Back to Blog

A Practical Guide to Earning USDC Yield Safely

Explore our complete guide to earning USDC yield. Learn proven CeFi and DeFi strategies, understand the key risks, and start earning on your stablecoins safely.

Dec 19, 2025

generated

Think of USDC yield as the crypto equivalent of putting your cash into a high-yield savings account. If your USDC is just sitting in your wallet, it’s not doing much for you—it’s safe, but it's not growing. Earning USDC yield means putting those digital dollars to work to generate passive income.

You’re essentially transforming an idle asset into a productive one. This isn't just some abstract crypto magic; it's a real economic engine running on the simple, time-tested principle of supply and demand.

What Is USDC Yield and How Does It Work

So, where does this "yield" actually come from? The short answer is: other people want to borrow your USDC, and they're willing to pay for the privilege.

The Engine Behind the Yield

You can earn a return because there's significant demand for a stable, dollar-pegged asset across the crypto world. When you deposit your USDC to earn yield, you become a lender, supplying liquidity to a market full of borrowers.

So who's on the other side of this trade? It’s usually one of three groups:

Traders and Arbitrageurs: These folks need quick access to liquidity to fund leveraged trades or jump on price differences between exchanges. Their need for speed drives a lot of the short-term borrowing demand.

DeFi Protocols: Many decentralized applications, like lending markets or automated market makers, need deep pools of stablecoins to function smoothly. They attract your deposits by offering you a cut of the interest or fees they generate.

Institutions: Big financial players use USDC for all sorts of things, from treasury management to cross-border payments. Their large-scale operations create a steady, foundational demand for borrowing.

In essence, you're the bank. You supply the capital that makes the crypto economy tick, and the interest borrowers pay becomes your return.

The APY you see advertised is a direct reflection of this market dynamic. When demand to borrow USDC is high, rates go up. When it's low, rates fall. If you want to see how this plays out in real-time, you can check out our stablecoin interest rates in our detailed guide. Getting a handle on this basic principle is the first step to figuring out which yield strategies are right for you.

Comparing CeFi and DeFi Yield Opportunities

When you start looking to earn a return on your USDC, you’ll quickly find yourself standing at a crossroads between two very different worlds: Centralized Finance (CeFi) and Decentralized Finance (DeFi).

Think of CeFi as the crypto equivalent of your online bank. It's run by a company, it’s generally user-friendly, and it's straightforward. You deposit your funds, and they handle the rest.

DeFi, on the other hand, is like becoming your own bank. It hands you the keys to the vault, offering direct control and often much juicier returns, but it comes with a steeper learning curve.

Choosing your path is all about balancing convenience, control, and your appetite for rewards. CeFi platforms—think major crypto exchanges—give you a curated experience. You send them your USDC, they lend it out behind the scenes, and you get a slice of the interest. It’s clean, simple, and doesn't demand much technical know-how.

DeFi protocols like Aave or Compound are a whole different beast. They're open financial markets built directly on blockchain code. You interact with smart contracts to lend your USDC to a global pool of borrowers, with no company in the middle. This direct access is what can unlock more competitive USDC yield opportunities, but it requires you to get your hands a bit dirty with the tech.

