Back to Blog

A Practical Guide to Protocol Diversification for Stablecoin Yield

Learn how protocol diversification can boost your stablecoin yield while managing DeFi risk. Explore strategies, examples, and how to automate the process.

Dec 26, 2025

generated

In DeFi, protocol diversification is the simple, powerful idea of spreading your stablecoins across several different protocols instead of piling them all into one. It’s the crypto native’s version of the oldest rule in the investing playbook: don't put all your eggs in one basket. This strategy is your first line of defense against the kind of single-point-of-failure risks—like a sudden hack or exploit—that can wipe out an entire position overnight.

Understanding Protocol Diversification In DeFi

If you've ever put together a traditional investment portfolio, you’re already halfway there. Just like a financial advisor would tell you to mix stocks, bonds, and maybe some real estate, protocol diversification means allocating your funds across various types of DeFi platforms.

Each protocol, whether it's a lending market like Aave, a liquidity pool on Curve, or a real-world asset (RWA) platform, carries its own unique baggage of risks. These aren’t just abstract threats; they're specific and varied. One protocol might have a hidden bug in its smart contract, while another could get drained by an economic exploit if its price oracle gets manipulated. When you go all-in on one, you're betting your entire stack against every single one of its potential weaknesses.

Single Protocol vs Diversified Protocol Strategy At a Glance

To put it in perspective, let's break down how a single-minded approach stacks up against a diversified one. The differences in risk and reward become pretty clear when you see them side-by-side.

Factor | Single Protocol Strategy | Diversified Protocol Strategy |

|---|---|---|

Risk Exposure | High. A single hack or exploit can result in a total loss of all deposited funds. | Mitigated. A failure in one protocol only affects a fraction of your total capital. |

Yield Potential | Concentrated. You might catch a high APY, but it’s volatile and can drop to zero. | Blended & More Stable. Averages out yields from multiple sources, providing more consistent returns. |

Flexibility | Low. Your capital is locked into one system's rules and performance. | High. You can reallocate funds between protocols as opportunities and risks change. |

Vulnerabilities | Exposed to one protocol’s entire set of smart contract, oracle, and economic risks. | Protected against any single vulnerability, as risks are not shared across independent protocols. |

Ultimately, the choice comes down to your risk appetite. A single protocol offers a high-stakes bet, whereas diversification provides a much more resilient foundation for long-term growth.

Mitigating Single Points of Failure

The whole point of protocol diversification is to crush concentration risk. By spreading your capital around, you dramatically shrink the fallout from any single negative event. If one protocol gets compromised, only a slice of your funds is in the line of fire, leaving the rest safe and still earning yield elsewhere.

This isn't just theory. It's practical protection against the most common threats in DeFi today:

Smart Contract Hacks: A bug in the code is found and exploited, draining the protocol.

Economic Exploits: Someone figures out a clever way to manipulate the protocol's mechanics and siphons out liquidity.

Sudden Yield Drops: Market conditions shift, and the juicy APY you were chasing evaporates overnight, leaving your capital sitting idle.

The essence of protocol diversification is moving from a high-stakes, single-bet approach to a more resilient, multi-pronged strategy that can withstand the inherent volatility of the DeFi ecosystem.

The entire DeFi space is already moving in this direction. A few years back, giants like Uniswap and Curve dominated, handling nearly 75% of all DEX volume. Now, that market share is spread much more evenly across a whole host of competitors, signaling a healthier, more mature ecosystem.

Of course, managing this diversification manually can be a full-time job. That's where tools like yield aggregators come in, automating the process of finding and allocating to the best opportunities.

Why Diversification Is Critical for Stablecoin Yield

Spreading your capital around just sounds smart, right? But for stablecoin holders, the benefits aren't just theoretical—they're real and powerful. Protocol diversification isn't just about playing defense; it’s a game plan for building a tougher, more profitable yield portfolio.

This strategy really boils down to three things: dodging major risks, smoothing out your returns, and getting in on new opportunities without betting the farm.

Think about a farmer who only plants one type of crop. One bad frost or a nasty pest could wipe out their entire year's harvest. The smart farmer, on the other hand, plants a variety of crops that grow in different seasons and handle different conditions. That way, no matter what happens, something is always growing, leading to a much more reliable income. That’s exactly what protocol diversification does for your stablecoins.

