Back to Blog

Crypto Portfolio Management Software: Track & Grow Assets

Use crypto portfolio management software to get a complete view of your investments. Learn how to track, analyze, and optimize your crypto assets today.

Oct 6, 2025

generated

Think of crypto portfolio management software as your personal command center for everything you own in the digital asset world. It pulls all the scattered info from your exchanges, wallets, and DeFi protocols into one clean dashboard.

It’s the killer app that finally lets you ditch the clunky manual spreadsheets. The goal? To turn a mountain of raw data into clear, actionable insights so you can make smarter moves.

Why You Need a Crypto Portfolio Command Center

Imagine trying to captain a massive ship, but instead of a single bridge with all your controls, you have to sprint between a dozen different panels in separate rooms. One shows your speed, another your heading, and a third has the fuel gauge. It's a mess.

That chaotic scramble is exactly what managing a crypto portfolio feels like without the right software. You’re constantly juggling browser tabs, punching numbers into a spreadsheet, and trying to piece together a real-time picture of your actual net worth. In a market that never sleeps, this isn't just a headache—it's a surefire way to miss opportunities and make costly mistakes.

Moving Beyond Manual Spreadsheets

The biggest problem this kind of software solves is fragmentation. Your crypto is probably all over the place:

Centralized Exchanges: Think Coinbase or Binance, where you’re buying and selling the big names.

Hardware Wallets: Secure little devices like a Ledger or Trezor that are holding your long-term bags.

DeFi Protocols: Platforms where you might be staking, lending, or farming for yield.

NFT Marketplaces: Wallets holding your digital art and collectibles.

Without a central hub, figuring out your true profit and loss is a frustrating puzzle. It’s way too easy to forget about transaction fees, mess up your cost basis, or just lose track of smaller assets you bought ages ago. This gives you a totally distorted view of how your investments are really doing.

A crypto portfolio management tool works like a financial aggregator for your digital assets. It connects to all your accounts using secure, read-only APIs and automatically sucks in every transaction. The result is a unified, up-to-the-minute overview of your entire portfolio's value.

Gaining Clarity and Making Smarter Decisions

Once all your data is in one spot, the benefits are immediate and obvious. You can see at a glance which assets are crushing it, spot where you might be over-exposed to risk, and make strategic decisions to rebalance based on hard data, not just gut feelings.

These tools have become essential for pretty much everyone in the space, from individual traders to big institutions. For example, a major player like CoinStats helps over 1.2 million active users keep track of everything from their Bitcoin to obscure DeFi tokens and NFTs, all in real time. If you want to dig deeper, you can read more about the top crypto asset management tools and see the impact they're having on modern investing.

The Hidden Costs of Manual Crypto Tracking

Most of us start our crypto journey with a simple spreadsheet. It makes sense at first—a few rows for what you bought, a couple of columns for what you sold, and a neat little formula to tell you if you're winning. But as your portfolio blossoms from two assets to twenty across different exchanges and wallets, that tidy spreadsheet turns into a monster.

Picture this: the market is pumping, and you need to know your real-time value to decide if you should take profits. You pull up your spreadsheet, but it’s ancient history. You start frantically logging into Coinbase, Binance, and that DeFi wallet you barely use, trying to copy-paste every transaction. By the time you’ve wrangled all the data, the market has already dipped, and your perfect exit is gone.

This isn't just a hassle; it's a real financial hit. The old manual way is packed with hidden costs that go way beyond the hours you spend punching in numbers.

The Problem with Human Error

The biggest downfall of manual tracking? We’re human. A single misplaced decimal or a forgotten transaction fee can throw off your entire P&L. These tiny mistakes stack up, and before you know it, you’re looking at a completely warped picture of your portfolio's health.

Just think about all the data points you have to nail every single time:

Transaction Dates: Absolutely crucial for figuring out short-term vs. long-term capital gains.

Purchase Prices: The exact price you paid for every fraction of every coin.

Trading Fees: These pesky fees are easy to ignore, but they chew into your profits more than you think.

Gas Fees: Every single on-chain move has a cost that needs to be tracked.

Wallet Transfers: Moving assets around creates a paper trail that you have to follow perfectly.

Trying to manage all this by hand is practically asking for trouble. You might think an asset is your golden goose when, after you factor in all the fees, it’s barely breaking even. Making big decisions with bad data is like trying to sail across the ocean with a broken compass—you’ll end up somewhere, but it won't be where you planned.