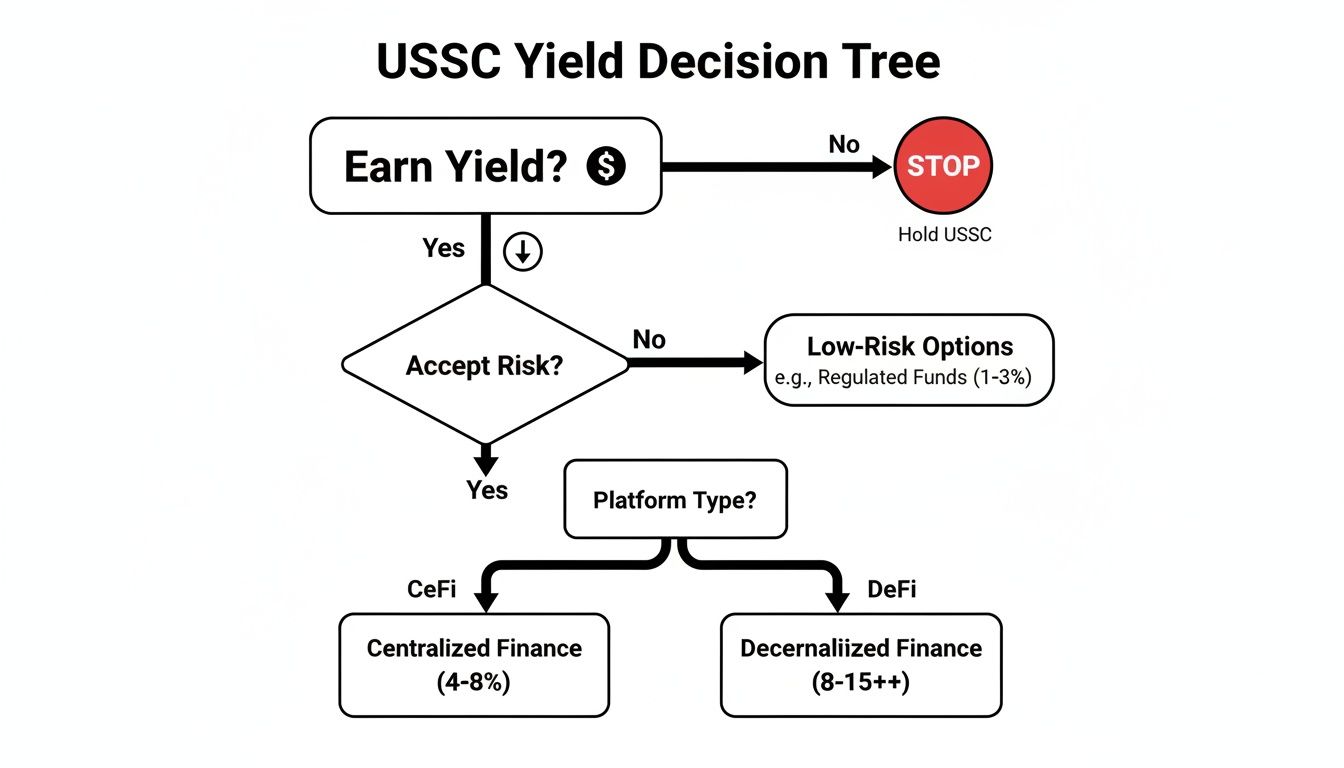

This decision tree gives you a simple visual for thinking through which path might suit you best.

The main takeaway? Your choice hinges on how comfortable you are with holding your own keys and whether you’re chasing higher, but often more volatile, returns.

User Experience and Control

The first thing you'll notice is just how different the user experience is. CeFi platforms are built for ease, often with slick mobile apps and customer support teams that make them feel a lot like a familiar fintech app.

DeFi, in contrast, requires you to use a non-custodial wallet and interact directly with protocols yourself. Before you even think about yield, it’s critical to get a grip on understanding custodial vs. non-custodial wallets, as this is the fundamental split. With DeFi, you are always in full control of your private keys—and therefore, your money.

In CeFi, you trust a company with your assets. In DeFi, you trust the code. This is the single most important distinction to make when you’re weighing your options.

This custody difference completely changes the game when it comes to risk. A CeFi platform could go bankrupt or get hacked, putting your funds at risk. A DeFi protocol, meanwhile, faces risks from potential bugs or exploits in its smart contract code.

Comparing Yields and Their Drivers

Historically, DeFi was the undisputed king of high yields because it cut out the corporate middleman. But as the market has grown up, those lines have started to blur.

We've seen yields on USDC enter a whole new phase, driven by both institutional and on-chain demand. On-chain lending markets like Aave v3 have posted juicy multi-percent APYs thanks to high borrowing demand. At the same time, big CeFi players started offering very competitive rates; Coinbase, for instance, advertised around 4.1% APY for USDC holders, showing how the two worlds are starting to converge, especially when traditional finance rates are also high.

This means the choice is no longer just about chasing the biggest number. It's about looking under the hood to understand where that yield is coming from and what risks are attached. If you want a constantly updated look at the market, our guide on the best stablecoin interest rates is a great place to start.