Mitigating Catastrophic Risk

The number one reason to diversify is simple: survival. DeFi is a wild place, full of hidden traps from smart contract bugs to clever economic attacks. When you dump all your stablecoins into one protocol, you're taking on 100% of its potential failures.

A diversified strategy is like a firewall. By splitting your funds across a few independent protocols, you contain the damage if something goes wrong. If one protocol gets hacked or its stablecoin de-pegs, only a slice of your capital is at risk. The rest of your portfolio is safe and sound, still chugging along and earning yield. It turns a potential disaster into a manageable bump in the road.

By diversifying, you stop making a single, high-stakes bet and start building a robust system where one failure doesn't collapse the whole thing. This is how you preserve your capital for the long haul in DeFi.

Optimizing and Stabilizing Yield

Beyond just playing it safe, diversification is how you get better, more predictable returns. DeFi yields are all over the place. A lending market might offer a juicy 15% APY one week, then crash to 3% the next because of market shifts. Constantly chasing the highest APY is a recipe for frustration and a mountain of gas fees.

Protocol diversification smooths out that wild ride. By blending yields from different sources—say, a steady lending protocol, a fee-generating liquidity pool, and an innovative real-world asset (RWA) platform—you create a more stable, "blended" average yield. This combined return is way less volatile than any single source. We actually break down what makes these rates tick in our guide on stablecoin interest rates.

This approach gives you a few key advantages:

Reduced Volatility: Your overall yield is less likely to tank because of one protocol's bad week.

Consistent Performance: It delivers a more predictable income stream, since a dip in one area is often offset by a spike in another.

Less Active Management: You can stop chasing the "hot" new yield every other day, saving yourself time and transaction costs.

Capturing New Opportunities Safely

The DeFi world never sleeps. New lending markets, clever liquidity strategies, and groundbreaking RWA protocols are popping up all the time, often dangling very attractive yields to bring in early users. Just look at the RWA tokenization market—it exploded from $8.5 billion to over $33.9 billion in just a couple of years.

But newer protocols always come with higher risk. Diversification lets you dip your toes into these exciting opportunities without going all in. You can allocate a small piece of your capital to a promising new protocol while keeping the bulk of your funds in battle-tested platforms you trust. This balanced approach lets you ride the wave of innovation while keeping your core portfolio safe and sound, making sure you're always evolving with the market.

Key Metrics for Evaluating DeFi Protocols

Real protocol diversification isn't about just randomly spraying your funds across a bunch of different platforms. It's a calculated move, one built on a solid foundation of careful evaluation. Before you even think about allocating a single dollar, you need a framework to tell the promising projects from the ones that could blow up in your face.

Think of it like inspecting a house before you buy it. You wouldn't just admire the new paint job, right? You'd check the foundation, look for leaks, and make sure the wiring isn't a fire hazard.

In DeFi, that means digging into a mix of hard data and the softer, more human signals. Once you know what to look for, you can make smarter decisions, build a tougher portfolio, and dodge the most common traps. This is how you go from being a passive degen to a sharp investor.

Quantitative Health Checks

Numbers don't lie. They give you an objective place to start when you're sizing up a protocol's health and how much the market trusts it. These metrics are your first line of defense, giving you a quick snapshot of a protocol's size, performance, and reliability.

Total Value Locked (TVL): This is the big one—the total amount of money users have deposited into a protocol. A high and growing TVL is a great sign; it shows that people trust the platform with serious capital. On the flip side, a sudden, steep drop in TVL is a massive red flag that screams "loss of confidence."

Historical Yield Performance (APR/APY): Don't get mesmerized by a huge advertised APY. What you really want is a consistent, stable yield history, not something that bounces from 25% to 2% in a few days. Wild swings often point to an unsustainable model that's probably propped up by risky token rewards. You can learn more about balancing returns and risk in our guide on calculating risk-adjusted returns.

Yield Source and Mechanism: You have to ask: where is this yield actually coming from? Healthy, sustainable protocols generate returns from real economic activity, like fees from lending or trading. Be very skeptical of protocols where the yield is almost entirely funded by printing their own token—that's a model with a very short shelf life.

