Back to Blog

Crypto Tax Software Comparison Finding Your Best Fit

Struggling with crypto taxes? Our crypto tax software comparison details top tools by features, integrations, and cost to find your perfect match.

Sep 18, 2025

generated

Doing your crypto taxes by hand is a special kind of nightmare. Between the sheer number of transactions and the wild diversity of assets, it’s a recipe for disaster, which is why a solid crypto tax software comparison is so important for anyone in this space. These tools are built to automate the painful process of tracking trades, calculating your gains, and spitting out the IRS-compliant reports you need.

The right software can literally save you dozens of hours and help you avoid costly mistakes.

Why You Need Specialized Crypto Tax Software

If you've ever tried wrestling your crypto activity into a spreadsheet, you know exactly what I'm talking about. The real challenge isn't just tracking a few buys and sells on one exchange; it's much, much deeper than that.

Today's crypto world is a spiderweb of platforms and activities, each leaving its own digital footprint. It's totally normal for a single person to have assets scattered across centralized exchanges like Coinbase and Kraken, a few non-custodial wallets like MetaMask, and a handful of different DeFi protocols.

The Problem with Old-School Methods

Let's be clear: traditional tax software like TurboTax or H&R Block just isn't built for this. These programs can't sync with hundreds of different exchanges and protocols, nor do they understand the mechanics of a liquidity pool transaction or an NFT mint. Trying to manually export CSV files and calculate the cost basis for thousands of trades isn't just a headache—it’s a minefield of potential errors.

This is where specialized software becomes a non-negotiable. These platforms were designed from the ground up to solve the exact problems crypto investors run into.

They aggregate your data automatically. Instead of downloading CSVs, you just connect your exchanges and wallets via an API, and the software pulls in your entire transaction history.

They understand complex transactions. These tools know how to correctly categorize things like staking rewards, NFT mints, airdrops, and DeFi lending.

They calculate cost basis accurately. They apply proper accounting methods like FIFO or HIFO to correctly calculate your capital gains and losses on every single trade.

And it's not just about simple trading anymore. Many of us are getting into more advanced crypto passive income strategies like staking and lending, and it’s critical to remember that every single reward payment is a taxable event that has to be tracked.

The real magic of crypto tax software is its ability to take a chaotic mess of thousands of transactions from dozens of platforms and turn it into a single, clean, IRS-ready report, like Form 8949.

Getting this wrong can lead to some serious penalties from the tax man. That makes good software a smart investment for both compliance and your own peace of mind. As our guide on crypto tax reporting requirements points out, the IRS is paying a lot more attention to digital assets these days.

So, let's dive in and compare the top contenders to help you find the right tool for the job.

How We Judged the Top Crypto Tax Software

To give you a genuinely useful comparison, we had to go way beyond a simple feature list. What really matters is how these tools perform in the real world—how they save you time, improve accuracy, and give you confidence when tax season rolls around. So, we developed a consistent framework to test each platform against the things that actually count.

This approach lets us give you a fair, side-by-side look at what each tool does best and where it falls short. We put every piece of software through the same wringer to see how it stacked up.

Integrations and Data Syncing

First things first: getting your transaction data into the software. This is the bedrock of the whole process. If you can't import your history accurately and without a massive headache, nothing else matters. Manually typing in thousands of trades is a recipe for disaster.

We focused on two key areas here:

API Connections: How many direct connections do they have to big exchanges like Coinbase or Binance? And more importantly, how reliable are they?

Blockchain Support: Can you just plug in your wallet address and have it sync your on-chain activity? This is non-negotiable for anyone active in DeFi or NFTs.

A platform that nails this means you spend less time wrestling with CSV files and more time getting your taxes done.

Support for Complex Transactions

Crypto isn't just buying and selling anymore. A modern tax tool has to understand the wild world of DeFi, NFTs, and everything in between. If it can't, you're left doing a ton of manual work to categorize everything correctly.

Our evaluation zeroed in on support for:

DeFi Protocols: How well does it handle liquidity pooling, staking rewards, yield farming, and lending? Does it recognize the protocols you actually use?

NFTs: Can it properly track mints, sales, and royalties across different marketplaces without getting confused?