CeFi vs DeFi for USDC Yield at a Glance

To really break it down, a side-by-side comparison makes the trade-offs crystal clear. Here’s a quick look at how CeFi and DeFi stack up against each other.

Feature | Centralized Finance (CeFi) | Decentralized Finance (DeFi) |

|---|---|---|

Asset Custody | Platform holds your funds (custodial) | You hold your own funds (non-custodial) |

User Experience | Simple, app-based, like a digital bank | Requires a crypto wallet and technical know-how |

Yield Potential | Generally more conservative and stable | Can be higher but more volatile |

Primary Risk | Counterparty risk (platform failure) | Smart contract risk (code exploits) |

Transparency | Opaque; relies on company reporting | Fully transparent on the blockchain |

Accessibility | May have geographic or KYC restrictions | Open to anyone with a wallet and internet |

At the end of the day, there's no single "best" choice here. It all boils down to your personal risk tolerance, how tech-savvy you feel, and what you’re trying to achieve financially.

In fact, many savvy investors don’t choose one or the other—they use both. They might keep a portion of their funds in a simple CeFi account for stability and deploy another chunk into the higher-potential world of DeFi to chase bigger returns.

Exploring Different DeFi Yield Strategies

Diving into Decentralized Finance (DeFi) unlocks a fascinating world of strategies to generate USDC yield. Unlike the more straightforward world of CeFi, DeFi is a vibrant ecosystem with multiple ways to put your assets to work, each with its own unique blend of risk, reward, and complexity.

You don't need to be a financial wizard to get started. The best way to think about these strategies is like different investment vehicles. Some are like conservative bonds, offering steady but modest returns. Others are more like active market trading, with higher potential rewards but also higher risks.

We’ll explore the three most common methods: lending protocols, liquidity pools, and yield aggregators. Getting a feel for how each one works is key to building a strategy that fits your financial goals and comfort level. Let’s break them down.

Lending Protocols: The DeFi Money Market

The most direct and popular way to earn USDC yield is through lending protocols. Think of platforms like Aave or Compound as decentralized, automated money markets that operate 24/7—no bankers or intermediaries needed.

Here’s a simple analogy: you deposit your USDC into a large, collective pool, much like putting money into a community savings account. Borrowers can then take loans from this pool, but first, they have to post other crypto assets (like ETH or WBTC) as collateral to back their loan.

The interest they pay on their loan is then distributed back to you and all the other lenders in the pool. This whole process is managed by smart contracts, which automatically enforce the rules, calculate interest rates, and handle liquidations if a borrower's collateral value drops too low.

The core idea is simple: you are supplying liquidity to borrowers and earning interest in return. The APY you receive is dynamic, changing in real-time based on the supply of USDC in the pool versus the demand from borrowers.

This strategy is often seen as one of the more conservative entry points into DeFi. The main risk is tied to the security of the protocol's code rather than the wild swings of market prices.

Liquidity Pools: Fueling Decentralized Exchanges

Another powerful strategy for earning USDC yield is providing liquidity to Automated Market Makers (AMMs). These are essentially decentralized exchanges (DEXs) like Uniswap or Curve, and your role here is a bit more active than just lending.

Imagine a currency exchange booth at an airport. To operate, it needs a ready supply of different currencies to facilitate trades. In DeFi, liquidity pools serve this exact function. By depositing your assets, you become the exchange booth.

Typically, you deposit a pair of assets—for example, 50% USDC and 50% ETH—into a specific trading pool. By doing this, you provide the liquidity needed for other users to swap between those two tokens.

In return for your contribution, you earn a share of the trading fees generated by that pool. Every time someone makes a trade, a small fee (often around 0.3%) is collected and split proportionally among all the liquidity providers.

This approach has a different risk-reward profile:

Higher Potential Returns: Fee income can sometimes be much higher than lending interest, especially in high-volume markets.

Impermanent Loss: This is a key risk unique to AMMs. If the price of the assets in the pool changes significantly, the value of your deposited assets could end up being less than if you had just held them in your wallet.

Providing liquidity is like being a market maker. You earn from the market's activity, but you're also exposed to its price movements.