Missed Opportunities and Flawed Strategies

The crypto market never sleeps, and the biggest moves always seem to happen when you're not looking. A manual spreadsheet gives you a static photo from the last time you had the energy to update it, which is completely useless when a sudden market tsunami hits. You miss the best times to sell at a peak or buy a dip because your info is stale.

The real cost of manual tracking isn't just the time you lose; it's the strategic advantage you give up. You're reacting to old information in a market that rewards speed and accuracy.

This outdated view also wrecks any chance of a coherent strategy. For instance, proper cryptocurrency portfolio rebalancing demands a live, accurate view of your asset allocation. If your spreadsheet claims you're at 30% ETH, but a recent price surge has actually pushed it to 45%, you're exposed to way more risk than you realize. Without automation, you can't rebalance properly to lock in gains and keep your risk in check.

The Nightmare of Tax Reporting

Maybe the most painful hidden cost smacks you right in the face during tax season. To calculate your capital gains and losses correctly, you need a flawless, chronological record of every single trade—the cost basis, sale price, and all the fees. Trying to piece this puzzle together from a messy spreadsheet and months-old exchange logs is an absolute nightmare.

This mess often leads to inaccurate tax filings, which can bring on costly penalties or mean you've overpaid. This is where dedicated crypto portfolio management software is a lifesaver. It automates the entire ordeal, generating the precise reports you need for tax time in just a few clicks. It transforms a week-long headache into a simple task, saving you from a world of pain and potential financial trouble.

What Makes a Great Portfolio Tracker Tick?

Not all crypto portfolio trackers are built the same. Sure, most can show you a total balance, but the best tools dig way deeper, turning a pile of raw data into a real strategic advantage. These are the core features that separate a glorified calculator from a true command center for your crypto assets, giving you the power to make smarter, more informed moves.

Think of it like swapping a paper map for a GPS with live traffic updates. They both show you the road, but only one helps you dodge traffic jams and find the fastest route in real-time. Let's break down the must-have features that deliver that level of clarity and control.

Automated API and Wallet Syncing

The absolute foundation of any serious portfolio tracker is its ability to automatically pull in your transaction data. This works through API (Application Programming Interface) connections to your exchanges and by syncing up with your public wallet addresses. This feature is like having a personal bookkeeper working for you around the clock.

Instead of painstakingly entering every single buy, sell, or transfer by hand, the software does all the heavy lifting. This pretty much eliminates human error, saves you countless hours, and guarantees your dashboard gives you a true, up-to-the-minute snapshot of your holdings. Without this, you’re basically just managing a fancy spreadsheet.

This infographic really drives home the point about securing these connections and your crypto assets as a whole.

As the image shows, strong security isn't just a feature; it's the bedrock everything else is built on. It ensures your financial data stays private and protected from any prying eyes.

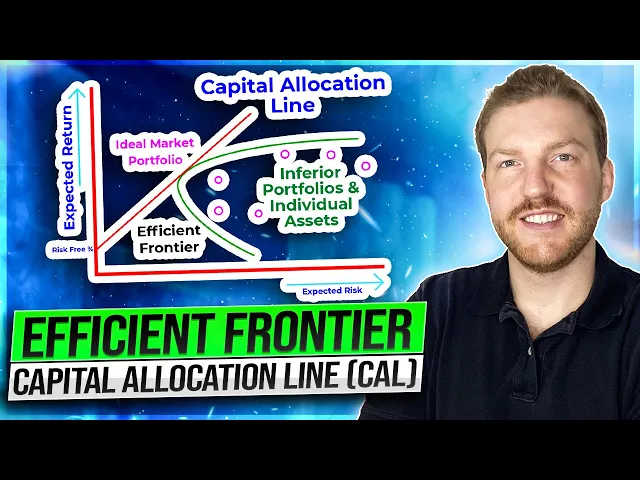

Advanced Performance Analytics

This is where you graduate from simply tracking your assets to actually understanding them. Advanced analytics peel back the layers to show you your true return on investment (ROI), factoring in all the pesky fees and hidden costs. They help you quickly identify your star performers and your duds, so you can double down on what’s working and cut your losses on what isn't.

Some of the key tools you'll find here include:

Profit/Loss Tracking: Instantly see your realized (cashed out) and unrealized (on paper) gains for every single asset and for your entire portfolio over any timeframe you choose.