Airdrops and Forks: Does the software automatically identify airdropped tokens and apply the right cost basis, or does it leave you to figure it out?

The ability to automatically classify complex DeFi transactions is a huge differentiator. A tool that gets this right can save you countless hours of manual reconciliation. If you're deep in DeFi, you might also want to look into a dedicated DeFi portfolio tracker to keep tabs on everything year-round.

Reporting and Accuracy

At the end of the day, you need accurate, IRS-compliant tax forms. We dug into the reporting capabilities of each platform to see how they deliver the final product. A good tool doesn't just spit out a form; it gives you options.

We looked closely at these reporting features:

IRS Form Generation: Does it produce a clean, ready-to-file IRS Form 8949 and any other schedules you might need?

Cost Basis Methods: Does it support different accounting methods like FIFO, HIFO, and LIFO? This flexibility can make a big difference in what you owe.

Tax-Loss Harvesting Tools: Are there built-in features to help you spot opportunities to sell assets at a loss to offset your capital gains?

A platform that excels here not only keeps you compliant but also empowers you to make smarter financial moves. This framework is the foundation for all the detailed comparisons you're about to see.

A Detailed Crypto Tax Software Comparison

Trying to pick the right crypto tax tool can feel like a nightmare. A lot of platforms talk a big game about making things simple, but their real worth shows when you throw your messy, real-world transaction history at them—everything from obscure DeFi protocols to high-frequency trades. This breakdown will cut through the marketing fluff and compare the top contenders based on how they actually perform.

We're going to put three of the biggest names under the microscope: Koinly, CoinLedger, and ZenLedger. The goal isn't to crown a single winner, but to give you a clear, honest analysis so you can figure out which one makes the most sense for your specific crypto activity, your comfort level with tech, and what you need for reporting.

Koinly: The All-Rounder for Diverse Portfolios

Koinly has earned its reputation as the go-to for investors with fingers in many pies. It’s a powerhouse, especially when it comes to integrations. We're talking support for over 800 exchanges, 170+ blockchains, and more than 17,000 cryptocurrencies. If your assets are scattered all over the place, Koinly is one of the few platforms that can likely pull it all together.

The user interface is another big win. It’s clean, intuitive, and gives you a solid overview of your entire portfolio, including your cost basis, unrealized gains, and ROI. This isn't just a nice-to-have feature for tax season; it's a year-round portfolio tracker that helps you make smarter moves, like spotting tax-loss harvesting opportunities as they pop up.

As you can see, the Koinly dashboard gives you a clean, visual breakdown of your holdings, making it easy to get a quick pulse check on your financial position.

Koinly's strength is its "connect-it-all" philosophy. If you've dabbled in everything from major exchanges to obscure altcoins and niche DeFi protocols, Koinly's massive database is your best bet for getting transactions categorized correctly with the least amount of manual work.

But that strength can also be a weakness for some. If you're a total beginner who only holds a couple of assets on Coinbase, Koinly’s sheer number of options might feel like bringing a bazooka to a knife fight. And while its auto-categorization is top-notch, transactions from brand-new or less common DeFi protocols can sometimes get flagged for review, meaning you'll have to jump in and classify them yourself.

CoinLedger: Simplicity and Seamless Integration

CoinLedger (you might remember it as CryptoTrader.Tax) has cornered the market on user-friendliness. It's a favorite for beginners or anyone who sticks to major US-based exchanges. The platform walks you through importing data and generating reports step-by-step, taking a lot of the usual stress out of the process.

Where CoinLedger really pulls ahead is its direct hook-ups with tax filing software like TurboTax and H&R Block. You can push your crypto tax data straight into your return with just a few clicks. For DIY filers, this is a massive time-saver and makes it a top contender in any document automation software comparison.

The trade-off? Its coverage isn't as wide as Koinly's. If you're deep into exotic DeFi or using a bunch of smaller international exchanges, you'll probably find yourself doing more manual CSV uploads. It’s a classic case of simplicity versus comprehensiveness.

Real-World Scenario: The Casual Investor

Profile: Someone who bought Bitcoin and Ethereum on Coinbase, staked a bit of ETH, and keeps it all on a Ledger hardware wallet.