Qualitative Trust Signals

While numbers tell one part of the story, the qualitative stuff reveals the people and the principles behind the code. These signals help you figure out if a protocol is truly committed to security, transparency, and sticking around for the long haul.

A protocol can have a billion-dollar TVL, but without a transparent team and verifiable security, it's a house of cards. Qualitative due diligence is what separates informed investors from speculators.

Here are the crucial signs you need to look for:

Security Audits: Has the protocol been audited by reputable firms like Trail of Bits, OpenZeppelin, or CertiK? More audits are always better than one. Make sure you also check if the team actually fixed the issues the auditors found. If there are no public audits? That’s an immediate deal-breaker.

Team Reputation and Transparency: Is the team public (doxxed) or anonymous? While anonymity is part of the crypto culture, a public team with a solid track record adds a huge layer of accountability. Look into their past projects, how they communicate on Discord and social media, and how open they are in general.

Community and Governance: A buzzing, active community is usually a great sign. Check out the governance forums. See how decisions get made and whether the community actually has a say in the protocol's future.

The explosive growth in DeFi lending really drives home why this evaluation matters. By early 2025, DeFi lending apps made up 45.31% of the entire crypto collateralized lending market. These apps saw $15.08 billion in new assets pour in, showing that well-vetted, diversified protocols are the ones that attract serious capital.

You can dig into the full report from Galaxy Research. It’s clear that a thorough, disciplined assessment is the key to smart protocol diversification.

