Back to Blog

A Practical Guide to Stablecoin Investing

Discover the world of stablecoin investing. This guide explains how to earn yield in DeFi through clear, practical strategies for building passive income.

Dec 29, 2025

generated

Think of stablecoin investing as a way to put your digital dollars to work, often earning you much better returns than a typical high-street savings account. It’s about taking the familiar stability of the U.S. dollar and plugging it into the high-yield opportunities buzzing within decentralized finance (DeFi).

Your Guide to Stablecoins and DeFi Yield

So, what exactly are stablecoins? The easiest way to think of them is as the digital twin of a dollar. They're designed to hold a steady value—usually $1—making them a reliable anchor in the often-choppy seas of the crypto world.

This rock-solid stability is what makes them so different from something like Bitcoin. Instead of wild price swings, stablecoins are built for one thing: consistency. This has turned them into the lifeblood of decentralized finance (DeFi), an open and global financial system built right on the blockchain.

Before we get into the nitty-gritty, let's quickly cover the key ideas you'll see throughout this guide. Think of this as your cheat sheet.

Key Stablecoin Investing Concepts at a Glance

Term | Simple Analogy | Primary Role in Investing |

|---|---|---|

Stablecoin | Digital U.S. Dollar | The core asset you invest to earn yield, avoiding price volatility. |

DeFi | Community-owned Bank | The ecosystem where you find yield opportunities like lending or providing liquidity. |

Yield Farming | High-Interest Savings | The act of actively seeking the best returns on your stablecoins across DeFi. |

Smart Contract | Digital Vending Machine | The self-executing code that powers DeFi protocols and manages your funds. |

Liquidity Pool | Foreign Exchange Booth | A pool of funds where you can deposit stablecoins to facilitate trades and earn fees. |

This table should give you a good foundation. Now, let's explore why this matters.

The Engine of DeFi

The stablecoin market has seen absolutely explosive growth. It's projected to hit a mind-boggling $308 billion in market cap by October 2025, which would mark its 25th straight month of expansion. That’s not just a random number; it's a massive signal of investor trust. You can dig into the findings on stablecoin market growth for a deeper look.

Within DeFi, stablecoins are the go-to currency. They power everything from simple lending and borrowing to much more complex trading strategies, all without the headache of price volatility. This has made them an incredibly powerful tool for anyone looking to put their capital to work.

Stablecoins offer a powerful premise: the global reach and speed of crypto combined with the price stability of fiat currency. They are the fundamental building block for earning reliable yield in the on-chain economy.

Simplifying Your Investment Journey

Let's be honest: finding the best yields in DeFi can feel like a full-time job. It takes constant research, monitoring, and a good bit of know-how. This is where modern tools are starting to change the game.

AI-powered platforms like Yield Seeker are built to cut through this complexity. Instead of you having to hunt for opportunities yourself, you can simply deposit your funds and let a dedicated AI agent find competitive, risk-managed yields on your behalf.

This approach automates all the heavy lifting—the allocation, the monitoring, the constant adjustments. It sets the stage for the powerful strategies we're about to dive into next.

How to Earn Yield with Your Stablecoins

Okay, so you've got some stablecoins. What's next? Letting them collect digital dust in a wallet is one option, but it's not the most exciting one. The real magic happens when you put those stablecoins to work in the world of decentralized finance (DeFi).

Think of it like this: you're moving your cash from under a mattress into a vehicle designed to generate some serious passive income. The DeFi ecosystem is packed with ways to earn a return, each with its own quirks and risk levels. Let's break down the most popular ways to get started.

Lending and Borrowing Protocols

The most straightforward path to earning yield is good old-fashioned lending. Platforms like Aave and Compound are basically decentralized money markets. You can deposit your stablecoins, like USDC, into a big pool of funds.

From there, borrowers can take out loans against their own crypto collateral, and they pay interest for the privilege. As a lender, you get a slice of that interest, paid out as an annual percentage yield (APY). It’s the DeFi version of a high-yield savings account, but with rates that often leave traditional banks in the dust, all thanks to the raw efficiency of the blockchain.

Providing Liquidity in Pools

Another core strategy is providing liquidity to decentralized exchanges (DEXs), such as Uniswap or Curve.