Cost Basis Calculation: The software automatically figures out the original value of your assets. This is absolutely critical for both smart trading and, of course, for tax time.

Asset Allocation Insights: Get a crystal-clear visual breakdown of your portfolio. Are you too heavily exposed to one coin or sector? This will tell you at a glance.

When you're really diving into performance, understanding how different platforms handle their robust analytics capabilities is crucial. This isn't just a nice-to-have; it's a feature that directly impacts your ability to grow your portfolio.

Comprehensive DeFi and NFT Dashboards

The crypto world is so much more than just buying and holding coins. Today's investors are deep into yield farming, staking, lending, and collecting NFTs. A top-tier tracker has to give you a clear view into all these complex activities.

A dedicated DeFi dashboard is a game-changer. It pulls together all your positions from different protocols and blockchains into one clean, simple interface. That means no more jumping between Zapper, Uniswap, and Aave just to figure out where your money is and what it's earning.

Likewise, NFT tracking should show you more than just a picture of what you own. You need to see the collection's floor price, the estimated value of your specific pieces, and recent sales history. As demand for these tools explodes, so does the market. The global crypto asset management market was valued at USD 0.9 billion back in 2021 and is projected to skyrocket to USD 7.71 billion by 2032.

To give you a clearer picture, here’s a breakdown of the features we've covered and why they matter.

Essential Features of Crypto Portfolio Management Software

Feature | Functionality | Primary Benefit |

|---|---|---|

API & Wallet Sync | Automatically imports transaction data from exchanges and blockchains. | Saves time, eliminates manual entry errors, and provides a real-time portfolio view. |

Performance Analytics | Calculates true ROI, tracks profit/loss, and visualizes asset allocation. | Provides deep insights to optimize strategy and make data-driven investment decisions. |

DeFi Dashboard | Aggregates positions in liquidity pools, staking, and lending protocols. | Offers a unified view of complex DeFi activities, simplifying management and tracking rewards. |

NFT Tracking | Displays NFT collections with floor prices, estimated values, and sales history. | Helps you value your digital collectibles and stay on top of the fast-moving NFT market. |

Tax Reporting | Generates detailed tax reports like IRS Form 8949 by tracking cost basis. | Turns a complicated, time-consuming tax process into a simple, few-click task. |

Smart Alerts | Sends customizable notifications for price changes, whale movements, etc. | Allows you to react quickly to market opportunities and threats without constant screen-watching. |

These features work together to create a powerful command center, giving you the information you need to navigate the crypto markets with confidence.

Tax Reporting and Smart Alerts

Honestly, one of the most valuable features you'll find is automated tax reporting. The right software can generate the detailed reports you need, like IRS Form 8949, by meticulously tracking the cost basis and proceeds for every single transaction. This can turn a multi-week tax season nightmare into a process that takes just a few clicks.

Finally, customizable smart alerts act as your personal market watchdogs. You can set up notifications for major price swings, new exchange listings, or even when a huge "whale" wallet moves a specific crypto. These alerts give you a serious edge, letting you react instantly to market opportunities or threats without having to be glued to your screen 24/7. Mastering these features is a huge part of getting the most out of a top-tier DeFi portfolio tracker.

How to Choose the Right Software for You

Picking the right crypto portfolio manager is like buying a car. You wouldn't buy a two-seater sports car for a family of five, right? The same logic applies here. The perfect tool for a hyperactive day trader is overkill for a long-term HODLer, and a beginner's tool will frustrate a seasoned DeFi pro.

You have to look past the flashy marketing and figure out what actually fits your investment style, your comfort with tech, and where you want to go. With dozens of options on the market, having a clear framework for your decision is crucial.

Start With Your Investor Profile

Before you even glance at a feature list, you need to get real about what you do in crypto. Your "investor profile" is the single most important factor that will guide you to the right software.

Are you a passive investor who just buys and holds a bit of Bitcoin and Ethereum? Or are you a DeFi degen, hopping between liquidity pools, staking protocols, and yield farms every other day? The needs of these two people couldn't be more different.

Ask yourself these questions to nail down your profile:

How many exchanges and wallets are you juggling? Someone using a single exchange has much simpler needs than a person with accounts on five CEXs, a hardware wallet, and a handful of hot wallets.

How deep are you into DeFi and NFTs? If you're a DeFi power user, you'll need a tool with powerful dashboards that can make sense of your complex positions across multiple blockchains.