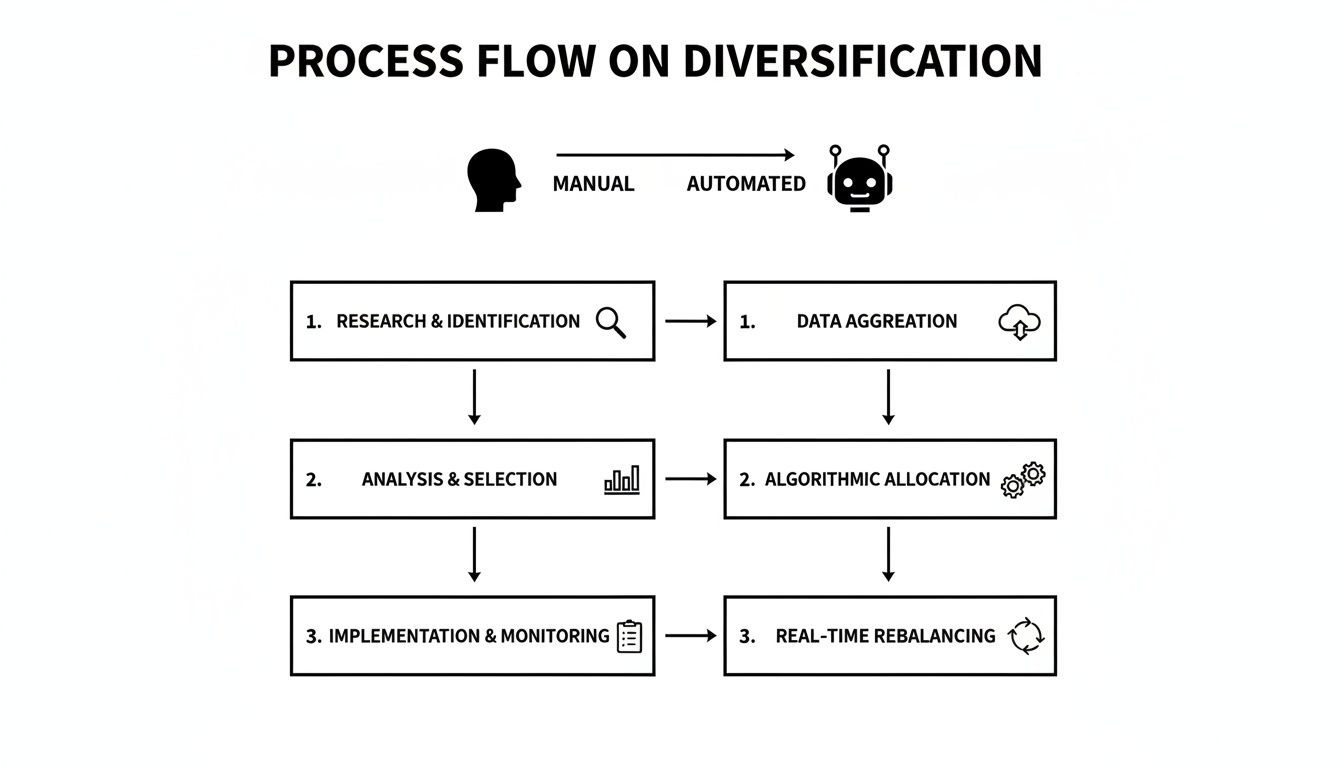

Manual vs. Automated Diversification Strategies

So, you're on board with protocol diversification. Awesome. The next big question is pretty simple: how do you actually do it?

You’ve got two main paths. You can either roll up your sleeves and manage everything yourself, or you can let a smart piece of tech do all the heavy lifting for you. This isn't just about what you prefer; it's about what fits your life—how much time, expertise, and mental energy you want to pour into managing your stablecoin yield.

The Do-It-Yourself Manual Approach

Going manual puts you squarely in the driver's seat. You have total, hands-on control over every single decision. You pick the protocols. You decide when to move your funds. This approach is a constant cycle of research, action, and monitoring. It never really stops.

A typical day in the life of a manual diversifier looks something like this:

Constant Research: You’re the one who has to find, vet, and keep a close eye on a handful of DeFi protocols.

Manual Transactions: Every move is on you. Connecting your wallet, approving contracts, depositing funds, withdrawing—and paying gas fees for every single click.

Fragmented Tracking: You're probably juggling a bunch of browser tabs, dashboards, or maybe even a custom-built spreadsheet just to get a clear picture of how you're doing.

Active Rebalancing: When yields dip or a new risk pops up, it’s your job to manually shift funds around to stay optimized, which means... you guessed it, more gas fees.

While maximum control sounds great on paper, the downsides are very real. It’s a massive time sink, and all those gas fees from frequent adjustments can quietly eat away at your returns. Plus, let's be honest, it makes you vulnerable to making emotional calls—chasing the latest hot yield or panic-selling when the market gets shaky.

The Efficient Automated Approach

The automated strategy, on the other hand, is like hiring a dedicated portfolio manager that works for you 24/7 and never sleeps. Platforms like Yield Seeker use smart technology to handle the entire diversification process for you, turning a complicated, stressful task into a simple, set-it-and-forget-it experience.

Instead of sweating the details, you just deposit your stablecoins. That's it. An AI-powered system takes over from there.

Automated diversification handles all the complexity behind the scenes. It gives you the full benefit of a dynamic, multi-protocol strategy without the endless grind of research, transaction management, and manual rebalancing.

These systems are constantly crunching thousands of on-chain data points in real time—tracking yields, liquidity levels, transaction costs, and protocol health. The moment a better opportunity appears, the platform can act on it instantly, often bundling transactions to slash gas fees. Your capital is automatically reallocated based on a solid, data-driven strategy, keeping you aligned with your goals and away from impulsive, sentiment-driven moves. If you're weighing the pros and cons, this AI Trading vs Manual Trading performance comparison offers some really interesting insights.

Comparing Manual and Automated Diversification

To make the choice crystal clear, let's put these two approaches side-by-side and see how they stack up on the things that matter most to a stablecoin investor.

This table breaks down the differences between a DIY manual approach and using an automated platform for protocol diversification.

Feature | Manual Diversification | Automated Diversification (e.g., Yield Seeker) |

|---|---|---|

Effort & Time | High. Requires daily research, tracking, and active management. | Low. A "deposit and forget" experience with automated monitoring. |

Transaction Costs | High. You pay individual gas fees for every deposit, withdrawal, and rebalance. | Optimized. Platforms often batch transactions to minimize gas costs for users. |

Efficiency | Low. Prone to delays, missed opportunities, and human error. | High. Executes rebalancing instantly based on real-time data. |

Decision-Making | Based on personal research; susceptible to emotional bias (FOMO, fear). | Data-driven and systematic, based on pre-set algorithms and risk models. |

Accessibility | Requires significant DeFi knowledge and technical confidence. | User-friendly and designed for both beginners and advanced users. |

Ultimately, the choice is yours. The manual path gives you total control, but the automated approach offers a far more efficient, accessible, and disciplined way to build a strong protocol diversification strategy—saving you a ton of time, money, and stress in the process.

