Back to Blog

How to Calculate Effective Yield and Why It Matters

Learn how to calculate effective yield to see your true investment returns. Our guide unpacks the formula with real-world examples that make sense.

Sep 17, 2025

generated

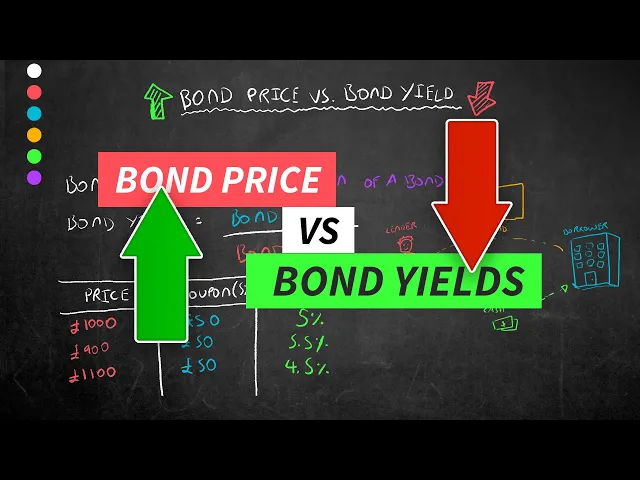

Ever felt like the advertised interest rate on an investment doesn't tell the whole story? You're not wrong. The number you see upfront—the nominal rate—often hides the more important truth.

This is exactly where effective yield becomes your secret weapon. It shows you the actual earnings you can expect once the magic of compounding kicks in.

Let’s get straight to it. The formula is (1 + i/n)^n - 1. This simple equation is all you need to cut through the noise and see your true potential return. It factors in how often your investment compounds, giving you the real number.

What Effective Yield Reveals About Your Investments

Think of it like this: a savings account advertising a 5% nominal rate that compounds monthly will make you more money than another account with the same rate that only compounds once a year. The effective yield is what captures that difference, finally giving you an apples-to-apples way to compare investments.

Why This Metric Is Crucial

Honestly, getting a handle on effective yield is a game-changer for making smart financial moves. You stop taking advertised rates at face value and start doing a much sharper analysis of what your money can actually earn.

This single metric helps you accurately compare a huge range of financial products, including:

Traditional bonds and Certificates of Deposit (CDs)

High-yield savings accounts

Modern crypto staking rewards and DeFi protocols

To really highlight the difference, let's look at nominal and effective yield side-by-side.

Nominal Yield vs Effective Yield at a Glance

This table breaks down the core differences, showing you exactly why relying on the nominal rate alone can be misleading.

Metric | Nominal Yield | Effective Yield |

|---|---|---|

Definition | The stated, advertised interest rate. | The actual return earned after compounding. |

Calculation | Simple interest; does not include compounding. | Complex interest; includes the effect of compounding. |

Accuracy | Less accurate for comparing investments. | Provides a true, "apples-to-apples" comparison. |

Best For | A quick, baseline understanding of a return. | Making precise and informed investment decisions. |

As you can see, the effective yield gives you the full story.

The concept isn't new; it's been a cornerstone of financial analysis for ages. For example, a bond with a 7% nominal rate paying interest semi-annually actually has an effective yield of 7.123%. If it paid out monthly, that yield would climb to 7.229%. These small-sounding differences add up in a big way, especially in large portfolios.

By focusing on the effective yield, you stop guessing and start seeing the true potential of your capital. It’s the difference between the sticker price and the total cost, but for your returns.

Ultimately, mastering this calculation is a fundamental step toward maximizing your earnings. For a broader look at financial analysis, check out our guide on how to calculate investment returns. And when you're ready to get a full view of your financial picture, tools like a business valuation estimator can offer some pretty valuable insights.

Breaking Down the Effective Yield Formula

That formula, (1 + i/n)^n - 1, might look a little intimidating at first glance. But once you pull it apart, it's actually pretty simple. Think of it as the tool that shows you what your money is really doing by factoring in the magic of compounding.

Let's unpack the pieces:

i (Nominal Interest Rate): This is just the advertised annual rate for your investment, but written as a decimal. So, a 6% rate becomes 0.06. Easy enough.

n (Compounding Periods): This is where the "effective" part comes in. It’s simply the number of times your interest gets calculated and paid out over a single year. The more frequent, the better.

This whole process is about taking those basic numbers and plugging them in to see the final, true yield.

As you can see, it flows from spotting the nominal rate and how often it compounds, right through to the final calculation.

So, How Does The Math Actually Work?

First, the formula chops up your annual rate (i) by the number of compounding periods (n). This gives you the interest rate you're earning per period. For a 6% bond that compounds quarterly (four times a year), you’re actually earning 1.5% (that's 0.06 / 4) every three months.

