Back to Blog

A Guide to Stablecoin Yield and Passive Income Strategies

Explore our guide to stablecoin yield. Learn how to generate passive income through proven strategies, manage risks, and maximize your returns in DeFi.

Dec 13, 2025

generated

Let's be honest, you've probably seen the interest rate on your bank's savings account and felt… underwhelmed. We've all been there. You put your money in, and it just kind of sits there, barely growing. What if your digital dollars could do more?

That's where stablecoin yield comes in. Think of it as putting your crypto to work to earn passive income, much like interest, by using decentralized finance (DeFi) protocols. It’s a way to make your money generate real returns, often at rates that make traditional banks look like they’re standing still.

Understanding Stablecoin Yield and Its Growing Appeal

You already know how a savings account works, right? You give the bank your money, they lend it out to others, and in return, you get a tiny slice of the profit as interest. Stablecoin yield follows the exact same logic but completely cuts out the middleman—the bank.

Instead, you interact directly with financial protocols built on the blockchain. These protocols take your stablecoins (digital assets pegged to a stable currency like the US dollar) and use them to power activities like lending or trading. For providing this much-needed liquidity, you get rewarded with a "yield." It's a simple idea, but it's powerful enough to attract a flood of investors looking for a safe harbor in the often-choppy crypto seas.

Why It Matters More Than Ever

The real magic of stablecoin yield is how it mixes the steadiness of traditional money with the earning power of DeFi. While big-name cryptos like Bitcoin can swing wildly in price, stablecoins are built to hold their value. This makes them a much more reliable foundation for building a passive income stream.

So, why are so many people turning to stablecoin yield? It boils down to a few key things:

Higher Potential Returns: DeFi protocols frequently offer Annual Percentage Yields (APYs) that blow the typical 0.5% from a traditional bank out of the water.

True Passive Income: Your digital assets genuinely work for you, 24/7, without you needing to actively trade or time the market.

Open to Everyone: Got an internet connection and a crypto wallet? You're in. The barrier to entry is dramatically lower than many old-school financial products.

This approach is a game-changer for anyone wanting to shield their capital from market swings while still making it productive. It’s one of the foundational strategies for earning passive income in the digital asset world.

Let's quickly compare what we're talking about here.

Stablecoin Yield vs Traditional Savings Accounts

Feature | Stablecoin Yield | Traditional Savings |

|---|---|---|

Typical APY | Often 2% - 20%+ | Around 0.5% or less |

Underlying Tech | Blockchain & Smart Contracts | Centralized Banking Systems |

Accessibility | Global, 24/7 Access | Bank Hours, Regional |

Custody | Self-custody (You own it) | Bank Custody |

Transparency | Fully transparent on-chain | Opaque, internal ledgers |

Risk Profile | Smart contract & protocol risk | FDIC/government insured |

As you can see, the trade-off is clear: higher potential returns in DeFi come with a different set of risks compared to the insured, but low-yielding, world of traditional banking.

The Core Idea: A Simple Analogy

Imagine a community lending pool. You chip in some of your dollars, and whenever someone borrows from that pool and pays it back with interest, you get a piece of that interest. That’s it.

DeFi lending protocols are just a high-tech version of this, automated by smart contracts to make everything efficient and transparent. This fundamental concept—providing capital to earn a return—is the engine driving most stablecoin yield opportunities. By getting a handle on the basics of stablecoin interest rates, you can start to see how these new financial machines create value.

As we'll dig into, this simple lending model has blossomed into a whole ecosystem of different strategies, each with its own unique flavor of risk and reward.

How Stablecoin Yield Is Actually Generated

Those attractive yields you see on stablecoins can feel a bit like magic, but I promise you, they aren't pulled from thin air. The return you earn is a direct payment for doing something valuable within the world of decentralized finance (DeFi). At its heart, stablecoin yield exists because there's real economic demand for your digital dollars.

This demand comes from all sorts of people and protocols that need stable, liquid cash to make their own financial strategies work. It's not so different from a bank paying you interest to use your deposits. In DeFi, protocols reward you for lending your stablecoins to others. Let's pull back the curtain on the three main engines that power these returns.

Lending and Borrowing Markets

The most straightforward way to earn yield on stablecoins comes from decentralized lending and borrowing. Platforms like Aave and Compound act like automated money markets, connecting people who have capital with those who need it, all without a traditional bank in the middle.