CoinLedger's Performance: This person would love CoinLedger. They can link their Coinbase account via API, plug in their Ledger public address, and the software syncs and sorts everything automatically. The direct import to TurboTax turns a multi-hour headache into a ten-minute task.

ZenLedger: The Professional's Choice for Complex Cases

ZenLedger markets itself as the heavy-duty solution for high-volume traders, tax pros, and anyone with a seriously complicated tax situation. They've been around since the early days and have a reputation for precision and incredibly detailed reports.

A key differentiator for ZenLedger is its professional services. For an extra fee, you can get a real tax expert to help reconcile your accounts, review your reports, or even assist with tax planning and audit defense. If you're dealing with a seven-figure portfolio or got a notice from the IRS, this level of support is priceless.

ZenLedger also offers what it calls "Grand Unified Accounting," which creates a single, consolidated ledger of every transaction you've ever made. It’s fantastic for hunting down discrepancies and is built to be auditable. While it supports plenty of DeFi and NFT platforms, the interface feels more like professional accounting software—data-dense and a bit clinical, which might intimidate a total newbie.

ZenLedger is what you grab when accuracy and professional oversight are non-negotiable. It’s built not just for filing taxes, but for creating a bulletproof, auditable record of your entire crypto history.

For those interested in the bigger picture of automation tools, a general document automation software comparison offers good context on the tech that powers specialized platforms like these.

Crypto Tax Software Feature Scorecard

To make things a bit clearer, I've put together a high-level scorecard. This isn't about which one is "best," but which one scores highest in the areas that matter most to you. Each is rated on a scale of 1 (basic) to 5 (excellent).

Software | Exchange/Wallet Integrations (Score) | DeFi & NFT Support (Score) | Ease of Use (Score) | Pricing Tiers (Count) | Best For |

|---|---|---|---|---|---|

Koinly | 5 | 5 | 4 | 4 | Investors with diverse assets across many platforms and chains. |

CoinLedger | 3 | 3 | 5 | 4 | Beginners and DIY tax filers using major exchanges. |

ZenLedger | 4 | 4 | 3 | 5 | High-volume traders, tax professionals, and complex cases. |

This table should give you a quick reference, but remember the scores reflect a trade-off. CoinLedger's perfect "Ease of Use" score comes at the cost of lower integration and DeFi support, while ZenLedger's focus on professional features makes it a bit less approachable for newcomers.