How Yield Seeker Automates Protocol Diversification

Let's be honest: manually managing a diversified DeFi portfolio is a full-time job. It’s a grind of constant research, eye-watering transaction fees, and a level of discipline that’s tough to maintain. This is exactly why we built Yield Seeker. We take the entire complex, time-sucking process of protocol diversification and turn it into something you don't even have to think about.

The journey starts with a simple USDC deposit on the Base chain. From there, your personal AI Agent takes the wheel. Think of it as your own dedicated portfolio manager, constantly scanning the DeFi landscape, crunching thousands of real-time data points to sniff out the best risk-adjusted yield opportunities out there.

All this powerful automation happens behind a super clean, simple interface. No more juggling a dozen dashboards or trying to track positions scattered across different protocols. Everything is in one place, giving you a clear picture of your capital and how it's performing, without any of the operational headaches.

Your Personal AI Portfolio Manager

Your Yield Seeker AI Agent is essentially your expert guide in the wild west of DeFi. It does all the heavy lifting—allocating, rebalancing, and executing a strategy that would be almost impossible to pull off by hand. The platform's intelligence is built to squeeze out the best possible returns while keeping a close eye on risk through purely data-driven decisions.

This is what that difference looks like in practice.

As you can see, automation collapses a complicated, labor-intensive workflow into a single, simple action. The time and effort saved is massive.

This kind of continuous optimization is a game-changer in a market where opportunities appear and disappear in the blink of an eye. With stablecoin usage exploding, the need for smart allocation is only getting bigger. A recent report from TRM Labs noted that stablecoins accounted for roughly 30% of all on-chain crypto transaction volume in 2025, which just goes to show how many individuals and treasuries are looking for diversified yield. You can dig into the full 2025 crypto adoption and stablecoin usage report for a deeper dive.

Effortless Experience Meets Total Control

Automation shouldn't mean giving up control. We built Yield Seeker on the belief that users deserve both simplicity and transparency. The entire platform is designed to give you a seamless experience while ensuring you're always in the driver's seat.

Yield Seeker was designed to deliver the benefits of sophisticated protocol diversification without the burden. Our goal is to save you time, reduce your research load, and optimize your returns through continuous, intelligent adjustments.

Here are a few key features that make this a reality:

At-a-Glance Dashboard: One clean, clear view of your total balance, earnings, and current allocations. Say goodbye to spreadsheet chaos.

Educational Terminal: For anyone who likes to look under the hood, our terminal gives you insights into the strategies your agent is deploying. You can learn as you earn.

Complete Accessibility: Your funds are never locked. We have a strict no-lockup and no-withdrawal-fee policy. Your capital is always liquid and ready when you need it.

By bringing all these pieces together in an intuitive interface, Yield Seeker makes a sophisticated yield strategy accessible to everyone, not just the DeFi power users. We translate the complex world of DeFi into something you can actually use, effortlessly.

Still Have Questions About Protocol Diversification?

Diving into protocol diversification always sparks a few questions. As you go from just understanding the idea to actually putting a strategy into practice, it's totally normal to wonder about the finer details. This section is here to clear up some of the most common questions we get, giving you straight-up answers so you can build your strategy with confidence.

Think of it like that final check before a big road trip. Your bags are packed, the route is planned, but now you’re just double-checking the tire pressure. These answers are designed to give you that last bit of peace of mind.

How Many Protocols Are Enough to Be Diversified?

This is the big one, but honestly, there’s no magic number that works for everyone. The goal isn't to just spray your funds across dozens of platforms; it's to meaningfully cut down your exposure to any single point of failure without making your portfolio a complete headache to manage.

For most folks managing their own funds, a portfolio of 3 to 7 well-vetted protocols usually hits the sweet spot. It’s a manageable number to keep track of, but it’s diverse enough to offer real protection.

But here’s the thing: the quality of your diversification is way more important than the quantity. The real key is to pick protocols with different risk profiles and ways of making money. For example, a solid manual strategy might look something like this:

A Blue-Chip Lending Protocol: Think of an established player like Aave or Compound, known for their long history and deep liquidity.

A Stable-Swap AMM: A protocol like Curve that’s built for low-slippage trades between stable assets and earns fees from huge trading volumes.