Yield Aggregators: The Automated Robo-Advisors

Juggling multiple yield strategies can quickly feel like a full-time job. You have to constantly monitor rates, move funds between different protocols, and stomach gas fees for every single move. This is where yield aggregators, or "yield optimizers," come in.

Think of a yield aggregator like a robo-advisor for your crypto. Platforms like Yearn Finance or Beefy automatically scan the DeFi landscape to find the best possible returns for your USDC. You just deposit your funds into one of their "vaults," and their automated strategies handle everything else.

Here’s how they work:

Pooling Funds: They gather deposits from many users, which helps save a ton on transaction fees.

Automating Strategy: The vaults automatically shift capital between different lending protocols and liquidity pools to chase the highest APY.

Compounding Returns: They frequently harvest the rewards you've earned and reinvest them, creating a powerful compounding effect that grows your holdings faster.

While they do add another layer of smart contract risk (you're trusting both the underlying protocol and the aggregator), the convenience is immense. For anyone who wants to optimize their USDC yield without the manual grind, aggregators offer a fantastic, hands-off solution. They basically do all the complex "yield farming" for you, turning a complicated process into a simple deposit.

Understanding the Key Risks of Earning Yield

The promise of a steady USDC yield is definitely compelling, but it's super important to remember that higher returns rarely come without some strings attached. There’s really no such thing as a free lunch in finance, and DeFi is no exception to that rule. Getting a handle on the potential downsides isn't just good practice—it’s absolutely essential for protecting your capital.

Of course, letting your stablecoins just sit there collecting dust has its own risk: opportunity cost. One research paper estimated that idle stablecoins missed out on tens of billions in potential yield when U.S. Treasury rates were high. That’s a massive incentive to put your capital to work. But jumping from zero-yield into active strategies means you first have to get comfortable with the risks involved. You can learn more about the economic impact of idle stablecoins in this research from Galaxy.

Before you deposit a single dollar, let’s walk through the main risks you'll bump into on your yield-seeking journey.

Smart Contract Risk

In the world of DeFi, code is law. Every single lending protocol, liquidity pool, and yield aggregator runs on smart contracts—bits of code that automatically execute when certain conditions are met on the blockchain. While this automation is what makes DeFi so incredibly powerful, it's also a major vulnerability.

A bug, a clever exploit, or some undiscovered flaw in a protocol's code could let a hacker drain all the funds. It helps to think of a smart contract like a high-tech digital vault. If a thief finds just one tiny flaw in its locking mechanism, they can bypass all the security and empty the whole thing.

This isn't just a "what if" scenario. We’ve seen even well-established, "blue chip" protocols fall victim to sophisticated attacks, leading to huge losses for users.

So, how do you protect yourself?

Prioritize Audited Protocols: Stick with platforms that have gone through multiple security audits from well-known cybersecurity firms. Audits aren't a 100% guarantee of safety, but they're a critical sign that the team has done its homework.

Look for a Track Record: Choose protocols that have been around for a while, operate securely, and have a large amount of capital (Total Value Locked, or TVL) entrusted to them. Time and money are good indicators of trust.

Counterparty Risk

This risk is a huge deal in Centralized Finance (CeFi), but it can pop up in DeFi, too. Counterparty risk is basically the danger that the company or group you trust with your money will go under or fail to give it back.

When you deposit your USDC on a centralized exchange to earn yield, you're handing over custody. You’re trusting that the company will manage those funds responsibly and will still be in business when you want to withdraw. The spectacular collapses of giants like Celsius and BlockFi are painful reminders of what happens when that trust is broken.

In CeFi, your main risk is the financial health and operational security of the company. In DeFi, your main risk is the integrity of the code you're interacting with.

Even in the decentralized world, you can still face counterparty risk. A DeFi protocol might rely on a centralized price feed, or it could be managed by a small, anonymous team that could just decide to disappear with the funds. Always do your homework on the team behind a project and understand what other systems it depends on.

De-Peg and Regulatory Risk

These two are foundational risks for the entire stablecoin ecosystem. They can affect every single strategy, no matter which platform you end up choosing.

De-Peg Risk is the chance that USDC could lose its 1-to-1 peg with the U.S. dollar. While USDC has a solid track record and is backed by high-quality reserves, no stablecoin is completely immune to market panic or problems with its underlying assets. A de-peg, even a temporary one, could seriously dent the value of your holdings.