Picture yourself running a currency exchange booth at an airport. To serve customers, you need to have both US Dollars and Euros on hand. For offering this service, you'd pocket a small fee from every swap. Liquidity pools are the digital equivalent.

A common stablecoin pool might pair USDC with DAI (USDC/DAI). By depositing an equal value of both into the pool, you're making it possible for traders to swap between them effortlessly. For providing this essential service, you earn a share of the trading fees from that pool, which can really stack up over time.

When you supply assets to a liquidity pool, you become a market maker. You’re not just holding crypto anymore; you’re an active piece of the market’s plumbing, earning fees for helping trades happen.

This does introduce a risk called impermanent loss, which is something to be aware of. The good news is that in pools pairing two stablecoins, this risk is usually pretty minimal. For a deeper dive, check out our guide on the factors that influence stablecoin interest rates.

Automated Yield Vaults

If you're looking for a more "set it and forget it" approach, automated yield vaults are your best friend. Platforms like Yearn Finance or Beefy Finance have vaults that take your stablecoins and automatically deploy them using sophisticated, pre-built strategies.

Think of a vault as an expert fund manager working around the clock for you. It might lend your funds on Aave one day, shift them to a Curve liquidity pool the next, and constantly reinvest—or "compound"—your earnings to squeeze out the maximum possible return. This saves you a ton of time and, just as importantly, the gas fees you'd burn managing all this yourself.

To quickly recap the main strategies:

Lending: The simplest way to earn direct interest.

Liquidity Providing: Earns trading fees but means you need to supply two different assets.

Yield Vaults: Puts everything on autopilot, automating and compounding your returns for you.

Each of these is a fundamental building block for a solid stablecoin investment plan. You can definitely go it alone and manage these manually, but this is where automated platforms like Yield Seeker come in. By making a single deposit, an AI agent takes over, automatically allocating your capital across these very strategies—lending, providing liquidity, and more—to find the best risk-adjusted returns without you having to lift a finger. It turns a complex web of decisions into one simple action.

Navigating the Real Risks of Stablecoin Investing

The promise of high DeFi yields is what gets everyone excited, but it's absolutely critical to go in with a clear-eyed view of what can go wrong. Understanding the risks isn't about scaring you off; it's about helping you make smarter, more informed decisions with your money. After all, high returns rarely come without a catch.

Knowing where the landmines are is the very first step toward building a strategy that can actually last. Let's break down the big ones you'll run into.

Peg Risk: The Unstable Stablecoin

The whole game with stablecoins rests on a simple promise: they hold a steady value, usually $1. Peg risk is the danger of that promise shattering. When a stablecoin "de-pegs," its price drops below its target, and sometimes, it's a long way down.

This can happen for a few reasons. An algorithmic stablecoin might hit a "death spiral" if its internal machinery breaks under heavy market pressure. Even stablecoins supposedly backed by real assets can get into trouble if people start doubting the quality—or even the existence—of those reserves. The spectacular collapse of TerraUSD (UST) in 2022 is a brutal reminder of just how devastating a de-peg can be, wiping out billions in the blink of an eye.

The stability of a stablecoin is only as strong as the assets and mechanisms backing it. A 1:1 peg is an ongoing effort, not a permanent guarantee, making reserve transparency and design crucial for investor confidence.

