts seeking efficiency. |

Risk of Human Error | High; mistakes in transactions or strategy can lead to significant losses. | Extremely low; strategies are executed flawlessly by code. |

Efficiency | Inefficient; gas fees can easily outweigh small gains if not managed perfectly. | Highly efficient; algorithms optimize transactions for maximum cost savings. |

Strategy Execution | Limited by human speed and availability; you can't operate 24/7. | Continuous 24/7 operation, capturing opportunities as they arise. |

As DeFi continues to mature, even the pros are shifting heavily toward automation. A common portfolio strategy emerging among savvy investors involves allocating 70% to established automated aggregators, 20% to newer auto-strategies, and reserving only 10% for high-risk manual plays on brand-new protocols. This hybrid model takes advantage of the relentless efficiency of algorithms while saving manual effort for speculative gambles where a human edge might still exist in the first few hours of a protocol’s launch. You can find more on this strategic split and what it means for profitability in 2025.

At the end of the day, while manual farming gives you total control, that control comes at the high cost of your time, stress, and capital. Yield farming automation offers a powerful alternative, delivering optimized returns without asking you to become a full-time DeFi analyst.

Understanding the Risks of Automated Yield Farming

While automated yield farming is a fantastic way to earn passive income, it's not a magic money machine. Just like any other corner of the crypto world, there are risks involved. Getting a handle on these risks is the first step to farming with confidence.

Think of it less like a list of deal-breakers and more like learning the rules of the road. You wouldn't drive without knowing what a stop sign means, right? Same principle. A smart farmer doesn't ignore the dangers; they understand them and figure out how to sidestep them.

Smart Contract Risk

At the very core of every DeFi protocol, you'll find a smart contract. This is just a piece of code that runs on the blockchain, moving funds around and executing trades automatically. The automation platforms we're talking about work by plugging into the smart contracts of dozens of different protocols to chase the best yields for you.

Here’s the catch: code can have bugs. And where there are bugs, there are hackers looking for a way in to drain a protocol's funds. It's an unfortunate reality that even big, reputable projects can get hit by a clever exploit.

The best defense here is to use an automation platform that is incredibly picky about where it puts your money. Top-tier services, like Yield Seeker, will only connect with protocols that have gone through multiple independent security audits and have a long, proven history of keeping user funds safe.

Impermanent Loss Explained

If you've ever dipped your toes into providing liquidity on a decentralized exchange (DEX), you've probably run into the term impermanent loss. It sounds scarier than it is. It’s a specific risk that only applies when you put assets into a liquidity pool.

Let's say you deposit an equal value of two tokens, like ETH and USDC, into a pool. If the price of ETH suddenly moons while USDC stays put, the pool's algorithm has to rebalance your share. You'd end up with less ETH and more USDC than when you started.

If you decided to pull your funds out right then, the total dollar value might actually be less than if you had just held onto your original ETH and USDC separately. That difference is the impermanent loss. It's "impermanent" because it only becomes a real loss if you withdraw your funds at that specific moment.

The easiest way to dodge this bullet entirely is to stick with stablecoin strategies. When you provide liquidity for pools with two tokens pegged to the same value (like USDC and DAI), the price divergence that causes impermanent loss is pretty much a non-issue.

Platform and Counterparty Risk

Lastly, you have to consider the risk of the automation platform itself. This is often called platform risk or counterparty risk. When you use a service to automate your yield farming, you’re placing a degree of trust in their team, their code, and their security measures. You're counting on their smart contracts being solid and their team to act in your best interest.

This is where reputation and transparency are everything. You should be on the lookout for platforms that:

Have experienced and public teams behind them.

Get their own systems audited by respected third-party security firms.

Are upfront about their strategies and the protocols they interact with.