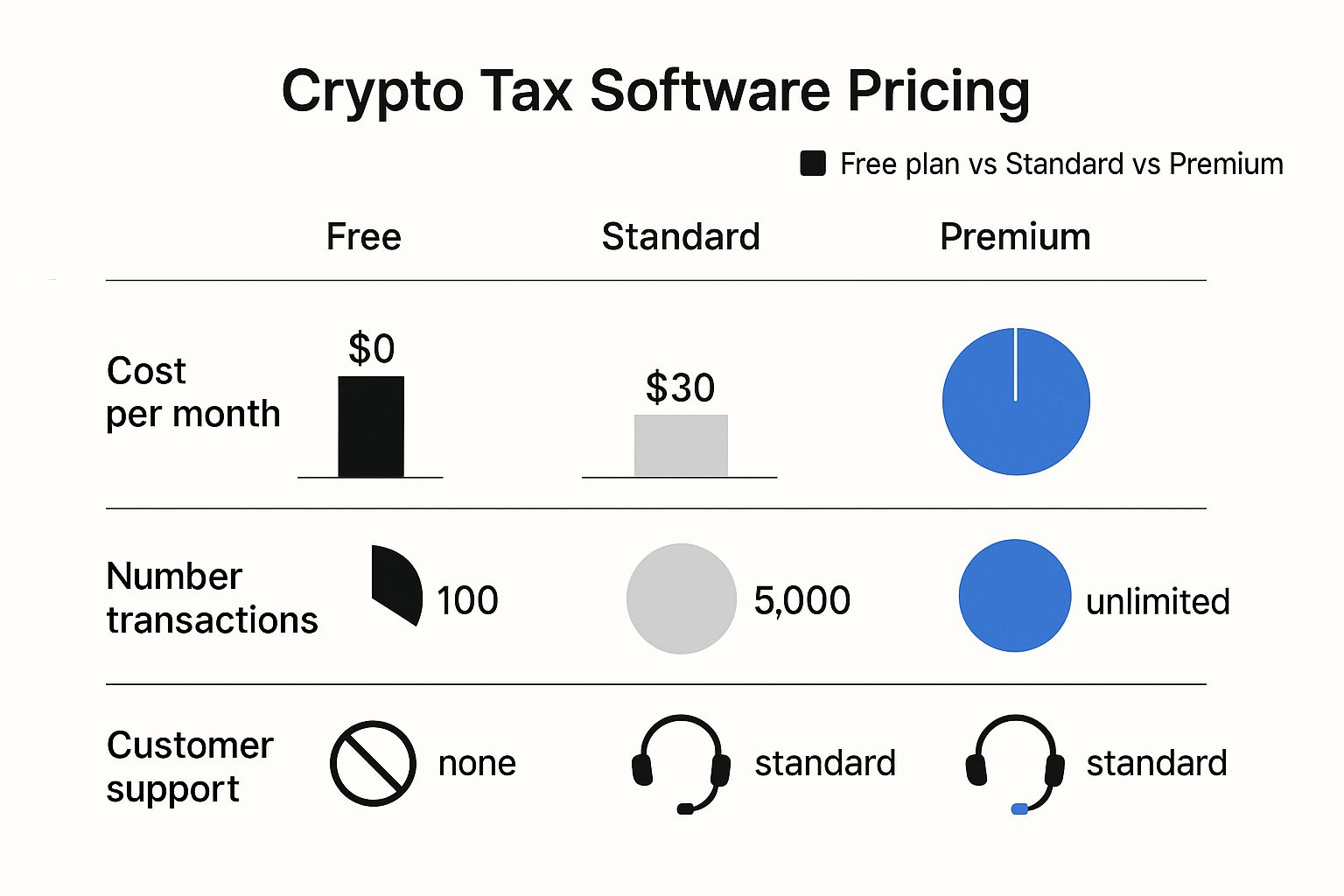

Pricing and Transaction Tiers

Ultimately, your choice might just come down to price, which is almost always tied to how many transactions you have. And be warned: a "transaction" usually means every single buy, sell, trade, deposit, withdrawal, and reward payment.

A few key things to keep in mind when looking at pricing:

Free Tiers: Most platforms let you connect your accounts and see a capital gains summary for free. But you'll almost always have to pay to download the actual tax forms (like the IRS Form 8949).

Transaction Limits: Don't underestimate your transaction count. DeFi activity, in particular, can rack them up fast. A single interaction with a liquidity pool can easily create multiple taxable events.

Support Levels: The more you pay, the better support you get. Higher tiers usually come with priority help, which can be a lifesaver when you're stuck on a tricky issue the day before the tax deadline.

The best advice? Don't just pick one from a review. Sign up for the free plan on your top two choices, connect your accounts, and see which one handles your data better. A hands-on test is the only way to know for sure which platform is the right fit for you.

Finding the Right Tool for Your Trading Style

Let’s be honest: the idea of a single “best” crypto tax software is a total myth. The right platform for a high-frequency trader flipping memecoins is going to be a terrible, clunky fit for someone who just buys and holds Bitcoin. A real crypto tax software comparison comes down to one thing: matching the software’s strengths to your personal investing strategy.

This section cuts through the noise and gives you targeted recommendations based on how you actually use crypto. Find the profile that sounds most like you, and you'll have a much clearer idea of which tool is built to handle your specific needs.

The Casual Investor and HODLer

This is the person who mostly buys crypto on a major exchange like Coinbase or Kraken and plans to hold it for the long haul. Your transaction history is pretty straightforward—maybe a few dozen buys, a couple of sells, and perhaps a transfer to a hardware wallet for safekeeping.

For this profile, simplicity is everything. You don't need a tool that supports every obscure DeFi protocol or has complex tax-loss harvesting features. Your main goal is to pull in data from one or two places and spit out an IRS Form 8949 without a headache.