What's your tech skill level? Be honest. Some platforms are built for absolute beginners, while others pack in advanced features that would just overwhelm a newcomer.

The goal is to find a platform that matches what you're doing now, but also gives you room to grow. Trust me, migrating all your data to a new tool later on is a massive headache. Choose something that can keep up with your ambitions.

Evaluate Core Security and Usability

Once you know who you are as an investor, it's time to check the non-negotiables: security and usability. A tool can have all the features in the world, but it's worthless if it's a security risk or a nightmare to use.

On the security front, look for platforms that require Two-Factor Authentication (2FA) and use end-to-end encryption. Most importantly, make sure the software only asks for "read-only" API keys. This permission lets the tool see your balances but gives it zero ability to make trades or withdraw funds. Your assets stay safe where they belong.

Usability is just as critical. The best portfolio managers take complicated data and make it clean, simple, and intuitive. A cluttered interface will just add to the stress of managing your crypto. Look for a free trial or a freemium plan to take it for a spin before you commit your cash.

Compare Pricing and Support

Finally, let's talk about the practical stuff: cost and customer support. Pricing models are all over the place, from free tiers with basic features to pricey monthly subscriptions for professional tools. Don't pay for advanced trading analytics if all you do is buy and hold. Match the plan to your portfolio size and the features you’ll actually use.

Customer support is one of those things you ignore until you desperately need it. Check for real support channels, like live chat or a dedicated email. A solid knowledge base or FAQ section is also a great sign that the company cares about its users.

The crypto market is global and never sleeps, and the demand for good management tools reflects that. Solution-based software now makes up over 55% of the market's revenue. And while North America currently holds the biggest slice, the Asia-Pacific region is the fastest-growing—proving this is a worldwide need. You can learn more about these crypto market trends here.

The table below offers a simple framework to help you match your profile to the right kind of software.

Choosing Your Crypto Portfolio Management Software

Consideration | Beginner Investor | Active Trader | DeFi Enthusiast |

|---|---|---|---|

Primary Goal | Track long-term holdings and see simple performance metrics. | Monitor real-time prices, execute trades, and analyze short-term performance. | Track complex positions across multiple protocols and chains (staking, LPs, etc.). |

Must-Have Features | Simple dashboard, automated exchange/wallet sync, basic profit/loss tracking. | Advanced charting tools, real-time data feeds, trade history analysis, tax reporting. | Multi-chain support, DeFi protocol integrations, impermanent loss tracking, transaction decoder. |

Key Differentiator | Extremely easy to set up and navigate. Minimalist interface. | Speed, reliability of data, and advanced analytics. | Breadth and depth of DeFi protocol and chain support. |

Cost Expectation | Free or low-cost subscription. | Mid to high-tier subscription. | Mid to high-tier subscription, often priced based on transaction volume. |

Ultimately, the best tool will feel like a natural part of your investment strategy. It should cut through the complexity, give you clear insights, and make painful tasks like tax prep a breeze. If you're dreading tax season, it might be worth checking out our complete guide to crypto tax reporting requirements to see what a good platform should handle for you.

So, you've seen the headaches that come with tracking your crypto manually and what a good portfolio manager should do. Now, the question is: what platform actually pulls it all together? You need something that cuts through the noise and delivers powerful insights without being a nightmare to use.

That's exactly why we built Yield Seeker.

We designed Yield Seeker from the ground up to solve the real frustrations modern crypto investors face every day. This isn't just another tracker. Think of it as a strategic partner, built to give you clarity, control, and real confidence over your digital assets. It tackles all the core pain points we've talked about, turning a chaotic mess into something clean and intuitive.

From Complexity to Clarity

Let's be honest, the biggest hurdle for most people—especially in DeFi—is the sheer complexity of it all. Trying to juggle multiple protocols, keep tabs on yield farming rewards, and figure out your actual returns across different chains is a massive headache.

This is where Yield Seeker’s unified DeFi dashboard becomes your best friend.

Instead of trying to stitch together a complete picture from a dozen different browser tabs, Yield Seeker pulls everything into one simple, understandable view. It automatically tracks your positions, calculates what you're earning in real-time, and shows you exactly how your capital is doing. This instant clarity means you can make smarter, data-driven decisions without burning hours on spreadsheets.

We built Yield Seeker on a simple idea: managing your crypto portfolio shouldn't be harder than investing in it. By automating the grunt work, we free you up to focus on strategy and growth.