Here’s the simple version: You deposit your stablecoins (like USDC or USDT) into a big lending pool. Borrowers can then take loans from that pool, but they have to put up other crypto assets as collateral—often worth much more than the loan itself. This over-collateralization is a crucial safety net.

These borrowers pay interest on their loans, and a huge chunk of that interest gets passed directly to you and the other lenders in the pool. The yield you get isn't fixed; it moves up and down with supply and demand. When lots of people want to borrow, interest rates go up, and so does your yield.

Think of it as a peer-to-peer lending service that runs entirely on code. By supplying the capital that others need, you earn a share of the profits in a completely transparent and automated way.

Providing Liquidity for Trading

Another huge driver of stablecoin yield is providing liquidity to decentralized exchanges (DEXs). A DEX like Uniswap or Curve needs massive pools of assets so users can swap one token for another without a hitch. This is where you come in as a liquidity provider (LP).

You can deposit a pair of assets—often two different stablecoins, like USDC and DAI—into a trading pool. When you do this, you’re basically acting as a market maker, making sure there's enough inventory for trades to happen smoothly.

Every time someone uses that pool to make a trade, they pay a small fee. A piece of these fees is then split among all the liquidity providers as a reward. If you provide 1% of the pool's assets, you get 1% of the trading fees. This whole process is often called liquidity mining, and it's the backbone of how decentralized trading works. We dive deeper into this in our guide on what is liquidity mining.

Your Role: You provide the inventory (stablecoins) for the "store" (the DEX).

The Reward: You earn a percentage of the sales tax (trading fees) on every transaction.

The Benefit: Your capital helps power a core function of DeFi—permissionless trading—and you get paid directly for it.

Staking and Protocol Incentives

While it's less common for stablecoins themselves, staking is another piece of the puzzle. Staking usually means locking up a protocol's own governance token to help secure the network or vote on its future.

But some protocols get creative. They might offer staking rewards paid out in stablecoins or create special incentives with stablecoin yields. For instance, a new DeFi project might offer a juicy stablecoin APY to anyone who deposits funds early on. This is basically a marketing tactic to attract the initial liquidity they need to get off the ground.

To really get a feel for the different ways yield is generated, it helps to look at various models, like the revolutionary stablecoin yield product highlighted recently for institutional players, which shows just how powerful demand can be in driving returns. These incentive-based yields can be incredibly high, but they can also be riskier since they're often temporary promotions designed to attract early birds.

At the end of the day, these three sources—lending, providing liquidity, and staking—are all connected. They create a dynamic marketplace where your stablecoins are a hot commodity, and different protocols will compete to pay you the best rate for putting them to work. Once you understand where the yield comes from, you're in a much better position to weigh the opportunities and the risks.

Finding Your Flavor of Stablecoin Yield

Once it clicks that stablecoin yield isn't magic internet money—it’s driven by real economic activity—the next step is to look at the menu. Not all strategies are built the same. They sit on a spectrum of risk and complexity, a lot like traditional investing where you have everything from safe government bonds to high-stakes venture capital. The game is to find what matches your own appetite for risk and your financial goals.

To get started, you need to know the core differences between how these returns are generated. From just lending out your coins to jumping into the deep end with liquidity provision, each path has its own set of trade-offs. Let's walk through the most common ways to earn, starting with the most straightforward one.

Single-Asset Lending on Blue-Chip Platforms

The easiest and generally safest way to get your feet wet is by lending your stablecoins on battle-tested DeFi protocols like Aave or Compound. You can think of this as the DeFi version of a high-yield savings account, except smart contracts are running the show instead of a bank.

It's simple: you deposit a single asset, like USDC, into a lending pool. Borrowers can then tap into that pool by putting up their own crypto as collateral, and you earn a variable interest rate based on how much demand there is for borrowing.

Simplicity: This is perfect for beginners. Just deposit your stablecoins and you'll start earning. No need to manage complex positions.

Lower Risk Profile: Sticking with platforms that have been around the block and have a solid security track record means you’re not exposing your funds to unaudited, risky smart contracts.

Flexibility: Your funds usually aren't locked up. You can pull out your capital and earnings whenever you feel like it.

This approach is a solid foundation for anyone looking to earn a stablecoin yield without taking on a ton of risk. The returns might be more modest, but they come from the transparent and fundamental activity of lending.