Next, the exponent (^n) is what shows you the real punch of that frequent compounding. It applies that smaller, periodic interest rate across all the periods in the year. Finally, subtracting the 1 at the end just isolates the interest you earned, giving you the effective annual rate as a clean percentage.

This wasn't always the standard. Back in the day, investors often had to go by simpler nominal rates. It wasn't until the 1970s and 80s, when computers made the math less of a headache, that effective yield calculations started to become common. Later on, regulations like the US Truth in Savings Act (1991) made it official, requiring banks to disclose the Annual Percentage Yield (APY)—which is really just another name for effective yield.

By translating the formula's variables into real-world numbers, you can confidently determine your actual investment returns. It’s the difference between seeing a sticker price and knowing the total cost.

Here's the key takeaway: the effective yield is almost always higher than the nominal rate as long as compounding happens more than once a year. That's why knowing how to calculate APY is such a crucial skill for any serious investor.

Putting the Effective Yield Formula to Work

Knowing the formula is one thing, but making it work for your own portfolio is where you really start to see the difference. The beauty of the effective yield calculation is its versatility—it works the same whether you're looking at a savings account from your local bank or a bleeding-edge digital asset.

Let's walk through a couple of real-world examples to show you just how essential this is. We’ll start with something familiar before jumping into the world of decentralized finance.

Traditional Finance: A Certificate of Deposit

Imagine you’ve just opened a Certificate of Deposit (CD) that advertises a 4.8% nominal annual interest rate. You read the fine print and see that it compounds monthly. That little detail is the key to unlocking your true return.

To find the effective yield, we'll grab our formula: (1 + i/n)^n - 1.

i (Nominal Rate): 4.8%, which is 0.048 in decimal form.

n (Compounding Periods): 12, since it compounds every month.

When you plug those numbers in, it looks like this: (1 + 0.048 / 12)^12 - 1. This breaks down to (1.004)^12 - 1, giving you an effective yield of roughly 4.907%. This is the actual return you'll pocket after a year, all thanks to the power of monthly compounding.

The effective yield reveals that the CD's true return is a bit higher than the number on the billboard. While the difference seems small, it really starts to add up with larger investments and longer timeframes.

This exact same logic applies to assets that compound much, much faster.

Decentralized Finance: A Stablecoin Staking Pool

Now let's pivot to a more modern scenario: staking a stablecoin like USDC in a DeFi protocol. These platforms often advertise an Annual Percentage Rate (APR)—which is just the nominal rate—but compound your rewards far more often, sometimes even daily.

Let's say you find a staking pool offering a 7.3% APR that compounds daily.

i (Nominal Rate): 7.3%, or 0.073.

n (Compounding Periods): 365 for daily compounding.

The math is (1 + 0.073 / 365)^365 - 1. This simplifies to (1.0002)^365 - 1, which works out to an effective yield of about 7.57%. In the crypto world, this is what they call the Annual Percentage Yield (APY).

The more frequently your investment compounds, the wider the gap between the advertised nominal rate and your actual effective yield becomes. The table below shows just how much of a difference this can make.

Impact of Compounding Frequency on a 5% Nominal Rate

Compounding Frequency | Calculation (n) | Effective Yield |

|---|---|---|

Annually | 1 | 5.000% |

Quarterly | 4 | 5.095% |

Monthly | 12 | 5.116% |

Daily | 365 | 5.127% |

As you can see, simply changing the compounding schedule from annual to daily on the same 5% nominal rate boosts your return. This isn't just a DeFi phenomenon, either. Analysis shows that traditional corporate bonds with an 8% nominal rate compounded quarterly actually have an effective yield of 8.243%. You can learn more about these fixed-income findings for a deeper dive.

By understanding how to calculate effective yield, you can accurately compare that DeFi opportunity against the traditional CD, even though they exist in two completely different financial universes.

Using Spreadsheets to Automate Your Calculations

Manually plugging numbers into the effective yield formula is a great way to wrap your head around the mechanics, but let's be honest—it's not practical for quick, everyday decisions. Why crunch the numbers by hand every single time when you can build a simple, reusable tool in just a few moments?

This is where spreadsheets like Google Sheets or Microsoft Excel really shine.

Meet the EFFECT Function

Both programs have a handy built-in function that does all the heavy lifting for you: the EFFECT function. Its syntax is incredibly simple and saves you from typing out the longer formula.

You just need to feed it two pieces of information:

nominal_rate: The advertised annual interest rate. Remember to enter it as a decimal (so 5% becomes 0.05).npery: The number of compounding periods per year (12 for monthly, 365 for daily, you get the idea).