Regulatory Risk is the big question mark hanging over how governments will treat stablecoins and DeFi down the line. New laws could suddenly impose restrictions, change how things are taxed, or even shut down certain platforms entirely. This risk is systemic and pretty much out of your control, which makes it crucial to stay plugged into the evolving legal landscape.

Navigating all these risks requires a clear-eyed, realistic approach. By understanding what can go wrong, you give yourself the power to build a more resilient and sustainable USDC yield strategy.

Your Step-by-Step Safety Checklist

Diving into USDC yield is exciting, but the single most valuable thing you can bring with you is a safety-first mindset. Before you even think about putting your capital to work, you absolutely need a methodical process.

Think of this checklist as your pre-flight routine before takeoff. Each step is there to make sure you’re prepared, your funds are buttoned up, and every move you make is an informed one. This is how you shift from just chasing returns to building a real, sustainable yield strategy for the long haul.

1. Secure Your Foundation

First things first: asset security. This is non-negotiable. Before you ever connect to a DeFi protocol, you have to be confident your funds are locked down. That process starts and ends with your wallet.

Use a Reputable Wallet: Go with a well-known, non-custodial wallet. Hardware wallets like Ledger or Trezor are the gold standard because they keep your private keys completely offline. For more frequent use, a trusted browser wallet like MetaMask or Rabby is fine, but only download them from their official websites.

Guard Your Seed Phrase: Your seed phrase (or recovery phrase) is the master key to everything. Write it down on paper, store it in a few secure, offline spots, and never, ever share it with anyone or save it digitally where it could get swiped.

2. Do Your Own Research (DYOR)

Every protocol out there will promise you the moon. It’s your job to look past the flashy marketing and actually verify what they’re telling you. Solid research is your best shield against sketchy projects and outright scams. If you don't understand a protocol, don't give it your money. Period.

Kick off your research by digging into these areas:

Check for Audits: Has a reputable security firm like Trail of Bits or OpenZeppelin audited the protocol's code? Look for multiple audits. More importantly, read the reports to see if they found any critical vulnerabilities and if the team actually fixed them.

Assess Community Trust: Take a look at the protocol’s Total Value Locked (TVL). A high and steady TVL (say, over $100 million) is a good sign that other people trust the platform with serious capital.

Evaluate the Team: Is the team public and do they have a track record? Anonymous teams are a massive red flag and bring a much higher level of risk.

3. Start Small and Diversify

Okay, you've picked a platform you feel good about. Resist the temptation to ape in with your whole bag. The smartest move is to start with an amount you'd be genuinely okay with losing. This lets you test the waters and get a feel for the entire process without putting your main stack on the line.

Treat your first deposit as tuition. It’s the price you pay to learn the mechanics of depositing, earning, and withdrawing your funds in a live environment.

From there, think about diversification. Spreading your USDC across two or three different, well-vetted protocols is a great way to manage platform-specific risk. That way, if one protocol hits a snag, your entire USDC yield portfolio doesn't go up in smoke.

4. Keep Meticulous Records

Last but not least, remember that the yield you earn from USDC is often taxable income. Get into the habit of keeping detailed records of every single deposit, withdrawal, and earnings transaction right from day one. Trust me, this will save you a world of pain when tax season rolls around. Using a crypto tax software can make this whole process way less of a headache.

The Future of Automated Yield Farming

Let's be honest: manually chasing the best USDC yield can feel like a full-time job. Rates are always on the move, new protocols pop up every week, and gas fees eat into your profits every single time you decide to switch strategies.

This constant need to monitor, research, and execute is a massive headache. It's the biggest hurdle stopping most people from earning a decent passive income in DeFi.

This is exactly where automated yield farming platforms come in. Instead of you doing all the heavy lifting, these systems use smart algorithms—and now, increasingly, AI—to manage and optimize your capital for you. Think of them as your personal digital asset manager, working 24/7 to hunt down the best opportunities so you don't have to.

The whole point is to take the manual grind and emotional decision-making out of the picture. By automating the process, you get a huge amount of your time back while potentially boosting your returns through constant, data-driven moves.