Providing Liquidity for Stablecoin Pairs

If you're ready to take a small step up in complexity for potentially higher rewards, providing liquidity is the next logical move. This is especially true for stablecoin-to-stablecoin trading pairs on platforms like Curve Finance. These decentralized exchanges are built for super-efficient swaps between assets that have similar values, like going from USDC to DAI.

To get involved, you deposit two different stablecoins into a liquidity pool. By providing this capital, you're making it possible for other users to trade, and in return, you get a cut of the transaction fees from every swap that happens in that pool.

Think of it like being a silent partner in a currency exchange booth at the airport. You put up the cash needed for the daily swaps, and for that, you get a piece of every fee collected from travelers trading one currency for another.

While this strategy is generally pretty stable, it does introduce a concept called impermanent loss, though it’s much less of a concern when you're dealing with two stablecoins. The real draw here is that these pools can rack up a lot of fee revenue, often leading to better APYs than you'd get from simple lending.

Using Yield Aggregators to Automate the Hustle

For those of us who want to squeeze the most out of our returns without manually hopping between protocols every day, yield aggregators (or "yield optimizers") are a game-changer. These platforms are like having a robot financial advisor for your crypto.

You deposit your stablecoins into a "vault," and the aggregator’s smart contracts get to work, automatically shifting those funds across different DeFi protocols to chase the highest yield available. One day it might be lending on Aave, the next providing liquidity on Curve, constantly rebalancing to keep your returns juiced.

Even after major market slumps, the stablecoin yield space has shown it can bounce back. At times, top-performing accounts have hit over 11%, easily beating the CeFi Yield index which was closer to 8.10%. This shows how DeFi protocols can offer seriously competitive, low-volatility returns. You can dive deeper into these yield index comparisons and their benchmarks.

These aggregators make what was once a complex, full-time job—yield farming—accessible to pretty much anyone. To round out your strategy and get smart about your after-tax gains, it's also worth getting your head around understanding crypto tax loss harvesting. By exploring these different approaches, you can build a stablecoin yield portfolio that's perfectly balanced for your needs.

Chasing a high stablecoin yield without understanding the risks is a bit like driving a race car without checking the brakes. It's thrilling, sure, but the dangers are very real. While stablecoins are built for stability, the DeFi protocols where you put them to work have their own set of hazards every investor needs to get their head around.

Knowing the risks doesn't mean you have to sit on the sidelines. It’s about making smart, informed decisions. Once you understand the potential pitfalls, you can build a tougher strategy, protect your capital, and invest with a lot more confidence.

Let's break down the four biggest risks you'll face out there.

Smart Contract Vulnerabilities

The entire world of DeFi runs on smart contracts—basically, chunks of code that automatically execute financial deals. This automation is incredibly powerful, but it's also a huge point of failure. If there's a bug, an exploit, or just a simple coding mistake in a protocol's smart contract, bad actors can potentially drain every last penny.

Think of a smart contract as a digital vault. If the lock has a flaw, a skilled safecracker could pop it open and take everything inside. This isn't just theory; billions of dollars have been swiped across DeFi because of smart contract exploits.

So, how do you protect yourself?

Stick to Audited Protocols: Focus on platforms that have been through multiple security audits from well-known cybersecurity firms. An audit isn't a 100% guarantee of safety, but it’s a massive tick in the box for due diligence.

Choose Battle-Tested Platforms: Protocols like Aave or Curve have been around for years, handling billions in assets and surviving major market storms. That long track record buys you a much higher degree of trust.

De-Peg Events

The whole point of a stablecoin is its promise to hold a 1-to-1 peg with a fiat currency, usually the U.S. dollar. A de-peg event is when a stablecoin’s price breaks away from that value. A small de-peg might see a coin dip to $0.99 for a bit, but a catastrophic one could send it spiraling towards zero.

This can happen for a bunch of reasons, from a total loss of faith in the issuer to fundamental flaws in an algorithmic stablecoin's design. The collapse of Terra's UST back in 2022 is a brutal reminder of how quickly an unbacked or badly collateralized stablecoin can implode, wiping out fortunes overnight.

A stablecoin is only as stable as the assets backing it and the market's trust in its ability to honor redemptions. When that trust erodes, the peg can shatter with alarming speed.

To stay safe, stick with stablecoins that have transparent, high-quality reserves—ideally fully backed by cash and short-term U.S. government bonds.