The function itself looks like this: =EFFECT(nominal_rate, npery). By setting up a basic sheet with cells for these inputs, you can instantly see the effective yield for any investment you’re looking at.

How to Set Up Your Spreadsheet

Pop open a new sheet and label three cells: "Nominal Rate," "Compounding Periods," and "Effective Yield."

In the "Effective Yield" cell, you'll type the formula, but instead of raw numbers, you’ll reference the other two cells. For example, if your nominal rate is in cell A2 and the compounding periods are in B2, your formula would be =EFFECT(A2, B2).

Just like that, you've built a dynamic calculator. Now you can plug in the numbers from a certificate of deposit, a bond, or a crypto staking pool and get an immediate, accurate result.

For a quick visual, here’s how the EFFECT function is structured in Excel.

As you can see, dropping in a nominal rate of 5.25% (as 0.0525) and 4 compounding periods (for quarterly) gives you an effective rate of 5.35%. No fuss, no manual math.

Setting this up transforms a tedious calculation into a powerful decision-making tool. You can now compare multiple investment opportunities side-by-side in real-time, making it much easier to spot the best deal.

This is especially useful when you're dealing with DeFi yields, which can change in the blink of an eye. If you’re juggling multiple digital assets, our compound interest calculator for crypto offers more specialized tools tailored for those exact scenarios.

Common Mistakes to Avoid When Calculating Effective Yield

Knowing the effective yield formula is one thing, but sidestepping the common pitfalls is what really saves you from making bad investment calls. A simple slip-up can completely skew your numbers, so let's walk through the mistakes that trip people up the most.

One of the easiest traps to fall into is mixing up the nominal rate with the periodic rate. It's a subtle but critical difference. The nominal rate is the big, advertised annual number, while the periodic rate is what you get after slicing it up by the number of compounding periods.

For instance, let's say you have an account with a 6% nominal rate that compounds monthly. If you plug that 6% straight into your monthly calculation, your result will be wildly off. You absolutely have to use the periodic rate, which is 0.5% (6% / 12 months). It's a small detail that changes everything.

Using the Wrong Compounding Periods

Another classic error is fumbling the value for "n," which represents the number of compounding periods in a year. It sounds almost too basic to mention, but you'd be surprised how often it happens. An investor might see "monthly compounding" and instinctively use 4 (for quarters) instead of the correct value, 12.

Here's a quick cheat sheet to keep you on track:

Annually: n = 1

Semi-Annually: n = 2

Quarterly: n = 4

Monthly: n = 12

Daily: n = 365

Getting "n" right is non-negotiable. This number is the exponent in the formula, meaning it's the engine driving the whole compounding effect. A wrong "n" guarantees a wrong answer.

The biggest flawed assumption you can make is directly comparing a nominal yield to an effective yield. This is the classic apples-to-oranges mistake that can make a genuinely weaker investment look like the better deal.

Think about it. You're looking at two bonds: one offers a 7% nominal yield that compounds annually, and the other offers a 6.8% nominal yield but compounds monthly. At first glance, 7% looks like the clear winner.

But when you run the numbers, the second bond's effective yield is actually 7.01%. It's the better option, but you'd never know that unless you converted both to their true, effective yields.

Got Questions About Effective Yield?

Let's clear up a few final points. Getting a real handle on effective yield means understanding how it stacks up against other common terms and knowing where its limits are. Here are the answers to the questions I get asked most often.

Is APY the Same as Effective Yield?

Yes, for all practical purposes, they're the same thing. Annual Percentage Yield (APY) and effective yield both show you an investment's true annual return once compounding enters the picture.

You'll usually see APY used by banks and credit unions for savings products. "Effective yield" tends to pop up more when discussing bonds and other types of investments. The key is that both go beyond the simple interest rate, also known as the Annual Percentage Rate (APR).

Here's the takeaway: APY (effective yield) shows what you actually earn. APR (the nominal rate) is just the base rate before compounding kicks in. Always compare APY to APY to get a true side-by-side comparison.

Can Effective Yield Be Lower Than the Nominal Rate?

Nope, never. The effective yield can't be lower than the nominal interest rate.

In the simplest case, where an investment compounds just once a year, the effective yield will be exactly the same as the nominal rate. No magic there.

But the moment compounding happens more often—whether it's quarterly, monthly, or daily—the effective yield will always be higher than the nominal rate. That's the whole point of compounding: you start earning interest on your previously earned interest, and your money starts working harder for you.

Ready to stop calculating and start earning? Yield Seeker uses an AI Agent to automatically find and manage the best stablecoin yields for you in real time. Put your capital to work effortlessly and safely. Discover your potential at https://yieldseeker.xyz.