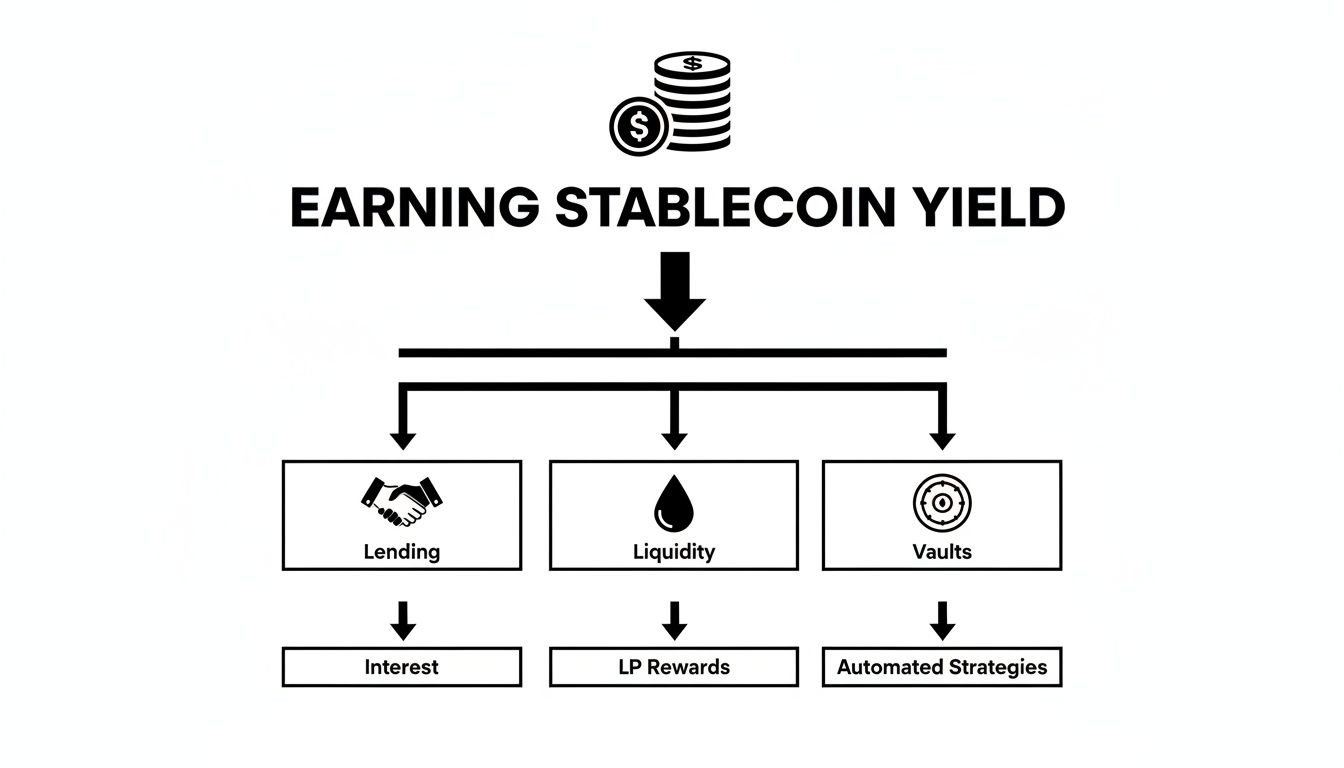

The flowchart below shows the main ways to put your stablecoins to work. Each path has its own unique set of risks.

As you can see, your initial capital is the foundation. If that foundation cracks, every strategy built on top of it is in jeopardy.

Smart Contract and Counterparty Dangers

Once you're confident in your stablecoin, you have to think about where you're putting it. This brings us to smart contract risk. Every single DeFi protocol—whether it's a lending market like Aave or a liquidity pool on Uniswap—is just a bunch of code. If that code has a bug, a flaw, or a vulnerability, hackers can exploit it and drain every last dollar.

These smart contracts are basically the digital vaults holding your money. A single weak point can lead to a total loss. This is exactly why audits and a long, clean track record are so important. The longer a protocol has been running without a major incident, the more "battle-tested" its code becomes.

Right alongside this is counterparty risk. When you deposit funds, you're placing your trust in the protocol's developers and its governance system not to do something malicious or just plain dumb. You're also trusting that the stablecoin issuer, like Circle for USDC, will manage its reserves properly and let you cash out when you want to. A failure anywhere in this chain of trust puts your funds on the line. A core part of managing this is a real commitment to evidence-based decision making, which means doing your homework on protocols and issuers before you jump in.

To make these risks easier to digest, here’s a quick comparison table breaking them down.