Impermanent Loss

This one is a headache specifically for liquidity providers. Impermanent loss (IL) is the difference between the value of your assets in a liquidity pool and what they would have been worth if you'd just held them in your wallet.

Now, providing liquidity for two stablecoins (like a USDC-DAI pair) slashes this risk dramatically, but it doesn't get rid of it completely. If one of the stablecoins in your pair were to de-peg, your pool would automatically rebalance by selling the "good" stablecoin to buy more of the failing one. You'd be left holding the bag.

This means even in a seemingly safe stablecoin pair, you're still exposed to the de-peg risk of both assets.

Regulatory Uncertainty

Last but not least, the rulebook for stablecoins and DeFi is still being written. Governments all over the world are trying to figure out how to handle this new financial frontier, and future regulations could totally change how stablecoin yield protocols operate.

Sudden policy changes could affect which stablecoins are allowed, how platforms are run, or even slap new restrictions on users. This uncertainty creates a layer of systemic risk that's pretty much out of your control as an individual investor. While many regulators are trying to bring clarity, the road ahead is still bumpy and unpredictable. Keeping an eye on developing policies is a key part of managing this long-term risk.

Alright, theory is great, but let's get our hands dirty. It's time to put what you've learned into practice.

This is your practical, no-nonsense walkthrough for earning your first bit of stablecoin yield. We'll go through everything from getting the right tools to making your first deposit, keeping a laser focus on doing things safely and clearly.

Think of it as your pre-flight checklist. Follow these steps, and you'll build a solid foundation for earning passive income with stablecoins. More importantly, you'll start your journey with confidence and the right security habits from day one.

Step 1: Choose Your Stablecoin and Wallet

Before you can earn a dime, you need two things: the right asset and a secure place to keep it. Getting this initial setup right is the most critical part of the whole process.

First up, pick a reputable, well-backed stablecoin. Coins like USDC (USD Coin) or USDT (Tether) are popular for a reason—they are backed by real-world reserves and have a long track record of holding their peg to the U.S. dollar.

Next, you need a non-custodial digital wallet. This just means a wallet where you have full control over your funds, not some company. MetaMask is a widely-used and trusted option that works as a simple browser extension, making it easy to plug into DeFi platforms.

Crucial Security Tip: When you set up your wallet, it will give you a "seed phrase" or "secret recovery phrase." This is everything. Write it down and store it somewhere safe and offline. Never, ever share this phrase with anyone. If someone gets your seed phrase, they can access and steal all of your funds. It's that simple.

Step 2: Select a Trusted DeFi Platform

With your wallet funded, the next step is finding a place to put those stablecoins to work. The DeFi space is massive and a bit like the Wild West, so it’s vital to stick with established, reputable platforms, especially when you're just starting out.

Look for protocols that have:

A long track record: Platforms like Aave or Compound have been around for years and have safely managed billions of dollars in assets.

Multiple security audits: This means reputable third-party security firms have combed through the platform's code looking for weaknesses.

A strong community: Active, engaged communities are often a good sign of a project's health and transparency.

Steer clear of new, unaudited platforms promising unbelievable returns. If an APY seems too good to be true, it almost certainly comes with ridiculously high risk.

Step 3: Deposit Your Funds and Start Earning

Once you've picked a platform, the last step is to connect your wallet and make a deposit. Let's use a lending protocol as an example of how this usually works.

Navigate to the Platform: Go to the official website of your chosen protocol. Always double-check the URL to make sure you aren't on a convincing-looking fake (phishing) site.

Connect Your Wallet: Look for a "Connect Wallet" button, which is usually in the top-right corner. Select your wallet (like MetaMask) from the list and approve the connection.

Find the Stablecoin Pool: Find the section for supplying or lending assets. Locate the stablecoin you're holding (e.g., USDC).

Approve and Deposit: Before you can deposit, you'll need to "approve" the protocol to interact with your stablecoin. This is a standard security step. Once that transaction is confirmed, you can enter the amount you want to deposit and confirm the final transaction.

And that's it! Once your deposit is confirmed on the blockchain, you'll start earning yield immediately. You can pop back to the platform's dashboard anytime to see how your earnings are growing.