Top Recommendation: CoinLedger

CoinLedger is hands-down the winner here. Its interface is the most beginner-friendly on the market, walking you through every step of connecting your exchange accounts. The killer feature is its direct integration with tax software like TurboTax, which can turn what feels like a daunting task into a ten-minute job.

The Active Trader

The active trader is in the trenches daily, constantly buying, selling, and swapping different cryptocurrencies across multiple exchanges. Your transaction count can easily hit thousands or even tens of thousands a year, making any attempt at manual tracking a complete nightmare.

If this is you, you need a seriously robust platform that can handle massive amounts of data without choking. Key features are reliable API connections to a wide range of exchanges, accurate cost basis tracking using methods like HIFO (Highest-In, First-Out), and tools for tax-loss harvesting to help offset some of those gains.

Top Recommendation: ZenLedger

ZenLedger was built for this exact kind of complexity. It’s designed to process millions of transactions and produces detailed, auditable reports that give high-volume traders true peace of mind. Its "Grand Unified Accounting" feature creates a meticulous log of your entire trading history, which is a lifesaver for finding and fixing discrepancies. While the interface isn't as slick as CoinLedger's, its raw power is a perfect match for serious traders.

For active traders, the ability to select different cost basis methods is not just a feature—it's a critical tool for tax optimization. Using HIFO in a volatile market can significantly reduce your taxable gains compared to the default FIFO method.

The DeFi Specialist and Yield Farmer

This person lives far beyond centralized exchanges, deep in the world of decentralized finance. You're interacting with liquidity pools, yield farming, staking tokens for rewards, and using lending protocols. Every single one of those actions can create a complex and often confusing taxable event.

A DeFi specialist needs software with exceptional on-chain support. The tool has to do more than just import a wallet address; it must automatically identify and correctly categorize transactions from smart contracts across chains like Ethereum, Solana, and Avalanche. It needs to understand the context behind what you're doing on-chain.

Top Recommendation: Koinly

Koinly stands out here because of its massive support for over 170 blockchains and its smart handling of DeFi transactions. It does a surprisingly good job of auto-categorizing tricky activities like adding liquidity or claiming staking rewards, which saves an incredible amount of manual work. For anyone earning yield, our guide on how staking rewards are taxed is a must-read, and Koinly’s ability to correctly tag these income events is a huge win.

The NFT Creator and Collector

The NFT enthusiast’s portfolio isn't about fungible tokens; it's filled with unique digital assets. Your transaction history is a mix of minting, buying, selling, and maybe even collecting royalty payments from marketplaces like OpenSea and Magic Eden.

This profile requires a tax platform that actually understands NFTs. It has to track the cost basis of individual assets, correctly handle minting fees (which can be added to the NFT's cost basis), and know the difference between capital gains from sales and ordinary income from creator royalties.

Top Recommendation: Koinly

Once again, Koinly’s deep blockchain and smart contract support gives it the edge. It generally does a better job than its competitors at identifying NFT mints, sales, and transfers across multiple chains and marketplaces. No platform is perfect—you'll likely need to do some manual review for more obscure collections—but Koinly provides the strongest foundation for NFT-heavy portfolios, ensuring your creative income and investment gains get sorted correctly.

Where Crypto Tax Is Headed

The crypto tax world isn't sitting still. Far from it. As digital assets worm their way deeper into the global economy, regulators and software developers are in a constant race to keep pace. Picking the right tool today isn't just about this year's taxes; it's about making sure you're not left scrambling when things get more complex tomorrow.

This evolution is really being pushed by two things: governments finally getting their act together on regulations and a huge leap in what the software can actually do. Regulators want more transparency, and frankly, so do we. In response, software companies are building much smarter, more automated tools that make the entire tax process less of a nightmare.

This whole situation has lit a fire under the market. The crypto tax software industry is growing at an estimated CAGR of 20.1%. It's projected to jump from $4.21 billion in 2024 to $5.06 billion by 2025. You can dig into the full projections, which forecast the market to more than double by 2029.

Key Innovations on the Horizon

So what's next? A few key trends are popping up that are set to completely change how we think about crypto tax software. These aren't just minor tweaks—they're fundamental shifts.