A really good automated system can also act as a shield against market chaos. When the Terra Luna ecosystem collapsed, manual farmers who were chasing that juicy 19.5% APY on Anchor Protocol got absolutely wrecked. By contrast, the algorithms at Yearn Finance had already sniffed out trouble and started pulling exposure to UST weeks before the crash, saving their users from disaster. As the global DeFi yield farming market is projected to hit USD 154 million by 2031, it's obvious that smart, risk-aware strategies are the only way to play the long game. You can find more details on how automated platforms navigate market volatility on bitcoin.tax.

At the end of the day, managing risk in automated yield farming isn’t about trying to avoid it completely—that’s just not possible. It's all about making smart, informed choices that put the odds in your favor. By sticking to audited platforms, focusing on stablecoin strategies, and understanding how things work under the hood, you can put your assets to work with peace of mind.

How AI Is Revolutionizing Yield Farming Automation

If standard yield farming automation is like a self-driving car sticking to a pre-programmed route, then AI-driven automation is a seasoned chauffeur. This chauffeur knows every shortcut, anticipates traffic jams, and can even predict where the next big event is happening. One follows rules; the other makes smart, forward-looking decisions.

This is the next evolution of yield farming. Instead of just executing simple commands like "harvest when gas fees are low," Artificial Intelligence brings predictive analytics and machine learning into the mix. We're moving beyond reactive tweaks to proactive, intelligent portfolio management.

From Rules-Based to Predictive Strategies

Traditional automation is great, but it has its limits. It runs on straightforward "if-this-then-that" logic. An AI-powered system, on the other hand, can chew through thousands of data points at once to forecast what might happen next.

This is huge. It means the system can spot opportunities before they hit the mainstream. An AI model can process a staggering amount of information that a human—or even a basic algorithm—could never manage, including:

On-chain data like transaction volumes, liquidity depths, and wallet activity.

Market sentiment scraped from social media, news articles, and developer forums.

Protocol health metrics such as developer commits, governance proposals, and tokenomics.

By weighing all these factors, an AI can flag a promising new protocol with solid fundamentals well before its APY skyrockets, getting you in early for the best possible returns. This idea is central to a modern yield optimization protocol, where the goal isn't just to find high yields, but to find them intelligently.

AI-Powered Dynamic Risk Assessment

One of the biggest leaps forward AI brings to the table is real-time, dynamic risk assessment. In older systems, risk is often just a static number based on a protocol's age or whether it's been audited. An AI model treats risk as something that's constantly changing.

AI can create a live "risk score" for every protocol it interacts with. This score is continuously updated based on factors like sudden drops in liquidity, unusual transaction patterns, or negative sentiment spreading online.

Think of this system as an early warning alarm. If a protocol's risk score suddenly spikes, the AI can automatically pull your funds to safety, long before any official news breaks. It’s like having a vigilant security guard watching your investments 24/7, spotting subtle signs of trouble that everyone else might miss. For those curious about the nuts and bolts, understanding how AI-powered software development strategies are used provides some fascinating insights into how these systems are built.

This intelligent approach turns yield farming from a simple chase for big numbers into a sophisticated game of managing risk-adjusted returns. Platforms like Yield Seeker are built on this philosophy, giving each user a personalized AI Agent. This agent doesn't just blindly chase the highest APY; it balances that ambition against a constantly shifting risk landscape to protect and grow your capital for the long haul.

By making strategies adaptive, predictive, and risk-aware, AI isn't just tweaking yield farming automation—it's completely redefining what's possible. It unlocks a level of performance and security that simple, rule-based systems just can't touch, making DeFi investing smarter and safer.

Getting Started with Automated Yield Farming

Jumping into automated yield farming is a lot less intimidating than it sounds. The first few steps are pretty straightforward, even if you’re totally new to DeFi. Think of it like opening a high-yield savings account, just with a few crypto tools instead of a bank.

The whole setup really just boils down to a few key moves: getting a digital wallet, loading it up with the right crypto, and linking it to a platform that can put your money to work. Once you’re connected, the system takes the wheel. Your main job is just to watch it grow.