Comparing Key Risks in DeFi Yield Farming

Risk Type | Description | Example Mitigation Strategy |

|---|---|---|

Peg Risk | The stablecoin you hold loses its $1 value due to reserve issues or flawed mechanics. | Stick to stablecoins with transparent, high-quality reserves (like USDC) and avoid unproven algorithmic models. |

Smart Contract Risk | A bug or vulnerability in a DeFi protocol's code is exploited, leading to stolen funds. | Use protocols that have undergone multiple security audits and have a long, proven track record. |

Counterparty Risk | The team behind a protocol or stablecoin acts maliciously, or an exchange goes insolvent. | Choose reputable, well-known issuers and protocols. Avoid centralized platforms with opaque operations. |

Liquidity Risk | You can't withdraw your funds because the pool has been drained or market conditions are poor. | Invest in deep liquidity pools on major platforms to ensure you can exit your position when needed. |

Regulatory Risk | A government bans or heavily restricts stablecoins or DeFi, making your assets inaccessible. | Stay informed on the regulatory climate and consider geographic diversification if possible. |

This table isn't meant to scare you, but to arm you with the knowledge to make better choices and protect your capital.

How to Actually Manage These Risks

So, how do you protect yourself without spending all day reading audit reports and tracking reserve attestations? It’s a massive job to do manually. This is where diversification and automation really shine. For a much deeper dive, check out our complete guide to DeFi risk management.

Spreading your capital across multiple, well-vetted protocols is rule number one. It means that if one thing blows up, it doesn’t take your entire portfolio with it.

This is exactly what an AI-powered platform like Yield Seeker is built for. It’s constantly scanning the ecosystem, analyzing the health of different protocols, and automatically moving your funds across a diversified set of opportunities. This automated oversight acts as a 24/7 risk manager, shifting your capital away from things that start looking sketchy and toward more reliable sources of yield. It turns a complex, full-time research job into a manageable, automated process, letting you get on with your life.

So, you're ready to jump into stablecoin investing? Perfect. This section will walk you through exactly how to get started, step by step. It might look a bit technical from the outside, but once you break it down, it's a lot more straightforward than you’d think.

We’re going to cover the manual process first. Why? Because understanding the plumbing—how everything actually works under the hood in DeFi—is crucial. Once you get that, you'll really appreciate how much easier automation makes things.

The Manual On-Ramp to DeFi

Your journey into DeFi really boils down to three core steps: getting a wallet, loading it up with stablecoins, and then moving those funds onto an efficient blockchain where the real action happens.

Set Up a Self-Custody Wallet: Think of this as your personal bank account for the crypto world. You hold the keys, you have all the control. MetaMask is the go-to for most people; it's popular, trusted, and pretty user-friendly. Just download the browser extension or mobile app and follow the setup prompts.

Purchase Your First Stablecoins: With your wallet ready, it's time to get some funds in there. The easiest way is to buy a stablecoin like USDC on a major exchange such as Coinbase or Kraken using your regular currency. Once you've bought them, you'll withdraw those stablecoins to your new MetaMask wallet address.

Bridge to an Efficient Blockchain: Here's a pro tip: transaction fees on networks like Ethereum can be a real killer, eating away at your potential returns. To get around this, you'll need to "bridge" your assets over to a more affordable blockchain, often called a Layer 2 network. Base is a fantastic choice for beginners because of its super-low fees and rapidly growing ecosystem.

Think of a "bridge" as a digital ferry. It takes your assets from one island (a blockchain) to another. You're basically hopping from the expensive mainland of Ethereum to a much cheaper island like Base, where doing anything costs just pennies instead of dollars.

Going through this process yourself gives you a genuine feel for the mechanics of DeFi. But let's be honest, juggling wallets, exchanges, and bridges can be a lot, especially when you're just starting out.

The Simplified Path with Automation

This is where platforms like Yield Seeker come in. They’re designed to take that multi-step, slightly clunky process and boil it down to just a few clicks. All that complexity gets handled for you.

Here's how it works instead:

Connect Your Wallet: You just connect the MetaMask wallet you've already set up. Simple.

Make One Deposit: Deposit your USDC directly onto the platform, which operates on the Base network.

Let AI Take Over: From there, an AI agent does all the heavy lifting. It researches the best opportunities, allocates your funds across different protocols, and keeps a constant watch on everything for you.

This approach completely changes the game. What was once an intimidating journey becomes an incredibly simple entry point into stablecoin investing. You get all the upside of DeFi yield without any of the operational headaches. It's the difference between building a car from scratch and just getting in and driving. You can focus on your destination—earning passive income—while the tech handles the engine.