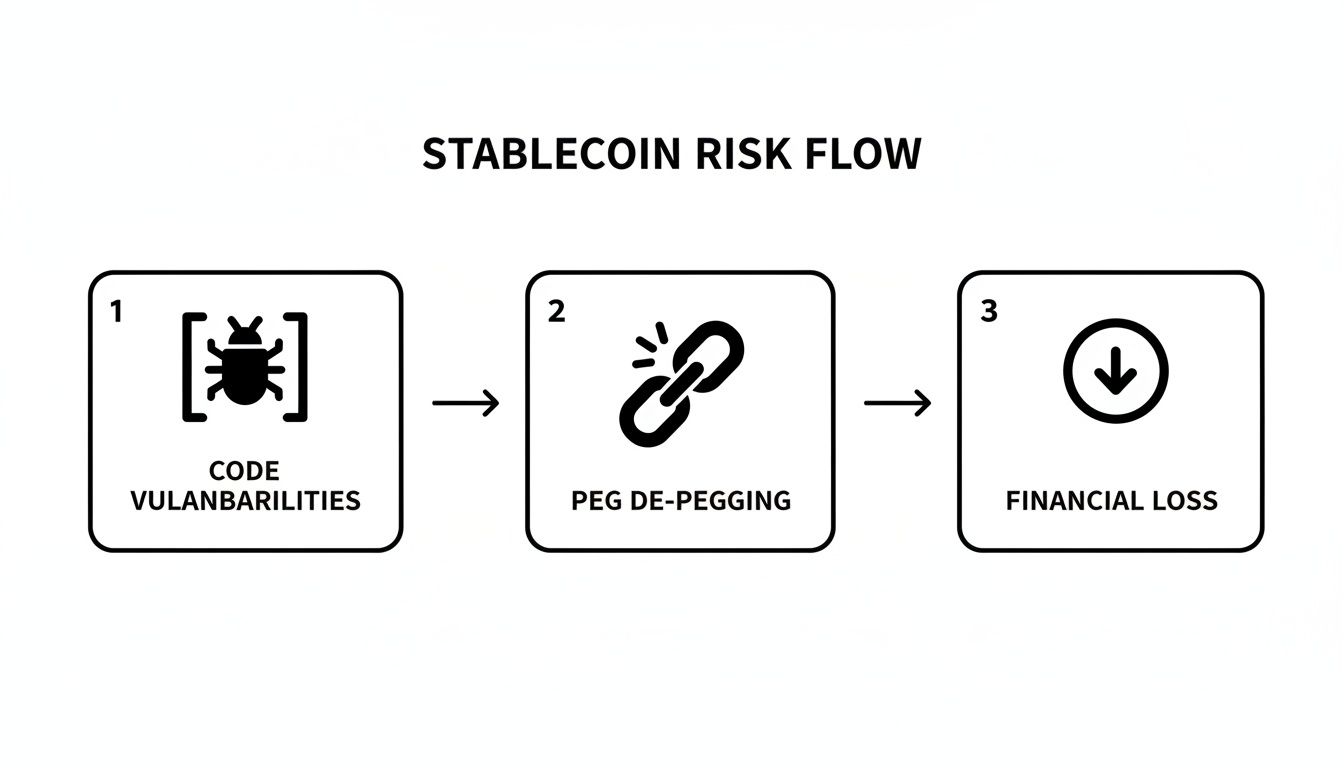

The infographic below shows the core risks to keep in mind, flowing from code vulnerabilities all the way to potential financial loss.

This flow really highlights how a single bug in a smart contract can set off a chain reaction, which underscores why choosing secure, well-audited platforms is so important.

As the market grows up, we're starting to see benchmarks emerge that help professionalize the space. For example, the CF USDT Interest Rate Curve now provides a daily, complete interest rate curve using rates from major decentralized lending pools. This is a huge step in bridging the gap between traditional finance and DeFi. You can read more about these stablecoin yield benchmarks and see how they are shaping the market. This move towards standardized metrics just shows how serious the demand for reliable stablecoin yield has become.

Using AI Tools to Automate Your Yield Strategy

Let's be honest, manually hunting for the best stablecoin yields across dozens of DeFi protocols can feel like a full-time job. Rates are always changing, new platforms pop up out of nowhere, and the risks are constantly shifting under your feet. This is where automated yield optimizers come in, and they're quickly becoming the modern solution to this complexity.

These platforms use sophisticated algorithms—and increasingly, AI—to constantly scan the market. Their goal? Find the best risk-adjusted returns for your stablecoins so you don't have to. For anyone serious about earning a consistent yield, this approach offers some serious advantages.