Your Onboarding Checklist

Getting started is a simple, logical sequence. Follow these steps, and you’ll be ready to make your first deposit and start earning passive income with your stablecoins. Each step builds on the last, giving you a solid footing for your DeFi journey.

Here's the simple, five-step game plan to get you up and running:

Set Up a Web3 Wallet: Your wallet is your key to the DeFi world. Options like MetaMask, Coinbase Wallet, or Rabby are all solid choices. They act like a digital bank account that only you control, letting you securely connect to blockchain apps.

Get Some Stablecoins: To keep things low-volatility, it’s smart to start with stablecoins like USDC. You can buy them on a major exchange and then send them over to your new Web3 wallet. This is the fuel for your yield farming engine.

Choose a Reputable Platform: Find an automation platform that fits what you’re looking for. You’ll want one with clear fees, no lock-up periods, and a serious focus on security. A clean, user-friendly interface is also a huge plus.

Connect and Deposit: Head to the platform’s website and connect your wallet—it’s usually just a single click. From there, you can decide how much USDC you want to put in. Platforms like Yield Seeker let you start with as little as $10, which makes it super easy to dip your toes in.

Track Your Earnings: Once your deposit goes through, the automation kicks in. You can use the platform's dashboard to see your balance grow in real time. This is where you really see the power of passive income, as earnings pile up without you having to do a thing.

Pro Tip: Always start with a small amount you're comfortable with. This lets you get the hang of the platform's dashboard and the withdrawal process, helping you build confidence before you decide to move in more capital.

By following this clear path, you cut out all the complexity and guesswork. The whole point of yield farming automation is to make passive income easy and accessible, and a structured onboarding process is the first step to making that happen.

Common Questions About Automation

As you start looking into automated yield farming, you're bound to have some questions. It's totally normal. Getting straight answers is the only way to feel confident enough to put your money to work. Let's tackle the big ones.

Is Automated Yield Farming Safe?

This is the most important question, and the answer isn't a simple yes or no. Nothing in DeFi is 100% risk-free, let's get that out of the way. However, a good automation platform dramatically improves your safety. How? By acting as a strict security filter.

Reputable platforms only work with DeFi protocols that are heavily audited and have been around the block—the ones with a long, proven track record of keeping funds safe. This curation process alone cuts out the vast majority of risky, fly-by-night projects you might otherwise stumble into.

What Kind of Earnings Are Realistic?

It's easy to get lured in by stories of crazy, triple-digit APYs. While those days aren't entirely gone, they're usually tied to extremely high-risk, brand-new protocols. That's not what reliable automation is about. The focus today has shifted to sustainable, steady growth.

For anyone holding stablecoins, a consistent single-to-double-digit APY is a very achievable goal. It might not sound as flashy as a 100x moonshot, but it's a massive improvement over what you’d get from a typical high-yield savings account. The name of the game is steady, passive income, not speculative gambling.

Do I Have to Pay Taxes on My Earnings?

Yep, in most places, any profit you make from yield farming is considered taxable income. This means every time rewards are harvested or sold (even by an automated system), it can trigger a taxable event. Trying to track all of this by hand is a nightmare—trust me.

I always tell people to talk to a qualified tax professional who actually gets crypto. On top of that, using a dedicated crypto tax software is a lifesaver. It’ll help you accurately track everything so you stay on the right side of your local regulations without pulling your hair out.

How Much Money Do I Need to Start?

One of the best things about DeFi right now is how open it is. Gone are the days when you needed a huge pile of cash to get involved in interesting strategies. The barrier to entry has been almost completely torn down.

Many automated platforms, including our own Yield Seeker, let you get started with a tiny amount—sometimes as little as $10. This is perfect because it lets you dip your toes in, get a feel for the dashboard, and see how the system works without having to commit any serious capital. It really makes it easy for anyone to start their journey.

Ready to let an intelligent strategy put your stablecoins to work? Yield Seeker gives you a personalized AI Agent to find and capture competitive, risk-aware yields on your behalf. Start earning smarter passive income today at https://yieldseeker.xyz.