The biggest game-changer is artificial intelligence and machine learning. The next generation of these platforms won't just pull data from an API. They'll be smart enough to classify those weird, complex transactions from some obscure DeFi protocol you tried out last month. AI will start recognizing patterns, cutting down on the tedious manual work and—more importantly—human error.

Another major move is toward real-time tax planning. Imagine not waiting until April to figure out you owe a massive tax bill. Advanced software will give you a live dashboard of your tax situation, 24/7. This opens the door for things like proactive tax-loss harvesting, pinging you when it's the perfect time to sell a loser to offset some gains.

The end goal here is to flip the script. Crypto tax software is moving from a reactive, year-end chore to a proactive, year-round financial planning partner. This is about empowering you to make smarter decisions that actually lower your tax bill.

What This Means for Your Choice

When you're shopping around for a platform, you have to think about which companies are actually building for this future. A tool that's already dipping its toes into these advanced features is a much safer bet to handle whatever new regulations or crypto trends get thrown at us.

Keep these questions in mind:

DeFi and NFT Roadmaps: Are they openly talking about their plans to support new chains, protocols, and the next wave of digital assets?

Automation Features: Is the platform getting smarter? Are they finding better ways to automatically categorize transactions and fix errors for you?

Tax Planning Tools: Does it do more than just spit out a Form 8949? Look for features that help you actively manage and optimize your tax strategy.

Picking a provider that's genuinely innovating means your tax process will be compliant today and won't become a massive headache as your crypto journey inevitably gets more complicated.

Got Questions About Crypto Tax Software?

Even after comparing all the top crypto tax software, you might still have a few lingering questions. It's a big decision, especially when we're talking about taxes. Let's clear up those final doubts so you can pick your tool and move forward with confidence.

Think of this as the final check-in before you commit. We'll tackle the practical, "how does this actually work?" questions that pop up the minute you start thinking about connecting your accounts.

Can This Software Really Connect to All My Accounts?

Yes, and that’s the magic of it. The whole point of these platforms is to connect directly to hundreds of exchanges, wallets, and blockchains. You just give them an API key or your public wallet address, and they slurp up your entire transaction history automatically. This is a huge time-saver and drastically cuts down on human error.

Of course, no platform supports every single integration under the sun. For the oddball exchanges or wallets that don’t have a direct connection, you can almost always upload your data with a standard CSV file.

Pro Tip: Before you pay for anything, check if the software supports your specific exchanges and wallets. Most platforms have a free plan that lets you test these connections. It's the best way to make sure everything will play nice.

How Does It Handle Complex Stuff like DeFi, Staking, or NFTs?

This is where the good software really separates itself from the basic tools. Top-tier platforms are built to automatically recognize and sort out complex transactions like DeFi staking rewards, liquidity pool moves, and NFT mints or sales. They can often read smart contract data to figure out what you were actually doing on-chain.

The level of automation isn't always perfect, though. Some tools might still need you to manually tag transactions from newer or more obscure protocols. If you're deep into DeFi or NFTs, you absolutely need to pick a platform known for its rock-solid on-chain support.

Are the Tax Reports from These Tools Actually IRS-Compliant?

Absolutely. These tools are specifically designed to generate IRS-compliant reports, especially Form 8949, which is where you list out your capital gains and losses. You can then import these forms directly into software like TurboTax or just hand them over to your accountant. They ensure all the calculations use accepted accounting methods like FIFO or HIFO.

But here’s the catch: the final report is only as good as the data you feed it. The software handles the number-crunching, but it’s still on you to double-check that all your transactions were imported correctly and you didn't forget about an old wallet somewhere.

What if I Have Thousands of Crypto Transactions?

That's exactly who this software is for! Trying to track thousands of transactions by hand is a recipe for disaster. These platforms are built to handle massive amounts of data without breaking a sweat.

They usually have tiered pricing based on how many transactions you have in a tax year. Whether you're a casual investor with a few hundred trades or a day trader with millions of transactions from a bot, there's a plan for you. The software just processes it all, calculates the cost basis for every single trade, and spits out the tax forms you need. It saves an unbelievable amount of time and stress.

Ready to put your stablecoins to work without the headache? Yield Seeker uses AI to automatically find and manage the best yield opportunities in DeFi, so you can earn passive income effortlessly.