This approach is a lifesaver for investors who feel buried by overly technical platforms. The interface gives you the critical info you need without the confusing jargon, making it perfect for beginners while still having the depth that seasoned pros demand.

Differentiators That Give You an Edge

Look, the market is crowded with tools that all promise the same thing. Yield Seeker stands out by focusing on features that give you a real, tangible advantage. It goes beyond just showing you numbers to provide tools that help you actively manage risk and grow your portfolio more effectively.

Here are a few things that set it apart:

Broad Integrations: Yield Seeker connects with a huge range of wallets and exchanges. This means you get a complete and accurate picture of your entire portfolio, no matter where you hold your assets.

Predictive Risk Analytics: Using some pretty smart algorithms, the platform gives you a heads-up on potential market risks. This helps you protect your capital when things get volatile.

Bank-Grade Security: Your security is everything. Yield Seeker uses top-tier encryption and follows best practices, like using read-only APIs, to make sure your funds and data are always locked down tight.

These features all work together to create a robust crypto portfolio management software experience that is both powerful and secure. The platform basically acts as your co-pilot, keeping a close watch on your assets and feeding you the intel you need to navigate the markets.

A Strategic Partner for Your Growth

At the end of the day, any portfolio management tool should help you hit your financial goals. Yield Seeker is designed not just to report on your past performance but to actually boost your future potential. By giving you clear insights, automating the boring stuff, and offering advanced risk management, it helps you operate with a level of sophistication that used to be reserved for the big institutional players.

Whether you're trying to squeeze more out of your DeFi yields, rebalance your holdings based on good data, or just get a clean look at your net worth, Yield Seeker gives you the framework you need. It’s the all-in-one solution that grows with you, helping you manage and expand your crypto portfolio with confidence. This is how modern crypto management is supposed to feel.

Still Have Questions? Let's Clear a Few Things Up

Jumping into the world of crypto portfolio management software can definitely bring up a few key questions. I get it. Below, I'll tackle the most common ones I hear, covering the big topics: security, taxes, and cost.

Hopefully, these quick insights will give you the confidence to pick the right tool for managing your digital assets.

Is My Data Secure with Portfolio Management Software?

This is usually the first question on everyone's mind, and for good reason. Security is everything in crypto. The good news is that any reputable platform is built from the ground up with robust safety measures to protect your financial data.

The main way they do this is by using read-only API keys. Think of it like giving an app permission to look at your bank balance but not touch the money. It can see your transactions and balances, but it's strictly prohibited from making any trades or withdrawals. Your assets never leave your control.

As a rule of thumb, always go for a service that requires two-factor authentication (2FA), encrypts your data, and has a clear, easy-to-read privacy policy. And I can't stress this enough: never share your private keys or wallet seed phrases with any application.

Can This Software Actually Make My Crypto Taxes Easier?

Absolutely. In fact, this is often one of the single most valuable features for anyone who's ever tried to untangle a year's worth of crypto trades. A top-tier portfolio manager can turn a painfully complex task into a much more straightforward process.

These tools automatically track the cost basis for every single asset you buy and calculate your capital gains and losses as you go. When tax season rolls around, they can generate detailed reports that you can plug right into your tax software or hand off to your accountant. It'll save you dozens of hours and help you sidestep costly filing mistakes.

Do I Really Need Software If I Only Use One Exchange?

It's a fair question. While the benefits definitely multiply the more accounts you have, a dedicated management tool still offers a huge leg up even for single-exchange users. Why? Because it provides far better performance analytics than what most exchanges offer on their native platforms.

You get much deeper insights into your portfolio's true performance over time, beyond just the current value. This allows you to make smarter, data-driven decisions about your strategy, even if all your assets are in one place.

How Much Do These Portfolio Trackers Cost Anyway?

The pricing for these tools is all over the map, which is great because it means there's an option for pretty much any budget. Many platforms have a free tier that gives you basic tracking, which is often more than enough if you're just starting out or have a small portfolio.

Paid plans unlock the more advanced features—things like connecting unlimited exchanges, detailed tax reporting, deep DeFi protocol tracking, and real-time smart alerts. You can find plans that range from a few dollars a month to more for professional-grade tools, so you can pick whatever fits your needs perfectly.

Ready to stop juggling spreadsheets and start making smarter, data-driven decisions? Discover how Yield Seeker can automate your DeFi strategy and provide a crystal-clear view of your entire portfolio.