A Real-World Asset (RWA) Protocol: One of the newer platforms that tokenizes off-chain assets like treasury bills, offering yield that isn’t tied to the usual crypto market swings.

The best diversification comes from blending different types of risk, not just adding more of the same. Spreading your money across five nearly identical lending protocols does nothing to protect you if the entire lending sector takes a hit.

This is where automated platforms have a massive edge. An AI-driven tool like Yield Seeker can analyze and manage a much larger, more dynamic portfolio of protocols—way more than any person could realistically keep up with. The algorithm figures out the optimal number and allocation by constantly analyzing risk, yield, and market conditions in real-time, bringing a level of sophistication that’s just not possible with a manual approach.

What Are the Main Risks of Protocol Diversification?

While protocol diversification is an incredibly powerful way to manage risk, it's important to remember that it reduces risk—it doesn't erase it. When you spread your capital out, you’re basically trading one big, concentrated risk for a handful of smaller, distributed ones.

Getting a handle on these new risks is crucial for building a strategy that's truly resilient. Here are the main ones to keep on your radar:

Smart Contract Risk: This is the most direct trade-off. Every new protocol you add to your portfolio means you’re trusting another set of smart contracts. No matter how many audits it has, every contract carries the potential for a hidden bug or vulnerability that could be exploited. This is exactly why you can’t skip the homework—focus on audited, battle-tested protocols.

Systemic Risk: Some risks are so huge they can rock the entire DeFi ecosystem at once, no matter how well-diversified you are. A major event, like a top stablecoin losing its peg or a critical piece of shared infrastructure (like a widely used price oracle) failing, could trigger a domino effect across many different protocols at the same time.

Complexity Risk: This one is a big deal for anyone managing their own portfolio manually. The more positions you have across different platforms, the higher the odds of making a simple mistake. You might forget about a position, miscalculate your total exposure, or just not act fast enough when one protocol starts showing warning signs. Automated tools are designed specifically to tackle this by centralizing management and sticking to a consistent, emotion-free strategy.

How Does Yield Seeker Select Protocols for Diversification?

At Yield Seeker, our protocol selection is all about rigorous, data-driven due diligence. We mix quantitative analysis with a deep qualitative review to make sure our users' capital only goes to opportunities that meet our highest standards for safety, reliability, and sustainable yield.

Our AI-powered system is the first line of defense, constantly scanning the DeFi ecosystem. It filters thousands of potential yield sources through a strict set of criteria, analyzing on-chain data like:

Total Value Locked (TVL) and Liquidity Depth

Historical Yield Stability and Volatility

Transaction Volume and User Activity

But data alone never tells the whole story. Any protocol that gets past the initial screening then goes through a thorough review by our team. This hands-on assessment looks at the stuff an algorithm can't easily measure, such as:

Security Audits: We verify audits from reputable firms and make sure any issues they found were actually fixed.

Team Experience and Transparency: We dig into the development team's track record, reputation, and how much they engage with their community.

Economic Model Sustainability: We break down the protocol's design to ensure its yield comes from real economic activity, not just from printing inflationary tokens.

Only the protocols that pass both of these demanding stages are added to the universe of strategies our AI can use. This multi-layered process ensures every opportunity has been thoroughly vetted for both performance and security.

Are My Funds Locked Up When Using an Automated Tool?

This is a huge question, because having access to your funds is non-negotiable. The answer can vary from platform to platform, but at Yield Seeker, we built our entire system on one core principle: your funds are always yours, and they are never locked up.

We designed our platform to give you the best of both worlds—the power of automated yield generation with the freedom of self-custody. You can deposit and withdraw your stablecoins whenever you want, for any reason, without ever hitting a lockup period or getting slapped with withdrawal fees.

Even while our AI agent is busy putting your capital to work across different DeFi protocols to maximize your yield, your funds stay completely liquid and accessible to you through the simple Yield Seeker interface. This means you can always adapt to your personal financial needs without being stuck, giving you total control over your money.

Ready to put the power of automated protocol diversification to work for you? With Yield Seeker, you can start earning smarter, risk-aware yield on your stablecoins in just a few minutes. Deposit as little as $10 USDC and let your personal AI Agent handle the rest. Start your journey with Yield Seeker today.