Why Automation Is a Game Changer

Automating your strategy does a lot more than just save you time. It fundamentally changes how you interact with DeFi, making the whole process more efficient and, in many cases, a lot safer.

Here are a few of the key perks:

Time Savings: Instead of burning hours on research, an automated system does the heavy lifting. This frees you up to think about your high-level strategy instead of getting bogged down in the day-to-day execution.

Reduced Human Error: We've all been there. Automation cuts down on the risk of making a costly mistake, like sending funds to the wrong address or messing up a transaction.

Access to Complex Strategies: AI-powered tools can pull off moves that would be nearly impossible to do by hand, like rebalancing your funds between multiple pools in a single, slick transaction.

This push toward automation is getting a massive boost from the explosive growth of stablecoins, which has cranked up the competition for deposits. The total stablecoin market is projected to hit nearly $2 trillion by 2030. This boom is continually expanding the landscape of yield opportunities for these tools to explore. You can dive into the numbers in this in-depth report on the stablecoin market.

Think of an automated platform as your own dedicated financial analyst, working 24/7 to make sure your capital is always positioned to capture the best yield based on the risk level you're comfortable with.

How AI-Powered Optimizers Work

Platforms like Yield Seeker take this a step further by giving you a personalized AI agent to manage your stablecoins. Once you deposit your funds, the AI agent gets to work, monitoring the entire DeFi landscape in real time. It analyzes yield sources, checks out smart contract risks, and automatically shifts your capital to the most promising spots.

This creates a completely hands-off experience where your passive income strategy is always adapting to what the market is doing. Whether you're a seasoned DeFi veteran or just getting started, these tools make earning a reliable stablecoin yield more effective and accessible than ever before.

To get a better sense of how the underlying tech works, check out our guide on choosing a yield optimization protocol. It's all about taking the guesswork out of the equation, letting you tap into DeFi's potential without all the constant manual effort.

Frequently Asked Questions About Stablecoin Yield

Jumping into the world of stablecoin yield always brings up a few questions. Let's tackle the most common ones head-on so you can get started with a clear picture of what to expect.

What Is a Realistic APY for Stablecoin Yield Farming?

In my experience, a realistic Annual Percentage Yield (APY) for most solid stablecoin strategies falls somewhere in the 5% to 20% range. This isn't a fixed number, of course. It dances around based on how much demand there is for borrowing, which DeFi protocol you're using, and just how complex your strategy is.

A word of caution: if you see platforms screaming about triple-digit APYs, your alarm bells should be ringing. Those eye-popping numbers almost always come with massive, often hidden, risks. A steady, reasonable yield from a protocol with a good reputation is a much smarter play than chasing flashy returns that might not be there tomorrow.

Can I Lose Money While Farming Stablecoin Yield?

Yes, absolutely. Don't let the "stable" part of the name fool you into thinking these are risk-free. The potential to lose your capital is very real, and it’s crucial to understand where those risks come from before you put a single dollar to work.

Here are the main ways you could lose your funds:

Smart Contract Failure: A bug or an exploit in a protocol's code is a hacker's dream. If they find a vulnerability, it could lead to a complete drain of all the funds you've deposited.

De-Peg Events: If your stablecoin loses its 1-to-1 peg to the dollar, its value can crash hard, taking your investment down with it. It’s happened before.

Impermanent Loss: This one's for the liquidity providers. It’s a weird situation where the value of your assets in a liquidity pool drops below what they would have been worth if you’d just held them in your wallet.

People often think stablecoins are as safe as cash sitting in a bank account. They're not. That yield you're earning is your compensation for taking on the unique risks that come with playing in the DeFi sandbox.

How Are Taxes Handled for Stablecoin Yield Earnings?

For most places, including the United States, the earnings you make from stablecoin yield are typically considered ordinary income. This means any rewards you get from lending, providing liquidity, or staking are taxed at your standard income tax rate, just like a salary.

But let's be clear: tax laws for crypto are a tangled mess and change depending on where you live. It's incredibly important to talk to a qualified tax professional who actually gets crypto. They can give you advice that fits your specific situation and make sure you're playing by the rules. Keeping detailed records of all your transactions will make their job—and yours—a lot easier come tax time.

Ready to earn smarter, automated yield without the full-time research? Yield Seeker uses a personalized AI Agent to find competitive, risk-aware stablecoin yields for you. Get started in minutes at https://yieldseeker.xyz.