Automating Your Strategy with AI

Let's be honest: manually managing a DeFi portfolio can feel like a full-time job. The market is always on, 24/7. Yields are constantly shifting, new risks pop up out of nowhere, and opportunities can vanish in the blink of an eye. Trying to stay on top of it all requires an exhausting amount of research and analysis—a commitment that most people just don't have the time for.

This is where automation completely changes the game for stablecoin investing. Instead of you hunting down the best returns, a smart system can do the heavy lifting for you, working around the clock to put your capital to work. It shifts the entire process from a hands-on, high-stress activity to something far more strategic and passive.

The Power of an AI Portfolio Manager

Imagine having a personal portfolio manager who thinks only about your stablecoins. That's exactly the role an AI-driven platform like Yield Seeker is built for. It uses a sophisticated AI agent to act on your behalf, navigating the maze of DeFi to find competitive, risk-adjusted yields.

This approach immediately solves two of the biggest hurdles for investors: emotional decision-making and the sheer volume of information you have to process. The AI runs on pure data, moving funds based on real-time market analysis, not on fear or greed.

An AI agent doesn't get tired, distracted, or emotional. It continuously analyzes yield opportunities, smart contract health, and liquidity levels to make data-driven allocation decisions, ensuring your portfolio is always positioned to capture the best risk-aware returns.

This constant, unemotional oversight is crucial in a market that never sleeps. It means your funds are always working as efficiently as possible, without you needing to be glued to dashboards and social media feeds. To get a better handle on how this works under the hood, you can explore how to apply AI-powered financial analysis techniques to your own strategies.

From Conservative to Aggressive Allocation

Of course, not everyone has the same appetite for risk, and a huge benefit of AI automation is its ability to adapt. An AI agent can execute different strategies based on your parameters, shifting between conservative and more aggressive approaches as the market changes.

Conservative Approach: This strategy sticks to the battle-tested, "blue-chip" protocols like Aave and Compound. The AI prioritizes security and stability, allocating funds to large, highly liquid lending markets with long, reliable track records.

Balanced Approach: Here, the agent might mix established protocols with newer, promising opportunities. It diversifies across both lending platforms and stablecoin liquidity pools to capture a blend of interest income and trading fees.

Aggressive Approach: For those chasing higher returns, the AI can explore newer vaults and liquidity pools that offer juicier APYs. It’s constantly assessing smart contract risk and protocol health to make sure the potential reward is worth the extra risk.

The AI dynamically moves capital between these strategies, so your portfolio is never just sitting there. If a protocol that was once safe starts showing red flags, the agent can automatically reallocate those funds to a more secure alternative. You can learn more about how this is done in our detailed guide on what a modern yield optimization protocol looks like.

Tapping into a Trillion-Dollar Market

The need for this kind of smart automation is driven by the mind-boggling scale of the stablecoin economy. Recent data shows stablecoin transaction volumes have exploded to an incredible $46 trillion over the last year. Organic activity alone hit $9 trillion—that’s more than five times PayPal's total throughput.

As of September 2025, monthly adjusted volume hit a record $1.25 trillion, cementing stablecoins as the true backbone of the onchain economy.

With this much value flowing through the system, the opportunities are massive, but so is the complexity. An AI-powered platform makes this enormous market accessible. It gives you a simple interface to a sophisticated engine, letting you deposit funds and trust that an intelligent agent is navigating this trillion-dollar ecosystem for you. Best of all, platforms like Yield Seeker make sure your funds remain liquid, with no lockups, so you always have full control.

Best Practices for Long-Term Success

Chasing the highest APY is a rookie mistake. Real, long-term success in stablecoin investing comes from building smart habits that protect your money and keep you one step ahead. It's about playing the long game.

The most important habit, by a long shot, is nailing your security. DeFi gives you incredible freedom, but it also makes you the sole person responsible for keeping your funds safe. It all starts with where you keep your crypto.

Secure Your Digital Assets

Your software wallet, like MetaMask, is great for everyday transactions. Think of it like the cash in your physical wallet—convenient, but you wouldn't walk around with your life savings in it.

For any serious amount of capital, a hardware wallet is non-negotiable. Grab one from Ledger or Trezor. These little devices keep your private keys completely offline, which means hackers and malware can't touch them. Simple as that.