How AI-Driven Yield Aggregators Work

The next step in this evolution is the rise of AI-powered yield aggregators, which are basically autonomous financial agents. These platforms don't just blindly follow a pre-programmed set of rules; they actually learn and adapt to the market as it changes in real-time.

Picture an agent that can:

Scan hundreds of pools at once: It’s constantly watching the entire DeFi space, comparing interest rates, trading fees, and reward tokens across countless protocols.

Judge risk on the fly: The agent looks at smart contract risk, how much liquidity is in a pool, and the track record of different opportunities, then allocates your funds based on your risk settings.

Handle all the complex transactions: It can automatically shift your funds between lending protocols and liquidity pools, harvest your rewards, and compound them back into your position to maximize growth.

This is a world away from sitting there clicking buttons in your wallet. You just deposit your USDC, and the AI agent takes the wheel, executing a strategy built to find that sweet spot between risk and reward for your USDC yield.

The goal of automation is to transform yield farming from an active, high-effort pursuit into a passive, "set-it-and-forget-it" experience, making sophisticated strategies accessible to everyone.

Benefits and New Considerations

The advantages here are pretty obvious. If you have a busy job or are just getting started in DeFi, automation dramatically lowers the barrier to entry. You no longer need to be a full-time analyst to earn a competitive return. It brings efficiency, consistency, and the magic of compounding without all the manual work.

However, this new technology also introduces a new layer of trust. Instead of just trusting a specific protocol's code, you're now placing your trust in the logic of the AI agent managing your funds. This is why transparency is so important.

Leading platforms in this space, like Yield Seeker, are focused on giving you a clear window into how their agents are thinking and acting. If you're interested in the nuts and bolts, you can learn more about how a yield optimization protocol uses automation to put your assets to work.

Ultimately, automated yield farming feels like the next logical step for DeFi. By blending user-friendly interfaces with the power of intelligent automation, these platforms are making it easier than ever to put your digital dollars to work safely and effectively.

A Few Common Questions About USDC Yield

Diving into the world of USDC yield usually brings up a handful of common questions. It’s smart to get clear, straight-to-the-point answers before you put any of your own money to work. This section is all about tackling those frequent queries to make sure you’re feeling confident.

We'll get into what kind of returns are actually realistic, how taxes work, and the big one: how to figure out if a platform is safe. Think of it as a final gut check to clear up any last-minute uncertainties.

What Is a Realistic APY for USDC?

Honestly, a "realistic" APY for USDC swings pretty wildly depending on what's happening in the market.

On the more established, conservative CeFi platforms, you're typically looking at something in the 2-5% range. Once you step into DeFi, yields on battle-tested protocols like Aave or Compound can often land anywhere from 5-15%.

These numbers are driven by one thing: how much demand there is from borrowers. Always be wary of platforms that promise ridiculously high or "guaranteed" returns. They almost always come with much bigger, often hidden, risks. A good rule of thumb is to compare any opportunity against the rates offered by the big, well-known protocols.

Is Earning Yield on USDC Taxable?

Yes, absolutely. In most places, including the United States, any yield you earn from USDC is treated as income and you'll need to pay taxes on it. This is a crucial detail that a lot of people miss when they're starting out.

It's so important to keep detailed records of all your earnings from day one. Tax laws around crypto can be a real headache and change based on where you live, so we can't stress this enough: talk to a qualified tax professional who knows their way around digital assets. It'll save you a world of pain later and ensure you're doing everything by the book.

How Do I Find the Safest Platform to Use?

Finding a safe platform is all about doing your own homework. There's no single "safest" choice, but you can slash your risk by sticking to platforms with a long, proven track record and multiple security audits from reputable third-party firms.

For DeFi, stick to protocols that have been running without major issues for years and have a huge amount of money locked in them (Total Value Locked, or TVL). A high TVL suggests a lot of people trust it.

For CeFi, go with the big, regulated exchanges that have a history of keeping user funds safe, even through crazy market swings.

Ready to put your USDC to work without all the manual clicking and constant monitoring? Yield Seeker uses a personalized AI Agent to automatically find and manage competitive, risk-aware yield opportunities for you. Start earning smarter today at Yield Seeker.