This one step creates a massive wall between your funds and anyone trying to get them. You also need to be paranoid about phishing scams. Never, ever click on sketchy links or type your seed phrase into a website. Scammers are experts at creating fake sites that look identical to the real thing, just to trick you into handing over your keys.

Treat your secret recovery phrase like the master key to your entire financial life. Write it down on paper, stash it somewhere safe, and never, ever save a digital copy or share it. One slip-up here means your funds are gone. Forever.

Understand Your Tax Obligations

Earning yield in DeFi is awesome, but don't forget the tax man. In most places, the rewards you earn are considered taxable income. Every time you collect interest from a lending pool or claim fees as a liquidity provider, that's a taxable event.

You absolutely have to keep detailed records of every single transaction. While this isn't financial advice, getting in touch with a tax professional who actually gets crypto is a must for any serious investor. They'll help you figure out the rules in your country and make sure you're playing by them.

Look Toward the Future

Finally, the best investors are always looking ahead. The stablecoin world isn't some tiny corner of crypto anymore; it’s quickly becoming a core piece of the new financial system. The growth projections from the big players are staggering.

For instance, analysts at J.P. Morgan are forecasting the stablecoin market could balloon from $300 billion to somewhere between $500–$750 billion, with some even whispering about $1 trillion. This explosion is being fueled by a huge demand for digital dollars that can move instantly and earn yield. You can read the full stablecoin research from J.P. Morgan to see for yourself.

This growth will bring incredible new opportunities, but also a ton more complexity. Trying to manage all of this by hand is going to become a full-time job. This is exactly why AI-driven platforms like Yield Seeker are the future. They handle the tedious research, risk analysis, and constant adjustments for you, letting you ride the wave without drowning in the details. By pairing solid security with a smart, automated strategy, you set yourself up to win for years to come.

Your Questions Answered: Stablecoin Investing FAQ

Diving into stablecoin investing always brings up a few good questions. Let’s tackle some of the most common ones to get you comfortable with how this all works.

How Much Can I Realistically Earn?

This is the big one, right? The honest answer is: it varies. DeFi yields aren't set in stone; they move with market demand, how much a protocol is being used, and the general crypto vibe.

You could see returns that look like a high-yield savings account, or you could find some killer double-digit APYs, especially if you venture into slightly more complex strategies. The key thing to remember is that these opportunities are always shifting. An AI-powered platform like Yield Seeker is a game-changer here because it's constantly scanning the market to hunt down the best risk-adjusted returns for you, taking all that manual legwork off your plate.

Is Stablecoin Investing Safe?

It’s definitely considered lower on the risk scale compared to buying something volatile like Bitcoin, but it's not risk-free. The main things to keep an eye on are potential smart contract bugs, protocol hacks, and the off chance that a stablecoin loses its $1 peg.

Your best defense is diversification. Never put all your eggs in one basket. Spreading your funds across several solid, vetted protocols is infinitely smarter than going all-in on just one.

This is another area where an automated platform like Yield Seeker really shines. It handles this for you by spreading your funds across a curated portfolio of protocols, which dramatically lowers the damage if any single point of failure occurs.

How Much Money Do I Need to Start?

One of the best parts about DeFi is how open it is. You absolutely do not need a pile of cash to get started. Many platforms have done away with the high minimums you see in traditional finance.

For instance, you could start earning yield with just $10 of USDC on a cheap network like Base. This makes it incredibly easy for anyone to dip their toes into the world of crypto passive income without having to make a huge financial commitment.

Why Use an AI Platform Instead of Investing Manually?

Look, the DeFi market is a wild place. It’s incredibly complex and moves at a blistering pace. Trying to manually research protocols, keep track of risks, and shuffle your investments around is more than a full-time job—it requires a ton of expertise.

An AI platform just automates that whole messy process. It crunches thousands of data points 24/7, shifts your portfolio around to get the best possible yield for the risk you're taking, and does it all way faster than any human could. It's like having a sophisticated portfolio manager working for you around the clock, without you having to lift a finger.

Ready to put your stablecoins to work the smart way? With Yield Seeker, you can deposit your USDC and let an AI agent handle the rest—finding, managing, and optimizing your yield across DeFi. Start earning with AI today.